Harris&Ewing “Congressional baseball game. President and Mrs. Wilson.” 1917

But that won’t last.

• Dollar Tumbles As Fed Rescues China In The Nick Of Time (AEP)

The US dollar has suffered one of the sharpest drops in 20 years as the Federal Reserve signals a retreat from monetary tightening, igniting a powerful rally for commodities and easing a ferocious squeeze on dollar debtors in China and emerging markets. The closely-watched dollar index (DXY) has fallen 3pc this week to 96.44 and given up all its gains since late October. This has instant effects on the world’s inter-connected financial system, today more geared to the US exchange rate and Fed policy than at any time in modern history. David Bloom, from HSBC, said the blistering dollar rally of the past three years is largely over and may go into reverse as weak economic figures in the US force the Fed to pare back four rate rises loosely planned for this year.

A more dovish Fed and a weaker dollar is a bitter-sweet turn for the Bank of Japan and the ECB as they try to push down their currencies to stave off deflation. Their task has become even harder. The euro has rocketed by more than 3pc this week to $1.12 against the dollar. In trade-weighted terms the euro is 5pc higher than it was in March, when the ECB began quantitative easing, showing just how difficult it has become for authorities to drive down their exchange rates. Everybody is playing the same game. Yet a halt to the dollar rally is a huge relief for companies and banks around the world that have borrowed a record $9.8 trillion in US currency outside the US, up from $2 trillion barely more than a decade ago. These debtors have faced a double shock from the rising dollar and a jump in global borrowing costs.

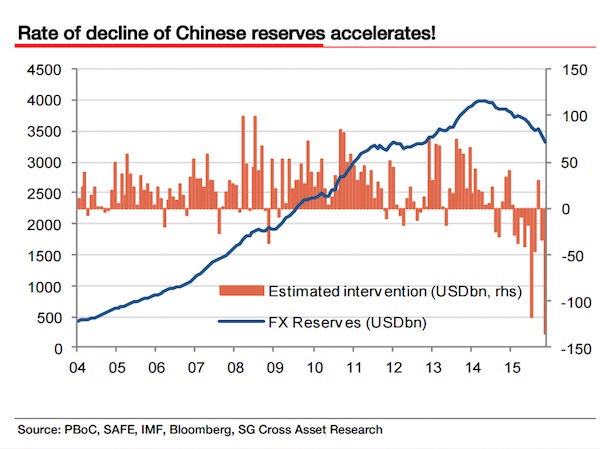

RBS calculates that more than 80pc of the debt of Alibaba, CNOOC, Baidu and Tencent is in US dollars, with Gazprom, Vale, Lukoil and China Overseas close behind. China’s central bank (PBOC) can breathe easier as it burns through foreign reserves to defend the yuan against capital flight. Wei Yao, from Societe Generale, said China’s holdings have fallen by $800bn to an estimated $3.2 trillion and are just months away from the danger zone. She warned that markets are likely to become “transfixed” on the rate of decline once reserves near $2.8 trillion, testing the credibility of the PBOC and raising the risk that Beijing will be forced to let the currency slide – with drastic global consequences. If so, only a change of course by the Fed can buy time for China to get a grip and avert a drift into dangerous waters.

Luckily it’s Lunar New year now.

• SocGen: China Only Months Away From Depleting Its Currency Reserves (MW)

China is burning through its foreign-currency reserves at such a blistering pace that the country will run down its cushion in a few months, forcing the government to wave the white flag and float the yuan, says Société Générale global strategist Albert Edwards. “The market remains content that massive firepower remains to support the renminbi. It does not,” Edwards, a perma-bear with a propensity for doom-and gloom-prognoses, said in a report published Thursday. Société Générale, using the IMF’s rule of thumb on reserve adequacy, estimates that China’s foreign-currency reserves are at 118% of the recommended level. But that cushion is likely to evaporate soon on a combination of capital flight and the continuing effort by financial authorities to stem a dramatic drop in the currency.

China’s reserves totaled $3.33 trillion in December, according to official government data. Edwards estimated that China’s foreign-exchange reserves fell by about $120 billion in January, a trend that is likely to continue in the foreseeable future. “When foreign exchange reserves reach $2.8 trillion—which should only take a few more months at this rate—foreign exchange reserves will fall below the IMF’s recommended lower bound,” he said. That is likely to trigger a “tidal wave of speculative selling,” which in turn will force the People’s Bank of China to allow the yuan to freely float within six months. The yuan currently moves within a trading band set by the People’s Bank of China that the central bank can change at will.

