Jack Delano Long stairway in mill district of Pittsburgh, Pennsylvania 1940

Damned if you do, doomed if you don’t.

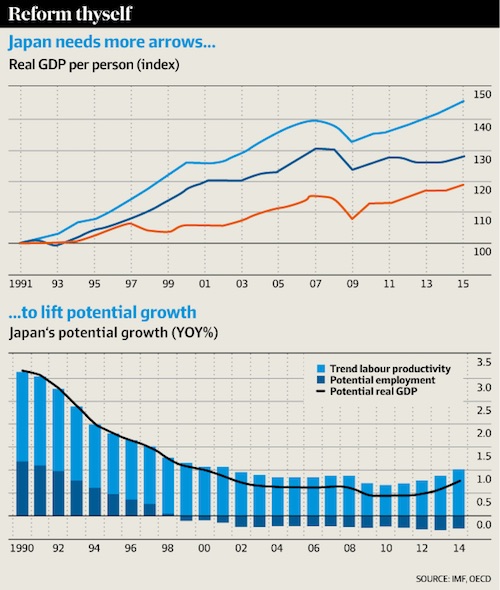

• Mizuho Chief: Tax Delay Means Abenomics Has Failed (WSJ)

The chief of Mizuho Financial Group said Japan risks a credit-rating downgrade if Prime Minister Shinzo Abe delays a scheduled sales-tax increase without explaining how the government plans to cut its deficit. Yasuhiro Sato, president of Japan’s second-largest bank by assets, said Mr. Abe’s framing of such a decision would determine whether it sparked concerns about the government’s credibility regarding its plans for fiscal consolidation. “The worst scenario is [the government] will just announce a delay in the tax increase. That could send a message that Abenomics has failed or Japan is heading for a fiscal danger zone and then it will harm Japanese government bonds’ credit ratings,” Mr. Sato said in an interview, referring to the prime minister’s growth program.

Mr. Abe acknowledged for the first time Friday that he was considering delaying an increase in the sales tax to 10% from 8% scheduled to take effect in April next year. He said he would decide before an upper house election to be held in July, but Japanese media have reported that a decision could come this week. Mr. Abe has delayed the tax increase once, after the rise to 8% in April 2014 derailed an economic recovery. Consumer spending has yet to fully rebound, and some economists say the prospect of another tax increase next year is already weighing on spending. Mr. Sato acknowledged that raising the tax again would pose a risk to Japan’s economy. “There will be a risk in either case of raising the tax or not, so as long as the government demonstrates a clear road map for fiscal reconstruction, Japanese credibility likely won’t be hurt so much,” he said.

Some bankers say Japan could damage its international credibility if it fails to raise taxes on schedule. The tax increases are part of long-standing efforts to reach a primary government surplus by 2020. A primary surplus is a balanced budget excluding interest payments on government debt. Japan’s government debt is among the largest in the world relative to the size of its economy. Moody’s Investors Service said in a March report, “Postponing the next [sales-tax] increase regardless of the reason would pose a big fiscal burden for Japan.”

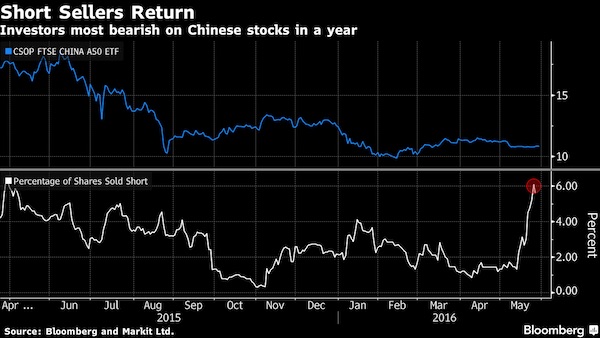

Last year, “Volumes shrank by more than 90% from their peak”. But there’s simply money in shorting China; you can’t stop that.

