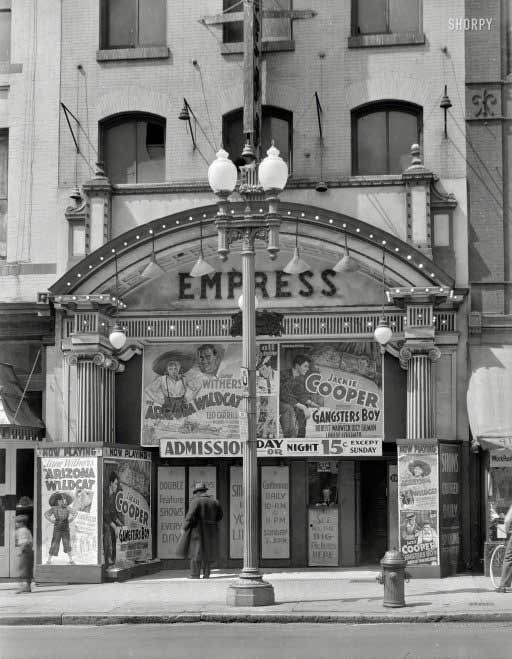

David Myers Theatre on 9th Street. Washington, DC July 1939

Absolutely nothing was achieved. €1 billion goes to UN to feed refugees outside Europe. Hollow vapor.

• EU Refugee Summit In Disarray, Greatest Refugee Tide ‘Yet To Come’ (Guardian)

European heads of government met in Brussels on Wednesday night in an attempt to bury months of mutual mudslinging over the EU’s biggest ever refugee crisis, but failed to come up with common policies amid signs they were unable to contain and manage the migration emergency. The emergency Brussels summit decided little but to throw money at aid agencies and transit countries hosting millions of Syrian refugees and to step up the identification and finger-printing of refugees in Italy and Greece by November. Calls for European forces to take control of Greece’s borders – the main entry point to the EU from the Middle East – fell on deaf ears. The summit’s chairman delivered coded criticism of the German chancellor, Angela Merkel, and of the European Commission while warning that the refugee crisis would get much worse before it might get better.

Turkey, which is the main source of Syrians trying to move to Germany, was recognised as the lynchpin of any strategy for containing the crisis and it emerged that Ankara was demanding a high price for its cooperation. Donald Tusk, the president of the European Council who chaired the summit, warned: “The greatest tide of refugees and migrants is yet to come.” In a barb directed at Merkel and Jean-Claude Juncker, the president of the European Commission, Tusk added: “We need to correct our policy of open doors and windows.” The summit pitted the governments of central Europe against Germany and France after Berlin and Paris on Tuesday forced a new system of imposed refugee quotas on a recalcitrant east.

There was talk of boycotts and threats to take the issue to court from the Czechs and Slovaks. The EU’s most robust anti-immigration hardliner, Viktor Orbán, the prime minister of Hungary, warned Merkel, against any “moral imperialism”. He argued that Greece was incapable of securing its borders with Turkey and that the job should be given to a pan-European force. He admitted he got no support, adding that he was left with two options – retaining the razorwire fences he has built on the borders with Serbia and Croatia or sending any refugees who enter Hungary straight through to Austria. The Austrian chancellor, Werner Faymann, replied that he should send the refugees through and take down the fence. Merkel said: “Setting up fences between members states is not the solution.” “The conditions for a comprehensive solution are not yet in place.”

Chinese have lost trust in their government.

• China Consumers Tighten Belts, A Red Flag For The Global Economy (Reuters)

Terry Xu considers himself one of the lucky ones. The 32-year-old father-of-one invested 10% of his savings earlier this year in Chinese stocks. Now, with markets down around 40% since mid-June, he’s selling off his portfolio at a loss. Painful, but not a catastrophe – he says his colleagues lost more, and he earns well above the average wage. But the equity market turmoil, coupled with signs the economy is slowing means Xu, and millions of other middle class Chinese consumers like him, is scaling back his spending in an ominous sign for China’s policymakers and the global economy. “This year’s economy has been uncertain,” he said. “It’s not like before, where we just used to buy everything for our child. Now, we only buy and spend what we need”.

Xu earns 20,000 yuan ($3,140) a month as a product development manager for a Western headphone maker in Shenzhen. A flat he bought in 2012 for 900,000 yuan, which he shares with his 4-year-old daughter, wife and parents-in-law, is now worth 2.5 million. Still, he plans to keep his Apple iPhone 4 rather than upgrade to the latest iPhone 6S, and his next pair of trainers will be from the Chinese brand Anta Sports rather than his preferred Nike. Xu’s worries are typical of middle class families – relatively minor compared with the millions of his compatriots who get by on lower incomes. But his belt-tightening jars with the Chinese government’s hopes that consumers will pick up the slack as exports fall and it tries to rebalance the economy away from a long-running reliance on trade and government spending.

Domestic consumption contributed 60% of China’s economic growth in the first half of 2015, up from 51.2% in the whole of 2014, suggesting Beijing’s desired rebalancing is on track. But forward looking indicators and companies’ experiences in China are more worrying. A China consumer confidence index produced by ANZ Bank and polling company Roy Morgan fell to a record low in August. Car sales in China could drop this year for the first time in two decades, while smartphone sales recorded their first fall in China during the second quarter, consumer research firm Gartner said. If that translates into a slowdown in overall consumer spending, the impact will be felt beyond China.

