NPC Fred Haas, Rhode Island Avenue NE, Washington, DC 1924

“..previous bull runs in the market lasting several years can also be explained by single factors each time.”

• The Fed Caused 93% Of The Entire US Stock Market’s Move Since 2008 (Yahoo)

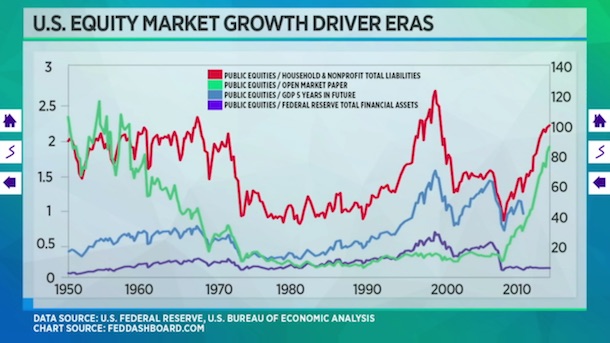

The bull market just celebrated its seventh anniversary. But the gains in recent years – as well as its recent sputter – may be explained by just one thing: monetary policy. The factors behind that and previous bubbles can be illuminated using simple visual analysis of a chart. The S&P 500 doubled in value from November 2008 to October 2014, coinciding with the Federal Reserve Bank’s “quantitative easing” asset purchasing program. After three rounds of “QE,” where the Fed poured billions of dollars into the bond market monthly, the Fed’s balance sheet went from $2.1 trillion to $4.5 trillion. This isn’t just a spurious correlation, according to economist Brian Barnier, principal at ValueBridge Advisors and founder of FedDashboard.com.

What’s more, he says previous bull runs in the market lasting several years can also be explained by single factors each time. Barnier first compiled data on the total value of publicly-traded U.S. stocks since 1950. He then divided it by another economic factor, graphing the ratio for each one. If the chart showed horizontal lines stretching over long periods of time, that meant both the numerator (stock values) and the denominator (the other factor) were moving at the same rate. “That’s the beauty of the visual analysis,” he said. “All we have to do is find straight, stable lines and we know we’ve got something good.”

Scouring hundreds of different factors, Barnier ultimately whittled it down to just four factors: GDP data five years into the future, household and nonprofit liabilities, open market paper, and the Fed’s assets. At different stretches of time, just one of those was the single biggest driver of the market and was confirmed with regression analyses.

“Oversupply destroys capitalism in a natural way.” Interesting Deutsche analysis, that unfortunately ignores debt just about completely and instead sees ‘consumers delaying purchases of goods, hoarding money’. But that’s not what happens. Consumers have no money to hoard, they have debt instead.

• ‘Negative Rates Confirm The Failure Of Globalization’ (DB)

Understanding how negative rates may or may not help economic growth is much more complex than most central bankers and investors probably appreciate. Ultimately the confusion resides around differences in view on the theory of money. In a classical world, money supply multiplied by a constant velocity of circulation equates to nominal growth. In a Keynesian world, velocity is not necessarily constant – specifically for Keynes, there is a money demand function (liquidity preference) and therefore a theory of interest that allows for a liquidity trap whereby increasing money supply does not lead to higher nominal growth as the increase in money is hoarded. The interest rate (or inverse of the price of bonds) becomes sticky because at low rates, for infinitesimal expectations of any further rise in bond prices and a further fall in interest rates, demand for money tends to infinity.

In Gesell’s world money supply itself becomes inversely correlated with velocity of circulation due to money characteristics being superior to goods (or commodities). There are costs to storage that money does not have and so interest on money capital sets a bar to interest on real capital that produces goods. This is similar to Keynes’ concept of the marginal efficiency of capital schedule being separate from the interest rate. For Gesell the product of money and velocity is effective demand (nominal growth) but because of money capital’s superiority to real capital, if money supply expands it comes at the expense of velocity. The new money supply is hoarded because as interest rates fall, expected returns on capital also fall through oversupply – for economic agents goods remain unattractive to money. The demand for money thus rises as velocity slows.

