Unknown Crack salesmen ‘Going East’ on streamliner City of San Francisco 1936

47% off 2015 highs.

• China Stocks Plunge to 13-Month Low Amid Capital Outflow Concern (BBG)

China’s stocks tumbled to the lowest levels in 13 months amid concern capital outflows may accelerate as the economy slows and after some of the nation’s most-accurate forecasters predicted further declines for equities. The Shanghai Composite Index plunged 5.2% to 2,784.88 at 2:24 p.m., heading for the lowest close since December 2014, as turnover shrank. Industrial and technology companies led declines. China Shipbuilding Industry and Hundsun Technologies slumped more than 8%. Hong Kong’s Hang Seng China Enterprises Index decreased 3.2%.

Huang Weimin, whose Chinese stock-index futures wagers returned more than 6,200% last year, says the Shanghai gauge could drop another 15% in the first half as slowing economic growth and a weaker yuan fuel capital outflows. Outflows jumped in December, with the estimated 2015 total reaching a record $1 trillion, more than seven times higher than the whole of 2014 based on Bloomberg Intelligence data dating back to 2006. “The pressure for capital outflow and yuan’s devaluation is still quite big,” said Dai Ming, a fund manager at Hengsheng Asset Management in Shanghai, adding that he’s cutting equity holdings. “We haven’t seen signs of a pick-up in the economy and the first and second quarters could be challenging.”

Oh darn, and we thought we’d grow happily ever after…

• China Shares Drop Sharply, as Region Suffers Rout (WSJ)

China shares fell sharply Tuesday afternoon, as oil prices sunk lower, pulling down energy shares across the region. The Shanghai Composite Index was last down more than 4%, at 2815.65, on track for a fresh low since Dec. 2014. The benchmark is now off roughly 45% since its June peak. While most of the region started in the red, China shares notably deepened their losses around one hour before the 3 p.m. local market close. Investors have been wary that the government may be stepping back from heavy intervention in the stock market, after state-owned funds had been tasked last summer with buying shares. Late last year, coordinated buying had often come in the afternoon hours, sending shares surging.

Meanwhile, in Hong Kong, the energy sector plunged 5.2%, dragging down the Hang Seng Index by 1.9%. The Hang Seng China Enterprises Index of Chinese firms trading in Hong Kong dropped 2.8% at 7948.28. That benchmark hit a closing low of 7835 last Thursday, and currently trades at its lowest levels since 2009. The Nikkei Stock Average fell 2.4%, with Tokyo-listed oil developer Inpex Corp. down 4.3%, South Korea’s Kospi was down 1.2%. Markets in Australia and India are closed for holidays. The same concerns that have haunted stocks this year remain: Oil prices are trading near multiyear lows, and investors are worried about a slowing China and plans by the U.S.Federal Reserve to raise interest rates. But increasingly, the oil market is driving the action.

“The volatility [in oil] is not helping restore confidence back in the market,” said Robert Levine, head of Asian sales and trading at brokerage CLSA. “It’s not easy to put on new bets.” Brent crude oil gave up gains earlier in Asia to trade down 3.2% at $29.53 a barrel. In the U.S., prices had fallen 5.7% on Monday to $30.34 a barrel. Brent oil has now fallen more than 20% this year.

Hong Kong on the verge of a currency peg collapse.

• Offshore Yuan Resumes Drop as Oil Reignites Global Risk Aversion (BBG)

The yuan traded in Hong Kong resumed declines as risk aversion crept back into global markets, spurred by a drop in oil and lingering concern about the health of China’s economy. Brent crude headed lower for a second day, causing Asian currencies and stocks to give up gains that were triggered by optimism central banks in Japan and Europe will add to monetary stimulus. Sentiment on the yuan is still fragile and any major shocks to confidence, along with policy uncertainties could significantly compound outflows, Goldman Sachs Group Inc. economists led by MK Tang wrote in a note Tuesday. “The yuan is pressured as oil slumped, while the outlook for the global and Chinese economy isn’t strong,” said Banny Lam at Agricultural Bank of China International in Hong Kong.

“The yuan will remain relatively stable due to the possible lack of news or major support from policy makers as the Lunar New Year is approaching.” The offshore yuan fell 0.09% to 6.6152 a dollar as of 11:09 a.m. local time, data compiled by Bloomberg show. The onshore exchange rate was steady at 6.5796, according to China Foreign Exchange Trade System prices. The People’s Bank of China set its daily fixing in Shanghai little changed from Monday at 6.5548. Outflows from China increased to $158.7 billion in December, the most since September and were $1 trillion last year, according to estimates from Bloomberg Intelligence. That’s more than seven times the amount of cash that left in 2014.

China is willing and able to withstand temporary fluctuations in the exchange rate to gain independence of its monetary policy, Mei Xinyu, a researcher at China’s Ministry of Commerce, wrote in a commentary on the front page of the overseas edition of the People’s Daily Tuesday. The official Xinhua News Agency published a commentary on Saturday saying speculators entering short positions are expected to “suffer huge losses” as Chinese policy makers will take measures to stabilize the yuan. The PBOC has intervened repeatedly in the currency markets at home and abroad to damp depreciation pressure since it devalued the yuan in August. Meddling in the offshore yuan soaked up liquidity in Hong Kong this month and sent interbank lending rates to record highs, making selling short the currency costlier.

The authorities have also tightened capital controls to stem outflows, with measures including suspending foreign banks from conducting some cross-border business until March and imposing reserve-requirement ratios on yuan deposited onshore by overseas financial institutions since Monday. “Capital outflows will continue” as bets for further yuan depreciation still persist and investor confidence has been hit by policy risks, said Ken Cheung, a Hong Kong-based strategist at Mizuho Bank Ltd. “China won’t tolerate sharper yuan declines because its collapse would reinforce outflows, jeopardize China’s real economy, trigger a currency war and drag on the pace of internationalization.”

