G. G. Bain Hudson-Fulton celebration. Union League Club. New York. 1909

Good bad news.

• Post-Brexit Worry Could Ignite A Powerful US Stock Rally (MW)

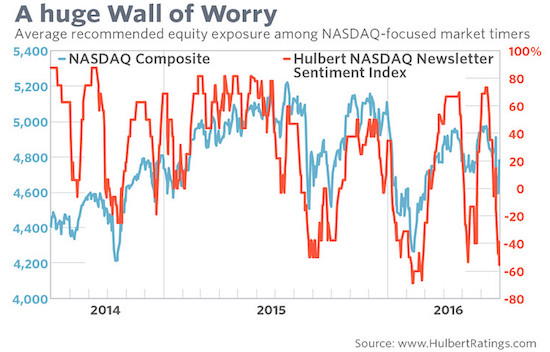

The U.S. stock market kicks off the second half of 2016 facing a huge Wall of Worry. And that’s bullish. In fact, one stock market sentiment index is now in the vicinity of the extremely low levels that, in the past, preceded sizeable rallies. Consider the average recommended equity exposure among a subset of short-term Nasdaq-oriented stock-market timers monitored by the Hulbert Financial Digest (as measured by the Hulbert Nasdaq Newsletter Sentiment Index, or HNNSI). Since the Nasdaq responds especially quickly to changes in investor mood, and because those timers are themselves quick to shift their recommended exposure levels, the HNNSI is my most sensitive barometer of investor sentiment.

This average currently stands at minus 55.6%, which means the average Nasdaq-oriented stock market timer is allocating more than half of his short-term equity trading portfolio to going short. That is an aggressive bet that the market will keep declining. As you can see from the chart above, the HNNSI just recently was quite a bit higher. On June 9 it stood at +73.5%. That means in just three weeks the average recommended equity exposure has fallen 129 percentage points. That’s an extraordinary drop in such a short period. Further evidence of how bearish the market-timing community is: Since Monday, the day of the post-Brexit correction low, the HNNSI has fallen an additional eight percentage points — even while the market staged a powerful rally. That’s not the kind of sentiment behavior typically seen at major market tops.

Excellent point from Ellen: ..Britain has left, and Armageddon hasn’t hit. Other Eurozone nations can now threaten to do the same if they don’t get debt forgiveness or a restructuring.

• Brexit and the Derivatives Time Bomb (Ellen Brown)

Brexit could trigger a $500 trillion derivatives meltdown, by forcing the EU to allow insolvent member governments and banks to write down debt. Italy is in financial crisis and is already petitioning for that concession. How to avoid collapse of the massive derivatives house of cards? Alternatives are considered. Sovereign debt – the debt of national governments – has ballooned from $80 trillion to $100 trillion just since 2008. Squeezed governments have been driven to radical austerity measures, privatizing public assets, slashing public services, and downsizing work forces in a futile attempt to balance national budgets. But the debt overhang just continues to grow. Austerity has been pushed to the limit and hasn’t worked. But default or renegotiating the debt seems to be off the table. Why? According to a June 25th article by Graham Summers on ZeroHedge:

“. . . EVERY move the Central Banks have made post-2009 has been aimed at avoiding debt restructuring or defaults in the bond markets. Why does Greece, a country that represents less than 2% of EU GDP, continue to receive bailouts instead of just defaulting?” Summers’ answer – derivatives: “[G]lobal leverage has exploded to record highs, with the sovereign bond bubble now a staggering $100 trillion in size. To top it off, over $10 trillion of this is sporting negative yields in nominal terms. . . .” Globally, over $500 trillion in derivatives trade [is] based on bond yields. But Brexit changes everything, says Summers. Until now, the EU has been able to reject debt forgiveness as an alternative, using the threat of financial Armageddon if the debtor country left the EU. But Britain has left, and Armageddon hasn’t hit.

Other Eurozone nations can now threaten to do the same if they don’t get debt forgiveness or a restructuring. That has evidently started happening, with Italy as the first challenger of EU rules. On June 27th, Ambrose Evans-Pritchard reported in the UK Telegraph that the first serious casualty of the Brexit contagion had struck. The Italian government is preparing a €40 billion rescue of its financial system, as Italian bank shares collapse. The government is now studying a direct state recapitalization of Italian banks, to be funded by a special bond issue. They also want a moratorium of the bail-in rules and bondholder write-downs, although those steps are prohibited under EU laws.

