Russell Lee Tracy, California. Gasoline filling station 1942

“Opponents of the return of Glass-Steagall were swift to react. “Glass-Steagall is dumb politics and dumb economics…”

• Republican Platform Calls For Return Of Glass-Steagall (MW)

Republicans and Democrats are both bending over backwards to show that they are not beholden to Wall Street. The Republican Party platform, released late Monday, calls for the return of Glass-Steagall restrictions on banks. Paul Manafort, campaign manager for presumptive GOP nominee Donald Trump, told reporters earlier Monday the language would be included. “We believe that the Obama-Clinton years have passed legislation that has been favorable to the big banks, which is one of the reasons why you see all the Wall Street money going to [Hillary Clinton],” Manafort said.

Glass-Steagall was a Depression-era measure restricting commercial banks from the investment-banking business. The measure was repealed in 1999. Some critics contend that loosening of the banking rules played a role in the subsequent financial crisis. Manafort’s comments suggest Republicans hope to use the issue against Clinton, the presumptive Democratic nominee. The measure was a major point of contention between Bernie Sanders and Clinton in the Democratic primary. The Democratic platform also includes language calling for a modern version of Glass-Steagall. Party platforms have no teeth. But having Glass-Steagall in both platforms suggests Congress will likely consider the issue next year.

Opponents of the return of Glass-Steagall were swift to react. “Glass-Steagall is dumb politics and dumb economics … returning to Glass-Steagall would be destructive and unworkable,” said Tony Fratto, managing partner in Washington at Hamilton Place Strategies, a lobbying firm that represents large banks. Brian Gardner, an analyst at Keefe, Bruyette & Woods, said the market may be underestimating the likelihood of a forced breakup of big banks. “There is an unappreciated risk that Glass-Steagall might be reimposed in 2017 or 2018, especially if Congress seriously looks at changes to the Dodd-Frank Act. We think this is the case regardless of who wins the presidential election,” he said in a note to clients.

And Calpers is not some outlier.

• Calpers Targets 7.5% Investment Return, Earns Just 0.6% In Latest FY (BBG)

The California Public Employees’ Retirement System, the largest U.S. public pension fund, earned a return of 0.6% on its investments last fiscal year, trailing its long-term target as holdings in stocks and forestland lost money. The pension’s public equity portfolio lost 3.4% in the year through June 30 and forestland assets declined 9.6%, Chief Investment Officer Ted Eliopoulos said Monday. Fixed-income holdings rose 9.3% and infrastructure investments gained 9%. “The longer-term returns of the fund – the three-, five-, 10-, 15- and 20-year total returns of the fund – are now below the assumed rate of 7.5% for the fund,” Eliopoulos said. “That’s a significant policy issue for us.”

The system must average at least 7.5% a year to match its assumed rate of return or turn to taxpayers to make up the difference. Calpers’s annualized returns were 6.9% for the last three years, 5.1% for the last 10 years and 7% over 20 years, according to a presentation to the board. It is among U.S. pensions under pressure to boost investment returns as funding shortfalls increase amid an aging population and low interest rates. In fiscal 2015, Calpers earned 2.4%. The pension lost a quarter of its value in 2009. Two years later, it earned a record 20.7% only to see the gain drop to 1% one year later. Since the recession, the fund has sought to better gauge its risks from market volatility.

One day even Reuters will have to admit that demand is way down…

• Oil Prices Fall On Oversupply Concerns Despite Output Cuts (R.)

Oil prices eased on Tuesday as concerns over a crude and refined fuel glut outweighed an expected cut in U.S. shale production and a probable further draw in U.S. crude inventories. Crude prices fell more than 1% in the previous session after worries about potential supply disruptions stemming from an attempted coup in Turkey proved unfounded. “Prices are a bit softer in the Asian trading period – traders and investors are torn which way prices are going to break. It’s a knife edge between optimism and pessimism,” said Ben Le Brun, market analyst at Sydney’s OptionsExpress. The market is waiting for U.S. crude stocks data on Tuesday and Wednesday to help give direction to prices, he said.

