Wyland Stanley General Motors exhibit, San Francisco 1939

“Won’t you make money shorting the doomed dollar? Heavens no! At least not any time soon.”

• Why The Dollar Is Rising As The Global Monetary Bubble Craters (David Stockman)

Contra Corner is not about investment advice, but its unstinting critique of the current malignant monetary regime does not merely imply that the Wall Street casino is a dangerous place for your money. No, it screams get out of harms’ way. Now! Yet I am constantly braced with questions about the US dollar and its impending demise. The reasoning seems to be that if America is a debt addicted dystopia—-and it surely is—- won’t the US dollar sooner or later go down in flames as the day of reckoning materializes? Won’t you make money shorting the doomed dollar? Heavens no! At least not any time soon. The reason is simply that the other three big economies of the world—Japan, China and Europe—are in even more disastrous condition.

Worse still, their governments and central banks are actually more clueless than Washington, and are conducting policies that are flat out lunatic—–meaning that their faltering economies will be facing even more destructive punishment from policies makers in the days ahead. Indeed, Draghi, Kuroda and the commissars of red capitalism in Beijing make Janet Yellen and Stanley Fischer (Fed Vice-Chairman) appear to be slightly sober. So as trite as it sounds, the US dollar is the cleanest dirty shirt in the laundry. And on a relative basis, its is going to look even cleaner as two decades of monetary madness around the world finally hit the shoals. You have to start with a stark assessment of the other three major economies.

To hear the Wall Street analysts and economists tell it, Japan, China and Europe are just variants of the US economy with different mixes of pluses and minuses, experiencing somewhat different stages of the economic cycle and obviously shaped by their own diverse brands of domestic politics and economic governance. Yet despite these surface difference, the non-US big three economies are held to be just part of a global economic convoy heading for continued economic growth, rising living standards and higher stock market prices. Actually, not so. Japan is a bankrupt old age colony. China is the most monumental credit and construction Ponzi in human history. Europe is a terminal victim of socialist welfare and statist dirigisme. All three are attempting to defer the day of reckoning via a resort to a final spasm of money printing and central bank manipulation that is so desperate and crazy that it can only end in disaster.

See: The American Story Is A Mystery Only to Economists

• American Mystery Story: Consumers Don’t Spend Even In Booming Job Market (BBG)

It’s an American mystery story: More people have jobs and extra pocket money from lower gas prices, but they aren’t buying as much as economists expected. The government’s count of how much people shelled out at retailers fell in February for a third consecutive month. Payrolls are up 863,000 over the same period. The chart below shows retail sales and payrolls generally move in the same direction, until now. The divergence could portend lower levels of economic growth if Americans’ usually reliable penchant to spend is less than what it once was.

YoY growth in U.S. retail and food services sales (red) against YoY change in non-farm payrolls (blue).

Sources: Bureau of Economic Analysis, Bureau of Labor Statistics

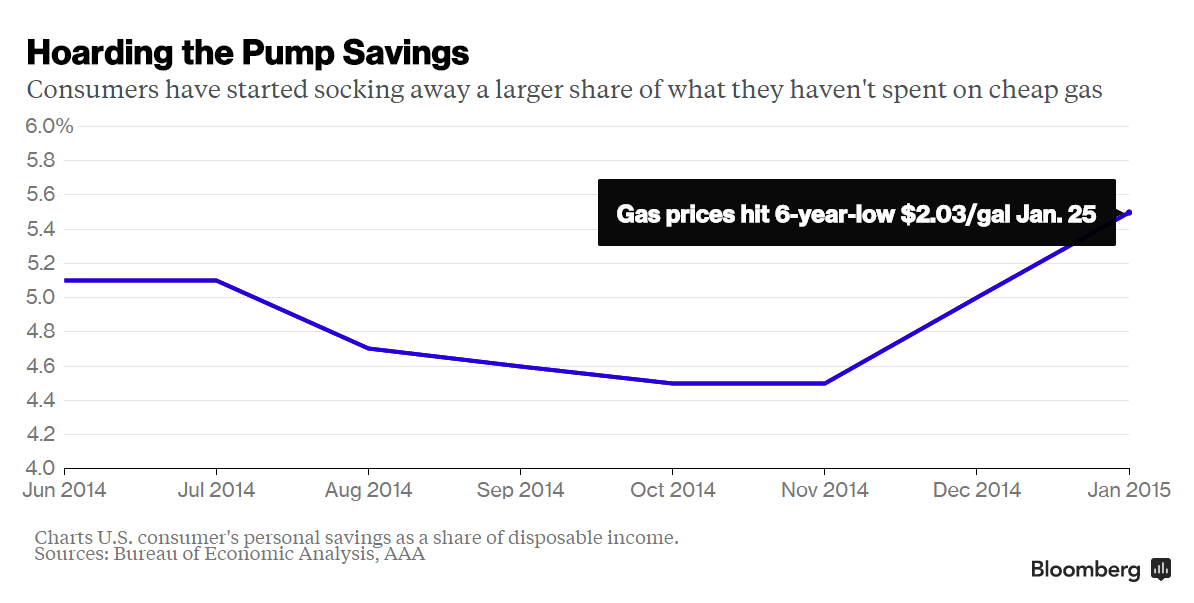

“The expenditures that add up to gross domestic product are coming in a lot softer than employment,” said Neil Dutta, head of U.S. economics at Renaissance Macro Research LLC. “Why would retailers be hiring if sales are falling? Why would they be boosting hours if sales are falling and why would they be paying more?” Also, take a look at the household saving rate. It’s gone up as gas prices fell:

Ben Herzon, a senior economist at Macroeconomic Advisers, isn’t that worried yet. As usual, the data is quirky. First, he notes, “it was crazy cold in February.” Aside from stocking up on milk in the snowstorm, staying indoors was probably a more attractive option for most shoppers. Purchases at online retailers in February showed a 2.2% increase, the largest since March 2014. In the region from the Mississippi River to the East Coast, Americans in 23 states lived through a “top-10-coldest February” in National Oceanic and Atmospheric Administration data back to the start of 1895. Herzon notes that lower gas prices also depressed the count in prior months. The government is adding up dollars spent, so fewer dollars to fill a gas tank results in lower sales.

That even bleeds into narrower measures of retail sales because grocery stores such as Safeway, Wal-Mart and Sam’s Club also sell gasoline. Herzon is counting on a March rebound. There won’t be the weather to blame anymore, and gas prices have rebounded off their lows of late January and early February. The average price of a gallon of unleaded gas $2.45 Wednesday compared with $2.06 Feb. 1, according to AAA. “Payroll employment has been great, and it is generating a lot of labor income that you think would be spent,” Herzon said. “March should be a rebound. Our story would be wrong if it doesn’t happen.”

How wrong Bloomberg usually is.

• Surprise: US Economic Data Have Been the World’s Most Disappointing (Bloomberg)

It’s not only the just-released University of Michigan consumer confidence report and February retail sales on Thursday that surprised economists and investors with another dose of underwhelming news. Overall, U.S. economic data have been falling short of prognosticators’ expectations by the most in six years. The Bloomberg ECO U.S. Surprise Index, which measures whether data beat or miss forecasts, fell to the lowest since 2009, when the nation was in the deepest recession since the Great Depression. There’s been one notable exception to the gloom, and it’s a big one: payrolls. The economy added 295,000 jobs in February and 1.3 million over four months, a reflection of a healthier labor market in which the unemployment rate has fallen to the lowest in almost seven years.

Most everything else? Blah. This month alone, personal income and spending, manufacturing as measured by the Institute for Supply Management, auto sales, factory orders, and retail sales have all come in a bit weak. Citigroup keeps economic surprise indexes for the world, and its scoreboard shows the U.S. is most disappointing relative to consensus forecasts, with Latin America and Canada next, as of March 12. Emerging markets were supposed to be hurt by falling oil prices but are now delivering positive surprises. U.S. policymakers frequently talk about weakness in Europe and China, though both are exceeding expectations. And there’s one rub. The surprise shortfall in the U.S. doesn’t necessarily mean the world’s largest economy is in dire straights. It’s just falling short of some perhaps overly elevated expectations.

“When no one is borrowing money, monetary policy is largely useless..”

• Why We’re At Risk Of A QE Trap: Richard Koo (CNBC)

The problem with central banks’ massive bond-buying programs is that if consumers and businesses fail to borrow money to stimulate economic growth, the policy is rendered mostly “useless,” one Nomura economist said Friday. The U.S. and U.K. embarked on asset-purchase, or QE programs, following the 2007-2008 global financial crisis. Japan joined the QE club in 2013 and the ECB began its 1 trillion euro ($1.06 trillion) bond-buying stimulus this week. “Both the U.S. and Europe are facing the same problem– which is that we are in a situation where the private sector in any of these economies is not borrowing money at zero interest rates or repairing balance sheets following what happened in the crisis,” Richard Koo, Chief Economist at Nomura, told CNBC on the side lines of the Ambrosetti Spring Workshop in Italy.

“When no one is borrowing money, monetary policy is largely useless,” he added. In the run-up to the launch of QE in the euro zone, loans to the private sector, which are a gauge of economic health, contracted. Data published late last month showed that the volume of loans to private firms and households fell by 0.1% on year in January, compared with a 0.5% drop in December. According to Koo, major central banks are holding reserves far in excess of levels they need because of the monetary stimulus. This has not led to a rise in private sector spending because big economies are struggling with a balance sheet recession – a situation where companies are focused on paying down debt rather than spending or investing – increasing the risk of QE trap.

