Harris&Ewing Goodyear Blimp at Washington Air Post ,DC 1938

Losses to date estimated at $15 trillion.

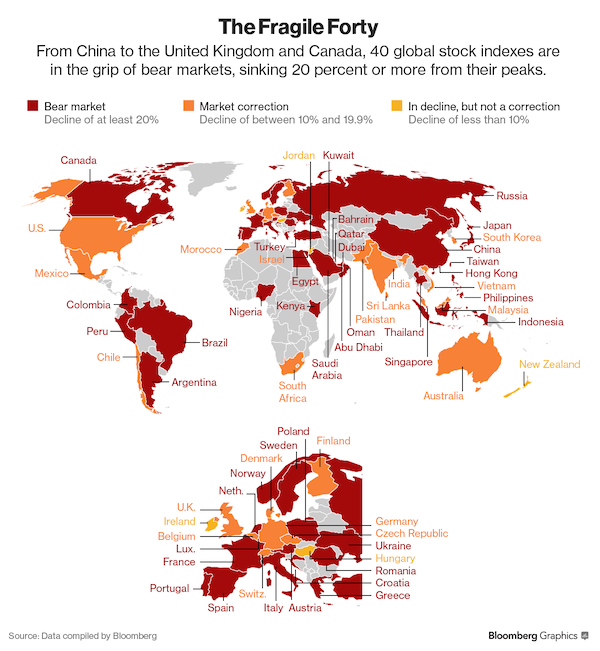

• Global Shareholders Have $27 Trillion Locked in Bear Markets (BBG)

At least 40 stock markets around the world with a total value of $27 trillion are in bear territory, as investors witness the worst start to a year on record. The U.K. was the latest market to fall 20% from its peak, while India is 1% away from crossing the threshold that traders describe as the onset of bear market. Nineteen countries with $30 trillion have declined between 10% and 20%, thereby entering a so-called correction, according to data compiled by Bloomberg from the 63 biggest markets.

“People are just bottom-fishing.”

• US Futures Drop With Asia Stocks as Oil Falls (BBG)

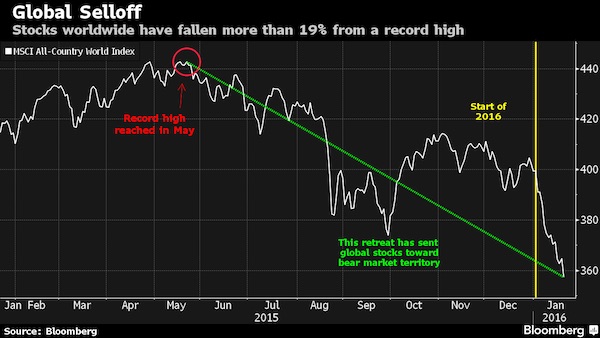

U.S. index futures declined after a rally in Asian stocks reversed, pushing a gauge of global equities back to the brink of a bear market. Oil fell and the yen strengthened. Benchmark share measures in Tokyo, Shanghai and Manila slumped at least 2.8%, while Standard & Poor’s 500 Index contracts erased early gains to trade 0.9% lower. European index futures slid after the region’s stocks plunged the most since August on Wednesday. China’s equitiesfell despite a drop in money-market rates as the People’s Bank of China injected the most cash via open-market operations since 2013. The yen approached a one-year high reached Wednesday. Copper pared an advance.

Volatility has coursed through financial markets in 2016, amid turmoil in Chinesemarkets and the almost uninterrupted selloff in crude oil. The S&P 500’s plunge Wednesday triggered a technical signal indicating U.S. stocks were oversold, spurring a paring of losses that prevented the MSCI All-Country World Index from entering a bear market. The ECB meets Thursday, the first major monetary authority to review interest rates and policy since turmoil gripped markets at the start of the year. “The ground right now is so unstable, and there’s so much anxiety,” said Ayako Sera at Sumitomo Mitsui Trust. “We saw a rally, but I wouldn’t say that we’re in a full rebound yet. People are just bottom-fishing.”

“The 31 biggest developing markets have lost a combined $2 trillion in equity values since the start of 2016.”

• Emerging Markets Lost $735 Billion in 2015, More to Go (BBG)

Global investors and companies pulled $735 billion out of emerging markets in 2015, the worst capital flight in at least 15 years, the Institute of International Finance said. The amount was almost seven times bigger than what was recorded in 2014, the Washington-based think tank said in a report on Wednesday. China was the biggest loser, with $676 billion leaving its markets. The IIF predicted investors may withdraw $348 billion from developing countries this year. Emerging-market stocks are trading at the lowest levels since May 2009 and a gauge of 20 currencies has slumped to a record. A meltdown in commodity prices and concern over the slowdown in China’s growth to the weakest since 1990 are spurring investors to dump assets from China to Russia and Brazil.

