Howard Hollem Assembly and Repairs Department Naval Air Base, Corpus Christi 1942

I haven’t seen anyone in the US whine about currency manipulators yet. Da Donald?

• China Slashes Yuan Reference Rate by Record 1.9% (Bloomberg)

China devalued the yuan by the most in two decades, ending a de facto peg to the dollar that’s been in place since March and battered exports. The People’s Bank of China cut its daily reference rate for the currency by a record 1.9%, triggering the yuan’s biggest one-day loss since China unified official and market exchange rates in January 1994. The change was a one-time adjustment, the central bank said in a statement, adding that it plans to keep the yuan stable at a “reasonable” level and will strengthen the market’s role in determining the fixing. “It looks like this is the end of the fixing as we know it,” said Khoon Goh, a Singapore-based strategist at Australia & New Zealand Banking Group. “The one-off devaluation of the fix and allowing more market-based determination takes us into a new currency regime.”

The PBOC had been supporting the yuan to deter capital outflows and encourage greater global usage as China pushes for official reserve status at the IMF. The intervention contributed to a $300 billion slide in the nation’s foreign-exchange reserves over the last four quarters and made the yuan the best performer in emerging markets, eroding the competitiveness of Chinese exports. [..] The currency’s closing levels in Shanghai were restricted to 6.2096 or 6.2097 versus the dollar for more than a week through Monday and daily moves has been a maximum 0.01% for a month. The devaluation triggered declines of at least 0.9% in the Australian dollar, South Korea’s won and the Singapore dollar, while Hong Kong’s Hang Seng Index of shares rose 0.7%.

China has to balance the need to boost exports with the risk of a cash exodus, Tom Orlik, chief Asia economist at Bloomberg Intelligence, wrote in a research note. He estimates a 1% depreciation in the real effective exchange rate boosts export growth by 1 percentage point with a lag of three months. At the same time, a 1% drop against the dollar triggers about $40 billion in capital outflows, he wrote. “The risk is that depreciation triggers capital flight, dealing a blow to the stability of China’s financial system,” Orlik wrote. The calculation from China’s leaders is that with their $3.69 trillion of currency reserves “they can manage any risks from capital flight,” he said.

The Fed must have been expecting this.

• How To Anger Asia And The Fed In One Go: Devalue The Yuan (CNBC)

A new Asian currency war and a delayed Federal Reserve rate hike; these are the potential market-shaking implications of Beijing’s decision to devalue the yuan, strategists told CNBC. “If they are true to their word today and this is a new regime for the fixed mechanism, we might think about using the word ‘floating’ associated with the Chinese exchange rate—that’s a massive change,” noted Richard Yetsenga, head of global markets research at ANZ, referring to Tuesday’s announcement by the People’s Bank of China to allow the yuan to depreciate as much as 2% against the U.S. dollar.

The move took global traders by surprise, with many pointing to weak July trade data, the recent stock market rout’s spillover impact on consumption, and aspirations for inclusion into the IMF’s Special Drawing Rights basket as factors motivating Beijing. “It’s an interesting move which means several things: when the People’s Bank of China first started lowering interest rates and reserve requirements, that freed up bank lending, which likely went to stocks. Now this yuan re-engineering will help companies that represent the greater economy, i.e. exporters, not just companies heavily weighted in stock markets,” explained Nicholas Teo, market analyst at CMC Markets.

China may be focused on becoming more market-oriented, but Tuesday’s announcement is the latest in a series of competitive devaluations in Asia and other emerging markets, traders said. “Clearly, this is a shock to the rest of Asia. If you look at China’s top trading partners—Korea, Japan, the U.S. and Germany—this is a competitive hit to the exports of those countries. China is exporting disinflation to countries who receive Chinese exports. This is especially negative for Asia currencies,” noted Callum Henderson, global head of FX Research at Standard Chartered.

There never was another option.

• Emerging Stocks Head for Two-Year Low After China Devalues Yuan (Bloomberg)

Emerging-market stocks headed for a two-year low and currencies sank after China devalued the yuan amid a deepening slowdown in its economy. China Southern Airlines and Air China sank at least 12% in Hong Kong on concern a weaker yuan will boost the value of their dollar-denominated debt. Indonesian stocks fell to a 17-month low. China’s currency slid the most in two decades versus the dollar. South Korea’s won fell 1.3% and Malaysia’s ringgit extended declines to a 1998 low. Russia’s ruble lost 0.6%. The MSCI Emerging Markets Index slid 0.4% to 884.02 at 3:28 p.m. in Hong Kong. China’s central bank cut its reference rate by 1.9%, triggering the yuan’s biggest one-day loss since the nation unified official and market exchange rates in 1994.

