Arthur Rothstein “Quack doctor, Pittsburgh, Pennsylvania” May 1938

Isn’t it fun to just watch the market numbers roll by from time to time as you go about your day, see Europe markets up 3%+, Dubai 13%, US over 2% (biggest two-day rally since 2011!), and you just know oil must get hit again? Well, it did. WTI down another 3%+. I tells ya, no Plunge Protection is going save this sucker.

And oil is not even the biggest story today. It’s plenty big enough by itself to bring down large swaths of the economy, but in the background there’s an even bigger tale a-waiting. Not entirely unconnected, but by no means the exact same story either. It’s like them tsunami waves as they come rolling in. It’s exactly like that.

That is, in the wake of the oil tsunami, which is a long way away from having finished washing down our shores, there’s the demise of emerging markets. And I’m not talking Putin, he’ll be fine, as he showed again today in his big press-op. It’s the other, smaller, emerging countries that will blow up in spectacular fashion, and then spread their mayhem around. And make no mistake: to be a contender for bigger story than oil going into 2015, you have to be major league large. This one is.

The US dollar will keep rising more or less in and of itself, simply because the Fed has ‘tapered QE’, and much of what happened in global credit markets, especially in emerging markets, was based on cheap and easily available dollars. There’s now $85 billion less of that each month than before the taper took it away in $10 billion monthly increments. The core is simple.

This is not primarily government debt, it’s corporate debt. But it’s still huge, and it has not just kept emerging economies alive since 2008, it’s given them the aura of growth. Which was temporary, and illusionary, all along. Just like in the rest of the world, Japan, EU, US. And, since countries can’t – or won’t – let their major companies fail, down the line it becomes public debt.

One major difference from the last emerging markets blow-up, in the late 20th century, is size: emerging markets today are half the world economy. And they’re about to be blown to smithereens. Sure, oil will play a part. But mostly it will be the greenback. And you know, we can all imagine what happens when you blow up half the global economy …

Erico Matias Tavares at Sinclair has a first set of details:

There are some signs of trouble in emerging markets. And the money at risk now is bigger than ever. The yield spread between high grade emerging markets and US AAA-rated corporate debt has jumped, almost doubling in less than three weeks to the highest level since mid-2012.

MSCI Emerging Markets Index and Yield Spread between High Grade Emerging Markets and US AAA Corporates: 14 March 2003 – Today. Source: US Federal Reserve.

MSCI Emerging Markets Index and Yield Spread between High Grade Emerging Markets and US AAA Corporates: 14 March 2003 – Today. Source: US Federal Reserve. This means that the best credit names in emerging markets have to pay a bigger premium over their US counterparts to get funding. When this spread spikes up and continues above its 200-day moving average for a sustained period of time, it is typically a bad sign for equity valuations in emerging markets, as shown in the graph above. One swallow does not a summer make, but it is worthwhile keeping an eye on this indicator.

As yields go up the value of these emerging market bonds goes down, resulting in losses for the investors holding them. The surge of the US dollar in recent months could magnify these losses: if the bonds are denominated in local currency they will be worth a lot less to US investors; otherwise, the borrowers will now have to work a lot harder to repay those US dollar debts, increasing their credit risk. Any losses could end up being very significant this time around, as demand for emerging markets bonds has literally exploded in recent years.

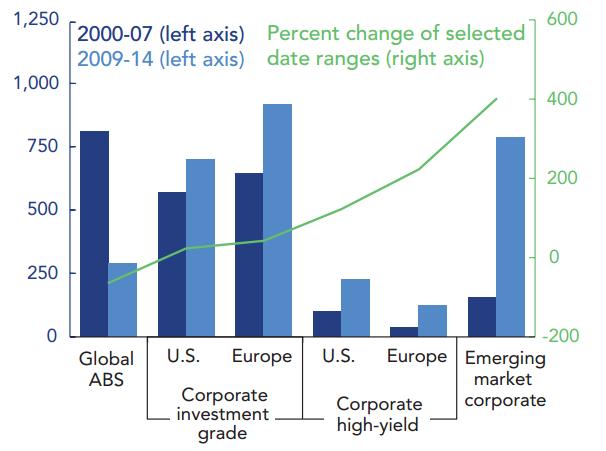

Average Annual Gross Debt Issuance ($ billions, percent): 2000 – Today. Source: Dealogic, US Treasury. Note: Data include private placements and publicly-issued bonds. 2014 data are through August 2014 and annualized.

