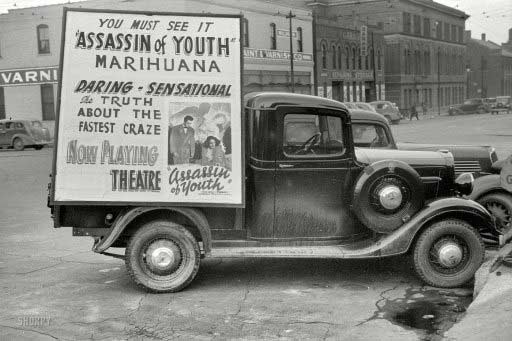

John Vachon Assassin of Youth November 1938

John Vachon Assassin of Youth November 1938

No, this is not the Onion. But it sure is funny, and not just the headline, try this one: “..the economy shows no signs of overheating..”

• The Fed Gives Growth a Chance (NY Times ed.)

The Federal Reserve did the right thing on Thursday when it opted not to begin raising interest rates. By holding steady, the Fed is acknowledging, correctly, that the economy shows no signs of overheating. Price inflation, for example, has been below the Fed’s 2% target for years and shows no signs of accelerating. The Fed also acknowledged the dampening effect global economic weakness and financial-market volatility may have on the American economy. In the past, the Fed played down those dangers, assuming they would be transitory or bearable. In the statement released after its policy-making committee meeting, it shifted, saying international and financial conditions could slow the domestic economy, making an interest-rate increase to restrain the economy unnecessary, at least for now.

In one important respect, however, the Fed appears to be doing the right thing for the wrong reasons. Judging from its statement and its economic projections, the Fed believes that the labor market has largely returned to health. That suggests it will be poised to raise rates as soon as the global headwinds abate. But the labor market is not healthy, and until it is, rate increases would be premature. Unemployment, at 5.1% in August, is still higher than it was before the recession. The share of part-time workers who need full-time jobs is still elevated, while the share of working-age adults with jobs is still well below its prerecession level. Most telling, broad wage growth — the clearest sign of labor market health — has been virtually nil during the six-year-old recovery.

The Fed is supposed to conduct policy in a way that fosters full employment, meaning rates should not be raised until jobs and wages are on a robust growth trajectory. But it seems more concerned with its mandate to fight inflation. That focus would be questionable even if there were nascent signs of inflation; in the absence of any signs, it is indefensible. In fact, inflation has been so low for so long now, it could run somewhat above the Fed’s target for an extended period without being disruptive and, in the process, allow wages to grow in line with productivity.

Just the fact that after two years we’re still stuck in the same spot should say plenty.

• Fed Delay Looks Like 2013 All Over Again-Rate Hike in December? (Bloomberg)

Federal Reserve Chair Janet Yellen shows signs of taking a page out of her predecessor’s policy playbook as she inches toward the central bank’s first interest rate increase in nine years: Delay action in September only to move in December. While the Fed on Thursday opted to keep rates pinned near zero for now, Yellen told a press conference that most policy makers still expect to raise rates this year. She highlighted the strength of the U.S. economy, tying the decision to delay liftoff to fresh uncertainty about the outlook abroad and to financial market turbulence over the past month. “I do not want to overplay the implications of these recent developments, which have not fundamentally altered our outlook,” she said. “The economy has been performing well, and we expect it to continue to do so.”

Yellen’s approach has parallels to the strategy that former Fed Chairman Ben Bernanke pursued in 2013 as officials debated whether to start scaling back bond purchases. Citing uncertainties to the outlook, Bernanke put off a move to begin tapering in September before deciding to go ahead in December. Just like today, much of the Fed’s initial reservations about acting in 2013 centered on developments in emerging markets, which had been rocked by Bernanke’s suggestion a few months earlier that a taper was on its way. Looming in the background then, as it is now, was the threat of a U.S. government shutdown. Today’s situation “lines up in so many ways” with that of 2013, said Aneta Markowska at SocGen, pointing to the upcoming fiscal showdown and emerging market concerns. “If all of that is resolved by December, my expectation is that the data will definitely support a hike.”

No matter what the Fed does, emerging markets can’t win.