Chasing shadows.

• China Prosecutor To Intensify Financial Markets Crackdown (Reuters)

China’s state prosecutor will intensify its crackdown on criminal activities in its stock and futures markets, following a series of high-profile cases involving one of the country’s market regulators and securities firms. The prosecutor told a news conference in Beijing it would strengthen coordination with market regulators as part of efforts to halt activities such as insider trading and spreading of false information, state radio said on its website on Wednesday. The authorities have stepped up investigations on market participants since June, when wild gyrations sent the equity market down as much as 40%. Amid the crackdown, investors, fund managers and watchdog officials have all been the subject of investigations. The China Securities Regulatory Commission said on Sept. 18 it has recently started investigating 19 cases of suspected illegal share sales and speculative activities.

Meanwhile, executives at the country’s largest broker CITIC Securities, including its general manager, are being investigated by authorities for alleged offences including insider trading and leaking information. The country’s securities watchdog has also been swept up in the crackdown. China’s Communist Party sacked CSRC Assistant Chairman Zhang Yujun, state media reported on Sept. 22, days after it was announced he was the subject of a graft probe. The campaign to identify and punish those deemed responsible for the market sell-off started shortly after June’s turmoil. However, most analysts attribute the summer crash to the bursting of a typical stock market bubble which was earlier spurred by official media and fueled in large part by borrowed money.

Perfect timing.

• China Is Sitting on an Ocean of Diesel Fuel (Bloomberg)

Add diesel to the commodities flooding global markets from China. The nation exported a record volume of the fuel last month after already shipping unprecedented amounts of steel and aluminum overseas. The weakest economic growth since 1990 is sapping domestic demand for commodities, while refineries, mills and smelters grapple with excess capacity after years of expansion. “A lot of it has to do with slowing demand at a time when companies had plans for much a better demand environment, so capacities had been increased,” said Ivan Szpakowski at Citigroup in Hong Kong. “As demand slows, that’s led to an overcapacity in the domestic market and producers have sought to export the surplus.”

Exports of Chinese raw materials are exacerbating a global glut that drove prices to the lowest since the 2008 financial crisis and prompted steel and aluminum producers around the world to protest against the deluge. While diesel exports are principally a risk to Asian refiners, the additional shipments threaten to worsen a glut that already extends from Singapore to Europe and the U.S. Refining profits, or cracks, from making diesel in the Asian oil trading hub of Singapore have shrunk about 30% from a year ago as exports from China, India and the Middle East create an oversupply, according to Ehsan Ul-Haq, an analyst at KBC Advanced Technologies in London.

“The world is becoming an ocean of diesel,” said Ul-Haq. “Demand in China is not as high as it was previously expected. Chinese refiners are becoming more export oriented.” China’s August shipments of the fuel, also known as gasoil, surged 77% from a year earlier to a record 722,516 metric tons, or about 175,000 barrels a day, according to data released this week by the General Administration of Customs. They may rise to about 250,000 barrels a day later this year, according to ICIS China and JBC Energy GmbH, industry consultants. “Inevitably, this should prevent gasoil cracks in Asia from going higher than they already are,” said David Wech, managing director of Vienna-based JBC.

Talking his book.

• Bill Gross: “Mainstream America Is Being Slowly Cooked Alive” (Zero Hedge)

While hardly as dramatic as Bill Gross’ last letter in which he urged readers to “go to cash” as a result of the “Frankenstein creation” that ZIRP has created, his latest letter “Saved by Zero” takes a calmer stance and urges central banks to “get off zero” as the “developed world is beginning to run on empty because investments discounted at near zero over the intermediate future cannot provide cash flow or necessary capital gains to pay for past promises in an aging society. And don’t think that those poor insurance companies and gargantuan pension funds in the hundreds of billions are the only losers.” His punchline:

“Mainstream America with their 401Ks are in a similar pickle. Expecting 8-10% to pay for education, healthcare, retirement or simply taking an accustomed vacation, they won’t be doing much of it as long as short term yields are at zero. They are not so much in a pickle barrel as they are on a revolving spit, being slowly cooked alive while central bankers focus on their Taylor models and fight non-existent inflation.”

We are not so sure about that non-existant inflation: sure, if one ignores healthcare, food, tuition and expecially rental costs, then sure. But let that slide for the time being. Gross’ conclusion: “get off zero and get off quick. Will 2% Fed Funds harm corporate America that has already termed out its debt? A little. Will stock and bond prices go down? Most certainly. But like Volcker recognized in 1979, the time has come for a new thesis that restores the savings function to developed economies that permit liability based business models to survive – if only on a shoestring – and that ultimately leads to rejuvenated private investment, which is the essence of a healthy economy. Near term pain? Yes. Long term gain? Almost certainly. Get off zero now!” Sure, it makes all the sense in the world… and that’s why the Fed won’t do it precisely because of the “stock prices going down” part.

