John Collier FSA housing project for Martin aircraft workers, Middle RIver, MD 1943

Any country heavily dependent on commodities trade must suffer the inevitable.

• Weakness in Asia Batters Currencies Abroad (WSJ)

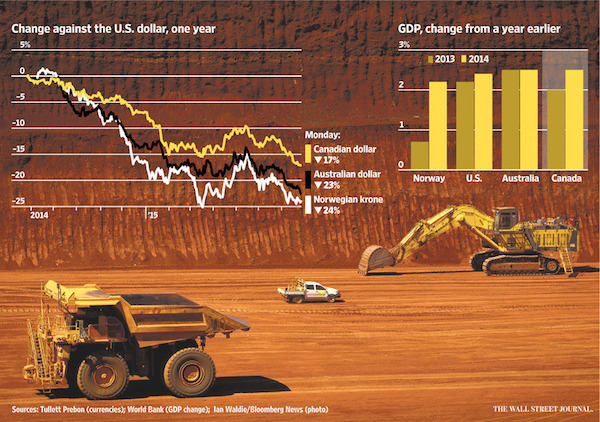

The global commodities slump is testing the resilience of resource-driven economies, pushing currencies from Australia, Canada and Norway to lows not seen since the financial crisis. Weakening energy and metals prices are punishing investors, companies and governments. Slumping demand from China, the world’s biggest purchaser of many materials, is rippling through foreign-exchange markets, reflecting expectations that a valuable source of export growth is drying up. But few countries are being battered as badly as Canada, due to its dependence on the hard-hit energy industry and its central bank’s decision this month to cut its key overnight interest rate for the second time this year.

The Bank of Canada expects Canada’s gross domestic product to rise a paltry 1.1% this year, down from previous forecasts of 1.9% made earlier in the year, as a persistent decline in oil prices and a drop in exports that the central bank described as “puzzling” hampered growth. The decision to reduce rates is adding to the woes of the Canadian dollar, which is called the loonie, underscoring the delicate balance that policy makers must strike at a time of uneven global growth and whipsaw trading in currency markets. At the same time, a boost in exports—often billed as one of the silver linings of a currency’s decline—has yet to arrive.

“My gut feeling is that it’s going to be bad for some time to come,” said Thomas Laskey at Aberdeen Asset Management, which has US$483 billion under management. Mr. Laskey said he is shorting the Canadian dollar—a bet that the currency will fall—until he sees an improvement in Canadian oil-and-gas companies’ investment spending. The loonie is down 8.1% against the U.S. dollar since May 14 in New York trading, making it one of the biggest victims of the steep decline in global commodity prices since then. In that same period, the Australian dollar is down 10% and the Norwegian krone, which is pegged to the euro, has dropped 9.8% against its U.S. counterpart.

Plunging commodity prices and the end of a mining investment boom have pushed the Reserve Bank of Australia to cut interest rates twice this year. The central bank said that while it is open to further easing monetary policy, it is also wary of some of the unintended consequences of lower rates, such as burgeoning real-estate prices in Sydney. Norway’s central bank cut interest rates in June in a bid to boost its flagging economy, which is closely tied to oil exports. Norges Bank said more reductions are likely before the end of the year.

“Inequality is much, much worse than official statistics show, but politicians are still relying on trickle-down to transfer wealth to poorer people. “This new data shows the exact opposite has happened..”

• Wealth Doesn’t Trickle Down, It Just Floods Offshore -$32 Trillion (Guardian)

The world’s super-rich have taken advantage of lax tax rules to siphon off at least $21 trillion, and possibly as much as $32tn, from their home countries and hide it abroad – a sum larger than the entire American economy. James Henry, a former chief economist at consultancy McKinsey and an expert on tax havens, has conducted groundbreaking new research for the Tax Justice Network campaign group – sifting through data from the Bank for International Settlements (BIS), the IMF and private sector analysts to construct an alarming picture that shows capital flooding out of countries across the world and disappearing into the cracks in the financial system.

Comedian Jimmy Carr became the public face of tax-dodging in the UK earlier this year when it emerged that he had made use of a Cayman Islands-based trust to slash his income tax bill. But the kind of scheme Carr took part in is the tip of the iceberg, according to Henry’s report, entitled The Price of Offshore Revisited. Despite the professed determination of the G20 group of leading economies to tackle tax secrecy, investors in scores of countries – including the US and the UK – are still able to hide some or all of their assets from the taxman. “This offshore economy is large enough to have a major impact on estimates of inequality of wealth and income; on estimates of national income and debt ratios; and – most importantly – to have very significant negative impacts on the domestic tax bases of ‘source’ countries,” Henry says.

Using the BIS’s measure of “offshore deposits” – cash held outside the depositor’s home country – and scaling it up according to the proportion of their portfolio large investors usually hold in cash, he estimates that between $21tn and $32tn in financial assets has been hidden from the world’s tax authorities. “These estimates reveal a staggering failure,” says John Christensen of the Tax Justice Network. “Inequality is much, much worse than official statistics show, but politicians are still relying on trickle-down to transfer wealth to poorer people. “This new data shows the exact opposite has happened: for three decades extraordinary wealth has been cascading into the offshore accounts of a tiny number of super-rich.”

In total, 10 million individuals around the world hold assets offshore, according to Henry’s analysis; but almost half of the minimum estimate of $21tn – $9.8tn – is owned by just 92,000 people. And that does not include the non-financial assets – art, yachts, mansions in Kensington – that many of the world’s movers and shakers like to use as homes for their immense riches.