The 31 biggest developing markets have lost a combined $2 trillion in equity values since the start of 2016. “We’ve seen massive outflows from emerging markets to the benefit of the euro zone and Japan,” said Ibra Wane at Amundi Asset Management. “Institutional investors have been more attracted by these regions.” Wane said the shift in flows is a result of monetary-policy changes, as the Federal Reserve raised interest rates in December for the first time in almost a decade, which is also partly to blame for the volatility in emerging-market currencies. “I’d rather look first at stabilization of currencies,” Wane said. “If this were to come true, then probably also flows would come on top of it.”

All 24 emerging-market currencies tracked by Bloomberg have depreciated against the dollar in the past year, with the Argentine peso, the Brazilian real and the South African rand getting hit the worst. “Countries with large current-account deficits, high levels of foreign-exchange corporate indebtedness and questionable macro policy frameworks would come under particular pressure in the event of further emerging-market retrenchment,” the IIF report said. “At-risk countries include Brazil, South Africa and Turkey.” The Chinese yuan’s 5.5% drop in the past 12 months was one of the drivers of outflows from the world’s second biggest economy, according to the IIF report. “The 2015 outflows largely reflected efforts by Chinese corporates to reduce dollar exposure after years of heavy dollar borrowing, as expectations of persistent RMB appreciation were replaced by rising concerns about a weakening currency,” the report said.

If global equities lost $15 trillion so far, what’s the tally for oil?

• US Oil Posts Biggest One-Day Percentage Loss Since September (WSJ)

The selloff in oil prices accelerated Wednesday, intensifying a slide in global financial markets as investors worried that oil’s relentless downdraft signaled global economic gloom. The front-month U.S. oil contract settled down 6.7%, posting the biggest one-day loss since September. Oil prices have dropped more than 25% this year. Much of the 19-month oil-market selloff has been driven by concerns about ample supplies. What’s increasingly weighing on investors is the fear that demand growth is wilting, particularly in China, which could reflect deeper economic woes. “Global economic forces appear to be driving down demand for commodities, ” Citigroup said in a note. “There is no doubt that declining expectations of global growth are exacerbating the results of oversupply across commodity markets.”

Light, sweet crude for February delivery settled down $1.91 to $26.55 a barrel on the New York Mercantile Exchange. The February contract expires at settlement Wednesday. Brent, the global benchmark, fell 82 cents, or 2.9%, to $27.94 a barrel on ICE Futures Europe, also on track for the lowest settlement since 2003. Oil investors fear that demand in China, which consumes about 12% of world’s crude, may falter as the country shifts to a less energy-intensive economic model. On Tuesday, the Chinese authorities announced the country’s gross domestic product rose 6.9% in 2015, its slowest pace in 25 years. ESAI Energy said Wednesday that the pace of demand growth in China from 2015 to 2030 will be 60% slower than the pace of demand growth from 2000 to 2015.

Spring cleaning?!

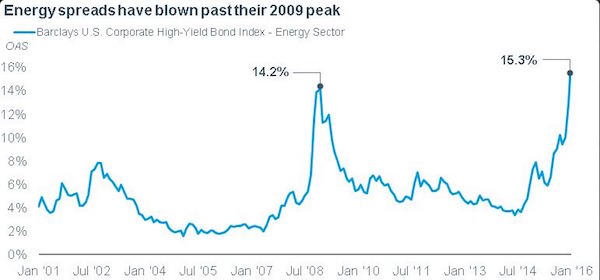

• Energy Sector’s Default Risk Higher Than In Great Recession (MW)

Markets are pricing in a higher default risk for the energy sector than they did at the peak of the Great Recession, according to data from Schwab and Barclays. As continued concerns about oil’s global supply glut pushed crude futures below $27 a barrel, sparking a global stock selloff, energy spreads surpassed their 2009 peak. A spread is a yield differential between the index and comparable risk-free Treasurys. Widening spreads mean investors are pricing in more risk for the energy sector and require a higher yield as compensation for their risk. As the following chart shows, the spread on the energy sector of the Barclays U.S. Corporate High-Yield Bond Index, a widely followed gauge of market-priced risk, reached 1,530 basis points as of Tuesday’s close, compared with 1,420 basis points reached during the height of the financial crisis seven years ago. One basis point is equivalent to 0.01% or one hundredth of a percentage point.