The Fed clearly confirmed that the stock market mandate is the only one it cares about, and as such it will let Wall Street trample over Main Street any day. Confirming this is the latest Fed Funds projection which has a December rate hike now at just 42% odds, meaning the majority of the market no longer believes the rate hike will come before 2016 (just as Goldman demanded), and is acting accoridngly. The real question, one not addressed by Gross in this letter, is the dramatic shift in the market’s posture, one where a continuation of easy conditions no longer leads to a surge in stocks. It is this that is the biggest threat to the Fed, as the market is now confirming a major easing episode such as QE4 or NIRP may not be what the Econ PhD doctor ordered to get new all time highs. This is why the Fed is not only trapped, but pushing on a string. And the longer it keeps rates at zero the greater the pain in the long-run.

“..scarce labour will set off a bidding war for workers, all spiced by a state of latent social warfare between the generations.” “The last time Europe’s serfs suddenly found themselves in huge demand was after the Black Death in the mid-14th century. They say it ended feudalism.”

• Deflation Supercycle Is Over As World Runs Out Of Workers (AEP)

Workers of the world are about to get their revenge. Owners of capital will have to make do with a shrinking slice of the cake. The powerful social forces that have flooded the global economy with abundant labour for the past four decades years are reversing suddenly, spelling the end of the deflationary super-cycle and the era of zero interest rates. “We are at a sharp inflexion point,” says Charles Goodhart, a professor at the London School of Economics and a former top official at the Bank of England. As cheap labour dries up and savings fall, real interest rates will climb from sub-zero levels back to their historic norm of 2.75pc to 3pc, or even higher. The implications are ominous for long-term US Treasuries, Gilts or Bunds. The whole structure of the global bond market is a based on false anthropology.

Prof Goodhart says the coming era of labour scarcity will shift the balance of power from employers to workers, pushing up wages. It will roll back the corrosive inequality that has built up within countries across the globe. If he is right, events will soon discredit the sweeping neo-Marxist claims of Thomas Piketty, the best-selling French economist who vaulted to stardom last year. Mr Piketty’s unlikely bestseller – Capital in the 21st Century – alleged that the return on capital outpaces the growth of the economy over time, leading ineluctably to greater concentrations of wealth in an unfettered market system. “Piketty was wrong,” said Prof Goodhart. What in reality happened is that the twin effects of plummeting birth rates and longer life spans from 1970 onwards led to a demographic “sweet spot”, a one-off episode that temporarily distorted labour economics.

Prof Goodhart and Manoj Pradhan argue in a paper for Morgan Stanley that this was made even sweeter by the collapse of the Soviet Union and China’s spectacular entry into the global trading system. The working age cohort was 685m in the developed world in 1990. China and eastern Europe added a further 820m, more than doubling the work pool of the globalised market in the blink of an eye. “It was the biggest ‘positive labour shock’ the world has ever seen. It is what led to 25 years of wage stagnation,” said Prof Goodhart, speaking at a forum held by Lombard Street Research. We all know what happened. Multinationals seized on the world’s reserve army of cheap leader. Those American companies that did not relocate plant to China itself were able play off Chinese wages against US workers at home, exploiting “labour arbitrage”.

US corporate profits after tax are now 10pc of GDP, twice their historic average and a post-war high. It was much the same story in Europe. Volkswagen openly threatened to shift production to Poland in 2004 unless German workers swallowed a wage freeze and longer hours, tantamount to a pay cut. IG Metall bowed bitterly to the inevitable. Cheap labour held down global costs and prices. China compounded the effect with a factory blitz – on subsidised credit – that pushed investment to a world record 48pc of GDP and flooded markets with cheap goods – first clothes, shoes and furniture, and then steel, ships, chemicals, mobiles and solar panels. Lulled by low consumer price inflation, central banks let rip with loose money – long before the Lehman crisis – leading to even lower real interest rates and asset bubbles. The rich got richer.

One in 7 German jobs is related to car industry.

• Volkswagen Could Pose Bigger Threat To German Economy Than Greek Crisis (Reuters)

The Volkswagen emissions scandal has rocked Germany’s business and political establishment and analysts warn the crisis at the car maker could develop into the biggest threat to Europe’s largest economy. Volkswagen is the biggest of Germany’s car makers and one of the country’s largest employers, with more than 270,000 jobs in its home country and even more working for suppliers. Volkswagen Chief Executive Martin Winterkorn paid the price for the scandal over rigged emissions tests when he resigned on Wednesday and economists are now assessing its impact on a previously healthy economy. “All of a sudden, Volkswagen has become a bigger downside risk for the German economy than the Greek debt crisis,” ING chief economist Carsten Brzeski told Reuters.

“If Volkswagen’s sales were to plunge in North America in the coming months, this would not only have an impact on the company, but on the German economy as a whole,” he added. Volkswagen sold nearly 600,000 cars in the United States last year, around 6% of its 9.5 million global sales. The U.S. Environmental Protection Agency said the company could face penalties of up to $18 billion, more than its entire operating profit for last year. Although such a fine would be more than covered by the €21 billion the company now holds in cash, the scandal has raised fears of major job cuts. The broader concern for the German government is that other car makers such as Daimler and BMW could suffer fallout from the Volkswagen disaster. There is no indication of wrongdoing on the part of either company and some analysts said the wider impact would be limited.

