Bob Sandberg "Commuters on train platform, Park Forest, Illinois." July 1954

At a time when perceptions of the real state of economies and markets seem to diverge ever more, ranging from the boundless optimism nearly all mass media now attempt to radiate, to the stark warnings from major investors, like here via Tyler Durden or here via John Mauldin, that the stock market is on the verge of a very substantial move down, the ways numbers are used to influence perception become increasingly evident in the example of the field of shale carbons and fracking.

There are lots of numbers floating around in the fracking industry, and the majority of them look unrealistic to the extent of being purely fictional. And not just of the innocent wishful thinking kind either; unrealistically high numbers have been used for pure speculation, to drive up land prices. It has been a successful drive. Until now.

The Automatic Earth has repeatedly pointed out the speculative part of shale before, and it's good to now see it confirmed from within the industry itself. Obviously, the prices paid in the land grab phase were based on expected returns, and what we see at present is that these expectations have been unrealistic. The US Energy Information Administration (EIA) appears to play a questionable role in this, and not only inside the US either.

It seems that perhaps the main reason why people believe the US has an energy revolution and/or independence on its hand is that they don't understand and/or care what for instance an annual 40% depletion rate means. True, more and more wells are drilled, but the pattern is that they deliver even less and deplete even faster than earlier wells (oil engineers will always go for the best stuff first, and they're good, they know where the best stuff is).

The shale and fracking revolution therefore looks to be far more short-lived than anyone with a vested interest is willing to recognize, while people who don't know the field continue to fall for the faulty impression created by the faulty numbers, hook, line and sinker.

An example: the US Energy Department predicts that shale oil will add 3.1 mbpd (million barrels per day) to America's oil output by 2020, and Leonardo Maugeri at Harvard even claims it will be 5.4 mbpd. But according to Rune Likvern, at the largest "play", North Dakota's Bakken, output looks set to first temporarily stabilize at 700 kbpd and then fall off a precipice.

Viewing through the data, it's doesn't even seem all too likely that there still will be a viable US shale industry by 2020. The predictions for the future of shale gas, whether they're accurate or not, have pushed domestic US gas prices so low that while the American economy enjoys a temporary windfall, profit margins for actually producing it have fallen so much it's hardly economically viable any longer. At the Bakken play, well over $1 billion worth of gas is simply flared off, and that's probably a lowball estimate. A waste? Absolutely. Polluting? You bet. But there's no profit in shale gas anymore.

As for shale oil, "tight oil", the numbers are, to say the least, "disappointing". Rune Likvern compared it last year at the now defunct Oil Drum to the Red Queen from Alice in Wonderland, who has to run ever faster just to stand still. But you're not going to hear this from the major players in the oil industry. They still have far too many losses to make up for to come clean on their mistakes.

First, to provide a clearer picture of everything tight and shale for those who wonder what exactly there is buried down there, Nicole explains about carbon chains:

Hydrocarbons come in a whole range in terms of length of carbon chain. Natural gas (primarily CH4/methane) has only one carbon and is at one end of the spectrum. Very short chain molecules can also be gases at room temperature, like ethane (2 carbons) and propane (3 carbons). As the chain gets longer you have substances that can be liquid or gas depending on exactly what the temperature is, like butane (4 carbons) that is a gas at summer temperatures and a liquid at other times.

Longer chain molecules are 'thin' liquids, and very long chains are 'thick', sticky (viscous) liquids, really long chains are like tar. In hydrocarbon deposits you can get a whole mixture that is then separated out using fractional distillation, because boiling points vary by carbon chain length. (Refining is fractional distillation combined with 'cracking' long chains in order to make them into shorter ones, because shorter ones are more valuable.)

Gas deposits are mixtures at the short end of the spectrum, light crude is a mixture in the middle to long end, and heavy crude is a mixture at the very long end. (At the medium to long end you have more than just chains, you also have complex molecules in carbon ring structures like benzene.)

Natural gas liquids are longer chain liquid molecules associated with deposits that are primarily gas. If a gas deposit has a lot of liquids associated with it, those have to be separated out before the gas can be put in a pipeline. They're valuable, because they're burnable hydrocarbons, but that's offset by the cost of separating them out.

Then, fracking industry Mark Papa gives his view on his own industry. Not coincidentally, he does so after announcing his retirement. It's not as if he comes completely clean, but it does seem to open up a man's conscience.