Data on Tuesday showed China’s broadest measure of new credit missed economists’ forecasts last month. “This is another effort by China to boost economic growth as a weaker currency could increase exports,” said Rafael Palma Gil, a trader at Rizal Commercial Banking Corp., which has $1.8 billion in trust assets. Investors should favor companies that earn dollars over those with large dollar-denominated debts, he said. MSCI’s developing-nation stock index has fallen 7.3% this year and trades at 11.2 times projected 12-month earnings, data compiled by Bloomberg show. The MSCI World Index has added 3.3% and is valued at a multiple of 16.4.

Eight out of 10 industry groups fell, led by industrial shares. China Southern Airlines tumbled 17% and Air China was poised for the biggest drop since April 2009. Hong Kong’s Hang Seng China Enterprises Index fell 0.6%, erasing earlier gains. The Shanghai Composite Index was little changed. Indonesia’s Jakarta Composite Index tumbled 2% on concern the yuan devaluation may weaken exports from Southeast Asia’s largest economy. Shipments to China, Indonesia’s third-largest trading partner, had already dropped 26% in the first half of 2015, according to government data.

Beggar thy neighbor to the bottom of the barrel.

• China Joins The Global Devaluation Party (Coppola)

As Chinese economic performance has worsened in recent months there has been a growing divergence between RMB “central parity” (the unofficial official exchange rate) and the RMB’s market rate. This increased sharply when the most recent statistics were released. Maintaining a higher parity than the market wants is costly, as Russia could tell you: China has been unloading its foreign reserves at a rate of knots to support its currency. Maintaining too high a parity is costly in other ways too. China’s precious export-led growth strategy is at risk from the rising dollar. The “macroeconomic and financial data” referred to by the PBOC includes sharply falling exports, particularly to the EU and Japan. July’s export figures were dismal, and the trade surplus was well below forecast.

Add to this the massive over-leverage of the Chinese economy – overtly engineered by the government – and recent stock market volatility, and devaluation was inevitable. The only surprise is that the PBOC has not acted sooner. Indeed, why hasn’t it acted sooner? After all, the Fed has been passively tightening monetary policy for a year now, ending QE and repeatedly signalling that rate hikes are on the horizon. This is principally why the yuan REER has been rising. Furthermore, both the ECB and the Bank of Japan are doing QE, depressing the Euro and the yen and forcing smaller countries to defend their currencies. Emerging market economies are particularly badly affected, but we shouldn’t forget about Switzerland, which is still trying to prevent its currency appreciating as capital flows in from the troubled Eurozone. Capital inflows can be every bit as damaging as capital outflows. Reuters has an explanation for the PBOC’s reluctance to join the devaluation party:

Analysts say Beijing has been keeping its yuan strong to wean its economy off low-end export manufacturing. A strong yuan policy also supports domestic buying power, helps Chinese firms to borrow and invest abroad, and encourages foreign firms and governments to increase their use of the currency.

This brings us back to the liberalization of the Chinese financial economy. China needs the yuan to be widely accepted OUTSIDE China if it is to have any chance of becoming one of the IMF’s SDR basket currencies – the essential prelude to becoming a global reserve currency. Hence PBOC’s reluctance to devalue. So now, having been forced to devalue because of bad economic news, the PBOC is making a virtue out of necessity. Devaluing the yuan is presented as part of its liberalization strategy. Not that the PBOC has any intention of moving to a free float any time soon, though its statement does signal that it might widen the band.

Might as well give them away. Next year’s models are on the way.

• Chinese Spurn Unprecedented 30% Car Discounts Amid Slowdown (Bloomberg)

Bill Shen wants to upgrade his 8-year-old Citroen to something fancier, maybe an Audi or a BMW. But the Shanghai resident is in no hurry. Cars keep getting cheaper. Facing the slowest growth in new car sales in four years, dealerships in China have chipped away at retail prices in the past several months. Now discounts of at least 30% are being offered in major cities on hundreds of models. Audi’s top-of-the-range A8L luxury sedan, originally listed for 1.97 million yuan ($317,000), is now going for 1.28 million yuan, according to Autohome, a popular car-pricing portal. “Prices are getting lower all the time, even as cars are getting better,” said Shen, 37, who works for an auto parts company. “If it’s not urgent, one can wait.”