The German government said on Wednesday that the auto industry would remain an “important pillar” for the economy despite the deepening crisis surrounding Volkswagen. “It is a highly innovative and very successful industry for Germany, with lots of jobs,” a spokeswoman for the economy ministry said. But analysts warn that it is exactly this dependency on the automobile sector that could become a threat to an economy forecast to grow at 1.8% this year. Germany is already having to face up to the slowdown in the Chinese economy. “Should automobile sales go down, this could also hit suppliers and with them the whole economy,” industry expert Martin Gornig from the Berlin-based DIW think tank told Reuters.

“Just four months before the VW emissions scandal broke, the EU’s three biggest nations mounted a push to carry over loopholes from a test devised in 1970..”

• UK, France And Germany Lobbied For Flawed Car Emissions Tests (Guardian)

The UK, France and Germany have been accused of hypocrisy for lobbying behind the scenes to keep outmoded car tests for carbon emissions, but later publicly calling for a European investigation into Volkswagen’s rigging of car air pollution tests. Leaked documents seen by the Guardian show the three countries lobbied the European commission to keep loopholes in car tests that would increase real world carbon dioxide emissions by 14% above those claimed. Just four months before the VW emissions scandal broke, the EU’s three biggest nations mounted a push to carry over loopholes from a test devised in 1970 – known as the NEDC – to the World Light Vehicles Test Procedure (WLTP), which is due to replace it in 2017.

“It is unacceptable that governments which rightly demand an EU inquiry into the VW’s rigging of air pollution tests are simultaneously lobbying behind the scenes to continue the rigging of CO2 emissions tests,” said Greg Archer, clean vehicles manager at the respected green thinktank, Transport and Environment (T&E). “CO2 regulations should not be weakened by the backdoor through test manipulations.” Vehicle emissions are responsible for 12% of Europe’s carbon emissions and by 2021, all new cars must meet an EU emissions limit of 95 grams of CO2 per km, putting accurate measurements of real emissions at a premium. The loopholes would not only raise real world CO2 emissions from new cars to 110g CO2 per km – well above the EU limit – but increase fuel bills for drivers by €140 per year according to T&E.

Huw Irranca-Davies, Labour MP and chair of an influential select committee of MPs, the environmental audit committee, said: “Given that the UK is struggling to bring down carbon emissions and other harmful pollutants from road vehicles it is extremely worrying that the UK government appears to be trying to water down the EU’s proposed new road testing regime. “As well as cutting CO2 emissions, improving the efficiency of vehicles can save lives by reducing the illegal levels of air pollution in UK cities, so the Department for Transport should be making these tests more rigorous not less.” The WLTP test was supposed to remove loopholes that had allowed a gap between real world CO2 emissions and test cycle ones to develop, which EU consultants have estimated at up to 20%.

But the UK lobbied for car makers to be allowed to exploit flexibilities such as externally charging their batteries to full before testing. The Department for Transport also argued that the best available technologies should be shunned in favour of outdated ‘inertia classes’, which involve manually adding 100 kilo weights to the car to see what effect greater weight on the amount of CO2 the car pumps out. Research by the International Council on Clean Transportation has found that car manufacturers often game these tests by optimising test car performances at one pound below the desired inertia class. Germany went further than the UK, calling for the tests to be conducted on sloping downhill tracks, and for allowing manufacturers to declare a final CO2 value 4% lower than the one measured. France supported all the proposed loopholes, bar the 4% lower CO2 value.

Can governments keep protecting their carmakers from the law?

• Volkswagen Emissions: Automakers’ Tobacco Moment? (CNBC)

The decimation of share prices across the autos industry this week highlights growing concerns that Volkswagen’s problem could quickly turn into one for the entire carmaking industry. The U.S. Environmental Protection Agency has accused Volkswagen of installing a device in its diesel vehicles to run maximum anti-pollution controls only when emissions tests were taking place. VW has admitted the mistake and apologised, with its U.S. boss, Michael Horn, saying the company had “totally screwed up.” No other car manufacturers have been accused of this kind of behavior. However, the light shone on what Volkswagen was trying to sell as emission-reducing cars, which were in fact pumping more nitrogen dioxide (NOx) into the air than thought, could be uncomfortable for others.

The scandal should be “a massive wake up call to governments and regulators around the world,” Friends of the Earth air pollution campaigner Jenny Bates told CNBC. “More than fifty thousand people die early every year in the UK due to our illegally filthy air. Vehicle pollution is the main problem, with diesel vehicles the biggest culprit. Tough pollution standards are crucial for cleaning up our sub-standard air quality – which is why an urgent investigation is needed to ensure that the motor industry is complying with EU regulations.” Even given the drastic share price falls, investors are likely to stay away from the automobile sector for a while as they wonder which company will be next.

Analysts have been producing gloomy forecasts for both Volkswagen and the sector as a result, with one typical example from Societe Generale, which downgraded the sector from Overweight to Neutral, deeming it “dead money”. Yet the fallout could be even worse than feared, if it emerges that the problem of promoting cars as more environmentally friendly than they are goes beyond Volkswagen. This kind of industry-wide problem is sometimes called a “tobacco moment” after the cigarette industry’s early denials of the links between smoking and lung cancer, which eventually proved futile.