Brent crude slipped 11 cents to $46.85 a barrel as of 0657 GMT after finishing the previous session down 65 cents, or 1.4%. U.S. crude, known as West Texas Intermediate (WTI), fell 11 cents to $45.13 a barrel after settling 71 cents, or about 1.6%, lower in the previous session. Fuel inventories in the United States, Europe and Asia are brimming despite this being the peak summer driving season, leading traders to store diesel on tankers at sea amid wilting demand growth. With landed oil product storage nearly full as well, there is little support for any sustained recovery in crude prices even as output tapers. U.S. shale oil production is expected to fall in August for a tenth straight month, by 99,000 barrels per day (bpd) to 4.55 million bpd, according to a U.S. drilling productivity report on Monday.

And here’s the result of the demand collapse:

• Alberta Is In The Midst Of Its Worst Recession On Record (BBG)

Alberta, the home of Canada’s oil sands, is going through its worst downturn in activity on record as a prolonged period of low oil prices and the wildfires earlier this year buffet the provincial economy. According to Toronto-Dominion Bank’s economics team, the cumulative annual%age contraction in real output projected for 2015 to 2016 exceeds even the financial crisis, as well as the last supply-side driven crash in oil prices in the mid-1980s, in magnitude. While the recent episode seems poised to be the worst single recession on record, the two recessions in the 1980s mean that stretch is still likely to be regarded as the most challeng≠ing period in the post-war period in Alberta, says a TD team led by Deputy Chief Economist Derek Burelton.

However, TD s team notes that labor market indicators point to a more mild downturn. Periods of boom followed by bust are no strangers to an econ≠omy that is tied to the vagaries of the global oil market, write the economists. The current recession is expected to yield a cumulative annual decline in real GDP of around 6.5%, which is more than twice that of the average of past downturns. While economic activity appeared to be picking up earlier this year, the wildfires that wreaked havoc in the region and disrupted oil operations threw a wrench in the province s nascent comeback story. The economists note that the softness in the Canadian dollar and low interest rates helped Alberta s economy escape an even worse fate.

Buying into the last stages of a bubble.

• China’s Local Debt Problem Goes Global (BBG)

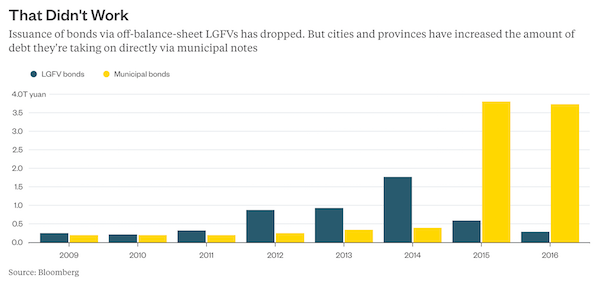

A very local problem in China is being exported at an alarming rate.Debt from special-purpose vehicles linked to municipal and provincial governments — leverage that central authorities are trying (unsuccessfully) to extinguish — is becoming more common in overseas markets. What’s worse, lately it’s been the weakest cities and provinces panhandling to international investors.Since June, as many as six local government financing vehicles have sold dollar bonds, bringing the total issued by such entities to at least $4 billion this year, just shy of the record $4.1 billion logged in all of 2015. Three offerings were scored below investment grade by Fitch, whereas prior to 2016, only one junk security of its kind had surfaced internationally.

Investors should ask why these localities are going abroad when all their revenue is onshore. Could it be that they’re having a harder time raising funds domestically?That wasn’t always the case.After a 1994 law banned regional authorities from issuing bonds directly, LGFVs were set up in their thousands in China to fund infrastructure projects like roads and bridges. Beijing lost track of how big the liabilities were and deployed about 50,000 auditors across the country in 2014. That crackdown culminated in authorities’ decision last year to open the municipal debt spigots and use funds raised that way to repay local governments’ off-balance-sheet debt. As a result, provincial and municipal governments issued an unprecedented 3.8 trillion yuan ($567 billion) directly last year, and may sell as much as 5 trillion yuan this year.

In case people still don’t get where Brexit came from.

• Middle-Income Families In UK Resemble The Poor Of Years Past (G.)

Plunging levels of homeownership and an increased reliance on state benefits to top up salaries have meant that Britain’s middle-income families increasingly look like the poor households of the past, according to one of the UK’s leading thinktanks. A report from the Institute for Fiscal Studies showed that the old link between worklessness and child poverty had been broken, with record levels of employment leading to a drop in the number of poor children living in homes where no adult works. However, the study found that by 2014-15, two-thirds of children classified as living below the poverty line had at least one parent who was working. If Theresa May wanted to take forward David Cameron’s “life chances” strategy, the IFS said, the prime minister needed to focus on lifting the incomes of working households.