How An Enron Cast-Off Became One Of America's Great Oil Companies

When it comes to energy’s fracking revolution, few men have contributed more–or played the trend as profitably–as Mark Papa, the 66-year-old chairman of EOG Resources. So when he lays a chart out on a conference table in his skyscraper aerie in Houston, it’s surprising to hear him say that the Great American Oil Boom, which he helped create, is "not going to be as massive as people think."

"The chances of the U.S. being independent in oil are very slim," he says.

The chart shows how different fields will contribute to future supplies. And it is dominated by two areas: the Bakken shale region of North Dakota and Eagle Ford in South Texas. Those two fields – helped by the revolutionary technologies of hydraulic fracturing and horizontal drilling – have furnished the bulk of the 43% jump in U.S. oil supplies over the last five years. [..]

The rest of America’s big finds? Even the third-biggest new oil play, in the Permian Basin of Texas and New Mexico, won’t measure up, says Papa. "We’ve studied this from the rocks’ point of view," he says, tapping the chart. Despite dozens of shale oil discoveries, he says, "there’s a whole lot of plays that will have zero significance."

Why listen to Papa? Because under his command EOG shares returned 650% in the past decade, more than any other sizable U.S. oil company. EOG’s market cap is closing in on $40 billion – more than Apache Corp. or Marathon Oil, and nearly triple the value of Chesapeake Energy.

During the land-grab phase of the shale boom EOG Resources – once a division of Enron – was one of the first companies into the Bakken shale, and it discovered the Eagle Ford (it has massive holdings in the sweet spots of both fields and many others). Unlike rival Chesapeake Energy, EOG didn’t go deep into debt to gobble up land. In fact, Papa had the discipline to sell off marginal acreage to greater fools willing to pay top dollar.

Now that the land grab is over, companies are stuck with more turf than they can drill, and prices have collapsed. Hess Corp. just dumped subpar acreage for an $800 million loss. "In the game of musical chairs, all of a sudden the music stopped," says Carl Tricoli, president of private equity firm Denham Capital. And EOG is sitting pretty. [..]

October 2007 Papa declared that industry had found so much shale gas that "we had probably ruined the market for 20 years." So, he said, EOG would shift entirely toward oil.

As natural gas prices climbed to a record $14 per thousand cubic feet in 2008, he stuck to his plan. "We still knew doom was going to hit," recalls Papa. It did. Prices plunged in 2009, bottoming out below $2 in early 2012. [..]

Of the roughly 26 billion barrels of original oil in place under EOG’s land in the Eagle Ford play, the company figures it can recover "only" 2.2 billion barrels.

That recovery rate of 8% is about standard across the shale plays but pales beside a rate of 30% or more in conventional fields.

Now that the shale land grab is done, analyst Bob Brackett of Bernstein Research sees the likelihood that cash-rich and growth-hungry super-majors like Chevron will soon look to acquire winners like EOG.

That already provides a different view than what you see repeated in the media time and again, doesn't it? The US consumes just less than 20 million bpd, or 7 billion barrels per year, and one of the largest producers in one of the two biggest shale oil plays can recover just 2.2 billion barrels over its entire lifetime.

What makes shale oil very different from conventional oil, apart from much lower EROEI (energy return) rates, is depletion rates. Let's turn to Rune Likvern's April 29 Oil Drum article for that:

Is the Typical NDIC Bakken Tight Oil Well a Sales Pitch?