Consumers like Shen represent the biggest threat to China’s new-vehicle market, which overtook the U.S. in 2009 to become the world’s biggest. With the Chinese economy flagging, and government curbs on car registrations and stock market volatility deterring would-be car buyers, the auto industry is pulling out unprecedented offers to drum up sales. Their success may be reflected in industry sales figures for July slated for release on Tuesday by both the Passenger Car Association and China Association of Automobile Manufacturers. “This round of price cuts is the worst in China’s auto industry history in terms of the number of models involved and the depth of the cuts,” said Su Hui, a deputy division head at the state-backed China Automobile Dealers Association and a 26-year veteran of the trade.

“Nobody saw it coming, not the government, not the automakers, not the dealers.” Besides discounting prices, carmakers and dealers are offering incentives such as subsidized insurance, zero down-payments, interest-free financing and boosting trade-in prices, according to brokerage Sanford C. Bernstein. Peugeot Citroen and Mazda. have warned of a looming price war that will damage profit margins. BMW said this month that slowing sales in China may force it to revise this year’s profitability goals.

They’re broke just like the Chinese?!

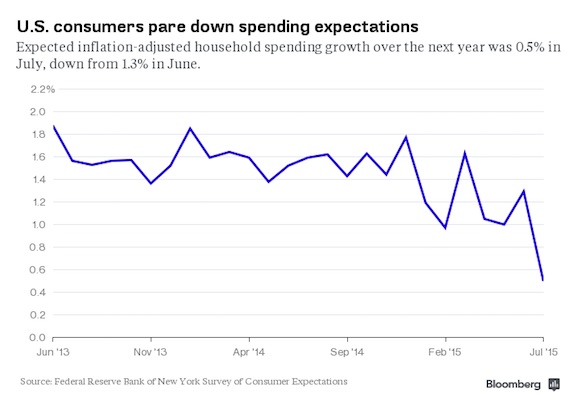

• U.S. Consumers Rein in Spending Growth Plans, New York Fed Says (Bloomberg)

U.S. consumers last month envisioned the slowest rate of growth in their planned spending in at least two years, according to a survey by the Federal Reserve Bank of New York released on Monday. The New York Fed’s July Survey of Consumer Expectations found that households expect to increase spending by 3.5% over the next year, down from the 4.3% gain seen in June, according to the median response. It was the lowest reading since the survey started in 2013. Median expected inflation over the next year was unchanged at 3%. The monthly New York Fed survey comes ahead of the release of a Commerce Department report on Thursday that is forecast to show U.S. retail sales rose 0.6% in July after falling 0.3% in June.

The Fed is looking for signs that the labor market and inflation have returned to normal before beginning to raise its benchmark federal funds rate. Most economists expect policy makers will act at their next meeting on Sept. 16-17. The Fed has kept rates near zero since 2008 to combat the worst economic crisis since the Great Depression. Spending data are important because the consumer underpins the Fed’s optimism that economic growth will accelerate. “That’s really fundamental to our improved outlook,” Chicago Fed President Charles Evans said during a breakfast with reporters last month. “We are really counting on the consumer playing a strong role.”

Tentatively for now.

• Greece And Lenders Reach Deal On Third Bailout (Kathimerini)

Greece and its lenders have reached an agreement on the terms of a third bailout, government sources said early on Monday. The deal appears to have been concluded shortly after 8 a.m. local time following a marathon last session of talks that began on Monday morning. Emerging from the Hilton hotel, where the negotiations were taking place, Finance Minister Euclid Tsakalotos suggested a deal is in place. “We are very close,” he told reporters. “There are a couple of very small details remaining on prior actions.”

Kathimerini understands that the agreement involves the government having to immediately implement 35 prior actions. The measures demanded include changes to tonnage tax for shipping firms, reducing the prices of generic drugs, a review of the social welfare system, strengthening of the Financial Crimes Squad (SDOE), phasing out of early retirement, scrapping tax breaks for islands by the end of 2016, implementation of the product market reforms proposed by the OECD, deregulating the energy market and proceeding with the privatization program already in place.

Should the agreement be finalized, it is likely to be voted on in Greek Parliament on Thursday. This would be followed on Friday by a Eurogroup and the process of other eurozone parliaments approving the deal. The European Stability Mechanism would then be in a position to disburse new loans to Athens before August 20, when Greece has to pay €3.2 billion to the ECB. Greece is aiming to receive €25 billion in the first tranche, allowing it to pay off international lenders, reduce government arrears and have €10 billion left for bank recapitalization.

Good. We wouldn’t want anything to run smoothly, would we? Where’s the fun in that?