As the graph above shows, the issuance of emerging market corporate debt has risen sharply since the depths of the 2008-09 financial crisis.These volumes are very large indeed, and now account for non-trivial portions of investors’ and pension funds’ portfolios worldwide.

As a result, emerging markets corporations are now leveraged to the hilt, easily exceeding the 2008 highs by almost a multiple to EBITDA. And why not? With foreign investors desperate for yield as a result of all the stimulus and money printing by their central banks, they were only too happy to oblige. And they were not alone. Governments in these countries were also busy doing some borrowing of their own, as their domestic capital markets deepened.

[..] foreign investors have also piled into locally denominated bonds of emerging markets governments. Countries like Peru and Latvia now have over 50% foreign ownership of their bonds. [..] But there are big speculative reasons behind the recent money flows going into these countries – which could reverse very quickly should the tide turn. [..]

If investors end up rushing for the emerging markets exit for whatever reason, with this unprecedented level of exposure they might be bringing home much more than a bruised ego and an empty wallet. For one, European banks are hugely exposed to emerging markets. Any impairment to their books would likely make any new lending even more difficult, at a time when there is already a dearth of non-government credit in Europe.

And if emerging economies falter, where will the growth needed to repair Western government and private balance sheets come from? It used to be said that when the US economy sneezes the rest of the world catches a cold. Now it seems all we need is a hiccup in emerging markets.

That’s what you get when emerging markets are both half the global economy AND they’ve accomplished that level off of ultra-low US Fed interest rates and ultra-high US Fed credit ‘accommodation’. All you have to do when you’re the Fed is to take both away at the same time, and you’re the feudal overlord.

Our favorite friend-to-not-like Ambrose Evans-Pritchard does what he does well: provide numbers:

Fed Calls Time On $5.7 Trillion Of Emerging Market Dollar Debt

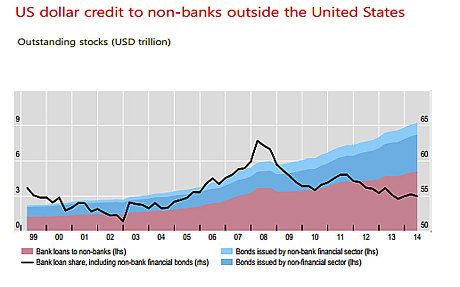

The US Federal Reserve has pulled the trigger. Emerging markets must now brace for their ordeal by fire. They have collectively borrowed $5.7 trillion in US dollars, a currency they cannot print and do not control. This hard-currency debt has tripled in a decade, split between $3.1 trillion in bank loans and $2.6 trillion in bonds. It is comparable in scale and ratio-terms to any of the biggest cross-border lending sprees of the past two centuries.

Much of the debt was taken out at real interest rates of 1% on the implicit assumption that the Fed would continue to flood the world with liquidity for years to come. The borrowers are “short dollars”, in trading parlance. They now face the margin call from Hell as the global monetary hegemon pivots. The Fed dashed all lingering hopes for leniency on Wednesday. The pledge to keep uber-stimulus for a “considerable time” has gone, and so has the market’s security blanket, or the Fed Put as it is called. Such tweaks of language have multiplied potency in a world of zero rates.

Officials from the BIS say privately that developing countries may be just as vulnerable to a dollar shock as they were in the Fed tightening cycle of the late 1990s, which culminated in Russia’s default and the East Asia Crisis. The difference this time is that emerging markets have grown to be half the world economy. Their aggregate debt levels have reached a record 175% of GDP, up 30 percentage points since 2009.

Most have already picked the low-hanging fruit of catch-up growth, and hit structural buffers. The second assumption was that China would continue to drive a commodity supercycle even after Premier Li Keqiang vowed to overthrow his country’s obsolete, 30-year model of industrial hyper-growth, and wean the economy off $26 trillion of credit leverage before it is too late. [..]