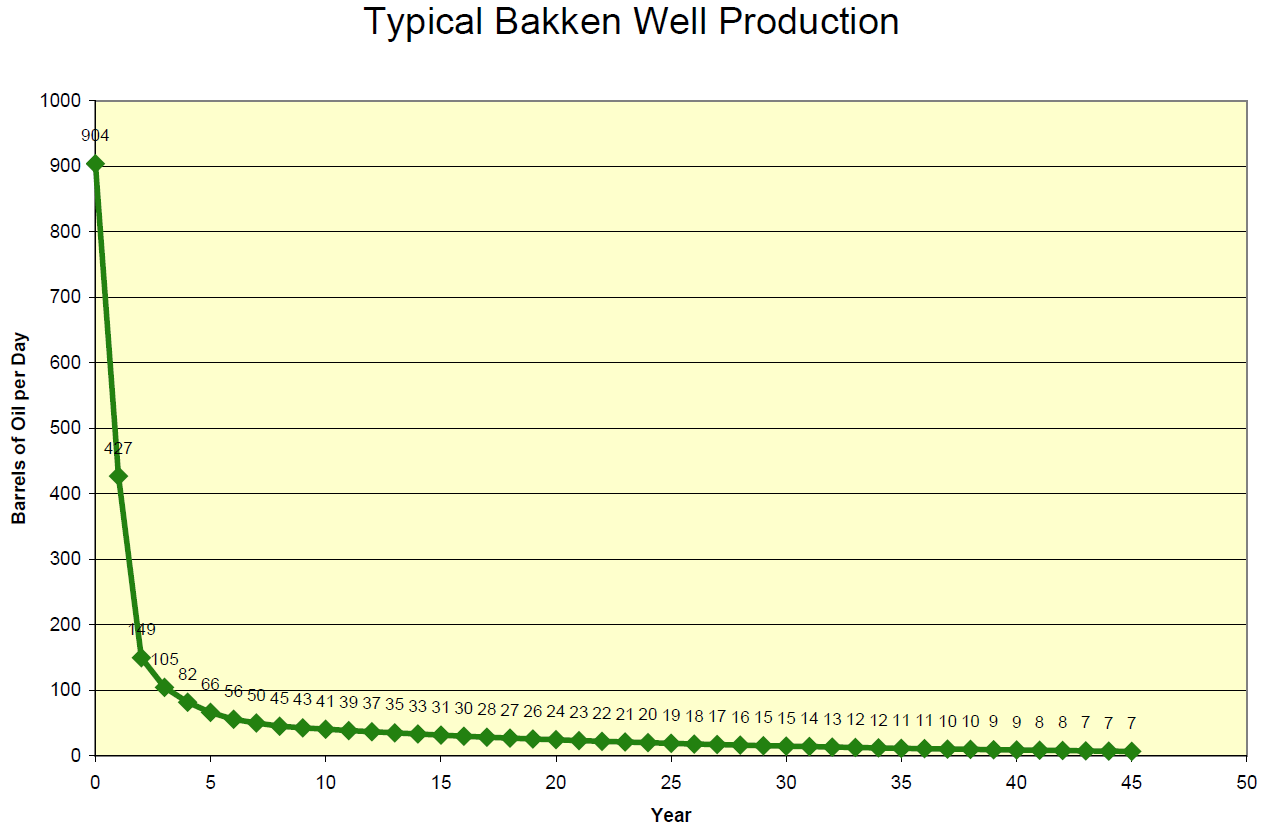

The use of the phrase "Typical Bakken Well" by NDIC (North Dakota Industrial Commission) as shown in Figure 01 is here believed to depict what is to be expected from the average tight oil well.

The results from the dynamic simulations show:

• If the "Typical Bakken Well" is what NDIC recently has presented, total production from Bakken (the portion that lies in North Dakota) should have been around 1.1 Mb/d in February 2013, refer also to Figure 03.

• Reported production from Bakken by NDIC as of February 2013 was 0.7 Mb/d.

• Actual production data shows that the first year's production for the average well in Bakken (North Dakota) presently is around 55% of the "Typical Bakken Well" presented by NDIC.

• The results from the simulations anticipate a slowdown for the annual growth in oil production from Bakken (ND) through 2013 and 2014.

Figure 01: The chart above is taken from the NDIC/DMR presentation Recent presentations "Tribal Leader Summit 09-05-12 slide no 5" (pdf; 8.7 MB). The chart shows NDIC's expected average daily oil production by year. The first number (on the y-axis) is the IP (Initial Production) number, and this is followed by the average daily production by year.

The well shown above has a first year total oil production of 156 kb (427 Bbl/d).

Similar well profiles may be found in other NDIC presentations.[..]

Figure 03: The colored bands show total production (production profile for the typical NDIC well multiplied by net added producing wells during the month) added by month and its projected development (left hand scale). The yellow circles show net added producing wells by month (right hand scale). The thick black line shows actual reported production from Bakken (North Dakota) by NDIC (left hand scale).

The model was calibrated to start simulations as of January 2010.

The results from the simulation show that if the wells added as from January 2010 were like the typical well used in recent presentations by NDIC, total production from Bakken (ND) by February 2013 would have been around 1.1 Mb/d.

The thick black line shows actual production from Bakken (ND) reported by NDIC which was 0.7 Mb/d in February 2013.

