Theodor Horydczak Sheaffer fountain pen factory, Fort Madison, Iowa 1935

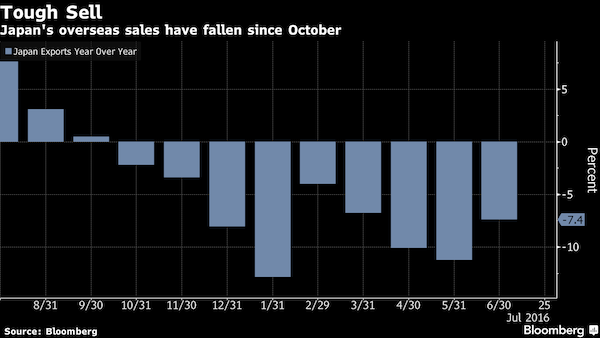

Japan shows the exact same trend as China, huge drops in exports AND imports: world trade is collapsing. Still, Reuters’ comment today: “exports fall less than expected, offer some hope of recovery”

• Japan’s Exports Decline for 9th Straight Month, Imports Plunge 18.8% (BBG)

Japan’s exports dropped again in June, with shipments down for a ninth consecutive month, underscoring the continuing challenge of reviving the nation’s economy. Overseas shipments declined 7.4% in June from a year earlier, the Ministry of Finance said on Monday. Imports slid 18.8%, leaving a trade surplus of 692.8 billion yen ($6.5 billion). Japan had a trade surplus of 1.81 trillion yen in the January-June period, the first surplus since the second half-year of 2010.

The weak exports data show that the nation’s economic recovery remains tepid and come before the Bank of Japan meets later this week to consider whether to further expand monetary stimulus. Japan’s growth is at risk as a slowdown in overseas demand and the yen’s surge this year make the nation’s products less attractive overseas and hurt the earnings of exporters. [..] Exports to the U.S. fell 6.5% in June from a year earlier, while shipments to the EU declined 0.4% and sales to China, Japan’s largest trading partner, dropped 10%.

And this is mostly just the US.

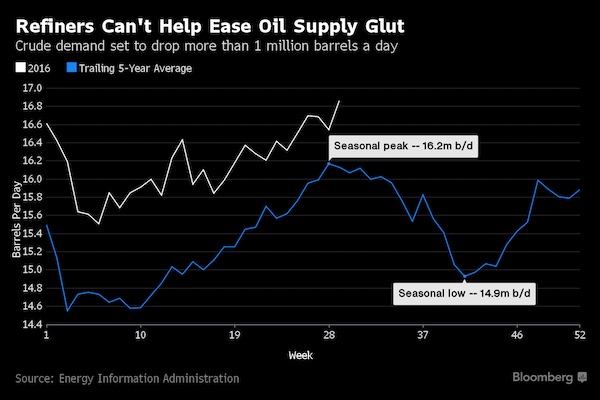

• Beware, Oil Bulls: Demand Is About To Fall Off A Cliff (BBG)

Beware, oil bulls: Just as U.S. oil production sinks low enough to drain supplies, demand is about to fall off a cliff. American gasoline consumption typically ebbs in August and September as vacationers return home, and refiners use that dip to shut for seasonal maintenance. Over the past five years, refiners’ thirst for oil has dropped an average of 1.2 million barrels a day from July to October. “People are looking ahead to the fall and are worried,” said Michael Lynch, president of Strategic Energy & Economic Research. “There’s more and more talk of prices going south of $40 and as a result people are going short.” Money managers added the most bets in a year on falling WTI crude prices during the week ended July 19, according to Commodity Futures Trading Commission data.

That pulled their net-long position to the lowest since March. WTI dropped 4.6% to $44.65 a barrel in the report week and traded at $44.14 at 11:53 a.m. Singapore time on Monday. With weekly Energy Information Administration data showing U.S. gasoline stockpiles at the highest seasonal level since at least 1990, refiners may shut sooner and for longer ahead of the Labor Day holiday in early September, the end of the driving season. “With gasoline supplies the highest since April, refiners may pull some projects forward,” said Tim Evans at Citi Futures Perspective. “This will take more support away the market and add to the broader problem of excess supply.”

“..oil bulls counting on further declines are fighting history..”