Stress is spreading beyond Russia, Nigeria, Venezuela and other petro-states to the rest of the emerging market nexus, as might be expected since this is a story of evaporating dollar liquidity as well as a US shale supply-glut.

[..[ the Turkish lira has fallen 12% since the end of November. The Borsa Istanbul 100 index is down 20% in dollar terms. Indonesia had to intervene on Wednesday to defend the rupiah. Brazil’s real has fallen to a 10-year low against the dollar, as has the index of emerging market currencies. Sao Paolo’s Bovespa index is down 23% in dollars in 3 weeks.

The slide can be self-feeding. Funds are forced to sell holdings if investors take fright and ask for their money back, shedding the good with the bad. Pimco’s Emerging Market Corporate Bond Fund bled $237m in November, and the pain is unlikely to stop as clients discover that 24% of its portfolio is in Russia.

One might rail against the injustice of indiscriminate selling. Such are the intertwined destinies of countries that have nothing in common. The Fed has already slashed its bond purchases to zero, withdrawing $85bn of net stimulus each month. It is clearly itching to raise rates for the first time in seven years. This is the reason why the dollar index has jumped 12% since May, smashing through its 30-year downtrend line, a “seismic change” in the words of HSBC. [..]

World finance is rotating on its axis, says Stephen Jen, from SLJ Macro Partners. The stronger the US boom, the worse it will be for those countries on the wrong side of the dollar.

“Emerging market currencies could melt down. There have been way too many cumulative capital flows into these markets in the past decade. Nothing they can do will stop potential outflows, as long as the US economy recovers.

Hold it there for a moment. I don’t think it’s the US economy (its recovery is fake), it’s the US dollar.

Will this trend lead to a 1997-1998-like crisis? I am starting to think that this is extremely probable for 2015,” he said.

This time the threat does not come from insolvent states. They have learned the lesson of the late 1990s. Few have dollar debts. But their companies and banks most certainly do, some 70% of GDP in Russia, for example. This amounts to much the same thing in macro-economic terms. Private debt morphs into state debt since governments cannot allow key pillars of their economies to collapse.

These countries have, of course, built $9 trillion of foreign reserves, often the side-effect of holding down their currencies to gain export share. This certainly provides a buffer. Yet the reserves cannot fruitfully be used in a recessionary crisis because sales of foreign bonds automatically entail monetary tightening. [..] .. these reserves are a mirage. If you deploy them in such circumstances, you choke your own economy unless you can sterilize the effects. [..]

Investors are counting on the European Central Bank to keep the world supplied with largesse as the Fed pulls back. Yet the ECB could not pick up the baton even if it were to launch a blitz of quantitative easing, and there is no conceivable consensus for action on such a commensurate scale.

The world’s financial system is on a dollar standard, not a euro standard. Global loans are in dollars. The US Treasury bond is the benchmarks for global credit markets, not the German Bund. Contracts and derivatives are priced off dollar instruments. Bank of America says the combined monetary stimulus from Europe and Japan can offset only 30% of the lost stimulus from the US.

What more can I say? This is the lead story as we go into 2015 two weeks from today. Oil will help it along, and complicate as well as deepen the whole thing to a huge degree, but the essence is what it is: the punchbowl that has kept world economies in a zombie state of virtual health and growth has been taken away on the premise of US recovery as Janet Yellen has declared it.

It doesn’t even matter whether this is a preconceived plan or not, as some people allege, it still works the same way. The US gets to be in control, for a while, until it realizes, Wile E. shuffle style, that you shouldn’t do unto others what you don’t want to be done unto you. But by then it’ll be too late. Way too late.

As I wrote just a few days ago in We’re Not In Kansas Anymore, there’s a major reset underway. We’re watching, in real time, the end of the fake reality created by the central banks. And it’s not going to be nice or feel nice. It’s going to hurt, and the lower you are on the ladder, the more painful it will be. Be that globally, if you live in poorer countries, or domestically, if you belong to a poorer segment of the population where you are. In both senses, the poorest will be hit hardest.

It’s the new model along which the clowns we allow to run the show, do so. Unless ‘we the people’ take back control, it’s pretty easy to see how this will go down.

Home › Forums › The Biggest Economic Story Going Into 2015 Is Not Oil