Harris&Ewing F.W. Grand store, Washington, DC 1925

“It really is coming to an end. It doesn’t mean tomorrow or the next day, but people are going to be really unhappy…”

• The End Of The EU Is Coming: Ron Paul (CNBC)

The historic U.K. vote to leave the European Union is a sign of a major global meltdown, not just a watershed that marks the end of a unified continent, former Rep. Ron Paul says. “I think [the EU] will become nonfunctional,” Paul told CNBC’s “Futures Now” on Tuesday. “It really is coming to an end. It doesn’t mean tomorrow or the next day, but people are going to be really unhappy. The end is coming, but it isn’t coming because of the breakup,” he added. Paul attributed the fallout to “bad fiscal policies” around the globe. He said that as long as interest rates remain low, the markets will remain in bubble territory.

“I think what everyone is looking at is there was a vote, an important vote and it went differently than expected and it sent shock waves through the markets, but I think the concentration is on the wrong issue,” the former Libertarian and Republican Party presidential candidate said. Instead, he said, what has caused so much turmoil is what happened before the recent declines. “What has been preceding this situation that we have throughout the world and this country as well is artificially low interest rates. It causes people to make mistakes in buying bonds,” he said.

Interesting correlation.

• ‘British Pound Signals US Stocks Are About To Fall Hard’ (CNBC)

The euro’s considerable rise against the British pound signals trouble to come for U.S. markets, according to Evercore ISI technical analyst Rich Ross. The euro and the pound fell against the dollar after the U.K. voters opted to leave the EU, but sterling fell further, hitting three-decade lows against the dollar. According to Ross, the relative weakness in the British currency mirrors the euro’s huge rally against the British pound from 2007 to 2009. During that period, U.S. stocks plummeted. As a result, Ross is particularly wary of the euro’s recent strength against the pound.

“This surge that we’re seeing is breaking this multiyear downtrend, breaking out through that 200-week moving average,” Ross said Tuesday on CNBC’s “Trading Nation.” “That could potentially spell problems for the S&P 500 and for risk assets [based on the past], so we want to watch that euro-pound.” Ross believes that the euro’s strength against the pound could just be getting started. “I think there could eventually be upside in the euro-pound to just around 86 cents, and that would likely correspond with further downside for risk assets like stocks, like the S&P 500,” Ross added.

Take a pinch of salt with every stress test.

• US Banks Beat Fed Stress Test as Deutsche Bank, Santander Fail Anew (BBG)

Federal Reserve officials cleared dozens of U.S. banks to boost shareholder payouts after conducting annual stress tests that proved too rigorous, again, for subsidiaries of Deutsche Bank and Banco Santander. JPMorgan Chase, Citigroup, Bank of America and 27 other firms with major U.S. operations passed the exam Wednesday, with many unveiling plans to distribute more capital through dividends and stock buybacks. Even Morgan Stanley, which must shore up internal systems before the Fed issues a final verdict, got conditional permission to boost its dividend 33%. Deutsche Bank and Santander were alone in failing, due to “broad and substantial weaknesses across their capital planning processes,” the Fed said.

While both had adequate capital and showed improvement after failing last year, their plans still relied on assumptions and analyses that “are not reasonable or appropriate,” the regulator said. The findings show U.S. banks have largely adapted to the Fed’s stiffer oversight of capital and internal controls in the wake of 2008’s financial crisis. After years spent cleaning up their balance sheets and stumbling in past exams, Citigroup and Bank of America cleared handily this time and are now moving beyond the penny and nickel dividends they’ve been stuck paying. Deutsche Bank and Santander, meantime, both vowed anew to do better next time.

We knew from their derivatives portfolio.

• Deutsche Bank Is The Riskiest Financial Institution In The World: IMF (ZH)

[..] not only did Deutsche Bank just flunk the Fed’s stress test for the second year in a row, but moments ago in a far more damning analysis, none other than the IMF disclosed that Deutsche Bank poses the greatest systemic risk to the global financial system, explicitly stating that the German bank “appears to be the most important net contributor to systemic risks.” Yes, the same bank whose stock price hit a record low just two days ago. Here is the key section in the report:

Domestically, the largest German banks and insurance companies are highly interconnected. The highest degree of interconnectedness can be found between Allianz, Munich Re, Hannover Re, Deutsche Bank, Commerzbank and Aareal bank, with Allianz being the largest contributor to systemic risks among the publicly-traded German financials. Both Deutsche Bank and Commerzbank are the source of outward spillovers to most other publicly-listed banks and insurers. Given the likelihood of distress spillovers between banks and life insurers, close monitoring and continued systemic risk analysis by authorities is warranted.

