Dorothea Lange Crossroads grocery store and filling station, Yakima, Washington, Sumac Park 1939

” They had no fall-back plans on how to tackle a systemic crisis in the eurozone [..] because they had ruled out any possibility that it could happen.”

“Some staff members warned that the design of the euro was fundamentally flawed but they were overruled..”

Ambrose on Twitter: ”IMF seems to have slipped leash of political control. Even its own watchdog in dark on EMU crisis. Astonishing saga..”

• IMF: Disastrous Love Affair With Euro, Apologies For Immolation Of Greece (AEP)

The IMF’s top staff misled their own board, made a series of calamitous misjudgments in Greece, became euphoric cheerleaders for the euro project, ignored warning signs of impending crisis, and collectively failed to grasp an elemental concept of currency theory. This is the lacerating verdict of the IMF’s top watchdog on the Fund’s tangled political role in the eurozone debt crisis, the most damaging episode in the history of the Bretton Woods institutions. It describes a “culture of complacency”, prone to “superficial and mechanistic” analysis, and traces a shocking break-down in the governance of the IMF, leaving it unclear who is ultimately in charge of this extremely powerful organisation. The report by the IMF’s Independent Evaluation Office (IEO) goes above the head of the managing director, Christine Lagarde.

It answers solely to the board of executive directors, and those from Asia and Latin America are clearly incensed at the way EU insiders used the Fund to rescue their own rich currency union and banking system. The three main bail-outs for Greece, Portugal, and Ireland were unprecedented in scale and character. The trio were each allowed to borrow over 2,000% of their allocated quota – more than three times the normal limit – and accounted for 80pc of all lending by the Fund between 2011 and 2014. In an astonishing admission, the report said its own investigators were unable to obtain key records or penetrate the activities of secretive “ad-hoc task forces”. Mrs Lagarde herself is not accused of obstruction.

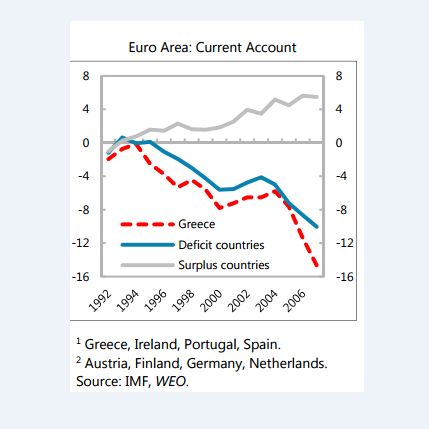

“Many documents were prepared outside the regular established channels; written documentation on some sensitive matters could not be located. The IEO in some instances has not been able to determine who made certain decisions or what information was available, nor has it been able to assess the relative roles of management and staff,” it said. The report said the whole approach to the eurozone was characterised by “groupthink” and intellectual capture. They had no fall-back plans on how to tackle a systemic crisis in the eurozone – or how to deal with the politics of a multinational currency union – because they had ruled out any possibility that it could happen. “Before the launch of the euro, the IMF’s public statements tended to emphasize the advantages of the common currency, “ it said. Some staff members warned that the design of the euro was fundamentally flawed but they were overruled.

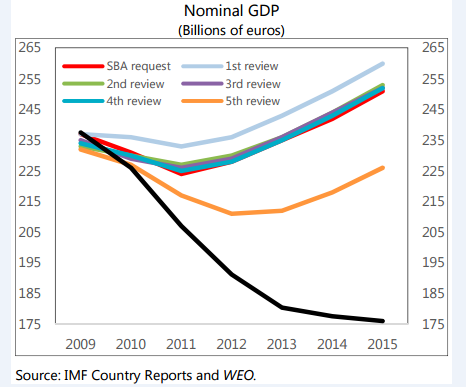

The forecasts for Greek growth compared to what actually happened Credit: IMF

[..] While the Fund’s actions were understandable in the white heat of the crisis, the harsh truth is that the bail-out sacrificed Greece in a “holding action” to save the euro and north European banks. Greece endured the traditional IMF shock of austerity, without the offsetting IMF cure of debt relief and devaluation to restore viability. A sub-report on the Greek saga said the country was forced to go through a staggering squeeze, equal to 11pc of GDP over the first three years. This set off a self-feeding downward spiral. The worse it became, the more Greece was forced cut – what ex-finance minister Yanis Varoufakis called “fiscal water-boarding”. “The automatic stabilizers were not allowed to operate, thus aggravating the pro-cyclicality of the fiscal policy, which exacerbated the contraction,” said the report.

