Harris&Ewing Boy Scout farm 1917

While you were sleeping…

• Who Needs The Fed? The Rate Hike Cometh On Its Own (Reuters)

As traders, market pundits and economists jaw over whether the Federal Reserve this year will lift its benchmark lending rate for the first time in almost a decade, several corners of the U.S. bond market are not waiting around. A wide range of short-term interest rates, which tend to be the most sensitive to Fed policy expectations, has been quietly grinding higher for weeks, or in some cases much longer. Several have even surpassed their levels of two years ago during the bond market’s “taper tantrum,” when prices dropped steeply and yields shot up as the Fed pondered whether to halt its massive asset-purchase program.

Banks, money market mutual funds and other investors do not want to be stuck with low-yielding debt when the U.S. central bank finally does begin raising interest rates, something it last did in June 2006. Generally positive comments about the economy by the Fed at the conclusion of its latest policy meeting on Wednesday signaled to many that a rate rise could come as early as September. “The confidence is starting to rise about a rate hike,” said Gennadiy Goldberg, interest rate strategist at TD Securities in New York. “You want to be compensated for at least one hike.” For example, overnight bank borrowing rates have been inching up for the better part of a year and are around 36% more costly than in May 2014, when they fell to a record low.

Yields on investment-grade corporate bonds are holding near recent two-year highs, and the premium paid for holding them relative to Treasuries is the steepest since September 2013. And even as yields on bond market benchmarks such as the 10-year Treasury note and 30-year T-bond have seen only intermittent upward pressure, those on shorter-dated Treasuries are decidedly higher. The yield on two-year Treasury notes, at 0.73% on Thursday, was just a tick from a four-year high and more than three times that of May 2013. Rates on T-bills with durations of less than a year are at their highest so far this year. Yields, or rates, move inversely to the price of bonds.

All that comes from China officials is politicized nonsense.

• China Central Bank Official Sees Downward Pressure On Economy Persist (Reuters)

Downward pressure on China’s economy will persist in the second half of the year as growth in infrastructure spending and exports is unlikely to pick up, a senior central bank official was quoted as saying. Chinese companies are not optimistic about business prospects according to the central bank’s second-quarter survey, Sheng Songcheng, the director of the statistics division of the People’s Bank of China (PBOC), was quoted as saying by the National Business Daily on Saturday. Pressured by uneven domestic and export demand, cooling investment and factory overcapacity, China’s economic growth is expected to slow to around 7% this year, the lowest in a quarter of a century, from 7.4% in 2014.

A plunge in the country’s share markets since mid-June has added to worries about the economy, and reinforced expectations that policymakers will roll out more support measures in coming months to avert a sharper slowdown. The PBOC has already cut interest rates four times since November and repeatedly loosened restrictions on bank lending in its most aggressive stimulus campaign since the global financial crisis. Sheng warned about the risks of local government debt, saying that 2 trillion yuan ($322.08 billion) in bond swaps may not be able to fully cover maturing debt, according to the report. Sheng said the PBOC needs to step up the monitoring of local government financing vehicles given the current downturn in property market and limited local government revenues.

Sheng also said he expected second-quarter net profit growth for banks to fall, adding that banks’ exposure to risk “has become clearer”. But he said the real-estate market could rebound in the second half and provide support for the economy. Sheng said he still expects economic growth this year of around 7%, an inflation target of around 1.5% and growth of M2 – a broad-based measure of money supply – of around 12%.

I’ve said this a lot: “China’s economic structure is built around the presumption of very rapid growth.” Beijing’s trying to make a supertanker change course on a dime.

• China’s Naked Emperors (Paul Krugman)

Politicians who preside over economic booms often develop delusions of competence. You can see this domestically: Jeb Bush imagines that he knows the secrets of economic growth because he happened to be governor when Florida was experiencing a giant housing bubble, and he had the good luck to leave office just before it burst. We’ve seen it in many countries: I still remember the omniscience and omnipotence ascribed to Japanese bureaucrats in the 1980s, before the long stagnation set in. This is the context in which you need to understand the strange goings-on in China’s stock market. In and of itself, the price of Chinese equities shouldn’t matter all that much. But the authorities have chosen to put their credibility on the line by trying to control that market — and are in the process of demonstrating that, China’s remarkable success over the past 25 years notwithstanding, the nation’s rulers have no idea what they’re doing.