“In a national economy if someone is saving money, you need someone to borrow money and this is the part that is missing. They [central banks] are pumping money but no one is borrowing, so you get negative interest rates and all sorts of distortions,” Koo said. He added that instead of looking to raise interest rates, the U.S. Federal Reserve should first focus on reducing its balance sheet which stands at over $4 trillion. The Fed, which meets next week, is widely expected to raise rates this year against a backdrop of improving economic data. “They [Fed policy makers] should not rush into a rate rise; they should reduce the balance sheet when people are not worried about inflation,” Koo said.

Roubini’s scenario? Anyone could have told you this.

• Roubini Greek Doom Scenario Is So Bad It May Keep the Euro Intact (Bloomberg)

Nouriel Roubini isn’t called “Dr. Doom” for nothing. He tends to be a glass half-empty kind of guy who worries a lot about looming crises. But in an interesting twist, when it comes to Greece, the economic professor’s not that concerned. Here’s why: the doomsday scenario he envisions if the country exited the euro zone is so bleak for the whole region that policy makers both in Athens and across Europe will never let it happen. It’s true other analysts are speculating that officials in Germany and other EU countries are more willing now to entertain the idea of a Greek exit, but that’s not how Roubini sees it.

Borrowing costs would soar for nations such as Italy and Spain and Europeans would race to withdraw cash from their bank accounts, according to Roubini, a professor at NYU’s Stern School of Business. Even Germany – Greece’s main nemesis as it negotiates a new financial aid package from European leaders — recognizes this risk, he said in a Bloomberg Television interview Friday. “It doesn’t make sense to have a Greek exit,” he said. “There would be massive contagion.” While bond buyers are selling Greek bonds, they seem complacent about the risk to the rest of the euro region and have been pouring money into debt of Italy, Spain and Portugal, sending yields on those nations’ debt to record lows.

Spanish and Italian 10-year bonds are yielding just 1.2%. Greek debt, meanwhile, has been falling. Yields on Greece’s 10-year bonds rose to 10.7% Friday from 8.6% on Feb. 24. Rates on its 3-year notes have climbed to 19% from 12.4%. So, maybe investors are right to dismiss concerns that a Greek exit would infect all of Europe, even as the nation with one-quarter of its working-age population unemployed faces very real deadlines for making debt payments. While Greece made a €350 million loan repayment to the International Monetary Fund Friday, it faces another financial hurdle on March 20, when the government has to pay the IMF another €346 million and refinance €1.6 billion of treasury bills.

Tensions have risen between Greece and Germany since the election of Prime Minister Alexis Tsipras on Jan. 25. Tsipras won on a platform of ending the austerity his Syriza party blames Chancellor Angela Merkel for pushing. Roubini says that, even though Germany has been vocal about its displeasure with Greece’s antics, everyone understands the potential consequences of failing to keep the region intact – which is why it won’t unravel. Dr. Doom almost sounds a little optimistic.

“If one country leaves this union, the markets will immediately ask which country is next. And that could be the beginning of the end.”

• Merkel’s Office Denies ‘Private Feud’ Between Greece And Germany (Guardian)

The spokesman of the German chancellor, Angela Merkel, has denied a “private feud” has broken out between Berlin and Athens, as the radical Syriza government battles to avoid leaving the single currency – a risk euro-watchers have dubbed “Grexident”. As Athens rushes to implement economic reforms and convince its creditors to extend emergency funding, Steffen Seibert, Merkel’s official spokesman, insisted Greece’s economic future should not be reduced to a face off between the two nations. “I neither see a private feud nor do I view the whole issue of Greece and how it solves its problems as a bilateral German-Greek topic”, he said, reiterating that Merkel wants Greece to stay inside the single currency.

Tensions between Greece and Germany have been running high, after Syriza rekindled a row over war reparations to the Greek people earlier this week. On Friday, France’s economics minister, Pierre Moscovici, said in a German magazine interview that a Greek exit from the euro would be a “catastrophe”, despite some analysts having sought to play down the consequences. “All of us in Europe probably agree that a Grexit would be a catastrophe – for the Greek economy, but also for the euro zone as a whole,” he told Der Spiegel. “If one country leaves this union, the markets will immediately ask which country is next. And that could be the beginning of the end.”

Greece has been granted a four-month window to implement economic reforms after striking a last-minute deal with its creditors to extend its €240bn bailout. Yanis Varoufakis, Syriza’s controversial finance minister, insisted his party would be able to satisfy the 20 February agreement – even if that means delaying some of its election promises. “We have a commitment, all of us, to reach an agreement by 20 April,” he told reporters on the sidelines of a conference in Italy. “If this means that, for the next few months that we have negotiations, we suspend or we delay the implementation of our [election] promises, we should do precisely that in the context to build trust with our partners,” he said. However, he is likely to face pressure from within his own party to live up to the anti-austerity rhetoric of the election campaign.

Must read from Der Spiegel. Watch Juncker. I’ve said it before, he will play a role.

