Jack Delano Truck service station on U.S. 1, NY Avenue, Washington, DC 1940

Why do these ‘official’ numbers get any attention at all?

• China Economy Logs Weakest Growth Since 2009 Despite Easing (Reuters)

China’s economic growth dipped below 7% for the first time since the global financial crisis on Monday, hurt partly by cooling investment, raising pressure on Beijing to further cut interest rates and take other measures to stoke activity. The world’s second-largest economy grew 6.9% between July and September from a year ago, the National Bureau of Statistics said, slightly better than forecasts of a 6.8% rise but down from 7% in the previous three months. That hardened expectations that China would avoid an abrupt fall-off in growth, with analysts predicting a more gradual slide in activity stretching into 2016. “Underlying conditions are subdued but stable,” said Julian Evans-Pritchard at Capital Economics in Singapore.

“Stronger fiscal spending and more rapid credit growth will limit the downside risks to growth over the coming quarters.” Chinese leaders have been trying to reassure jittery global markets for months that the economy is under control after a shock devaluation of the yuan and a summer stock market plunge fanned fears of a hard landing. Some analysts were hopeful that the third-quarter cooldown could mark the low point for 2015 as a burst of stimulus measures rolled out by Beijing comes into force in coming months, but muted monthly data for September kept such optimism in check.

“As growth slows and risk of deflation heightens, we reiterate that China needs to cut reserve requirement ratio (RRR) by another 50bps in Q4,” economists at ANZ Bank said in a note to clients. “Looming deflation risk suggests that the People’s Bank of China will also adjust the benchmark interest rates, especially lending rate, down further.” In its battle against China’s worst economic cooldown in more than six years, the central bank has cut interest rates five times since November and reduced banks’ reserve requirement ratios three times this year. Despite the spate of easing, Monday’s GDP reading was still the worst since the first quarter of 2009, when growth tumbled to 6.2%.

The real problem is everyone’s lying about growth numbers.

• The Fed Is Stuck, With US At The Mercy Of China (MarketWatch)

The U.S. economy used to be like a muscleman surrounded by 98-pound weaklings. It regularly flaunted its power and was little swayed by what happened to the crowd on the beach. Those days, if they ever really existed, ended long ago. Although the U.S. is still more insular than its major economic rivals, some 30% of the nation’s economy involves trade through imports and exports. That’s a record high and about three times larger compared to several decades ago. The result: U.S. policy on interest rates and related matters are at the tender mercy of events around the globe, and the picture isn’t pretty. That’s why the Federal Reserve last month jettisoned a pending increase in interest rates and is now likely to wait until 2016.

Three things are holding the Fed back: Softer growth in China, a strong dollar and weak U.S. inflation. They are all tied together. Start with China. Evidence of slower growth caused stock markets worldwide to slump in August and September, freezing the Fed in place. Central bankers worry about spillover effects if the Asian giant’s slide continues. With a light U.S. economic calendar, investors will pay close attention this week when China gives an update on third-quarter gross domestic product. The pace of annual growth is expected to dip below 7%, but if it falls under 6.5%, another global stock rout could ensue. “There is a lot of fear about the news out of China,” said Scott Brown, chief economist of Raymond James. He thinks the worries are overblown.

Yet with China fresh on their minds, top Fed officials are worried that an increase in interest rates now could cause more harm than good. They are particularly concerned about making a move that would boost an already soaring dollar even further. The strongest dollar in more than a decade has dealt a heavy blow to manufacturers and companies that rely on exports, making American-made goods more expensive for foreigners to buy. Amid a slump in exports, those companies have responded in turn by cutting investments, postponing new hires or even eliminating jobs. That might help explain why hiring in the U.S. slowed sharply toward the end of the summer, giving the Fed even more reason to wait on rates.

Think anyone told Cameron China’s imports dropped by 20%?