All together now.

• US Stocks Slump as Oil Resumes Rout (BBG)

U.S. stocks halted a two-day rebound, with losses piling up in the last hour of trading as crude oil resumed a selloff that has rocked financial markets this year. Commodity-linked currencies slid as investors sought refuge in haven assets from gold to Treasuries. Energy and mining shares pushed the Standard & Poor’s 500 Index’s retreat to 1.6% as U.S. crude tumbled back below $31 a barrel, winding back a sizable chunk of Friday’s gains. Sentiment was better in emerging markets, where stocks headed for their steepest two-day advance since September on bets central banks will bolster stimulus to soothe the market turbulence. While the ruble weakened against all but one of its 31 major peers and Canada’s dollar sank, gold jumped. 10-year Treasury yields dropped five basis points.

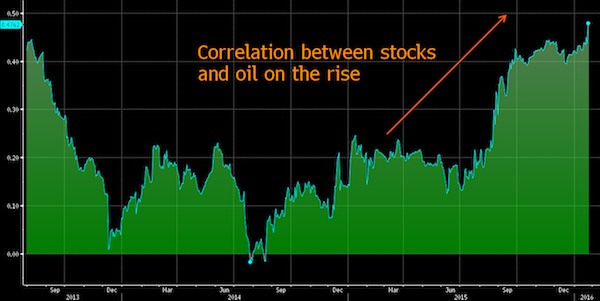

Even after it staged a recovery late last week, crude is still nearing a 20% decline this year as brimming U.S. stockpiles and the prospect of additional Iranian exports fuel anxiety over a global glut. The slump in energy prices has also amplified concern over world growth and disinflation, as it also points to weaker industrial demand. With energy and commodity companies sliding, a measure of the correlation between global stocks and oil prices over the past 120 days has climbed to 0.5, the highest level since 2013. “Obviously investors are working through some potentially difficult issues in their minds about the state of the world economy,” said John Carey at Pioneer Investment Management. “It might might be a while before we emerge from this period of uncertainty. I’ve noticed that pattern of end-of-day volatility and wonder if there are programs that kick in at the end of the day that contribute to that.”

The S&P 500 fell to 1,877.07 as of 4 p.m. in New York, following a 2% rebound on Friday. Equities are on track for their worst January since 2009 amid concern China’s slowdown will weigh on global growth, with plunging oil prices exacerbating that angst. The U.S. benchmark sank to a 21-month low last week before rallying.

Guess stocks can fall as much as oil then?

• Oil And Stocks Dance The Bear Market Tango (WSJ)

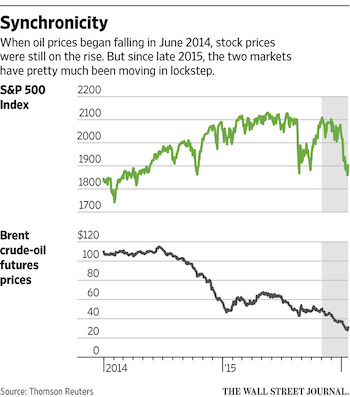

Oil and stock markets have moved in lockstep this year, a rare coupling that highlights fears about global economic growth. As oil prices tumbled early in 2016, global equities recorded one of their worst-ever starts for a new year. On Monday, oil and stocks were lower again. The S&P 500 index was down 0.7% in midday New York trading, and Brent crude futures, the global benchmark, were down $1.37 a barrel, or 4.3%, to $30.81. That followed a joint rebound on Friday. The correlation between daily moves in the price of Brent and the S&P 500 stock index is at levels not seen in the past 26 years. January isn’t over yet, but over the past 20 trading days—an average month—the correlation is 0.97, higher than any calendar month since 1990, according to data from both benchmarks examined by The Wall Street Journal.

A correlation of 1 would mean oil and stock prices move by the same proportion in the same direction, while a correlation of minus 1 would mean they move proportionally in opposite directions. The unusually strong link between the two markets partly reflects a common theme driving both: fears that a slowing Chinese economy could tip the global economy into recession. But as traders and investors in each market look at the other for clues as to how bad things are, they have exacerbated the overall bearish mood. The recent pattern marks a shift in the dynamics of oil’s 19-month collapse. Traders who long worried that the oil market was suffering from oversupply are now growing concerned that demand may be weakening as well.

“There is a vicious-cycle mentality among investors,” said François Savary, chief investment officer at Prime Partners, a Swiss investment firm managing $2.6 billion of assets. “It has become self-sustaining.” Even in the oil-rich Middle East, the mood has changed. In Dubai, businessman Ramesh Manglani never used to look at the oil price when investing in equity, despite the influence of energy in the region and its companies. “Everything’s changed since last year,” Mr. Manglani said, after investing in stocks for nearly a decade. “First thing in the morning we now check oil prices and Asian markets.”

More tangoing. In reality, it’s all one big thing of course.

• So Yes, the Oil Crash Looks a Lot Like Subprime (Alloway)

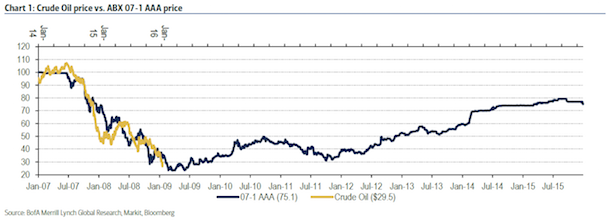

One year ago, analysts at Bank of America Merrill Lynch drew a parallel between the subprime mortgage crash and the disorderly fall in the price of oil. Led by Chris Flanagan, a veteran of the securitization space, the team drew attention to Markit’s ABX Index, better known as the mother of all synthetic subprime credit indexes. Created in January 2006 and consisting of a basket of credit default swaps (CDS) tied to the welfare of subprime mortgages, it allowed a bevy of investors to bet on the future direction of riskier home loans and helped inflate the massive amounts of leverage tied to the U.S. housing bubble.