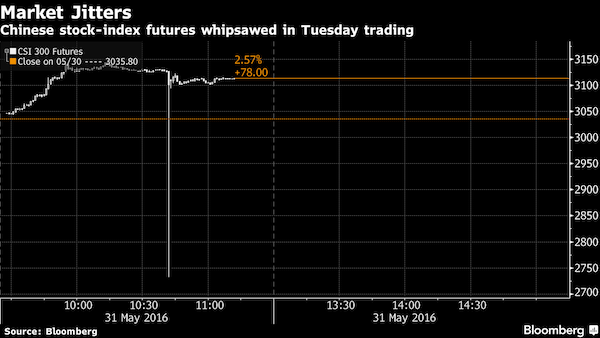

• One-Minute Plunge Sends Chinese Stock Futures Down by 10% Limit (BBG)

Chinese stock-index futures plunged by the daily limit before snapping back in less than a minute, the second sudden swing to rattle traders this month. Contracts on the CSI 300 Index dropped as much as 10% at 10:42 a.m. local time, recovering almost all of the losses in the same minute. More than 1,500 June contracts changed hands in that period, the most all day, according to data compiled by Bloomberg. The China Financial Futures Exchange is investigating the tumble, said people familiar with the matter, who asked not to be named because they aren’t authorized to speak publicly. The swing follows a similarly unexplained drop in Hang Seng China Enterprises Index futures in Hong Kong on May 16, a move that heightened anxiety among investors facing slower Chinese economic growth and a weakening yuan.

Volume in China’s stock-index futures market, which was the world’s most active as recently as July, has all but dried up after authorities clamped down on what they deemed excessive speculation during the nation’s $5 trillion equity crash last summer. Tuesday’s volatility had little impact on the underlying CSI 300, which rose 3%. “Liquidity in the market is really thin at the moment,” Fang Shisheng at Orient Securities said by phone. “So the market will very likely see big swings if a big order comes in. The order looks like it’s from a hedger.” Chinese policy makers restricted activity in the futures market last summer because selling the contracts is one of the easiest ways for investors to make large wagers against stocks. Volumes shrank by more than 90% from their peak after officials raised margin requirements, tightened position limits and started a police probe into bearish wagers.

Xi Jinping is one nervous man right now.

• The Big Short Is Back in Chinese Stocks (BBG)

Chinese equities are once again in the cross hairs of short sellers. Short interest in one of the largest Hong Kong exchange-traded funds tracking domestic Chinese stocks has surged fivefold this month to its highest level in a year, according to data compiled by Markit and Bloomberg. The last time bearish bets were so elevated, such pessimism proved well-founded as China’s bull market turned into a $5 trillion rout. While trading in the Shanghai Composite has become subdued this month amid suspected state intervention, pessimists are betting that equities face renewed selling amid a slumping yuan. The Chinese currency is heading for its biggest monthly loss since last year’s devaluation as the nation’s economic outlook worsens and the Fed prepares to raise borrowing costs, driving a rally in the dollar.

“Some macro funds are seeking opportunities to short index futures to play the currency movement,” said Wenjie Lu at UBS. “A higher chance of a Fed rate hike means there’s pressure for the yuan to soften.” Short interest in the CSOP FTSE China A50 ETF climbed to 6.1% on May 25, the highest level since April 2015, two months before Chinese equities peaked, and up from 1.3% at the end of last month. Bearish bets in the U.S. traded iShares China Large-Cap ETF jumped to a two-year high of 18% of shares outstanding on the same day, up from 3% a month ago. Even as Chinese equities rallied on Tuesday, traders were rattled by a sudden plunge in index futures. Contracts on the CSI 300 Index dropped as much as 10% at around 10:42 a.m. local time, recovering almost all of the losses in the same minute. The move had little effect on the underlying stock gauge, which rose 2.6% at the break.

I think there’s more to it than that.

• You’re Witnessing The Death Of Neoliberalism – From Within (G.)

You hear it when the Bank of England’s Mark Carney sounds the alarm about “a low-growth, low-inflation, low-interest-rate equilibrium”. Or when the Bank of International Settlements, the central bank’s central bank, warns that “the global economy seems unable to return to sustainable and balanced growth”. And you saw it most clearly last Thursday from the IMF. What makes the fund’s intervention so remarkable is not what is being said – but who is saying it and just how bluntly. In the IMF’s flagship publication, three of its top economists have written an essay titled “Neoliberalism: Oversold?”. The very headline delivers a jolt. For so long mainstream economists and policymakers have denied the very existence of such a thing as neoliberalism, dismissing it as an insult invented by gap-toothed malcontents who understand neither economics nor capitalism.