“Chinese tour group visitors to Hong Kong plunged 40% in the first two weeks of July compared with the same period a year earlier..”

• Hong Kong Is Feeling China’s Pain (Bloomberg)

For Hong Kong, it’s been one thing after another when it comes to China. A series of anti-China and pro-democracy protests last year prompted stores to close and mainland tour groups to cancel bookings. Meanwhile, a slowing Chinese economy and President Xi Jinping’s anti-corruption and austerity campaigns have also made the Chinese more wary of buying pricey cognac and Gucci bags in the city. While the biggest outbound destination for Chinese tour groups last year, Hong Kong is in danger of losing its lead to regional rivals such as Thailand and South Korea, as well as mainland alternatives including Shenzhen and Shanghai. Mainland Chinese travelers to Hong Kong last year grew by the slowest pace since 2009, Bloomberg Intelligence data show.

Chinese tour group visitors to Hong Kong plunged 40% in the first two weeks of July compared with the same period a year earlier, the Hong Kong Economic Times reported Monday, citing Michael Wu, head of the city’s Travel Industry Council. With fewer mainland Chinese staying overnight, average daily rates at Hong Kong’s hotels fell for a ninth straight month through June. In addition, China slashed tariffs on products such as face creams and imported sneakers from June 1, reducing Hong Kong’s draw as a cheaper shopping destination. The effect on Hong Kong’s retailers has been immediate and painful. Retail sales fell in four of the five months through May, with jewelry, watches and other high-end gifts the worst hit.

Burberry Group Plc, whose stores in Hong Kong’s Causeway Bay and Tsim Sha Tsui shopping districts sell HK$18,500 ($2,400) handbags and HK$24,000 dresses, has said it may try and lower its rent bill to offset a worsening slump in Hong Kong, while Emperor Watch & Jewellery, which sells Cartier and Montblanc watches, said it may shut one or two of its Hong Kong stores when their leases end this year. And the news out of China doesn’t inspire much confidence. French distiller Remy Cointreau reported first-quarter sales that missed analyst estimates as Chinese wholesalers continued to hold back on cognac orders. Prada also reported first-quarter profit that trailed analyst estimates on slumping sales in China, while foreign carmakers including Audi have stepped up discounts to woo buyers.

So there’s no relief in sight for Hong Kong. The tourism board forecasts overall visitor arrival growth to slow to 6.4% in 2015 from 12% last year, with mainland Chinese tourist arrivals expected to drop by half to 8%. Hong Kong’s economy expanded 2.1% in the first quarter from a year earlier, weaker than a revised 2.4% expansion in October through December. “We’re just too exposed to China,” said Silvia Liu at UBS. “Structurally, until the tourism sector consolidates and Hong Kong finds new growth engines, I don’t see the way out yet.”

It will force a free market?!

• The Good News in China’s Stock Plunge (Pesek)

Panic is in the air as China suffers its biggest one-day stock plunge since 2007. It shouldn’t be. The 8.5% slide in the Shanghai Composite Index is actually a development that could leave China better off eight years from now. I’m focusing on eight both because it’s an auspicious number in Chinese folklore (the Beijing Olympics didn’t begin on 8/8/08 by accident) and Beijing’s idea of nirvana. Growth returning to 8% (relative to this year’s 7% target) would buttress President Xi Jinping’s reformist bona fides. Instead, stocks fell by that much Monday as Xi’s magic has lost potency. Why is that a good thing? It’s at once a reminder that rationality is returning to mainland markets and a message to Xi to stop putting the financial cart before the proverbial horse.

Since mid-June, when shares began sliding, Xi’s market-rescue squad has tried everything imaginable: interest-rate cuts, margin-lending increases, bans on short selling, a moratorium on initial public offerings, hauling supposedly rogue traders in for a talking to, ordering state-run institutions to buy shares, halting trading in at least half of listed companies, you name it. What Xi hasn’t tried is upgrading the economy and financial system in such a way as to help the stock market thrive. To find out what he should do next, Xi could do worse than to check in with Henry Paulson. Even though Paulson might regard with scorn China’s love of the number eight, it was on his watch as Treasury secretary in 2008 that the U.S. had its own brush with financial collapse.

Paulson has been merciless in his all-hype-and-no-fundamentals critique of Xi’s government. “China is especially vulnerable at this point because while its economy has grown and matured, its capital markets have lagged behind,” he wrote in the Financial Times. “It is no surprise that those ideologically opposed to markets would use recent events to make the opposite argument — that to prevent market instability, Beijing should slow the pace of financial liberalisation or perhaps even abandon market-based reforms altogether.” Yet, he argued, “while Beijing’s instinct to protect investors is understandable, the best way of doing so is to create a modern capital market.”

That’s why ambivalence toward Xi’s titanically large market interventions could be a positive. It refocuses Beijing on what’s needed to re-create the vibrant markets that prevail in New York and Hong Kong. Xi’s Communist Party has tried and failed to stabilize things by edict. In fact, heavy-handed manipulation has set back Beijing’s designs on making the yuan a global reserve currency and getting Shanghai shares included in MSCI’s indexes.

Junk bonds dive with commodities.