Industry + governments.

• Volkswagen Test Rigging Follows a Long Auto Industry Pattern (NY Times)

Long before Volkswagen admitted to cheating on emissions tests for millions of cars worldwide, the automobile industry, Volkswagen included, had a well-known record of sidestepping regulation and even duping regulators. For decades, car companies found ways to rig mileage and emissions testing data. In Europe, some automakers have taped up test cars’ doors and grilles to bolster their aerodynamics. Others have used “superlubricants” to reduce friction in the car’s engine to a degree that would be impossible in real-world driving conditions. Automakers have even been known to make test vehicles lighter by removing the back seats. Cheating in the United States started as soon as governments began regulating automotive emissions in the early 1970s.

In 1972, certification of Ford Motor’s new cars was held up after the EPA found that the company had violated rules by performing constant maintenance of its test cars, which reduced emissions but did not reflect driving conditions in the real world. Ford walked away with a $7 million fine. The next year, the agency fined Volkswagen $120,000 after finding that the company had installed devices intended specifically to shut down a vehicle’s pollution control systems. In 1974, Chrysler had to recall more than 800,000 cars because similar devices were found in the radiators of its cars. Such gadgets became known as “defeat devices,” and they have long been banned by the EPA. But their use continued to proliferate, and they became more sophisticated, as illustrated by Volkswagen’s admission this week that 11 million diesel cars worldwide were equipped with software used to cheat on emissions tests. [..]

In the United States, automakers’ lobbying has ensured that the statute giving powers to the National Highway Traffic Safety Administration “has no specific criminal penalty for selling defective or noncompliant vehicles,” says Joan Claybrook, a former administrator of the agency and a longtime advocate of auto safety. There are no criminal penalties under laws applying to the E.P.A. for violations of motor vehicle clean air rules, though there is a division of the Justice Department devoted to violations of environmental law. “I don’t see them changing this behavior unless criminal penalties are enacted into law that allow the prosecutor to put the executives in jail,” Ms. Claybrook said.

Criminal investigation MUST follow.

• VW Chief Winterkorn Steps Down After Emissions Scandal (Bloomberg)

Volkswagen CEO Martin Winterkorn resigned after U.S. officials caught the company cheating on emissions tests, leaving the world’s top-selling automaker to appoint a fresh leader to repair its reputation among customers, dealers and regulators around the globe. Stepping down after almost a decade in charge, Winterkorn said he was accepting the consequences of the mushrooming scandal that has wiped €20 billion off the company’s market value. Possible replacements include Matthias Mueller, head of the Porsche brand who has the support of the family that controls a majority stake of Volswagen, and Herbert Diess, who recently joined from rival BMW, a person familiar with the matter said.

Meantime, the company expects more executives to be targeted in the coming days in its investigation, the executive committee of the supervisory board said in a statement, exonerating Winterkorn of being involved in the manipulations. Volkswagen also asked local German prosecutors to assist and open a criminal probe. “The incident must be cleared up mercilessly, and it must be assured that such things cannot ever happen again,” said Stephan Weil, a member of the board committee and the prime minister of Lower Saxony, a key Volkswagen shareholder. “We are very much aware of the scope of this issue, the economic damage and the implications for VW’s reputation.”

Winterkorn, who was supposed to receive a contract extension on Friday, had a dramatic fall from grace that began last week with the revelation that the Wolfsburg, Germany-based company fitted diesel-powered vehicles with software that circumvented air pollution controls, then lied about it to the U.S. Environmental Protection Agency for nearly a year. The 68-year-old CEO, who had repeatedly apologized for the manipulations, was unable to hang on as the stock price plummeted 35% over two days and pressure grew from the German government for quick action. “He had little choice,” said Erik Gordon at the University of Michigan. “The company’s reputation is in tatters.” Volkswagen shares rose 5.2% to close at €111.50 on Wednesday, clawing back some of the losses earlier this week. “Volkswagen needs a fresh start,” Winterkorn said in a statement. “I am clearing the way for this fresh start with my resignation.”

Insanity squared.

• Volkswagen CEO Likely to Get $32 Million Pension After Leaving (Bloomberg)

Martin Winterkorn, engulfed by a diesel-emissions scandal at Volkswagen AG, amassed a $32 million pension before stepping down Wednesday, and may reap millions more in severance depending on how the supervisory board classifies his exit. After Winterkorn disclosed Wednesday that he had asked the board to terminate his role, company spokesman Claus-Peter Tiemann declined to comment on how much money the departing CEO stands to get. Volkswagen’s most recent annual report outlines how Winterkorn, its leader since 2007, could theoretically collect two significant payouts. Winterkorn’s pension had a value of 28.6 million euros ($32 million) at the end of last year, according to the report, which doesn’t describe any conditions that would lead the company to withhold it.

And under certain circumstances, he also can collect severance equal to two years of “remuneration.” He was Germany’s second-highest paid CEO last year, receiving a total of 16.6 million euros in compensation from the company and majority shareholder Porsche SE.