This is simply a deflation spiral, consumers delaying purchases of goods, hoarding money, expecting further falls in goods prices before they are willing to part with their money. For an economy that suffers from deficient demand, lowering interest rates doesn’t work if it simply lowers expected returns on real capital through oversupply. The shale boom in the US is blamed on cheap money. As Gesell also argued, where Marx was wrong but Proudhon was right, is that to destroy capitalism you don’t need workers to strike and close the capitalists’ factories; instead the workers should organize and build another factory next to the capitalists. The means of the production are nothing more than capitalized labor. Oversupply destroys capitalism in a natural way. In this way the demise of positive interest rates may be nothing more than the global economy reacting to a chronic oversupply of goods through the impact of globalization including the opening up of formerly closed economies as well as ongoing technological progress.

“Too many companies make products that are pretty much the same..” Yeah, and that nobody wants to buy anymore either.

• China Economic Data Paints Gloomy Picture (WSJ)

Factories and retailers in China put in weaker-than-expected performances in the first two months of the year, as anemic demand and excess capacity continued to bear down on the world’s second-largest economy. Industrial production grew 5.4 % in January and February compared with a year earlier, down from December’s 5.9% pace, according to government data released Saturday, and just below the 5.6% forecast by economists polled by The Wall Street Journal. Meanwhile, retail sales clocked 10.2% growth in the two-month period, slower than December’s 11.1% increase. While industries have been battered by the economic slowdown, retail sales have been relatively buoyant, so the downtick surprised some economists, especially since it occurred around the Lunar New Year holiday when consumption is usually strong.

“Overall, the picture is still quite gloomy”, said Commerzbank Aeconomist Zhou Hao. “Normally, because of Chinese New Year, there’s a big drop and a big jump. This year there s only a big drop.” The government combines some economic data for January and February to minimize distortions tied to the Lunar New Year holiday, which falls during those two months. It was in early February this year. One area that did pick up was investment in factories, buildings and other fixed assets, which increased a faster-than-expected at 10.2 % year-over-year in January and February, compared with a 10% increase for all of 2015. Economists said that boost came largely from government spending on infrastructure and from investment in parts of the overbuilt property market.

Mostly, economists said, weak demand at home and abroad is weighing on industries and many factories continue to churn out unneeded goods. Jiang Yuan, an economist with China’s National Bureau of Statistics, said makers of steel, cement and tobacco reduced output in response to slack demand. “A recovery is still eluding China’s industrial sector,” Mizuho Securities Asia Ltd. said in a recent report, before the release of the data Saturday. Chen Zhenxing, sales manager with Zhejiang Lanxi Shanye Machinery Co., which produces hand carts and other logistics equipment in the eastern city of Jinhua, said his company faces ongoing problems raising capital and boosting prices. “Competition is cutthroat,” he said. “Too many companies make products that are pretty much the same, so the focus turns to lowering prices.”

“The foundations we have now are much stronger than before.” That is highly questionable in itself, but more importantly, debt is now much higher than before. That is what will drive China going forward.

• China’s Restructuring Will Not Lead To Mass Layoffs: Regulator (Reuters)

China’s economic restructuring will not lead to the kind of mass layoffs that took place in the 1990s, the country’s state assets regulator said on Saturday. China will focus on mergers and restructuring, not bankruptcies, Xiao Yaqing, the head of the State-owned Assets Supervision and Administration Commission (SASAC), told a news conference. As it tries to rejuvenate its economy, China aims to reduce the number of central government-managed enterprises and launch pilot programs that will allow more private investment in state-dominated sectors. It is also trying to slash overcapacity in the labor-intensive coal and steel sectors.

Reform plans have prompted fears that the country would face its fiercest unemployment pressures since the late 1990s, when about 28 million people were made redundant. “The situation in the 1990s was completely different,” Xiao told reporters. “The foundations we have now are much stronger than before.” “Protecting the interests of workers is an important aspect of the next stage of reforms, and there will be more mergers and restructurings, and as few bankruptcies as possible.” Sources have told Reuters that China is expecting to lay off 5 million to 6 million state workers over the next two to three years as part of efforts to curb industrial overcapacity and pollution.