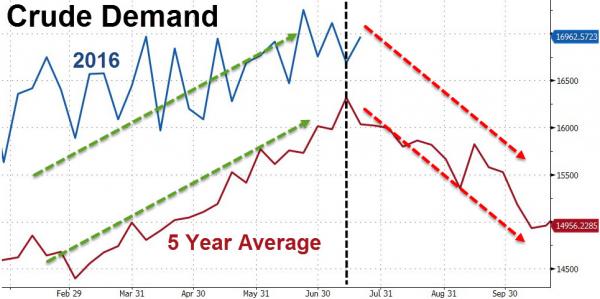

• Peak Oil ‘Demand’ & The Duelling Narratives Of Energy Inventories (ZH)

Crude oil inventories in the U.S. have fallen 23.9 million barrels since the end of April, but, as Bloomberg notes, oil bulls counting on further declines are fighting history. Over the past five years refiners’ crude demand has fallen an average of 1.2 million barrels a day from the peak in July to the low in October. “The rough part will be once refineries start going into maintenance,” said Rob Haworth, a senior investment strategist in Seattle at U.S. Bank Wealth Management. “We aren’t drawing down inventories very fast and the pressure on prices will increase.”

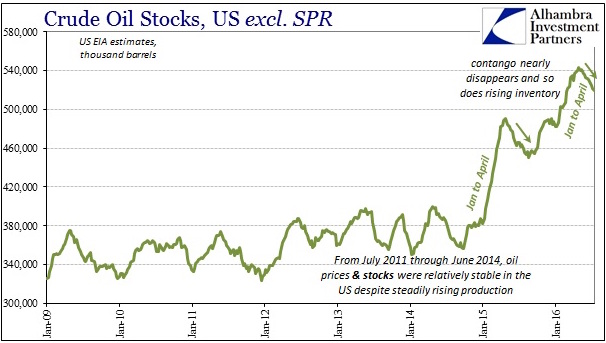

But, as Alhambra Investment Partner’s jeffrey Snider notes, the significance of crude and gasoline inventory (and price) changes is the difference in narratives and what is supporting them. While there is a direct relationship between the steepness of contango in the oil futures curve and the amount of crude siphoned from the market to storage, it is not an immediate one. When crude prices originally collapsed starting in late 2014, twisting the WTI curve from backwardation to so far permanent contango (of varying degrees), it wasn’t until January 2015 that domestic inventories began their surge. And while oil prices rose through spring, flattening out again the futures curve and drastically reducing that contango, the spike in oil stocks didn’t actually end until almost the end of last April.

Given the “dollar’s” explicit seasonality, combined with the usual intra-year swings of crude itself, it isn’t surprising to find the process repeated almost exactly a year later. This time it happened in two separate events, the latter of which was a near replica of the start to 2015. The futures curve was pressed into deep contango after October 2015, and sure enough oil inventories spiked again in early January 2016. And like last year, though the futures curve would begin to flatten out again starting February 12, oil storage levels continued to build until the end of April.

“Most investors today have no idea what is happening in the bond market and have exposed themselves to incredible amounts of risk.”

• What Happens When The Bond Bubble Finally Pops (IceCap)

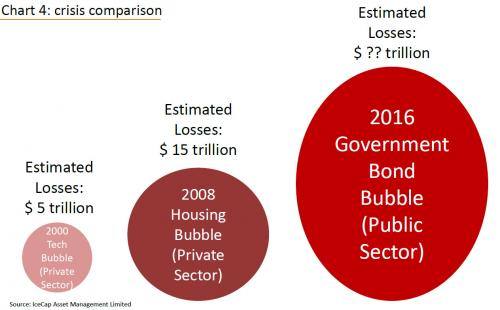

The 2008-09 crisis was caused by the private sector. Regardless of the reason or the assigned blame, far too many people and companies borrowed way too much money and when the bubble eventually popped (they always do), millions of people and companies lost an awful lot of money. The one important thing to know from those dark days is that governments were told (by the banks) that in order to save the world they had to save the banks. But what few people realise is that when they saved the banks, two things happened:

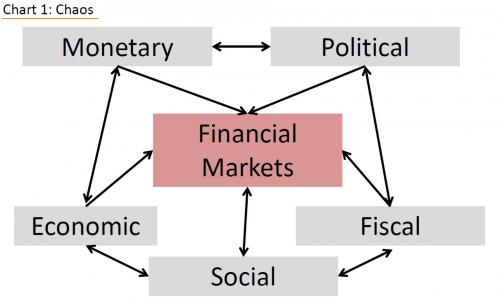

1. Tax payers and the most conservative investors from all over the world saved the banks – in other words, many who didn’t take the risk had to bailout those who took excessive risks. 2. The bailout and stimulus programs simply shifted the enormous debt crisis away from the private sector and straight onto the laps of the public sector. In other words, the bubble has shifted away from the PRIVATE sector to the GOVERNMENT sector. And when the government sector has a crisis, it is reflected in the GOVERNMENT BOND MARKET. To put this government bond market crisis into perspective, we offer our Chart 4 which shows a relative comparison to recent crises from the private sector.

To really understand how serious of a problem this is, just know that a mere 1% rise in long-term interest rates, will create losses of approximately $2 Trillion for bond investors. The fun really starts when long-term yields increase by 3%, and then 6% and then 10%. This is the point when certain government bonds simply stop trading altogether, and losses pile up at 50%-75%. When long-term rates decline, it is usually in a gradual trending manner – such as what we are experiencing today. For those of you shaking your heads in disagreement, we kindly suggest you research your history of long-term interest rates.

However, when long-term rates go higher – it is an explosive move. Long-term rates ratchet up VERY quickly making the sudden loss instant, while exponentially increasing the funding cost of the borrower. Most investors today have no idea what is happening in the bond market today and have exposed themselves to incredible amounts of risk. And more importantly, because a global crisis in the government bond market has never occurred in our lifetime – advisors, financial planners and big banks continue the tradition of telling their clients that bonds are safer than stocks. As a result, the most conservative investors in the word remain heavily invested in the bond market and are therefore smack dab in the middle of the riskiest investment they’ll ever see. Chaotic indeed.

“Not unlike the Fed, it is clear that the BOJ is trapped in its own end game.”

• With Kuroda Under Pressure To Increase Stimulus Again, Dissenters Appear (ZH)

With what little credibility it still has, the Bank of Japan is set to meet this week and likely agree on the size of yet another stimulus package for the economy. Prime Minister Abe’s main economic advisor Etsuro Honda recently detailed in an interview that the BOJ should increase its Qualitative and Quantitative Monetary Easing (QQE) program from ¥80 trillion to ¥90 trillion. In addition, there has been growing speculation regarding coordinated fiscal and monetary stimulus. The fiscal stimulus efforts are not expected to be unveiled until August, according to the WSJ. Expectations point to a “multiyear program valued at ¥20 trillion ($188 billion), including direct spending, government loans and public-private financing.”

Perhaps more interesting, this time, Kuroda may have a difficult time convincing the 8 remaining members of the monetary board. As the Journal notes, “other BOJ officials are signaling a reluctance to act, underscoring questions about whether the central bank has reached the limits of its powers to revive Japan’s economy. They note that monetary policy is already extremely accommodative, with bond yields and interest rates at or near record lows, and express doubts that additional easing would make fiscal stimulus much more effective, according to people familiar with the central bank’s thinking.” As core metrics and corporate expectations of inflation plummet, Kuroda’s promise to do “whatever it takes” to reach 2% inflation seems to be under significant threat.

Doing nothing now would “amount to an admission that the BOJ’s monetary policy has reached its limits—it wants to move, but it can’t,” said Yuichi Kodama, chief economist at Meiji Yasuda Life Insurance. Not unlike the Fed, it is clear that the BOJ is trapped in its own end game. As Kyle Bass recently told CNBC, “The textbooks aren’t working for the academics … I fear they’re going to have to go into some sort of jubilee where the central bank just forgives the debt that they own…I don’t know what happens to the yield curve then. The unconventional policies aren’t working, so they’re going to have to go to unconventional, unconventional policies next. I don’t know where that takes them.”