While the severance package kicks in if the supervisory board terminates his contract early, there’s a caveat. If the board ends his employment for a reason for which he is responsible, then severance is forfeited, according to company filings. The supervisory board’s executive committee said in a statement Wednesday that Winterkorn “had no knowledge of the manipulation of emissions data,” and that it respected his offer to resign and request to be terminated. It also thanked him for his “towering contributions” to the company.Winterkorn, 68, said in his statement Wednesday that he was stunned to learn of the scope of alleged misconduct occurring at the company. U.S. officials said Sept. 18 the carmaker had cheated during tests of diesel-powered vehicles sold since 2009. “As CEO I accept responsibility for the irregularities that have been found in diesel engines and have therefore requested the supervisory board to agree on terminating my function as CEO,” he said. “I am doing this in the interests of the company even though I am not aware of any wrongdoing on my part.” The annual report also mentions another piece of his pension: He can use a company car in the years that benefit is being paid out.

Being a VW dealership is a nightmare right now.

• What Volkswagen’s Crisis Could Mean for Auto Asset-Backed Securities (Alloway)

From the Environmental Protection Agency to … securitized bonds? The emissions scandal currently rocking Volkswagen is having ripple effects across markets, potentially moving all the way to sliced-and-diced bonds tied to car loans and leases. Sales of auto asset-backed securities, or ABS, have been booming in recent years as investors seek out higher-yielding products. According to Deutsche Bank estimates, about $5.6 billion worth of VW auto ABS is outstanding, with some $4.39 billion of that figure coming from bonds backed by loans and leases. Volkswagen, now facing potential fines and litigation, could find its ability to attract new business temporarily crimped, forcing down the values of the cars backing such loans. But that will probably have little impact on ABS investors, according to Elen Callahan, Deutsche Bank analyst.

“Given that the vehicles are still ‘safe and legal to drive’ and that the repairs will come at no cost to the owner, we do not expect borrowers to become disincentivized from making their contractual monthly payment on their VW vehicle,” she wrote in a note published on Wednesday. Still the $1.25 billion worth of bonds that Deutsche bank estimates are backed by car dealer inventories of VW cars—known as dealer floorplan ABS—could be a more complicated story. “As is typical for dealer floorplan ABS, the ABS trust benefits from VW financing assistance including but not limited to VW’s pledge to repurchase unsold new vehicles and inventory,” Callahan said. “We believe that despite the financial burdens associated with the recalls, VW will continue to honor this commitment given the importance of its dealer network to its primary business.”

The revelations made public last week by the EPA have reminded some auto bond analysts of recalls that hit Toyota Motor in 2009 and 2010, which affected some 9 million vehicles. Car dealers, told to immediately halt sales of popular 2015 and 2016 models, including Volkswagen’s Jetta and Beetle convertible, “are now saddled with unsalable product, at least for the time being,” Barclays analyst Brian Ford told clients in a Tuesday report. “Dealers now have a number of cars that they cannot sell; so inventory will not turn over as rapidly,” he said in a follow-up interview. “The ABS most affected by VW’s sales stoppage of certain 2015 and 2016 diesel models is the dealer floorplan securitizaiton.”

This is not new.

• VW Recall Letters In April Warned Of An Emissions Glitch (Reuters)

In April of 2015, Volkswagen of America, Inc. sent letters to California owners of diesel-powered Audis and Volkswagens informing them of an “emissions service action” affecting the vehicles. Owners were told they would need to take their cars to a dealer for new software to ensure tailpipe emissions were “optimized and operating efficiently.” The company didn’t explain that it was taking the action in hopes of satisfying government regulators, who were growing increasingly skeptical about the reason for discrepancies between laboratory emissions test results and real world pollution from Volkswagen’s diesel cars. Officials at the California Air Resources Board and the EPA agreed in December of 2014 to allow a voluntary recall of the company’s diesel cars to fix what Volkswagen insisted was a technical – and easily solved – glitch.

The recall was rolled out nationally over a period of months. On Wednesday, California Air Resources Board spokesman Dave Clegern confirmed that the letters were part of that recall. “This is one of the fixes they presented to us as a potential solution. It didn’t work,” he said. Volkswagen, which had no obligation at the time it initiated the recall to disclose the discussions that had led to it, declined to comment on the letter. The controversy came to public attention last week after Volkswagen acknowledged it had deliberately deceived officials about how much its diesel cars polluted. The recall letter instructed owners of certain 2010-2014 Volkswagen vehicles with 2-liter diesel engines to contact dealers for a software update in order to fix an issue with the malfunction indicator light illuminating.

“If the [light] illuminates for any reason, your vehicle will not pass an IM emissions inspection in some regions,” the letter warned, noting that California required the update before it would renew vehicle registrations. “The vehicle’s engine management software has been improved to assure your vehicle’s tailpipe emissions are optimized and operating efficiently,” read the letter, which said an earlier software update increased the likelihood of the light illuminating.

“We had 10 meetings with VW..” “Time and again they refused to tell us what was going on.”