• Power Struggle in Brussels and Berlin over Fate of Greece (Spiegel)

Many in the ECB are aware that they are operating at the very fringes of legality. French Executive Board member Benoît Coeuré issued a public warning a few days ago that the ECB is not allowed to finance the Greek government. Doing so, he said, is illegal. Draghi, said an official in Berlin, “could cut Greece off at any moment.” But, the official added, he doesn’t dare. Which means it is up to the politicians to find the way forward. And finding that path has become dependent on the ongoing conflict between Juncker and the EU member states, led by the chancellor. It has long been apparent that the Commission president wants to prevent a Grexit at all costs, at least since he received the Greek prime minister in Brussels five weeks ago as though welcoming a long lost friend.

Two weeks after that, Economic and Financial Affairs Commissioner Pierre Moscovici presented a plan that looked more like a package for growth than like strict requirements for Greece. Greek Finance Minister Yanis Varoufakis had nothing but praise for the paper. The other Euro Group finance ministers weren’t nearly as enthusiastic. In the end, the Moscovici paper proved largely irrelevant, but it had, from Juncker’s perspective, had its effect. It was a demonstration of power; he had simply wanted to send a message to Merkel. The conflict between Brussels and Berlin is a fundamental one. Juncker is taking the position that Christian Democrats have supported for decades.

The European Union, in his view, is the answer to the horrors of the wars that destroyed Europe in the first half of the 20th century – and the Continent’s salvation, he believes, lies in further deepening the ties that bind the European Union together. It is no accident that he presented former German Chancellor Helmut Kohl’s book last fall. The book is called “Out of Concern for Europe,” and many have interpreted it as indirect criticism of Merkel’s approach to the EU. Though Merkel is a Christian Democrat herself, she has broken with the Kohl line. For her, Europe is not a matter of war and peace, but of euros and cents. Merkel has used the euro crisis to reduce the European Commission’s power and to return some of it to member-state capitals. From this perspective, she could be seen as a 21st century de Gaulle.

Juncker would like to get in her way and the Greece crisis is the instrument that has presented itself. “We have to keep the shop together,” Juncker has said repeatedly in background sessions with journalists in recent weeks. This Friday, Juncker received Tsipras in Brussels yet again, with the Greek prime minister also holding talks with European Parliament President Martin Schulz. Juncker entered office wanting to make the Commission, the European Union’s executive body, more powerful and more political — and thus far, he has been successful. He defanged the European Stability Pact, that German invention that was to prevent euro-zone member states from taking on too much debt. And he has ensured that France’s Socialist government receive an additional two years to reduce its budget deficit.

Syriza is becoming a comedy act. Hard to predict.

• Tsipras Reaches Out to Euro Region Amid Spat With Germany (Bloomberg)

Prime Minister Alexis Tsipras reached out to Greece’s creditors, saying he’ll iron out the kinks in relations with the rest of the euro area days after his government lodged a complaint about the German finance minister. Tsipras, speaking as his country met a loan repayment to the International Monetary Fund of about €350 million, said that Greece has already starting delivering the action required to release more bailout funding and that he expects the euro region to do its part. “We will solve all these misunderstandings,” Tsipras told reporters in Brussels on Friday before meeting with European Commission President Jean-Claude Juncker. The Greek people need to hear a “hope message,” he said.

Tsipras and his finance minister, Yanis Varoufakis, are negotiating with the euro region to release more funds from the country’s €240 billion bailout amid concern that his government could run out of cash at any moment. The Greece Public Debt Management Agency issued a payment order to be transferred to the IMF and the money will be deposited today, government spokesman Gabriel Sakellaridis said by telephone. Greek bonds fell, with the 10-year government bond yield gaining 29 basis points to 10.71% at 1:17 p.m in Athens. The Athens Stock Exchange dropped 1.1% to 785.53. The next financial hurdle comes on March 20, when the government has to pay the IMF another €346 millions and refinance €1.6 billion of treasury bills. That’s at the same time as EU leaders including Tsipras and German Chancellor Angela Merkel will be meeting for a two-day summit in Brussels.

“Ya boo to that, says Jens Weidmann [..] See if I care, says Varoufakis.”

• Schism Between Germany And Greece Grows Wider By The Day (Guardian)

It is the politics of the playground. The German finance minister, Wolfgang Schäuble, is accused of calling his Greek counterpart Yanis Varoufakis “foolishly naive” in his dealings with the media. Athens lodges a formal complaint with Berlin, saying a minister of a country that is a “friend and ally” cannot go around insulting a colleague. Ya boo to that, says Jens Weidmann, the president of Germany’s Bundesbank. Greece is losing the trust of its partners and it is only right that the ECB should think very hard about whether it wants to extend its exposure to the crisis-ridden country. See if I care, says Varoufakis. I have never had the trust of the German government. What matters is that I have the trust of the Greek people at a time when the ECB is “asphyxiating” the country.