• Fed Rate Decision Roils Emerging-Market Currencies (WSJ)

Many emerging-market currencies slumped against the dollar on Thursday despite the Federal Reserve’s decision to hold interest rates near zero for now. Currencies in Brazil, Turkey and South Africa, which have been among the hardest-hit by fears of a U.S. rate increase, enjoyed a short-lived reprieve after the central bank’s announcement. But they gave back all the gains within hours, as investors realized the Fed is still on track to raise interest rates later in the year. Many investors said the Fed’s reluctance to raise rates on Thursday signaled policy makers’ concerns about slowing global growth, which reflects a deepening economic malaise across emerging markets.

Many emerging countries rely on external capital flows to finance growth. The prospect of higher rates in the U.S. has led to outflows from these countries, contributing to weakening currencies and higher bond yields that drive up borrowing costs. The continuation of easy-money policies in the U.S. “buys some time for further adjustments by emerging-market economies, but this decision also confirms the fact that the U.S. economy continues to expand at a modest pace, which is not particularly emerging-market friendly,” said George Hoguet at State Street Global Advisors.

The Brazilian real took a roller-coaster ride. The currency, which was under pressure early in the day, rallied immediately upon the release of the Fed statement at 2 p.m. Eastern time, rising as much as 1.3% against the dollar. But the gains quickly dissipated. By late afternoon, the real lost 1.5% against the dollar to 3.8974, the weakest level in 13 years. Indonesia’s rupiah, after a brief rally, closed at its lowest level against the greenback since July 1998. Both the South African rand and the Turkish lira appreciated against the dollar shortly after the Fed announcement, but ended the day with losses.

A neat excuse to hide their ignorance behind.

• It’s a New World: How China Growth Concerns Kept the Fed on Hold (Bloomberg)

Here’s the latest sign of China’s arrival as a global economic power: It’s roiled financial markets enough to nudge the Federal Reserve away from raising interest rates. Fed policy makers left their benchmark rate near zero Thursday, saying the U.S. economy and inflation may be restrained by “recent global economic and financial developments.” Fed Chair Janet Yellen elaborated in a press briefing, saying the financial turmoil reflected investor concerns about risks to Chinese growth. “If it weren’t for China and all the turmoil surrounding China, I think the Fed would have hiked rates,” said Mickey Levy at Berenberg in New York, who has analyzed Fed policy for more than 30 years.

The focus on China comes after a market rout that wiped $5 trillion in value off the nation’s stocks and after a sudden move on Aug. 11 to change its exchange rate regime, a decision which triggered the yuan’s biggest depreciation in two decades and roiled global markets. The world’s second-largest economy is set to grow at its slowest pace in a quarter century this year even after five central bank interest rate cuts and fiscal stimulus. “China was an influence in this meeting, whereas in the past that would have been much less important,” said Tai Hui at JPMorgan Asset Management in Hong Kong. China affects the world more than ever before, and its influence over global markets will only increase as it approaches the U.S. economy in size. It accounted for 13.3% of global gross domestic product last year, from less than 5% a decade earlier, according to World Bank data.

Croatia gave it their best, but they too need help.

• Europe Lacks Strategy to Tackle Crisis, but Refugees March On (NY Times)

Europe’s failure to fashion even the beginnings of a unified solution to the migrant crisis is intensifying confusion and desperation all along the multicontinent trail and breeding animosity among nations extending back to the Middle East. With the volume of people leaving Syria, Afghanistan and other countries showing no signs of ebbing, the lack of governmental leadership has left thousands of individuals and families on their own and reacting day by day to changing circumstances and conflicting messages, most recently on Thursday when crowds that had been trying to enter Hungary through Serbia diverted to Croatia in search of a new route to Germany.

Despite the chaos, there were few signs that EU leaders, or the governments of other countries along the human river of people flowing from war and poverty, were close to imposing any order or even talking seriously about harmonizing their approaches and messages to the migrants. Instead, countries continue to improvise their responses, as Croatia did Thursday, and Slovenia — the next stop along the rerouted trail — is likely to do in coming days. The migrants did not shift course to Croatia on a whim. When Hungary effectively blocked their access on Tuesday with a border crackdown — which resulted in an ugly skirmish Wednesday between the police and migrants — they had few options.