“We estimate that if capital outflows maintain their current pace, the PBoC would be unable to defend the yuan for more than two to three quarters,” Wei Yao, Société Générale’s China economist, said in a report published earlier this month. “China’s reserves have already fallen by $663 billion from mid-2014, and a further decline of this scale would start to severely impair the Chinese authorities’ ability to control the currency and mitigate future balance of payments,” she said. Against this backdrop, Société Générale is projecting the yuan to sink to 7.5 against the U.S. dollar this year, significantly weaker than 7 yuan to the buck predicted by most economists. The dollar is currently at 6.56 yuan.

Lowball du jour: “The economy itself cannot turn this around.”

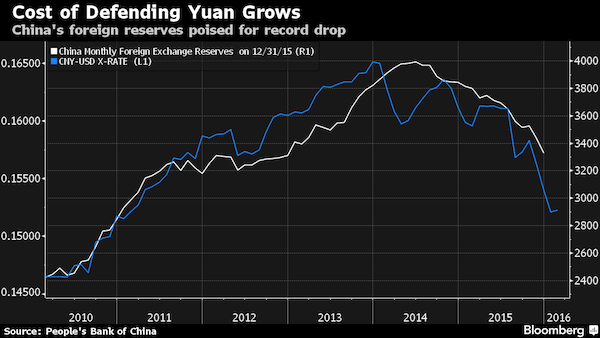

• China Foreign Reserves Head for Record Drop on Yuan Defense (BBG)

China’s foreign-exchange reserves, already at a three-year low, are poised to post a second consecutive record monthly drop as policy makers intervene to support the yuan. The central bank will say Sunday that the currency hoard fell by $118 billion to $3.2 trillion in January, according to economists’ estimates in a Bloomberg survey. That would exceed a record $108 billion decline in December, which brought last year’s total draw-down to more than half a trillion dollars and capped the first annual decrease in the reserves since 1992. Policy makers are burning through billions of dollars to hold up a weakening currency amid flagging growth and $1 trillion in capital outflows last year. The yuan sank to a five-year low last month as the People’s Bank of China set the reference rate at an unexpectedly weak level, a signal that it’s more tolerant of depreciation as growth slows.

“China is facing a significant capital outflow problem,” said Krishna Memani at Oppenheimer in New York. “It’s an astounding reduction in their capital account position. This is an issue they’ve been aware of, and they have to find a way of managing it. The economy itself cannot turn this around.” The draw-down has accelerated since the central bank’s surprise devaluation of the currency in August. Reserves tumbled $94 billion that month, a record at the time. Another cut to the yuan’s reference rate last month spurred a stock sell-off that has helped push the Shanghai Composite Index down 21 percent this year and into a bear market.

The benefits of low prices…

• Citi: ‘We Should All Fear Oilmageddon’ (BBG)

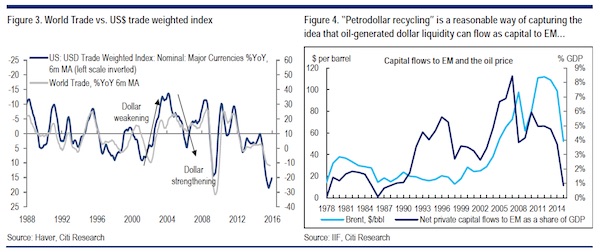

Markets are currently in a well-oiled “death spiral,” according to Citigroup analysts led by Jonathan Stubbs. “It appears that four inter-linked phenomena are driving a negative feedback loop in the global economy and across financial markets,” the analysts write, citing the resilient U.S. dollar, lower commodities prices, weaker trade and capital flows, and declining emerging market growth. “It seems reasonable to assume that another year of extreme moves in U.S. dollar (higher) and oil/commodity prices (lower) would likely continue to drive this negative feedback loop and make it very difficult for policy makers in emerging markets and developing markets to fight disinflationary forces and intercept downside risks,” the analysts add.