Credit-market spreads are often viewed as a leading indicator for equity markets. Spreads in the energy sector have been widening since the summer of 2014, and spiked over the past few months amid the recent rout in oil prices. That dynamic has certainly played out lately. Stocks followed oil’s decline, weighed by sinking shares of energy companies. The energy sector was the worst performer on the S&P 500 on Wednesday, and is down nearly 15% since the beginning of the year. Meanwhile, energy companies led decliners among the Dow industrials. Widening credit spreads imply that “the market is clearly expecting the default rate to pick up, as the balance sheets of some of the riskier energy companies won’t be able to sustain this drop in oil prices” said Collin Martin, director of fixed-income strategy for the Schwab Center for Financial Research.

Orderly way down or mayhem?

• Some Bankrupt Oil and Gas Drillers Can’t Give Their Assets Away (BBG)

Oil is in free fall and Terry Clark couldn’t be happier. In mid-2014, when the crude price topped $100 a barrel, Clark made an offer to buy properties from Dune Energy, a small driller with money trouble. Dune turned him down. A year later, as oil plunged to $60 a barrel, Dune filed for bankruptcy and Clark’s White Marlin Oil & Gas picked up the assets at auction at a deep discount. “What we offered versus what we got it for, it’s a great price,” Clark said. “We’re going to continue to play these bankruptcies. We’re participating in two more right now.” Winners and losers are emerging from the energy bust. What’s a meal for Clark is indigestion for banks that financed the boom using oil and gas properties as collateral. The four biggest U.S. banks – Bank of America, Citigroup, JPMorgan and Wells Fargo – have set aside at least $2.5 billion combined to cover souring energy loans and have said they’ll add to that if prices stay low.

There’s plenty to keep Clark bargain-hunting. Last year, 42 U.S. energy companies went bankrupt, owing more than $17 billion, according to a report from law firm Haynes & Boone. Dune went belly up owing $144.2 million. Its assets sold for $20 million. In May, American Eagle filed for bankruptcy with debts of $215 million. Its properties sold for $45 million in October. BPZ Resources owed $275.2 million. Its assets fetched about $9 million. Endeavour went into bankruptcy owing $1.63 billion. The company sold some assets for $9.65 million and handed over the rest to lenders. ERG Resources opened an auction with a minimum bid of $250 million. Response? No takers. “A lot of people got into this business and didn’t really understand the ups and downs of price cycles,” said Becky Roof, a managing director for turnaround and restructuring with the consulting firm AlixPartners. “They’re getting a very bad dose of reality right now.”

It worked for mere hours. Reminiscent of Bernanke’s 2008 moves.

• PBOC Injects Most Cash in Three Years in Open-Market Operations (BBG)

The People’s Bank of China injected the most cash in almost three years in its open-market operations, helping ease a cash squeeze as the coming Chinese New Year holiday spurs demand for funds at a time when capital outflows are mounting. The central bank said it conducted 110 billion yuan ($16.7 billion) of seven-day reverse-repurchase agreements and 290 billion yuan of 28-day contracts. That compares with 160 billion yuan of contracts that matured and resulted in a net cash injection of 315 billion yuan for this week’s two auctions. Other lending tools were used to add about 700 billion yuan this week for terms ranging from three days to a year.

China is trying to hold borrowing costs down to support its economy without spurring an exodus of funds that drove the yuan to a five-year low this month. Gross domestic product rose last year at the slowest pace in a quarter century and intervention to prop up the exchange rate led to a record $513 billion plunge in the nation’s foreign-exchange reserves. The Chinese New Year holiday – a period for feasting and exchanging gifts – will shut China’s financial markets throughout the week starting Feb. 8. “The market is a bit nervous and liquidity is also needed to cover the Chinese New Year,” said Frances Cheung, Hong Kong-based head of rates strategy for Asia ex-Japan at Societe Generale.

“The fact that they are going for longer tenors on reverse repos and its MLF does add to market expectations for a delay in a reserve-ratio cut, which in itself could be linked to the currency market performance.” The central bank injected 410 billion yuan into the banking system via three- and 12-month loans under its Medium-Term Lending Facility this week, while Short-term Liquidity Operations were used to add 55 billion yuan of three-day loans on Monday and another 150 billion yuan of six-day funds on Wednesday. The PBOC also auctioned 80 billion yuan of treasury deposits on behalf of the Ministry of Finance this week.

“Many of those products have a “knock-in” feature at the 8,000 level that will spur banks to cut futures positions..”