“Due to scientific, technological and economic progress we are all trained to believe that whatever comes later must be better. But this just isn’t so..”

• EU: Going … Going … Gone (Tenebrarum)

[..] we personally always thought it would be best if the world consisted of a collection of territories the biggest of which was Switzerland. The Germany we like best politically is the one that consisted of more than 360 independent sovereign states, prior to 1794. Citizens could literally “vote with their feet” – and nothing is better to keep one’s rapacious and power-hungry rulers in check. However, we are not “isolationist” by any means – as our readers know, we fully support free markets, free trade, and free movement of people and capital. In fact, one can have all these things, even if there is no central political power imposing them (actually: especially when there is no such central power!).

Germany before 1794: a collection of independent ecclesiastical principalities, free imperial cities, secular principalities and other minor self-ruling entities. Click to enlarge in new window

For instance, the 360 German states mentioned above all used the same money (the coins all had different pictures, but the mints had gotten together to standardize weights), and traded freely with each other. As to the free movement of people – no-one would even have thought to wonder about that point or would have considered “should people be free to go where they want” a legitimate question – passports didn’t even exist yet! Locking up people within the territory ruled over by a specific force monopolist and forcing them to carry papers and ask their bureaucratic overlords for permission to travel is an invention of the modern “free world”.

Due to scientific, technological and economic progress we are all trained to believe that whatever comes later must be better. But this just isn’t so (the science of economics is a pertinent example). We have gained many valuable things, even liberties, we didn’t have before – but we have also lost a great many things that would have been well worth preserving. The Dark Ages weren’t as dark as most people assume, so to speak…in fact, the darkest of all ages was the 20th century, when governments murdered more people than in all of the rest of history combined – all for the “greater good”! As an aside to this, what ended the brief period of economic liberty that followed on the heels of the Western Roman Empire’s collapse?

Charlemagne – the first medieval central planner, who at the synod of Aachen in AD 789 and at the Council of Nijmegen in AD 806 introduced a “usury ban”, price controls, and a “ban on speculation”. In short, as soon as a new central power arose in Europe, it was all over with leaving people alone to do their thing in peace. If Europeans want to have free trade, do they really need a bureaucratic Leviathan in Brussels regulating every nook and cranny of their lives? No. All they need is the back of a napkin, on which they could write: “Henceforth, there will be no more tariffs between us” – and then shake hands on it. Alas, they probably won’t sleep as well anymore. Brussels has ensured that Europe’s citizens all sleep like babies: There are 109 EU regulations concerning pillows, 5 EU regulations concerning pillow cases, and 50 EU laws regulating duvets and sheets.

“..the new narrative isn’t the whole truth.”

• The Economy Was Struggling Long Before Brexit (ZH)

As a result of Brexit, we pointed out that companies now will have a convenient scapegoat for any future earnings misses, or at the very least use Brexit as a reason to lower guidance for the remainder of the year without any pushback from analysts. We also noted that with the referendum behind us, everyone would conveniently forget that earnings expectations had already been continuously revised down for quite some time now, long before Brexit.But if you don’t want to take our word for it, here is CLSA reminding everyone as well. In a recent note, CLSA wrote that world trade growth had hit a new post-global financial crisis low long before Brexit ever came about. From CLSA:

The UK’s surprise Brexit vote has caused a spike in risk perceptions but even before the vote the global economy was struggling. With the March data world trade growth hit a new post-GFC low. Emerging Market demand has contracted on a YoY basis for six back-to-back months. And developed economy demand has weakened, from +3.7% YoY in the three months to November 2015 to 1.2% YoY in the three months to March.

Of course this won’t stop companies from using Brexit as a hall pass in order to explain away any and all misses and forward guidance revisions, and it also won’t stop analysts from using the infamous “one-time adjustment” line in order to paper over the weaker earnings, but it is good to keep this in mind that the new narrative isn’t the whole truth.

Bloomberg’s ‘expert analysts’ strike again.

• Almost Everyone Thinks the Pound’s Days Are Numbered (BBG)

The pound will fall even further than its three-decade low reached in the immediate aftermath of the Brexit vote, according to almost all the analysts who’ve changed their forecasts since the referendum. Of the 36 new predictions in a Bloomberg survey, 32 are for sterling to end the year at or below $1.30, with only two forecasting a rally from current levels. The median estimate is even more bearish at $1.25. That’s 6% weaker than the pound’s level of $1.3277 at 5 p.m. London time on Friday and would push the currency through the 31-year low of $1.3121 set on June 27 as traders digested the U.K.’s vote to leave the European Union.