Who says we need global growth?

• Global Trade Is Not Growing Slower – It’s Not Growing At All (WEF)

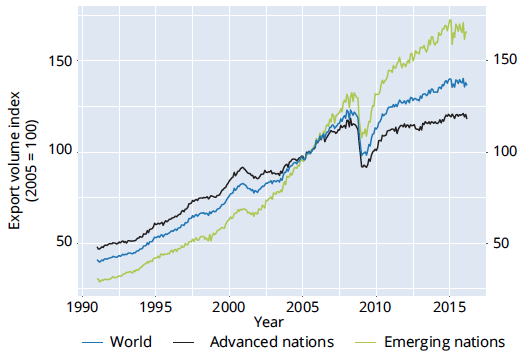

Falling rates of global trade growth have attracted much comment by analysts and officials, giving rise to a literature on the ‘global trade slowdown’ (Hoekman 2015, Constantinescu et al. 2016). The term ‘slowdown’ gives the impression of world trade losing momentum, but growing nonetheless. The sense of the global pie getting larger has the soothing implication that one nation’s export gains don’t come at the expense of another’s. But are we right to be so sanguine? Using what is widely regarded as the best available data on global trade dynamics, namely, theWorld Trade Monitor prepared by the Netherlands Bureau of Economic Policy Analysis, the 19th Report of the Global Trade Alert, published today, evaluates global trade dynamics (Evenett and Fritz 2016).

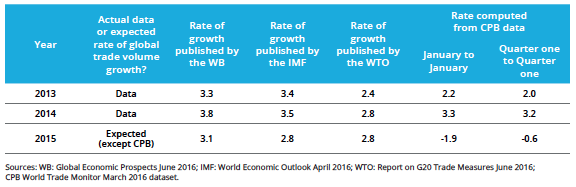

Figure 1 World trade plateaued around the start of 2015

Our first finding that the rosy impression painted by some should be set aside. We demonstrate that: •World export volumes reached a plateau at the start of January 2015. The same finding holds if import volume or total volume data are used instead. •Both industrialised countries’ and emerging markets’ trade volumes have plateaued (Figure 1). •Except during global recessions, a plateau lasting 15 months is practically unheard of since the Berlin Wall fell. •In 2015 the best available data on world export volumes diverges markedly from that reported by the WTO, IMF, and World Bank, and probably explains why analysts at these organisations have missed this profound change in global trade dynamics (Table 1).

Table 1 Marked differences in reported global trade volume growth in 2015

“The fight against sluggish growth rates..” Maybe we should stop that fight?

• Not Even Fiscal Stimulus Will Save Global Growth – Deutsche Bank (BBG)

While monetary policy may be at — or beyond — the limits of its usefulness in stoking global growth, economists at Deutsche Bank say fiscal stimulus is unlikely to be much more effective. At least, not the kind that is politically possible. The fight against sluggish growth rates and low inflation has seen central banks from Europe to Japan buy up swaths of the bond market, and experiment with negative interest rates. Yet with growth still stubbornly slow, these efforts are seen either as ineffective or counterproductive, spurring calls for more active fiscal policy, whether it take the form of tax cuts or ‘helicopter money’ transfers to the private sector. Just this past weekend, finance ministers from the Group of Twenty meeting in China gave strong backing to this view.

“Monetary policy alone cannot lead to balanced growth,” they said. “Fiscal strategies are equally important to support our common growth objectives.” Those comments could signal a “new direction for fiscal policy,” according to Deutsche Bank economists led by Peter Hooper. Yet while they welcomed the potential dethroning of monetary policy as “the principal lever of support,” the economists expect that the boost to global growth from the most probable fiscal packages “is likely to be modest.” Europe is in greatest need of fiscal stimulus — even though the ECB has been gobbling up bonds since 2014, and has cut its deposit rate to minus 0.4% — and it’s also where fiscal stimulus would be most effective, according to the Deutsche Bank economists.

Are Kuroda and Abe drifting apart?

• Kuroda’s $26 Billion Gift to Stock Market Underwhelms Investors (BBG)

Welcome to Japan, where a central bank plan to pump $26 billion a year more into stocks and continue buying 30 times that in debt sees equities struggle to advance and bonds plunge. The Topix index slid as much as 1.4% in Tokyo after the Bank of Japan boosted its annual exchange-traded fund budget to 6 trillion yen ($58 billion), from 3.3 trillion yen. Japanese government bonds headed for their steepest slump since 2008, as policy makers retained a plan to expand the monetary base by an annual 80 trillion yen. Speculation among investors and analysts that Friday’s policy announcement might even see the adoption of so-called helicopter money, as well as a cut to the negative deposit rate, resulted in a lukewarm reception for the expanded stimulus program.