• China Stock Rout Seen Getting Uglier as Derivative Trigger Looms (BBG)

If Bank of America is right, Chinese stocks in Hong Kong are poised for a fresh wave of selling. That’s because the benchmark Hang Seng China Enterprises Index is approaching a level that forces investment banks to pare back their bullish futures positions, according to William Chan, the head of Asia Pacific equity derivatives research at BofAML in Hong Kong. The trades, tied to banks’ issuance of structured products, are likely to start unwinding when the index falls through 8,000, a level it briefly breached on Wednesday. The gauge dropped 1% to 7,932.24 at 1:05 p.m. local time on Thursday. Banks have purchased futures on the gauge of so-called H shares to hedge exposure to structured products that they’ve sold to clients, according to Chan.

Many of those products have a “knock-in” feature at the 8,000 level that will spur banks to cut futures positions to maintain the effectiveness of their hedges, he said. Additional pressure points may also come at lower levels, Chan said. “As the market goes lower from here, the downward move may accelerate,” he said. “There will be a large amount of hedging in futures which dealers need to unwind.” While the opaque nature of structured products makes it difficult to gauge how much money is riding on any particular level of the Hang Seng China index, Chan came to his conclusion by analyzing regulatory data from South Korea, one of the few countries that publicizes such figures.

The nation is among the region’s biggest markets for structured products and there’s currently a notional value of about $34 billion from Korea linked to the Hang Seng China measure, according to Chan. When banks sell the structured products to investors, they take on an exposure that’s similar to purchasing a put option on the index, Chan said. To hedge against the possibility of a rally, the banks buy Hang Seng China index futures. If the stock gauge falls below knock-in levels for the structured products – the price at which investors begin to lose their principal – the sensitivity of the bank’s position to index swings gets smaller, and banks respond by selling futures to reduce their hedge.

Along with everyone else.

• China Is Drowning In Private Sector Debt (Ormerod)

The eyes of the financial and economic worlds are now fixed on China, with focus predominantly on Chinese stock markets and the country’s GDP figures. A fascinating perspective was provided last week in the leafy borough of Kingston upon Thames. The university there has recruited the Australian Steve Keen as head of its economics department, and it was the occasion of his inaugural lecture. Keen was one of the few economists to highlight the importance of private sector debt before the financial crisis began in 2008. The title of the lecture itself was exciting: “Is capitalism doomed to have crises?” Judging by the beards and dress style of the audience, many may have expected a Corbynesque rant. Instead, we heard an elegant exposition based on a set of non-linear differential equations.

Private sector debt is the sum of the debts held by individuals and companies, excluding financial sector firms like banks. Keen pointed out that, in the decade prior to the massive crash of 1929, the size of private debt relative to the output of the economy as a whole (GDP) rose by well over 50%. The increase from the late 1990s onwards meant that debt once again reached dizzy heights. In ten years, it rose from being around 1.2 times as big as the economy to being 1.7 times larger. This may seem small. But American GDP in 2007 was over $14 trillion. If debt had risen in line with the economy, it would have been about $17 trillion. Instead, it was $24 trillion, an extra $7 trillion of debt to worry about. Japan experienced a huge financial crash at the end of the 1980s.

The Nikkei share index lost no less than 80% of its peak value, and land values in Tokyo fell by 90%. During the 1980s, private sector debt rose from being some 1.4 times as big as the economy to 2.1 times the size. In China, in 2005, the value of private debt was around 1.2 times GDP. It is now around twice the size. Drawing parallels with the previous experiences of America and Japan, a major financial crisis is not only overdue but it is actually happening. And Keen suggests there is still some way to go. So is it all doom and gloom? Up to a point, Lord Copper. High levels of private sector debt relative to the size of the economy do indeed seem to precede crises. But there is no hard and fast rule on the subsequent fall in share prices.

Japanese shares fell 80% and have not yet recovered their late 1980s levels. In the 1930s, US equities fell 75%, and took until 1952 to bounce back. In the latest financial crisis, they fell by 50% but are even now above their 2007 high. Equally, output responds to these falls in completely different ways. In the 1930s, American GDP fell by 25%, compared to just 3% in the late 2000s. Japan has struggled, but never experienced a major recession. Still, Keen’s arguments leave much food for thought.

World’s biggest bank. Huge derivatives holdings.

• Deutsche Bank Shares Fall 6% On News Of €2.1 Billion Loss (BBG)

Deutsche Bank AG, Germany’s biggest lender, expects to post a €2.1 billion loss for the fourth quarter after setting aside more money for legal matters and taking a restructuring charge. The stock is at the lowest since 2009. About €1.2 billion were earmarked for litigation and €800 million for restructuring and severance costs, mainly in the private and business clients division, the Frankfurt-based firm said Wednesday in a statement. “Challenging market conditions” also hurt earnings at the investment bank during the quarter, cutting group revenue to about €6.6 billion, it said. The bank had reported €7.8 billion of net revenue a year earlier. Co-CEO John Cryan has been seeking ways to restore investor confidence and earnings growth battered by costs tied to past misconduct.

