Harris&Ewing “Pennsylvania Avenue with snow, Washington, DC” 1918

Recovery, anyone? The new slump has smoothed a bit as of now.

• Oil Falls 4% On Swelling Oversupply

Oil prices fell 4% on Monday as Iraq announced record-high oil production feeding into a heavily oversupplied market, wiping out much of the gain made in one of the biggest-ever daily rallies last week. Brent crude, the global benchmark, was down $1.35 at $30.83 a barrel at 0851 GMT, losing more than 4% from Friday’s closing price, when Brent surged 10%. U.S. crude traded $1.15 lower at $31.04 a barrel, regaining its unusual premium to Brent prices. Iraq’s oil ministry told Reuters on Monday oil output had reached a record high in December. Its fields in the central and southern region produced as much as 4.13 million barrels a day, the government said.

“The news that Iraq has probably hit another record builds on the oversupply sentiment,” said Hans van Cleef, senior energy economist at ABN Amro in Amsterdam. “The oversupply will keep markets depressed and prices low, and on the other hand short positions are in excessive territory,” he said. Indonesia’s OPEC governor said that support among OPEC for taking steps to prop up crude prices is slim, with only one OPEC country supporting an emergency meeting over the matter.

Bad Hair Groundhog Day.

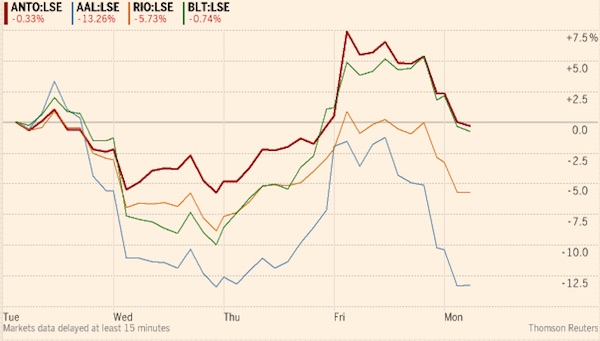

• Commodities Stocks Sink As Oil Resumes Downward Slide (FT)

Oil prices are sinking again, fast, and miners and commodities stocks are once again finding themselves in that all-too familiar position at the bottom of the FTSE 100. As fastFT reported earlier, oil prices are once again heading south after a short-lived rally last week. Brent crude is falling 3.7% at publication time to $30.99 a barrel while WTI, the US benchmark, is down 3.91% at $30.93 a barrel. There had been hopes that the worst may be over for oil prices but clearly the market didn’t get the memo today. Miners and commodities stocks are once again having another bad today.

At publication time:

Anglo American is 3.4% lower at 219p

BHP Billiton is down 2.6% at 632.1p

Rio Tinto is losing 2.6% to £16.10

Copper miner Antofagasta is off 2.4% at 362.5p.

BP is dropping 2.4% to 344.2p.

A worldwide event.

• Oil Price Crash Is Completely Changing The Industry’s Landscape (BIA)

The crash in oil, which has seen the price of crude fall by more than 75% in the last 18 months, is fundamentally changing the landscape of the resources industry in the UK as big numbers of oil firms go into insolvency, or look to take advantage of rivals’ weaknesses and increase their M&A activity. A survey released by accountancy firm Moore Stephens this week showed that the number of UK-based oil and gas companies folding jumped by more than 55% in 2015, with 28 firms entering insolvency, compared to 18 over the course of 2014. In its report, Moore Stephens called the rise in failing oil and gas firms “an almost inevitable result” of the crash in the price of oil, and said that upwards of £140 billion ($200 billion) worth of projects are likely to have been cancelled thanks to the crash.

Moore Stephens’ head of restructuring and insolvency, Jeremy Willmont said: “Oil and gas service companies expanded their businesses over the last decade based on an oil price well above the current one.” “The pain caused by the oil price fall has translated into a rising tide of financial distress across the sector,” he added. The contrast between 2015, and 2010, when oil was on its way up from its last crash in 2008, is pretty stark. According to the research, just four oil and gas companies went under that year. Essentially, the number of oil companies going bust has increased by 600% in just five years. A separate survey, released by law firm Pinsent Mason, said that 90% of those who responded expect the number of M&A deals to rise in 2016, while 30% think that there’ll be a “major surge” and around two thirds believe that Britain’s oil and gas sector is a good area for acquisitions.