“There is no banking problem in Italy..” There’s only €360 billion in bad loans…

• Italy Insists There’s ‘No Banking Problem’ As Stress Tests Loom Large (CNBC)

Top finance officials in Italy have moved to play down the issues the country’s banking industry is facing, just days ahead of crucial stress tests by the ECB. Speaking on the outskirts of a G20 finance leaders meeting in Chengdu, China, Italy’s Finance Minister, Pier Carlo Padoan, told CNBC that the Italian banks “do not need [a] rescue.” “There is no banking problem in Italy, it’s one particular case which is being dealt with … I’m confident this will be successful,” he said Sunday, highlighting issues at Monte dei Paschi (BMPS). That institution is thought to be the weakest link among lenders in the euro zone’s third-largest economy. Italian policymakers and EU officials have been trying to deal with its fragile banking system, bogged down by non-performing loans (NPLs) estimated to total €360 billion.

Reports had suggested that Matteo Renzi, the Italian prime minister, is hoping to bailout the banking sector, which would contravene EU rules. Such a solution would stand in contrast to a bondholder “bail-in,” as Italian households are heavily exposure to the asset class. These reports have since been denied. These problems in Italy have roiled stock markets in the past few weeks, alongside the uncertainty following the British vote to leave the European Union. Shares of BMPS have been particularly volatile. However, Padoan told CNBC that this particular bank had put in place a “very effective restructuring plan” and said there had been a widespread misunderstanding of the whole industry. “(Italian banks are) not more vulnerable than they used to be. They have been strengthening over time due to reforms that have been introduced by the government,” he added.

It will cost the global economy $1.6 trillion if companies don’t go deeper into debt to buy each other… Completely empty rhetoric.

• Brexit Will Cost UK Up To $340 Billion In Lost M&A: Study (CNBC)

The Brexit vote will cost the U.K. up to $338 billion in lost merger-and-acquisition (M&A) activity by 2020 and the global economy up to $1.6 trillion, law firm Baker & McKenzie said on Monday. “An active M&A market is all about confidence and credibility,” Michael DeFranco, global chair of M&A at Baker & McKenzie, said in a report. “To restore that confidence the U.K. government will need to get to grips with the enormous challenge of negotiating a new trading relationship with the EU as quickly as practically possible. Otherwise we move into more dangerous territory,” he added. The forecasts above are based on an adverse scenario where Brexit incites growing populism in mainland Europe and undermines EU support among remaining members.

In Baker & McKenzie’s central forecast, Brexit still knocks $239 billion off U.K. M&A activity by 2020 and $409 billion off global volumes. In 2017 alone, U.K. M&A transactions are seen falling by 33%. “In the last few days we have seen evidence that the M&A market in the U.K. won’t come to a crashing halt even if it won’t be at its previous pace,” Tim Gee, London M&A partner at Baker & McKenzie, said. “There are still plenty of buyers and sellers for the right deal at the right price. There are already some clear upsides — global organizations looking to acquire U.K. companies will find that a weaker pound makes U.K. valuations more attractive, although the uncertainty surrounding trade negotiations could deter the more risk averse,” he added.

Hilarious.

• “Putin’s Useful Idiot”: Anyone Who Disagrees With The Establishment (ZH)

This weekend we once again got confirmation that any time the generic narrative spectacularly falls apart, and the “establishment” is caught with its pants down (or, in the case of the DNC, engaging in borderline election fraud leading to what the FT just described as “Democrats in turmoil“) what does it do? Why blame Putin of course, and more specifically his “useful idiots”, and hope the whole thing blows over quickly.

Not convinced? Here is the proof.

And of course:

So sad it’s funny. Hubris rules.

• Leaked DNC Emails Reveal Inner Workings Of Party’s Finance Operation (WaPo)

In the rush for big donations to pay for this week’s Democratic convention, a party staffer reached out to Tennessee donor Roy Cockrum in May with a special offer: the chance to attend a roundtable discussion with President Obama. Cockrum, already a major Democratic contributor, was in. He gave an additional $33,400. And eight days later, he was assigned a place across the table from Obama at the Jefferson Hotel in downtown Washington, according to a seating chart sent to the White House. The 28-person gathering drew rave reviews from the wealthy party financiers who attended. “Wonderful event yesterday,” New York lawyer Robert Pietrzak wrote to his Democratic National Committee contact. “A lot of foreign policy, starting with my question on China. The President was in great form.”