Under his overhaul, Deutsche Bank plans to shrink headcount by 26,000, or a quarter of the workforce, by 2018 while planning to suspend the dividend to help shore up capital buffers. “A real fresh start means even lower stated net profits for some time,” Daniele Brupbacher at UBS in Zurich who has a neutral rating on the shares, wrote in a note on Thursday. Conditions for the company will probably “remain challenging” in the first quarter, he wrote. The stock fell as much as 6% and was down 3.5% at 17.10 euros as of 9:16 a.m. in Frankfurt, the biggest decline in the 46-member Stoxx Europe 600 Banks Index. Deutsche Bank’s 24% decline this year means it’s the worst-valued global bank.

“..obesity and poverty “are neighbours”

• One In 6 Americans Go Hungry, One In 3 Kids Will Develop Diabetes (Ind.)

Film director Lori Silverbush has spoken out on hunger in the US and says it is still a massive problem three years after making a documentary on the subject. The US faces staggering statistics on food poverty – the highest under the current government administration since the 1970s when hunger was almost eradicated in the US. One in six Americans are hungry, while 30% of Americans are described as “food insecure” – meaning they can’t guarantee they can always put food on the table. Mrs Silverbush’s film “A Place At The Table”, which she co-directed alongside Kristi Jacobsen, reveals that 44 million Americans rely on food stamps, which are worth around $3 to $4 per day.

Insufficient funds mean that people can’t afford to buy fresh fruit or vegetables, which have gone up in price by 40% since the obesity crisis began, according to author Marion Nestle, and instead they rely on cheap, processed foods. As a result, obesity and poverty “are neighbours”, said End Hunger Network founder Jeff Bridges. Speaking at the Brooklyn Historical Society on Tuesday evening, Mrs Silverbush said her “blood boiled” when she realized that food poverty is a result of politics. The government has spent $0.75 trillion since 1995 on subsidies to wealthy agriculture companies that are responsible for processed foods, a policy that started during the Great Depression of the 1930s.

“We didn’t know there was hunger in every county or that there were millions of working families that were hungry,” she said. “Malnutrition and hunger cause a cascade of terrible, life-long consequences for kids.” The film also revealed that one in three children born in the year 2000 will be diagnosed with type 2 diabetes. Hunger is expensive. It costs the US government $167 billion a year, according to the film. One interviewee, Barbie Izquierdo, lives in Philadelphia with two children, and her food stamps were taken away once she secured full time employment, leaving her without enough money to feed her family. “Define starving,” she said. “Are you starving if you don’t eat for a day?“

Can’t we just ignore it instead?

• For the Sake of Capitalism, Pepper Spray Davos (Yra Harris)

Please, PEPPER SPRAY ALL THE ATTENDEES OF DAVOS in order to halt the rape of taxpayers and consumers across the globe. This annual conclave is responsible for more wealth destruction and the widening disparity in GINI coefficients than any public policy. I believe that the cost of attending Davos is priced at such an extravagant rate because it is a giant insider scam. Hobnob with politicians and policy makers in an effort to be part of the “smart money” crowd. It was the great moral philosopher and economist Adam Smith who so presciently noted: “People of the same trade seldom meet together, even for the merriment and diversion, but the conversation ends in a conspiracy against the public, or in some contrivance to raise prices.” The conspiracy against the public has been the financial repression of the global middle class in an effort to bail out those who are attached themselves to the public treasury to maintain the “animal spirits” of crony capitalism.

The cost of an entrance pass to this private/public congress of mover and shakers should sound an alarm to all those who desire transparency in financial markets. In contemporizing the words of Adam Smith, Samuel Huntington was credited in the online research cite, Acton Commentary, as creating the phrase DAVOS MAN: “A soulless man, technocratic, nationless and cultureless, severed from reality. The modern economics that undergirded Davos capitalism is equally soulless, a managerial capitalism that reduces economics to mathematics and separates it from human action and human creativity.”

Friday’s release of the 2010 FOMC transcripts reveals that Chair Bernanke raised concerns “… about inappropriate access to information by outsiders other than the media, including consultants, market people and so on.” It was earlier revealed that Bernanke had held discussions with ECB President Trichet about the seriousness of the European sovereign debt crisis. The Reuters story post-transcript release–“Fed Helped ECB With Swaps after Trichet ‘Personal Appeal’”–quotes Chairman Bernanke: “Yesterday [ECB Chief] Jean-Claude Trichet called me and made what I would characterize as a personal appeal to re-open the swaps that we had before,” Bernanke told his colleagues at the UNSCHEDULED meeting.”