Now here comes the IMF, describing how a “neoliberal agenda” has spread across the globe in the past 30 years. What they mean is that more and more states have remade their social and political institutions into pale copies of the market. Two British examples, suggests Will Davies – author of the Limits of Neoliberalism – would be the NHS and universities “where classrooms are being transformed into supermarkets”. In this way, the public sector is replaced by private companies, and democracy is supplanted by mere competition. The results, the IMF researchers concede, have been terrible. Neoliberalism hasn’t delivered economic growth – it has only made a few people a lot better off. It causes epic crashes that leave behind human wreckage and cost billions to clean up, a finding with which most residents of food bank Britain would agree.

And while George Osborne might justify austerity as “fixing the roof while the sun is shining”, the fund team defines it as “curbing the size of the state … another aspect of the neoliberal agenda”. And, they say, its costs “could be large – much larger than the benefit”. Two things need to be borne in mind here. First, this study comes from the IMF’s research division – not from those staffers who fly into bankrupt countries, haggle over loan terms with cash-strapped governments and administer the fiscal waterboarding. Since 2008, a big gap has opened up between what the IMF thinks and what it does. Second, while the researchers go much further than fund watchers might have believed, they leave in some all-important get-out clauses.

You kidding me? They’re overloaded to their necks in overvalued property loans.

• Australia’s Big Four Banks Are Much More Vulnerable Than They Appear (Das)

Today they face little competition in their home market and have benefited tremendously from Australia’s strong growth, underpinned by China’s seemingly insatiable demand for the country’s gas, coal, iron ore and other raw materials. During the 2012 European debt crisis, Australia’s banks were worth more than all of Europe’s. But Australian financial institutions have made the same fundamental mistake the rest of the country has, assuming that growth based on “houses and holes” – rising property prices and resources buried underground – can continue indefinitely. In fact, despite a recent rebound in Chinese demand, commodities prices look set to remain weak for the foreseeable future. Banks’ exposure to the slowing natural resources sector has reached nearly $70 billion in loans outstanding – worryingly large relative to their capital resources.

If anything, their exposure to the property sector is even more dangerous. Mortgages make up a much bigger proportion of bank portfolios than before – more than half, double the level in the 1990s. And they’re riskier than they used to be: many loans are interest-only, while around 80% have variable rates. With a downturn likely – everything from price-to-income to price-to-rent ratios suggests houses are massively overvalued – losses are likely to rise, especially if economy activity weakens. Australian banks are also more vulnerable to outside shocks than they may first appear. Their loan-to-deposit ratio is about 110%. Domestic deposits fund only around 60% of bank assets; the rest of their financing has to come from overseas. While that hasn’t been a problem recently, Australia’s external position is deteriorating.

The current account deficit is expected to climb to 4.75% in the year ending June 30. Weak terms of trade, a rising budget deficit, slower growth and a falling currency are likely to drive up the cost of funds. If Australia’s economy or the financial sector’s performance falters, or international markets are disrupted, banks’ access to external funds could be threatened.

“..only 18% of Americans and 17% of Germans support TTIP..”

• Ceta: The Trade Deal That’s Already Signed (G.)

The US-Europe deal TTIP (the Transatlantic Trade and Investment Partnership) is the best known of these so-called “new generation” trade deals and has inspired a movement. More than 3 million Europeans have signed Europe’s biggest petition to oppose TTIP, while 250,000 Germans took to the streets of Berlin last autumn to try to bring this deal down. A new opinion poll shows only 18% of Americans and 17% of Germans support TTIP, down from 53% and 55% just two years ago. But TTIP is not alone. Its smaller sister deal between the EU and Canada is called Ceta (the Comprehensive Economic and Trade Agreement). Ceta is just as dangerous as TTIP; indeed it’s in the vanguard of TTIP-style deals, because it’s already been signed by the European commission and the Canadian government. It now awaits ratification over the next 12 months.

The one positive thing about Ceta is that it has already been signed and that means that we’re allowed to see it. Its 1,500 pages show us that it’s a threat to not only our food standards, but also the battle against climate change, our ability to regulate big banks to prevent another crash and our power to renationalise industries. Like the US deal, Ceta contains a new legal system, open only to foreign corporations and investors. Should the British government make a decision, say, to outlaw dangerous chemicals, improve food safety or put cigarettes in plain packaging, a Canadian company can sue the British government for “unfairness”. And by unfairness this simply means they can’t make as much profit as they expected. The “trial” would be held as a special tribunal, overseen by corporate lawyers.