• How Smog Cops Busted Volkswagen and Brought Down Its CEO (Bloomberg)

The revelation that ended Martin Winterkorn’s career at Volkswagen AG came on Sept. 3 in a meeting at an office park east of Los Angeles. After months of obfuscation, company engineers finally divulged a secret to engineers at the California Environmental Protection Agency’s Air Resources Board: Volkswagen had installed a “defeat device” to cheat on vehicle emissions tests — and then lied about it to the board and the U.S. EPA for more than a year. On Sept. 23, Europe’s largest automaker announced that Winterkorn, its 68-year-old chief executive officer, had resigned. While the company exonerated him of involvement in the manipulations, it said it will conduct an internal investigation and has asked local German prosecutors to assist and open a criminal probe.

The unraveling began in 2013. European regulators, concerned about diesel pollution there, wanted to test emissions on vehicles sold in the U.S. under actual driving conditions. The results were expected to show real-world emissions were closer to lab performance in America than in Europe. But they weren’t. That prompted investigations in California that ultimately involved 25 technicians working almost full time. They discovered the software Volkswagen used to circumvent air-pollution regulations in at least 11 million cars. “This is going to become a very, very serious problem for Volkswagen and any other companies that may have had such practices,” said Donald W. Lyons, who founded the Center for Alternative Fuels, Engines and Emissions at West Virginia University.

The nonprofit International Council on Clean Transportation, with offices in Washington, Berlin and San Francisco, got the emissions-testing contract from European regulators. It then hired researchers at the Morgantown, West Virginia, center in early 2013. The center, which has studied engine emissions and use of alternative fuels since 1989, was going to evaluate three diesel passenger cars, including a Volkswagen Passat and Jetta. m“We never went into it saying,‘we’re going to catch a manufacturer,”’ said Arvind Thiruvengadam, a research assistant professor at the center. “We were totally looking and hoping to see something different.”[..]

Using portable measuring equipment with hoses attached to vehicle exhaust pipes, researchers drove the Jetta and BMW through Los Angeles and took the Passat to Seattle and back. They also worked with the California Air Resources Board’s laboratory in El Monte, which tested the cars on a dynamometer, a device that measures engine performance. When the Volkswagen cars were in the lab, they met the Clean Air Act standards. In the real world, they were belching out oxides of nitrogen at much higher levels than allowed. “There was a lot of texting and e-mailing back and forth,” among the two groups: “‘Whoa, things aren’t looking good here,”’ Carder said. In May 2014, the West Virginia center published the results of its study, prompting the California board to start an investigation.

“..his team’s findings were made public nearly a year and a half ago..”

• West Virginia Engineer Proves To Be A David To VW’s Goliath (Reuters)

Daniel Carder, an unassuming 45-year-old engineer with gray hair and blue jeans, appears an unlikely type to take down one of the world’s most powerful companies. But he and his small research team at West Virginia University may have done exactly that, with a $50,000 study which produced early evidence that Volkswagen AG was cheating on U.S. vehicle emissions tests, setting off a scandal that threatens the German automaker’s leadership, reputation and finances. “The testing we did kind of opened the can of worms,” Carder says of his five-member engineering team and the research project that found much higher on-road diesel emission levels for VW vehicles than what U.S. regulators were seeing in tests.

The results of that study, which was paid for by the nonprofit International Council on Clean Transportation (ICCT) in late 2012 and completed in May 2013, were later corroborated by the U.S. Environmental Protection Agency and California Air Resources Board (CARB). Carder’s team – a research professor, two graduate students, a faculty member and himself – performed road tests around Los Angeles and up the West Coast to Seattle that generated results so pronounced that they initially suspected a problem with their own research. “The first thing you do is beat yourself up and say, ‘Did we not do something right?’ You always blame yourself,” he told Reuters in an interview. “(We) saw huge discrepancies. There was one vehicle with 15 to 35 times the emissions levels and another vehicle with 10 to 20 times the emissions levels.”

Despite the discrepancies, a fix shouldn’t involve major changes. “It could be something very small,” said Carder, who’s the interim director of West Virginia University’s Center for Alternative Fuels, Engines and Emissions in Morgantown, about 200 miles (320 km) west of Washington in the Appalachian foothills. “It can simply be a change in the fuel injection strategy. What might be realized is a penalty in fuel economy in order to get these systems more active, to lower the emissions levels.” Carder said he’s surprised to see such a hullabaloo now, because his team’s findings were made public nearly a year and a half ago. “We actually presented this data in a public forum and were actually questioned by Volkswagen,” said Carder.

Perpetual growth.

• Forget ‘Developing’ Poor Countries, It’s Time To ‘De-Develop’ Rich Countries (Guardian)

This week, heads of state are gathering in New York to sign the UN’s new sustainable development goals (SDGs). The main objective is to eradicate poverty by 2030. Beyoncé, One Direction and Malala are on board. It’s set to be a monumental international celebration. Given all the fanfare, one might think the SDGs are about to offer a fresh plan for how to save the world, but beneath all the hype, it’s business as usual. The main strategy for eradicating poverty is the same: growth. Growth has been the main object of development for the past 70 years, despite the fact that it’s not working. Since 1980, the global economy has grown by 380%, but the number of people living in poverty on less than $5 (£3.20) a day has increased by more than 1.1 billion. That’s 17 times the population of Britain. So much for the trickle-down effect.