• Germans And Slovaks Stand Ready To Scupper Greek Deal (Telegraph)

Eurozone creditor governments raised fresh concerns about the viability of a new Greek rescue package on Monday despite hopes from Athens that an agreement to unlock vital rescue funds was inching ever closer. Greeca and its creditor partners reportedly agreed on fiscal targets the country will need to hit over the next two years, on Monday evening. They would amount to a baseline of 0pc in 2015, followed by a primary surplus of 0.5pc the following year, and 1pc in 2017, according to an official quoted by Reuters. The targets would represent significant easing of the initial austerity measures demanded from Athens Leftist government, and reflect the severity of the damage that has been wrought to the economy by capital controls.

Creditors projections assume Greece will contract by another 0.5 pc in 2016, before returning to a 2.3% growth in 2017, the official added. However, in a sign of continued dissent among the ranks of Europe’s creditor nations, both Germany and Slovakia stood firm on the tough conditions Athens must accept as its price to stay in the eurozone. Sloviakian prime minister Robert Fico, who represents one of the most hardened member states against further eurozone largesse to Greece, insisted his government would not stump up a “single cent” in debt write-offs on Greece’s €330bn debt mountain. Without debt relief, the IMF has said it will pull out of talks with Athens until there is an “explicit and concrete agreement”, jeopardising the entire basis of a new three-year rescue package.

But Mr Fico said Slovakia would reject any attempt to cut the value of Greece’s debt and was “nervous” about the current status of talks between the Syriza government and its creditors. “Slovakia will not adopt a single cent on Greek sovereign debt, as long as I am prime minister”, he told Austria’s Der Standard. “There are other options: You can drag redemption dates but this also has limits: We can not wait 100 years until Greece repays its debts.” The IMF has recommended a maturity extension of another 30 years on Greece’s debt mountain; the country will already be paying back its creditors in 2057. Mr Fico added that he “wholeheartedly” supported German finance minister Wolfgang Schaeuble’s proposal for a “temporary” eurozone exit for Greece during eleventh hour summit talks in July.

“There are no rules in the EU over a euro exit…But that does not mean however, that you can not create the rules. The proposal with a fixed-term euro exit has advantages. I support the agreement reached for Greece, but we will be watching very closely what is happening now. We are nervous.”

Meanwhile, in the real world..

• Germany Gained €100 Billion From Greece Crisis, Study Finds (AFP)

Germany, which has taken a tough line on Greece, has profited from the country’s crisis to the tune of €100 billion, according to a new study Monday. The sum represents money Germany saved through lower interest payments on funds the government borrowed amid investor “flights to safety”, the study said. “These savings exceed the costs of the crisis – even if Greece were to default on its entire debt,” said the private, non-profit Leibniz Institute of Economic Research in its paper. “Germany has clearly benefited from the Greek crisis.” When investors are faced with turmoil, they typically seek a safe haven for their money, and export champion Germany “disproportionately benefited” from that during the debt crisis, it said.

“Every time financial markets faced negative news on Greece in recent years, interest rates on German government bonds fell, and every time there was good news, they rose.” Germany, the eurozones effective paymaster, has demanded fiscal discipline and tough economic reforms in Greece in return for consenting to new aid from international creditors. Finance Minister Wolfgang Schaeuble has opposed a Greek debt write-down while pointing to his own government’s balanced budget. The institute, however, argued that the balanced budget was possible in large part only because of Germany’s interest savings amid the Greek debt crisis.

The estimated €100 billion euros Germany had saved since 2010 accounted for over 3% of GDP, said the institute based in the eastern city of Halle. The bonds of other countries – including the United States, France and the Netherlands – had also benefited, but “to a much smaller extent”. Germany’s share of the international rescue packages for Greece, including a new loan being negotiated now, came to around €90 billion, said the institute. “Even if Greece doesn’t pay back a single cent, the German public purse has benefited financially from the crisis,” said the paper.

And on top of the €100 billion German profit from Greece, there are the secret side deals with German arms industry. That the Troika will refuse for Syriza to cut.

• Greek Military: Armed and Financially Dangerous (Zeit)

The Bonn International Center for Conversion has listed Greece among the most militarized countries since 1990. It was ranked ninth in 2014, ahead of all other NATO members – despite Greece’s financial crisis. “Athens’ high arms expenditures and extensive weapons purchases over the past years have contributed to the desolate budget situation,” according to BICC. The figures show that Greece invested nearly €6 billion in its military in 2000. Eight years later, the figure was €8.6 billion. In 2009, Europe’s NATO member countries spent an average of 1.7% of their GDPs on defense – Greece was at 3.1%. The country was among the world’s five biggest arms importers between 2005 and 2009, according to the Stockholm International Peace Research Institute.