Start with the fundamentals. China is at the end of an era – the era of superfast growth, made possible in large part by a vast migration of underemployed peasants from the countryside to coastal cities. This reserve of surplus labor is now dwindling, which means that growth must slow. But China’s economic structure is built around the presumption of very rapid growth. Enterprises, many of them state-owned, hoard their earnings rather than return them to the public, which has stunted family incomes; at the same time, individual savings are high, in part because the social safety net is weak, so families accumulate cash just in case. As a result, Chinese spending is lopsided, with very high rates of investment but a very low share of consumer demand in GDP.

This structure was workable as long as torrid economic growth offered sufficient investment opportunities. But now investment is running into rapidly decreasing returns. The result is a nasty transition problem: What happens if investment drops off but consumption doesn’t rise fast enough to fill the gap? What China needs are reforms that spread the purchasing power — and it has, to be fair, been making efforts in that direction. But by all accounts these efforts have fallen short. For example, it has introduced what is supposed to be a national health care system, but in practice many workers fall through the cracks.

But there are no markets left these days. There’s only QE.

• China’s Stock Markets: Nearly 25 Years of Wild Swings (WSJ)

In the two years after China opened its stock markets, shares soared 1200% and twice fell by half. Investors seeking IPO shares rioted, overturning cars and smashing windows, leading police to use tear gas and fire their guns in the air to quell the disturbance. China will celebrate the 25th anniversary of the opening of its stock markets later this year, and not much has changed since their founding. They vacillate between big government-driven rallies and equally dramatic selloffs that leave once-euphoric investors disillusioned and angry. “China’s stock markets have developed quickly and their accomplishments are great, but they are very irregular,” Zhu Rongji, China’s premier at the time, said in 2000. “If they are to receive the people’s trust, the investors’ trust, then they have a lot of work to do.”

Stocks are down by 29% from their peak in June, and investors have continued to sell shares despite the strongest efforts ever by Beijing to prop up prices. The current bear market—defined as a fall of 20% or more from a peak—is the 27th that investors have suffered in the past 25 years. It is the 21st worst in terms of losses. Shares have lost half their value three times, and plummeted by two-thirds once, in 1993-1994, when the Shanghai Composite Index fell by 67% from its peak to its low point. The 27 bull markets have been equally dramatic, though none has come close to the initial 1200% gain. The market has gained more than 100% on eight occasions. The most recent bull market, which began in December 2012 and stretched until June, making it the longest in China’s history, clocked in at 164%.

The reopening of the Shanghai market, which dated to the 1860s and had been closed since the Communist takeover in 1949, signaled a victory for economic reformers led by Deng Xiaoping. The Shenzhen market, created in 1990, was a boost for the southern Chinese city that was home to some of the most far-reaching economic overhauls. Still, the government maintained heavy control over the markets. Investors based their buy and sell decisions on what they thought Beijing would do next. The 1992 riots, in a tense period just three years after the Tiananmen Square crackdown, highlighted the perception among investors that the government effectively ran the stock markets. Hundreds of thousands of people lined up over a hot August weekend to get applications to invest in initial public offerings, which they believed would soar because every IPO had to be approved by the government.

Can we have a bit more depth from the Observer next time?

• Fears For Chinese Economy As Shares Fall (Observer)

[..] there are growing concerns about what the stock price rollercoaster reveals about the health of the world’s second largest economy. Christine Lagarde, the managing director of the IMF, played it cool when asked about the Chinese market gyrations in a press conference on Wednesday. She pointed out that the market was still up an extraordinary 80% over the past year, and added she was not surprised the government in Beijing was intervening to prevent the “disorderly functioning” of markets. “That is the duty of central authorities,” she said. “The fact that they want to maintain a level of liquidity that is commensurate with an orderly process is quite good.”

In other words, while some have condemned Beijing’s efforts to arrest the share slide as clunky and authoritarian, Lagarde saw it as little different to the scramble by western governments during the 2008 crisis to prevent their financial systems from seizing up. She was relaxed, too, about the potential impact of the share price slide on China’s real economy – the shops, factories and farms that create jobs and generate growth. “We believe that the Chinese economy is resilient and strong enough to withstand that kind of significant variation in the markets,” she said. Yet many analysts believe that as well as the bursting of a financial bubble, the downturn in the stock market reflects a wider economic slowdown.