And Macedonian and Serbian officials, along with many aid organizations, were urging them to circumvent a hostile Hungary and even providing maps and nonstop bus service to the Croatian frontier. Initially, Croatia’s foreign minister, Vesna Pusic, seemed to encourage them, too. “They can move freely in this period,” she said. “We will try to restore a decent face to this part of Europe.” So, since Wednesday morning, more than 11,000 migrants have entered Croatia, and officials said 20,000 more were already in Serbia, making their way to the Croatian border and likely to arrive soon — while untold tens of thousands more waited in Turkey and Greece for a clear signal about whether to follow.

But what the first arriving migrants found on the Croatian border was only more fog. The Croatian interior minister said that the country would abide by European Union rules and register all arriving asylum seekers and that they could not simply pass through the country unfettered. Then late Thursday, swamped by the crush of migrants, Croatia announced that the border would be closed altogether, indefinitely. Slovenian officials said that, no matter how many migrants Croatia lets through, they would register all arrivals and turn back any who do not qualify as refugees — a task that Hungary can attest is easier said than done.

Dear MSM: Stop calling refugees ‘migrants’. And stop calling a meeting next week an ‘emergency’ meeting.

• Losing Control Of Refugees, Croatia Closes Serbia Border Crossings (Reuters)

Croatia has closed seven of eight road border crossings with Serbia after complaining of being overwhelmed by an influx of more than 11,000 migrants who evaded police, trekked through fields and tried to sneak into Slovenia by train in a march westwards that is dividing Europe. Only the main Bajakovo crossing, on the highway between Belgrade and Zagreb, appeared to be open to traffic on Friday, while neighboring Slovenia stopped all rail traffic on the main line from Croatia after halting a train carrying migrants on the Slovenian side of the border. Migrants have been streaming into European Union member Croatia for two days, their path into the bloc via Hungary blocked by a metal fence, the threat of imprisonment and riot police who fired teargas and water cannon on Wednesday to drive back stone-throwing men.

There were desperate scenes at a railway station on Croatia’s eastern frontier with Serbia, where thousands were left stranded overnight under open skies. The EU has called an emergency summit next week to overcome disarray in the 28-nation bloc. Croatian Interior Minister Ranko Ostojic warned on Thursday that Croatia would close its border with Serbia if the flow of migrants continued at the same rate, saying his country was full to capacity. The president of Croatia told the military to be ready to join the effort to stop thousands of people criss-crossing the Western Balkans in their quest for sanctuary in the wealthy bloc. Late on Thursday, police announced they had banned all traffic at seven border crossings. “The measure is valid until further notice,” police said in a statement.

Serbia’s main highway north into Hungary is already closed by Hungarian riot police on the border. It remained unclear whether or how police would stop migrants, many of them refugees from Syria, from streaming through fields across the border away from official crossings, though their path across much of the frontier is made more difficult by the Danube river. Serbia warned its neighbors against shutting down the main arteries between them. “We want to warn Croatia and every other country that it is unacceptable to close international roads and that we will seek to protect our economic and every other interest before international courts,” Aleksandar Vulin, Serbia’s minister in charge of migration, told the Tanjug state news agency.

And so we move from country to country and border to border, while Europe refuses to set up a meeting. To them, it’s an emergency only for refugees.

• Croatia’s Resources Stretched as Thousands of Refugees Arrive (Bloomberg)

Croatia wavered in its commitment to accept a growing influx of migrants after 5,600 refugees poured into the country in one day, underscoring the massive task facing Europe as people flee war and poverty. “If migrants continued to arrive in larger numbers, Croatia would have to consider an entirely different approach,” Interior Minister Ranko Ostojic said in a statement on Thursday. Prime Minister Zoran Milanovic said Croatia will help refugees “as long as we can,” after throwing open its doors Wednesday. The people have been stranded in Serbia trying to enter the European Union through Hungary, which closed its southern frontier and fired tear gas and water cannons at migrants trying to break through a barrier on the border. Police said they used force to repel the crowd after refugees threw rocks and other projectiles.