If the NDIC typical well represented the"average" , the production build up would have been steeper as shown in Figure 03.

This supports earlier findings that the "average" well yields less than what has been reported, and actual well data from NDIC shows that the first year's production from the average well presently yields around 55% of the typical NDIC well production used in several public presentations.

Numbers such as these have forced Shell to simply write down over $2 billion of its shale holdings in just one year. Big Oil typically came in late and overpaid. Companies like Shell, Chevron and Exxon are so eager to add to their reserves even they, with all the knowledge at their disposal, sometimes rush in blind.

Shell's Profit Falls on Shale Write-Down

U.K.-listed oil and gas company Royal Dutch Shell on Thursday posted a 60% fall in profit for the 2nd quarter, largely from a charge of more than $2 billion on the value of its liquids-rich shale assets in North America.

The company warned that its North American exploration and production division was likely to remain at a loss during at least the second half of the year, and announced a strategic review of its North American portfolio with a view to selling some assets.

The write-down on the North American shale assets reflected new information from exploration and appraisal drilling, and production, Shell said.

Shell [..] took a $2.1 billion write-down on its shale-oil exploration in North America, a key focus of company investment; and it abandoned plans to raise production to four million barrels per day by 2017-18.

The shale write-down is something of a mystery. The move acknowledges some of Shell's spending on shale-oil exploration will not prove economically viable though it wouldn't disclose which of its fields have disappointed. Nor did Shell rule out further write-downs on its $24 billion of capital invested in shale oil and gas.

Shell's decision to speed up the rate at which it disposes of assets is a clue that hitting its cash flow targets could get tougher.

Shell writes down over $2 billion on recent acquisitions, and has invested another $22 billion in the same assets. More write downs will follow. The company even broke with its tradition of setting future production targets. And it's not just Shell either; you can bet the other major oil firms will run into similar obstacles. They're not just eager, they're downright desperate: if they can't get access to more oil, they're done. Flows from existing fields are plunging at a 5% annual rate. Big Oil needs to make up for those losses or risk seeing their business models crumble.

Commodity supercycle in rude health despite shale

A new Eos report by the American Geophysical Union, "Peak Oil and Energy Independence: Myth and Reality", argues that global crude output has been stuck on a plateau of around 75m barrels per day (bpd) since 2005 despite enticing returns. "Global net oil exports from oil-exporting countries have peaked and are in decline."

The output of the big five oil majors – Exxon, BP, Total, Chevron and Shell – has fallen by 26% over the past nine years …

Theoretical reserves are meaningless. What matters is the break-even cost.

Eos said flows from the world's existing fields are falling at 5% a year, and it is questionable whether shale or tar sands can easily step into the breach. "Production from these unconventional sources is difficult and expensive, and has a very low energy return on investment. Simply stated, it takes energy to get energy," it said.

The depletion rate on rigs at the Bakken field in North Dakota – the biggest US shale field – is precipitous. Output falls 30% within two years, and a third is leaking into the air. Shale bears say average declines are nearer 70% in the first year …

Kevin Norrish from Barclays said US drillers have already tapped the "best plays" for shale, with newer Utica ventures in the north east of the US and Canada coming up short. The biggest productivity leaps may already have happened. "We expect a steep slowdown in the rate of tight oil production growth from the middle of this decade onward," he said.

How do you keep a company, any company, alive when its output falls 26% in less than a decade? You invest more, and if that doesn't work, you invest even more. Until you can't.

Shale-Boom Profits Bypass Big Oil

Some of the world's biggest energy companies are struggling to make money from massive bets on the shale boom in North America, where deposits of oil and gas are proving abundant but not always profitable.

Royal Dutch Shell, which has had a tough time coaxing crude oil from dense rock formations, said Thursday its shale holdings in the U.S. are worth $2.2 billion less than it had previously determined. The write-down helped push the Anglo-Dutch oil giant's second-quarter earnings down 60% from a year earlier. The company said it would explore selling some of its U.S. shale properties.

Exxon Mobil Corp., the world's largest publicly traded energy producer, is still feeling the effects of its plunge into U.S. shale gas in 2010, which left it with a big exposure to persistently low natural-gas prices. Rising expenses and falling oil-and-gas production contributed to a 57% drop in quarterly earnings for the Irving, Texas, company. Its profit per barrel of oil and gas fell 23% from a year earlier.