Robert Shapiro, a former economic adviser to Bill Clinton, who now works at US consultancy Sonecon, says: “The Chinese leadership have had a fundamental policy of driving growth sufficiently great to generate employment for about 10 million people a year. The main way they’ve done this is through public investment, or semi-public investment. A lot of these projects are now going bust, because there’s nobody to purchase the apartments, and there are no businesses to rent the offices.”

This is a trend far from finished.

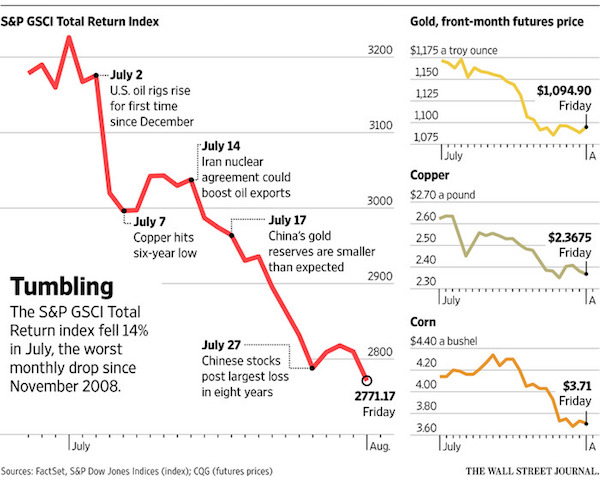

• Commodities Slide Deeper Into a Rut (WSJ)

Commodity prices tumbled anew, plunging the S&P GSCI Total Return index to its worst monthly loss since November 2008 and deepening a yearslong rout that few observers expect to moderate. The index, which tracks a basket of commodities, fell to its lowest level since 2002 on Friday, according to data from S&P Dow Jones Indices. All but one of the 24 index components posted losses for July. Investors in commodity markets are confronting threats from a slowdown in China, an anemic global economy and the prospect of higher U.S. interest rates from the Federal Reserve.

The dollar, which has rallied this summer on expectations of tighter U.S. monetary policy, is also pressuring prices of raw materials, which are traded in the U.S. currency and become more expensive for buyers in other countries when the buck rallies. Hopes that China has seen the worst of its economic slowdown were spurned after the country’s stock market dived in July, notching its worst month in six years. China is the largest consumer of raw materials, and investors now fear that problems in its equity market will reverberate across the economy in coming months as cash-strapped consumers abort purchases of new cars, homes and other goods. Europe is battling to stave off another economic downturn. A weaker euro hasn’t buoyed exports from the region, and growth and inflation remain stubbornly low.

This dims any prospect of higher demand for raw materials from the region. Commodity prices are also under pressure as supply of many raw materials runs ahead of global demand. Companies that grow soybeans or mine for coal outside the U.S. are opting to keep up production because weaker domestic currencies keep their costs low, while a stronger dollar means they bring home larger profits despite falling prices. Against this backdrop, many investors are choosing to give commodities the cold shoulder. “Folks are being very cautious in terms of where they want to apply their capital, we’ve seen that in commodities…it just continues to be an area that people want to avoid,” said Dan Farley at State Street Global Advisors.

Excellent write-up. The term ‘financial realism’ must be a keeper.

• In Favour Of Varoufakis’ Plan B (Paul Tyson)

Mr Varoufakis’ plan B, including the mode in which he developed this plan, is a function of his rejection of the social and political unaccountability of foreign financial power within the Greek nation. Perhaps it may also be a moral rejection, under extreme circumstances, of the validity of laws that facilitate the destruction of the Greek finance sector by the troika. Given that Varoufakis was given political authority by his Prime Minister to pursue this plan, then perhaps his mode of pursuit should be evaluated in relation to the political agendas he was politically authorized to advance. The salient evaluation questions are then would this plan save, in some form, the personal savings of the Greek people, and would it facilitate an operational finance sector for Greece, after Grexit?

I think there can be little doubt that Varoufakis’ plan B would have been the best practical option for the Greeks if they had of been forced out of the Eurozone after June 5 referendum, if Syriza had held fast to its original platform. In thinking about the rules of finance outside of the box mandated to him by the troika, Varoufakis acts out of a concern to promote the wellbeing of the Greek people. Such free and creative thinking, and such motivations, are an affront to the financial realism of the troika because Greece is a small and indebted player in someone else’s financial game, ridiculously seeking to operate outside of the rules that those in power have set in place to suit themselves. This Greek rule-bending ambition, from a position of weakness, violates the basic principles of financial realism.