The details of the high-dollar event were captured in the trove of internal DNC emails released last week by the site WikiLeaks that has riled the party as delegates gather in Philadelphia to nominate Hillary Clinton. Internal discussions of the May 18 event with Obama and other aggressive efforts to woo major donors reveal how the drive for big money consumes the political parties as they scramble to keep up in the age of super PACs. The DNC emails show how the party has tried to leverage its greatest weapon — the president — as it entices wealthy backers to bankroll the convention and other needs. At times, DNC staffers used language in their pitches to donors that went beyond what lawyers said was permissible under a White House policy designed to prevent any perception that special interests have access to the president.

Facebook plays multiple questionable roles these days. This is an ugly one.

• Facebook Admits To Blocking Wikileaks Links In DNC Email Hack (NYP)

Facebook admitted Sunday that it had blocked links to the Wikileaks trove of emails hacked from the Democratic National Committee. In a Twitter post late Saturday, WikiLeaks accused the social media giant of “censorship” and gave its followers an online workaround, saying “try using https://archive.is.” The WikiLeaks allegation followed a firestorm of controversy that erupted earlier this year when former Facebook workers admitted routinely suppressing conservative news. In response to the WikiLeaks charge, another Twitter user, @SwiftOnSecurity, chimed in that “Facebook has an automated system for detecting spam/malicious links, that sometimes have false positives,” which prompted a response from the company’s chief security officer. “It’s been fixed,” Facebook CSO Alex Stamos tweeted.

“..retribution for monetary donations to Sanders’ campaign..” That would be some $220 million?!

• How Can You Join the DNC Class Action Lawsuit? (Heavy)

With news about the WikiLeaks dump showing the Democratic National Committee working to push Hillary Clinton’s nomination rather than remaining neutral, there may be more evidence than ever for a class action lawsuit that has been filed against the Democratic National Committee. But how can you join the fraud lawsuit? There’s still time and we have all the details below. Here’s what you need to know. So far, thousands of Bernie Sanders supporters and other voters have requested to join DNC class action lawsuit, which is being led by Beck & Lee Trial Lawyers, a civil litigation firm based in Miami. The lawsuit is based on DNC internal emails hacked by Guccifer 2.0 which show the DNC was working behind the scenes to boost Clinton.

These emails show that work starting as early as May 2015, a month after Sanders had entered the race. Jared Beck told US Uncut that Article 5 Section 4 of the Democratic Party charter and bylaws requires the chair of the DNC to stay neutral during the primaries: “In the conduct and management of the affairs and procedures of the Democratic National Committee, particularly as they apply to the preparation and conduct of the Presidential nomination process, the Chairperson shall exercise impartiality and evenhandedness as between the Presidential candidates and campaigns. The Chairperson shall be responsible for ensuring that the national officers and staff of the Democratic National Committee maintain impartiality and evenhandedness during the Democratic Party Presidential nominating process.”

[..] Beck said there were six claims to the case. The first is fraud against the DNC and Wasserman Schultz, stating that they broke legally binding agreements by strategizing for Clinton. The second is negligent misrepresentation. The third is deceptive conduct by claiming they were remaining neutral when they were not. The fourth is retribution for monetary donations to Sanders’ campaign. The fifth is that the DNC broke its fiduciary duties during the primaries by not holding a fair process. And the sixth is for negligence, claiming that the DNC did not protect donor information from hackers.

“..can only carry reports provided by government-controlled print or online media..”

• China Slaps Ban on Internet News Reporting as Crackdown Tightens (BBG)

China’s top internet regulator ordered major online companies including Sina and Tencent to stop original news reporting, the latest effort by the government to tighten its grip over the country’s web and information industries. The Cyberspace Administration of China imposed the ban on several major news portals, including Sohu.com and NetEase, Chinese media reported in identically worded articles citing an unidentified official from the agency’s Beijing office. The companies have “seriously violated” internet regulations by carrying plenty of news content obtained through original reporting, causing “huge negative effects,” according to a report that appeared in The Paper on Sunday.

The agency instructed the operators of mobile and online news services to dismantle “current-affairs news” operations on Friday, after earlier calling a halt to such activity at Tencent, according to people familiar with the situation. Like its peers, Asia’s largest internet company had developed a news operation and grown its team. Henceforth, they and other services can only carry reports provided by government-controlled print or online media, the people said, asking not to be identified because the issue is politically sensitive.