In the last year or so, the number of new oil projects has slowed significantly as fewer and fewer can be profitable thanks to the rock bottom price of the commodity. This is particularly true in Britain, where producing a barrel of oil now costs more than double its market price. 2015 was a record breaking year for mergers and acquisitions, with more than $5 trillion worth of deals taking place last year, largely driven by big healthcare deals, like the join up of pharma firms Pfizer and Allergan. One of the most prominent deals, which is set to be completed pretty soon, is the merger between BG Group and Shell, both FTSE100 listed oil and gas giants.

A very strong indicator of just how badly China is doing. Alibaba was supposed to be bigger than Apple, Amazon.

• US Short Sellers Target China’s Alibaba (BBG)

U.S. short sellers have pushed bets against Alibaba to the highest in more than 14 months on concern that China’s deepest economic slowdown since 1990 will only get worse. Short interest in China’s biggest online retailer surged to 7.5% of shares outstanding on Jan. 21, the highest since November 2014, according to data compiled by Markit and Bloomberg. That is more than double from a Dec. 1 low. Bearish bets on rival JD.com have hovered around 2% since last month. Pessimists are once again taking aim at Alibaba – a bellwether for U.S. investor sentiment on China – as mainland stocks entered a bear market last week. Those wagers are already starting to pay off as a selloff since the start of the year sent the American depositary receipts of Alibaba down more than 13%.

Investors see Alibaba as a stock that reflects the state of the Chinese economy, said Henry Guo at Summit Research, who has a buy rating on the stock. “With China’s economic outlook worsening, that’s just an easy way for people to have short China exposure,”

China’s top leadership has signaled it may accommodate more economic slackness as officials tackle delicate tasks such as reducing excess capacity. The world’s second-largest economy will slow to 6.5% this year and 6.3% next year, according to the median of economist estimates. At a corporate level, counterfeit products and accounting frauds of Alibaba are also on the mind of investors since the company’s record 2014 debut on the New York Stock Exchange. Kynikos Associates LP founder Jim Chanoswarned against the stock in November, according to a CNBC report. In December, Russian billionaire Alisher Usmanov said he has started to sell his stake in the e-commerce giant.

How to make trouble sound like ‘I meant to do that’.

• China Pledges Steel, Coal Capacity Cuts in Supply-Side Reforms (BBG)

China is targeting further cuts in crude steel production capacity by as much as 150 million tons and “large scale” reductions in coal output as part of supply-side measures aimed at curbing overcapacity and excess labor in state-owned industries. The country has lowered steel production by about 90 million tons “in recent years” and will push to cut a further 100 million to 150 million tons, while “strictly controlling” steel capacity increases and halting new coal mine approvals, according to a Sunday statement on the Chinese government’s website, citing a State Council meeting on Jan. 22 chaired by Premier Li Keqiang. No time line was mentioned.

China has vowed in the past to curb capacity in industries such as coal and steel as the world’s second-largest economy slows amid a shift towards consumer-led growth. Still, it has struggled to meet stated coal capacity limits spelled out in the 12th Five-Year plan that ended last year, according to Bloomberg Intelligence. Coal demand in the country is also declining with the government keen to curb pollution. The government plans to set up a fund to help coal miners and steelmakers reduce their workforce and dispose of bad assets, Li said during a meeting in Shanxi province, according to a Jan. 7 China Central Television report. The financial help is dependent on the companies cutting capacity, he said.

As part of re-balancing the economy towards domestic consumption, the country’s cabinet also pledged to ease conditions for rural-to-urban migration and expand “new urbanization” trials to more regions, the government said in Sunday’s statement. China will “more aggressively develop” small- and medium-sized cities and give more administrative authority to areas with populations of more than 100,000, the government said. China will also expand shantytown development in major cities, while reducing the barriers to entry to attract private capital investment in transportation, underground pipe networks and other forms of construction, according to the statement.

Manufacturing jobs are going going gone.