According to official estimates, layoffs from the coal and steel sectors alone are expected to reach 1.8 million as the country works to tackle price-sapping overcapacity and shut down so-called zombie enterprises – loss-making firms that cannot afford to continue operating but are propped up by local authorities. Xiao said 12 central government-run firms had been merged, bringing the total number of enterprises controlled by SASAC to 106. Profits at the firms fell 6.7% last year to 2.3 trillion yuan. Xiao said the main reason for the decline was the collapse in the prices of oil and steel. China has about 150,000 state-owned enterprises that manage more than 100 trillion yuan ($15.40 trillion) in assets and employ more than 30 million people, according to the official Xinhua news agency.

Wonder what they do if prices drop 10% or more in a day.

• China ‘Won’t Bring Back Stock Market Circuit Breaker For Years’ (Reuters)

China won’t reintroduce the circuit breaker mechanism in its stock markets in the next few years, Liu Shiyu, chairman of the China Securities Regulatory Commission, told reporters in Beijing on Saturday. A circuit breaker mechanism introduced in January by Liu’s predecessor Xiao Gang was dismantled after only a few days. The mechanism was blamed by investors for worsening a sharp selloff in Chinese stocks. China’s Shanghai and Shenzhen stock markets slumped as much as 40% in just a few months last summer. Liu, previously the chairman of the Agricultural Bank of China, was named the new chief of China’s top securities regulator in February. Earlier in February, Premier Li Keqiang offered a rare public criticism, stating regulators didn’t respond adequately, or react in a timely way to the stock market turmoil. Saturday’s press conference was the first occasion for the new securities regulator chief to answer questions from reporters.

So no talks. Or at least no freeze.

• Iran To Join Oil Freeze Talks Only After Raising Output To 4 mbpd (Reuters)

Oil Minister Bijan Zanganeh said Iran would join discussions between other producers about a possible freeze of oil production after its own output reached four million barrels per day (bpd), Iran’s ISNA news agency reported on Sunday. Zanganeh said Iran saw $70 per barrel as a suitable oil price, but would be satisfied with less, ISNA reported. Asked whether Russian Energy Minister Alexander Novak would try to convince Iran to join an oil output freeze during a visit this week, Zanganeh said Iran may join the freeze after its production reaches 4 million bpd. “They should leave us alone as long as Iran’s crude oil has not reached 4 million. We will accompany them afterwards,” Zanganeh was quoted as saying.

Iran has rejected freezing its output at January levels, put by OPEC secondary sources at 2.93 million barrels per day, and wants to return to much higher pre-sanctions production. It is working to regain market share, particularly in Europe, after the lifting of international sanctions in January. The sanctions had cut crude exports from a peak of 2.5 million bpd before 2011 to just over 1 million bpd in recent years. Iran’s oil exports are due to reach 2 million bpd in the Iranian month that ends on March 19, up from 1.75 million in the previous month, he said. A meeting between oil producers to discuss a global pact on freezing production is unlikely to take place in Russia on March 20, sources familiar with the matter said last week, as OPEC member Iran is yet to say whether it would participate in such a deal.

But who’s been propping up prices lately?

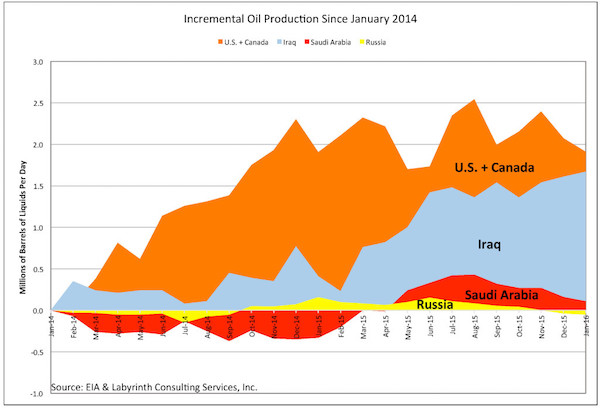

• Oil Prices Should Fall, Possibly Hard (Berman)

Oil prices should fall, possibly hard, in coming weeks. That is because fundamentals do not support the present price. Prices should fall to around $30 once the empty nature of an OPEC-plus-Russia production freeze is understood. A return to the grim reality of over-supply and the weakness of the world economy could push prices well into the $20s. An OPEC-plus-Russia production cut would be a great step toward re-establishing oil-market balance. I believe that will happen later in 2016 but is not on the table today. In late February, Saudi oil minister Ali Al-Naimi stated categorically, “There is no sense in wasting our time in seeking production cuts. That will not happen.” Instead, Russia and Saudi Arabia have apparently agreed to a production freeze. This is meaningless theater but it helped lift oil prices 37% from just more than $26 in mid-February to almost $36 per barrel last week. That is a lot of added revenue for Saudi Arabia and Russia but it will do nothing to balance the over-supplied world oil market.