More recently it played a starring role in the film version of Michael Lewis’s The Big Short—when protagonists Christian Bale, Steve Carell, et al. are tracking their bets against the U.S. housing market, they are tracking the ABX. Fast-forward to today and the BofAML analysts provide an update to their previous thesis, which was that the downward spiral in the price of oil was shaping up to look a lot like the negative trend that engulfed the subprime space circa the year 2007. Here’s what they say:

“The pattern of the decline in the price of oil that began in mid-2014 is remarkably similar to the 2007-2009 pattern of the price decline of ABX, the credit derivative index that referenced subprime mortgages and, ultimately, the U.S. housing market (Chart 1). The ABX history suggests that oil will see more declines in the next couple of months and find a floor somewhere in the low 20s in the March-April time frame. Both the duration of the decline (1.5+ years) and the scale of the decline (100 neighborhood starting price down to the sub-30 neighborhood) are similar. Given that both housing and oil prices were fueled to spectacular heights in the two periods by massive credit expansion, it’s probably more than just coincidence that the respective “bubble” bursting patterns are so similar.

Consider how things tend to work. Denial on what constitutes fair value is a big component of bubbles, on the part of both market participants and policymakers. When perceived “bubbles” burst, markets take their time in steadily shredding views of the perception of fundamental value, as prices move lower and lower. Along the way, many will cite “technical factors” as the cause of the decline, which in some way suggests the price decline may not be real when in fact it is all too real. In the end, the technicals drive the fundamentals, as credit flees and borrowers go bust, and a feedback loop lower kicks in. Lower prices beget accelerated selling, as asset owners need to raise cash. It could be margin calls or it could be producer selling needs, it doesn’t really matter: the selling becomes inevitable and turns into forced selling.”

The point here is not that oil is necessarily the new subprime crisis per se but that the recent action in the price of crude resembles nothing if not the bursting of a bubble and the sudden realization that the asset has been overvalued for too long. More worrying for oil investors will be BofAML’s idea of forced selling. As Flanagan notes: “The systemic margin call of 2008 seems to be back for now, albeit to a far lesser degree.”

Doesn’t seem feasible inside the IMF basket.

• Capital Controls May Be China’s Only Real Option (FT)

Chinese officials readily admit that communication has not been their strong point when it comes to dealing with international investors. The question of how China manages the renminbi is critical for global trade and commodity prices; the market turmoil following recent changes in the currency regime was exacerbated by Beijing’s failure to explain its intentions. Policymakers have now made it explicit that they have no wish to engineer a big devaluation. However, they are much less forthcoming about how they plan to reconcile a desire for currency stability with the realities of capital flight and a slowing economy. Greater clarity would be a help to investors, who struggle at present to interpret cryptic press releases and gauge the extent of central bank intervention in markets. However, improving communication by the People’s Bank of China is not an easy matter.

In a system where even the central bank governor cannot speak with complete authority — given political constraints and resistance to its reformist policies in other parts of the Chinese state — it would constitute a revolution. Moreover, central bank guidance is most effective when the policy is clear and it is relatively straightforward to work out how it will evolve in response to changes in economic data. At present, the reality in China is that the PBoC has no clear course of action and wants to leave itself flexibility. No amount of clarification wouldhelp to varnish the underlying problem: capital flight. The corruption clampdown and a lack of investment opportunities at home are driving Chinese people to take their money out of the country, just as the prospect of higher US interest rates is prompting companies to pay off dollar debt.

Fear of a devaluation has fuelled the outflows. Far from seeking a weaker renminbi, the central bank has been forced to spend a big chunk of its reserves to prop it up. Given this continuing pressure, Chinese policymakers have few attractive options. Even with a $3.3tn stockpile, they cannot continue to run down foreign exchange reserves indefinitely, nor would the government countenance it. Raising interest rates to make domestic investments more attractive would be unlikely to slow outflows while worsening the already painful slowdown in the real economy. Letting the renminbi find its own level — while intellectually coherent — risks enormous market dislocation in the short term and would be a huge shock to the global economy. Few policymakers either within China or outside are likely to contemplate such a course.

“The world will have to learn to live without demand from China,” he says. “It’ll come as a shock.”

• Yuan’s Fall Is Just ‘Noise’ Amid Deeper China Woes (WSJ)

When the financier George Soros attacked the British pound in 1992 and famously “broke the Bank of England” he was trading on a conviction that the currency was misaligned. Britain devalued after squandering its reserves in a vain defense. Mr. Soros walked off with $1 billion or more. To the surprise of many, though, the U.K. economy soon picked up once the pound found its proper level. China’s raging battles with currency speculators are unlikely to end as happily for the country. That’s because turmoil in the currency markets reflects a much more perilous imbalance than an overvalued yuan: China is now lopsidedly dependent on ever larger inputs of local bank credit to keep sputtering growth from declining further.