European leaders have been at odds for weeks over how to deal with the region’s biggest refugee crisis since World War II, with Hungarian Prime Minister Viktor Orban fortifying his border to keep refugees out and German Chancellor Angela Merkel saying Europe has a moral responsibility to help. Orban has built a razor-wire fence along the border with Serbia and announced plans to extend the barrier to part of the frontier with Romania. The crisis claimed its first political casualty in Germany, with the government’s point person on the refugee crisis stepping down. The Interior Ministry announced Thursday that Manfred Schmidt, who headed the office for migration and refugees, was leaving for personal reasons.

Schmidt’s office was responsible for the initial decision to allow all Syrians entering the country to stay – a departure from an EU agreement requires refugees to be registered in the country where the arrive in the bloc and remain there to have their asylum applications processed. “The dramatically increased number of asylum seekers in Germany present the federal agency, as well as the states and municipalities, with an enormous challenge,” Interior Minister Thomas de Maiziere said in a statement thanking Schmidt for his “excellent work.” The departure comes after Merkel was criticized in recent days by some in her own coalition for her handling of the crisis as the country struggles to keep up with the influx. The chancellor has defended her decision to allow in refugees.

What else are they going to say?

• OPEC Assumes Oil Price Will Recover Gradually to $80 in 2020 (Bloomberg)

OPEC is assuming the oil price will rise gradually to $80 a barrel in 2020 as supply growth outside the group weakens, a slower recovery than several member nations have said they need. The average selling price of the Organization of Petroleum Exporting Countries’ crude will increase by about $5 annually to 2020 from $55 this year, according to an internal research report from the group seen by Bloomberg News. Iran and Venezuela said they would like to see a price of at least $70 this month and most member countries cannot balance their budgets at current prices. “It’s much harder for OPEC to lift prices” after the revolution of U.S. shale oil, said Bjarne Schieldrop, Oslo-based chief commodities analyst at SEB AB, which forecasts Brent crude at $73 by the end of the decade.

“Eighty dollars by 2020 is pretty close to consensus view.” The price of crude has tumbled more than 50% in the past year as OPEC followed Saudi Arabia’s strategy of defending its share of the global market against competitors like U.S. shale oil. While both OPEC and the International Energy Agency expect growth in global supply to slow as low prices bite, Goldman Sachs predicts that a persistent glut will keep crude low for the next 15 years. Production from nations outside OPEC will be 58.2 million barrels a day in 2017, 1 million lower than previously forecast, according to the internal report.

The impact low prices is “most apparent on tight oil, which is more price reactive than other liquids sources,” according to the report. “Supply reductions in U.S. and Canada from 2014 to 2016 are clearly revealed.” OPEC expects little stimulus to global demand in the medium term as a result of cheaper oil, with daily consumption growing by about 1 million barrels a year to 97.4 million in 2020, according to the report. While demand from China, Russia and OPEC members will grow more slowly than forecast a year ago, developing nations with still account for the bulk the expansion, it said.

Debt dominoes.

• Defaults Mount in Beleaguered US Energy Industry (WSJ)

The well is running dry for deeply indebted energy companies. Samson Resources became the latest, and largest, victim of an industry downturn, as it filed for chapter 11 protection late Wednesday. Industry experts say more oil-and-gas companies are poised to follow the Tulsa, Okla., company into bankruptcy as oil prices remain low following a steep drop that began last year. The default rate among U.S. energy companies has accelerated in recent months to 4.8%, the highest level since 1999 and up from 3.3% in August, according to Fitch Ratings. Within that group, exploration and production companies like Samson are defaulting at an even higher rate, 8.5%, Fitch said. Default volume for such companies is the highest it has been in five years, at $10.4 billion in debt.