[..] It is a sign of how bad things have gotten in oil markets that we feel optimistic about $35 oil prices. It should also be a warning that the over-supply that got us here has not gone away. Oil storage volumes continue to grow and that is the surest indication that production has not declined enough yet to make a difference. It is impossible to imagine oil prices rising much beyond present levels until storage starts to fall. In fact, it is difficult to understand $35 per barrel prices based on any measure of oil-market fundamentals. The OPEC-plus-Russia production freeze is a cynical joke designed to increase their short-term revenues without doing anything about production levels. An output cut would make a difference but a freeze on current Saudi and Russian production levels means nothing.

It apparently made some investors feel better but it didn’t do anything for me. Iran got this one right by calling it ridiculous. No terrible economic news has surfaced in recent weeks but that does not change the profound weakness of a global economy that is burdened with debt and weak demand. The announcement last week by the People’s Bank of China that it sees room for more quantitative easing may have comforted stock markets but it only added to my anxiety about reduced oil consumption and future downward shocks in oil prices. I hope that oil prices increase but cannot find any substantive reason why they should do anything but fall. As market balance reality re-emerges in investor consciousness and the false euphoria of a production freeze recedes, prices should correct to around $30. A little bad economic or political news could send prices much lower.

An astonishingly low number.

• Oil Crash Risks $19 Billion Wave of Junk Debt Defaults (BBG)

Investors are facing $19 billion in energy defaults as the worst oil crash in a generation leaves drillers struggling to stay afloat. The wave could begin within days if Energy XXI, SandRidge and Goodrich fail to reach agreements with creditors and shareholders. Those are three of at least eight oil and gas producers that have announced missed debt payments, triggering a countdown to default. “Shale was a hot growth area and companies made the mistake of borrowing too much,” said George Schultze of Schultze Asset Management in New York, which has been betting against several distressed energy companies. “It’s amazing that so many people were willing to lend them money. Many are going to file for bankruptcy, and bondholders and equity are going to get wiped out en masse.”

Bondholders are paying dearly for backing a shale boom that was built on high-yield credit. Since the start of 2015, 48 oil and gas producers have gone bankrupt owing more than $17 billion, according to law firm Haynes and Boone. Fitch Ratings predicts $70 billion of energy, metal and mining defaults this year, and notes that $77 billion of energy bonds are bid below 50 cents, according to a note Thursday. “Absent a material improvement in oil and gas prices or a refinancing or some restructuring of our debt obligations or other improvement in liquidity, we may seek bankruptcy protection,” Energy XXI said in a March 7 public filing. Goodrich Petroleum is asking shareholders and bond investors to approve a restructuring deal that would convert its unsecured debt and preferred shares into common stock.

For the plan to work, shareholders must approve it at a March 14 meeting and enough bondholders need to participate by the March 16 exchange deadline. “Absent a successful completion of the recapitalization plan, the company will have no alternatives other than to seek protection through the bankruptcy courts,” Walter Goodrich, chairman and chief executive officer, said on a March 9 conference call.

Could be ugly.

• Merkel Crosses Fingers Before German ‘Super Sunday’ Regional Polls (Reuters)

Germans vote in three regional state elections on Sunday, with Chancellor Angela Merkel’s conservatives at risk of setbacks that would weaken her just as she tries to push through a deal to resolve Europe’s migrant crisis. Migration is the hot topic, as worry how Germany will cope with an influx, totaling more than a million last year alone, that has come to define Merkel’s leadership, and on which she has staked her reputation. Merkel’s conservative Christian Democrats (CDU) have been losing support to the anti-immigration Alternative for Germany (AfD) party, which has profited from the growing unease. Asked at a campaign rally on Saturday how she was preparing for Sunday’s results, Merkel said: “I’m crossing my fingers.”