• How Much Worse Can the Junk-Bond Sell-Off Get? (WolfStreet)

Commodities had once again an ugly week. Copper hit the lowest level since June 2009. Gold dropped below $1,100 an ounce. Other metals dropped too. Agricultural commodities fell; corn plunged nearly 7% for the week. Crude oil swooned, with West Texas Intermediate dropping nearly 7% to $47.97 a barrel, a true debacle for energy junk-bond investors. It was the kind of rout that bottom fishers a few months ago apparently didn’t think was possible. For example, in March, coal miner Peabody Energy had issued 10% second-lien notes due 2022 at 97.5 cents on the dollar. Now, these junk bonds are trading at around 49 cents on the dollar, having lost half their value in four months, and 17% in July alone, according to S&P Capital IQ’s LCD HY Weekly.

Yield-hungry fund managers that bought them at issuance and stuffed them into their bond funds that people hold in their retirement accounts should be sued for malpractice. Among the bonds: Cliffs Natural Resources down 27.6%, SandBridge down 30%, Murray Energy down 21.2%, and Linn Energy down 22.3%, according to Bloomberg. For example, Linn Energy 6.25% notes due in 2019 were trading at 78 cents on the dollar at the beginning of July and at 58 on Friday, according to LCD. There was bloodshed beyond energy, such as AK Steel’s 7.625% notes due in 2021. They were trading at 62 cents on the dollar, down 22% from the beginning of July. “The performance is a disappointment to investors who purchased about $40 billion of junk-rated bonds from energy companies this year, thinking that the worst of the slump was over,” Bloomberg noted.

The riskiest junk bonds, tracked by the BofA Merrill Lynch US High Yield CCC or Below Effective Yield Index, have been hit hard, with yields jumping from the ludicrous levels below 8% of last summer to 12.19% as of Thursday, the highest since July 2012. Note the spike in yield during the “Taper Tantrum” in the summer of 2013 when the Fed discussed ending “QE Infinity.” After which bonds soared once again and yields descended to record lows, until the oil panic set in, as investors in the permanently cash-flow negative shale oil revolution were coming to grips with the plunging price of oil. But in the spring, bottom fishers stepped in and jostled for position as energy companies sold them $40 billion in new bonds, including coal producer Peabody. Now a lot of people who touched these misbegotten bonds are scrutinizing their burned fingers.

“..the Gramm-Leach-Bliley Act of 1999..”

• The Few Who Won’t Say ‘Sorry’ for Financial Crisis (Ritholtz)

“Some people look at subprime lending and see evil. I look at subprime lending and I see the American dream in action. My mother lived it as a result of a finance company making a mortgage loan that a bank would not make. – Former U.S. Senator Phil Gramm”

Many elected or appointed officials have a specific belief system that they may act upon in the implementation of policies. When the policies that flow from those beliefs go terribly wrong, it is natural to want to learn why. As is so often the case, that underlying ideology is usually a good place to begin looking. In the aftermath of the great credit crisis, we have seen all manner of contrition from responsible parties. Most notably, Alan Greenspan admitted error, saying as much in Congressional testimony. Greenspan was unintentionally ironic when he answered a question about whether ideology led him down the wrong path when it came to preventing irresponsible lending practices in subprime mortgages: “Yes, I’ve found a flaw. I don’t know how significant or permanent it is. But I’ve been very distressed by that fact.”

Other contributors to the crisis have been similarly humbled. In “Bailout Nation,” I held former President Bill Clinton, and his two Treasury secretaries, Robert Rubin and Larry Summers, responsible for signing the ruinous Commodity Futures Modernization Act that exempted derivatives from regulation and oversight. The CFMA was passed as part of a larger bill by unanimous consent, and that Clinton signed on Dec. 21, 2000. Clinton joined Greenspan in admitting his contribution to the credit crisis, as well as saying the advice he received from his Treasury secretaries – Rubin and Summers – was wrong. The CFMA removed the standard regulations that all other financial instruments follow: reserve requirements, counter-party disclosures and exchange listings.

Bloomberg reported that Clinton said his advisers argued that derivatives didn’t need transparency because they were “expensive and sophisticated and only a handful of people will buy them and they don’t need any extra protection. The flaw in that argument was that first of all, sometimes people with a lot of money make stupid decisions and make it without transparency.” Even the American Enterprise Institute changed the name of its “Financial Deregulation Project” to the more benign “program on financial policy studies.” That is as close to an apology as we can expect for its part in pushing for market deregulation.

The exception to any post-crisis self-reflection is former Senator Phil Gramm. Although he was one of the chief architects of the radical gutting of financial regulations and oversight rules during the two decades that preceded the financial crisis, the former senator remains a stubborn believer that banks and markets can regulate themselves. Perhaps more than anyone else, Gramm drove the legislation that allowed banks to get much bigger and derivatives to run wild. His name is on the law – the Gramm-Leach-Bliley Act of 1999 – that overturned the Glass-Steagall Act, a Depression-era law that forced commercial banks to get out of the risky investment-banking business.

It really is very revealing. How about: “Marsh wraps up the teleconference [..], reminding everyone Varoufakis’ remarks were under the so-called Chatham House rules, which means the information can be passed on but Varoufakis should not be cited as the source of the information.

• Varoufakis Unplugged: The London Call Transcript (FT)

The London-based Official Monetary and Financial Institutions Forum, headed by two ex-Financial Times scribes – chairman John Plender and managing director David Marsh – on Monday released a 24-minute audiotape of a teleconference they held nearly two weeks ago with Yanis Varoufakis, the former Greek finance minister. Details of the call were first revealed by the Greek daily Kathimerini, and much of most sensational revelations Varoufakis made were about a surreptitious project he and a small team of aides worked on to set up a parallel payments system that could be activated if the European Central Bank forced the shutdown of the Greek financial system.