This outbreak of undiplomatic language might sound funny, but it isn’t. The schism between Germany and Greece is growing wider by the day. Unless Berlin and Athens can come to an amicable agreement, something that looks increasingly less likely, there are only two possible outcomes: Greece capitulates or Greece leaves the euro. Schäuble clearly believes that Greece has no intention of going back to the drachma. Varoufakis has said as much, as has the new Greek prime minister, Alexis Tsipras. However, if Greece wants to remain inside the single currency, it is going to need the cooperation and financial support of the other members of the club, including Germany. Greece is going to have to do what it is told by the troika of the ECB, the EU and the IMF at some point, so it makes no sense for Athens to start dredging up memories of German occupation in the second world war.

Varoufakis is making it even more likely that the rest of the eurozone will play hardball with Greece. It is not clear if Schäuble really said the words “foolishly naive” – but that would be a fair judgment if the end result is abject capitulation to whatever the troika demands. But as the Labour peer Meghnad Desai points out in an OMFIF blog, there is a way out for the Syriza-led coalition. That is to call a referendum on the basis of who governs Greece. As Desai notes, Tsipras and Varoufakis could say they had underestimated how difficult it would be to end austerity and it was up to the Greek people whether they wanted year after year of externally-imposed pain or exit from the eurozone.

Peanuts.

• US Seeks Billions From Global Banks For Currency Manipulation (Bloomberg)

The U.S. Justice Department is seeking about $1 billion each from global banks being investigated for manipulation of currency markets, according to two people familiar with the talks. The figure is a starting point in settlement discussions, with some banks being asked for more and some less than $1 billion. One bank that has cooperated from the beginning is expected to pay far less, one of the people said. Penalties of about $4 billion are on the table, according to one of the people, though the number could change markedly. Banks are pushing back harder than in some previous negotiations, including those for mortgage-backed securities, and the final penalties could be lower, people close to the talks said.

The discussions, which have begun in earnest in recent weeks, could lead to settlements that would resolve U.S. accusations of criminal activity in the currency markets against Barclays, Citigroup, JPMorgan, RBS and UBS. The government has also said it is preparing cases against individuals. Prosecutors are also pressing Barclays, Citigroup, JPMorgan and the Royal Bank of Scotland to plead guilty, people familiar with the matter have said. In the worldwide investigation into currency-rigging, six banks have already agreed to pay regulators about $4.3 billion. The Justice Department’s move signals that investigations are giving way to wrangling over issues such as whether the banks plead guilty to antitrust or fraud charges, what behaviors the banks will admit to in settlement documents and how much they will pay.

Hats off to Beversdorf.

• The Fed Gives A Giant F##k You to Working Class Americans (Beversdorf)

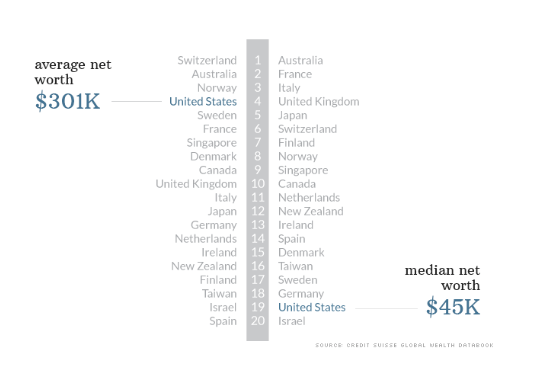

I was shocked today by the absolute gaul of the Fed releasing a statement about Net Worth in America reaching record levels. Now I get that they are under extreme pressure to sell the story that everything is rainbows and butterflies. But surely they understand that working class Americans are going along with the story because they really don’t have any say in our nation’s policies anymore. That doesn’t mean they want it thrown in their faces that the Fed has spent 6 years now inflating the wealth of the top 10% so much that it actually lifts the total wealth of the nation’s citizens to record highs. The ugly reality is that the bottom 80% of Americans experienced none of that gain. That’s right a big ole goose egg.

And so when the Fed via its ass pamper boy, Steve Liesman, start banging on about the fact that some sliver of society is being handed extraordinary wealth while the working class has lost 40% of their net worth since 2007, well a big fuck you right back at ya bub! The Fed is very aware that the bottom 80% of Americans own less than 5% of US equity markets. And so the Fed is very aware that its manipulation of stock prices such that it creates immense unearned wealth to those in the markets doesn’t reach the bottom 80%. So why celebrate the results of the stock market price manipulation?? It is embarrassing that our policymakers are either that inconsiderate or that stupid to celebrate such a brutal dislocation between the haves and have nots.

I don’t know what one can even say about the Fed making a celebratory statement like that today. It is somewhat beyond words. And really paints the picture as to how little thought goes into the lives and well being of the bottom 80%. Just to give you something to compare and contrast the situation of the bottom 80% here in the US to counter the Fed’s celebration today. I want you to think about how lucky we are not being in one of the PIIGS nations of Europe. These are the nations that are essentially bankrupt and just hanging on by the kindness of the Troika.