The broader U.S. corporate default rate is 2.9%, according to Fitch. Meanwhile, the yield on a basket of U.S. junk-rated energy bonds has risen to 11%, just off its highest level since July 2009 and up from 5.9% a year ago, according to Barclays PLC. The increase indicates a lack of investor confidence that the bonds will be repaid in full. Yields on debt rise as prices fall. “Everything has been turned upside down,” said Marc Lasry, head of hedge- fund firm Avenue Capital Group, which recently raised $1.3 billion for an energy-focused fund. “If you’re equity it’s been total devastation. If you’re the high-yield guys you’re in total shock and you have no idea what to do,” he said, referring to investors in stocks and risky debt.

It took 8 years to figure that one out?!

• Central Banks’ Lesson: Easy Money Alone Isn’t a Growth Salve (WSJ)

Central bankers have injected roughly $8 trillion into the global economy since the financial crisis. In return, the world has remained in a low-growth rut. The Federal Reserve cited market turmoil and a weak economic picture overseas in deciding Thursday not to back off from one of the most aggressive global monetary policies in decades. Whenever the Fed moves to raise interest rates, one lesson remains: Cheap money alone can’t solve the world’s economic ills. The Fed noted positive developments at home, including increased household spending and business investment, but worried conditions overseas could restrain U.S. growth and put further downward pressure on near-term inflation.

“A lot of our focus has been on risks around China, but not just China—emerging markets more generally and how they may spill over to the U.S.,” said Fed Chairwoman Janet Yellen, noting “the significant economic and financial interconnections between the U.S. and the rest of the world.” Her unease underscores in part the limits of loose monetary policy as a singular response to economic weakness. Instead of using the breathing room of low interest rates to revamp their economies, governments around the globe have failed to enact longer-lasting policy overhauls as they try to combat an array of demographic and other challenges.

“Finance, especially as motivated by central banks, is really only a lubricant to growth,” said Raghuram Rajan, head of the Reserve Bank of India, at a recent meeting of top global finance officials. “It can’t be the underlying driver of growth.” Since the financial crisis began in 2007, the average key interest rate set by central banks has fallen by around 4 percentage points in advanced countries and 2 points in emerging markets. Central banks have also bought bonds and other assets equal to 10% of global output to stir growth in the postcrisis era.

TEXT

• China Outflows Said To Surpass A Staggering $300 Billion In Just 75 Days (ZH)

We’ve detailed the story exhaustively, so we won’t endeavor to recap it all here, but the short version is that what was billed as a move to give the market a greater role in setting the yuan’s exchange rate actually had the opposite effect – at least in the short run. That is, the PBoC used to manipulate the fix to control the spot and now they simply manipulate the spot to control the fix, but unabated devaluation pressure has forced China to intervene on a massive scale and that intervention recently moved into the offshore market as well, as Beijing scrambled to close the onshore/offshore spread. This is costing China dearly in terms of FX reserves, the liquidation of which was so massive in August as to prompt Deutsche Bank to brand it “Quantitative Tightening”, as the reserve drawdowns are effectively QE in reverse.

This is of course the same dynamic that’s been taking place in Saudi Arabia in the wake of the petrodollar’s demise and mirrors the response across EMs which are struggling to support commodity currencies as prices collapse. Attempts to quantify the scope of China’s reserve burn have become ubiquitous, as the cost of offsetting the outflows from China effectively serves as a proxy for the extent to which the Fed would, were they to hike, be “tightening into a tightening”, as we’ve put it. On Wednesday we showed that Beijing liquidated $83 billion in Treasurys in July. That, as we also noted, “is before China announced its devaluation on August 11 and before, as we also first reported, it sold another $100 billion in Treasurys in August.”

Today, we get a fresh look at the numbers courtesy of SAFE which shows that on net, banks sold $128 billion in FX to Chinese non-banks in August. Nothing too surprising there, given that we already knew positioning for FX purchases for the banking sector as a whole dropped by $115 billion for the month. As Goldman notes however, when you include banks’ forward books the picture worsens materially. An alternative gauge that we believe is a closer reflection of the underlying trend of currency demand shows a significantly larger outflow of $178bn. Today’s data at US$178bn on our preferred gauge of underlying currency demand (i.e., outright spot plus freshly-entered forward contracts) is significantly higher than any of [the previous] releases.