Orthodox economists insist that all we need is yet more growth. More progressive types tell us that we need to shift some of the yields of growth from the richer segments of the population to the poorer ones, evening things out a bit. Neither approach is adequate. Why? Because even at current levels of average global consumption, we’re overshooting our planet’s bio-capacity by more than 50% each year. In other words, growth isn’t an option any more – we’ve already grown too much. Scientists are now telling us that we’re blowing past planetary boundaries at breakneck speed. And the hard truth is that this global crisis is due almost entirely to overconsumption in rich countries.

Scientists tell us our planet only has enough resources for each of us to consume 1.8 “global hectares” annually – a standardised unit that measures resource use and waste. This figure is roughly what the average person in Ghana or Guatemala consumes. By contrast, people in the US and Canada consume about 8 hectares per person, while Europeans consume 4.7 hectares – many times their fair share. What does this mean for our theory of development? Economist Peter Edward argues that instead of pushing poorer countries to “catch up” with rich ones, we should be thinking of ways to get rich countries to “catch down” to more appropriate levels of development.

We should look at societies where people live long and happy lives at relatively low levels of income and consumption not as basket cases that need to be developed towards western models, but as exemplars of efficient living. How much do we really need to live long and happy lives? In the US, life expectancy is 79 years and GDP per capita is $53,000. But many countries have achieved similar life expectancy with a mere fraction of this income. Cuba has a comparable life expectancy to the US and one of the highest literacy rates in the world with GDP per capita of only $6,000 and consumption of only 1.9 hectares – right at the threshold of ecological sustainability. Similar claims can be made of Peru, Ecuador, Honduras, Nicaragua and Tunisia.

Move over, darling.

• ‘Downsizing Could Free Up 2.5 Million British Homes’ (Guardian)

More than 2.5m homes could be released on to the property market if older owners were given better incentives and information on downsizing, the Royal Institution of Chartered Surveyors (Rics) has claimed. It said tackling the housing crisis needed to address barriers to supply, rather than simply addressing demand, and that 2.6m homes worth a combined £802bn could be released if homeowners received greater support to move into specialist retirement or smaller properties. The group’s Residential Policy Review also recommended that second homeowners should be charged full council tax to encourage them to sell or let the property, and that new developments should have a statutory percentage of affordable rented accommodation.

The report comes just days after the City regulator was forced to deny its policy was to encourage older homeowners to move, after comments made by a member of staff on its mortgage team sparked controversy. Increased life expectancy means that there around 11.4 million over-65s in the UK, and the figure is projected to rise to around 17.2 million by 2033. Currently, homeownership is concentrated in older age groups, with many owning their properties outright. Rics said communication about alternatives to staying in the family home were poor, meaning that options like retirement rental, housing co-operatives and shared housing were not being fully exploited. It acknowledged “there is a very strong emotional dimension to people’s homes, with considerable effort, both physical and emotional, to moving”.

Jeremy Blackburn, head of policy at Rics said: “Britain’s older homeowners are understandably reluctant to move out of much-loved, but often under-occupied family homes. “Clearly, it’s an emotive issue and one that needs to be treated with sensitivity, but we would like to see central and local government provide older people with the information, practical and financial support they need to downsize if that is their choice.” Blackburn cited the example of Bristol City council, which said it was offering a fund to support moving costs. “Almost a third of over 55s have considered downsizing in the last five years; yet we know that only 7% actually did,” he said.

Not the first NHS warning in recent days.

• Prepare For A Catastrophic NHS Winter Meltdown (Guardian)

The NHS is on the brink of a major, messy failure. If nothing is done to address the underlying issues now, the failure will be deep with grave consequences and a long recovery. This winter things are set to go catastrophically wrong. Pressure on health services normally reduces in summer, often producing undue optimism about how they will cope come winter and delaying necessary preparations. Last summer there was virtually no reduction in pressure. Oddly, this failed to dent the optimism. The revised story was that unrelenting pressure had become a year-round phenomenon, so increased numbers and longer waits were now normal and the coming winter wouldn’t be any worse. Unfortunately it was, the worst in 20 years.

Demand for healthcare had simply reached a new (summer) plateau, with new peaks of winter demand inevitable and predictable – but not predicted and not prepared for. Waits and delays soared, even though demand increased modestly, following a well-established trend. The crisis happened because the NHS starved itself of the capacity it needed, in the futile belief that lack of supply would constrain demand and so save money. This led not only to running out of spare capacity, but to shortages and the loss of the elasticity to cope with new peaks in demand. The result was waits and delays multiplied rather than increased, and it contributed to the worst NHS deficit in a decade.

Despite this, the lesson has not been learned that the NHS’s struggles this summer foreshadow a meltdown this winter. Some 90% of trusts are predicting a deficit this year. The deficits add up to £2bn, double last year’s figure. Performance continues to wallow, with little or no recovery from the long delays and extended waiting times of last winter. Crucially, performance this summer was worse than last summer, which prefigured last winter’s crisis. The obvious conclusion is that it prefigures something worse.

Home › Forums › Debt Rattle September 24 2015