So there it is. While the average net worth of Americans is 4th in the world pulled up by the top 10%, the median net worth of Americans comes in the 19th spot. Yep, behind Spain, Italy and Ireland so 3 of the 5 PIIGS nations. Meaning the bottom 80% in these broke ass barely hanging on nations have more wealth than the bottom 80% of us here in America. So I’d like to ask the Fed, is it that you just hate the working class here in America and thus like to torment them or are you truly that stuck up your own asses that you just cannot see the light? Celebrating the fact you did today is downright nasty you lowlife scoundrel pieces of shit. It’s akin to a family showing off and celebrating a new born baby at the funeral of another family’s child. It is just a very ugly thing to do. Even if it wasn’t meant to be malicious it looks very much like a giant FU.

“The industry has been watching oil supplies surge to 80-year highs..”

• Oil Plunges On Bloated US Supply (CNBC)

Oil prices plunged on the double whammy of a surging dollar and a new report that raised worries about a U.S. oil glut that could send crude dramatically lower. The drop in oil also slammed the stock market, reeling too from the stronger dollar. The Dow tumbled more than 145 points to 17,749, while the S&P 500 lost 12 points to 2053. West Texas Intermediate futures for April fell 4.7% to settle at $44.84 per barrel, and Brent, the international benchmark, was trading below $55 per barrel. For WTI, the closing low of the year was $44.45 per barrel on Jan. 28, though it touched an intraday low of $43.58 per barrel on Jan. 29.

Oil analysts have expected the market to challenge those lows on strong U.S. supply, and a report Friday from the International Energy Agency fed those fears. The IEA said U.S. production increased by 115,000 barrels a day in February and the growing inventories threaten to drive prices lower. Oil was also hurt by gains in the dollar. The dollar index rose to a 52-week high, crossing above 100. “This has been a building situation—the massive inventory increases of the past several weeks and the production level showing no sign of relenting despite the decline in the rig count,” said John Kilduff analyst and founder at Again Capital. “What’s setting us up for another selloff is that we’re hitting a slack demand period in between the winter heating fuel season and the summer driving season.”

The industry has been watching oil supplies surge to 80-year highs, and inventories at the Cushing, Oklahoma, delivery hub for WTI futures contracts continue to balloon. “There’s speculation the tanks in Cushing could get full or reach capacity,” said Kilduff. “If no further oil could get into that delivery point, it would send a ripple effect into the futures market and beyond. It could create a break.” He also said it could send cash prices lower across the U.S. and possibly globally. While some analysts expect to see $40 as a floor, other say it could be much lower if buyers don’t step up and the spiral is rapid. “If we test that low, going back to the $30s could be in the cards,” said Kilduff.

Can’t be a good isgn that the largest Bakken producer must sell itself.

• Shale Producer Whiting Draws Exxon, Others as Suitors (Bloomberg)

Whiting Petroleum, the North Dakota oil explorer, has attracted interest from Exxon Mobil and Continental Resources Inc. as it explores a sale of the entire company, people with knowledge of the situation said. Hess and Statoil are also looking at Denver-based Whiting. Whiting has set up a data room for potential buyers to evaluate the company’s financial information and asked them to submit bids next week, the people said. The discussions are ongoing and there’s no guarantee a deal will be reached. A potential deal for Whiting, the largest producer in North Dakota’s Bakken shale formation, may be the first in an anticipated pickup of merger activity for U.S. energy producers as they grapple with heavy debt and an oil selloff.

Continental, Exxon, Hess and Statoil are already among the 10 largest holders of acreage in the Bakken, a giant slab of oil-soaked rock that lies beneath Montana, North Dakota and parts of Canada, according to data compiled by Bloomberg. Consolidation is likely to pick up in the oil patch this year as larger U.S. and international buyers seek to “snatch up” valuable shale producers, according to a statement from Paulson & Co., which owns 8.1% of Whiting. Whiting is probably exploring a sale along with other strategic alternatives, including selling assets, raising debt and selling shares in order to address “investor liquidity concerns,” Phillip Jungwirth, an analyst with Bank of Montreal, wrote in a research note last week.

Bloomberg News reported in February that Whiting was exploring selling up to $700 million of oil and natural gas processing assets. “While some reports implied Whiting was a distressed seller, we don’t view this as the case,” Jungwirth wrote. “We’d expect interest in Whiting to come from larger Bakken peers that are looking to expand their footprint.” Buying a shale producer such as Whiting is cheaper than it has been at any time in recent years as companies used new technology to unlock a boom in North American supplies, flooding world markets and depressing prices. The value of reserves held by about 75 drillers based on their reserves fell by a median of 25% by the end of 2014 compared to the previous year, according to data compiled by Bloomberg.

Tyler Durden ran this week-old piece, which I had also missed. Don’t miss.