• China’s Migrants Go Home – And Stay There (BBG)

Every year, tens of millions of China’s 246 million migrants return home to celebrate the Chinese New Year. It’s the world’s biggest annual migration, and it typically goes off smoothly. This year, however, something’s amiss. Although the holiday doesn’t start until Feb. 8, millions of workers – especially in the construction and electrical-appliance industries – have already returned home due to the country’s slowing economy. For local governments across China, this is raising a tough question: What happens if these laborers don’t go back to work after the holiday? The concern isn’t a new one. In early 2009, 20 million unemployed migrants returned home for the holidays in the wake of the global financial crisis, raising fears of social unrest. Labor riots did, in fact, take place.

But most of the unemployed appear to have gotten back to work when China’s monster stimulus kicked in later that year. This time is notably different. Prospects for a 2009-style stimulus are slim. More important, China is on the cusp of a long-term trend of reverse migration back to the countryside. This week, the National Bureau of Statistics reported that the migrant population dropped by 5.68 million in 2015 – its first decline in about three decades. Some of that decline is simple demographics, and parallels China’s rapidly shrinking labor force. But much of it is attributable to a slump in the labor-intensive manufacturing sector, and a steady improvement in rural economies.

These trends haven’t caught authorities completely off-guard: Despite a long-term commitment to urbanization (in 1980, China was 19.6% urbanized; today the figure is more than 50%), the government has recently directed more attention and money to rural development projects, ranging from infrastructure improvement to credit support for the country’s hundreds of millions of farmers. This year, rural per-capita income is expected to exceed 10,000 yuan for the first time, surpassing urban income growth for the fifth straight year. But just as economics were never the sole reason for moving to the city, many migrants also have non-economic motives for moving back home, including a desire to care for aging parents left behind and a hunger for uncontaminated food.

“The migrant workers are rooted in the countryside,” said Yang Tuan, a prominent sociologist at the China Academy of Social Science, in a September interview. “They have feelings for the land.” She predicted that reverse migration might peak in the next five to 10 years.

It makes no difference what Beijing wants.

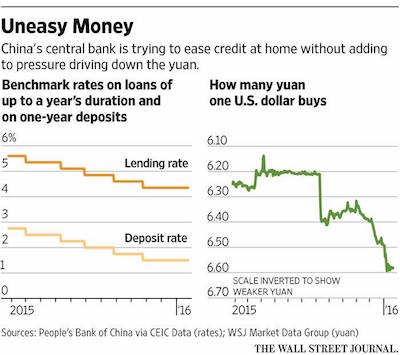

• China’s Central Bank Prioritizes Strong Yuan (WSJ)

China’s central bank faces a tough balancing act, trying to ease credit in the financial system without adding to pressures weakening the Chinese currency. Concerns about the yuan and the annual cash crunch ahead of next month’s Lunar New Year holiday dominated a meeting held by the People’s Bank of China on Tuesday, according to minutes of the meeting reviewed by the WSJ and to accounts from banking executives close to the PBOC. Central bank officials delayed using a traditional credit-easing tool for fear that it could add more downward pressure on the yuan, according to the minutes and the executives. Instead, to meet the rising cash needs from banks, the central bank turned to short-term and medium-term loan facilities to pump about 1.6 trillion yuan ($243 billion) of temporary liquidity into the banking system in the past week.

The decision highlights the bank’s deepening dilemma in helping to cushion the slowing Chinese economy. Just a year ago, the PBOC addressed preholiday cash demands by resorting to a more typical method—cutting the amount banks are required to keep in reserve. Since then, the economic slowdown and volatility in the stock markets have led to a flood of capital leaving China, as Chinese investors seek better returns abroad. The yuan, also known as the renminbi, has been battered harder than the central bank would like, even as it faces calls to keep easing credit and rekindle growth. “Currently, we need to put a high emphasis on maintaining the renminbi’s stability when managing liquidity,” Zhang Xiaohui, an assistant governor at the central bank, said at the Tuesday meeting, according to the minutes.