U.S. oil production has soared to levels not seen in decades, and profits at some smaller energy companies have surged. But big international oil companies, which were late to exploit shale rocks, haven't capitalized on the boom in the same way.

Exxon and Shell have spent billions to acquire companies and drilling rights to shale discovered by others at a lower cost. Their sheer size – Exxon produces nearly as many barrels of crude a day as the entire state of Texas – also makes it harder for them to replace the reserves they deplete and increase their output.

As for shale, "they bought in late in the game, and it's hit or miss," said Ken Medlock, senior director of the Center for Energy Studies at Rice University in Houston. "Whether or not it pays off is going to be highly dependent on what happens to commodity prices."

Along with Chevron Corp., Exxon and Shell are investing at record levels to find and produce energy, aiming to spend a combined total of about $111 billion this year, 8% more than in 2012. They are adjusting to a world in which countries with some of the richest oil deposits from Iraq to Mexico have limited their access, adding to the difficulty of expanding production.

Exxon and Chevron are sticking to aggressive goals to increase their slumping production over the next four years, by about 14% and 26%, respectively, from 2012 levels. But Shell said it would stop setting targets for how much oil and gas it hopes to pump and just focus on profits. "If we are solely focused on a volume-related target, we may make less profitable long-term investments," Simon Henry, Shell's chief financial officer, said in an interview.

In Big Oil's hunt to add to its reserves, North America emerged as a bright spot in recent years. Smaller companies like EOG Resources Inc. and Chesapeake Energy Corp. capitalized on drilling sideways through shale, breaking it up with a high-pressure stream of water, sand and chemicals, allowing oil and gas to flow.

The Energy Information Administration said Thursday that exploration and production companies operating in the U.S. raised their oil reserves by nearly 3.8 billion barrels in 2011, the largest single-year increase since the government starting publishing the data in 1977. The EIA now estimates the U.S. has about 29 billion barrels of oil that companies can recover at a profit, the most since 1985.

Natural-gas reserves also expanded to 348.8 trillion cubic feet, the EIA said, a 9.8% annual jump that ranks as the second-largest increase on record.

The problem, then, is manifold. The profits from shale investments are nowhere near what they were hoped to be. Depletion rates are much higher than anticipated. Domestic US natural gas prices have plummeted to levels that make it near impossible to turn a profit. And oil prices may remain high for the moment, but global demand is not rising, or at least not enough to justify these price levels.

And then there are of course the pesky fracking issues that won't go away. Fracking as it is done today, invented to a large degree by recently deceased George Mitchell, is a hugely water intensive process, feared to risk contamination of aquifers and drinking water supplies. The industry uses large amounts of chemicals which, due to competition regulations, they don't need to report to anyone. They're free to use any toxin they want and nobody's allowed to ask any questions. That may be putting it black and white, but that doesn't make it a lie.

Oh, and then of course there's the matter of fracking causing earthquakes. The industry calls it preposterous, but we haven't heard the last of it. There can be no doubt that fracking is a dirty industry. The gas flaring issue may look strange at first sight, but at current price levels flaring beats building infrastructure from a profit point of view.

US fracking industry 'wasting $1 billion a year in gas flaring'

The full scale of the gas flaring undertaken by the North Dakota fracking industry has been laid bare, after a new report suggested the practice resulted in approximately $1bn of gas being wasted last year.

The new study from the Ceres group of sustainable investors draws on official figures from the North Dakota Industrial Commission and reveals that the state's oil and gas developers flared 29% of the natural gas they produced during May 2013. The proportion of gas being flared has actually fallen from a peak of 36% in September 2011, but the rapid expansion of the sector means that the total volume being flared is continuing to rise.

The analysis calculates that flaring throughout 2012 saw $1 billion of gas burnt, resulting in greenhouse gas emissions equivalent to putting an additional one million cars on the road.

All of which should make the American taxpayer feel proud to know they paid for a substantial part of the industry's development. Right? Will the government see a return on that investment? Sure. In taxes.

The Silent Partner Behind the Shale Energy Boom – Taxpayers

George Mitchell, celebrated father of the American shale fracking revolution, died last week, leaving behind a strong reputation as innovator-philanthropist and the legacy of cheap and abundant energy in the United States.

The richer and more complete story reveals that George Mitchell did not act alone, but rather was the beneficiary of decades of U.S. federal investments in fossil energy innovation.