The yen surged as much as 2.4%, the most since the U.K. decision to leave the European Union, even as BOJ Governor Haruhiko Kuroda hinted more easing might still be in the pipeline. “The BOJ had a choice of about five boxes to tick today, but only chose one,” said Sean Callow, a senior FX strategist at Westpac Banking in Sydney. “Buying more ETFs was as widely expected as balloons dropping on Hillary.” [..] In an unexpected development, Kuroda has ordered an assessment of the effectiveness of BOJ policy, to be undertaken at the next meeting, which is scheduled for Sept. 20-21.

“The BOJ won’t admit it, but it has reached the limits of quantitative easing and negative rates.”

• Bank of Japan Blames Brexit As It Unleashes More Monetary Stimulus (G.)

The Bank of Japan has announced a modest expansion of its monetary easing programme, blaming Britain’s decision to leave the European Union as the biggest uncertainty facing world markets. The central bank acknowledged government pressure for more action to drive the yen lower and help Japan’s legion of exporters, but stopped short of upping its bond purchases or cutting interest rates. Instead the bank sanctioned an increase in purchases of exchange-traded funds as it attempted to accelerate inflation towards its 2% target. The moves disappointed the markets, which had expected another big influx of liquidity. The Nikkei stock average yo-yoed wildly in the aftermath of the move before falling nearly 2% in late afternoon trade.

Other stock markets in the region were also down while futures trading indicated the FTSE100 and Dow Jones would open slightly down on Friday morning. The yen rose 2% against the US dollar, which will frustrate government attempts to devalue the stubbornly high currency. [..] Some market experts said the lack of bold action suggested the bank had decided that the effectiveness of its huge monetary easing programme had reached its limits. “The BOJ did not live up to expectations … increasing ETF purchases makes no contribution to achieving 2% inflation,” said Norio Miyagawa, senior economist at Mizuho Securities. “The BOJ won’t admit it, but it has reached the limits of quantitative easing and negative rates.”

After Abenomics has been running for 3 years, deflation continues unabated.

• Japan Sees Weaker Consumer Spending, Manufacturing In June (AP)

Japan reported further signs of weakness in its economy in June, with industrial output and consumer spending falling from the year before. The data released Friday were in line with expectations the central bank may follow the government’s lead in opting for more stimulus at a policy meeting that ends Friday. Core inflation excluding volatile food prices dropped 0.5% from 0.4% in May. The Bank of Japan and government have made scant progress toward a 2% inflation goal set more than three year ago, partly due to the prolonged slump in crude oil prices.

Household spending fell 2.2% from a year earlier, while industrial output slipped 1.9% on an annual basis. Earlier this week Prime Minister Shinzo Abe announced plans to propose 28 trillion yen ($267 billion) in spending initiatives to help support the sagging economic recovery. Household incomes rose 0.3% in June, weak for a month when workers commonly receive bonuses.

Let’s not pretend there is a way out for Japan.

• Japan Should Stop Chasing A Weaker Yen – Steen Jakobsen (CNBC)

Japan has aimed a lot of firepower at keeping its currency weak, but a stronger yen might be just what the long moribund economy really needs, said Saxo Bank’s Chief Investment Officer Steen Jakobsen. “The government of Japan sort of quasi-promises to maintain a weak yen in order to support and buy time for the export companies,” Jakobsen said. “Having a focus only on the export sector takes away from [what] the focus should be: To reform the domestic economy.” Jakobsen’s comments came just as Japan appears set to level a double bazooka of easing at its sluggish economy, firepower that appears aimed, at least in part, at wiping out the recent gains in the newly resurgent yen.

The Bank of Japan was widely expected to announce another monetary easing bomb at the close of its two-day meeting on Friday, with analysts anticipating that the central bank would either cut interest rates deeper into negative territory or expand its asset purchase program or both. At the same time, fresh fiscal stimulus was expected to offer additional cross fire. News agency Jiji reported that Prime Minister Shinzo Abe had revealed a 28 trillion yen ($265 billion) injection, which Reuters estimated at 6% of Japan’s economy.