The sweeping ban gives authorities near-absolute control over online news and political discourse, in keeping with a broader crackdown on information increasingly distributed over the web and mobile devices. President Xi Jinping has stressed that Chinese media must serve the interests of the ruling Communist Party.

China, Turkey, good thing there’s the internet.

• Turkey Issues Arrest Warrants For 42 Journalists After Coup (AFP)

Turkish authorities have issued arrest warrants for 42 journalists as part of the investigation into the failed coup aimed at toppling President Recep Tayyip Erdogan, television news channels said Monday. Among those targeted by the warrants were prominent journalist Nazli Ilicak who was fired from the pro-government Sabah daily in 2013 for criticising ministers caught up in a corruption scandal, NTV and CNN-Turk said. There was no indication any of the journalists had been detained so far. The government blamed the 2013 corruption scandal on the US-based cleric Fethullah Gulen who it also accuses of being behind the coup.

The Hurriyet daily said that the warrants – the first to target several members of the press in the crackdown over the failed July 15 coup bid – were issued by the office of Istanbul anti-terror prosecutor Irfan Fidan. The prosecutor said an operation was already in progress to detain the journalists but Ilicak was not found at home in Istanbul and could be holidaying on the Aegean. Provincial police there have been alerted, it said. Erdogan’s government had been under fire even before the coup for restricting press freedoms in Turkey, accusations the authorities strongly deny.

It’s the government, parliament, all the individuals that make up these institutions, that should be held accountable.

• Refugee Camp Company In Australia ‘Liable For Crimes Against Humanity’ (G.)

The company that has taken over the management of Australia’s offshore immigration detention regime has been warned by international law experts that its employees could be liable for crimes against humanity. Spanish infrastructure corporation Ferrovial, which is owned by one of the world’s richest families and the major stakeholder in Heathrow airport, has been warned by professors at Stanford Law School that its directors and employees risk prosecution under international law for supplying services to Australia’s camps on Nauru and Manus Island in Papua New Guinea.

“Based on our examination of the facts, it is possible that individual officers at Ferrovial might be exposed to criminal liability for crimes against humanity under the Rome Statute,” said Diala Shamas, a clinical supervising attorney at the International Human Rights and Conflict Resolution Clinic at Stanford Law School. “We have raised our concerns with Ferrovial in a private communication to their officers and directors detailing our findings. We have yet to hear back.” Shamas said her colleagues’ findings should be a warning to any company or country seeking to replicate Australia’s refugee policies elsewhere. “One of the things that we and our partners are concerned about is the timing of all of this,” said Shamas, who also worked in conjunction with the Global Legal Action Network.

[..] The NBIA executive director, Shen Narayanasamy, told the Guardian that Ferrovial’s complicity in the abuses on Nauru and Manus was “incredibly cut-and-dried under international law”. “There is no shadow of a doubt that gross human rights violations are occurring, no shadow of a doubt that Ferrovial is complicit,” she said. “The risk to Ferrovial is essentially the annihilation of its reputation. As a company that relies upon contracting with governments for service provision, they put at risk all of their contracts, and all of the future contracts they hope to win. They put at risk all of their ratings, all of their client relationships – people will assess that they are too controversial, too unethical to have a relationship with, and they could see large institutional investors divesting.”

NBIA links the Pacific Ocean camps to the 22 mainly European banks that fund Ferrovial’s activities, and six European and American investment funds that own shares in the company. Twenty-two mainly European banks – many of them household names – have jointly provided Ferrovial with a €1.25bn (£1bn) loan for general corporate purposes. The banks include Barclays, RBS, Santander, HSBC, Goldman Sachs, BNP Paribas, Citigroup, JP Morgan Chase – as well as Instituto de Crédito Oficial, a bank owned by the Spanish state. The other banks are Banca IMI (Intesa Sanpaolo), Banco Sabadell, Banco Popular Español, Bank of America, Bankinter, BBVA, Crédit Agricole, Deutsche, Mediobanca, Mizuho, Morgan Stanley, Société Générale, and the Royal Bank of Canada.

Home › Forums › Debt Rattle July 25 2016