• UK In Economic Kowtow To Xi Seeks ‘Golden Era’ In China Trade (Bloomberg)

The U.K. is rolling out the red carpet for Chinese President Xi Jinping’s state visit starting Monday. Amid the pomp of a 41-gun salute, lunch with Queen Elizabeth II and lodging at Buckingham Palace, Prime Minister David Cameron will be looking to Xi to open up the purse strings and dole out billions of pounds of new investment. China opening the investment spigot would help redress a lopsided trade relationship that’s left the U.K. lagging its continental peers in winning Chinese largess. Chinese officials have said the amount of deals Xi will announce during the trip will be “huge.” The U.K. is back in China’s good graces after Cameron’s May 2012 meeting with the Dalai Lama plunged the two countries into a near two-year diplomatic freeze.

Chancellor of the Exchequer George Osborne reflected the U.K.’s more accommodative tone on a September trip to China when he signaled the U.K. would refrain from criticism on human rights and not engage in “megaphone diplomacy.” The U.K., the first major Western country to get behind China’s Asian Infrastructure Investment Bank, was striving to be China’s “best partner in the West” and usher in a “golden era” between the countries, he said. While the U.K. is now China’s second biggest European Union trading partner after Germany, it has the biggest trade imbalance of the five largest EU economies. That trade deficit reflects its relatively weak exports of goods and services compared with imports from China. The U.K. is counting on Xi making progress in his drive to transform China’s economy from an export-driven model to a consumption-driven one to create new markets for British firms.

There’s always another bubble just around the corner. “If you stop the trading in one part of the market and there’s a proxy for offloading that risk elsewhere, you’ll use that proxy.”

• Chinese Copper-Trading Surge Shakes Up Market (WSJ)

Chinese investors hamstrung by stock-trading restrictions are piling into copper trading, a shift that analysts and traders say has distorted the global market for the metal. Since the start of July, when authorities began limiting stock trading in China, trading in stock-index futures has fallen 97% to around 65,000 contracts a day, while trading in Chinese copper futures has nearly doubled to roughly 710,000 contracts a day. Because investors now face obstacles in betting against stock futures, they have turned to the copper market as they seek avenues to bet on a deepening slowdown in the world’s second-largest economy, traders and other market experts say.

Spikes in activity on China’s main commodities exchange have coincided with a period of heightened volatility in copper prices and are driving copper-trading volumes world-wide. Global volumes are on track to hit a record high this year, with traders in China accounting for the largest share. The rising prominence of Chinese investors in the copper market is the latest example of the country’s increased heft in financial markets. In recent years, Chinese investors who used physical metals as collateral for bank loans were credited with driving up demand for copper, zinc and nickel and contributing to higher global prices.

Now, some industry officials have said the heavy selling of copper futures in China has skewed prices so much that they no longer accurately reflect the supply and demand for a metal used in everything from iPhones to refrigerators. “We saw copper being sold heavily [by Chinese traders] when trading was first being restricted in Chinese equities; it was an outlet to be able to sell risk,” said David Donora, who oversees $600 million invested in commodities at Columbia Threadneedle Investments. “If you stop the trading in one part of the market and there’s a proxy for offloading that risk elsewhere, you’ll use that proxy.”

Sounds terrifc: “..bad-debt securitization..”

• China Ponders Tool Deemed Too Risky Post 2008 to Cut Bad Loans (Bloomberg)

China is facing calls to bring back an instrument to fight bad loans it had deemed too dangerous after the global financial crisis: debt tied to failed assets. China Construction Bank said in August it’s exploring bad-debt securitization, in which lenders package soured loans into notes sold to investors. While a central bank official said in May such products are under study, regulators this month declined to comment on the plans. Only three Chinese firms have issued such bonds before a 2009 halt to all asset-backed securities that ended in 2012 with products tied only to performing assets. President Xi Jinping faces pressure to help banks cut the biggest pile of bad loans since 2008 as sliding corporate profits, rising defaults and a stock rout worsen credit strains.

Structures that allow lenders to move troubled credit off their books won’t encourage prudence among banks and Chinese raters are unlikely to be better than their U.S. counterparts that failed to anticipate the 2008 global turmoil, according to R&R Consulting. “Although China has some genuine strengths in ABS market building, risk measurement is its Achilles heel,” said Ann Rutledge, founding principal at the firm that assesses structured products and has its main offices in New York and Hong Kong. “The U.S. rating agencies that are active in China would probably be relied upon by investors, and it is well to bear in mind, they did not do a stellar job rating NPL securitizations in 1997-98, not to mention their role in non-performing securities production in the 2000s.”