It is true, Varoufakis defies the laws of financial realism. However, he does not take this stance up out of naivety. Indeed, Varoufakis is all too aware of how financial realism operates. What makes him such a political anomaly is that he is also aware of three other things. Firstly, as an “erratic Marxist” and a gifted mathematician and political economist, Varoufakis is aware that indeterminacy is a basic feature in all human arenas of belief and action. This gives him a philosophical awareness of the dialectic between necessity and freedom which enables him to believe in politics rather than simply in power. This delineates him from the blind determinacy and complete political indifference of dedicated financial realists, both in Brussels and in the mainstream media.

Secondly, he is aware that financial realism violates the basic principles of democratic accountability, national sovereignty and moral responsibility. As he believes in that which financial realism violates, he must reject financial realism. Thirdly, he is aware that the rules of finance do not have to be set up to function in financial realist terms. He is intelligent enough to be able to think outside the box, and morally and philosophically courageous enough to make practical plans on the basis of genuinely creative initiatives. In today’s very conformist world of power, this sort of leader is very hard to find. These three factors make Varoufakis a potentially radical political non-conformist in the Eurozone, who just might upset the whole apple cart of the financial realist status quo.

This is why the likes of Schäuble loathe Varoufakis. Yanis threatens the very philosophical foundations of their power. In order to preserve the power of the financial realists, Varoufakis simply must not be taken seriously. Hence, all this patronising media dribble about his clothes, motorbike and hair. Hence, all these relentless media beat-ups about any action he takes that is not coherent with financial realism. Hence all these red herrings about how undiplomatic he is without comment on how sensible and genuinely interested in constructive outcomes he is. The media loves to analyse his style and manner, but seldom has any serious interest in the substance of what he says.

” In that respect, and that’s a very important respect, the parliament in Greece is no longer even remotely a sovereign entity.”

• James Galbraith on Greek Plan B (TRN)

PERIES: So James, let’s begin with what your role was in deriving Plan B. GALBRAITH: Well, I had to do background research and to assemble experiences of other countries and other situations, including some of the experiences in the United States during the depression, to basically to put together for the use of the Greek government of a list of problems, challenges that would have to be faced if Greece were forced against its will to exit the eurozone. This was contingency planning, it was precautionary.

PERIES: And did it include a process to deal with printing the drachma, and reviving the mint? GALBRAITH: Well you know, if you have to completely go over to a new banknote you’re going to have a considerable time lag before it becomes available. So we were concerned, for example, with how you handle the need for cash liquidity during that intervening period. That was a substantial challenge, for example.

PERIES: Okay. Could you expand on some of the intricacies of what Plan B looked like? GALBRAITH: That’s a discussion I think for another time, but there were a great many things that you would worry about. Fundamentally if you’re, have to transition currency you have a considerable cost of making that transition. The challenge is how to protect the most vulnerable people in society from those costs. How to protect, for example, retirees. How to protect people who are in need of healthcare. And after that immediate transition has passed there’s a question of how you manage the new currency, how you in particular control foreign exchange transactions and the exchange rate.

PERIES: Let’s get to the, so the relationship with Europe and the Troika here. In this op-ed that Varoufakis penned in FT he complains, and I quote, there is a hideous restriction of national sovereignty imposed by the Troika. Here he is complaining about being denied access to departments of his own ministries which he says is pivotal in implementing innovative policies. So I guess the question is, who does collect the taxes and who has access to the tax system and tax collection data in Greece? GALBRAITH: We were not engaged in anything that was internal to the operations of the finance ministry. But there are issues in which the, in the dictat that was imposed on Greece in July, for example, there are further inroads on the sovereignty of the Greek state, the imposition of requirements that major offices, including the Statistical Office, be taken basically out of the control of Greek government and placed more or less directly in the hands of the creditor institutions.

And that’s problematic. The most problematic thing of all along that line is the requirement in the terms that were dictated to Greece that new proposals to the parliament not even be made by the government unless they’ve been previously approved by the creditors. So that is in some sense a blatant, a flagrant violation of the basic principle of the European Union, which is that it’s built upon representative democracy. In that respect, and that’s a very important respect, the parliament in Greece is no longer even remotely a sovereign entity.

But nothing for the Greeks.