The country is already littered with “zombie” factories, empty apartment blocks that form ghostly suburbs, mothballed power stations and other infrastructure that nobody needs. But yet more wasteful projects are in the pipeline, even as the government talks about cutting industrial overcapacity. “That’s the misalignment—everything else is noise,” says Rodney Jones, the Beijing-based principal of Wigram Capital Advisors, who was a partner at Soros Fund Management during the 1990s. If debt keeps piling up at the current rate, China faces an eventual financial crisis, perhaps leading to years of subpar growth, mirroring the fate of Japan after its bubble burst in the early 1990s.

Mr. Jones argues that global equity markets haven’t property adjusted to this risk, even after a 16% decline in U.S. dollar terms from their May peak. “The world will have to learn to live without demand from China,” he says. “It’ll come as a shock.” A sharp devaluation won’t fix these distortions, and might even make matters worse if, as likely, it were to trigger financial mayhem in China’s trading partners. An alternative—further clamping cross-border currency controls—would be a humiliating retreat from Beijing’s policy of making the yuan more international.

Going to be picking up speed if Beijing lets it.

• China Capital Outflows Rise to Estimated $1 Trillion in 2015 (BBG)

China’s capital outflows jumped in December, with the estimated 2015 total reaching $1 trillion, underscoring the scale of the battle facing policy makers trying to hold up the yuan amid slower economic growth and slumping stocks. Outflows increased to $158.7 billion in December, the second-highest monthly outflow of the year after September’s $194.3 billion, according to estimates compiled by Bloomberg Intelligence. The total for the year soared more than seven times from $134.3 billion in the whole of 2014 to a record for Bloomberg Intelligence data dating back to 2006. December’s outflows increased by almost $50 billion from a month earlier after the central bank unnerved markets by saying it would refocus the yuan’s moves against a wider basket of currencies rather than the dollar.

In addition to capital exiting the economy, exporters are holding funds in dollars instead of converting them to yuan, said Tom Orlik, Bloomberg’s chief Asia economist in Beijing. “The immediate trigger for a pickup in capital outflows toward the end of the year was the People’s Bank of China’s poor communication over its shift in currency policy,” said Mark Williams, chief Asia economist for Capital Economics Ltd. in London, who previously worked on China issues at the U.K. Treasury. “Outflows are likely to remain strong because the People’s Bank still has not been able to generate confidence among investors that it knows what it’s doing or that it’s able to achieve its policy objectives.” China’s cross-border capital flow risks are controllable and the nations’ foreign exchange reserves are ample to help it defend against external shocks, the State Administration of Foreign Exchange said on its website Jan. 21.

China’s foreign exchange reserves are seen tumbling $300 billion this year to the $3 trillion level some analysts say risks undermining confidence in the central bank’s ability to defend the currency, according to a Bloomberg News survey. Policy makers have been burning through reserves to reduce yuan volatility as the currency lost its status as a one-way bet on appreciation amid the slowest economic growth in a quarter century and an unexpected devaluation in August. The stockpile of reserves plunged $513 billion last year to $3.33 trillion, the first annual drop since 1992. Outflows spiked in September and December after currency policy changes caught markets by surprise, said Williams.

Ha ha ha: “..China’s economic activity is still growing steadily..”

• China Business Confidence, Recruitment Hit Record Lows In January (Reuters)

China’s business confidence and recruitment activity slipped to record lows in January, a survey showed, adding to signs of weakness in the world’s second-largest economy that could prod policymakers to roll out more support measures. The Sales Managers’ Index, compiled by London-based World Economics, fell to 51.0 in January from 51.7 in December. “The Headline SMI index fell slightly in January, but continues to suggest ongoing, albeit modest growth in economic activity,” World Economics Chief Executive Ed Jones said.

The index has averaged 51.4 since the second half of last year, indicating China’s economic activity is still growing steadily, albeit at a much slower rate than a year ago. The Sales Managers’ Index covers all private sectors of the economy. It is designed to reflect overall economic growth, bringing together the average movement of Confidence, Market Expansion, Product Sales, Prices Charged and Staffing Indices. The staffing index fell to 50.3 in January, near the 50 no-change mark, from 50.8 in December, hitting its lowest since the survey began, as businesses have become more hesitant to recruit as economic activity weakens, the survey showed.

And will remain so for the rest of their lives.

• Americans Are Trapped In A ‘Cycle Of Financial Insecurity’ (MW)

Nearly seven years after the Great Recession, millions of Americans are stuck in a financial rut. Home ownership rates are at an historic low, renters are burdened by rising rents and — even though unemployment has fallen considerably in recent years — the percentage of underemployed Americans is twice those who are unemployed, according to the “2016 Assets & Opportunity Scorecard” released Monday by the Corporation for Enterprise Development, a nonprofit group in Washington, D.C. focused on expanding opportunity for low-income households. It assessed the 50 states and the District of Columbia on 61 measurements spanning financial assets and income, businesses and jobs, housing, health care and education. It also ranked these states on 69 policies that promote financial security.

Building up even a small amount of savings is a challenge. In fact, 44% of households are “liquid asset poor,” meaning they have less than three months of savings to live above the poverty level if they suffer a loss of income, the report notes, echoing the findings in several recent surveys on American savings. “Housing expense reduces income to pay for food, doctors and child care, leaving bills that can’t be paid on time and forcing consumers to take on high-cost, short-term loans,” it adds. (Over half of renters spend more than 30% of their gross income on rent, the traditional measure of affordability, according to data released last year by Harvard University’s Joint Center for Housing Studies.) Among the other key highlights, home ownership rates are hovering at just under 64% in the final quarter of 2015, still near the lowest level in three decades.

And while the national unemployment rate has fallen to 5% in December 2015, down from a recent high of 10% in October 2009, the underemployment rate was nearly 9.9% in December 2015, showing that people are still struggling to find full-time employment. “What’s more, one-in-four jobs are in a low-wage occupation,” the report adds. (On a more positive note, the government recently said more than 11 million people had signed up for the Affordable Care Act, including 4 million under the age of 35.)