Debt deflation.

• The World Hits Its Credit Limit, And The Debt Market Starts To Realize It (ZH)

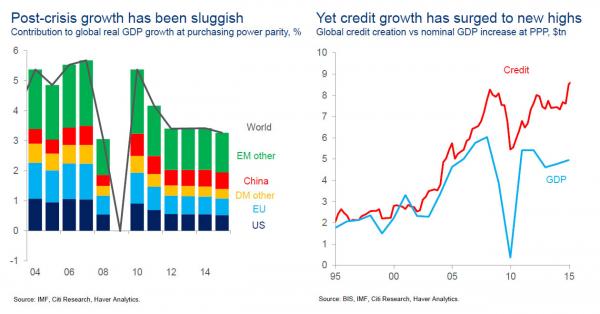

One month ago, when looking at the dramatic change in the market landscape when the first cracks in the central planning facade became evident and it appeared that central banks are in the process of rapidly losing credibility, and the faith of an entire generation of traders whose only trading strategy is to “BTFD”, we presented a critical report by Citigroup’s Matt King, who asked “has the world reached its credit limit” summarized the two biggest financial issues facing the world at this stage. The first is that even as central banks have continued pumping record amount of liquidity in the market, the market’s response has been increasingly shaky (in no small part due to the surge in the dollar and the resulting Emerging Market debt crisis), and in the case of Junk bonds, a downright disaster.

As King summarized it “models linking QE to markets seem to have broken down.” Needless to say this was bad news for everyone hoping that just a little more QE is all that is needed to return to all time S&P500 highs. And while this concern has faded somewhat in the past few weeks as the most violent short squeeze in history has lifted the market almost back to record highs even as Q3 earnings season is turning out just as bad, if not worse, as most had predicted, nothing has fundamentally changed and the fears over EM reserve drawdown will shortly re-emerge, once the punditry reads between the latest Chinese money creation and capital outflow lines.

The second, and far greater problem, facing the world is precisely what the Fed and its central bank peers have been fighting all along: too much global debt accumulating an ever faster pace, while global growth is stagnant and in fact declining. King’s take: “there has been plenty of credit, just not much growth.” Our take: we have – long ago – crossed the Rubicon where incremental debt results in incremental growth, and are currently in an unprecedented place where economic textbooks no longer work, and where incremental debt leads to a drop in global growth. Much more than ZIRP, NIRP, QE, or Helicopter money, this is the true singularity, because absent wholesale debt destruction – either through default or hyperinflation – the world is doomed to, first, a recession and then a depression the likes of which have never been seen.

Space for stockpiling is always limited. Then it’s on to dumping.

• Saudi Crude Stockpiles at Record High in August as Exports Fell (Bloomberg)

Saudi Arabia’s crude inventories rose to a record level in August as production and exports by the world’s biggest oil shipper declined. Commercial crude stockpiles increased to 326.6 million barrels, the highest since at least 2002, from 320.2 million barrels in July, according to data posted on the website of the Riyadh-based Joint Organisations Data Initiative. Exports slumped 3.8% in August to 7 million barrels a day from 7.28 million the previous month. Saudi international shipments dropped each month since March except for June, the data show.

Brent crude oil prices have slid 12% this year as Saudi Arabia led the Organization of Petroleum Exporting Countries in boosting production to defend the group’s market share amid a global supply glut. Brent futures for December settlement closed Friday at $50.46 a barrel in London, up 73 cents. Saudi Arabia cut back oil production in August to 10.27 million barrels a day from 10.36 million in July, according to the JODI data. The kingdom told OPEC that it produced 10.23 million barrels daily in September. It pumped at an all-time high of 10.56 million barrels a day in June, exceeding a previous record from 1980.