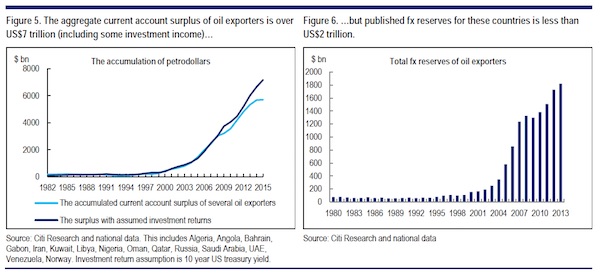

“Corporate profits and equity markets would also likely suffer further downside risk in this scenario of Oilmageddon.” Their case is bolstered by a collection of charts showing the linkages between the four factors cited above, including the importance of lofty oil prices to the ready supply of petrodollars circulating in the world economy and flowing to financial assets. Oil exporters have enjoyed more than $6 trillion flowing into their current accounts, according to Citi’s estimates, implying some $4 trillion of capital in sovereign wealth funds (SWFs).

“But, the collapse in oil/commodity prices and sharp fall in the pace of world trade means that these same economies will likely experience an aggregate current account deficit for the first time since 1998,” says Citi. “In turn, this is likely to put pressure on SWF and broader emerging market liquidity as governments and emerging market economies would need to ‘lean’ on reserves in order to maintain economic, political and social stability. This has clear feedback loops across emerging markets.” Accordingly, the impact of the feedback loop is being felt far and wide in financial markets, extending even to U.S. inflation expectations. Where once 10-year inflation breakevens had little relationship with the price of oil they have for the past two years moved in tandem.

Pump and Jump.

• Just 0.1% Of Global Oil Output Has Been Halted By Low Prices (BBG)

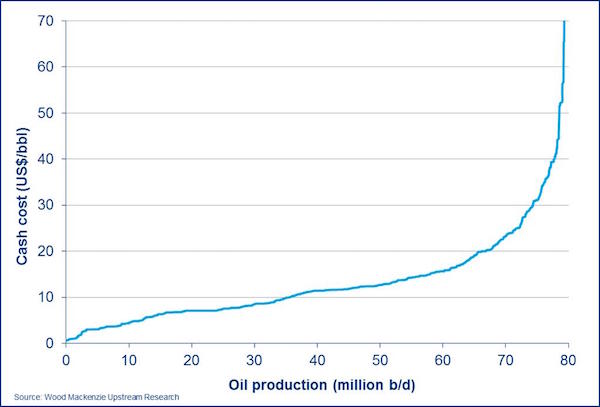

After a year of low oil prices, only 0.1% of global production has been curtailed because it’s unprofitable, according to a report from consultants Wood Mackenzie that highlights the industry’s resilience. The analysis, published ahead of an annual oil-industry gathering in London next week, suggests that oil prices will need to drop even more – or stay low for a lot longer – to meaningfully reduce global production. OPEC and major oil companies like BP and Occidental Petroleum are betting that low oil prices will drive production down, eventually lifting prices. That’s taking longer than expected, in part due to the resilience of the U.S. shale industry and slumping currencies in oil-rich countries, which have lowered production costs in nations from Russia to Brazil.

The Wood Mackenzie analysis provides an estimate for the amount directly impacted by low prices – to the tune of 100,000 barrels a day since the beginning of 2015 – rather than output affected as new projects build up and aging fields decline. Canada, the U.S. and the North Sea have been affected the most by closures related to low prices. The International Energy Agency does estimate year-over-year change, and says global production in the fourth quarter was 96.9 million barrels a day. It forecast that outside OPEC, output will fall this year by 600,000 barrels a day, the largest annual decline since 1992. Last year, non-OPEC output rose 1.4 million barrels a day. “Since the drop in oil prices last year there have been relatively few production shut-ins,” according to the report.

The company, which tracks production and costs at more than 2,000 oilfields worldwide, estimates that another 3.4 million barrels a day of production are losing money at current prices, of about $35 a barrel. It cautioned against expecting further closures, because “many producers will continue to take the loss in the hope of a rebound in prices.” For major oil companies, a few months of losses may make more sense than paying to dismantle an offshore platform in the North Sea, or stopping and restarting a tar-sands project in Canada, which may take months and cost millions of dollars. “There are barriers to exit,” said Robert Plummer at Wood Mackenzie.

China must have the same issue.