Polls indicate that the CDU will remain the biggest party in Saxony-Anhalt, in former East Germany. In the west, it could be pipped by the Greens in Baden-Wuerttemberg, where it is currently the largest party. And in Rhineland-Palatinate, where the CDU came a close second last time, the race is too close to call. A failure to win at least two of the three states would be a blow for Merkel just as she is trying to use her status as Europe’s most powerful leader to push through an EU deal with Turkey to stem the tide of migrants. The chancellor alarmed many European leaders at a summit earlier this week by gambling on the last-minute draft deal with Turkey to stop the migrant flow, and demanding their support. Merkel still needs to seal the deal at another summit on March 17-18.

If her party performs poorly on Sunday, she will go into that meeting weakened. One of those draining support from Merkel’s CDU is the AfD. Already represented in five of Germany’s 16 regional parliaments, the anti-immigration party looks set to burst into three more on Sunday, campaigning on slogans such as “Secure the borders” and “Stop the asylum chaos”. Polls put the AfD’s support as high as 19% in Saxony-Anhalt, where the CDU and Social Democrats now govern in a ‘grand coalition’ that mirrors Merkel’s federal government. If the AfD performs as well as the polls indicate, the coalition partners may need to team up with a third party to assemble a majority – one of a number of potential ‘firsts’ for German politics as voter loyalties splinter.

The pot, the kettle and the kitchen sink.

• US Too Racist And Violent To Criticize Others On Human Rights, Says China (Q.)

The United Nations Human Rights Council is in the midst of a three-week meeting in New York, and sparks are flying between the US and China. After 12 nations, led by the US, denounced China’s “deteriorating human rights record,” including an apparent illegal abduction of five Hong Kong booksellers and the arrest of hundreds of lawyers and activists, China fired back at the US. Fu Cong, China’s ambassador to the UN, said: “The US is notorious for prison abuse at Guantanamo prison, its gun violence is rampant, racism is its deep-rooted malaise. The United States conducts large-scale extra-territorial eavesdropping, uses drones to attack other countries’ innocent civilians, its troops on foreign soil commit rape and murder of local people. It conducts kidnapping overseas and uses black prisons.”

Fu’s comments are an abbreviated version of China’s latest annual scathing report on human rights in the US, which Beijing has issued for 16 years in a row (and for no other country but the US). Last year’s report included a litany of problems that the US faces, from Detroit’s water crisis to the CIA’s use of torture to teen unemployment, and concluded that human rights in the US were “terrible,” and that, even worse, there appears to be no “intention to improve” them in Washington, DC. Who gets to lecture who on human rights is an increasingly political issue, as Quartz reported earlier. As other governments adjust to Beijing’s rising economic might, some have scaled back their criticism of China’s human rights abuses, even as those abuses have increased under Xi Jinping in recent years.

Beijing’s abduction of five Hong Kong booksellers is just the latest in a widespread crackdown on activists, lawyers, and free speech in China. Human rights experts believe the tit-for-tat criticism misses the bigger picture. “We reject idea that countries have to have a perfect human rights record to criticize other governments,” Nicholas Bequelin, Amnesty International’s director for East Asia, told Quartz earlier. “If we were to follow this road, human rights could never be discussed since no country has a perfect human rights record.”

“The fuel rods melted through their containment vessels in the reactors, and no one knows exactly where they are now.”

• Fukushima Radiation Kills Robots Too (Reuters)

The robots sent in to find highly radioactive fuel at Fukushima’s nuclear reactors have “died”; a subterranean “ice wall” around the crippled plant meant to stop groundwater from becoming contaminated has yet to be finished. And authorities still don’t know how to dispose of highly radioactive water stored in an ever mounting number of tanks around the site. Five years ago, one of the worst earthquakes in history triggered a 10-meter high tsunami that crashed into the Fukushima Daiichi nuclear power station causing multiple meltdowns. Nearly 19,000 people were killed or left missing and 160,000 lost their homes and livelihoods in the quake and tsunami.