Athens’ high arms expenditures and extensive weapons purchases over the past years have contributed to the desolate budget situation. In May 2010, Greece had to be saved from financial ruin, and eventually received a loan package of hundreds of billions of euros. The government used some of this money to buy more weapons. Now, even more cash is on the table. The Greek government, led by Alexis Tsipras, has accepted a number of conditions connected to the deal. Greece must save money. The value-added tax has been increased, pension payments are to decrease, state-owned companies are to be privatized, and corruption weeded out. But only marginal consideration has been given to the country’s huge military expenditures. The army remains sacrosanct.

Politicians and others in Germany have often harshly criticized Mr. Tsipras. But the critics seem to forget that debt-ridden Greece until recently was ordering armaments worth billions of euros from Germany. Between 2001 and 2010, Greece was the most important customer for the German defense industry. During this period, Greece bought 15% of all of Germany’s exports, SIPRI estimates. Greece’s armed forces have nearly 1,000 German-developed model Leopard 1 and 2 combat tanks. Including models from other countries, Greece has 1,622 tanks. The German military has 240 Leopard tanks in service. (That number is to increase by around 90 because of the crisis in Ukraine.) While the German armed forces have been shrinking and phasing out military equipment for years, Greece has gone the other way. No other E.U. country has more combat tanks today.

A very flawed article that presents predictions by Bloomberg Survey economists as fact.

• Deflation Stalks the Euro Zone (Bloomberg)

The euro zone is poised to record its ninth quarter of economic growth, with economists predicting that gross domestic product figures scheduled for release Friday will show the economy expanded by 0.4% in the second three months of the year. Unfortunately for the ECB, that revival isn’t dispelling the risk that disinflation will worsen into deflation. For reasons that future historians of economic policy may struggle to unravel, modern central bankers have decided that the Goldilocks rate of acceleration for consumer prices to run not too hot, not too cold, is 2%. And while forecasts compiled by Bloomberg suggest that economists expect the U.S. to achieve that state of inflationary nirvana in the first three months of next year, prices in the euro region are seen languishing at 1.5% in the first quarter of 2016 and then decelerating.

That outlook helps to explain why almost a quarter of the market for euro-zone government bonds has negative yields, meaning investors are paying for the privilege of keeping their money in $1.5 trillion of securities, according to data compiled by Bloomberg reporters Lukanyo Mnyanda and David Goodman. It has been almost a year, for example, since German two-year notes paid more than zero. The disparity in the inflation outlooks for the euro region and the U.S. is also driving a divergence in borrowing costs. As Bloomberg strategist Simon Ballard points out, investment-grade borrowers are paying more to borrow dollars than euros, and the gap has reached its widest level since at least December 2009.

I said it before: Elvira Nabiullina is a smart cookie. Moreover, Russian debt levels are very low compared to western nations. The demise of Putin is greatly exaggerated in the western press.

• Bank of Russia Gets Putin’s Praise as Ruble Rebounds With Crude (Bloomberg)

Russian President Vladimir Putin commended the central bank for its efforts to keep the ruble stable after policy makers called for calm as the currency bounced back from a six-month low. “The central bank is doing a lot to strengthen the national currency or in any case to ensure its stability and the stability of the financial system as a whole,” Putin said at a meeting with Governor Elvira Nabiullina. “I see how persistent you are in going down that path.” The Bank of Russia said on Monday that corporate debt payments in 2015 won’t overwhelm the foreign-exchange market with “excessive demand” after redemptions last year helped spark the worst currency crisis since 1998.

Companies and lenders have to repay as much as $35 billion out of the $61 billion that falls due from September to December, the central bank said on its website. The rest may be rolled over or refinanced because some of it is owed to affiliated companies, it said. [..] Policy makers are short on instruments as they try to avert another ruble collapse after a rushed switch to a freely floating currency in November. While the central bank has faced questions about its commitment to allow the market to set the ruble’s exchange rate, the Russian leadership has been more unabashed in acknowledging a measure of control over the currency market as the economy succumbs to a recession. Putin said in June that a weaker ruble was helping Russian companies weather the economic crisis.

The central bank last month halted foreign-currency purchases, started in mid-May to boost reserves, after a renewed slide in commodity prices triggered further ruble declines. It defended the operations as compatible with its free float and has pledged to avoid interventions unless the ruble’s swings threatened financial stability. With its statement on Monday, the central bank is conducting “verbal intervention aimed at stabilizing market sentiment regarding the ruble,” Dmitry Dolgin, an economist at Alfa Bank in Moscow, said by e-mail. “There are concerns on the market that the looming repayment of external debt will exert significant pressure on the balance of currency demand and supply on the domestic market, especially under the conditions of falling oil prices.”

Her popularity rate is at 8%.