In a further analysis by Reuters, the article notes, “The transcripts, which are released after five years, show how closely Bernanke worked with Trichet, who shared ‘highly confidential’ information about the ECB’s part in a trillion-dollar ‘shock and awe’ rescue plan launched by EU leaders to combat an escalating financial crisis in Europe.” Ten months later Chairman Bernanke is openly warning FOMC members about leaks from its meetings. Curious about how much the DAVOS crowd made from the whispers emanating from the Fed Board Room? It costs more than $600,000 to be a strategic partner at Davos and be allowed into the most high-level meetings with the most important CEOs and policy makers. But if the inside scoop is info beyond the ears of mere mortals PRICE IS NO OBJECT BUT INSIDER PROFITS CERTAINLY ARE. More pepper spray to stop the rapes.

H/t Steve Keen.

• 6 Years Suffering The Violence Of A 1,000 Economic Cuts (DI)

“My generation can’t afford houses. My generation can’t afford to have children. My generation are either leaving the country or jumping in rivers. That’s my generation, man,” Blindboy said on RTE’s Late Late Show on 8 January. “My generation is dealing with neoliberalism [sic] economic policies that are similar enough to the economic liberalism at the time of the Famine,” he said. “It’s a laisse-faire system, where our resources of the country are being sold for private interests and our generation, my generation is screwed.” When I saw that, it got me thinking: negative perceptions of the working class are so strong in Irish society that people who use food banks would rather call themselves “poor” than “working class”. This is the result of successful divide-and-conquer tactics.

Because the truth is that these days – the poor, the working poor, the working class, the middle-class – almost all of us are screwed. The wealth is trickling upwards to a very few. You can see it in a survey the Dublin think tank TASC released in December, which laid out the division of wealth in Ireland. The top 20% are the ones squeezing everybody’s middle: they have almost 73% of Ireland’s wealth. So if we look at a financial definition of working class, rather than a cultural one, the majority of us fit right in there together, even those notionally middle-class people who would recoil if you tried to tell them they were working class. Given this situation, I would expect to see howls of protest in the mainstream media, all the time. But I don’t see this kind of media outcry, and I wonder why.

Maybe it’s because the mainstream media usually take the side of the market, seeing issues from a market perspective. And I guess the market doesn’t care if our generation is screwed. It might actually be a good thing, from a market perspective, because it ensures there’s a steady supply of young people desperate for jobs, which keeps demand for wages and benefits to a minimum. And that would be rather attractive to multinationals looking for cheap workers. Meanwhile, journalists are just trying to survive too. Most of them are in precarious positions, and, unless they want a ticket to the hunger games, it’s human nature for them to keep their heads down and go with the status quo.

Eat jellyfish.

• We’ve Hugely Underestimated The Overfishing of The Oceans (WaPo)

The state of the world’s fish stocks may be in worse shape than official reports indicate, according to new data – a possibility with worrying consequences for both international food security and marine ecosystems. A study published Tuesday in the journal Nature Communications suggests that the national data many countries have submitted to the UN’s Food and Agriculture Organization (FAO) has not always accurately reflected the amount of fish actually caught over the past six decades. And the paper indicates that global fishing practices may have been even less sustainable over the past few decades than scientists previously thought. The FAO’s official data report that global marine fisheries catches peaked in 1996 at 86 million metric tons and have since slightly declined.

But a collaborative effort from more than 50 institutions around the world has produced data that tell a different story altogether. The new data suggest that global catches actually peaked at 130 metric tons in 1996 and have declined sharply – on average, by about 1.2 million metric tons every year – ever since. The effort was led by researchers Daniel Pauly and Dirk Zeller of the University of British Columbia’s Sea Around Us project. The two were interested investigating the extent to which data submitted to the FAO was misrepresented or underreported. Scientists had previously noticed, for instance, that when nations recorded “no data” for a given region or fishing sector, that value would be translated into a zero in FAO records – not always an accurate reflection of the actual catches that were made.