Ms. Zhang said cutting the reserve requirement would send “too strong an easing signal,” so the bank should turn to other tools. A reduction in so-called reserve-requirement ratio frees up funds for banks to lend on a permanent basis, while injecting liquidity through short-term and medium-term tools means the money can be taken back by the central bank when those loans expire. Ms. Zhang told officials at the meeting that the combination of cuts to interest rates and reserve requirements made by the central bank in late October contributed to the pressure on the yuan. “Because of the double reductions, there was too much liquidity and depreciation pressure on the renminbi,” she said.

Ahead of Tuesday’s meeting, China’s big banks called on the central bank to cut the reserve requirement in the lead-up to the holiday. But the central bank balked at doing that because of worries over the stability of the yuan, the banking executives close to the PBOC said. “They decided to put off the reserve-requirement cut until later,” one of the executives said. The executive said the central bank would have to make the cut “at some point” because the surge in money leaving China, as well as the PBOC’s efforts to buy yuan to prop up its value, are squeezing liquidity.

The west knows the east is bankrupt, too.

• The East Knows The West Is Bankrupt (Holter)

[..] what would the world look like the day following a “truth bomb” dropped by Mr. Putin and the Chinese. Would Americans even notice if he documented several false flags or frauds embedded in U.S. finance such as outright monetization of U.S Treasuries? No, most certainly not. Americans would however notice if financial markets collapsed or were shut down. Russia and China know full well the situation in the West. It is a bankruptcy waiting to happen as everything is fractional reserve and running on maximum margin while the underlying system is shrinking and no longer supplying enough liquidity. The way I see it, the stage is truly set for a financial attack on anything and everything American. Is it implausible for the Saudis to announce they will sell oil in yuan to China?

Or Iran to withdraw their funds from U.S. institutions and then bid for gold with these funds? If the East does in fact have jamming or hacking capability of Western technology, is it far fetched for them to show it very publicly in one or several situations? How would the “bookies” react if they saw a prize fighter enter one of the later rounds with his hands tied behind his back? You can laugh at the above speculation if you choose but it is all quite plausible and actually probable if you look at where things are and what posturing has already been done leading up to this. Western markets, ALL markets are a fraud. Our Treasury market is one where the biggest buyer is “our self” …the Fed and the ESF.

We have already seen $1 trillion of foreign reserves offloaded with no effect on yield nor the dollar itself and NO ACCOUNTING ANYWHERE as to “who” bought these offloaded central bank reserves. Accounting fraud and no rule of law here, nothing to see …please move along! You can laugh if you want and say Saudi Arabia will never move toward the East … Saudi Arabia is now in very dire straits financially, who do you think they will side with when Western markets melt down? Do you really believe they will go down trying to support our dollar?

The stage has already been set. The East knows the West has bankrupted. They know we have no gold left because they have it! They can see the finances of the various cities, states and federal government. They know the situation in derivatives is one giant mountain of dynamite waiting for a spark. They know our rule of law is gone and bail ins of depositor funds is next. We are monetizing their sales of Treasury securities. “We” are fooling no one except ourselves. And by “ourselves” I am talking about the vast majority of the population who have grown to rely on the government for everything. Everyone knows we are broke, yet ask anyone and the odds highly favor you will hear “the government will never let it happen”. Even if you are silly enough to believe this you must ask yourself, what are the ramifications when markets become “make believe”?

They’ll be picking them off one by one again. Bye, Draghi.

• Don’t Forget the Irish When Looking at New Risks in Euro Region (BBG)

Ireland gets to decide on its next government as early as next month, and if elections in other countries once at the heart of the European debt crisis are anything to go by, investors should be wary. Portugal’s vote on Oct. 4 produced an inconclusive result, leading to weeks of brokering before Socialist leader Antonio Costatook power with promises to put the brakes on austerity measures. Bond yields have jumped to the highest in six months since then. In Spain, Prime Minister Mariano Rajoy lost his majority last month after years of belt-tightening and the country still doesn’t have a new government.

Ireland is another European electorate jaded by budget cuts. Polls indicate that Prime Minister Enda Kenny’s ruling coalition will struggle to win a majority, though there’s no clear alternative. The country, European Central Bank President Mario Draghi’s model for economic recovery, saw its 10-year bond yields sink below 1% this month. But banks and brokers are already sounding warnings. “The ballot is the most important potential flash-point of the year,” said Dermot O’Leary, economist at Goodbody Stockbrokers in Dublin. “Investors got caught out by the inconclusive result in Spain, and so there is more focus now on Ireland.”