But Varoufakis also made some other interesting allegations, including claims the IMF believes the Greek bailout is doomed and that Alexis Tsipras, the Greek prime minister, offered him another ministry shortly after he was relieved as finance minister. We’ve had a listen to the entire call, and transcribed most of it – excluding some inconsequential asides to the teleconference’s hosts, Messrs Marsh and Norman Lamont, the former UK finance minister.

Have the tapes taken Plan B off the table for good?

• Statement on the FinMin’s Plan B Working Group (Yanis Varoufakis’ office)

During the Greek government’s negotiations with the Eurogroup, Minister Varoufakis oversaw a Working Group with a remit to prepare contingency plans against the creditors’ efforts to undermine the Greek government and in view of forces at work within the Eurozone to have Greece expelled from the euro. The Working Group was convened by the Minister, at the behest of the Prime Minister, and was coordinated by Professor James K. Galbraith. It is worth noting that, prior to Mr Varoufakis’ comfirmation of the existence of the said Working Group, the Minister was criticized widely for having neglected to make such contingency plans. The Bank of Greece, the ECB, treasuries of EU member-states, banks, international organisations etc. had all drawn up such plans since 2012.

Greece’s Ministry of Finance would have been remiss had it made no attempt to draw up contingency plans. Ever since Mr Varoufakis announced the existence of the Working Group, the media have indulged in far-fetched articles that damage the quality of public debate. The Ministry of Finance’s Working Group worked exclusively within the framework of government policy and its recommendations were always aimed at serving the public interest, at respecting the laws of the land, and at keeping the country in the Eurozone. Regarding the recent article by “Kathimerini” newspaper entitled “Plan B involving highjacking and hacking”, Kathimerini’s failure to contact Mr Varoufakis for comment and its reporter’s erroneous references to “highjacking tax file numbers of all taxpayers” sowed confusion and contributed to the media-induced disinformation.

The article refers to the Ministry’s project as described by Minister Varoufakis in his 6th July farewell speech during the handover ceremony in the Ministry of Finance. In that speech Mr Varoufakis clearly stated: “The General Secretariat of Information Systems had begun investigating means by which Taxisnet (Nb. the Ministry’s Tax Web Interface) could become something more than it currently is, to become a payments system for third parties, a system that improves efficiency and minimises the arrears of the state to citizens and vice versa.” That project was not part of the Working Group’s remit, was presented in full by Minister Varoufakis to Cabinet, and should, in Minister Varoufakis’ view, be implemented independently of the negotiations with Greece’s creditors, as it will contribute considerable efficiency gains in transactions between the state and taxpayers as well as between taxpayers.

What I said yesterday.

• Varoufakis: It Would Be Irresponsible Not To Have Drawn Up Contingency Plans (E)

Google Translate: Official statement issued by Yanis Varoufakis to be placed in relation to what came to light during the last two days after the publication of “Kathimerini” leaving clear spikes in the newspaper, noting that it would be irresponsible not to have alternative plans the Ministry of Finance . In its notification, the former Minister of Finance notes that “During the negotiations, and until the day of the Referendum, the t. Finance Minister. Yanis Varoufakis, as required, and at the behest of Prime Minister, oversaw working group which, coordinator Professor James K. Galbraith , elaborating emergency plan and response of the government to undermine plans by lenders , including the country known extrusion projects outside the eurozone. ”

Former Finance Minister points out that before the announcement that there was such a group accept continuous and intense criticism for the lack of response plan in the country to undermine plans by lenders. He adds, in fact, that “The Bank of Greece (which had, for example, ready PNP plan for a bank holiday), the ECB, the EU country governments, banks and international organizations have such groups and design by 2012. Indeed, it would be of utmost irresponsibility not drafted such plans the Ministry of Finance . ” “Since the t. Minister of Finance, announced the existence of that working group, the media inundated with imaginative “story” that affect the quality of public debate by trying to delineate as a group “conspiring” to restore national currency. This is pure slander.

The working group of the Ministry of Finance has always worked in the government policy and recommendations had as a permanent reference to the public interest, compliance with legality and stay in the country in the eurozone, “noted the statement of Yanis Varoufakis press office. In response to the “Daily report” leaves clear spikes in the newspaper stating that ” the pension “neglected” to request explanations and commentary by Mr. Varoufakis Before publishing inaccurate references to “tapping AFM of all taxpayers.” So, deliberately or not, sowed confusion contributed to widespread misinformation of SMEs “.

“In substance, the report appears to refer to plans of the Ministry of Finance that section. Minister stated boldly in the account at the ministry handover ceremony on July 6 with the following reference: The General Secretariat of Information Systems has started to process how whom taxisnet can become something more than what it is, be a payment system and to third parties, a system that increases efficiency and minimizes arrears of government to citizens and to businesses “noted the statement.

What I said.

• Yanis Varoufakis Admits ‘Contingency Plan’ For Euro Exit (Guardian)

Greece’s former finance minister, Yanis Varoufakis, has been thrust back in the spotlight as he vigorously defended plans to launch a parallel payment system in the event of the country being ejected from the euro. Saying it would have been “remiss” of him not to have a “plan B” if negotiations with the country’s creditors had collapsed, the outspoken politician admitted that a small team under his control had devised a parallel payment system. The secret scheme would have eased the way to the return of the nation’s former currency, the drachma. “Greece’s ministry of finance would have been remiss had it made no attempt to draw up contingency plans,” he said in a statement.