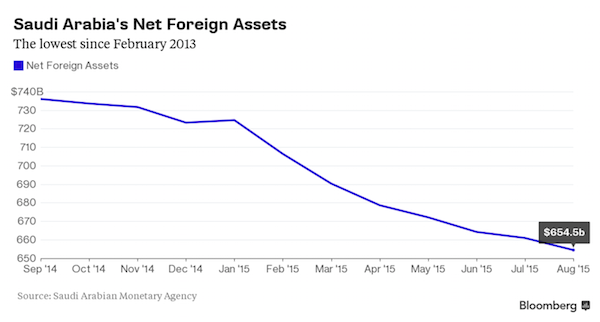

In worse shape than anyone lets on.

• Saudi Arabia Said to Delay Contractor Payments After Oil Slump (Bloomberg)

Saudi Arabia is delaying payments to government contractors as the slump in oil prices pushes the country into a deficit for the first time since 2009, according to three people with knowledge of the matter. Companies working on infrastructure projects have been waiting six months or more for payments as the government seeks to preserve cash, the people said, asking not to be identified as the information is private. Delays have increased this year and the government has also been seeking to cut prices on contracts, the people said. Saudi Arabia is tackling the slump in crude, which accounts for about 80% of revenue, by tapping foreign reserves, cutting spending and selling bonds. Net foreign assets fell by about $82 billion at the end of August after reaching an all-time high last year.

The country has raised 55 billion riyals ($15 billion) from debt issuance this year. The government is also seeking to cut capital spending and delay projects. “It’s hard to hold back from boosting spending when oil is on the rise, but very hard to cut when oil prices fall,” Simon Williams at HSBC said in e-mailed comments. “Cuts are coming – the budget deficit is too large to ignore and pretend it’s business as usual.” Payment delays could slow the completion of projects under construction, including the $22 billion Riyadh metro, and curb the expansion needed to create jobs for a rising population. In the past, government spending has been a catalyst for growth. For example, when authorities announced $130 billion in social spending in 2011, the economy expanded 10%.

This year, growth will probably be about 3%, according to data compiled by Bloomberg. Crude’s decline – it’s about halved in the past 12 months – coupled with the kingdom’s spending plans, will leave Saudi Arabia with a budget deficit exceeding 400 billion riyals this year ($107 billion), according to the IMF. The aggregate deficit for 2015 to 2017 is likely to exceed $300 billion, according to a report by HSBC.

A bank in big trouble.

• Deutsche Bank Restructures, Splits Investment Bank (CNBC)

German banking giant Deutsche Bank on Sunday announced a sweeping reorganization plan designed to “fundamentally change” how it does business, cleaving its investment bank into two parts and parting ways with some of its key executives. As the bank continues to grapple with the fallout of trading and governance scandals, Deutsche made an announcement that was widely anticipated by Wall Street watchers. In a statement, Deutsche said it plans to combine its corporate finance and global transaction banking businesses, while making its private and business clients division an independent business unit. As a result of the changes, its asset management arm will operate as a stand-alone division focused solely on institutional clients and funds.

In what it called “an extraordinary meeting” at the bank’s headquarters in Frankfurt, Deutsche’s management “resolved to restructure the bank’s business divisions,” including reorganizing its senior ranks and abolishing certain units. “The Supervisory Board’s guiding principle, in light of the Bank’s Strategy 2020, was to reduce complexity of the Bank’s management structure enabling it to better meet client demands and requirements of supervisory authorities,” the statement added. In addition, the bank said it would abolish its group executive committee, while putting a representative of each of its four core operations on a newly constituted board. In recent months, Deutsche has been enmeshed in investigations, amid allegations that it was rigging financial markets. Since taking the reins after the departure co-CEO Anshu Jain earlier this year, analysts have been anticipating that newly installed CEO John Cryan would move quickly to restructure the bank.

Centralization.

• Why Americans Don’t Trust the Fed (Lowenstein)

When Woodrow Wilson ran for president in 1912, he was forced to declare himself “opposed to the idea of a central bank”—though in his heart, he was an avid supporter. Rep. Carter Glass, a Virginia Democrat, drafted a bill to restructure the banking system along regional lines. Not unlike Sen. Paul a century later, Glass didn’t trust Washington experts. But Wilson, after his election, insisted that Glass’s bill include a Reserve Board under federal control. The Federal Reserve Act, which Wilson signed in 1913, traveled a tortuous legislative path. Westerners and farmers worried that the new bank would crimp the money supply, preventing farmers from raising prices. But many bankers feared that the Fed would print too much money.