EU.

• There’s a Giant Elephant at the Bank of England (BBG)

It’s a new year and Bank of England officials have been sharing their views on the outlook for the U.K. and the risks. Well, some of the risks. So far in January, policy makers have spouted more than 20,000 words in three speeches and the minutes of their monthly meeting. They’ve cited a global slowdown, weak wage growth and a slump in oil as key issues for 2016. However, their official communications offer no guidance on what economists say is the top risk facing the U.K.: the forthcoming referendum on its membership in the European Union. Lawmakers could try to change that Tuesday – Governor Mark Carney appears in Parliament to talk about financial-stability risks, and they may well ask him about the elephant in the room.

“It’s such a hot issue, I’d be surprised if it didn’t come up,” said Chris Hare at Investec in London. “Carney would probably try to continue to tread a fine line on potential implications of “Brexit.” You might think they’d want to put some kind of downside skew in to their forecast, but if they really pile into those debates, they’d be criticized. They’ll probably try and stay coy.” It’s certainly on the mind of U.K. economists. They cited the buildup to the vote on EU membership and the potential for Britain to exit as the biggest risks in 2016, according to a Bloomberg News survey. Prime Minister David Cameron has yet to call a date, but it could happen as soon as June.

The absence of “Brexit” analysis from the BOE is getting conspicuous. Last October, Carney skirted the tense political battle with a speech that addressed the U.K.’s relationship with Europe, but offered no final conclusion on its merits. His remarks were accompanied by a 100-page report that assessed the issue but offered no judgment on the impact on the U.K. economy of a British exit. Carney went a step further last week, insisting that not only has he said nothing on “Brexit,” he’s not planning to, either. He told the Wall Street Journal: “We have said all we are going to say about that. We deal with the facts on the ground and the facts on the ground are the status quo. Our job is to make the status quo work as effectively as possible.”

Recommended read.

• The End Of Economic Growth (Robert Gordon)

The idea that a single 100-year period, the “special century,” was more important to economic progress than any other so far, goes against the theory of economic growth as it has evolved over the last 60 years. Growth theory features an economy operating in a “steady state” in which a continuing inflow of new ideas and technologies creates opportunities for investment. But this model does not apply to most of human history. According to Angus Maddison, the great historian of economic growth, the annual rate of growth in the western world from AD 1 to AD 1820 was a mere 0.06% per year, or 6%%ury.

Or, as summed up by the economic commentator Steven Landsburg: “Modern humans first emerged about 100,000 years ago. For the next 99,800 years or so, nothing happened. Well, not quite nothing. There were wars, political intrigue, the invention of agriculture—but none of that stuff had much effect on the quality of people’s lives. Almost everyone lived on the modern equivalent of $400 to $600 a year, just above the subsistence level… Then—just a couple of hundred years ago—people started getting richer. And richer and richer still.” The designation of a “special century” applies only to the US, which has carved out the technological frontier for developed nations since the Civil War. However, other countries have also made stupendous progress.

Western Europe and Japan largely caught up to the US in the second half of the 20th century, and China and other emerging nations are well on their way. Progress did not suddenly begin in 1870, but the US Civil War (1861-65) provides a sharp historical marker. The first Census of Manufacturing was carried out in 1869; coincidentally, that year brought the nation together in a real sense, when the transcontinental railroad was joined at Promontory Summit in Utah.

Lapavitsas is one of the guys who left Syrixa, for the left.

• One Year On, Syriza Has Sold Its Soul For Power (Lapavitsas)

Today marks a year since a radical left government was elected in Greece; its dynamic young prime minster, Alexis Tsipras, promising a decisive blow against austerity. Yanis Varoufakis, his unconventional finance minister, arrived in London soon after and caused a media sensation. Here was a government that disregarded stuffy bourgeois conventions and was spoiling for a fight. Expectations were high. A year on, the Syriza party is faithfully implementing the austerity policies that it once decried. It has been purged of its left wing and Tsipras has jettisoned his radicalism to stay in power at all costs. Greece is despondent. Why did it end like this? An urban myth propagated in some media circles suggests that the radicals were stopped by a coup engineered by conservative politicians and EU officials, determined to eliminate any risk of contagion.