Americans are still struggling to regain their pre-recession wealth and the scorecard estimates that this is far worse for people of color. Households of color are 2.1 times more likely to live below the federal poverty level and 1.7 times more likely to lack liquid savings, it says. “Those who once enjoyed a modicum of financial stability have settled into a new normal of ongoing financial vulnerability, while the struggles of those who were financially insecure before the recession have only deepened,” the authors write. “The number of households below the poverty line has barely budged and millions of low- and moderate-income people live paycheck to paycheck.”

“And none of this includes the more than $69 trillion in unfunded liabilities being run up by Medicare and Social Security.”

• US National Debt Set To Top $27 Trillion (Tanner)

Does anyone remember the national debt? Judging from the presidential campaign so far, perhaps we should put the debt’s image on a milk carton somewhere. In the last Republican debate, there was precisely one question on the debt — and the candidates answered it by talking about their tax plans. That was far too typical. According to the FiveThirtyEight website, “the deficit” was mentioned an average of two times in the first five televised Republican debates (including the “undercard” debates) by all the candidates — and the moderators — combined. And “the national debt” was brought up an average of 6.5 times. This compares to an average of 3.2 “deficit” mentions and 10.9 “debt” mentions in the 20 GOP debates during the 2012 campaign.

But while the candidates have been wrangling over such vital issues as fantasy sports betting or Ted Cruz’s citizenship status, our growing sea of red ink has quietly risen toward $19 trillion. One might think our impending national bankruptcy might be worth a bit more attention. In his State of the Union address, President Obama took a bow for reducing our annual budget deficit by two-thirds during his time in office. He’s correct. Since its high of $1.4 trillion in 2009, the deficit had dropped to just $439 billion last year, although the president failed to mention that his policies, including the 2009 stimulus bill, helped drive the deficit to those record levels, and policies that he opposed, such as sequestration, helped bring it down.

But the respite is just temporary. According to the Congressional Budget Office’s newest estimates, released yesterday, the deficit is already rising again, and will exceed $544 billion this year. By 2022, just six years from now, we will once again be experiencing trillion-dollar deficits every year. And even with lower deficits, the national debt is still rising. By 2025, our debt will top $27 trillion. Yet, Congress is not only kicking the can down the road, it is making the problem worse. Just last year, Congress put in place spending that will raise the debt by $1.2 trillion over the next ten years. The Committee for a Responsible Federal Budget called 2015 “a banner year for fiscal irresponsibility.” And none of this includes the more than $69 trillion in unfunded liabilities being run up by Medicare and Social Security. But out on the campaign trail? Crickets.

That’s a mighty long way down ahead.

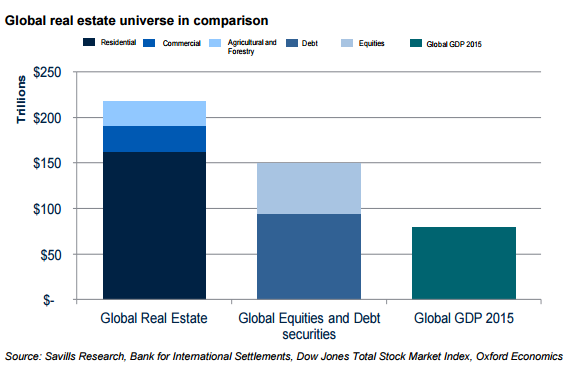

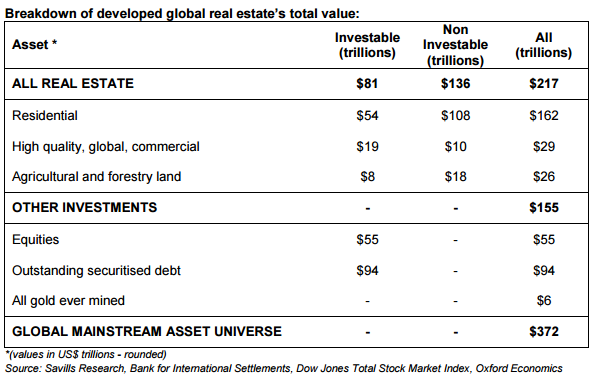

• Global Real Estate Value Hits $217 Trillion In 2015 (VW)

The total value of all developed real estate on the globe reached US$217 trillion in 2015, according to calculations by international real estate adviser, Savills. The analysis, published today for the first time, measures the entire developed property universe including commercial and residential property as well as forestry and agricultural land. The value of global property in 2015 amounted to 2.7 times the world’s GDP, making up roughly 60% of mainstream global assets and representing an important store of national, corporate and individual wealth. Residential property accounted for 75% of the total value of global property.

Yolande Barnes, head of Savills world research, comments: “To give this figure context, the total value of all the gold ever mined is approximately US$6 trillion, which pales in comparison to the total value of developed property by a factor of 36 to 1. “The value of global real estate exceeds – by almost a third – the total value of all globally traded equities and securitised debt instruments put together and this highlights the important role that real estate plays in economies worldwide. Real estate is the pre-eminent asset class which will be most impacted by global monetary conditions and investment activity and which, in turn, has the power to most impact national and international economies.” In recent years, quantitative easing and resulting low interest rates have suppressed real estate yields and fuelled high levels of asset appreciation globally.