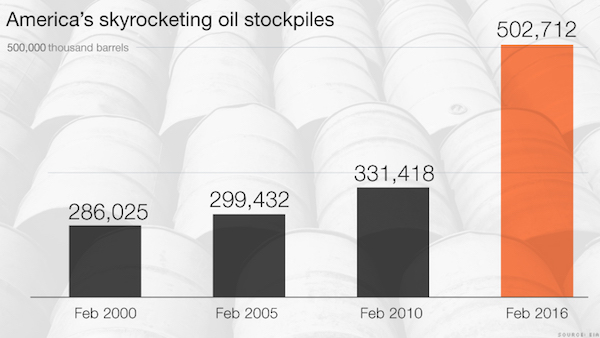

• US Running Out Of Space To Store Oil (CNN)

The U.S. now has nearly 503 million barrels of commercial crude oil stockpiled, the Energy Information Administration said on Wednesday. It’s the highest level of supply for this time of the year in at least 80 years. The sky-high inventories are the latest sign that the U.S. oil boom is still alive and kicking. U.S. oil production is near all-time highs despite the epic crash in oil prices from $107 a barrel in June 2014 to just $30 a barrel now. Sure, domestic oil production has slowed – but just barely. Oil stockpiles are so high that certain key storage locations are now “bumping up against storage and logistical constraints,” according to Goldman Sachs analysts. In other words, these facilities are nearly overflowing. Cushing, Oklahoma is the delivery point for most of the oil produced in the U.S. This key trading hub is currently swelling with 64 million barrels of oil.

That represents a near-record 87% of the facility’s total storage capacity as of November, according to the EIA. “There is a fear of tank topping in Cushing. We’re seeing it get to its brims,” said Matthew Smith at ClipperData. Cushing has had to ramp up its storage capabilities in recent years just to deal with all this oil. If this key hub ran out of room to stockpile oil, that crude would have to be diverted elsewhere – and that would hurt oil prices. “There would be a ripple effect across the U.S. that would impact prices everywhere,” said Smith. Global inventories also remain high, with the International Energy Agency recently saying the world is “drowning” in oil. The agency is bracing for oversupply of 1.5 million barrels per day in the first half of 2016.

Wall Street is nervously watching supply constraints since they can have dramatic repercussions on prices. More so than other commodities, oil is vulnerable to so-called “operational stress” due to the expensive and sophisticated infrastructure that is needed for storage. “Each time the market brushes up against infrastructure constraints, oil prices will likely spike to the downside to make oil supplies back off,” Goldman wrote. By comparison, it’s relatively easy to pile up unwanted metals in an open space like a warehouse. “Aluminum only needs a grassy field,” Goldman wrote. To put these storage issues into context, Goldman estimates $1 billion of gold would fit into a bedroom closet. Crude oil of the same value would require 17 supertanker ships that can hold about 2 million barrels of oil each.

Timing, sir?

• Obama Proposes $10-a-Barrel Oil Tax (MW)

President Barack Obama is proposing a $10-a-barrel tax on oil to pay for clean transportation projects, the White House said Thursday. The tax, which will be part of the budget request Obama unveils next week, would be paid for by oil companies and gradually phased in over five years. It would apply to imported oil, not exported U.S. oil, White House National Economic Council Director Jeff Zients told reporters. Obama’s proposal lands in the midst of the 2016 election campaigns, and is likely to be harshly criticized by both Republican presidential candidates and lawmakers. In past years, Obama has proposed eliminating subsidies for the oil-and-gas industries. But those efforts have never made it through Congress. House Majority Whip Steve Scalise of Louisiana said the proposal could be Obama’s worst idea ever.

The tax would add roughly 25 cents to a gallon of gasoline, at current prices. The White House said Obama’s plan would boost investments in clean transportation by about 50%. Zients said the administration recognized oil companies would “likely pass on some of these costs” to consumers. But he added that the U.S.’s “crumbling infrastructure imposes a huge cost on American families,” by reducing competitiveness and by adding time and fuel costs to workers who are stuck in traffic. Brian Milne, energy editor and product manager at Schneider Electric, said the tax would “definitely” increase gasoline prices. “Maybe the president thinks because oil and gasoline prices are low, he can slip the tax through that will eventually be passed on to consumers without many realizing that they’re paying the government more to fuel their vehicles and warm their houses,” Milne said in an email. “However, I don’t think it will have enough support to move through Congress.”