Among the G-SIBs, Deutsche Bank appears to be the most important net contributor to systemic risks, followed by HSBC and Credit Suisse. In turn, Commerzbank, while an important player in Germany, does not appear to be a contributor to systemic risks globally. In general, Commerzbank tends to be the recipient of inward spillover from U.S. and European G-SIBs. The relative importance of Deutsche Bank underscores the importance of risk management, intense supervision of G-SIBs and the close monitoring of their cross-border exposures, as well as rapidly completing capacity to implement the new resolution regime.

The IMF also said the German banking system poses a higher degree of possible outward contagion compared with the risks it poses internally. This means that in the global interconnected game of counterparty dominoes, if Deutsche Bank falls, everyone else will follow.

Notwithstanding moderate cross-border exposures on aggregate, the banking sector is a potential source of outward spillovers. Network analysis suggests a higher degree of outward spillovers from the German banking sector than inward spillovers. In particular, Germany, France, the U.K. and the U.S. have the highest degree of outward spillovers as measured by the average percentage of capital loss of other banking systems due to banking sector shock in the source country.

Obviously, I’m with Steve on this.

• Steve Keen on Brexit (Hartmann)

Thom Hartmann talks to Prof. Steve Keen of Kingston University, London, about why Brexit is a response to failed neoliberal policies and why that could be good for all of us.

One less bubble maker.

• Singapore Bank Suspends London Property Loans (R.)

United Overseas Bank, Singapore’s number 3 lender, became the first bank in the city state to suspend its loans program for London properties in the wake of uncertainties caused by Britain’s vote to leave the European Union. As Brexit spooked global markets and pushed the pound to multi-year lows, other Singaporean banks were also advising clients about risks such as currency losses even though they have not followed UOB’s move. “We will temporarily stop receiving foreign property loan applications for London properties,” a UOB spokeswoman said in an email.

“As the aftermath of the UK referendum is still unfolding and given the uncertainties, we need to ensure our customers are cautious with their London property investments.” The Singaporean dollar has gained 10% against the British pound since the referendum, eroding the value of assets held in Britain. Other risks for Singaporean banks have been exacerbated in recent months by an economic slowdown in Asia and rising bad debts in energy-related industries. Moody’s Investors Service on Thursday revised the outlook on Singapore’s banks to negative from stable. This reflected the “weaker operating conditions” against the backdrop of softer regional economic and trade growth, Moody’s said.

Deflation is coming from the east.

• Was Brexit Fear A Giant Hoax Or Is This The Calm Before The Next Storm? (AEP)

Devaluation strikes no fear in a chronic deflationary world where almost every major country is trying to push down its currency to break out of the trap, and largely failing to do so. It would facetious to suggest that Britain has pulled off this trick. Crumbling investor confidence is never a good thing. But the UK has stolen a march of sorts, carrying out a beggar-thy-neighbour devaluation by accident. The pound needs to fall further. It is still too strong for a country with a current account deficit running consistently above 5pc of GDP. The IMF said just before Brexit that sterling was 12pc to 18pc overvalued, and may have to fall more than this to force a lasting realignment of the British economy.

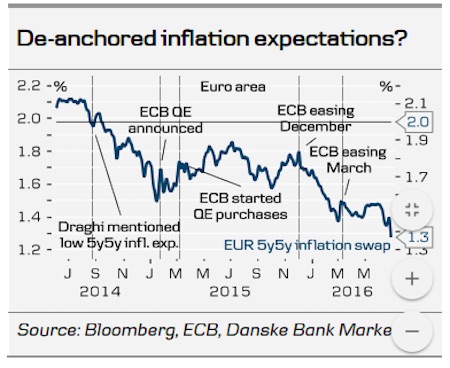

This cure has hardly begun. As of today, sterling is 5pc below its trading range for the last month against the euro and the Chinese yuan. It is weaker against the US dollar but the dollar is on steroids, much to the horror of the US Treasury. The more sterling falls, the greater the net stimulus for the British economy. The reverse holds for the eurozone. It is a further deflationary shock at a time when Europe is already in deflation, when inflation expectations are in free-fall and bond yields are collapsing below zero, and when the ECB is running out of options. There are two dangers for the world economy. One is that China is exporting deflation with alarming intensity. Morgan Stanley estimates that China’s trade-weighted devaluation is running at an annual rate of 11pc, and factory gate deflation adds another 2pc.