This means, as Goldman goes on to point out, that outflows are actually far worse than what’s indicated by simply looking at China’s reserve drawdown, as banks look to be shouldering some of the burden themselves. So between July and August (inclusive of freshly entered forwards), outflows total around $261 billion. But that’s not all. Nomura is out with an estimate of what’s taken place since the start of September. Between onshore spot intervention and offshore spot and forward intervention, the bank estimates China has spent some $47 billion month-to-date stabilizing the yuan, $25 billion of which in the offshore market, reinforcing what we said a week ago after CNH soared the most on record [..]

What grandmas can move their savings in.

• China’s Top Financial Firms Get Green Light for $3 Billion IPOs (WSJ)

China International Capital and China Reinsurance each received approval from the Hong Kong stock exchange late Thursday to hold initial public offerings worth a combined $3 billion, people familiar with the deals said, signaling a possible revival of what has been a quiet quarter for the city’s capital market. CICC, which is China’s top investment bank, and China Reinsurance, its biggest reinsurer, have yet to decide when to go public due to volatile stock markets, though they are aiming to do so this year, the people said. The turmoil in Chinese stocks is hurting investor appetite for initial public offerings in Hong Kong, the world’s top venue for listings this year. In the third quarter, IPOs in Hong Kong have raised $1.8 billion, down significantly from $5.4 billion in the same period last year..

The two IPOs would be the first major offering since China Railway Signal & Communication’s $1.4 billion Hong Kong IPO in August. Hong Kong’s Hang Seng Index, which is weighted heavily with mainland Chinese stocks, has fallen 17% in the third quarter so far, as mainland stocks have tumbled. Those declines have weighed on investor sentiment. On Monday, the short-haul carrier Hong Kong Airlines called off indefinitely a planned listing in which it had hoped to raise $500 million. The potential listing of CICC would give its shareholders, including KKR & Co. and TPG Capital, the chance to exit their investments despite turmoil in Chinese stocks. Central Huijin Investment, the domestic investment arm of China’s sovereign-wealth fund, is the largest shareholder in CICC with a 43.35% stake.

Singapore’s sovereign-wealth fund GIC Pte. Ltd. holds 16.35%, while TPG Capital owns 10.3% and KKR holds 10%, according to its annual report. CICC was formed in 1995 by Morgan Stanley and China Construction Bank. as China’s first Sino-foreign joint-venture investment bank. Morgan Stanley sold its stake in December 2010 to a consortium that included GIC; Great Eastern Holdings, the insurer controlled by Oversea-Chinese Banking; and the private-equity firms KKR and TPG Capital. CICC has played a key role in advising the Chinese government on state-owned enterprise reform and guiding the listing of the country’s major overseas IPOs.

Investment. In productive areas, that is.

• Here’s Why China Could Drag The US Into Recession (Fortune)

No one can say for sure just how bad China’s economic situation has become, but analysts in the United States have been taking comfort in the fact that U.S. trade to China, and the Pacific Rim in general, constitutes a small sliver of U.S. GDP. And while the emerging world makes up a much bigger share of the global economy than it did a generation ago, the U.S. economy is still the largest in the world. When capital flees riskier economies like Brazil or Turkey, the U.S. is where it will run to. There’s one problem. These arguments ignore the fact that economists don’t agree on what, exactly, causes recessions. True, the Asian financial crisis of 1998 didn’t lead to slower growth in the U.S. But that doesn’t mean that a recession in the emerging world will fail to drag us down this time.

David Levy, economist and chairman of The Jerome Levy Forecasting Center, has been predicting that China would suffer an economic crisis and he believes that turmoil in emerging markets can take down the U.S. economy. Levy subscribes to what he calls “the profits perspective,” which examines global profits rather than country-specific GDP for indications of economic turmoil. How can global profits help predict recessions? Profits are the main factor that guides economic activity: when profits are high, businesses will invest and hire workers, and lenders will extend credit. When profits are low, the opposite occurs.

As it turns out, the largest contributor to global profits is net investment. When firms invest in capital equipment or when an individual invests in residential real estate, this is an act of wealth creation that does not require an immediate expense, in accounting terms. On a global scale, then, when investment is rising, we should also see profits rise and the global economy expand. But when we start to see investment stagnate or decline, we should expect profits to fall, putting recessionary conditions right around the corner.