• Impeaching Rousseff Would Set Brazil On Fire: Senate Chief (Reuters)

The president of Brazil’s Senate said on Monday that attempting to impeach President Dilma Rousseff was not a priority and warned that seeking her removal in Congress would “set the country on fire.” Renan Calheiros, who is often critical of the administration, struck a more positive tone amid a deepening political crisis after seven months into Rousseff’s second term. Many of the president’s opponents in Congress have called for her impeachment for allegedly breaking the law by doctoring fiscal accounts to allow her government to spend more in the run-up to her re-election in October. Calheiros, a leader of the country’s biggest party, the PMDB, spoke to reporters after meeting with Finance Minister Joaquim Levy to discuss the government’s fiscal austerity plan.

He promised to bring to a vote this week a bill that rolls back payroll tax breaks, which would save the government nearly 13 billion reais ($3.78 billion) a year. The rollback is the last key bill to be approved in an austerity package aimed at preserving the country’s investment-grade rating. The Brazilian real, buffeted by political uncertainty in recent weeks, added some gains after Calheiros’ comments. The lower chamber of Congress, whose speaker recently defected to the opposition, decides whether to start an impeachment process, which then goes to the Senate for a final ruling. Rousseff would be suspended as soon as the lower chamber agrees to impeach her, which requires two-thirds of the votes.

Rousseff’s support in Congress is rapidly fading as the economy heads toward a painful recession and a widening corruption scandal at state oil company Petrobras rattles the country’s political and business elite. Her popularity is at record lows and opponents plan a nationwide anti-government protest on Sunday. Congress has resisted Rousseff’s austerity efforts by watering down measures to cut expenditure and raise taxes, while passing bills that raise public spending.

But.. but.. that’s protectionism…!

• UK Farming Unions Call For ‘Seismic Change’ In Way Food Is Sold (Guardian)

Farming is in a “state of emergency” and a “seismic change” is needed to the way food is sold in Britain, agriculture leaders have warned after a crisis summit on falling milk prices. Leading farming unions called on the government to introduce long-term contracts between farmers, distributors and supermarkets and to force retailers to clearly label whether their products are British or imported. The emergency summit in London followed days of protests from farmers over the sharp fall in the prices they are being paid for milk. Asda and Morrisons distribution centres have been blockaded, farmers have removed cartons of milk from supermarkets and cows were paraded through the aisles of an Asda store in Stafford.

Figures from AHDB Dairy, the trade body, show that the average UK farmgate price for milk – the price that farmers are paid – has fallen by 25% over the last year, to 23.66p per litre. Industry experts claim it costs farmers 30p per litre to produce milk, meaning farms have been thrown into chaos by the drop in prices. Farmers have blamed the fall in prices on a supermarket price war but retailers claim the drop reflects declining commodity prices and an oversupply of milk, partly caused by Russia’s block on western imports. Farmers For Action, the campaign group behind the milk protests, is scheduled to meet representatives from Morrisons on Tuesday to discuss the crisis.

The farming unions warned of “dire consequences for the farming industry and rural economy” if the way in which food is sold does not change in the near future. The presidents of the NFU, NFU Scotland, NFU Cymru, Ulster Farmers Union and four other unions, said: “We would urge farm ministers across the UK to meet urgently. They need to admit that something has gone fundamentally wrong in the supply chain and take remedial action. “In general, voluntary codes are not delivering their intended purpose. Government needs to take action to ensure that contracts to all farmers are longer-term and fairer in apportioning risk and reward. “Government also needs to urgently ensure that rules are put in place regarding labelling so that it is clear and obvious which products are imported and which are British.”

Sold their soul.

• New Zealand A ‘Virtual Economic Trade Prisoner Of China’ (Nz Herald)

No one doubts the benefits of extending our trade opportunities – but many are alarmed at a dangerous naivety in what passes for our trade policy. That policy reflects our unfortunate dependence on a single commodity; our anxiety to maximise our one trading advantage by currying favour with powerful trading partners has led us into some treacherous waters. We have, for example, rapidly built up a Chinese market for our dairy produce with the result that – without any assurance that that market will remain open to us – we are now virtually economic prisoners, forced to meet almost any Chinese demand in order to retain a market that has become our life blood.

We have chosen, for example, to avert our gaze from the obvious effects of Chinese intervention in the Auckland property market for fear of offending Chinese opinion. More importantly, we have apparently not recognised that the Chinese interest goes beyond merely buying our products in a normal trading relationship, but extends to obtaining control of the productive capacity itself. Dairy farms themselves, processing plants, manufacturing capacity, expertise of various sorts are now owned by Chinese operators; their production increasingly by-passes New Zealand economic entities and suppliers and is marketed by Chinese companies directly to the Chinese consumer.