IMF sees great opportunities for power grabs. Pennies on the dollar. Or the SDR, rather.

• IMF Honing Tools To Rescue EMs From China Spillover (Reuters)

China can avoid a “hard landing” if Beijing pursues reforms to state enterprises and sticks to a more market-driven and well-communicated exchange rate policy, IMF Managing Director Christine Lagarde said on Thursday. But Lagarde said spillovers from China’s transition to a slower, more sustainable growth rate would continue to pressure oil and commodity exporters around the globe, increasing demands for financing help from the IMF and other international institutions. She told an online media briefing that the IMF wanted to be ready to handle any emerging market difficulties with new and improved financing tools.

“China is going through that massive, multi-faceted transition and we do not expect a hard landing of China as has been talked about for many years,” Lagarde said. She noted that China’s transition will still be difficult and create market volatility, however. Oil and metals prices, now two thirds below their most recent peaks in 2014, will likely stay low for some time. As a result, the international financial safety net “needs to be strong and needs to be readily available to face any circumstances,” Lagarde said.

The IMF will be working in coming months to improve existing financing instruments, such as credit and liquidity lines, as well as new instruments to address their situations. Lagarde’s remarks came as several oil and commodity exporters, including Peru, Nigeria, Angola and Azerbaijan, are in talks with the World Bank on financing to cope with widening budget deficits. In a speech earlier on Thursday at the University of Maryland, Lagarde said a larger and more robust financial safety net would reduce the need for many emerging market countries to hold large foreign exchange reserves, freeing up funds for investments in infrastructure and education.

The smell of Abenomics in the morning. This kind of decision making kills so much trust it can’t possibly be worth the price paid. But Abe gets to kick the can a while longer…

• BOJ Board Among Those Surprised By Negative Interest Rate Plan (Reuters)

Just days before the Bank of Japan stunned financial markets with its radical adoption of negative interest rates, members of the central bank’s own policy board had also been taken by surprise by the move. Most of the nine board members were only told of the scheme in the week leading up to last Friday’s rate review, according to interviews with more than a dozen officials familiar with the deliberations. The startling speed and secrecy with which such a major policy shift was executed suggest its intent was more about delivering a shock to markets that would weaken the yen, than about maximising the stimulative impact of further easing. That would be in keeping with the single-minded style of central bank Governor Haruhiko Kuroda, people who know him well or have worked with him say, but could risk entrenching divisions between BOJ policymakers.

“If you’re a board member, you’re told about the plan at the last minute,” said a former board member, speaking on condition of anonymity. “It’s hard to argue against it or draft a counter proposal when there’s so little time left.” Kuroda had been saying for months that taking rates below zero was not a timely option, a position he had repeated as recently as Jan. 21. But the global market turbulence that greeted the start of 2016 had been threatening two planks of Prime Minister Shinzo Abe’s reflationary agenda – rising asset prices and a cheap yen. Before leaving for the annual World Economic Forum in Davos on Jan. 22, Kuroda instructed his staff to come up with options for further easing of the BOJ’s already ultra-loose policy, and report back to him when he returned to Tokyo three days later.

Expanding the bank’s massive asset purchasing programme, known as “quantitative and qualitative easing” (QQE), by 10-20 trillion yen ($83-$167 billion) was one option, sources said, though it was quickly ruled out as too weak to shock markets. Something more arresting was needed, and few investors were predicting negative rates. “The key was to show people that the BOJ will really do anything to achieve 2% inflation,” said a BOJ official. The complex plan, formulated by four top officials from the monetary affairs department, drew on studies of negative interest rate policies in Denmark, Switzerland and Sweden. By charging interest on just a fraction of banks’ deposits with the BOJ, they hoped to ease the pain on financial institutions and get around one of the big problems of twinning negative interest rates with QQE – that the central bank is force-feeding lenders cash it then penalises them for holding.

Thinking bailouts?

• US Banks Targeted By Activist Investors (Reuters)

Activist investors are putting the U.S. banking sector in their crosshairs, betting that headwinds whipping through the industry will accelerate consolidation among lenders. While these activist hedge funds have already targeted some major financial companies, such as insurer AIG and auto loan lender Ally Financial, banks have historically stayed out of their sights. Activists launched 97 campaigns last year aimed at the U.S. financial sector, around triple the amount from 2009, according to Thomson Reuters Activism data. Of those campaigns, 22 were aimed at banks, up from eight in 2009, the data show. The number has increased every year since the 2008 financial crisis.