Slap that wrist!

• Primary Dealers Rigged Treasury Auctions, Investor Lawsuit Says (Bloomberg)

The same analytical technique that uncovered cheating in currency markets and the Libor rates benchmark – resulting in about $20 billion of fines – suggests the dealers who control the U.S. Treasury market rigged bond auctions for years, according to a lawsuit. The analysis was part of a 115-page lawsuit filed in Manhattan federal court on Aug. 26 by Quinn Emmanuel Urquhart & Sullivan LLP and other law firms. The plaintiffs built their case against the 22 primary dealers who serve as the backbone of Treasury trading – including Goldman Sachs JPMorgan and Morgan Stanley – using data from Rosa Abrantes-Metz, an adjunct associate professor at New York University who has provided expert testimony in rigging cases.

Her conclusion: More than two-thirds of a certain type of Treasury auction appear to have been rigged. She found issues with other auctions, too. “The only plausible explanation is that Defendants coordinated artificially to influence the results of the auctions in the primary market,” according to the complaint filed by the Cleveland Bakers and Teamsters Pension Fund and other investors. The lawsuit, which seeks unspecified damages, comes as the U.S. Justice Department probes whether information in the Treasury auction market is being shared improperly by financial institutions, three people with knowledge of the investigation said in June.

Treasury traders at some banks learn of customer demand hours before auctions, and were communicating with their counterparts at other firms via chat rooms as recently as last year, Bloomberg News reported earlier this year. Abrantes-Metz’s analysis is similar to one used in lawsuits claiming bank and broker manipulation of the London interbank offer rate, or Libor. Those cases resulted in about $9 billion in settlements from the financial firms. Banks and brokers have paid about $9.9 billion in fines to global regulators related to manipulation of currency markets as of May.

Bitcoin, rhubarb, it’s all the same.

• Bitcoin Is Officially a Commodity, According to US Regulator (Bloomberg)

Virtual money is officially a commodity, just like crude oil or wheat. So says the Commodity Futures Trading Commission (CFTC), which on Thursday announced it had filed and settled charges against a Bitcoin exchange for facilitating the trading of option contracts on its platform. “In this order, the CFTC for the first time finds that Bitcoin and other virtual currencies are properly defined as commodities,” according to the press release. While market participants have long discussed whether Bitcoin could be defined as a commodity, and the CFTC has long pondered whether the cryptocurrency falls under its jurisdiction, the implications of this move are potentially numerous.

By this action, the CFTC asserts its authority to provide oversight of the trading of cryptocurrency futures and options, which will now be subject to the agency’s regulations. In the event of wrongdoing, such as futures manipulation, the CFTC will be able to bring charges against bad actors. If a company wants to operate a trading platform for Bitcoin derivatives or futures, it will need to register as a swap execution facility or designated contract market, just like the CME Group. And Coinflip—the target of the CFTC action—is hardly the only company that provides a platform to trade Bitcoin derivatives or futures.

“While there is a lot of excitement surrounding Bitcoin and other virtual currencies, innovation does not excuse those acting in this space from following the same rules applicable to all participants in the commodity derivatives markets,” said Aitan Goelman, the CFTC’s director of enforcement, in a statement. A request for comment sent to Coinflip’s chief executive via LinkedIn was not immediately returned. Coinflip consented to the order without admitting or denying any of its findings or conclusions. Since Coinflip is not alone in providing a platform to trade Bitcoin derivatives or futures, Goelman’s words imply that other unregulated exchanges could soon attract the attention of the CFTC.

For calling a tool a tool.

• Beppe Grillo Gets One Year Jail Sentence for “Defamation” (Tenebrarum)

Former Italian prime minister Silvio Berlusconi – the cavaliere – has been successful in fighting off legal challenges ranging from sex with minors to alleged tax fraud involving humungous amounts for well over adecade. On a number of occasions, the Italian State even created new laws specifically designed to keep the cavaliere out of jail. We admittedly just loved his constant successful evasions of justice. First of all, we were deeply worried by the thought of potentially losing this unsurpassed master of political entertainment. Secondly, when the Eurocracy decided it didn’t like him anymore, he was basically putsched out of office, and we greatly dislike the meddlers administering the Moloch in Brussels. Incidentally, ever since he has lost political power, Berlusconi’s successes in evading justice have been waning rather rapidly.