There are of course many instances of Chinese capital being deployed across the globe in pursuit of assets and capacity. This is not a cause for criticism – the Chinese are entitled like anyone else to pursue their own interests. It is simply a statement of fact. We, however, seem unaware of what is happening. It is no accident that this direct supply to the Chinese market has accompanied a fall in the proportion of New Zealand dairy production handled by Fonterra. While the proportion of our dairy production under Chinese control is still quite small, there can be little doubt that it will grow.

Low dairy prices will force the sale of a number of farms to foreign owners. As the Chinese increasingly control their own sources of supply, their reduced requirements for dairy produce on international markets will inevitably mean downward pressure on prices. Nor is it just the ownership of the physical product that has passed into foreign and often Chinese hands. The decision to allow non-farmer ownership of “units” (or, in other words, shares) in Fonterra has meant that we must now face the prospect of a significant part of the income stream from our most important industry to pass into private and often foreign hands.

Over 6 years?! How about right now, and handle the issue properly?

• EU To Provide $3.6 Billion Funding For Migrant Crisis Over 6 Years (Reuters)

The European Commission on Monday approved €2.4 billion of aid over six years for countries including Greece and Italy that have struggled to cope with a surge in numbers of immigrants. Italy is to receive the most aid – nearly €560 million, while Greece will receive €473 million. Tensions have escalated this year as thousands of migrants from the Middle East and Africa try to gain asylum in the European Union. In Calais, a bottleneck for migrants attempting to enter Britain illegally through the Eurotunnel from France, has seen several migrant deaths this month.

Britain has already received its €27 million from the commission in emergency aid funding, which it applied for in March. France will receive its €20 million later this month. Neither country has requested additional aid for security in Calais and will not receive funds from the latest aid program. “We are now able to disburse the funding for the French national program and the UK has already received the first disbursement of its funding,” Natasha Berthaud, a European Commission spokeswoman, said. . “Both of these programs will, amongst other things, also deal with the situation in Calais.” The Commission plans to approve an additional 13 programs later this year, which will then be implemented by EU member states.

The only answer Europe ever seems to have.

• French Police Say Time To ‘Bring In British Army’ To Calais (RT)

Police in Calais, from where thousands of illegal immigrants from Africa and the Middle East risk their lives trying to cross the English Channel to make it to the UK, have suggested bringing in the British army to curb the crisis. The head of the Alliance union for police deployed to the French port and Eurotunnel site, Bruno Noel, has warned that the situation could soon get out of control if additional help is not provided. He complained that his unit is “doing Britain’s dirty work.” “We have only 15 permanent French border police at the Eurotunnel site,” the Daily Telegraph quoted him as saying. “Can you imagine how derisory this is given the situation? “So I say, why not bring in the British Army, and let them work together with the French?” Mr Noel added.

According to different estimates, between 2,000 and 10,000 migrants in Calais are trying to cross the English Channel. Many have attempted to reach Britain by boarding trains through the tunnel or on lorries bound for UK destinations. Twelve people have died this year attempting to reach the UK. The numbers of migrants in the Calais camp, known as The Jungle, have soared over the past few months from 1,000 in April to nearly 5,000 by August. The first call to use British troops was made by Kevin Hurley (former Head of Counter Terrorism for City of London Police, an ex-Paratrooper and an expert on international security), who is currently Police and Crime Commissioner for Surrey. He said the problems stemming from the crowds of migrants trying to enter the UK from Calais through the Channel Tunnel could be dealt with efficiently by Gurkha regiments, based close by in Hythe, a small British coastal market town on the south coast of Kent.

The 700-strong 2nd Battalion of the Royal Gurkha Rifles has been based in the Shorncliffe and Risborough barracks just outside Hythe since 2000, according to Office of the Police and Crime Commissioner for Surrey. “I am increasingly frustrated by the huge numbers of illegal migrants who jump out of the backs of lorries at the first truck stop – Cobham Services in Surrey – and disappear into our countryside. There were 100 in the last month alone,” Mr Hurley said late last month. “But, while the UK and French governments decide their next prevention strategy we, the British police, have to deal with the immediate problem. The Gurkhas are a highly respected and competent force, and are just around the corner. They could help to ensure that our border is not breached,” he added.

Mass migrations cannot be stopped.

• History In Motion (Pantelis Boukalas)

Throughout the history of mankind the walls protecting cities under siege were never able to keep a determined enemy away forever – a first wave would be followed by a second, and so on. But when that enemy conquered those cities, the waves would stop. However, the overwhelming waves of migrating people that are reaching our shores today, mobilized by the desperate need for survival as opposed to the desire to conquer, will simply keep coming. These desperate people are trying to escape Middle Eastern, Asian and African countries where poverty, war and a lack of freedom threaten their very existence. What has been set in motion now is not the persecution of certain populations, but history itself.