Would anyone doubt it?

• Britain Is ‘World’s Most Corrupt Country’, Says Italian Mafia Expert (ES)

Britain has been described as the most corrupt country in the world, according to a journalist and expert on the Italian Mafia. Roberto Saviano, who wrote best-selling exposés Gomorrah and ZeroZeroZero, made the claim at the Hay Literary Festival. The 36-year-old has been living under police protection for 10 years since revelations were published about members of the Camorra, a Neapolitan branch of the mafia. Mr Saviano told the audience at Hay-on-Wye: “If I asked you what is the most corrupt place on Earth you might tell me well it’s Afghanistan, maybe Greece, Nigeria, the South of Italy and I will tell you it’s the UK. “It’s not the bureaucracy, it’s not the police, it’s not the politics but what is corrupt is the financial capital. 90% of the owners of capital in London have their headquarters offshore.

“Jersey and the Cayman’s are the access gates to criminal capital in Europe and the UK is the country that allows it. “That is why it is important why it is so crucial for me to be here today and to talk to you because I want to tell you, this is about you, this is about your life, this is about your government.” David Cameron came under pressure for the UK to reform offshore tax havens operating on British overseas territories at an anti-corruption summit earlier this month. Mr Saviano also weighed in on the EU referendum debate, warning a vote to leave the union would see Britain even more exposed to organised crime. He added: “Leaving the EU means allowing this to take place. It means allowing the Qatari societies, the Mexican cartels, the Russian Mafia to gain even more power and HSBC has paid £2 billion in fines to the US government, because it confessed that it had laundered money coming from the cartels and the Iranian companies. “We have proof, we have evidence.”

How power rules.

• The Untold Story Behind Saudi Arabia’s 41-Year US Debt Secret (BBG)

Failure was not an option. It was July 1974. A steady predawn drizzle had given way to overcast skies when William Simon, newly appointed U.S. Treasury secretary, and his deputy, Gerry Parsky, stepped onto an 8 a.m. flight from Andrews Air Force Base. On board, the mood was tense. That year, the oil crisis had hit home. An embargo by OPEC’s Arab nations—payback for U.S. military aid to the Israelis during the Yom Kippur War—quadrupled oil prices. Inflation soared, the stock market crashed, and the U.S. economy was in a tailspin. Officially, Simon’s two-week trip was billed as a tour of economic diplomacy across Europe and the Middle East, full of the customary meet-and-greets and evening banquets.

But the real mission, kept in strict confidence within President Richard Nixon’s inner circle, would take place during a four-day layover in the coastal city of Jeddah, Saudi Arabia. The goal: neutralize crude oil as an economic weapon and find a way to persuade a hostile kingdom to finance America’s widening deficit with its newfound petrodollar wealth. And according to Parsky, Nixon made clear there was simply no coming back empty-handed. Failure would not only jeopardize America’s financial health but could also give the Soviet Union an opening to make further inroads into the Arab world. It “wasn’t a question of whether it could be done or it couldn’t be done,” said Parsky, 73, one of the few officials with Simon during the Saudi talks.

At first blush, Simon, who had just done a stint as Nixon’s energy czar, seemed ill-suited for such delicate diplomacy. Before being tapped by Nixon, the chain-smoking New Jersey native ran the vaunted Treasuries desk at Salomon Brothers. To career bureaucrats, the brash Wall Street bond trader—who once compared himself to Genghis Khan—had a temper and an outsize ego that was painfully out of step in Washington. Just a week before setting foot in Saudi Arabia, Simon publicly lambasted the Shah of Iran, a close regional ally at the time, calling him a “nut.” But Simon, better than anyone else, understood the appeal of U.S. government debt and how to sell the Saudis on the idea that America was the safest place to park their petrodollars.

Inappropriate, illegal, and a public service, all at the same time.