Additionally, recreational fishing, discarded bycatch (that is, fish that are caught and then thrown away for various reasons) and illegal fishing have often gone unreported by various nations, said Pauly. “The result of this is that the catch is underestimated,” he said. So the researchers teamed up with partners all over the world to help them examine the official FAO data, identify areas where data might be missing or misrepresented and consult both existing literature and local experts and agencies to compile more accurate data. This is a method known as “catch reconstruction,” and the researchers used it to examine all catches between 1950 and 2010. Ultimately, they estimated that global catches during this time period were 50% higher than the FAO reported, peaking in the mid-1990s at 130 million metric tons, rather than the officially reported 86 million. As of 2010, the reconstructed data suggest that global catches amount to nearly 109 million metric tons, while the official data only report 77 million metric tons.

Bigger than Star Wars.

• Italy’s Blockbuster Quo Vado? Draws On Bitter Economic Reality (Guardian)

A comedy that captures Italians’ love for il posto fisso – a job for life – has become an unlikely blockbuster hit in Italy. Quo Vado? – or Where Am I Going? – is close to overtaking Avatar as the highest-grossing film in Italian box office history, having generated €59m since its opening on New Year’s Day and beaten international rivals such as Star Wars: The Force Awakens. Even Matteo Renzi, the energetic Italian prime minister, is said to have seen the film with his children. He told one newspaper that he laughed “from the beginning to the end”. The success of Quo Vado? reflects a relatively recent change in Italy: the cushy public sector jobs promising steady income and great benefits that were a staple of the country’s economic engine are now considered a thing of the past.

In their place has come high unemployment – which, while improving, is still at 11.3% – and job insecurity, which has hit young workers particularly hard. Alessandro Giuggioli, a film-maker who produced an independent film, In Bici Senza Sella (On a Bike Without a Saddle), about precarious jobs, said the posto fisso was like the holy grail in Italy: “You know it is a possibility and that you are never going to reach it.” While his parents’ generation enjoyed lifelong job security, Giuggioli said young people in Italy today had to make do with rolling short-term contracts, which have become the new normal. He partly blames Italy’s tax system and bureaucracy. “If an employer wants to hire you for €1,000 (£770) a month, they end up paying €2,500 a month. It’s crazy. And so they hire you for three months instead, paying €600,” he said.

Tusk is the bottom of the barrel, he represents the lowest the EU has to offer. Brussels is setting itself up for a world of pain.

• EU Chief Tusk Gives Refugee Plan 2 Months To Work (AP)

The European Union’s top official warned Tuesday the bloc has just two months to get its migration strategy in order amid criticism that its current policies are putting thousands of people in danger and creating more business for smugglers. “We have no more than two months to get things under control,” European Council President Donald Tusk told EU lawmakers, warning that a summit of EU leaders in Brussels on March 17-18 “will be the last moment to see if our strategy works.” The EU spent most of 2015 devising policies to cope with the arrival of more than 1 million people fleeing conflict or poverty but few are having a real impact. A refugee sharing plan launched in September has barely got off the ground and countries are still not sending back people who don’t qualify for asylum.

A package of sweeteners earmarked for Turkey – including €3 billion, easier visa access for Turkish citizens and fast-tracking of the country’s EU membership process – has borne little fruit. The failure has raised tensions between neighbors, particularly along the Balkan route used by migrants arriving in Greece to reach their preferred destinations like Germany or Sweden further north. Tusk warned that if Europe fails to make the strategy work “we will face grave consequences such as the collapse of Schengen,” the 26-nation passport-free travel zone.

2016 can only be a hot year.

• ‘We Will Come To Athens And Burn Them All’: Protest Returns To Greece (Guardian)

Farmers’ roadblocks, ferries immobilised in ports, pensioners taking to the streets: protest has returned to Greece in what many fear could be the beginning of the crisis-plagued country’s most confrontational winter yet. From the Greek-Bulgarian frontier to the southern island of Crete, farmers are up in arms over the spectre of more internationally mandated austerity. “It’s war,” says Dimitris Vergos, a corn grower speaking from the northern town of Naoussa. “If they [politicians] go on pushing us to the edge, if they want to dehumanise us further, we will come to Athens and burn them all.” With the rhetoric at such levels, prime minister Alexis Tsipras’s leftist-led administration has suddenly found itself on the defensive. Faced with a series of demonstrations – fishermen and stockbreeders will join blockades on Thursday when public and private sector workers also take to the streets – analysts say any honeymoon period Tsipras may once have enjoyed is over.

On Wednesday, convoys of tractors in Thessaly, the nation’s breadbasket, blocked the road at Tempi, effectively cutting the country’s main north-south highway. Hundreds more lined the seafront in Thessaloniki while, further north, police were forced to fire rounds of tear gas at protestors barricading Evangelos Apostolou, the agriculture minister, in an administrative building as fierce clashes erupted in Komotini. The focus of their fury was proposed pension and tax measures, the latest in a battery of reforms set as the price of the debt-stricken nation receiving a third, €86bn, bailout last summer. For farmers, the draft policies are tantamount to the kiss of death. “We are going for all out confrontation,” said the prominent unionist Yannis Vangos, warning that by Friday roadblocks would be erected across a large swath of the county.