This process cannot be halted, no matter how many fences are erected, no matter how many high walls are put up, such as the ones under construction by Hungary at its border with Serbia, or those envisioned by controversial mogul Donald Trump, a candidate for the Republicans’ presidential ticket, at the US-Mexico border. As for the Channel Tunnel, do the British truly believe that 50,000 – instead of 5,000 – determined refugees in Calais could be prevented from crossing at the mere sight of police officers and weapons? A recent editorial in The New York Times was poignant: “Residents on the island of Lesbos – where many refugees from the Middle East land because of its proximity to Turkey – have responded generously, providing meals, blankets and dry clothing.

Their response should shame others in Europe, particularly the British government, which is panicking over the prospect that a mere 3,000 migrants in Calais, France, might make it across the English Channel.” So far, despite officials’ meetings, the positions of Central and Northern Europe with regard to the refugee issue leaves a lot to be desired. As if Italy’s southern borders and Greece’s eastern borders were not the European Union’s own borders.

“..only two of 85 medical institutes and 15 of 159 nursing and other care facilities within a 30-kilometre radius of the Sendai plant had proper evacuation plans.”

• Japan Restarts Sendai Nuclear Reactor Despite Public Opposition (Fairfax)

Japan has restarted its first nuclear reactor since new safety rules were ordered in the wake of the 2011 Fukushima disaster, despite vocal public opposition and anxiety. After months of debate about safety, the No 1 reactor at the 30-year-old Sendai nuclear power plant, on the southwest island of Kyushu, became the first to be brought back to life on Tuesday morning. The reactor, one of 25 which have applied to restart, will begin generating power by Friday and reach full capacity next month. Prime Minister Shinzo Abe has made the restart of the country’s nuclear energy industry a priority of his administration, with the hiatus sending electricity bills soaring, providing a drag on his so-called Abenomics reforms, and serving to highlight Japan’s dependence on energy imports.

But with the scars of Fukushima yet to fade, newspaper polls have shown a majority of Japanese oppose the restart. Mr Abe’s personal approval ratings have also plumbed new depths, having also come under fire for pushing through a controversial new national security bill that will see Japanese troops fight overseas for the first time since World War II. “I would like Kyushu Electric to put safety first and take utmost precautions for the restart,” he said. Yoshihide Suga, the chief cabinet secretary, said “it is important for our energy policy to push forward restarts of reactors that are deemed safe”.

But local residents said they are worried about potential dangers from active volcanoes in the region, and there was no clarity around the evacuation plans for nearby hospitals and schools. An Asahi Shimbun newspaper survey found only two of 85 medical institutes and 15 of 159 nursing and other care facilities within a 30-kilometre radius of the Sendai plant had proper evacuation plans. About 220,000 people live within a 30-kilometre radius – the size of the Fukushima no-go zone – of the Sendai plant. “You will need to change where you evacuate to depending on the direction of the wind. The current evacuation plan is nonsense,” Shouhei Nomura, a 79-year-old former worker at a nuclear plant equipment maker, who now opposes atomic energy and is living in a protest camp near the plant told Reuters.

A little physics fascination.

• A Good Week For Neutrinos (Butterworth)

Neutrinos are made by firing protons into a target. This produces lots of mess, including charged particles called pions (made of a quark and an antiquark), which travel a while and can be focussed into a beam. They eventually decay to neutrinos, which remain in a collimated beam and, mostly, just carry on without interacting with anything. Crucially though, a few of them will, by random luck (maybe bad luck from the neutrinos point of view) collide with normal matter, some of it (by good luck from the physicists point of view) the matter inside the NOvA far detector, which can measure what kind of neutrinos they were.

The vast majority of neutrinos produced when a pion decays are so-called “muon neutrinos”. This means when they interact they should produce muons (a heavier version of the electron). If the neutrinos did nothing odd during their 800 km journey to NOvA, about 200 of them should have been seen by now. However, only 33 turned up. Also, six electron neutrinos turned up, when only about one would be expected.

This is evidence that the neutrinos transmogrify, or “oscillate”, during their journey. That is, they change types. This behaviour is already known; it is how we know neutrinos have mass (in the original version of the Standard Model of particle physics they were massless), and it may be connected with mysterious fact that there is so much matter around and so little antimatter. Studying this kind of mystery is what Nova was built for, and this confirmation of neutrino oscillations is just the start.

Home › Forums › Debt Rattle August 11 2015