Investment activity and capital growth has swept around the major real estate markets of the world and led to asset price inflation in many instances. Overall, the biggest and most important component of global real estate value is the homes that people live in, totalling US$162 trillion. The sector has the largest spread of ownership with approximately 2.5 billion households and is most closely tied with the fortunes of ordinary people. Residential real estate value is broadly distributed in line with the size of affluent populations: China accounts for nearly a quarter of the total value, containing nearly a fifth of the world’s population. Yet the weight of value lies with the West, over a fifth (21%) of the world’s total residential asset value is in North America despite the fact that only 5% of the population lives there.

This is just too crazy. The American Dream is voluntary force-fed peonage. This country deserves a Trump.

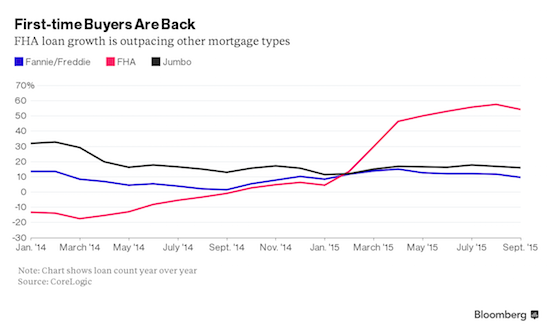

• First-Time Homebuyers Are Finally Jumping Into The US Property Market (BBG)

First-time homebuyers are finally jumping into the U.S. property market. Need proof? Look at the mortgage market’s fastest-growing segment: loans with low down payments insured by the Federal Housing Administration. Originations of FHA-backed mortgages, used predominately by first-time buyers, were up 54% in September from a year earlier, according to the most recent data from CoreLogic. By December, the FHA insured 22% of all loan originations, up from 17% a year earlier, according to data compiled by Ellie Mae. “The FHA will be a contributing factor to homeownership rising again in America,” said David Lykken, president and founder of Transformational Mortgage Solutions in Austin, Texas. “We’re seeing the return of first-time buyers.”

President Barack Obama’s administration, in January 2015, reduced mortgage-insurance premiums for FHA loans. That lowered the cost of getting a home loan and brought in at least 75,000 new borrowers with credit scores of less than 680, according to a November report from the U.S. Department of Housing and Urban Development. The rate of FHA lending, which had been in decline through most of 2014, tripled the month after the insurance premium was cut, according to CoreLogic. The FHA estimates that borrowers save $900 a year on average as a result of the lower premium. The move made FHA-backed mortgages more competitive with other loans that have low-down-payment options, said Guy Cecala, publisher of the newsletter Inside Mortgage Finance.

While mortgage giants Fannie Mae and Freddie Mac have an option for borrowers to put down as little as 3%, they require private insurance with risk-adjusted premiums based on credit scores, debt-to-income ratios and other factors. “It still costs more to get a 3%-down loan with Fannie and Freddie if you have a lower FICO score,” Cecala said. The homeownership rate in the third quarter was 63.7%, up from 63.4% in the previous three months and the first quarterly rise in two years, according to the U.S. Census Bureau, which is scheduled to release fourth-quarter data next week. “Last year’s decision to lower premiums was designed to open the door to those previously priced out of homeownership,” HUD Secretary Julian Castro said in an email. “We’ve seen positive results with new buyers entering the market and making the American dream of homeownership a reality.”

How Wal-Mart destroys American communities.

• Wal-Mart: It Came, It Conquered, Now It’s Packing Up and Leaving (BBG)

The Town’n Country grocery in Oriental, North Carolina, a local fixture for 44 years, closed its doors in October after a Wal-Mart store opened for business. Now, three months later — and less than two years after Wal-Mart arrived — the retail giant is pulling up stakes, leaving the community with no grocery store and no pharmacy. Though mom-and-pop stores have steadily disappeared across the American landscape over the past three decades as the mega chain methodically expanded, there was at least always a Wal-Mart left behind to replace them. Now the Wal-Marts are disappearing, too. “I was devastated when I found out. We had a pharmacy and a perfectly satisfactory grocery store. Maybe Wal-Mart sold apples for a nickel less,” said Barb Venturi, mayor pro tem for Oriental, with a population of about 900.

“If you take into account what no longer having a grocery store does to property values here, it is a significant impact for us.” Oriental is hardly alone. Wal-Mart said on Jan. 15 it would be closing all 102 of its smaller Express stores, many in isolated towns, to focus on its supercenters and mid-sized Neighborhood Markets. The move, which will begin by the end of the month, was a relatively quick about-face. As recently as 2014, Wal-Mart was touting the solid performance of its smaller stores and announced plans to open an additional 90. That’s a big problem for small towns, often with proportionately large elderly populations. For the older folks of Oriental – a retirement and summer vacation town along the inter-coastal waterway – the next-nearest grocery and pharmacy is a 50-minute round-trip drive.

Wal-Mart says it is sensitive to the dislocations its business decisions are causing. “In towns impacted by store closures, we have had hundreds of conversations with elected officials and community leaders to discuss relevant issues and we are working with communities on how we can be helpful,” said Wal-Mart spokesman Brian Nick. Wal-Mart has been under increasing pressure lately as sales in the U.S. have failed to keep up with rising labor costs. It’s also been spending more on its Web operations. In October, the company announced that profit this year would be down as much as 12%. The outlook contributed to a share decline of 29% during the past 12 months. “It is more important now than ever to review our portfolio and close the stores and clubs that should be closed,” Wal-Mart’s Chief Executive Officer Doug McMillon said in a statement on the company’s website.

Timing is everything?!