But Varoufakis, who resigned this month to facilitate talks between Athens’ left-led government and its creditors, denied that the group had worked as a rogue element outside government policy or beyond the confines of the law. “The ministry of finance’s working group worked exclusively within the framework of government policy and its recommendations were always aimed at serving the public interest, at respecting the laws of the land, and at keeping the country in the Eurozone,” the statement said. Earlier on Monday the Official Monetary and Financial Institutions Forum, which had organized a conference call between Varoufakis and investors, released a recording of the conversation held between the former minister and financial professionals on 16 July .

Varoufakis is heard saying that he ordered the ministry’s own software programme to be hacked so that online tax codes could be copied to “work out” how the payment system could be designed. “We were planning to create, surrepticiously, reserve accounts attached to every tax file number, without telling anyone, just to have this system in a function under wraps,” he says, adding that he had appointed a childhood friend to help him carry out the plan. “We were ready to get the green light from the PM when the banks closed.” The plan was denounced by Greek opposition parties, which in recent weeks have called for Varoufakis to be put on trial for treason. The academic-turned-politician has been blamed heavily for the handling of negotiations with Greece’s creditors which saw Greece come close to leaving the eurozone.

” I think he called it wrong, but God knows it was an awesome responsibility – and we may never know who was right.”

• Contingency Plans (Paul Krugman)

People are apparently shocked, shocked to learn that Greece did indeed have plans to introduce a parallel currency if necessary. I mean, really: it would have been shocking if there weren’t contingency plans. Preparing for something you know might happen doesn’t show that you want it to happen. Someday, maybe, we’ll know what kind of contingency plans the United States has had over the years. Plans to invade Canada? Probably. Plans to declare martial law in the event of a white supremacist uprising? Maybe. The issue now becomes whether Tsipras was right to decide not to invoke this plan in the face of what amounted to extortion from the creditors. I think he called it wrong, but God knows it was an awesome responsibility – and we may never know who was right.

Be its own master?!

• Greece’s Headache: How To Lift Capital Controls (AFP)

It is just the headache Greece’s government does not need right now: How can it loosen the capital controls that are shielding its banks, but strangling the rest of the economy? For the past month, Greece has been financially cut off from the rest of the world. It is almost impossible for most Greeks to take money out of the country, thanks to a raft of capital control measures put in place on June 29 amid fears of a catastrophic bank run. For companies, the capital controls have meant waiting for a government commission to sign off on large bills owed to foreign firms – a process that has slowed payments so much that distrustful suppliers started asking to be paid in advance.

Bank of Greece chief Yannis Stournaras on Friday loosened the restrictions to allow banks to greenlight companies’ foreign payments up to €100,000 But people remain unable to open new foreign bank accounts, buy shares, or transfer large sums of money. Athens is tolerating two main exceptions to the rules: Greek students abroad can receive €5,000 per quarter, while citizens having medical treatment in other countries can receive up to €2,000. Cash withdrawals were limited to €60 per day after Greeks emptied ATMs, worried for the safety of their savings. Greek Economy Minister Giorgos Stathakis warned on July 12 that it could be “several months” before it is deemed safe to lift the measures completely.

Announced in the throes of the crisis, when Greece appeared to be teetering on the brink of a chaotic eurozone exit, the capital controls were brought in with just one immediate concern in mind: protect the banks. Some €40 billion euros have left the banks’ coffers since December. As the world waits to see whether Greece and its creditors can hammer out a bailout worth up to €86 billion, staving off a panicked outpouring of the country’s cash remains a paramount concern. According to Diego Iscaro, an economist at consultancy IHS, the problem with capital controls is that they are “easy to implement but very difficult to lift.” Or as Moody’s analyst Dietmar Hornung put it: “Confidence (in the banks) is lost quickly, but it takes time to restore it.”

“Apparently (and unfortunately), this is not a joke.”

• Germany Rides Into Its Greek Colony On The “Quadriga” (Zero Hedge)

With creditors’ motorcades having officially returned to the streets of Athens in the wake of Greek lawmakers’ approval of the second set of bailout prior actions last Wednesday, tensions are understandably high. After all, these are the same “institutions” which Yanis Varoufakis famously booted from Greece after Syriza swept to power in January, and they’ve come to represent the oppression of the Greek people and are now a symbol of the country’s debt servitude. Although an absurd attempt was made to rebrand the dreaded “troika” earlier this year, the new and rather amorphous moniker – “the institutions” – never really stuck and perhaps because everyone involved felt the need to put a new name to the group that Greeks regard as the scourge of the Aegean in order to make negotiators feel safer on their trips to Athens, creditors have now added the ESM to their collective and rebranded themselves “The Quadriga.” Apparently (and unfortunately), this is not a joke. Here’s MNI:

The source from the Commission also noted that the group formerly known as Troika is now being renamed as “Quadriga”, to note the inclusion of the ESM in the talks. “Quadriga is the name inspired by Commission President, Jean-Claude Juncker for the new Greek project” the Commission source said, adding that “the EU side is a bit nervous of not knowing the IMF stance.”