“In key respects, middle-income families with children now more closely resemble poor families than in the past,” the IFS said. “Half are now renters rather than owner-occupiers and, while poorer families have become less reliant on benefits as employment has risen, middle-income households with children now get 30% of their income from benefits and tax credits, up from 22% 20 years ago.” The report divided the population into five groups according to income and found that for the middle 20% of children, half were living in an owner-occupied house, down from 69% two decades ago. It also found that mothers’ earnings were increasingly important for households with children. More than 25% of the incomes of middle-income households came from mothers in 2014-15, up from less than 20% in 1996, while this figure doubled from 7% to 15% for the poorest group over the 20-year period.

“We see a classic housing bubble in London and Brexit as the trigger for the correction..”

• Brexit Could Cut London House Prices By 30-50%: SocGen (G.)

London property prices could fall by more than 30% in the wake of Britain’s vote to leave the EU and may halve in the most expensive parts of the city, according to analysts at the French bank Société Générale. Brexit may be the trigger to end London’s seven-year house-price boom as companies move employees out of the UK, forcing sales of high-end properties, the company’s real estate analyst Marc Mozzi said in a note to clients. Commercial property has been at the centre of post-Brexit fears as investors have tried to get their money out of property funds, but residential real estate could be hit harder, Société Générale said. “While in recent stress tests the major UK banks were assessed with declines of about 30% in commercial real estate prices, we fear that London residential could experience an even more severe downturn,” it said.

Prices are already falling on properties previously valued at £1m or more, and may have further to go, particularly in the priciest parts of town. London’s highly paid investment bankers and hedge fund managers congregate in boroughs such as Hammersmith and Fulham as well as Kensington and Westminster. Société Générale added: “We see a classic housing bubble in London and Brexit as the trigger for the correction … Given the current ratio of prices to incomes in London, a price correction of even 40-50% in the most expensive London boroughs does not seem impossible.” London property prices have more than doubled since they began to recover from the financial crisis in 2009. Last month, the average London house price was £472,000 – 12 times average London earnings compared with a long-term average of six times, Société Générale said.

Too late. Way.

• New Zealand to Rein in Housing Boom (BBG)

New Zealand’s central bank is moving to quell the country’s housing boom by restricting the amount of money property investors can borrow, paving the way for another cut in interest rates. The Reserve Bank will require investors across New Zealand to have a deposit of at least 40%, it said in a statement Tuesday in Wellington. The new rule, which tightens an existing requirement that investors in Auckland have at least a 30% deposit, will be introduced Sept. 1, the RBNZ said. New Zealand’s dollar fell as markets bet Governor Graeme Wheeler will now be free to respond to persistently weak inflation by cutting the official cash rate to a record-low 2% on Aug. 11.

He has been reticent to lower borrowing costs for fear of stoking housing demand. The proposed new lending rules remove the distinction between Auckland and the rest of the country, Wheeler said in the statement. Since November, the RBNZ has required most investors buying Auckland properties to have a 30% deposit, but that has prompted many to look at opportunities in other centers. In the North Island city of Hamilton, house prices rocketed 29% in the year through June. [..] “A sharp correction in house prices is a key risk to the financial system, and there are clear signs that this risk is increasing across the country,” Wheeler said. “A severe fall in house prices could have major implications for the functioning of the banking system and cause long-lasting damage to households and the broader economy.”

New Zealand politics as a whole built this bubble. And now comes the time to blame each other for it. It will take a long time for the country to live this down.

• ‘NZ First-Home Buyers Should Benefit From Central Bank Proposal’ (Stuff)

The Reserve Bank made the “right decision” to impose new lending rules on property investors, says Prime Minister John Key. Proposed restrictions announced on Tuesday would require banks to lend only a small fraction of their loans to investors with less than a 40% deposit. Key said “in theory” the restrictions would help first-home buyers get into the market by making it more difficult and “less economic” for investors to buy a property. “What the Reserve Bank’s trying to do here is not be forced to increase interest rates, while at the same time trying to take a little bit of steam out of the housing market,” he said. “It’s got a fine line to walk here and I think it’s walking it about right.”