Even after a two-day rally earlier in the week, the pound was still down 11% versus the dollar since polls closed on June 23. The U.K. currency fell further Thursday and Friday after Bank of England Governor Mark Carney signaled the central bank may ease policy within months to deal with the economic fallout of the vote. It dropped 3% last week. “The pound will continue to bear the brunt of the Brexit result,” said Roberto Mialich at UniCredit in Milan, who’s cut his year-end forecast to $1.20. The pound tumbled the most on record on June 24 as the referendum plunged the country into political and market turmoil, leading to the resignation of Prime Minister David Cameron.

“What is happening is that after dithering for 90 months on the zero bound the Fed has run out the clock.”

• Humpty-Dumpty, Teetering On The Eccles Building Wall (David Stockman)

The Eccles Building trotted out Vice-Chairman Stanley Fischer this morning. Apparently his task was to explain to any headline reading algos still tracking bubblevision that things are looking up for the US economy again and that Brexit won’t hurt much on the domestic front. As he told his fawning CNBC hostess: “First of all, the U.S. economy since the very bad data we got in May on employment has done pretty well. Most of the incoming data looked good,” Fischer said. “Now, you can’t make a whole story out of a month and a half of data, but this is looking better than a tad before.” You might expect something that risible from Janet Yellen – she’s just plain lost in her 50-year old Keynesian time warp. But Stanley Fischer presumably knows better, and that’s the real reason to get out of the casino.

What is happening is that after dithering for 90 months on the zero bound the Fed has run out the clock. The current business cycle expansion—as tepid as is was— is now clearly rolling over. So the Fed has no option except to sit with its eyes wide shut while desperately trying to talk-up the stock market. And that means happy talk about the US economy, no matter how implausible or incompatible with the facts on the ground. No stock market correction or sell-off of even 5% can be tolerated at this fraught juncture. That’s because the U.S. economy is so limp that a proper correction of the massive financial bubble the Fed and other central banks have re-inflated since March 2009 would send it careening into an outright recession.

And that, in turn, would blow to smithereens all of the FOMC’s demented handiwork since September 2008, and indeed since Greenspan launched the era of Bubble Finance back in October 1987. So when Fischer used the phrase “the incoming data looked good”, he was doing his very best impersonation of Lewis Carroll’s version of Humpty Dumpty. “Good” is exactly what our monetary politburo says it is: “When I use a word,” Humpty Dumpty said, in rather a scornful tone, “it means just what I choose it to mean—neither more nor less.” The fact is, the “lesses” have it by a long shot, but the Fed cannot even whisper a word about the giant risks, challenges and threats which loom all across the horizon.

See my article yesterday: Deflation Is Blowing In On An Eastern Trade Wind.

• Why Central Planners Can’t Generate Any Inflation (ZH)

As China continues to weaken the Yuan, it’s important to note the impact that it has on the inflation expectations of other economies, namely the US, Japan, and Europe. As central planners aggressively try to boost inflation, and in the meantime have created a stunning $11.7 trillion in negative yielding debt, China could be hindering that effort quite a bit. As Morgan Stanley points out, CNY has weakened over the last year or so versus the Euro, Yen, and Dollar and is helping to explain the continued undershoot of inflation in Japan and Europe – and we would add in the US. From MS: “The RMB decline has materialized mainly against the EUR and even more so against the JPY. This may explain the continued undershoot of inflation in Europe and Japan.”

MS goes on to note that the overcapacity in Asia (something we have discussed often) and a weaker currency will continue to lead to lower export prices, and thus dampen future inflation expectations, which can be seen in the US 5y5y inflation expectations. MS also observes that developed market inflation behavior is led by movements in Chinese prices, and the rally in global bonds will continue to push the USD higher, putting further downward pressure on prices.

Moderate US growth together with overcapacity in Asia and a weaker RMB will likely result in lower export prices from Asia. Market-based US inflation expectations are now lower than April, supported by Michigan survey data, all despite commodity prices being generally higher. Post Brexit our rates strategy team remains long duration, which is further supported by this lacklustre inflation environment. Inflation expectations might be held back by falling import prices from economies that run spare capacity. Exhibit 23 shows that the recent DM inflation behaviour was actually led by the movements in Chinese prices. The rally in global bonds, particularly in the US, may actually push USD higher as foreign investors look for places with a relatively high yield.