• The Coming Chinese Crackup (WSJ)

Predicting the demise of authoritarian regimes is a risky business. Few Western experts forecast the collapse of the Soviet Union before it occurred in 1991; the CIA missed it entirely. The downfall of Eastern Europe’s communist states two years earlier was similarly scorned as the wishful thinking of anticommunists—until it happened. The post-Soviet “color revolutions” in Georgia, Ukraine and Kyrgyzstan from 2003 to 2005, as well as the 2011 Arab Spring uprisings, all burst forth unanticipated, China-watchers have been on high alert for telltale signs of regime decay and decline ever since the regime’s near-death experience in Tiananmen Square in 1989.

Since then, several seasoned Sinologists have risked their professional reputations by asserting that the collapse of CCP rule was inevitable. Others were more cautious—myself included. But times change in China, and so must our analyses. The endgame of Chinese communist rule has now begun, I believe, and it has progressed further than many think. We don’t know what the pathway from now until the end will look like, of course. It will probably be highly unstable and unsettled. But until the system begins to unravel in some obvious way, those inside of it will play along—thus contributing to the facade of stability.

Communist rule in China is unlikely to end quietly. A single event is unlikely to trigger a peaceful implosion of the regime. Its demise is likely to be protracted, messy and violent. I wouldn’t rule out the possibility that Mr. Xi will be deposed in a power struggle or coup d’état. With his aggressive anticorruption campaign—a focus of this week’s National People’s Congress—he is overplaying a weak hand and deeply aggravating key party, state, military and commercial constituencies. The Chinese have a proverb, waiying, neiruan—hard on the outside, soft on the inside. Mr. Xi is a genuinely tough ruler. He exudes conviction and personal confidence. But this hard personality belies a party and political system that is extremely fragile on the inside.

How much longer for Abe?

• Japan’s Orwellian Politics About Ukraine (Eric Zuesse)

Yukio Hatayama, who during 2009 and 2010 had been the first and only non-LDP, or non-one-party-state, Prime Minister of Japan (and he was then quickly ousted by the LDP), said in Crimea on Tuesday, March 10th, that Japan should not be so totally controlled by the U.S. Government, and that, “It’s shameful that information from Japanese and Western media is one-sided.” Hatayama also praised “the happy, peaceful life in Crimea,” as opposed to the war-torn and economically collapsing Ukraine, which the IMF, EU and especially the U.S., keep lending money to pay Ukraine to bomb the residents in Ukraine’s strongly anti-fascist eastern area. Japan’s LDP Foreign Minister, Fumio Kishida, promptly dismissed the Hatayama statement by saying that it came from a “gaffe-prone” man. Telling the truth is a ‘gaffe.’

Mitsuhiro Kimura, leader of another small anti-U.S.-control-of-Japan party, travelled with Hatayama, and supported this initiative for increasing trade and cultural exchanges with Crimea and with Russia generally. He said that this visit was “historic,” and that “Maybe it will give us a chance to influence Japan’s foreign policies and change them.” The Agence France Presse report on this event referred to Kimura’s party as “the right-wing political group Issuikai,” implicitly suggesting thereby that opposition to U.S. control of Japan is “right-wing.” This propaganda effort aimed to insinuate that since the U.S. had defeated the fascist Government of Japan in 1945, the LDP, which the U.S. installed in Japan post-War, can only be the opposite of fascist.

On 17 May 2007, Britain’s conservative Economist had headlined “Japan’s Ultra-Nationalists: Old Habits Die Hard,” and it reported that Kimura was rabble-rousing, and that Japan’s Prime Minister Shinzo Abe said that Kimura and other “ultra-nationalist” politicians in Japan constituted a “threat to democracy.” The Economist also noted, however, ironically, that: “It was Mr Abe’s own grandfather, Nobusuke Kishi, who as prime minister cemented ties between the government, the uyoku dantai and the mob back in 1960, when he enlisted yakuza help against left-wing opponents of Japan’s alliance with America.“ Abe is considered, by the U.S. and its allies, to be “conservative,” instead of “far-right.”

“The Department of State acknowledged receipt of the request but the AP has received nothing under that request after more than five years.”

• Hillary’s Email Mess Gets Messier (Pam Martens)

There’s an old adage that goes: “never pick a fight with anyone who buys ink by the barrel.” It’s generally interpreted to mean don’t go to war with the press. That would surely include syndicated reporters working for the Associated Press, which says in a lawsuit filed yesterday that it has “one billion readers, listeners and viewers.” Despite the sage advice, Hillary Clinton is now in a full blown war with the press over how she became the Decider in Chief over which government emails would be preserved from her time as Secretary of State versus the tens of thousands that she elected to erase, ruling them to be about personal matters.

AP has filed its lawsuit against the U.S. Department of State because the Federal agency has defied the Freedom of Information Act and stonewalled AP reporters for as long as five years over requests for records pertaining to Hillary Clinton’s term as Secretary of State. The lawsuit suggests a Department of State flagrantly ignoring Federal FOIA laws. One section reads: “In early March 2015, Secretary Clinton confirmed reports that she used a personal email account, rather than a government account, for government business during her tenure at State. Although AP’s FOIA requests have been pending for years, State first asked Secretary Clinton to turn over emails from that personal account only last summer.

