Jack Allison “Utopia Children’s House, Harlem, New York.” 1938

“Between 2000 and 2014, the share of British exports to Europe fell from 60 to 45%.”

• Don’t Panic. Britain’s Economy Can Survive Just Fine Outside The EU (Mody

The European Union was not the principal reason why many felt economically and politically powerless, but its bureaucratic creep became a potent symbol of the overpowering force of globalization. The outgoing Prime Minister of Britain David Cameron, who likes to think of himself as modern-day Winston Churchill, had little understanding of these historical forces. Indeed, even Churchill had his historical blind spots. He petulantly called Gandhi a “half-naked fakir” and vehemently opposed Indian independence. But Cameron, seeking his petty political victories, was largely clueless about the larger stakes he ended up playing for. Tactical gains can lead to strategic advance only when guided by a larger vision. All Cameron wanted was greater hold over his party.

But once he let the genie out of the bottle, Cameron misjudged again by making an economic case for remaining in the European Union rather than attempting a serious political argument for Europe—one based on shared values. Perhaps there was no political argument to be made, but the effort to present an economic calculus for a political decision was bound to backfire. The economic numbers to make the case for Britain remaining in Europe were fanciful, however many economists and international organizations joined to endorse them.

Following Brexit, productive British trade with the European Union will survive just fine wherever it is based on long-lasting economic gains and social relationships. At the same time, the shift toward trade with the faster-growing United States and Asia will continue. Between 2000 and 2014, the share of British exports to Europe fell from 60 to 45%. Almost all new British trade is being created outside of Europe. The new tougher trade regime could even spur productivity growth. As the British economy inevitably disengages from Europe, empathy for European Union will decline further. A referendum five years from now will produce an even clearer decision to say out.

“The UK’s problem remains their double deficit. The chronic budget and the current account deficits.”

• The UK Desperately Needs A Lower Pound (Steen Jakobsen)

I am writing this chronicle from South Africa which is almost as far away from Europe and the constant and never ending Brexit talk as you can come. It’s hard even here to avoid the turbulence and never ending ‘need’ for investors and media to understand what comes next. The best analogy I can use is one from my extensive travels: When you arrive at an airport to check in, you have to pass security control when two options are at hand: The fast track or the slow version (economy class). Using the fast track gets you quicker to the gate and allows you pre-boarding, but what really should matter is that the actual flight time and route is the same for everyone in business and in economy. We arrive at EXACTLY the same time.

The point? What is now transpiring in an economic sense is that we have entered the fast track courtesy of Brexit, the selloff in GBP, the lowering of growth projections and in some places talk about reform and change which would have happened with or without the Leave vote. The UK’s problem remains their double deficit. The chronic budget and the current account deficits. The last time the UK ran a surplus on the current account was the year Italy won the World Cup in Spain and the top scorer was Paolo Rossi. you guessed it — 1982. The UK also has the lowest productivity of the G7 countries together with Japan.

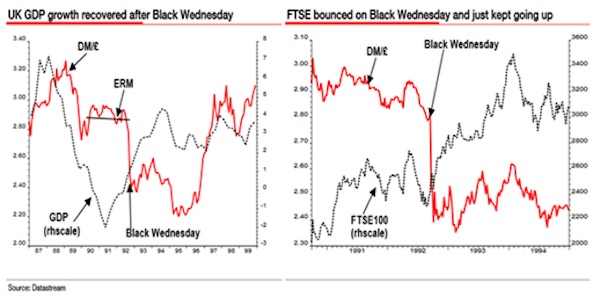

Yes, the UK needs a lower GBP and desperately so and if the ERM crisis of 1992 is any guideline, what comes next for UK is more employment and a stronger GDP as seen in this chart from the excellent research done by Societe Generale. It would be naive to anticipate only positive changes from the increased political uncertainty but do realise that the slowdown in the UK but also Europe was happening before the surprise ‘Leave’ result.

Loss of empire.

• Brexit Accelerates the British Pound’s 100 Years of Debasement (BBG)

There have been few better ways to chart Britain’s decline from empire than its currency. Historians, economists and foreign-policy specialists point to the more-than 10% plunge since the June 23 referendum as signaling another downward leg in the U.K.’s global role and influence. “The history of the pound against the dollar over the last century is essentially a downward ladder with big permanent steps,” according to Rui Pedro Esteves, an associate professor in economics at Oxford University. The world’s oldest currency — sterling is derived from the old German “ster” for strong or stable – bought almost $5 during World War I. The day of the EU referendum, it traded at $1.50. It was at $1.3330 as of 4:33 p.m. on Monday.