Hedge funds such as Ancora Advisors, Clover Partners and Seidman & Associates are buying up stakes in lenders across the U.S., from community banks to large regional lenders. Driving these investments is the view that ultra-low interest rates, lagging returns on equity and tough regulations will push more banks to merge, with buyers willing to pay a hefty multiple to a bank’s tangible book value. Activist investors interviewed by Reuters say another factor is exposure to energy-related loans, which is driving down the valuations of certain banks and making them all the more vulnerable to a takeover. “Bigger banks are back in the market doing deals,” said Ralph MacDonald at law firm Jones Day. U.S. bank mergers and acquisitions volume rose 58% last year to $34.5 billion, according to Thomson Reuters data.

Last week alone saw two mergers. Huntington Bancshares said it would acquire FirstMerit for $3.4 billion in stock and cash, combining two Ohio-based lenders. And Chemical Financial said it was merging with Talmer Bancorp in an all-Michigan transaction that will create a bank with $16 billion in assets. To be sure, activists’ bets on banks are not without risk – especially if they get the timing wrong. The S&P 500 Financials index is down 14% since mid-December on fears that the Federal Reserve will take longer than previously expected to raise interest rates, hurting banks’ profitability. Another worry is that oil prices drop further, making a bank’s energy loan book more of a liability than an opportunity.

A takeout by a larger rival is also never a guarantee, but that is a risk activists are willing to take. On Monday, Hudson Executive Capital, a New York-based hedge fund, announced it had acquired a $56 million stake in Dallas-based Comerica Bank, a lender with $71 billion in assets under management. Among the banks that could buy Comerica is North Carolina-based BB&T Bank, according to activist investors who spoke to Reuters. [..] Zions Bancorporation, a Salt Lake City lender with $60 billion in assets, is another bank that activists said is vulnerable to an approach.

And will be ignored again.

• Two Anonymous Whistleblowers Are Pounding on the SEC’s Door Again (Martens)

Last night ABC began its two-part series on the Bernie Madoff fraud. Viewers will be reminded about how investment expert, Harry Markopolos, wrote detailed letters to the SEC for years, raising red flags that Bernie Madoff was running a Ponzi scheme – only to be ignored by the SEC as Madoff fleeced more and more victims out of their life savings. Today, there are two equally erudite scribes who have jointly been flooding the SEC with explosive evidence that some Exchange Traded Funds (ETFs) that trade on U.S. stock exchanges and are sold to a gullible public, may be little more than toxic waste dumped there by Wall Street firms eager to rid themselves of illiquid securities. The two anonymous authors have one thing going for them that Markopolos did not.

They are represented by a former SEC attorney, Peter Chepucavage, who was also previously a managing director in charge of Nomura Securities’ legal, compliance and audit functions. We spoke to Chepucavage by phone yesterday. He confirmed that two of his clients authored the series of letters. Chepucavage said further that these clients have significant experience in trading ETFs and data collection involving ETFs. Throughout their letters, the whistleblowers use the phrase ETP, for Exchange Traded Product, which includes both ETFs and ETNs, Exchange Traded Notes. In a letter that was logged in at the SEC on January 13, 2016, the whistleblowers compared some of these investments to the subprime mortgage products that fueled the 2008 crash, noting that regulators and economists were mostly blind to that escalating danger as well. The authors wrote:

“The vast majority of ETPs have very low levels of assets under management and illiquid trading volumes. Many of these have illiquid underlying assets and a large group of ETPs are based on derivatives that are not backed by physical assets such as stocks, bonds or commodities, but rather swaps or other types of complex contracts.

Many of these products may have been designed to take what were originally illiquid assets from the books of operators, bundle them into an ETP to make them appear liquid and sell them off to unsuspecting investors. The data suggests this is evidenced by ETPs that are formed, have enough volume in the early stage of their existence to sell shares, but then barely trade again while still remaining listed for sale. This is reminiscent of the mortgage-backed securities bundles sold previous to the last financial crisis in 2008.”

If you look beyond the obvious play on fearmongering, this is still curious.