The U.S. federal government spent billions of dollars over three decades to make today’s shale gas revolution a reality.

But we're not done yet. the perhaps worst piece of recent news for the fracking industry did not come from the US, but from Europe. It had been accepted for a long time that if fracking there were to develop into a viable industry, it would be in Poland, which had the most promising assets on the continent, the largest public acceptance of the process, and the desire to break free from its dependence on Russian gas and oil. Well, those days are gone.

As Poland's fracking future turns cloudy, so does Europe's

If any European country could have a US-like fracking boom, it's Poland. But optimism has waned.

It was only two years ago that Poland was positioning itself at the forefront of a shale gas revolution for Europe. Estimated to have more untapped reserves than any other European Union nation, Poland was eager to replicate the boom from hydraulic fracturing, or fracking, in the United States that has helped lower energy prices and carbon emissions.

But now the scenario is increasingly cloudy. Poland's estimates of shale have been reduced, and three major energy companies, including ExxonMobil, have recently pulled out of the country after disappointing results. [..]

Two years ago, the Continent's shale gas seemed a great opportunity for a Europe struggling with a debt crisis, crippling austerity, and record high unemployment. Many thought that Europe could benefit as the US industry has, with gas prices that have dropped by nearly 66% since 2008, according to the US Energy Information Administration (EIA).

But tapping those reserves requires both political and public support for fracking, which exist at varying levels across Europe. While Poland and Britain have supported the initial stages of an industry, Germany and France have been more resistant. Beer producers in Germany recently sided with anti-fracking advocates, claiming that the process will pollute ground water. France, which could have some of the greatest sources of shale, has outright banned fracking since 2011.

"The debate on shale gas has gone on for too long," French President François Hollande recently said. "As long as I am president, there will be no exploration for shale gas in France." [..]

Poland's initial enthusiasm has been tempered since 2011, as hurdles have arisen. EIA estimates initially showed Poland had 5.3 trillion cubic meters of gas, but Polish geological studies, using different methodologies, estimate potential at only a fraction of that.

It's a familiar tale in Europe, where companies weigh whether harder-to-access gas is commercially viable with current technology and unclear regulations that could affect investment gains. Last year, ExxonMobil left Poland after drilling two vertical test wells; two other major energy companies followed suit this spring.

Poland's answer? A renewed focus on real dirty low-grade coal. An answer we may see repeated, in various forms, in many other countries.

Poland to get dirtier as it leans towards lignite coal

Poland, one of the heaviest polluters in Europe, will become even dirtier now that its shale gas ambitions have faded and it turns to cheap domestic lignite coal to secure its energy supply. Poland already relies on coal to produce more than 90% of its electricity and is home to the European installation that emits the most carbon dioxide – utility PGE's lignite power plant in Belchatow.

Its choice of fuel now could determine its energy and environmental situation for decades to come, given that Poland needs to build new power stations to replace ageing plants and cope with future demand as its power system operates close to capacity. [..]

Poland had aspired to become Europe's main producer of cleaner shale gas, but its ambitions for a U.S.-style boom were thwarted when estimates of its shale gas reserves were slashed by over 90%. Potential shale investors including Exxon Mobil, Marathon Oil and Talisman Energy quit Poland, which then set its sights on boosting lignite production.

See? Estimates from the US Energy Information Administration were slashed by 90% within a few years time. That makes one wonder what role the EIA plays in this. Is this a 90% innocent mistake or have for instance US companies (Halliburton, anyone?) perhaps made a killing on investments (based on these estimates) by the Polish government that is now left holding the empty bag? What would you think?

That leaves one (western) European country that wants to go ahead with establishing a fracking industry. Or a government that wants to, to be more precise.

UK chancellor George Osborne pledges most generous tax regime for shale gas

Chancellor George Osborne has pledged to make Britain's tax regime the "most generous for shale in the world" as the Treasury pressed ahead with promised tax breaks for fracking firms. "I want Britain to be a leader of the shale gas revolution – because it has the potential to create thousands of jobs and keep energy bills low for millions of people," Mr Osborne said.

A new tax allowance will see a certain portion of income from each shale gas "pad" — or production site – receive an effective tax rate of 30%, rather than 62%. The tax break is similar to those on offer to oil and gas explorers in technically-challenging and less economic fields in the North Sea, where they have been credited with revitalising interest. [..]