Syriza was overcome by the monsters of neoliberalism and privilege. Still, it fought the good fight, perhaps even sowed the seeds of rebellion. The reality is very different. A year ago the Syriza leadership was convinced that if it rejected a new bailout, European lenders would buckle in the face of generalised financial and political unrest. The risks to the eurozone were, they presumed, greater than the risks to Greece. If Syriza negotiated hard, it would be offered an “honourable compromise” relaxing austerity and lightening the national debt. The mastermind of this strategy was Varoufakis, but it was avidly adopted by Tsipras and most of Syriza’s leadership.

Well-meaning critics repeatedly pointed out that the euro had a rigid set of institutions with their own internal logic that would simply reject demands to abandon austerity and write off debt. Moreover, the European Central Bank stood ready to restrict the provision of liquidity to the Greek banks, throttling the economy – and the Syriza government with it. Greece could not negotiate effectively without an alternative plan, including the possibility of exiting the monetary union, since creating its own liquidity was the only way to avoid the headlock of the ECB. That would be far from easy, of course, but at least it would have offered the option of standing up to the catastrophic bailout strategies of the lenders. Unfortunately, the Syriza leadership would have none of it.

Dijsselbloem and Schäuble making sure Greece will never recover as long as it’s in the EU.

• Greece On The Brink Of ‘Education Tragedy’ (EurActiv)

The economic crisis has dramatically impacted the already struggling Greek education system, according to a trade union report published last week (19 January). EurActiv Greece reports. The report by the General Confederation of Labour in the area of Education and Lifelong learning ( KANEP-GSEE), examined the state of the Greek primary and secondary education system in the 2002-2014 period. “We are on the brink of an unprecedented education tragedy in recent decades,” the authors of the report warn, underlining that the issue is mainly “political”. “The image of the Greek primary and secondary education, compared to the European mainstream, causes deep concerns for the future of younger generations and for the future of Greece itself.”

The alarming report warned that Athens was a champion in underfunding and inequalities in its education system, as well as a laggard in innovation and learning results at the EU level. The report stressed that actual expenses did not reflect the amount of money earmarked in the annual budget of Greece. Eurostat, the EU’s statistics office, said that public expenditure on education accounted for 4.5% of GDP in 2013. However, it was just 3.2% of GDP, according to official statistics by the State General Accounting Office. “A 1.3% difference is excessively high […] and it cannot be accepted,” the report reads. The underfunding, in combination with the “ineffective study programmes”, resulted in low educational performance. Greek students are amongst the worst performers in basic subjects (mathematics, language, natural sciences).

And production is soaring.

• We Produced Enough Plastics Since WWII To Cover The Entire Earth (Guardian)

Humans have made enough plastic since the second world war to coat the Earth entirely in clingfilm, an international study has revealed. This ability to plaster the planet in plastic is alarming, say scientists – for it confirms that human activities are now having a pernicious impact on our world. The research, published in the journal Anthropocene, shows that no part of the planet is free of the scourge of plastic waste. Everywhere is polluted with the remains of water containers, supermarket bags, polystyrene lumps, compact discs, cigarette filter tips, nylons and other plastics. Some are in the form of microscopic grains, others in lumps. The impact is often highly damaging. “The results came as a real surprise,” said the study’s lead author, Professor Jan Zalasiewicz, of Leicester University.

“We were aware that humans have been making increasing amounts of different kinds of plastic – from Bakelite to polyethylene bags to PVC – over the last 70 years, but we had no idea how far it had travelled round the planet. It turns out not just to have floated across the oceans, but has sunk to the deepest parts of the sea floor. This is not a sign that our planet is in a healthy condition either.” The crucial point about the study’s findings is that the appearance of plastic should now be considered as a marker for a new epoch. Zalasiewicz is the chairman of a group of geologists assessing whether or not humanity’s activities have tipped the planet into a new geological epoch, called the Anthropocene, which ended the Holocene that began around 12,000 years ago.