• Eric Holder Says Edward Snowden Performed A ‘Public Service’ (CNN)

Former U.S. Attorney General Eric Holder says Edward Snowden performed a “public service” by triggering a debate over surveillance techniques, but still must pay a penalty for illegally leaking a trove of classified intelligence documents. “We can certainly argue about the way in which Snowden did what he did, but I think that he actually performed a public service by raising the debate that we engaged in and by the changes that we made,” Holder told David Axelrod on “The Axe Files,” a podcast produced by CNN and the University of Chicago Institute of Politics. “Now I would say that doing what he did – and the way he did it – was inappropriate and illegal,” Holder added. Holder said Snowden jeopardized America’s security interests by leaking classified information while working as a contractor for the National Security Agency in 2013.

“He harmed American interests,” said Holder, who was at the helm of the Justice Department when Snowden leaked U.S. surveillance secrets. “I know there are ways in which certain of our agents were put at risk, relationships with other countries were harmed, our ability to keep the American people safe was compromised. There were all kinds of re-dos that had to be put in place as a result of what he did, and while those things were being done we were blind in certain really critical areas. So what he did was not without consequence.” Snowden, who has spent the last few years in exile in Russia, should return to the U.S. to deal with the consequences, Holder noted. “I think that he’s got to make a decision. He’s broken the law in my view. He needs to get lawyers, come on back, and decide, see what he wants to do: Go to trial, try to cut a deal. I think there has to be a consequence for what he has done.”

Times editors’ curious timing.

• Vague Promises of Debt Relief for Greece (NY Times Ed.)

European leaders congratulated themselves last week for reaching an agreement to provide more loans to Greece and eventually ease the terms of the country’s huge debt. But there is little to celebrate. Greece is bankrupt in all but name. The country has a debt of more than €300 billion, or about 180% of its GDP, a sum it cannot hope to repay in full. Most of that money is owed to Germany, France, Italy and other countries in the eurozone. After an 11-hour meeting last week, the eurozone finance ministers said that they would lend another €7.5 billion to Greece next month to help it pay off debt and grant it some relief, possibly including lower interest rates and extended payment periods, but not until mid-2018.

The reality is that Greece can’t be squeezed any harder. But the finance ministers are seeking still more spending cuts and increased taxes. They want to see a budget surplus of 3.5% of GDP before interest payments by 2018. A stable and fast-growing country might be able to hit that target, but it is preposterous to expect that from Greece. The IMF wants to see a more realistic surplus of 1.5%. Delaying meaningful debt relief until 2018 will further harm the struggling Greek economy. The Greek unemployment rate was 24.4% in January, and Greece’s economy shrunk in the first three months of the year. The I.M.F., which has also lent Greece money, recently estimated that at its current trajectory, the country’s debt would eventually grow to 250% of GDP.

Forcing Greece into foolish measures: “..Schaeuble described the decision to raise value-added tax in Greece as “economic foolishness” but noted that Athens was obliged to take that route due to a revenue shortfall.”

• Glitch In Greek Bailout Talks Fuels Fears Of Delay (Kath.)

There was fresh concern on Monday that there could be further delays in the disbursement of much-need bailout money to Greece owing to a disagreement between Athens and its creditors, who have demanded changes to prior actions passed in Parliament earlier this month. EU officials on Monday appeared to dismiss Greece’s refusal to implement some of these changes, saying that these are issues that have already been agreed with the Greek government. The country’s lenders had given the green light for the disbursement of a tranche of 10.3 billion euros last week, on the condition the government made amendments to recent legislation it passed on pension, bad loans and privatizations.

However, Finance Minister Euclid Tsakalotos had informed the European Commission representative and the IMF in a letter last week that their demands could not be met, neither could Athens fulfill the demands enshrined in the bailout deal signed last summer to privatize ADMIE, the country’s grid operator, and to freeze the wages of essential services, like those of the coast guard and police. Greece desperately needs the new bailout money to pay state arrears as well as debt repayments to the IMF and European Central Bank in the coming weeks. There were reports on Monday that the government is planning to submit its own amendments on Wednesday to Parliament. If the disagreement between Greece and its creditors persists, then it is likely it will be discussed at the Euro Working Group on Thursday.

In comments on Monday, German Finance Minister Wolfgang Schaeuble described the decision to raise value-added tax in Greece as “economic foolishness” but noted that Athens was obliged to take that route due to a revenue shortfall. “This is why Greece needs an effective public administration,” Schaeuble told a conference on fiscal sustainability, observing that Greek tax collection must be improved to bring in the higher revenues that are being targeted.