The double-barreled approach was in line with Abe’s plan to break Japan’s economy out of a decades-long deflationary spiral. That effort, dubbed Abenomics, was introduced in 2013 with a plan for three “arrows:” A first arrow of massive quantitative easing from the BOJ, followed by a second arrow of increased government spending and a third arrow of structural reforms, including immigration and labor changes. But Jakobsen noted that the latest plan for combined BOJ and fiscal easing just replayed the same strategy. “The present situation we’re talking about is just re-launching arrow one and two,” he said. “We’re still missing arrow number three, which is the reform side.”

It didn’t take long to kill the dream.

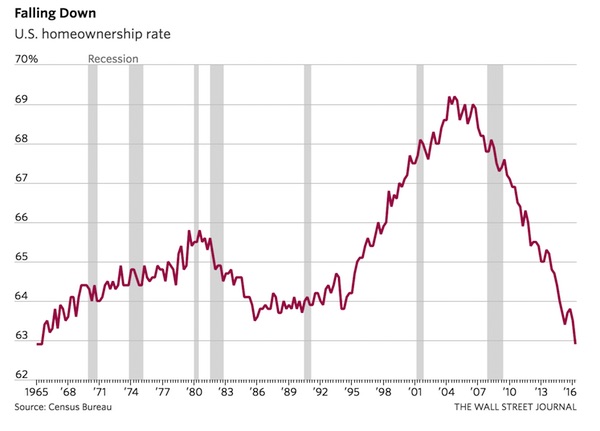

• US Homeownership Rate Falls to Five-Decade Low (WSJ)

The U.S. homeownership rate fell to the lowest level in more than 50 years in the second quarter of 2016, a reflection of the lingering effects of the housing bust, financial hurdles to buying and shifting demographics across the country. But the bigger picture also suggests more Americans are gaining the confidence to strike out on their own, albeit as renters rather than buyers. The homeownership rate, the proportion of households that are owner-occupied, fell to 62.9%, half a percentage point lower than the second quarter of 2015 and 0.6%age point lower than the first quarter 2016, the Census Bureau said on Thursday. That was the lowest figure since 1965.

There are many ways to interpret the numbers. Part of the story is the catastrophic housing market collapse, which was especially severe for Generation X—those born from 1965 to 1984. Younger households may struggle to save amid student debt, growing rents, rising home prices and limited inventories of starter homes. Indeed, the homeownership rate for 18- to 35-year-olds slipped to 34.1%, the lowest level in records dating to 1994. At 77.9%, the homeownership rate was highest for those 65 years and over.

But the broader picture suggests a degree of economic strength: Renters are spurring a steady increase in overall household formation. Renter-occupied housing units jumped by 967,000 from the same period a year earlier. Overall, household formation has been fairly steady since the early days of the expansion. A rising number of households suggests more people are optimistic enough to strike out on their own and helps further spur growth as they buy furniture, start families and move up the economic ladder. Indeed, moving into a rental unit has been entirely responsible for rising household formation since the recession began.

“It’s probably going to take a little longer than they expected.” “Demand growth has faltered a bit.”

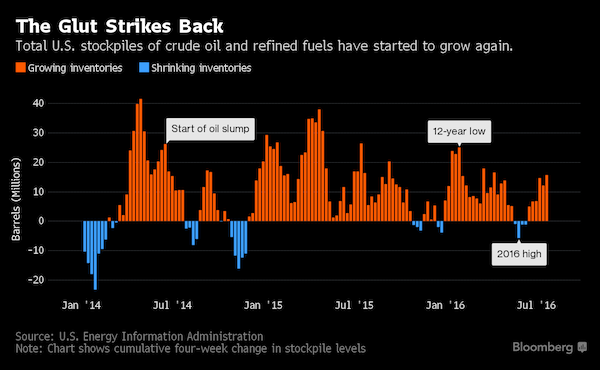

• Oil Glut Proves Harder To Kill Than Saudis To Goldman Predicted (BBG)

The bullish spirit that gripped oil traders as industry giants from Saudi Arabia to Goldman Sachs declared the supply glut over is rapidly ebbing away. Oil is poised for a drop of 20% since early June, meeting the definition of a bear market. While excess crude production is abating, inventories around the world are brimming, especially for gasoline, and a revival in U.S. drilling threatens to swell supplies further. As the output disruptions that cleared some of the surplus earlier this year begin to be resolved, crude could again slump toward $30 a barrel, Morgan Stanley predicts. “The tables are turning on the bulls, who were prematurely constructive on oil prices on the basis the re-balancing of the oil market was a done deal,” said Harry Tchilinguirian at BNP Paribas in London.