Most members of Zalasiewicz’s committee believe the Anthropocene has begun and this month published a paper in Science in which they argued that several postwar human activities show our species is altering geology. In particular, radioactive isotopes released by atom bombs left a powerful signal in the ground that will tell future civilisations that something strange was going on. In addition, increasing carbon dioxide in the oceans, the massive manufacture of concrete and the widespread use of aluminium were also highlighted as factors that indicate the birth of the Anthropocene. Lesser environmental impacts, including the rising use of plastics, were also mentioned in passing.

But Zalasiewicz argues that the humble plastic bag and plastic drink container play a far greater role in changing the planet than has been realised. “Just consider the fish in the sea,” he said. “A vast proportion of them now have plastic in them. They think it is food and eat it, just as seabirds feed plastic to their chicks. Then some of it is released as excrement and ends up sinking on to the seabed. The planet is slowly being covered in plastic.”

“An Indigenous child is more likely to be locked up in prison than they are to finish high school.”

• Racism ‘Is At The Heart Of The Australian Dream’ (Guardian)

The veteran journalist and Wiradjuri man, Stan Grant, has told a Sydney audience that racism is “at the heart of the Australian dream,” as he delivered a sobering speech about the impact of colonisation and discrimination on Indigenous people and their ancestors. It has provoked a powerful reaction from Australians, going viral on Facebook with 850,000 views and 28,000 shares, and had been watched more than 50,000 times on YouTube by Sunday night. As part of the IQ2 debate series held by the Ethics Centre, Grant joined immigration lawyer Pallavi Sinha, Herald Sun columnist Rita Panahi and Australian actor Jack Thompson to argue for or against the topic “Racism is destroying the Australian dream”. The event was held last year, but the Ethics Centre only released the video online on Friday.

In his opening address, Grant, who is also Guardian Australia’s Indigenous affairs editor, argued that racism was at “the foundation of the Australian dream”. “The Australian dream,” Grant said. “We sing of it and we recite it in verse; ‘Australians all let us rejoice for we are young and free’. “My people die young in this country. We die 10 years younger than the average Australian, and we are far from free. We are fewer than 3% of the Australian population and yet we are 25% – one quarter – of those Australians locked up in our prisons. And if you’re a juvenile it is worse, it is 50%. An Indigenous child is more likely to be locked up in prison than they are to finish high school.”

He spoke of his Indigenous ancestors, including his grandmother and great-grandmother, who were among those institutionalised in missions, where Indigenous people were forced into unpaid labour and abused. He referenced the “war of extermination” against his ancestors. “I love a sunburned country, a land of sweeping plains, of rugged mountain ranges,” Grant said, referencing the famous poem, My Country, by the Australian writer Dorothea Mackellar. “It reminds me that my people were killed on those plains. We were shot on those plains, diseases ravaged us on those plains.

“Our rights were extinguished because we were not here according to British law, and when British people looked at us, they saw something subhuman. We were fly-blown, Stone-Age savages, and that was the language that was used. Captain Arthur Phillip, a man of enlightenment … was sending out raiding parties with the instruction; ‘bring back the severed heads of the black trouble-makers’.

What does this make me think of? Just because they don’t call them camps….

• Merkel’s Party, Sliding In Polls, Weighs German ‘Border Centres’ (Reuters)

A senior figure in Chancellor Angela Merkel’s conservative party has proposed setting up “border centres” along the frontier with Austria to speed up the repatriation of those asylum seekers deemed unqualified to stay. Julia Kloeckner, leader of Merkel’s Christian Democrats in the western state of Rhineland-Palatinate, was careful to style her proposal as a “Plan A2” rather than a “Plan B”, adding that the chancellor’s push for a European solution to a large influx of asylum seekers into the continent was still right. “We want to complement it,” she wrote in a paper setting out her position, a copy of which Reuters obtained. In the paper, Kloeckner proposed that: “On the German-Austrian border, border centres will be set up.”