The Labour Party accused National of being “stuck in denial mode” over the housing crisis, but Key said it was up to everyone – central government, the Reserve Bank and councils – to stem the rate of increase in house prices. Key said the new rules would not lead to a drop in house values. “I don’t think anyone’s really arguing that house prices should dramatically fall, other than probably (economist) Arthur Grimes and Don Brash, and that’s not a view supported by the Government.” Labour and the Greens both supported the bank’s proposal. Labour’s finance spokesperson Grant Robertson said it was “the right thing to do” as nearly half of property purchases in Auckland were made by speculators and there were signs of house price increases spreading to other regions.

However, Robertson said the bank was openly calling on the Government to “step up and fix the crisis”. “Labour’s plan to fix the housing crisis includes banning offshore speculators from buying residential properties, an extension of the bright line test to five years and consulting on ending the practice of negative gearing,” he said. “It is clear that the only way to bring stability to the housing market and give first home buyers a fair go is to change the government.” [..] NZ First leader Winston Peters did not think the lending rules would have much of an effect on the housing market. “Given the way house financing is constructed from offshore, foreign investors will carry on as usual whilst New Zealand investors will simply have to stump up a greater deposit. “Accordingly, for a short time longer the house price bubble will just get greater before the inevitable crash.”

Futile. The EU has willed it. But devastating too.

• Greek Pensioners Protest Cuts At Top Constitutional Court (Kath.)

The new law on social security brings fresh cuts to new pensions that could reach up to €722 per month, generating more concern among citizens who are close to retirement. The law introduced by Labor Minister Giorgos Katrougalos provides for adjustments to pensions that have not yet been issued of between €11.38 and €722.09, prompting a group known as the Single Network of Pensions to oppose it at the Council of State, the country’s top constitutional court. The pensioners argue that the law introduces cuts that violate the constitution.

Redefining ‘police state’.

• There Will Be No Second American Revolution (Whitehead)

America is a ticking time bomb. All that remains to be seen is who – or what – will set fire to the fuse. We are poised at what seems to be the pinnacle of a manufactured breakdown, with police shooting unarmed citizens, snipers shooting police, global and domestic violence rising, and a political showdown between two presidential candidates equally matched in unpopularity. The preparations for the Republican and Democratic national conventions taking place in Cleveland and Philadelphia—augmented by a $50 million federal security grant for each city—provide a foretaste of how the government plans to deal with any individual or group that steps out of line: they will be censored, silenced, spied on, caged, intimidated, interrogated, investigated, recorded, tracked, labeled, held at gunpoint, detained, restrained, arrested, tried and found guilty.

For instance, anticipating civil unrest and mass demonstrations in connection with the Republican Party convention, Cleveland officials set up makeshift prisons, extra courtrooms to handle protesters, and shut down a local university in order to house 1,700 riot police and their weapons. The city’s courts are preparing to process up to 1,000 people a day. Additionally, the FBI has also been conducting “interviews” with activists in advance of the conventions to discourage them from engaging in protests. Make no mistake, the government is ready for a civil uprising. Indeed, the government has been preparing for this moment for years. A 2008 Army War College report revealed that “widespread civil violence inside the United States would force the defense establishment to reorient priorities in extremis to defend basic domestic order and human security.”

The 44-page report goes on to warn that potential causes for such civil unrest could include another terrorist attack, “unforeseen economic collapse, loss of functioning political and legal order, purposeful domestic resistance or insurgency, pervasive public health emergencies, and catastrophic natural and human disasters.” Subsequent reports by the Department of Homeland Security to identify, monitor and label right-wing and left-wing activists and military veterans as extremists (a.k.a. terrorists) have manifested into full-fledged pre-crime surveillance programs. Almost a decade later, after locking down the nation and spending billions to fight terrorism, the DHS has concluded that the greater threat is not ISIS but domestic right-wing extremism.

Meanwhile, the government has been amassing an arsenal of military weapons for use domestically and equipping and training their “troops” for war. Even government agencies with largely administrative functions such as the Food and Drug Administration, Department of Veterans Affairs, and the Smithsonian have been acquiring body armor, riot helmets and shields, cannon launchers and police firearms and ammunition.

Are there perhaps more important discussions to be had than who’s to blame for Brexit?

• Britain’s Part In Torture And Rendition Is Still Kept Hidden (Conv.)

Even as the Chilcot Report lays bare the sad story of the UK’s decision to join in the 2003 invasion of Iraq, a veil is still drawn over another dark aspect of Britain’s partnership with George W Bush’s administration. For years now, the British state has barely acknowledged its alleged deep involvement in the abuse of terror suspects, and there has been very little in the way of justice for the victims of torture and “rendition” – the practice of abducting suspects without due legal process and transferring them to other countries or territories for interrogation. Nonetheless, my colleague Ruth Blakeley and I have found that this involvement was direct, deep and longstanding. Moreover, most official channels have been closed to keep the extent of the UK’s co-operation from coming to light.