What was of course also great about Berlusconi’s brushes with the law was that they demonstrated unequivocally that the concept of “equality before the law” is a basically a bad joke. They showed the hoi-polloi that the modern-day rulers of the “democratic” societies of the West are in many respects really not much different from the feudal robber barons of the past. This seemed eminently useful from an educational perspective to us. This week we have been provided with yet another interesting demonstration by Italy’s justice system. An oppositional critic of the establishment who is seen as a genuine danger to the “European project” and the structures of the State because he enjoys massive voter support can evidently not hope to evade the long arm of the law as easily as the cavaliere was able to do in his heyday.

Beppe Grillo, leader of the wildly successful “5 Star Movement” has been handed a one year jail sentence (suspended, but still – one more misstep, and he’s locked up) and has been ordered to pay altogether 51,250 euro in fines and restitution. What was his crime? Did he defraud the tax man? Did he engage in bunga-bunga with minors? Did he have truck with the mafia? Nope – his alleged crime is defamation – and it appears that the law’s definition of “defamation” is “saying something about a public personality that said person doesn’t like”. Here is what happened, according to the press:

“Ascoli Piceno, September 14 – A judge here handed a suspended sentence of one year to 5-Star Movement (M5S) leader Beppe Grillo on Monday, for defamation of university professor Franco Battaglia. Grillo publicly insulted Battaglia during a speech on nuclear energy in May 2011 in the town of San Benedetto del Tronto, over an appearance Battaglia had made on the TV program Anno Zero. Referring to Battaglia’s comments, Grillo said, “You can’t let an engineer (…) go on television and say, with nonchalance, that no one died in Chernobyl. I’ll kick your ass, I’ll throw you out of television, I’ll report you to the police and send you to jail”. Battaglia testified that his car was also vandalized and he received a “strange phone call” prior to the act of vandalism. Grillo was ordered to pay a fine of €1,250 , and Battaglia was awarded compensation of €50,000.

It is well known that Beppe Grillo doesn’t mince words, but we can be reasonably sure that he was neither the man behind the “strange phone call” (we only have Battaglia’s say-so regarding this call), and that he probably didn’t vandalize the good professor’s car either. Most press reports didn’t go into too many details though – after all, Grillo had it coming, right?

“Are the record temperatures due to climate change or due to El Niño? The answer is yes..”

• Scorching Year Continues With the Hottest Summer on Record (Bloomberg)

Last month was the hottest August on record, topping out the hottest summer on record, according to data released on Thursday by the National Oceanic and Atmospheric Administration. It was the sixth month this year to set a new record: February, March, May, June, July, and August. This has been the hottest start to a year on record and the hottest 12 months on record. It follows the hottest calendar year (2014), and the hottest decade. In 136 years of global temperature data, we are in uncharted territory. And this year’s extremes are likely to continue as a strong El Niño weather pattern in the Pacific Ocean continues to rip more heat into the atmosphere. There’s now a 97% chance that 2015 will set yet another record, according to NOAA.

Results from the world’s top monitoring agencies vary slightly. NOAA and the Japan Meteorological Agency both listed August as the hottest month. NASA rated it one degree cooler than the previous record, set last year. All three agencies agree that 2015 is on track to be the hottest yet, by a long shot. The heat was experienced differently across the world, but few places escaped it altogether. In the U.S., chances are growing that above-normal temperatures will persist in Alaska and along the West Coast, as well as in the upper Midwest and Northeast, through February. That’s in line with what can happen during a strong El Niño. “Are the record temperatures due to climate change or due to El Niño? The answer is yes,” said Deke Arndt, chief of NOAA’s climate monitoring branch in Asheville, N.C.. “Long-term climate change is like climbing a flight of stairs. El Niño is like standing on tippy toes while you are on one of those stairs.”

Home › Forums › Debt Rattle September 18 2015