The proposal, endorsed by the Christian Democrats’ (CDU) secretary general, highlights the frustration in Merkel’s party with the slow progress in achieving a European Union-wide solution to the refugee crisis, which is straining the infrastructure of many German municipalities. Germany attracted 1.1 million asylum seekers last year, leading to calls from across the political spectrum for a change in its handling of the number of refugees coming to Europe to escape war and poverty in Syria, Afghanistan and elsewhere. Growing concern about Germany’s ability to cope with the influx and worries about crime and security after assaults on women at New Year in Cologne are weighing on support for the CDU and its Bavarian sister party, the Christian Social Union (CSU). An Emnid poll for the newspaper Bild am Sonntag showed support for the CDU/CSU bloc down 2%age points at 36% from the previous week. The right-wing Alternative for Germany (AfD) gained 1 point to 10%. Merkel’s coalition partners, the Social Democrats (SPD), gained a point to 25%.

Should you really want an award that you share with Obama and Kissinger?

• Greek Islanders To Be Nominated For Nobel Peace Prize (Observer)

Greek islanders who have been on the frontline of the refugee crisis are to be nominated for the Nobel peace prize with the support of their national government. Of the 900,000 refugees who entered Europe last year most were received –scared, soaked and travelling in rickety boats – by those who live on the Greek islands in the Aegean Sea. The islanders, including fishermen who gave up their work to rescue people from the sea, are in line to be honoured with one of the world’s most esteemed awards. Eminent academics from the universities of Oxford, Princeton, Harvard, Cornell and Copenhagen are drafting a submission in favour of awarding the prize to the people of Lesbos, Kos, Chíos, Samos, Rhodes and Leros.

The nomination deadline is 1 February, but those behind the plan have already met the Greek minister for migration, Yiannis Mouzalas, who they say has offered his government’s full support. A petition on the website of the grassroots campaign group, Avaaz, in favour of the nomination has amassed 280,000 signatures. According to the petition: “On remote Greek islands, grandmothers have sung terrified little babies to sleep, while teachers, pensioners and students have spent months offering food, shelter, clothing and comfort to refugees who have risked their lives to flee war and terror.”

While the official nomination letter is yet to be finalised, it is understood the academics, whose identities will be revealed in the coming days, will implore the Nobel committee members to accept their nomination. They will say that it must be noted that a people of a country already dealing with its own economic crisis responded to the unfolding tragedy of the refugee crisis with “empathy and self-sacrifice”, opening their homes to the dispossessed, risking their lives to save others and taking care of the sick and injured. [..] One of the organisers of the Solidarity Networks, Matina Katsiveli, 61, a retired judge who lives on Leros, welcomed the move but said there was “reward enough in the smiles of the people we help”.

That was not clear?

• Sealing Greek Sea Border Is Impossible (AP)

Hour after hour, by night and by day, Greek coast guard patrols and lifeboats, reinforced by vessels from the European Union’s border agency Frontex, ply the waters of the eastern Aegean Sea along the frontier with Turkey. They are on the lookout for people being smuggled onto the shores of Greek islands – the front line of Europe’s massive refugee crisis. Although smugglers are often arrested, the task is mainly a search-and-rescue role. Hours spent on patrol shows the near-impossibility of sealing Europe’s sea borders as some have demanded of Greece, whose islands so near to Turkey are the most popular gateway into Europe. Some European countries – notably Hungary and Slovakia – have blasted Greece for being unable to secure its border, which also forms part of the external limits of Europe’s borderless Schengen area.

“We have been saying all along that if the Greeks are unable to protect the borders of their country, we should jointly go down south and protect them,” Hungarian Prime Minister Viktor Orban said in November, with his Slovak counterpart Robert Fico echoing the thought. But such calls ignore the realities at sea. No matter how many patrol boats are out in Greek waters, attempting to force a vessel of asylum-seekers back into Turkish waters is both illegal and dangerous, even in calm seas. So unless a Turkish patrol stops a migrant boat and returns it to Turkey, there is little Greek or Frontex patrols can do once it has entered Greek territorial waters but arrest the smugglers and pick up the passengers or escort the vessel safely to land.

“Greece is guarding the national and European borders,” Greek Alternate Foreign Minister Nikos Xydakis said in a statement Sunday. “What it cannot do and will not do … is to sink boats and drown women and children, because international and European treaties and the values of our culture forbid it.”

Home › Forums › Debt Rattle January 25 2016