• Europe’s Ports Vulnerable As Ships Sail Without Oversight (FT)

As Europe’s politicians struggle to control a deepening migrant crisis and staunch the rising threat of Islamist terrorism on their borders, little attention is being paid to the continent’s biggest frontier: the sea. New data highlight the extent to which smuggling, bogus shipping logs, unusual coastal stop-offs and inexplicable voyages are increasing across the Mediterranean and Atlantic for ships passing through Europe’s ports — with little or nothing being done to combat the trend. There is currently no comprehensive system to track shipments and cargos through EU ports and along its approximately 70,000km of coastline — a deficiency that has long been exploited by organised criminals and which could increasingly prove irresistible to terrorists too, say European security officials.

“So far, the thing about maritime security, and particularly terrorists exploiting weaknesses there, is that it’s the dog that’s not barked,” says former Royal Navy captain Gerry Northwood, chief operating officer of Mast, a maritime security company, and commander of the counter-piracy task force in the Indian Ocean. “But the potential is there. The world outside Europe – North Africa for example – is awash with weapons. If you can get a bunch of AK47s into a container, embark that container from Aden then you could get them into Hamburg pretty easily. A whole armoury’s worth.” In January, 540 cargo ships entered European ports after passing through the territorial waters of terrorist hotspots Syria and Libya, as well as Lebanon, for unclear or uneconomic reasons during the course of their voyages.

The number of vessels using flags of convenience — using the ensign of a state different to that in which a ship’s owners reside to mask identity or reduce tax bills — is also rising. Of the 9,000 ships that passed through European waters last month, 5,500 used flags of convenience.

“We have to be demanding and disciplined [over the budget], but Portugal is not a pupil. There are no professor-states or student-states in the EU.”

• Portugal’s Anti-Austerity Budget Provokes Brussels Showdown (FT)

Portugal’s new Socialist government faces an embarrassing rejection of its first “anti-austerity” budget by the European Commission on Friday after eleventh-hour talks failed to break a stalemate over additional cuts needed to bring Lisbon in line with EU deficit rules. Portuguese officials expressed confidence they would overcome objections from the commission, which last week warned Lisbon it risked “serious non-compliance” with the bloc’s fiscal rules. At the same time, they continued to show defiance, insisting they would not return to the spending policies of the previous centre-right administration. “We cannot continue following a path of blind austerity,” Augusto Santos Silva, Portugal’s foreign minister, told RTP television on Wednesday.

“We have to be demanding and disciplined [over the budget], but Portugal is not a pupil. There are no professor-states or student-states in the EU.” The commission announced it would hold a special meeting on Friday afternoon to decide whether Portugal’s 2016 budget — submitted three months late after protracted post-election coalition negotiations — would be rejected. If it is, it would mark the first time a eurozone government has had its spending plan vetoed by Brussels since the new crisis-era rules went into effect in 2011. Lisbon’s tussle with Brussels calls into question the government’s ability to deliver on election pledges to roll back years of austerity by cutting taxes and increasing public sector wages without running foul of the EU’s strict budgetary rules.

After Portugal emerged from its bailout in 2014, it was supposed to bring its deficit under the EU ceiling of 3% of economic output by 2015. But economic forecasts published by Brussels on Thursday, which take into account the government’s initial budget plan, show Lisbon with a 4.2% deficit in 2015 — and deficits above 3% in both 2016 and 2017. The 3.4% deficit projected for 2016 is in sharp contrast to the 2.6% Lisbon has forecast. Lisbon, however, said the commission’s forecasts do not take into account revisions to its budget proposals made over the past week. Under eurozone rules, a country that misses its deficit target must at least demonstrate it is undertaking significant economic reforms. But the Portuguese budget reins back such measures, prompting a warning from Brussels that its efforts were “well below” target.

Desperate regime.

• Saudis Say Cash Crunch Won’t Derail an Ambitious Foreign Agenda (BBG)

Saudi Arabia won’t let the plunge in oil prices derail a regional agenda that includes waging war in Yemen and funding allies in Syria and Egypt, Foreign Minister Adel al-Jubeir said in an interview. “Our foreign policy is based on national security interests,” al-Jubeir said on Thursday at the Ministry of Foreign Affairs headquarters in the kingdom’s capital, Riyadh. “We will not let our foreign policy be determined by the price of oil.” The world’s largest oil exporter, traditionally a cautious actor on the Middle Eastern stage, has become more assertive during the 13-month reign of King Salman. Saudi Arabia is fighting in Yemen against Shiite rebels it says are backed by Iran. It’s also sending billions of dollars to Egypt, to fend off instability in the most populous Arab country, and arming the increasingly beleaguered rebels in Syria’s civil war.