An aborted judge-led inquiry into British involvement in prisoner mistreatment uncovered more than 200 separate allegations of abuse, at least 40 of which were significant enough to warrant detailed investigation. Some of these cases have led to civil action against the British government in the UK courts, others have led to police investigations and criminal inquiry. In response, however, the government has maintained its innocence in every individual case while simultaneously working to block the release of relevant information. There have been attempts to withhold publication of key documents in open court, such as those which demonstrate that British intelligence knew about the torture of prisoners by the CIA before participating directly in their interrogation.

Where British courts have refused to accept government attempts to hold hearings in camera, the government has offered substantial payouts without any admission of liability. Indeed, the 2013 Justice and Security Act, which introduced so-called “closed material procedures” into the main civil courts, gave the state the legal ability to keep details of British involvement in torture out of the public record.

One of my ‘pet’ themes. Not sure Hoppe understands this is an economic phenomenon, in that centralization depends one-on-one on a growing economy. He seems to think it’s political.

• Hans-Hermann Hoppe: “Put Your Hope In Radical Decentralization” (Mises Inst.)

Can one say, then, that the politicians running the EU are even worse than the politicians running national affairs? No, and yes. On the one hand, all democratic politicians, with almost no exception, are morally uninhibited demagogues. One of my German books is titled The Competition of Crooks, which captures what democracy and democratic party politics are really all about. There is in this regard little if any difference between the political elites of Berlin, Paris, Rome, etc., and those running the show in Brussels. In fact, the EU elites are typically political has-beens, with the same mentality as their domestic counterparts, on the lookout for the super-lavish salaries, benefits, and pensions doled out by the EU. On the other hand, the EU elites are worse than their political cronies at home, of course, in that their decisions and rulings always affect a far larger number of people.

What do you predict, then, will be the future of the EU? The EU and the ECB are a moral and economic monstrosity, in violation of natural law and the laws of economics. You cannot continuously punish productivity and success and reward idleness and failure without bringing about the disaster. The EU will slide from one economic crisis to the next and ultimately break apart. The Brexit, that we have just experienced, is only the first step in this inevitable process of devolution and political decentralization.

Is there anything that an ordinary citizen can do in this situation? For one, instead of swallowing the high-sounding blabber of politicians about “freedom,” “prosperity,” “social justice,” etc., people must learn to recognize the EU for what it really is: a gang of power-lusty crooks empowering and enriching themselves at other, productive people’s expense. And secondly, people must develop a clear vision of the alternative to the present morass: not a European Super-State or even a federation of nation States, but the vision of a Europe made up of thousands of Liechtensteins and Swiss cantons, united through free trade, and in competition with one another in the attempt of offering the most attractive conditions for productive people to stay or move.

Can you give a comparative assessment of the USA and the situation in Europe? The difference between the situation in the US and Western Europe is much smaller than is generally surmised on either side of the Atlantic. For one, the developments in Europe since the end of World War II have been closely watched, steered and manipulated, whether through threats or bribes, by the political elites in Washington DC. In fact, Europe has essentially become a dependency, a satellite or vassal of the US. This is indicated on the one hand by the fact that US troops are stationed all across Europe, by now all the way right up to the Russian border. And on the other hand, this is indicated by the steady pilgrimage, performed more regularly and dutifully than any Muslim’s pilgrimage to Mecca, of the European political elites and their intellectual bodyguards to Washington DC, in order to receive their masters’ blessings.

Especially the German political elite, whose guilt complex has meanwhile assumed the status of some sort of mental illness, stands out in this regard by its cowardice, submissiveness, and servility. As for US domestic affairs, both Europeans and Americans have it typically wrong. Europeans still frequently view the US as the “land of the free,” of rugged individualism, and of unhampered capitalism. Whereas Americans, insofar as they know or claim to know anything about the world outside the US at all, frequently view Europe as a place of unhinged socialism and collectivism, entirely alien to their own “American way.” In fact, there exists no principal difference between the so-called “democratic capitalism” of the US and Europe’s “democratic socialism.”

Home › Forums › Debt Rattle July 19 2016