“It seems we can’t see eye to eye at all. Things are out of control. It’s not just one thing we have to negotiate.” Six years into Athens’ economic crisis, even more Greeks claim they have been pushed to the point where they can no longer survive the rigours of austerity. With an unprecedented 1.2 million people unemployed – more than 25% of the population – many have been pauperised by the biting effects of keeping bankruptcy at bay. Pensioners, whose incomes have been reduced 12 times at the behest of the EU and IMF, this week also upped the ante taking to the streets. Creditors argue that at 17% of GDP, Greece’s pension system is Europe’s costliest and to great degree the generator of its fiscal dysfunction. But those who stand to be affected by the overhaul counter the changes go too far. For farmers, the reforms will not only raise social security contributions from 6.5% to 27%, but double income tax payments from 13% to 26%, eradicating more than three quarters of their annual earnings.

How can AFP write this without questioning what the IMF did to bail out Ukraine?

• IMF Cancels Systemic Exemption Rule Created In 2010 To Bail Out Greece (AFP)

The IMF abolished Wednesday a rule created in 2010 that allowed it to participate in an international bailout of Greece despite doubts about the country’s debt sustainability. “Today the executive board of the IMF approved an important reform to the Fund’s exceptional access lending framework, including the removal of the systemic exemption,” IMF spokesman Gerry Rice said in a brief statement. The “systemic exemption” amounted to a loophole in the IMF’s longstanding policy that required the crisis lender to judge a member country’s public debt to be sustainable with “high probability” before it could provide financial assistance that exceeds a member’s contribution to the institution.

Reeling from budget and banking crises in 2010, deeply indebted Greece did not meet the sustainability condition and the IMF decided that a debt restructuring could pose severe negative spillovers on the rest of the eurozone. The IMF thus created the “systemic exemption” provision which paved the way for it to join the EU and the ECB in the so-called “troika” of international lenders throwing a lifeline to Greece. For the IMF, that amounted to 30 billion euros ($32.7 billion) in May 2010, then an additional 18 billion euros in a second bailout two years later. The systemic exemption was used more than 30 times to permit loan payments to Greece but also for Ireland and Portugal, two other eurozone members receiving assistance from the troika, by end-May 2014.

Its use, nevertheless, has stirred criticism, notably from some emerging-market countries that saw it as giving favorable treatment to European states in response to pressure from Western powers. With the elimination of the loophole, the IMF is seeking to close a controversial chapter in its recent history as it decides whether to join the EU and ECB in a third bailout of Greece launched last August. In a sign that the abolition of this “systemic exemption” was already effectively in place, the IMF is demanding this time, before unblocking any new loans, that the Europeans first agree to ease Greece’s debt burden to ensure its sustainability.

Greece needs to protest much louder in Brussels.

• Greece Re-Opens Refugee Camp On Border in Sub-Zero Weather (Kath.)

Some 350 refugees and migrants, including many children, had gathered by Wednesday night in freezing conditions near Idomeni on Greece’s border with the Former Yugoslav Republic of Macedonia (FYROM) after the latter closed its borders. Greek officials said that the border has been closed since Tuesday night, leaving dozens of people unable to cross into FYROM and continue their journeys to Central and Northern Europe. Seven coaches full of refugees and migrants that had traveled north from Greece’s Aegean islands arrived at the border on Wednesday, prompting the government to allow the camp in Idomeni that had been constructed by nongovernmental organizations during the summer to be used to provide shelter and medical assistance to the migrants. Over the last few weeks, officials had refused to allow the camp to be used due to fears that hundreds of people would start gathering at the border again. The cold weather has also made conditions difficult on the islands.

Neverending?!

• Two Refugees –One 5-Year Old Child– Die Of Hypothermia Off Lesvos (Kath.)

Two refugees – one a 5-year-old child – died from hypothermia on Lesvos on Wednesday. The child died after the dinghy it was traveling in capsized off the island. It was taken to a medical center on Lesvos but doctors were unable to save its life. The coast guard rescued 46 people. The other person who died was a woman who reached the island safely but succumbed to the subzero temperature. Authorities said that despite the worsening weather, about 1,000 people arrived on Lesvos on Tuesday and another 1,000 reached the island on Wednesday.

Home › Forums › Debt Rattle January 21 2016