We assume the reference to the IMF’s “stance” there refers to the size of the bailout and the prospects for debt relief and not to the new nickname choice, but whatever the case, here’s the definition of “quadriga” from Wikipedia:

A quadriga (Latin quadri-, four, and iugum, yoke) is a car or chariot drawn by four horses abreast (the Roman Empire’s equivalent of Ancient Greek tethrippon). It was raced in the Ancient Olympic Games and other contests. It is represented in profile as the chariot of gods and heroes on Greek vases and in bas-relief. The quadriga was adopted in ancient Roman chariot racing. Quadrigas were emblems of triumph; Victory and Fame often are depicted as the triumphant woman driving it. In classical mythology, the quadriga is the chariot of the gods; Apollo was depicted driving his quadriga across the heavens, delivering daylight and dispersing the night.

We’re not sure what’s more ironic there, the fact that an image which once appeared on Greek ceramics is now the symbol of serfdom or the fact that it’s the “chariot of the gods”, who in this case would be eurocrats and IMF officials. As amusing – and somewhat sad – as this is, perhaps the most tragically ironic part of the entire rebranding effort is that one of the most significant representations of a quadriga the world over sits atop the Brandenburg Gate in Berlin.

IMF tells China central bank to cool it down, and at the same time tells ECB to turn up the heat. Vested interests?!

• IMF Paints Dim Europe Picture, Says More Money Printing May Be Needed (Reuters)

The IMF warned on Monday that the euro zone’s prospects were modest and that more money printing than planned may be needed. Contrasting the IMF’s relative gloom, however, German think tank Ifo reported improving confidence the 19-country bloc’s largest economy. The IMF, saying medium-term growth would be subdued, urged the ECB to keep its money presses rolling, perhaps beyond the target late next year. “The important thing is that the ECB intends to stay the course until September 2016 and that, we think, will be necessary,” said Mahmood Pradhan, deputy director of the IMF’s European department, referring to QE. Letting the €1 trillion plus scheme to buy chiefly government bonds run longer could be better still, he suggested. “It may need to go beyond that,” he said.

Worries about the global economy, prompted by a slowdown in China where shares slid more than 8% on Monday , are weighing on many countries in Europe. Manufacturing confidence in the Netherlands, with huge exposure to international trade though several of Europe’s largest ports, slipped back in July, reflecting pessimism among companies over the prospects for the coming three months. Finnish consumer and industry confidence also weakened in July compared to the previous month. But the data was mixed, with the positive Ifo report on German business confidence after two monthly drops and the ECB reporting a boom in lending for home buyers, which could bolster the bloc’s economy.

The ECB also said is M3 measure of money circulating in the euro zone, which is often an early indicator of future economic activity, grew by 5.0% in June, in line with the previous month. But lending to companies fell by 0.2% in June. This was a slower pace of decline for the 11th month in a row, but still suggested most of the ECB’s largest is going to consumers not companies. In its report on the euro zone, the IMF said that the bloc was getting stronger thanks to lower oil prices, a weaker euro and central bank action, but that medium-term prospects were for an average potential growth of just 1%. The IMF said euro area GDP should accelerate to 1.7% next year from 1.5% in 2015, with inflation of 1.1% from zero.

“In essence, Germany established that some democracies are more equal than others.”

• How the Greek Deal Could Destroy the Euro (NY Times)

Indeed, the European institutions led by Germany seem to have decided that waging an ideological battle against a recalcitrant and amateurish far-left government in Greece should take precedence over 60 years of European consensus built painstakingly by leaders across the political spectrum. By imposing a further socially regressive fiscal adjustment, the recent agreement confirmed fears on the left that the EU could choose to impose a particular brand of neoliberal conservatism by any means necessary. In practice, it used what amounted to an economic embargo — far more brutal than the sanctions regime imposed on Russia since its annexation of Crimea — to provoke either regime change or capitulation in Greece. It has succeeded in obtaining capitulation.

Through its actions, Germany has made a broader political point about the governance of the euro. It has confirmed its belief that federalism by exception — the complete annihilation of a member state’s sovereignty and national democracy — is in order whenever a eurozone member is perceived to challenge the rules-based functioning of the monetary union. In essence, Germany established that some democracies are more equal than others. By doing so, the agreement has sought to remove politics and discretion from the functioning of the monetary union, an idea that has long been very dear to the French.

The negotiations leading to the Greek agreement also destroyed the constructive ambiguity created by the Maastricht Treaty by making it absolutely clear that Germany is prepared to amputate and obliterate one of its members rather than make concessions. Germany appears to believe that the single currency ought to be a fixed exchange-rate regime or not exist at all in its current form, even if this means abandoning the underlying project of political integration that it was always meant to serve. Finally, and perhaps most importantly, Germany signaled to France that it was prepared to go ahead alone and take a clear contradictory stand on a critical political issue.

This forceful attitude and the several taboos it broke reveal that the currency union that Germany wants is probably fundamentally incompatible with the one that the French elite can sell and the French public can subscribe to. The choice will soon be whether Germany can build the euro it wants with France or whether the common currency falls apart. Germany could undoubtedly build a very successful monetary union with the Baltic countries, the Netherlands and a few other nations, but it must understand that it will never build an economically successful and politically stable monetary union with France and the rest of Europe on these terms.

Over the long run, France, Italy and Spain, to name just a few, would not take part in such a union, not because they can’t, but because they wouldn’t want to. The collective GDP and population of these countries is twice that of Germany; eventually, a confrontation is inevitable.

Yeah, but which banks? Only the Greek ones? Would that suffice? How about the rest of Europe?