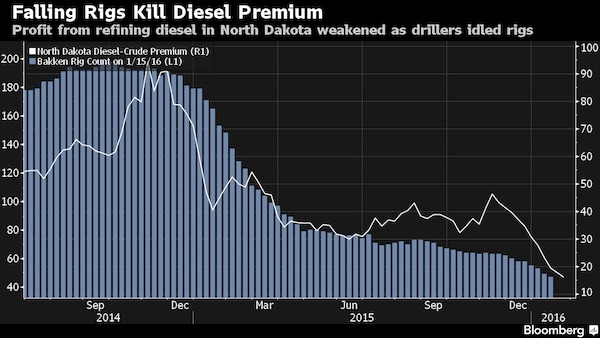

• How the Oil Bust Wiped Out One North Dakota Oil Refiner (BBG)

For the first new refinery in the U.S. in seven years, the idea was simple: Buy cheap oil from shale producers, then score a quick profit by selling it right back to them as more expensive diesel needed to power their trucks and drilling rigs. Now the shale bust is threatening to ruin a renaissance in small refineries, known as teapots, before it even begins. When Dakota Prairie Refining was building its plant in 2014, it could buy some of the cheapest oil in America and sell among the most expensive diesel in America. But the oil bust obliterated its local diesel market, along with the fat premium the fuel used to fetch, as its potential customers shut down operations.

In the fall of 2014, when tiny Dakota Prairie was getting ready to open its processing plant in Dickinson, North Dakota, diesel fuel near the state’s Bakken oil fields sold for $100 a barrel more than the oil produced there. Now it’s selling for just $16 a barrel more. “The last thing you want to be doing right now is running a refinery that makes a lot of diesel and very little gasoline,” said Robert Campbell at Energy Aspects. It’s a “double whammy,” he said, as the diesel market weakens worldwide and demand in their specific local market plunges. Dakota Prairie lacks the pipelines and storage units a larger refiner uses to sell to customers farther away, and it’s not equipped to make vehicle-ready gasoline instead of diesel. “These guys don’t have alternative markets, and they don’t have a lot of competitiveness to export, so they’re pretty stuck,” Campbell said.

“President Obama has already far surpassed even his predecessor, George W. Bush, in taking the country to war without even the fig leaf of an authorization.”

• Congress is Writing the President a Blank Check for War (Ron Paul)

While the Washington snowstorm dominated news coverage this week, Senate Majority Leader Mitch McConnell was operating behind the scenes to rush through the Senate what may be the most massive transfer of power from the Legislative to the Executive branch in our history. The senior Senator from Kentucky is scheming, along with Sen. Lindsey Graham, to bypass normal Senate procedure to fast-track legislation to grant the president the authority to wage unlimited war for as long as he or his successors may wish. The legislation makes the unconstitutional Iraq War authorization of 2002 look like a walk in the park. It will allow this president and future presidents to wage war against ISIS without restrictions on time, geographic scope, or the use of ground troops. It is a completely open-ended authorization for the president to use the military as he wishes for as long as he (or she) wishes.

Even President Obama has expressed concern over how willing Congress is to hand him unlimited power to wage war. President Obama has already far surpassed even his predecessor, George W. Bush, in taking the country to war without even the fig leaf of an authorization. In 2011 the president invaded Libya, overthrew its government, and oversaw the assassination of its leader, without even bothering to ask for Congressional approval. Instead of impeachment, which he deserved for the disastrous Libya invasion, Congress said nothing. House Republicans only managed to bring the subject up when they thought they might gain political points exploiting the killing of US Ambassador Chris Stevens in Benghazi.

It is becoming more clear that Washington plans to expand its war in the Middle East. Last week the media reported that the US military had taken over an air base in eastern Syria, and Defense Secretary Ashton Carter said that the US would send in the 101st Airborne Division to retake Mosul in Iraq and to attack ISIS headquarters in Raqqa, Syria. Then on Saturday, Vice President Joe Biden said that if the upcoming peace talks in Geneva are not successful, the US is prepared for a massive military intervention in Syria. Such an action would likely place the US military face to face with the Russian military, whose assistance was requested by the Syrian government. In contrast, we must remember that the US military is operating in Syria in violation of international law.

A quote from years ago: “We’re raising a generation of blind amputees”. PS: What on earth are “lower middle-income countries”?

• Childhood Obesity ‘An Exploding Nightmare’ (Guardian)

The number of children under five who are overweight or obese has risen to 41 million, from 31 million in 1990, according to figures released by a World Health Organisation commission. The statistics, published by the Commission on Ending Childhood Obesity, mean that 6.1% of under-fives were overweight or obese in 2014, compared with 4.8% in 1990. The number of overweight children in lower middle-income countries more than doubled over the same period, from 7.5 million to 15.5 million. In 2014, 48% of all overweight and obese children aged under five lived in Asia, and 25% in Africa. The expert panel, commissioned by the WHO, said progress in tackling the problem had been “slow and inconsistent” and called for increased political commitment, saying there was a “moral responsibility” to act on behalf of children.

Peter Gluckman, a co-chair of the commission, said childhood obesity had become “an exploding nightmare” in the developing world. He added: “It’s not the kids’ fault. You can’t blame a two-year-old child for being fat and lazy and eating too much.” The report’s authors said that addressing the problem must start before the child is conceived and continue into pregnancy, through to infancy, childhood and adolescence. They pointed out that where a mother entering pregnancy is obese or has diabetes, the child is predisposed “to increased fat deposits associated with metabolic disease and obesity”. Many children are growing up in environments encouraging weight gain and obesity, they observed. “The behavioural and biological responses of a child to the obesogenic environment can be shaped by processes even before birth, placing an even greater number of children on the pathway to becoming obese when faced with an unhealthy diet and low physical activity,” they said.

Very nice video.