Secretary Clinton reportedly provided about 50,000 pages of printed emails to State late last year, and has said she wants those emails to be released to the public. State’s failure to ensure that Secretary Clinton’s governmental emails were retained and preserved by the agency, and its failure timely to seek out and search those emails in response to AP’s requests, indicate at the very least that State has not engaged in the diligent, good-faith search that FOIA requires.” Not only have Clinton’s emails been denied to AP reporters, but her daily calendar of appointments, record of phone calls and meetings have also been withheld for the past five years. All of this opacity is raising curiosity in the press as to just what might be hiding in these troves of unreleased documents.

The earliest request filed by the AP was by reporter Robert Burns on March 9, 2010, according to the lawsuit. Burns requested “a copy of Secretary of State Hillary Rodham Clinton’s daily calendar of appointments, phone calls, and meetings, from the first day of the Obama Administration to the present,” i.e., “from 1/20/2009 to [March 9, 2010].” The Department of State acknowledged receipt of the request but the AP has received nothing under that request after more than five years.

Vintage Taibbi.

• For David Brooks, The Rich Are People, the Poor Are Numbers (Matt Taibbi)

Everybody gets on famed New York Times columnist Thomas Friedman’s case for quoting cab drivers, but say this about Friedman: At least he talks to somebody outside his own house. The same can’t be said for his colleague on the Times editorial page, David Brooks, who with this week’s “The Cost of Relativism” column has written roughly his 10 thousandth odious article about how rich people are better parents than the poor, each one apparently written without the benefit of actually talking to any poor people. The column is a review of a new book by the academic Robert Putnam called Our Kids, about a widening gap in the way the children of different classes are raised in America.

Putnam begins his book by telling a story about his childhood in the Fifties in Port Clinton, Ohio, when both rich and poor children grew up in two-parent households where the fathers had steady jobs. Since, then, Putnam argues, deindustrialization has led to increasingly segregated communities for the wealthy on the one hand, and a sharp decline in stability for poor children on the other. Here’s Brooks describing the findings: Roughly 10% of the children born to college grads grow up in single-parent households. Nearly 70% of children born to high school grads do… High-school-educated parents dine with their children less than college-educated parents, read to them less, talk to them less, take them to church less, encourage them less and spend less time engaging in developmental activity.

Brooks then goes on to relate some of the horrific case studies from the book – more on those in a moment – before coming to his inevitable conclusion, which is that poor people need to get off the couch, stop giving in to every self-indulgent whim, and discipline their wild offspring before they end up leaving their own illegitimate babies on our lawns: Next it will require holding people responsible. People born into the most chaotic situations can still be asked the same questions: Are you living for short-term pleasure or long-term good? Are you living for yourself or for your children? Do you have the freedom of self-control or are you in bondage to your desires?

Brooks has devoted an extraordinary amount of his literary efforts over the years to this subject, focusing particularly on declining marriage rates among the poor. He wrote a piece last winter that ludicrously pooh-poohed the issue of income inequality, citing certain “behaviors” among the poor that “damage their long-term income prospects” and cause a “fraying” of the social fabric, single motherhood being an example.

Dry.

• California Has About One Year Of Water Left. Will You Ration Now? (NASA)

Given the historic low temperatures and snowfalls that pummeled the eastern U.S. this winter, it might be easy to overlook how devastating California’s winter was as well. As our “wet” season draws to a close, it is clear that the paltry rain and snowfall have done almost nothing to alleviate epic drought conditions. January was the driest in California since record-keeping began in 1895. Groundwater and snowpack levels are at all-time lows. We’re not just up a creek without a paddle in California, we’re losing the creek too. Data from NASA satellites show that the total amount of water stored in the Sacramento and San Joaquin river basins – that is, all of the snow, river and reservoir water, water in soils and groundwater combined – was 34 million acre-feet below normal in 2014.

That loss is nearly 1.5 times the capacity of Lake Mead, America’s largest reservoir. Statewide, we’ve been dropping more than 12 million acre-feet of total water yearly since 2011. Roughly two-thirds of these losses are attributable to groundwater pumping for agricultural irrigation in the Central Valley. Farmers have little choice but to pump more groundwater during droughts, especially when their surface water allocations have been slashed 80% to 100%. But these pumping rates are excessive and unsustainable. Wells are running dry. In some areas of the Central Valley, the land is sinking by one foot or more per year.

As difficult as it may be to face, the simple fact is that California is running out of water — and the problem started before our current drought. NASA data reveal that total water storage in California has been in steady decline since at least 2002, when satellite-based monitoring began, although groundwater depletion has been going on since the early 20th century. Right now the state has only about one year of water supply left in its reservoirs, and our strategic backup supply, groundwater, is rapidly disappearing. California has no contingency plan for a persistent drought like this one (let alone a 20-plus-year mega-drought), except, apparently, staying in emergency mode and praying for rain.

Home › Forums › Debt Rattle March 14 2015