• Greece May Seek Up To €24 Billion In First New Aid Tranche (Reuters)

Greece may seek €24 billion in a first tranche of bailout aid from international lenders in August to prop up its banks and repay debts falling due at the ECB, a pro-government Greek newspaper said in its early Sunday editions. Athens is now in talks with the EC and IMF to secure up to €86 billion in bailout aid. It will be its third bailout since 2010. Avgi newspaper, which is close to the leftist Syriza government, said Greek authorities expected to conclude talks with lenders by mid-August. The first tranche of €24.36 would be used to channel €10 billion as an initial recapitalization to Greek banks, €7.16 billion to repay an emergency bridge loan, €3.2 billion toward Greek bonds held by the ECB and other payments, Avgi said.

It has been estimated that Greek banks may require up to €25 billion to be recapitalized, a shortfall exacerbated by an outflow of deposits when a stalemate with lenders threatened Athens’ place in the euro zone. The flood of money leaving the country culminated in authorities imposing capital controls on June 29 to prevent a financial meltdown. In exchange for funding Greece has accepted reforms including making significant pension adjustments, increasing value added taxes, overhauling its collective bargaining system, and measures to liberalize its economy and limit public spending. If the talks are not completed in time, European authorities may have to provide further temporary financing as they did with a July bridge loan, though Avgi said that possibility had not been discussed with lenders.

1000 things could go wrong.

• Greece May Miss ECB Payment As Germany Says Bailout Timeline Not Realistic (ZH)

Greek PM Alexis Tsipras won a hard fought victory over party rivals on Thursday when Syriza’s central committee voted to postpone an emergency congress until after formal discussions on the country’s third bailout program are complete. Syriza has been grappling with bitter infighting since more than 30 MPs in Tsipras’ parliamentary coalition defected during a vote on the first set of bailout prior actions, forcing the PM to rely on opposition votes to clear the way for formal discussions with creditors. The party dispute was exacerbated by reports that ex-Energy Minister and incorrigible Grexit proponent Panayiotis Lafazanis (along with several Left Platform co-conspirators) planned to storm the Greek mint and seize the country’s currency reserves.

Fed up, Tsipras told 200 members of Syriza’s central committee on Thursday that essentially, they could either hold a party referendum on the bailout on Sunday or wait until September to sort things out, leading us to note that “were Syriza to vote on whether or not Greece should follow through on the agreement with creditors, the market could be in for an event that is far more dramatic and important than the original referendum.” Lafazanis refused to go along with the idea. “How many referenda are we going to hold? We’ve already done one and we won with 62% of the vote”, he said. Ultimately, the party approved a September congress. This gives Tsipras some “breathing space,” FT notes, “but Thursday’s highly charged debate signalled that the Left Platform, which supports an end to austerity and a ‘Grexit’ from the euro, would continue to oppose a fresh bailout.”

And the party’s radical leftists aren’t alone in their opposition to the third program for Athens. On Thursday, FT reported that according to “strictly confidential” minutes from the IMF’s Wednesday board meeting, the Fund will not support the new bailout until the debt relief issue is decided and until it’s clear that Greece “has the institutional and political capacity to implement economic reforms.” Somehow, all of this must be worked out in the next three weeks. Greece must make a €3.2 billion payment to the ECB on August 20 and if the bailout isn’t in place by then, it’s either tap the remainder of the funds in the EFSM (which would require still more discussions with the UK and other decidedly unwilling non-euro states) or risk losing ELA which would trigger the complete collapse of not only the Greek economy but the banking sector and then, in short order, the government.

The question is whether Germany can be reasonably expected to take it on faith that i) the Greek political situation will not eventually result in Athens walking back its austerity promises, and ii) that the IMF will eventually hold up its end of the deal once Berlin approves some manner of debt re-profiling for the Greeks. Now, according to Focus magazine, there are questions as to whether the timetable for cementing the bailout agreement is realistic. German lawmakers may now have to postpone a Bundestag vote and Athens has already discussed the possibility of taking a second bridge loan from the EFSM, Focus says.

Keep your eye on them. They don’t sit still.

• Italy’s Anti-Establishment Five Star Party Ready To Govern (AFP)

Italy’s anti-establishment Five Star party, founded in 2009 by former comedian Beppe Grillo, is itching to govern and has a man primed for the top job. The movement celebrated a shock success in 2013’s general election when it snapped up a whopping 25.5% of the votes, becoming the second biggest political force behind the centre-left Democratic Party. “Today we are ready, much more than in 2013,” Luigi di Maio, one of Five Star’s most prominent members, told AFP. Di Maio, 29 years old and the youngest deputy president of the lower house of parliament in Italian history, has become the new face of the movement, displacing its loud and truculent founder, who is now rarely seen in public.