• 15 Of The 16 Hottest Years On Record Have Been This Century (UNFCCC)

The trend for increasingly extreme and frequent weather matching climate change forecasts has been put into stark perspective by the latest data while the economic impact of one of the strongest El Nino’s on record is acting as a red warning light of worse to come, if the world does not act fast enough to cut the concentrations of greenhouse gases in the atmosphere. Drawing on consolidated analysis of the world’s major meteorological agencies, the World Meteorological Organization (WMO) has confirmed that the global average surface temperature in 2015 broke all previous records by a wide margin. For the first time on record, temperatures in 2015 were about 1°C above the pre-industrial era.

The WMO says that the fifteen of the 16 hottest years on record have all been this century, with 2015 being significantly warmer than the record-level temperatures seen in 2014. Underlining the long-term trend, 2011-15 is the warmest five-year period on record. The news comes as Asia is experiencing unusually cold weather and the United States a major blizzard, a sobering reminder that climate change is about extreme impacts from all kinds of weather as the weather systems we have taken for granted for so long shift into more chaotic patterns under the influence of the greenhouse effect.

No single weather event can be attributed to climate change but the frequency and intensity of extreme weather events is increasing as predicted as global average temperatures rise, and this will have severe economic implications. For example, a warmer world means fewer days of snowfall, but heavier snowfall on those days when it does snow. This is because snow requires moist air, and a warmer atmosphere holds more moisture.

The EU puts itself on notice but is too blind to see it. No Schengen, no EU.

• ‘Running Out Of Time’, EU Puts Greece, Schengen On Notice (Reuters)

The European Union edged closer on Monday to accepting that its Schengen open-borders area may be suspended for up to two years if it fails in the next few weeks to curb the influx of migrants from the Middle East and Africa. Shorter-term dispensations for border controls end in May. EU migration ministers meeting in Amsterdam decided they may be extended for two years – an unprecedented extension – because the migrant crisis probably will not be brought under control by then, according to the Dutch migration minister, who chaired the meeting. Some ministers made clear such a – theoretically temporary – move would cut off Greece, where more than 40,000 people have arrived by sea from Turkey this year, despite a deal with Ankara two months ago to hold back an exodus of Syrian refugees.

More than 60 have drowned on the crossing since Jan. 1. Greek officials noted that closing routes northward, even if physically possible, would not solve the problem. But electoral pressure on governments, including in the EU’s leading power Germany, to stem the flow and resist efforts to spread asylum seekers across the bloc are making free-travel rules untenable. “We are running out of time,” said EU Migration Commissioner Dimitris Avramopoulos. He urged states to implement agreed measures for managing movements of migrants across the continent — or else face the collapse of the 30-year-old Schengen zone.

But the Dutch minister, Klaas Dijkhoff, said time has effectively already run out to preserve the passport-free regime. The system has allowed hundreds of thousands of people to make chaotic treks from Greece and Italy to Germany and Sweden over the past year. “The ‘or else’ is already happening,” he said. “A year ago, we all warned that if we don’t come up with a solution, then Schengen will be under pressure. It already is.” Under pressure from domestic opinion, several governments have already reintroduced controls at their borders with fellow EU states. Those controls should be better coordinated, said Dijkhoff, whose government last year floated the idea of a “mini-Schengen”, which critics saw as a way for Germany and its northern neighbours to bar the influx from the Mediterranean.

“..we do not intend to become a cemetery of souls here..”

• Athens Hits Back At EU Plan To Ringfence Greece (FT)

Greece has hit back at European proposals for tightened security on its northern border with Macedonia, describing the latest plans to staunch the flow of refugees into Europe as a dangerous experiment that would traumatise the country. The proposals to dispatch joint police forces along Macedonia s border with Greece first outlined in a letter sent by Miro Cerar, prime minister of Slovenia, to fellow EU leaders last week have gained political momentum ahead of a meeting of EU interior ministers in Amsterdam on Monday. The plan seeks to shift the frontline of Europe’s refugee control efforts to the northern part of Greece, where the government is already straining to manage the influx with limited resources.

A Slovenian government statement on Friday claimed the proposal would allow an end to internal Schengen border controls and said it had received strong backing from central European countries, including Hungary and Poland, while positive signals had been received from Brussels. EU officials were in Macedonia on Friday to assess conditions on the ground ahead of Monday s talks. A letter from Jean Claude Juncker to Slovenian Prime Minister Miro Cerar, seen by the Financial Times, shows that the European Commission has outlined its backing for the plan.

“I welcome your suggestion that all EU member states should provide assistance to the Former Yugoslav Republic of Macedonia authorities to support controls on the border with Greece through the secondment of police/law enforcement officers, and the provision of equipment”, the commission president wrote. Mr Juncker reiterated that EU countries have the right to block entry to people who do not want to apply for asylum in that country in order to apply elsewhere in Europe. “Member states should indeed refuse entry at the external border to third-country nationals who do not satisfy the entry conditions, including third-country nationals who have not made an asylum application despite having had the opportunity to do so”.

But Ioannis Mouzalas, Greece’s minister for migration, said ringfencing Greece from the Schengen zone would not stop asylum seekers making their way to northern Europe, adding that Athens had not been consulted on the plan in advance. Instead, Mr Mouzalas called for greater assistance for Turkey to help it reduce the numbers crossing the Aegean Sea to Greece. More than 2,000 asylum seekers arrive from Turkey each day before making the journey overland to the EU through the western Balkans. “It’s not easy to trap [asylum seekers] and we do not intend to become a cemetery of souls here. We cannot understand what kind of policy it is that a country would close its borders with Greece,” he said on Sunday evening. “We do not have time to experiment with things that will only worsen the trauma.”

Home › Forums › Debt Rattle January 26 2016