Today, these groups have switched sides. Wall Street has largely supported Fed Chairwoman Janet Yellen’s low-interest-rate policy while populist critics have castigated the Fed for promoting inflation. Still, inflation remains low; a basket of goods that cost $20 a decade ago costs $24.41 today. And with the U.S. economy growing (albeit at a modest rate) for six straight years, credit eminently affordable, and the dollar still prized world-wide, it is hard not to conclude that the Fed is doing at least a reasonable job. But if the Federal Reserve didn’t exist, Congress would have a hard time enacting it now.

Gary Gorton, a banking expert at the Yale School of Management, says that if the Fed were designed today, “It would have severely restricted powers. It might not be independent at all.” This is what several bills that are now before Congress attempt to bring about. Current criticism of the Fed is basically twofold: Some object to ultralow interest rates, fearing that they will lead to economic distortions, while others resent the bailouts and other programs designed to ease the 2008 financial crisis. Acting as this sort of “lender of last resort” was the Fed’s original purpose, of course, but many Americans still think that the Fed has too much power. Jackson’s ghost lives on.

“Our leaders celebrate dying coal not rising solar. Terrified of the household debt underpinning banks, they preen “confidence” instead of shifting funding structures to productive lending.”

• The Rise And Rise Of Australian Wussonomics (MB)

I put it to you that there are four main drivers of Australian wussonomics, some deeper than others, and all of them go to the heart of the economic challenge confronting Australia’s future. The first pillar of wussonomics is our peculiar economic structure. After a three decade run of good fortune, we are left with a massively inflated cost structure that means the only two economic activities of any magnitude that are left are shipping dirt and borrowing money to inflate house prices. This in itself leads to Banana Republic dynamics in which two dominant rent-seeking sectors – mining and banking – control policy, and various bizarre ideologies rise to justify that concentration.

The second pillar of wussonomics is the cyclical implications of the above. As we pass through cycles, bad decisions are made over and again, and those making them become more and more compromised. One example is the extraordinary turnover in our political leadership. As each new leader takes on the trappings of the dominant rent-seekers, wussonomics is sustained as economic narrative of the day. Our leaders celebrate dying coal not rising solar. Terrified of the household debt underpinning banks, they preen “confidence” instead of shifting funding structures to productive lending. A second example is the RBA which went from over-egging a commodity bubble and setting policy to let it run and, when its first bubble popped, shifting to over-egging a housing bubble and setting policy to let it run.

Each blunder begets another as institutions and their leaders sink further and further into arse-covering over national interest. Then, one after another, these same leaders are torn down by a disaffected polity because wussonomics only makes things worse by entrenching the economic vandals while promising the world. The third pillar of wussonomics is a really sick media. The timing here is unfortunate in that media is undergoing huge disruption that has bereft it of its traditional business model. That has killed vigorous journalism as cost cuts destroy corporate memory and talent, and as advertising becomes advertorial because managers are afraid to upset a narrowing set of business clients, that tend again to be in the dominant rent seeking sectors. One needs only to observe the centrality of real estate and banks to media profit growth to see this.

The fourth pillar of wussonomics is older and deeper. It is Australia’s unique sub-altern identity, it’s long term inferiority complex, a mind set that over-celebrates achievements and buries failures, which leaves Australians at constant peril of psychological colonisation.

This will not end well either.

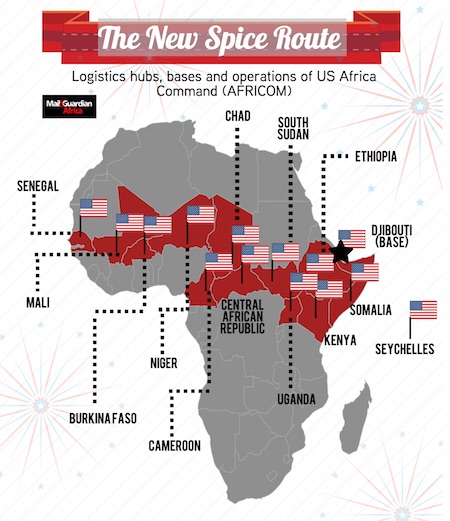

• US Military Quietly Builds Giant Security Belt Through Middle Of Africa (MGA)