Germany has exported its unemployment to Greece and Spain.

• German Unemployment Rate Falls to Record Low (BBG)

German unemployment declined more than economists estimated, pushing the jobless rate to the lowest level since reunification. The number of people out of work fell by a seasonally adjusted 11,000 to 2.695 million in May, data from the Federal Labor Agency in Nuremberg showed on Tuesday. The median estimate in a Bloomberg survey was for a decline of 5,000. The jobless rate dropped to 6.1 percent. The report comes two days before ECB officials convene in Vienna to set monetary policy and assess whether they’ve done enough to sustain an economic recovery in the 19-nation euro region.

The ECB is expected to keep its stimulus plan unchanged after President Mario Draghi announced an expansion of quantitative easing by a third to €80 billion in March and cut the deposit rate further below zero. Unemployment dropped by 8,000 in western Germany and declined by 3,000 in the eastern part of the country, the report showed. Growth momentum in Europe’s largest economy remains strong after gross domestic product expanded at the fastest pace in two years in the first quarter. German business sentiment rose to the highest level in five months in May and consumer prices unexpectedly halted their decline. The Bundesbank predicts the economy will retain its underlying strength, even though expansion will probably slow somewhat this quarter.

Obviously not a surprise for me, or Automatic Earth readers. And lest we forget: Norway does a lot of good in silence. But more austerity is definitely not going to fix anything at all.

• Majority Of Athens Homeless Ended Up On Street In Past 5 Years (Kath.)

71% of the Greek capital’s homeless population has ended up on the streets in the last five years and 21.7% in the last year alone, a study by the City of Athens’s Homeless Shelter (KYADA), funded by the Norwegian government and other European countries, has found. According to the study, which was conducted as part of the “Fighting Poverty and Social Exclusion” program and whose findings were presented by Athens Mayor Giorgos Kaminis on Monday evening, 62% of the capital’s homeless are Greeks, the overwhelming majority (85.4%) are men and most (57%) are aged between 35-55. Of the 451 respondents questioned by KYADA workers from March 2015 until the same month this year, 47% said they ended up on the street after losing their job and 29% said they do not want to move to a shelter or other organized facility.

Less than half of the respondents (41.2%) admitted to using drugs, 7.3% to alcohol and 2% to both. Kaminis also said that in the one-year period, the solidarity program helped distribute 46,156 supermarket food coupons worth around 1.85 million euros to nearly 9,000 beneficiaries in over 3,700 families. “Through its social structures and strong alliances with agencies, partners and simple citizens, the City of Athens help give support to more than 25,000 residents,” Kaminis said at the presentation, which was also attended by Norwegian Ambassador to Athens Jorn Eugene Gjelstad.

Who we are. Not including debt slaves.

• More Than 45 Million Trapped In Modern Slavery (AFP)

More than 45 million men, women and children globally are trapped in modern slavery, far more than previously thought, with two-thirds in the Asia-Pacific, a study showed Tuesday. The details were revealed in the 2016 Global Slavery Index, a research report by the Walk Free Foundation, an initiative set up by Australian billionaire mining magnate and philanthropist Andrew Forrest in 2012 to draw attention to the issue. It compiled information from 167 countries with 42,000 interviews in 53 languages to determine the prevalence of the issue and government responses. It suggested that there were 28% more slaves than estimated two years ago, a revision reached through better data collection and research methods.

The report said India had the highest number of people trapped in slavery at 18.35 million, while North Korea had the highest incidence (4.37% of the population) and the weakest government response. Modern slavery refers to situations of exploitation that a person cannot leave because of threats, violence, coercion, abuse of power or deception. They may be held in debt bondage on fishing boats, against their will as domestic servants or trapped in brothels. Some 124 countries have criminalised human trafficking in line with the UN Trafficking Protocol and 96 have developed national action plans to coordinate the government response.

In terms of absolute numbers, Asian countries occupy the top five for people trapped in slavery. Behind India was China (3.39 million), Pakistan (2.13 million), Bangladesh (1.53 million) and Uzbekistan (1.23 million). As a %age of the population, Uzbekistan (3.97%) and Cambodia (1.65%) trailed North Korea, which the study said was the only nation in the world that has not explicitly criminalised any form of modern slavery.

Home › Forums › Debt Rattle May 31 2016