“It’s probably going to take a little longer than they expected.” Oil almost doubled in New York between February and June as big names from Goldman and the International Energy Agency to new Saudi Energy Minister Khalid Al-Falih said declining U.S. oil production and disruptions from Nigeria to Canada were finally ending years of oversupply. Prices retreated to a three-month low near $41 a barrel this week amid a growing recognition the surplus will take time to clear. “There’s lots of crude and refined products around,” said David Fransen, Geneva-based head of Vitol SA, the biggest independent oil trader. “Demand growth has faltered a bit.”

Don’t worry, prices will come down.

• Wholesale California Gasoline Prices Plunge, Consumers Still Pay Up (R.)

Wholesale gasoline in California became the cheapest in the country this week, but that change has largely gone unseen at the pump, where consumers are still paying the highest prices in the continental United States to fill up their cars. Ample inventories along with relatively stable refinery operations and imports has driven down the spot value of gasoline in Los Angeles at the wholesale level by more than 60 cents since mid-June. However, that has not translated to similarly lower retail fuel prices for consumers because of peculiarities in California’s market. The declines in the state’s retail gasoline market over that period of time have averaged less than 14 cents, according to data from the U.S. Energy Information Administration.

On Thursday, wholesale California gasoline was trading below $1.20 a gallon. The spread between California’s wholesale and retail gasoline markets was about $1.50 a gallon the week to July 25, about 40 cents wider than a similar spread in the New York market. California is one of the most expensive places in the United States to produce gasoline because of the state’s unique blending requirements and its relative isolation from the rest of the country, which makes securing crude oil to refine pricier. Gasoline prices across the country have plunged as crude has also slumped in the past two years, pressured by a global supply glut. On the West Coast, gasoline stocks are at a five-year seasonal high of 29.6 million barrels, according to the EIA.

Lots of reports due later today.

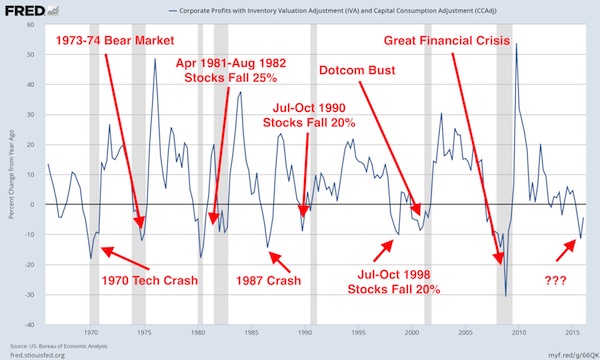

• In Past 50 Years Earnings Recession This Big Always Triggered Bear Market (F.)

It’s earnings season once again and it looks as if, as a group, corporate America still can’t find the end of its earnings decline since profits peaked over a year ago. What’s more analysts, renowned for their Pollyannish expectations, can’t seem to find it, either. So I thought it might be interesting to look at what the stock market has done in the past during earnings recessions comparable to the current one. And it’s pretty eye-opening. Over the past half-century, we have never seen a decline in earnings of this magnitude without at least a 20% fall in stock prices, a hurdle many use to define a bear market. In other words, buying the new highs in the S&P 500 today means you believe “this time is different.” It could turn out that way but history shows that sort of thinking to be very dangerous to your financial wellbeing.

Great idea. There should be one in Athens too.

• Barcelona Unveils ‘Shame Counter’ That Tracks Refugee Deaths (AFP)

Spain’s seaside city of Barcelona on Thursday unveiled a large digital counter that will track the number of refugees who die in the Mediterranean, next to one of its popular beaches. “We are inaugurating this shame counter which will update all known victims who drowned in the Mediterranean in real time,” said Mayor Ada Colau. The monument consists of a large metal rectangular pillar that comes decked out with a digital counter above the inscription “This isn’t just a number, these are people.”

The counter kicked off with 3,034 — the number of migrants and refugees who have died trying to cross the Mediterranean to Europe in 2016, according to the International Organization for Migration (IOM). “We’re here to look the Mediterranean in the face and look at this number — 3,034 people who drowned because they were not offered a safe passage,” said Colau, as swimmers took advantage of the last rays of sunshine nearby.

Barcelona’s mayor Ada Colau poses in front a digital billboard that shows the number of refugees who died in the Mediterranean sea, named “the shame counter” (AFP Photo/Josep Lago)

Home › Forums › Debt Rattle July 29 2016