MS concludes by saying that deflationary pressures are likely to remain in place as overcapacity persists.

Important for the outcome is the evaluation of global deflationary pressures, which may be primarily fed from Asia. Yes, China’s PPI has improved from -5.9%Y to -2.9%Y, but RMB has declined over the past couple of quarters at an annualized rate of 11%, suggesting that import price deliveries from China are currently falling by 5%. Importantly, deflationary pressures are likely to remain in place as overcapacity persists. Take for instance the steel sector, where production capacity has increased by 35 million tons as China progressed through its recent mini-cycle.

This could turn into a big challenge to Merkel, both domestically and from other European countries. Ironically, Merkel knows better than anyone that she’s dead wrong.

• Europeans Contest US Anti-Russian Hype (Lauria)

“The statesmen will invent cheap lies, putting the blame upon the nation that is attacked, and every man will be glad of those conscience-soothing falsities, and will diligently study them, and refuse to examine any refutations of them; and thus he will by and by convince himself the war is just, and will thank God for the better sleep he enjoys after this process of grotesque self-deception,” wrote Mark Twain.

So suddenly, after many years of an air-tight, anti-Russia campaign believed unquestioningly by hundreds of millions of Westerners, comes Steinmeier last week blurting out the most significant truth about Russia uttered by a Western official perhaps in decades. “What we shouldn’t do now is inflame the situation further through saber-rattling and warmongering,” Steinmeier stunningly told Bild am Sontag newspaper. “Whoever believes that a symbolic tank parade on the alliance’s eastern border will bring security is mistaken.” Instead Steinmeier called for dialogue with Moscow. “We are well-advised to not create pretexts to renew an old confrontation,” he said, saying it would be “fatal to search only for military solutions and a policy of deterrence.”

In keeping with the U.S. propaganda strategy, the U.S. corporate media virtually ignored the remarks, which should have been front-page news. The New York Times did not report Steinmeier’s statement, but two days later ran a Reuter’s story only online leading with the U.S. military’s rejection of his remarks. Just a day after Steinmeier was quoted in Bild, General Petr Pavel, chairman of NATO’s military committee, dropped another bombshell. Pavel told a Brussels press conference flat out that Russia was not at a threat to the West. “It is not the aim of NATO to create a military barrier against broad-scale Russian aggression, because such aggression is not on the agenda and no intelligence assessment suggests such a thing,” he said.

What? What happened to Russian “aggression” and the Russian “threat?” What is the meaning then of the fear of Russia pounded every day into the heads of Western citizens? Is it all a lie? Two extraordinary on-the-record admissions by two men, Steinmeier, the foreign minister of Europe’s most powerful nation, and an active NATO general in charge of the military committee, both revealing that what Western officials repeat every day is indeed a lie, a lie that may be acknowledged in private but would never before be mentioned in public.

Next week?! Chilcot. Pack your pajamas, Tony!

• British MPs Seek To Impeach Tony Blair Using Ancient Law (Ind.)

Chilcot Inquiry: A number of MPs are seeking to impeach former prime minister Tony Blair using an ancient Parliamentary law. The move, which has cross-party support, could be launched in the aftermath of the Chilcot Inquiry report because of the Labour leader’s alleged role in misleading Parliament over the Iraq War. MPs believe Mr Blair, who was in office between 1997 and 2007, should be prosecuted for breaching his constitutional duties and taking the country into a conflict that resulted in the deaths of 179 British troops. Not used since 1806, when Tory minister Lord Melville was charged for misappropriating official funds, the law is seen in Westminster as an alternative form of punishment if, as believed, Mr Blair will escape serious criticism in the Chilcot Inquiry report.

Triggering the process simply requires an MP to propose a motion, and support evidence as part of a document called the Article of Impeachment. If the impeachment attempt is approved by MPs, the defendant is delivered to Black Rod ahead of a trial. A simple majority is required to convict, at which point a sentence can be passed, which could, in theory, involve Mr Blair being sent to prison. Last year, current Labour leader Jeremy Corbyn said the former prime minister could be made to stand trial for war crimes, saying that he thought the Iraq War was an illegal one and that Mr Blair “has to explain that”. He added: “We went into a war that was catastrophic, that was illegal, that cost us a lot of money, that lost a lot of lives. “The consequences are still played out with migrant deaths in the Mediterranean, refugees all over the region.”

