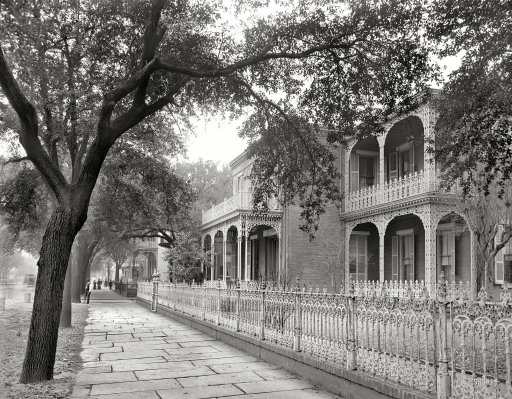

DPC Government Street, Mobile, Alabama 1906

Is the Plunge Protection Team really buying oil now? That would be so funny. Out of the blue, up almost 5%? Or was it the Chinese doing some heavy lifting stockpiling for their fading industrial base? Let’s get to business.

First, in the next episode of Kids Say The Darndest Things – oh wait, that was Cosby .. -, we have New York Fed head (rhymes with methhead) Bill Dudley. Dudley’s overall message is that the US economy is doing great, but it’s not actually doing great, and therefore a rate hike would be too early. Or something. Bloomberg has the prepared text of a speech he held today, and it’s hilarious. Look:

Fed’s Dudley Says Oil Price Decline Will Strengthen US Recovery

The sharp drop in oil prices will help boost consumer spending and underpin an economy that still requires patience before interest rates are increased, Federal Reserve Bank of New York President William C. Dudley said. “It is still premature to begin to raise interest rates,” Dudley said in the prepared text of a speech today at Bernard M. Baruch College in New York. “When interest rates are at the zero lower bound, the risks of tightening a bit too early are likely to be considerably greater than the risks of tightening a bit too late.” Dudley expressed confidence that, although the U.S. economic recovery has shown signs in recent years of accelerating, only to slow again, “the likelihood of another disappointment has lessened.”

How is this possible? ‘The sharp drop in oil prices will help boost consumer spending’? I don’t understand that: Dudley is talking about money that would otherwise also have been spent, only on gas. There is no additional money, so where’s the boost?

Investors’ expectations for a Fed rate increase in mid-2015 are reasonable, he said, and the pace at which the central bank tightens will depend partly on financial-market conditions and the economy’s performance. Crude oil suffered its biggest drop in three years after OPEC signaled last week it will not reduce production. Lower energy costs “will lead to a significant rise in real income growth for households and should be a strong spur to consumer spending,” Dudley said.

The drop will especially help lower-income households, who are more likely to spend and not save the extra real income, he said.

Extra income? Real extra income, as opposed to unreal? How silly are we planning to make it, sir? Never mind, the fun thing is that Dudley defeats his own point. By saying that lower-income households are more likely to spend and not save the ‘extra real income’, he also says that others won’t spend it, and that of course means that the net effect on consumer spending will be down, not up. He had another zinger, that the whole finance blogosphere will have a good laugh at:

[..] He also tried to disabuse investors of the notion that the Fed would, in times of sharp equity declines, ease monetary conditions, an idea known as the “Fed put.” “The expectation of such a put is dangerous because if investors believe it exists they will view the equity market as less risky,” Dudley said. That could cause investors to push equity markets higher, contributing to a bubble, he said. “Let me be clear, there is no Fed equity market put,” he said.

That’s in the category: ‘Read my lips’, ‘Mission Accomplished’ and ‘I did not have sex with that woman.’ I remain convinced that they’ll move rates up, and patsies like Dudley are being sent out to sow the seeds of confusion. Apart from that, this is just complete and bizarre nonsense. And that comes from someone with a very high post in the American financial world. At least a bit scary.

Another great one came also from Bloomberg today, when it reported that US holiday sales had missed by no less than 11%. Maybe Dudley should have put that in his speech?! This one turns the entire world upside down:

US Consumers Reduce Spending By 11% Over Thanksgiving Weekend

Even after doling out discounts on electronics and clothes, retailers struggled to entice shoppers to Black Friday sales events, putting pressure on the industry as it heads into the final weeks of the holiday season. Spending tumbled an estimated 11% over the weekend, the Washington-based National Retail Federation said yesterday. And more than 6 million shoppers who had been expected to hit stores never showed up. Consumers were unmoved by retailers’ aggressive discounts and longer Thanksgiving hours, raising concern that signs of recovery in recent months won’t endure.

The NRF had predicted a 4.1% sales gain for November and December – the best performance since 2011. Still, the trade group cast the latest numbers in a positive light, saying it showed shoppers were confident enough to skip the initial rush for discounts. “The holiday season and the weekend are a marathon, not a sprint,” NRF Chief Executive Officer Matthew Shay said on a conference call. “This is going to continue to be a very competitive season.” Consumer spending fell to $50.9 billion over the past four days, down from $57.4 billion in 2013, according to the NRF. It was the second year in a row that sales declined during the post-Thanksgiving Black Friday weekend, which had long been famous for long lines and frenzied crowds.

Shoppers are confident enough to not shop. And why do they not shop? Because the economy’s so strong. Or something. They were so confident that 6 million of them just stayed home. While those that did go out had the confidence to spend, I think, 6.4% less per capita. Maybe that confidence has something to do with at least having some dough left in our pocket.