In a blow for shale gas explorers and government alike, Water UK, which represents all major water suppliers, has published a series of concerns about fracking and warned that failure to address them could "stop the industry in its tracks".

Water UK, which is demanding an urgent meeting with shale companies to discuss its fears, warns: "Shale gas fracking could lead to contamination of the water supply with methane gas and harmful chemicals if not carefully planned and carried out." It suggests aquifers could be contaminated by fracking, by leaks from wells, or by poor handling of chemicals or waste water on the surface.

In a way, of course, it makes sense for the UK to look into the development of energy sources, since the country is looking at a literally dark future when it comes to energy supplies. But it's hard not to get the impression that the present government doesn't quite know what it's getting into. And not just when it comes to pollution issues, and the population's perception of those, but also with regards to outright energy return questions. Everyone in Britain should take a long hard look at what happened in Poland, and learn the lessons available from that example.

Elsewhere on the planet, China may look like an obvious choice for fracking, since it needs huge amounts of additional oil and gas if it wishes to keep growing its economy. Unfortunately, much of the country's shale potential is situated in areas that are both too dry (fracking needs copious amounts of water) and too earthquake prone. Maybe fracking should make the Chinese people very nervous. Here's two quotes from the techno-happy western press:

China Fracking Quake-Prone Province Shows Zeal for Gas

China won't let earthquakes hinder its quest for energy. Companies such as Royal Dutch Shell and China National Petroleum Corp. are starting to drill for gas and oil in shale rock in Sichuan, the nation’s most seismically active province, a process geologists say raises the risk of triggering quakes.

"For the Sichuan basin, earthquakes are a problem for shale gas and shale oil production because of the tectonic conditions," said Shu Jiang, a professor at the University of Utah’s Energy & Geoscience Institute in Salt Lake City. "The siting of the wells could cause some artificial earthquakes." China’s shale gas reserves may be almost double those of the U.S., where unlocking the commodity slashed energy costs, reduced imports and raised the prospect of energy independence.

The U.S. shale boom may add as much as $690 billion a year to GDP and create 1.7 million jobs by 2020, according to a study by McKinsey & Co.

[..] More than 2,700 quakes of varying magnitude were recorded around an underground injection well in Zigong, Sichuan, during a three-and-a-half year study by the Earthquake Administration Bureaux of Sichuan, Hebei and Zigong Municipality. "With the beginning of increased water-pressure injection, seismic activity around the test well showed a significant increase," researchers led by Zhang Zhiwei wrote in a 2012 paper.

China Ready to Reap Billions From U.S. Shale Gas Technology

China has spent billions of dollars in the U.S. to snap up joint venture deals with the pioneers of the shale gas revolution. While it would appear on the surface that China is interested in locking up its own supply of natural gas, that might not be the case. Instead, what's much more likely is that China is using these deals to gain valuable education and access to U.S. shale gas technology. It's now poised to take what it learned back home so that it can start its own shale gas revolution.

According to estimates by the U.S. Energy Information Agency, China has the most technically recoverable shale gas in the world. In fact, it estimates that China has nearly double the technically recoverable reserves of the U.S. The problem was that it didn't know how to develop its own reserves, until now.

[..] While China is the world's fourth-largest natural gas consumer, so far the country has only drilled 150 shale gas wells, with minimal commercial success. China's reserves are locked in much more technologically and environmentally challenged locations due to complex geology, high population density, and water shortages.

Given that water is a big issue for China (remember, hydraulic fracturing requires millions of gallons of water per well), Halliburton has the advanced technology which could be key to unlocking the country's resources. The company is currently pushing ahead with its H2O Forward service in the Bakken, which is designed to recycle produced water onsite saving oil and gas producers from having to constantly secure sources of fresh water.

Yeah, you really want to depend on Dick Cheney and Halliburton for your energy safety and independence issues …. What's not to like?

Note that again, it's EIA estimates that are being used, the same EIA that was off by 90% in its estimates for Poland. Anyone want to bet how far off they are in China? We probably won't know until Halliburton has its profits locked in. But those estimates are highly suspect. As for McKinsey's prediction of 1.7 million additional jobs in the US shale industry by 2020, that's not just suspect, it's ridiculous with 40% depletion rates. Not even going to happen if they drill another 1.7 million wells.