This is a tsunami coming from the epicentre of global overcapacity. The other danger is that British and European politicians fail to understand what is coming straight at them from Asia. Britain’s Brexiteers must come up with a coherent policy on trade very fast, and the EU must come off their ideological high-horse and face the reality that they have absolutely no margin for economic error. US Secretary of State John Kerry warned in stark terms on his post-Brexit swoop into Europe that nobody should lose their head, or go off half-cocked, or “start ginning up scatter-brained or revengeful premises.” Nobody seemed to heed his words at the EU’s imperial summit in Brussels, an exercise in righteous anger but not much else. The markets may yet speak in harsher language.

Why do I have the impression the right is sharper these days than the left?

• Poland Calls For Juncker To Quit As Others Fume EU Has Too Much Power (EUK)

After Britain’s shock vote to quit the EU, remaining countries are looking for better deals for themselves, and ordering the union to learn from its mistakes or face further calls for a total break up. Poland, Slovakia, Hungary and the Czech Republic called on Tuesday for the powers of the European Commission to be curbed with Warsaw calling for the dismissal of Mr Juncker, the executive’s head. Last week’s referendum alarmed governments in the former communist eastern region of the EU who had seen London as their main eurosceptic ally in efforts to reduce centralised control from Brussels. Poland’s Foreign Minister Witold Waszczykowski said: “We are asking if this leadership of the European Commission has a right to continue functioning, fixing Europe.

“In our opinion, it does not. New politicians, new commissioners should undertake this task, and first of all we should give new prerogatives to the European Council, because it consists of politicians who have a democratic mandate.” Warsaw has clashed with the Commission over its controversial attempt to curb the powers of the constitutional court, which led Brussels to launch an investigation into the rule of law in Poland. Tension between the Brussels executive, which drafts and enforces EU legislation, and member states, which exercise their authority collectively in the EU Council, has been a permanent feature of the bloc over six decades.

And then throw a surging yen into the mix.

• Japan Factory Output Hits 3-Year Low On Weak Domestic Demand, Exports (R.)

Japan’s industrial output slid in May at the fastest rate in three months to its lowest level since June 2013, highlighting concerns about falling exports and weak consumer spending. May’s 2.3% fall in industrial output considerably exceeded the median estimate for a 0.1% decline forecast in a Reuters poll. “The decline in industrial output is directly related to the decline in exports,” said Hidenobu Tokuda, senior economist at Mizuho Research Institute. “Another factor is the slow recovery in domestic consumer spending. The government should consider some measures to improve domestic demand.” Japan’s government plans to announce more fiscal stimulus spending this autumn to revive Prime Minister Shinzo Abe’s economic agenda.

Strengthening domestic demand has become even more urgent as gains in the yen further threaten exports. Output fell in May due to declines in the production of chemicals, cosmetics, construction equipment and semiconductors, data from the Ministry of Economy, Trade and Industry showed. Manufacturers surveyed by the ministry expect output to rise 1.7% in June and increase 1.3% in July. Exports fell at the fastest pace in four months in May on supply chain disruptions from an earthquake and slow growth in emerging markets, data earlier this month showed. The Bank of Japan’s closely-watched tankan business sentiment survey due on Friday is forecast to show confidence fell to the lowest in three years in April-June.

When things get serious, you lie. Shanghai’s 49% crash over the past year is serious.

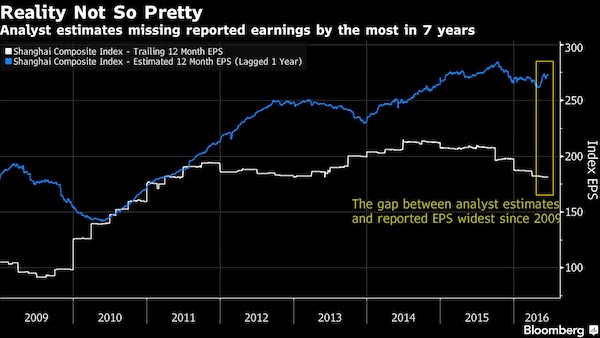

• China’s Analysts Haven’t Been This Wrong on Equities Since 2009 (BBG)

China’s gap between profit forecasts and reality is turning into a chasm. Firms in the Shanghai Composite Index reported earnings per share for the past year that were 33% below what analysts had predicted 12 months ago, according to data compiled by Bloomberg. The gap, which this month widened to the most since 2009, far outstrips the difference between projections and actual earnings in the U.S., and is more than double that of Chinese companies in Hong Kong. So how did they get it so wrong? China’s industrial giants are being squeezed as the government reorients the economy around services, leaving excess capacity that translates into volatile earnings.