• The Way To Fix Greece Is To Fix The Banks (Coppola)

Successive bailout strategies for Greece have failed to grasp the nettle of the zombie banks. The banking sector is highly concentrated, with 90% of banking assets held by four players — Alpha Bank, Eurobank, Piraeus Bank and National Bank of Greece (not to be confused with Bank of Greece, which is the central bank). All four required recapitalisation in 2012 when the “public sector involvement” restructuring impaired their holdings of Greek sovereign debt. The funds to do this were provided by eurozone and IMF creditors via the Hellenic Financial Stability Fund, the entity created in 2010 to channel bailout funds to banks. The HFSF now holds majority stakes in all four. However, recapitalising did not mean restructuring them. Nor did it mean ensuring good practice in balance sheet management.

Although the proximate cause of the 2012 bailout was the PSI, their performance had declined sharply since 2008 and they have been persistently lossmaking since about 2010. The biggest single-year loss was in 2012, but the underlying decline in profitability is actually far more damaging both to the banks themselves and to the Greek economy. The headline explanation for the banks’ problems is lack of liquidity. From 2009, successive credit rating downgrades of their own bonds and Greek sovereign debt increased their cost of funding at the same time as deposit flight increased their need of it. They lost market access in 2009 and have since relied entirely on eurosystem aid, both funding from the ECB and emergency liquidity assistance from Bank of Greece. Since March 2015, only ELA has been available, and this is currently capped by the ECB.

The banks’ dependence on official sector liquidity makes it easy to claim that their problems are caused by the restriction of it — what the former Greek finance minister Yanis Varoufakis called “asphyxiation”. Although providing liquidity beyond their credit appetite does not increase lending, restricting liquidity does force them to avoid activities that could create funding gaps. Lending, by its very nature, creates a funding gap: if banks are not confident of being able to obtain the funding to settle loan drawdowns, they will not lend. But liquidity restriction is not the whole story. The other side of the banks’ balance sheets is also to blame for the credit crunch. Since 2009, non-performing loans have risen considerably and now make up at least a third of Greek bank assets: some estimates put the figure as high as 50%.

They can start with Greece then.

• France Wants To Outlaw Discrimination Against The Poor (Guardian)

In France it could soon be illegal to discriminate against people in poverty. Under proposed legislation – already approved by the senate and likely to be passed by the chamber of deputies – it would be an offence in France to “insult the poor” or to refuse them jobs, healthcare or housing. Similar laws banning discrimination on the grounds of social and economic origin already exist in Belgium and Bolivia, but the French version is said to be the most far-reaching. Anyone found guilty of discrimination against those suffering from “vulnerability resulting from an apparent or known economic situation” would face a maximum sentence of three years in prison and a fine of €45,000.

It is easy to judge the proposed French law as showing the worst excesses of the state, or to bemoan the practicalities of how difficult it could be to implement. But most of us are content to outlaw discrimination on the grounds of race, religion, or sex. Is it so ridiculous to add poverty to that list? And if it does feel ridiculous, why is that? Whether it’s the discrimination of people in poverty or how government should respond to it, this is not a problem just for other countries. “People think that because we are poor, we must be stupid,” Oréane Chapelle, an unemployed 31-year-old from Nancy told Le Nouvel Observateur. Micheline Adobati, 58, her neighbour, who is a single mother with no job and five children, said: “I can’t stand social workers who tell me that they’re going to teach me how to have a weekly budget.”

One study reported by The Times found that 9% of GPs, 32% of dentists and 33% of opticians in Paris refused to treat benefit claimants who lacked private medical insurance. Doctors say they are “reluctant to take on such patients for fear that they will not get paid”. Does any of this sound familiar? These are attitudes – and even outright discrimination – that have been growing in Britain for some time. You can hear it in stories about local authorities monitoring how much people drink or smoke before awarding emergency housing payments. Or when politicians respond to a national food bank crisis by saying the poor are going hungry because they don’t know how to cook. It is there in the fact that it’s now all too common for landlords to refuse to rent flats to people on benefits. Britain is front and centre of its own discrimination of the poor – whether that’s low-income workers, benefit claimants, or the recurring myth that these are two separate species.

Another farce that keeps on giving.

• Dutch Journalist, MH17 Expert: ‘UN Tribunal Attempt to Hide Kiev’s Role’ (RI)

The proposed UN-backed MH17 tribunal is a “desperate attempt to hide Kiev’s responsibility”, Dutch journalist and blogger Joost Niemoller argues in his post “How Chess Player Putin Wins the MH17 Game”. Niemoller is no layman. In October 2014 he published a book on the MH17 disaster whose title De Doofpotdeal (“The Cover Up Deal”) summarizes its key argument. The inside flap explains what the author means:

“The Netherlands took charge of the investigation into the cause of the disaster, but agreed to grant a covert deal to Kiev. It thus became a pawn in an international political chess game. Unvarnished Cold War rhetoric is making a comeback. Putin here is the ultimate bad guy. What he says is labeled as poisonous propaganda in the West. Meanwhile, it seems, all those concerned suffer from tunnel vision. Can we still be assured that the investigators do their work independently and objectively?”

In his piece, Niemoller laments the shortcomings of the Dutch Safety Board, the body charged with conducting the investigations on the MH17 disaster. The ever-postponed deadline – the final report might be released at the end of the year, hence one and a half year after the crash, but that too is still uncertain – he finds perplexing:

“When the co-operating countries, the JIT (Joint Investigation Team), intend to complete their probe, is not known. Then, something gets leaked to the press: ‘At the end of this year’. With which legal framework? It is not yet known. Under which conditions? No idea. How will the co-operation between the Ukrainian, the JIT and Dutch Safety Board unfold?” “Everything is vague and secret. That is not the way it should be for such an important study.”