The pair could not be more different: where bearded, wild-eyed Grillo, 67, shouted abuse to rouse the crowds, Di Maio, who hails from Naples and studied law, speaks quietly but firmly and dresses in an impeccable suit and tie, never a hair out of place. He has tried to restore credibility to the Five Star (M5S) after a fallout within the party forced the ex-comic to take a step back. While Grillo called last October for the country to leave the euro “as soon as possible”, Di Maio is more prudent – perhaps having watched Greece teeter on the edge of a “Grexit”, which some warned could force the country to exit from the EU. “Our line doesn’t foresee a straightforward exit from the euro”, he says, insisting that it would only ever be considered if the common currency “continues to strangle our economy”.

The party would like a reformed eurozone but believes centre-left Prime Minister Matteo Renzi lacks “the authority” in Europe to make that happen. Renzi, 40, is the Five Star’s main adversary in the run-up to the next general election, scheduled to be held in 2018. And Di Maio – who began following Grillo back in 2007 – is often named by political watchers as the man to challenge the PM. [..] The Five Star party “continues to grow because Italian politics continues to be a ‘rubber wall'”, he says, describing the way the hopes and ambitions of the population appear to bounce straight off the walls of power and disappear into nothing.

Polls published this week show the Five Star gaining ground on the Democratic Party, with 25% of those polled now favouring the anti-establishment movement compared to 34% for Renzi’s party, which has dropped in popularity since last year. The movement is keen to seize the moment to make its mark – especially now that even the left has been hit by corruption scandals. “It seems to us that we are elected when the Italians see all the nastiness the (mainstream) political world is capable of,” he says. His mobile phone beeps. A breaking news alert tells him that the Senate has just voted to protect a centre-right senator suspected of graft, fraud and racketeering, by refusing to strip him of his political immunity.

The vote passed thanks to several members of the centre-left Democratic Party, who were afterwards accused of having saved the senator’s skin because they had received favours from him when he was chair of the budget committee. “You see, things never change,” Di Maio says with a smile.

Quelle surprise!

• Liar Loans Pop up in Canada’s Magnificent Housing Bubble (WolfStreet)

For a long time, the conservative mortgage lending standards in Canada, including a slew of new ones since 2008, have been touted as one of the reasons why Canada’s magnificent housing bubble, when it implodes, will not take down the financial system, unlike the US housing bubble, which terminated in the Financial Crisis. Canada is different. Regulators are on top of it. There are strict down payment requirements. Mortgages are full-recourse, so strung-out borrowers couldn’t just mail in their keys and walk away, as they did in the US. And yada-yada-yada. But Wednesday afterhours, Home Capital Group, Canada’s largest non-bank mortgage lender, threw a monkey wrench into this theory.

Through its subsidiary, Home Trust, the company focuses on “alternative” mortgages: high-profit mortgages to risky borrowers with dented credit or unreliable incomes who don’t qualify for mortgage insurance and were turned down by the banks. They include subprime borrowers. So it disclosed, upon the urging of the Ontario Securities Commission, the results of an investigation that had been going on secretly since September: “falsification of income information.” Liar loans. Liar loans had been the scourge of the US housing bust. Lenders were either actively involved or blissfully closed their eyes. And everyone made a ton of money.

So Home Capital revealed that it has suspended “during the period of September 2014 to March 2015, its relationship with 18 independent mortgage brokers and 2 brokerages, for a total of approximately 45 individual mortgage brokers,” who’d together originated nearly C$1 billion in single-family residential mortgages in 2014. That’s 5.3% of the company’s total outstanding loan assets, and 12.5% of its total single-family mortgage originations in 2014. That’s a big chunk. The company, however, didn’t disclose why it took so long to disclose this. It said an “external source” had warned it about income falsification on mortgage applications submitted by a number of brokers. Its investigation did not find any evidence of falsified credit scores or property values, it said.

Not a trust booster.