There is no more surefire way of destroying an economy and society than chasing out its educated young.

• Nearly Half A Million Greeks Have Left Their Country Since 2008 (Kath.)

Nearly half a million Greeks have left the country in search of better opportunities abroad since 2008 due to the financial crisis, with educated professionals among those leading the exodus, a Bank of Greece report has shown. According to the report, which Kathimerini made public on Saturday, more than 427,000 Greeks have emigrated since 2008. The exodus started gradually in 2008, a year before Greece’s debt crisis erupted, exceeding 100,000 in 2013 and growing in 2014 and 2015. As noted in the report, Greek emigres’ main motive is to find work as opportunities in crisis-hit Greece are few and far between, with an unemployment rate that remains above 25%.

It is not the first time that Greeks have abandoned their country en masse. Over the past century, Greece has seen two other major exoduses, one between 1903 and 1917 and the other between 1960 and 1972. The difference between the first two and the current one is that in the 20th century, it was mostly unskilled workers and farmers that left while now educated professionals and young graduates are leading the exodus. There are similarities, however, as pointed out in the report. “It is no coincidence that both phases took place following an intense period of recessionary upheaval that widened the chasm between our country and developed nations and fueled the mass departure of people, chiefly young people, who were seeking new opportunities and prospects for progress,” Sofia Lazaretou, a BoG economist and the author of the report, told Kathimerini.

In the first exodus, between 1903 and 1917, Greeks traveled chiefly to the USA, Australia, Canada, Brazil and southeastern Africa, according to the report, which noted that seven in 10 were aged between 15 and 44 and fewer than two in 10 were women. In the second wave, in 1960-72, seven out of 10 were young people aged 20-34, with five in 10 declaring themselves as manual workers. Six out of 10 traveled to Germany or Belgium to work in factories. The current exodus is being led by young professionals seeking their fortune in Germany, the UK and the United Arab Emirates, the report said. Greece ranks fourth among the 28 EU member-states in terms of mass emigration in proportion to its work force, after Cyprus, Ireland and Lithuania. It ranks third, after Cyprus and Spain, in terms of the proportion of young people leaving the country.

Why Brexit is a good thing: this must stop.

• Greece – Life in a Modern-day Debt Colony (Nevradakis)

In May, likely for the first time in the post-war history of the Western world, a national parliament willingly ceded what remained of its country’s sovereignty, essentially voting itself obsolete. This development, however, did not make headlines in the global news cycle and was also ignored by most of the purportedly “leftist” media. The country in question is Greece, where a 7,500-page omnibus bill was just passed, without any parliamentary debate, transferring control over all of the country’s public assets to a fund controlled by the European Stability Mechanism, for the next 99 years. This includes all public infrastructure, harbors, airports, public beaches, and natural resources, all passed to the control of the ESM, a non-democratic, supranational body which answers to no parliamentary or elected body.

Within this same bill, the “Greek” parliament also rendered itself voteless: the legislation annuls the role of the parliament to create a national budget or to pass tax legislation. These decisions will now be made automatically, at the behest of the European Union: if fiscal targets set by the EU, the IMF, and the ESM are not met, automatic “cuts” will be activated, without any parliamentary debate, which could slash anything from social spending, to salaries and pensions. In earlier legislation, the Greek parliament agreed to submit all pending bills to the “troika” for approval. For historical precedent, one needs to look no further than the “Enabling Act” passed by the Reichstag in 1933, where the German parliament voted away its right to exercise legislative power, transferring absolute power to govern and to pass laws, including unconstitutional laws, to Chancellor Adolf Hitler.

The Greek omnibus bill was preceded by another piece of legislation, “reforming” Greece’s pension system through the enactment of further cuts to pensions, while increasing taxes almost entirely across the board.

Despite government lies to the contrary, these cuts are regressive and will disproportionately impact the poorer strata of society: the basic pension has been cut to €345 per month, supplementary pensions to poor individuals have been eliminated, the value-added tax on many basic goods has been raised to 24%, the number of households which qualify for heating oil subsidies has been slashed in half while taxes on oil and fuel have again been increased, co-pays on prescription drugs covered by public health insurance have been hiked by 25%, employees’ contributions to the social security fund have been raised (effectively lowering salaries), special taxes have been introduced on coffee and alcoholic beverages, while Greece’s suffering small businesses have been saddled with an increase in their tax rate from 26% to 29%.

Home › Forums › Debt Rattle July 3 2016