Niemoller contrasts this with the approach taken by Moscow:

“Russia proposed last year to conduct an international study based on research carried out by the UN – and not by means of a secret deal of countries, where one of the possible culprits, namely Ukraine, has veto power.”

Niemoller, a Dutchman, laments the dubious role of his country, especially when considering that it was the one affected most by the MH17 tragedy: 193 of the 298 victims were Dutch. And yet, Niemoller says:

“What we know for sure is that the Netherlands from day zero intensely cooperates with Kiev. What we know is that the Russians are kept out and that there is a blame game played against Putin.”

Now Niemoller focuses his attention on the role Russia is about to play. He argues that Moscow holds all the cards, and that Kiev & co apparently hold none:

“When the Russians said that if a BUK had been fired by the separatists, they would have certainly seen it on their radar, the Russians indicated that they know much more”. “After a year, there is still no evidence of that alleged separatist Buk on the table. Kindergarten-level work from Bellingcat has been dismissed. And there was no ‘Buk-track’ through the Donbas region.”

“..1) our society faces a crisis, and 2) the existing political parties are not up to the task of comprehending what society faces.”

• Potemkin Party (Jim Kunstler)

The “to do” list for rearranging the basic systems of daily life in America is long and loaded with opportunity. Every system that is retooled contains jobs and social roles for people who have been shut out of the economy for two generations. If we do everything we can to promote smaller-scaled local farming, there will be plenty of work for lesser-skilled people to do and get paid for. Saying goodbye to the tyranny of Big Box commerce would open up vast vocational opportunities in reconstructed local and regional networks of commerce, especially for young people interested in running their own business.

We need to prepare for localized clinic-style medicine (in opposition to the continuing amalgamation and gigantization of hospitals, with its handmaidens of Big Pharma and the insurance rackets). The train system has got to be reborn as a true public utility. Just about every other civilized country is already demonstrating how that is done — it’s not that difficult and it would employ a lot of people at every level. That is what the agenda of a truly progressive political party should be at this moment in history. That Democrats even tolerate the existence of evil entities like WalMart is an argument for ideological bankruptcy of the party. Democratic Presidents from Carter to Clinton to Obama could have used the Department of Justice and the existing anti-trust statutes to at least discourage the pernicious monopolization of commerce that Big Boxes represented.

By the same token, President Obama could have used existing federal law to break up the banking oligarchy starting in 2009, not to mention backing legislation to more crisply define alleged corporate “personhood” in the wake of the ruinous “Citizens United” Supreme Court decision of 2010. They don’t even talk about it because Wall Street owns them. So, you fellow disaffected Democrats — those of you who can’t go over to the other side, but feel you have no place in your country’s politics — look around and tell me who you see casting a shadow on the Democratic landscape. Nobody. Just tired, corrupt, devious old Hillary and her nemesis Bernie the Union Hall Champion out of a Pete Seeger marching song.

I’ve been saying for a while that this period of history resembles the 1850s in America in two big ways: 1) our society faces a crisis, and 2) the existing political parties are not up to the task of comprehending what society faces. In the 1850s it was the Whigs that dried up and blew away (virtually overnight), while the old Democratic party just entered a 75-year wilderness of irrelevancy. God help us if Trump-o-mania turns out to be the only alternative. Oh, by the way, notice that the lead editorial in Monday’s New York Times is a plea for transgender bathrooms in schools. What could be more important?

The western model has died.

• It’s Really Very Simple (Dmitry Orlov)

The old world order, to which we became accustomed over the course of the 1990s and the 2000s, its crises and its problems detailed in numerous authoritative publications on both sides of the Atlantic—it is no more. It is not out sick and it is not on vacation. It is deceased. It has passed on, gone to meet its maker, bought the farm, kicked the bucket and joined the crowd invisible. It is an ex-world order. If we rewind back to the early 1980s, we can easily remember how the USSR was still running half of Europe and exerting major influence on a sizable chunk of the world. World socialist revolution was still sputtering along, with pro-Soviet regimes coming in to power here and there in different parts of the globe, the chorus of their leaders’ official pronouncements sounding more or less in unison.

The leaders made their pilgrimages to Moscow as if it were Mecca, and they sent their promising young people there to learn how to do things the Soviet way. Soviet technology continued to make impressive advances: in the mid-1980s the Soviets launched into orbit a miracle of technology—the space station Mir, while Vega space probes were being dispatched to study Venus. But alongside all of this business-as-usual the rules and principles according which the “red” half of the globe operated were already in an advanced state of decay, and a completely different system was starting to emerge both at the center and along the periphery. Seven years later the USSR collapsed and the world order was transformed, but many people simply couldn’t believe in the reality of this change.

In the early 1990s many political scientists were self-assuredly claiming that what is happening is the realization of a clever Kremlin plan to modernize the Soviet system and that, after a quick rebranding, it will again start taking over the world. People like to talk about what they think they can understand, never mind whether it still exists. And what do we see today? The realm that self-identifies itself as “The West” is still claiming to be leading economically, technologically, and to be dominant militarily, but it has suffered a moral defeat, and, strictly as a consequence of this moral defeat, a profound ideological defeat as well. It’s simple.

Home › Forums › Debt Rattle July 28 2015