• MtGox Bitcoin Chief Arrested In Japan (BBC)

Japanese police have arrested the CEO of the failed company MtGox, which was once the world’s biggest exchange of the virtual currency, bitcoin. Mark Karpeles, 30, is being held in connection with the loss of bitcoins worth $387m last February. He is suspected of having accessed the exchange’s computer system to falsify data on its outstanding balance. MtGox claimed it was caused by a bug but it later filed for bankruptcy. Japan’s Kyodo News said a lawyer acting on Mr Karpeles’ behalf denied his client had done anything illegal. Mr Karpeles is suspected of benefiting to the tune of $1m, the agency said. In March 2014, a month after filing for bankruptcy, MtGox said it had found 200,000 lost bitcoins. The firm said it found the bitcoins – worth around $116m – in an old digital wallet from 2011. That brings the total number of bitcoins the firm lost down to 650,000 from 850,000. That total amounts to about 7% of all the bitcoins in existence.

Brazil’s economy has already conceded defeat.

• In Hideaway for Brazil’s Rich, a New Scandal Emerges (Bloomberg)

Just south of Rio de Janeiro, along a strip of coastline known for its white-sand beaches and high-end resorts, Brazil’s next big corruption scandal is starting to unfold. This one bears striking similarities to the colossal bribery case that has engulfed state-run oil giant Petrobras pushed Brazil toward its worst recession in a quarter century and left President Dilma Rousseff fighting for her political survival. That’s no coincidence: Many of the players are the same. At the center of this story is another state-run company, Eletrobras, and its Angra III project, a nuclear power plant tucked into a bay with jungle-covered islands that have become something of a playground for Brazil’s rich and famous. Five of the builders whose executives have been jailed on allegations they bribed officials at Petrobras also won contracts to build the 14.9 billion-real ($4.4 billion) nuclear plant.

“The model is the same as Petrobras,” said Adriano Pires, head of CBIE, a Rio de Janeiro-based energy and infrastructure consultant. “Brazil’s government created a system in which big state-owned companies are used for political objectives and are in charge of these big infrastructure consortiums. It’s an atmosphere that favors corruption.” The sweeping investigation into Petrobras – dubbed “Carwash” by prosecutors after a gas station used to launder money – has helped make Brazil’s real the world’s worst-performing major currency this year, wiped out $33 billion in the market value of Petrobras in the past year and tanked the bonds of builders including Odebrecht and OAS. This new phase has earned the nickname “Radioactivity.”

Federal Police on Tuesday arrested the former head of Eletrobras’s nuclear unit, Eletronuclear, and the president of builder Andrade Gutierrez’s energy unit. The arrest warrants were among 30 court orders issued based on testimony by Dalton Avancini, the CEO of builder Camargo Correa SA, who said his firm and others won contracts for Angra III by paying kickbacks, police Chief Igor Romario de Paula told reporters in Curitiba, Brazil. Camargo Correa didn’t respond to requests for comment. In the same testimony, Avancini also pointed his finger at another Eletrobras project, the 30 billion-real Belo Monte hydroelectric dam deep in Brazil’s Amazon Jungle, a person with direct knowledge of the matter told Bloomberg News in March.

Sure, gold will recover. Question is what will happen in the meantime.

• Africa’s Biggest Gold Deposit Becomes Burden as Prices Plunge (Bloomberg)

After production delays and fatal accidents, the plunging price of bullion is making Africa’s richest gold deposit the biggest burden for owner Gold Fields. And the bond market’s taking note. The 81 million-ounce resource at South Deep near Johannesburg is still burning cash after Gold Fields bought it for $3 billion in 2006. The mine has helped lift the company’s break-even price to $1,105 an ounce, according to Moody’s Investors Service. Yields on the company’s bonds climbed to a six-month high during July as gold fell 6.7% to $1,093 an ounce. “You’ve got a perfect storm now, with a low gold price environment and the potential for South Deep to continue to consume cash,” Douglas Rowlings at Moody’s said.

“The question on everybody’s mind is how much more cost can sustainably be taken out of South Deep and other mines?” The failure to exploit South Deep profitably is hastening the decline of South Africa’s gold-mining industry, which has produced a third of all the world’s bullion over 120 years. The country is today ranked sixth in the world among gold producers, down from first just eight years ago. South Deep, with the potential to produce 700,000 ounces a year costing as little as $900 an ounce for the next 70 years, may change that. Yet its complex ore body has so far proved too difficult for Gold Fields to extract profitably, even after $1 billion of investment over nine years.

Britain looks everywhere BUT the right place.