Nigeria has welcomed a US decision to send up to 300 military personnel to Cameroon to help the regional fight against Boko Haram, despite having itself requested more direct help from Washington. President Muhammadu Buhari’s spokesman Garba Shehu on Thursday said the deployment was a “welcome development” while the military said it demonstrated cooperation was needed against the Islamists. Washington last year provided intelligence, surveillance and reconnaissance expertise to Nigeria in the hunt for more than 200 schoolgirls abducted from their school. The assistance included drones and spy planes as well as up to 80 military personnel sent to Chad’s capital, N’Djamena. In 2013, the US set up a drone base in neighbouring Niger.

But the US is not only involved in fighting back Boko Haram on the continent. In recent years, the US has quietly ramped up its military presence across Africa, even if it officially insists its footprint on the continent is light. The decisive point seems to have been the election of President Barack Obama in 2008. For years, the United States Africa Command (known by the acronym AFRICOM) has downplayed the size and scope of its missions on the continent, and without large battalions of actual boots on the ground, as was the case in Afghanistan and Iraq, you’d be forgiven for missing its unfolding.

But behind closed doors, US military officials are already starting to see Africa as the new battleground for fighting extremism, and have begun to roll out a flurry of logistical infrastructure and personnel from West to East – colloquially called the “ new spice route” – and roughly tracing the belt of volatility on the southern fringes of the Sahara Desert; the deployment to Cameroon is just the latest of many. These support all the activities that American troops are currently involved in Africa: airstrikes targeting suspected militants, night raids aimed at seizing terror suspects, airlifts of French and African troops onto the battlefields, and evacuation operations in conflict zones.

Winter is coming.

• Thousands Stranded On New Migrant Route Through Europe (AP)

Tension was building among thousands of migrants as they remained stranded in fog and cold weather in the Balkans on Sunday local time in their quest to reach a better life in Western Europe, a day after Hungary closed its border with Croatia and the flow of people was redirected to a much slower route via Slovenia. Tiny Slovenia has said it will only take in 2,500 people a day, significantly stalling the movement of people as they flee their countries in the Middle East, Asia and Africa. On Saturday, more than 6,000 people reached Croatia, but most of them were stuck in the country as well as in neighboring Serbia on Sunday – and thousands kept on arriving. On the Serbian-Croatian border, tensions flared and scuffles erupted as hundreds of irritated migrants faced a cordon of Croatian policemen preventing them from entry.

The Balkan migrant route switched to Slovenia early Saturday after Hungary’s right-wing government closed its border to Croatia for the influx, citing security concerns and saying it wants to protect the European Union from an uncontrolled flow of people. Slovenian officials said they can’t accept 5,000 migrants per day as asked by Croatia, which is likely to cause a further backlog in the flow. Interior Ministry official Bostjan Sefic said Slovenia can’t take more than neighboring Austria, which said it can accept 1,500 per day. “If we would accept 5,000 migrants per day that would mean 35,000 would be in Slovenia in 10 days,” Sefic said, taking into account those who leave for Austria. “That would be unacceptable.”

Craziest thing of all in this cattle trade: Turkey asking for “a change in the EU’s stance on the 1915 massacres of Ottoman Armenians..”

• Brussels Draws Up Plan To Resettle 200,000 Refugees Across Europe (FT)

Brussels will propose a large-scale refugee resettlement scheme early next year in a move that could see 200,000 migrants distributed across the bloc directly from camps in countries such as Turkey, Jordan and Lebanon. The European Commission plans to propose a “structural EU-wide resettlement scheme” in March as part of a host of reforms aimed at stemming the flow of people from Turkey and nearby countries into the EU. Massive resettlement is seen as part of a quid pro quo of any deal with Turkey, which the EU is hoping to persuade to play a bigger role in stemming the flow of migrants to Europe. Angela Merkel, Germany’s chancellor, met Recep Tayyip Erdogan, Turkey’s president, in Istanbul on Sunday and promised her government would help breathe life into the country’s stalled accession negotiations with the EU in exchange for its help in stemming the tide of migrants and refugees into Europe.