That’s a costly agenda to finance with Brent crude at the lowest in more than a decade. The oil shock left Saudi Arabia with a budget deficit of about $98 billion last year, pushing the kingdom to cut spending on energy subsidies and building projects. It’s also considering selling sovereign bonds and shares in its giant state oil company. The return to world markets of Iran, Saudi Arabia’s regional rival, is set to add to global supply. Sanctions on the Islamic Republic “are being lifted and will be removed as long as Iran complies with the terms of the nuclear agreement,” al-Jubeir said. “We believe there is sufficient room in the market for countries who produce oil.” Tensions between the two OPEC members have undermined efforts to end the war in Syria, where Saudi Arabia supports mainly Sunni militant groups trying to overthrow President Bashar al-Assad, who’s backed by Iran.

The countries are also at loggerheads over Yemen, though Western diplomats have played down Saudi claims about Iran’s involvement on the Houthi rebel side there. The Saudi-led intervention in Yemen, which began with airstrikes in March last year and has escalated to include ground troops, “was a war that nobody wanted to wage,” al-Jubeir said. “This was a war to protect Yemen from collapsing and to protect the kingdom from the dangers of a militia that is armed with ballistic missiles and in possession of an air force that is allied with Iran and Hezbollah.” Saudi Arabia said this week that 375 of its civilians have been killed by missile strikes around the border with Yemen. The United Nations says about 6,000 Yemenis have died in the conflict.

While the U.S. has expressed support for the Saudi engagement in Yemen, in other areas the longstanding alliance between the countries has shown signs of fraying. Saudi officials have expressed concerns about last year’s U.S.-backed nuclear agreement with Iran, and were angered when the U.S. called for former Egyptian President Hosni Mubarak to step down in 2011.

Deflation.

• World Food Prices Tumble Near 7-Year Low (CNBC)

World food prices fell to almost a seven-year low at the start of the year on the back of sharp declines in commodities, particularly sugar, according to the latest data from the UN. The Food Price Index, published by the UN’s Food and Agriculture Organization (FAO), averaged 150.4 points in January, down 16% from a year earlier and registering its lowest level since April 2009. The trade-weighted index tracks international market prices for five key commodity groups – major cereals, vegetable oils, dairy, meat and sugar – on a monthly basis. In January, the Sugar Price Index showed the largest declines having fallen 4.1% from December, its first drop in four months. The FAO said the drop was down to improved crop conditions in Brazil, the world’s leading sugar producer and exporter. The second largest declines were seen in the FAO’s Dairy Price Index which dropped by 3.0% in the same time period “on the back of large supplies, in both the EU and New Zealand, and torpid world import demand,” the FAO noted.

The Cereals and Vegetable Oils indices both saw declines of 1.7% in January from the previous month and the Meat Price Index fell 1.1%. The main factors underlying the lingering decline in basic food commodity prices are “the generally ample agricultural supply conditions, a slowing global economy, and the strengthening of the U.S. dollar,” the FAO noted. Food commodities are not the only ones suffering from demand failing to keep up with a glut in supply with oil prices suffering a similar fate with a steady decline since mid-2014. Signaling no let-up in production, the food agency raised its forecasts for worldwide cereal crops in 2016. “As a result of the upgraded production and downgraded consumption forecasts, world cereal stocks are set to end the 2016 seasons at 642 million tons, higher than they began,” the agency noted.

Far from over. Pyrrhic.

• Julian Assange Should Be Freed, Entitled To Compensation: UN Panel (AP)

A UN human rights panel says WikiLeaks founder Julian Assange has been “arbitrarily detained” by Britain and Sweden since December 2010. The UN Working Group on Arbitrary Detention said his detention should end and he should be entitled to compensation. Swedish prosecutors want to question Assange over allegations of rape stemming from a working visit he made to the country in 2010 when WikiLeaks was attracting international attention for its secret-spilling ways. Assange has consistently denied the allegations but declined to return to Sweden to meet with prosecutors and eventually sought refuge in the Ecuadorean embassy in London, where he has lived since 2012.

Home › Forums › Debt Rattle February 5 2016