Those stocks dominate the Shanghai Composite and have been among its steepest decliners in 2016, helping drag the gauge down 17%. As to why analysts didn’t anticipate the scale of the shift: Foundation Asset Management says in a market where short-selling is almost impossible, there’s little demand for negative research and strategists face more pressure to present an optimistic outlook. “The transitioning of the economy from exports to consumer, that’s a painful adjustment that occurs over a number of years,” said Ben Surtees at Jupiter Asset Management in London. “Analysts aren’t capturing the changes that are occurring.”

[..] In just over a year, China’s stock forecasters have weathered a rally that took the Shanghai Composite to a 7-year high in June 2015, and then a 49% crash that prompted authorities to crack down on alleged market manipulation by discouraging short-selling and targeting brokerage executives and journalists. That backdrop is an added reason to present positive research, Ample Capital’s Alex Wong said.

“..37 times more money [left] China than enter[ed] so far this year.”

• Yuan Heads for Worst Quarter on Record as Outflows Seen Rising (BBG)

The yuan’s worst quarterly performance on record is raising the risk of capital flight. China’s currency has slumped 2.9% since the end of March, the most since the nation unified the official and market rates at the start of 1994, to trade near its lowest level in five years. Losses deepened after the U.K.’s vote to secede from the European Union led to a jump in the dollar and dented the outlook for Chinese exports. After turmoil in its currency and stock markets in the past year shook investor confidence, China stopped granting quotas for residents to invest overseas and clamped down on illegal fund transfers to restrain capital outflows.

Policy makers are trying to guide the currency lower versus its trading partners as the economy slows while simultaneously damping expectations of faster depreciation. Goldman Sachs warned Thursday that metals investors are concerned China may sharply weaken its exchange rate. “We see a rising risk that capital outflows could pick up again causing negative headlines and adding to the fragility of current market sentiment,” said Allan von Mehren at Danske Bank. “We expect the depreciation pressure on the Chinese currency to continue over the coming years.” [..] A program allowing some domestic and Hong Kong mutual funds to be sold on either side of the border has seen about 37 times more money leave China than enter so far this year.

Yes, housing bubbles leave people homeless in their wake.

• New Zealand Businessmen Mull Buying Cruise Ship To House Homeless (G.)

A group of New Zealand businessman have come up with an idea to help New Zealand’s homeless – place them on a cruise ship. Charity groups in Auckland estimate hundreds of people are sleeping rough in the city every night, with dozens of working families also bedding down in cars, garages and Te Puea Marae (Maori meeting houses). Christchurch businessman Garry House said: “Living on a cruise ship is not a long-term solution but things are so bad for so many families now it could help ease the pressure for two or three years while longer-term strategies are put into place.”

House has, with a number of colleagues, begun investigating purchasing a 400-bed Italian cruise liner and docking it in Auckland harbour. He estimates the cost of purchasing and transporting it to New Zealand to be at least NZ$5m. It could reach New Zealand from Europe in a month, House said. Auckland’s housing market is one of the most expensive in the world; property prices have increased 77.5% in the past five years, and the average house price is more than NZ$940,000 (£498,000), according to property data provider CoreLogic New Zealand.

Europe’s human values.

• More Than 57,000 Migrants And Refugees Still Stranded In Greece (Kath.)

A total of 57,155 migrants and asylum-seekers are currently in Greece according to fresh data provided by the government. According to the data, 23,675 individuals are currently in northern Greece, 1,703 in central Greece, and 240 in southern Greece. An estimated 8,643 people are scattered around the Aegean islands. No arrivals were recorded in the past 24 hours, the government said. Meanwhile, up to 10,198 refugees are currently staying at official centres set up in Attica region, while the number of those camping out at makeshift facilities is 4,915.

Home › Forums › Debt Rattle June 30 2016