“Germany is ready this year to open chapter 17, and fix benchmarks for 23 and 24,” Ms. Merkel said at a press conference with Turkey’s prime minister Ahmet Davutoglu, referring to three areas, or chapters, of EU law that make up the membership talks. “We can talk about the details.” A candidate for EU membership since 1999, Turkey has opened only 14 out of 35 chapters since talks began in 2005. It has closed only one. Ms. Merkel, however, stopped short of endorsing a list of separate demands to which Turkey appears to have tied its support for the EU plan, including lifting visa restrictions for Turkish nationals by next summer and a change in the EU’s stance on the 1915 massacres of Ottoman Armenians, referred to by many historians as the first genocide of the 20th century.

Last week, EU member states agreed a package of up to €3bn in aid for Turkey to cope with its 2.5m refugees, mostly from neighbouring Syria. Brussels will also re-examine whether Turkish citizens should automatically qualify for Schengen visas in exchange for Ankara’s help. Mr. Erdogan has poured scorn on what he and many of his countrymen see as Europe’s inability to cope with the influx. “They announce they’ll take in 30,000 to 40,000 refugees and then they are nominated for the Nobel for that,” the Turkish leader said on Friday, in a pointed reference to Ms. Merkel. “We are hosting 2.5 million refugees but nobody cares.”

They’re having the wrong discussion.

• As Merkel, Erdogan Discuss Refugee Crisis, More Die In Aegean (Kath.)

As German Chancellor Angela Merkel and Turkish President Recep Tayyip Erdogan prepared to discuss the refugee crisis in Istanbul on Sunday, at least five more migrants died in the Aegean. A boy was pronounced dead after arriving on the island of Farmakonisi with another 109 migrants aboard a smuggling vessel. According to an account by the boy’s parents, who were also on the boat, the child fell off the boat close to shore. He was pulled back aboard but remained unconscious and was pronounced dead by a local doctor. In another incident, off Kastellorizo, a sailing boat reported the discovery of a dead baby on Sunday morning. A Coast Guard vessel was subsequently dispatched and discovered the bodies of two women and a small boy. According to the accounts of the 11 survivors, a man remained unaccounted for.

It’s not just off the Greek coast.

• Italy Navy Says Eight Migrants Die In Mediterranean, 113 Rescued (Reuters)

Eight bodies have been recovered from a rubber boat carrying migrants trying to cross the Mediterranean, the Italian navy said in a Tweet on Sunday. It said the ship Bersagliere had rescued 113 migrants from the boat. It gave no further details. On Saturday, the navy rescued 562 migrants trying to reach Europe on five boats. Nearly all of those rescued on Saturday were from sub-Saharan African countries.

Dead children’s bodies are piling up. It’s what we have become.

• Five Refugees Drown Off Greek Islands, One Missing (Reuters)

Five people, including a baby and two children, drowned and one was missing in two separate incidents of migrants trying to reach Greece from nearby Turkey on Sunday, the Greek coastguard said. The service said a sail boat early on Sunday reported it had recovered the body of a baby and had rescued 11 migrants off the Kastellorizo island. The coast guard, which then rushed to the spot, recovered the corpses of another two women and a boy, while it was looking for a missing man, it said. Thousands of refugees – mostly fleeing war-torn Syria, Afghanistan and Iraq – attempt daily to cross the Aegean Sea from neighboring Turkey, a short trip but a perilous one in the inflatable boats the migrants use, often in rough seas.

Almost 400,000 people have arrived in Greece this year, according to the U.N. refugee agency UNHCR, overwhelming the cash-strapped nation’s capacity. In a separate incident, a boy, part of a group of about 110 people, drowned when he fell off a boat en route to the island of Farmakonisi. The rest of the people managed to get ashore. The EU has offered Turkey 3 billion euros ($3.4 billion) in aid and the prospect of easier travel visas and “re-energized” talks on joining the bloc if it helps stem the flow across its territory.

Home › Forums › Debt Rattle October 19 2015