One last and more sobering quote comes from Russian Gazprom Export CEO Aleksandr Medvedev:

Gazprom CEO: Shale gas not Russia's concern this century

In my opinion [US shale gas production] was booming and now we are seeing a slowdown, not only in production but also in the speed of drilling, and many companies are forced to sell their assets in shale gas production. Actually, with the current level of price in the US, it’s not possible to have a profitable production in the majority of shale gas fields. [..]

…. there are quite a number of disturbing facts associated with production of shale gas. It’s not surprising that in Poland all the majors actually stepped out of the shale gas exploration.

… production of traditional gas in Europe, and I mean first of all Russia, is incomparably more competitive than production of shale gas – if it will ever happen.

Russia is very rich with shale gas resources, and probably in the next century the time will come when shale gas production will be considered in Russia, but currently, for the current century, we have enough reserves of traditional resources, and new areas of offshore fields – not to forget the Arctic, and I’m rather sure that cost effectiveness for these reserves will be unbeatable, and that’s why we are rather sure that we were, are, and will stay competitive on the oil and gas market.

The shale industry has from the start been based on huge, and hugely exaggerated, reserve estimates. This is not an innocent mistake, it's part of an enormous speculative landgrab. The profits on buying and selling land have been mind-boggling. But now the best land has been traded to the greater fools, and it's time for profits from actual production. Which turns out to be so far below the initial estimates that even a wealthy corporation like Shell has started to write down its worst assets, for which it realizes there is no greater fool available anymore; Shell itself is the greatest fool.

There is no doubt Shell will sell off and write down more shale "assets" going forward, at great losses. And so will Exxon, and Chevron, and many other companies. But while Shell can dump billions worth of worthless assets and live, for smaller operations that's less obvious, so they will keep up appearances for longer.

In the media, too, the game will continue for a while longer, because energy independence is a great – political – sell in the US. But as we've seen above, the government's own EIA has been so wrong in its estimates that it has no objective credibility left. And that's putting it very kindly. So what if you could get more realistic estimates? Easy, there would be no industry.

In China, shale is simply a disaster waiting to happen. One major earthquake in a drilling area and the powers that be in Beijing won't know how to react to the people's anger. One major case of fracking related water pollution in already severely water challenged regions, and they could face a severe revolt. Will they find it worth the risks?

If global economies were booming, shale might have been a more promising endeavor, since oil and gas prices could rise, freeing up more costly plays to come into the markets at a profit. Presently, however, there are no such prospects.

And once more: look at the depletion rates for shale wells, and at the rates at which more wells need to be drilled just to maintain a temporary plateau. The best stuff has gone first, and it turns out it wasn't all that good to begin with. It will be funny to see how the promise of giant amounts of natural gas first drove down the price to a level the industry can't function with, only to figure out no such amount of gas is economically recoverable. "Theoretical reserves are meaningless. What matters is the break-even cost."

Even if we don't see it yet, shale is a pipedream sold to greater fools. What matters is not how many new jobs there are today in Williston, North Dakota. What matters is how many will be left 5 years from now, or 10. With wells depleting at the present rate, or, more likely, even faster. And a "typical" recovery rate of just 8%. Sure it looks viable today, but so did Enron, for years.

It should perhaps be obvious that in the end, what it all comes down to is that we should – learn to – use a lot less energy, and not just fossil fuels, but all forms of energy, if we wish for our economies and societies to survive looking anything like what they look like today, for any stretch of the future. The problem with that is that we have built our societies on a premise of wasting energy.

Our cities and towns have been "designed" to accommodate automobiles – not public transport or our own two feet -, our homes have been built where we need automobiles to reach them, once we're inside, these homes need huge amounts of energy to heat and cool, and we fill them with stuff that was mostly produced far away and transported using huge amounts of energy.

None of this is necessary, we could have been much smarter about it all, but we haven't. This is true to such an extent that if tomorrow we would drop our energy use by even just 25%, let alone 50%, our present economic models wouldn't survive. Our economies are designed around the principle that we use much more energy than we really need, that we drive cars and reside in homes that use no more than 10% or so of the effective energy we put in (and no, wind or solar don't solve these issues; they can be useful, but not until we snap out of the present paradigm).

This is the blueprint we have used to construct our societies, and it guarantees that we will buy into more pipedreams, ever more desperately as we go along.

Home › Forums › Shale Is A Pipedream Sold To Greater Fools