On the – even – more serious side, two different reports on how much stocks in the US are overvalued. First John Hussman talking about his investment models, an where he did get it right:

Hard-Won Lessons and the Bird in the Hand

[..] the S&P 500 is more than double its historical valuation norms on reliable measures (with about 90% correlation with actual subsequent 10-year market returns), sentiment is lopsided, and we observe dispersion across market internals, along with widening credit spreads. These and similar considerations present a coherent pattern that has been informative in market cycles across a century of history – including the period since 2009. None of those considerations inform us that the U.S. stock market currently presents a desirable opportunity to accept risk.

I know exactly the conditions under which our approach has repeatedly been accurate in cycles across a century of history, and in three decades of real-time work in finance: I know what led me to encourage a leveraged-long position in the early 1990’s, and why were right about the 2000-2002 collapse, and why we were right to become constructive in 2003, and why we were right about yield-seeking behavior causing a housing bubble, and why we were right about the 2007-2009 collapse. And we know that the valuation methods that scream that the S&P 500 is priced at more than double reliable norms, and that warn of zero or negative S&P 500 total returns for the next 8-9 years, are the same valuation methods that indicated stocks as undervalued in 2008-2009.

As an important side note, the financial crisis was not resolved by quantitative easing or monetary heroics. Rather, the crisis ended – and in hindsight, ended precisely – on March 16, 2009, when the Financial Accounting Standards Board abandoned mark-to-market rules, in response to Congressional pressure by the House Committee on Financial Services on March 12, 2009. The decision by the FASB gave banks “significant judgment” in the values that they assigned to assets, which had the immediate effect of making banks solvent on paper despite being insolvent in fact.

Rather than requiring the restructuring of bad debt, policy makers decided to hide it behind an accounting veil, and to gradually make the banks whole by lowering their costs and punishing ordinary savers with zero interest rates, creating yet another massive speculative yield-seeking bubble in risky assets at the same time. [..]

This is 5.5 years ago. Do we still think about this enough? Do we still realize what the inevitable outcome will be? Hussman suggests the moment is near.

The equity market is now more overvalued than at any point in history outside of the 2000 peak, and on the measures that we find best correlated with actual subsequent total returns, is 115% above reliable historical norms and only 15% below the 2000 extreme. Based on valuation metrics that are about 90% correlated with actual subsequent returns across history, we estimate that the S&P 500 is likely to experience zero or negative total returns for the next 8-9 years. At this point, the suppressed Treasury bill yields engineered by the Federal Reserve are likely to outperform stocks over that horizon, with no downside risk.

As was true at the 2000 and 2007 extremes, Wall Street is quite measurably out of its mind. There’s clear evidence that valuations have little short-term impact provided that risk-aversion is in retreat (which can be read out of market internals and credit spreads, which are now going the wrong way). There’s no evidence, however, that the historical relationship between valuations and longer-term returns has weakened at all. Yet somehow the awful completion of this cycle will be just as surprising as it was the last two times around – not to mention every other time in history that reliable valuation measures were similarly extreme. Honestly, you’ve all gone mad.

115% above reliable historical norms. That’s what the equity put that doesn’t exist, plus the Plunge Protection Team, have achieved. None of that stuff is worth anything near what you pay for it. But people do it anyway, and think very highly of themselves for doing it. Because it makes them money. And anything that makes you money makes you smart.

Then, the crew at Phoenix Capital, courtesy of Tyler Durden:

Stocks Have Been More Overvalued Only ONCE in the Last 100 Years (Phoenix)

Stocks today are overvalued by any reasonable valuation metric. If you look at the CAPE (cyclical adjusted price to earnings) the market is registers a reading of 27 (anything over 15 is overvalued). We’re now as overvalued as we were in 2007. The only times in history that the market has been more overvalued was during the 1929 bubble and the Tech bubble. Please note that both occasions were “bubbles” that were followed by massive collapses in stock prices.

Source: https://www.multpl.com/shiller-pe/

Then there is total stock market cap to GDP, a metric that Warren Buffett’s calls tge “single best measure” of stock market value. Today this metric stands at roughly 130%. It’s the highest reading since the DOTCOM bubble (which was 153%). Put another way, stocks are even more overvalued than they were in 2007 and have only been more overvalued during the Tech Bubble: the single biggest stock market bubble in 100 years.

Source: Advisorperspectives.com

1) Investor sentiment is back to super bullish autumn 2007 levels.

2) Insider selling to buying ratios are back to autumn 2007 levels (insiders are selling the farm).

3) Money market fund assets are at 2007 levels (indicating that investors have gone “all in” with stocks).

4) Mutual fund cash levels are at a historic low (again investors are “all in” with stocks).

5) Margin debt (money borrowed to buy stocks) is near record highs.In plain terms, the market is overvalued, overbought, overextended, and over leveraged. This is a recipe for a correction if not a collapse.

If we combine Hussman and Phoenix, we see an enormous amount of people playing with fire. And their lives. And that of their families. All as ‘confident’ as those American shoppers are (were?) supposed to be. At least a whole bunch of those were smart enough not to show up. How smart will the investment world be? Their senses have been dulled by 6 years of low interest rates, handouts and other manipulations. They’re half asleep by now.

Nobody knows what anything is worth anymore, investors probably least of all. After all, their sentiment is back to ‘super bullish autumn 2007’ levels. And they listen to guys like Dudley, who don’t have their interests at heart. Everybody thinks they’ll outsmart the others, and the falling knife too. Me, I’m wondering how much y’all lost on oil stocks and bonds recently. And how much more you’re prepared to lose.

Home › Forums › Oil, Gold And Now Stocks?