Today, the radiation at the Fukushima plant is still so powerful it has proven impossible to get into its bowels to find and remove the extremely dangerous blobs of melted fuel rods, weighing hundreds of tonnes. Five robots sent into the reactors have failed to return. The plant’s operator, TEPCO, has made some progress, such as removing hundreds of spent fuel roads in one damaged building. But the technology needed to establish the location of the melted fuel rods in the other three reactors at the plant has not been developed. “It is extremely difficult to access the inside of the nuclear plant,” Naohiro Masuda, Tepco’s head of decommissioning said in an interview. “The biggest obstacle is the radiation.”

The fuel rods melted through their containment vessels in the reactors, and no one knows exactly where they are now. This part of the plant is so dangerous to humans, Tepco has been developing robots, which can swim under water and negotiate obstacles in damaged tunnels and piping to search for the melted fuel rods. But as soon as they get close to the reactors, the radiation destroys their wiring and renders them useless, causing long delays, Masuda said. Each robot has to be custom-built for each building.“It takes two years to develop a single-function robot,” Masuda said.

Like the angle, but the execution leaves to be desired. And the promised land saga predates the bible.

• A Hope In The World Since Biblical Times Is Officially Over (Reuters)

A “promised land” has been a constant hope in the world since the Lord promised what became Israel to Abraham, in the Book of Genesis (15:18). Some centuries later, the Lord told Moses (according to Numbers 34) to lead the Israelites out of Egypt to occupy a somewhat smaller space than he had outlined to Abraham — the land east from the Jordan River to the sea. Zionism was built on these promises, its fulfillment in modern times powered by the Holocaust’s message that defensible land was necessary for the continued existence of the Jews. It’s gone well and badly. In his 2013 book “My Promised Land,” a fine confrontation by an Israeli journalist of the grace and disgrace of his state, Ari Shavit writes: “Israel is the only nation of the West that is occupying another people. On the other hand, Israel is the only nation in the West that is existentially threatened… intimidation and occupation have become the twin pillars of our existence.”

That’s the condition of the “real” promised land. Others were less canonically blessed, but did deliver on some of their promise. The promised land for centuries — since the Pilgrims landed on Plymouth Rock, Massachusetts, in 1620 — has been North America. The United States promised freedom to the masses yearning to breathe free, or at least make a living. It’s the only country in the world that has, at what was once its main entry point, a statue which promises a welcome to all the huddled masses — a welcome which, in advances and retreats, has remained till now. Today that spirit of inclusion is waning. Figures from the Pew Research Center show that a majority of Republican voters want a strong barrier along the border with Mexico, and a rising minority doesn’t want automatic U.S. citizenship conferred on the immigrants’ children.

Democrats are different: a decade ago, a majority of Democrats and Republicans agreed that illegal immigration should be checked. Today the parties diverge sharply — with less than a third of Democrats holding to that belief, against nearly two-thirds of Republicans. Still, a solid bipartisan majority of 72% doesn’t want mass deportation of illegal immigrants if they meet certain requirements: perhaps realizing that to do so would need require the deployment of most of the army, and approach civil war. Yet popular views shift as elite positions do. When Donald Trump made the Mexican wall and forced repatriation centerpieces of his campaign last autumn, and began winning, his fellow Republican candidates slithered after him. Has Trump’s blunt demand that illegal immigrants be deported and Muslims kept out released popular frustrations and directed them at foreign targets – so that what had been relatively liberal views are now overturned, including among some Democrats?

Going to push it through regardless: “..he claims that an acting government is not subject to parliamentary control.”

• Majority in Spanish Congress Opposes EU-Turkey ‘Pact Of Shame’ (El Pais)

Acting Prime Minister Mariano Rajoy will go to the European Council on March 17 to defend a position that most of Spanish Congress radically rejects. Except for his own Popular Party (PP), all other congressional groups – 227 deputies out of a total of 350 – feel that the European Union’s deal with Turkey to expel refugees is illegal. Podemos leader Pablo Iglesias said on Twitter that he felt “ashamed of an EU that systematically violates human rights” Rajoy, who signed the agreement on Monday, has refused to appear before his own Congress to explain the deal and negotiate a common Spanish position on the subject of refugees. Instead, he will send a state secretary to do the explaining, as he claims that an acting government is not subject to parliamentary control.