• We’re Looking In The Wrong Place To Solve Calais Migrant Problem (Independent)

Parkinson’s Law declares that work expands to fill the time available for its completion. But its author, the British historian Cyril Northcote Parkinson, coined a second less well-known adage. Parkinson’s Law of Triviality took the example of the committee asked to approve a new nuclear reactor, a new bike shed for the clerical staff and a rise in the price of coffee in the canteen. It asserted that people will always spend most time talking about the smallest issue, because the big one is generally beyond their comprehension. The Triviality Principle clearly applies to what is being called “the Calais migrant crisis”. So the biggest row has been over whether David Cameron should use words like “swarm” when describing the migrants trying to board UK-bound trucks coming through the Channel Tunnel.

Secondary stories include how terrible it is that British holidaymakers are having the start of their holidays delayed – and how useless the French are at maintaining law and order. But there is very little focus on the real problem. Perhaps that is because the real problem is so intractable. Politicians and press – committed as they are to facile solutions and easy scapegoating – are reluctant to acknowledge their impotence in the face of an issue of international complexity. That is why David Cameron, after Friday’s crisis committee meeting, was unable to come up with anything better than: “We rule nothing out in taking action to deal with this very serious problem. We are absolutely on it. We know it needs more work.” Indeed it does. His critics were not impressed.

The current moral panic about illegal migrants is based on two facts that are comparatively minor in the wider context of a global movement of refugees that is now bigger than at any time since the Second World War. The first is that the number of migrants at Calais has risen from around 600 in January to 5,000 today. The second is that this larger figure has caused the migrants’ tactics to change; stealthy attempts to slip unnoticed aboard lorries bound for England have given way to an ability to surge through police lines by sheer weight of numbers. Hence the word swarm. There is a new, brazen aggression in the attitude of the migrants that one police officer put down to the grimness of the ordeal so many of them have endured in the perilous crossings of the Mediterranean, which have increased dramatically over the past year.

Lorry drivers fear the Stanley knives that the men wield to cut their way through the tarpaulins of their trucks – though it has to be said that the only deaths around Calais this year have been those of nine desperate migrants. Yet the 5,000 migrants camped out in Calais are a drop in the tide of human misery that has flowed from the massive dislocation in countries like Syria, Iraq, Libya, Somalia, Eritrea and Sudan. War has now uprooted half the entire population of Syria. More than four million Syrians are refugees in neighbouring countries. Only a small percentage have made it into Europe. Around 170,000 migrants arrived in Italy last year. This year Greece has taken the most of any country, with 63,000. Last year Germany gave asylum to 41,000; Sweden took 31,000; and France 15,000. The UK accepted 10,050. At the last summit on how Europe should share the burden of incomers the British government announced it would take none.

As I said yesterday.

• Bishop Attacks David Cameron’s Lack Of Compassion Over Refugee Crisis (Guardian)

The Church of England has made a dramatic intervention in the migrant crisis, delivering a stern rebuke to David Cameron for his “unhelpful” rhetoric. Speaking with the backing of the church, the bishop of Dover accused senior political figures, including the prime minister, of forgetting their humanity and attacked elements of the media for propagating a “toxicity” designed to spread antipathy towards migrants. After another tense day in Calais, following a night in which fewer migrants tried to enter the Eurotunnel terminal in northern France, the bishop, the Right Rev Trevor Willmott, urged Cameron to ameliorate his rhetoric. “We’ve become an increasingly harsh world, and when we become harsh with each other and forget our humanity then we end up in these standoff positions,” he said.

“We need to rediscover what it is to be a human, and that every human being matters.” On Thursday the prime minister drew international opprobrium when he described migrants trying to reach Britain as a “swarm” and promised to introduce strong-arm tactics, including extra sniffer dogs and fencing, at Calais. On Saturday No 10 announced it had also agreed with France to bolster security around Eurotunnel, with reinforcements joining the 200 guards already on patrol. Extra CCTV, infra red detectors and floodlighting will also be funded. Throughout Saturday disquiet continued to rise over Cameron’s handling of the issue.

Willmott said: “To put them [migrants and refugees] all together in that very unhelpful phrase just categorises people and I think he could soften that language – and that doesn’t mean not dealing with the issue. It means dealing with the issue in a non-hostile way.” Save the Children also voiced dismay at the way political discourse had taken a “sour turn”. In a piece published online by the Observer, Justin Forsyth, chief executive of the international charity, echoed Willmott’s call to remember the fact that the migrants were humans and many were refugees fleeing horrific abuse or extreme danger. “We are in danger of shutting our hearts to the desperation of the people pleading at the door, refugees not economic migrants,” he said, adding that Britain needed to pull its weight in accepting more refugees.

Home › Forums › Debt Rattle August 2 2015