Following an inconclusive election on December 20, Spain has yet to name a new prime minister, and could face a fresh vote in June if no progress is made in the coming weeks. Other parties are now seeking ways to force Rajoy to come before them ahead of the European Council date. This is the first time that a vast majority of Congress has rejected a deal subscribed to by the EU government. Socialist leader Pedro Sánchez said the European deal with Turkey was “immoral” and possibly even “illegal.” “We have a week to change this agreement. The European Council of March 17 and 18 cannot approve this pact of shame,” he said. But options are few, as Rajoy has no plans to appear in Congress before those dates, nor will the chamber have a chance to vote on initiatives like the one put forward by the Socialist Party, amending the whole of the EU-Turkey agreement.

The opposition feels that Rajoy has no right to go to the Council without first reaching domestic consensus, as he would be overstepping his own role as acting executive official. The deal, say critics, involves future budget increases and political decisions outside Rajoy’s current legal mandate. Podemos leader Pablo Iglesias said on Twitter that he felt “ashamed of an EU that systematically violates human rights.” The deal, he said, breaks asylum laws. Ciudadanos representative Miguel Ángel Gutiérrez described the agreement “as a symptom of weakness” because it was akin to “subcontracting the problem” to Turkey, a country that is “moving in an autocratic direction.”

The crazy consequences of that pact of shame.

• Greece Says Turkish Observers Will Be Posted In Its Refugee Centers (Kath.)

Alternate Minister for Citizens’ Protection Nikos Toskas on Saturday confirmed that Turkish officials will be posted to the Greek islands of the eastern Aegean to act as observers and oversee the relocation of migrants who are not eligible for protection from Greece back to Turkey. Speaking on Skai TV amid media reports that Turkish officials would be allowed into refugee documentation centers, Toskas said that this is part of a protocol he signed with his Turkish counterpart during a Greek government mission to Izmir earlier in the week in order to speed up relocations. “In this framework, it will be possible for Turkish observers to be admitted at Greek islands to speed up procedures so that migrants who are not eligible for protection are returned [to Turkey] within 48 hours,” Toskas said.

The observers, he said, will be responsible for checking identification and travel documents together with Greek officials, and signing the protocol for the return of non-refugees to Turkey. For the time being, he said, one Turkish observer will be assigned to the Moria camp on the island of Lesvos, with a view to expanding their presence to the other islands struggling with inflows. Turkey agreed at an emergency European Union summit last week to take back migrants from over-burdened Greece in exchange for more aid from the bloc. European leaders will meet with Turkish officials again next week to hammer out the details of the deal. “The big gamble that is being played out in light of the March 17 and 18 summit is the relocation of refugees from Greece to countries of the European Union and the readmission of ‘illegal’ migrants by Turkey,” Toskas said.

This and more is what we can expect. And this is with a camera present.

• Turkish Guards Hit Refugee Boat With Sticks (BBC)

The BBC has been given a video showing Turkish coastguard using sticks against a boat full of migrants as they sail to Greece in the Aegean Sea. The incident is said to have happened in Turkish waters as the migrants were on their way to the island of Lesbos. The migrants accused the coastguard of attacking them, but the coastguard say they were trying to stop the boat without harming the occupants. The EU and Turkey are discussing new moves to curb the flow of refugees. Europe is facing its biggest refugee crisis since World War Two. Last year, more than a million people entered the EU illegally by boat, mainly going from Turkey to Greece. More than 132,000 migrants have arrived by boat into Greece so far this year – a large increase on the same period last year.

The vast majority of coastguard patrols in the Aegean are professional, with Turkish and Greek personnel either towing migrant vessels back ashore or rescuing those that capsize. But there have been reports of attacks. Masked officials on the Greek side were filmed last year appearing to puncture inflatable dinghies with migrants on board – and now this, with the Turkish coastguard claiming they were merely trying to stop the engine and stop the boat advancing. It could be that these are individual coastguard officers acting on their own and not following orders, perhaps fuelled by machismo and even xenophobia. But it’s also possible that this is more than an isolated case, showing the Turkish authorities going to any length to stem the migration flow under renewed pressure from Brussels. Either way, it will worry EU leaders meeting later this week to finalise a plan with Turkey to reduce migrant numbers. Could these scenes be repeated as Turkey steps up patrols of Europe’s borders?

Home › Forums › Debt Rattle March 13 2016