HSBC analysts are among those forecasting $1.20 as a likely destination. Billionaire investor George Soros suggests $1.15, the equivalent of about a euro – about 60 cents below its average since 1971. “A country’s economic size measured in other currencies – for the U.K., measured say in dollars – is an indicator of its capacity to project power and influence internationally,” said Barry Eichengreen, a professor of economics at the University of California Berkeley. While some economists, including former BOE Governor Mervyn King, see the weaker currency as leading to more export competitiveness, others see the threat of recession and lower interest rates – combined with more insular politics and withdrawal from the world’s largest trading bloc – as undermining appetite for U.K. assets.

“If you look at the U.K. now, certainly part of what is going on is a result of the exchange rate’s adjustment to growth expectations,” said Maurice Obstfeld, chief economist at the IMF. The pound has been in steady decline, spurred on by a series of financial jolts, for most of the past century – just as Britain’s prominence on the international stage has diminished.

Correlation AND causation.

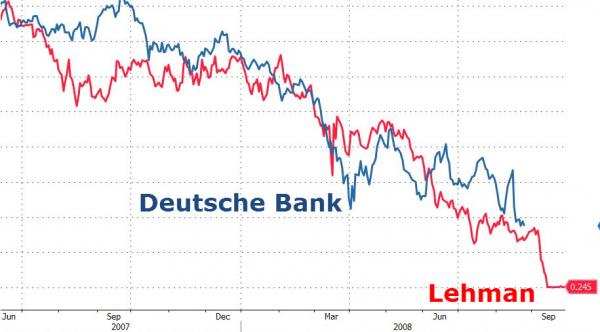

• Meanwhile At The Most Systemically Dangerous Bank In The World… (ZH)

Another day, another fresh record low in Deutsche Bank’s stock price… For comparison’s sake, Deutsche Bank is analogically equivalent to where Lehman was in August 2008… when the stock soared 16% on chatter of a Korean Development Bank bailout… which then was denied, crashing the stock and ending the party…

Shares in Lehman Brothers rose substantially Friday as investors renewed hopes that the troubled investment bank was moving closer to raising capital to buffer it against a deteriorating economic environment. Capping a volatile week, the stock soared 16% on a report that the state-run Korea Development Bank was considering buying the bank, an idea that a spokesman for the South Korean firm said was “erroneous.” Lehman’s stock closed the day up 5% at $14.41.

The spokesman for Korea Development Bank told The New York Times that the bank was in the process of being privatized and was looking at various acquisitions. But he denied that buying Lehman was an option. “We have various thoughts for our future, but we don’t have any specific institutions in mind,” said the spokesman, who declined to be named, citing company policy. Lehman’s suddenly soaring stock underscores the volatility surrounding the firm as it scrambles to assess its options in the face of an abysmal third quarter. Only days ago, its shares tumbled more than 13%.

We wait for chatter of a Deutsche Bank ‘offer’ rumor any day now. We are sure it’s nothing. How can it be a problem given that US equities are so strong? right?

Can’t be just one fund that has these problems.

• Standard Life Shuts Property Fund Amid Rush Of Brexit Withdrawals (G.)

Investors in Standard Life’s property funds have been told that they cannot withdraw their money, after the firm acted to stop a rush of withdrawals following the UK’s decision to leave the EU. The firm halted trading on its Standard Life Investments UK Real Estate Fund and associated funds at midday on Monday, citing “exceptional market circumstances” for the decision. It said the suspension would remain in place until it is “practicable” to lift it, and that it would review the decision at least every 28 days. The £2.9bn fund, which invests in commercial properties including shopping centres, warehouses and offices, is thought to be the first UK property fund to suspend trading since the 2007-2009 financial crisis, when some of the biggest names in investment management stopped withdrawals because they did not have the money to repay investors.

Standard Life’s decision is the latest in a line of moves by investment firms to stem flows out of their property funds. Standard Life last week, together with rivals Henderson, Aberdeen and M&G, reduced the amount investors cashing in holdings would get back by up to 5%. In a statement, Standard Life said the decision followed an increase in redemption requests from investors. “The suspension was requested to protect the interests of all investors in the fund and to avoid compromising investment returns from the range, mix and quality of assets within the portfolio,” the company said.

Juncker’s days are definitely numbered. But nobody seems to either know nor agree what should be next.

• EU Authority Fraying In Reaction To Brexit Vote (R.)

[..] Italian Prime Minister Matteo Renzi, who has fought to bend EU budget deficit rules and now seeks to pump billions of euros into his country’s ailing banks if needed to shore them up, said on Monday the EU was run by “a technocracy with no soul”. He also opposed sanctions against fellow southern members Spain and Portugal for violating the EU’s deficit limits last year – a step the Commission is due to consider on Tuesday in a German-backed drive to uphold the much-abused budget rules. Italy’s banks are saddled with €360 billion in bad loans and their share prices plunged after last month’s Brexit vote. Rome is in talks with the EU Commission to devise a plan to recapitalize its lenders with public money limiting losses for bank investors.

Dutch and German ministers have attacked a Commission decision that the European Parliament can approve a trade pact with Canada without referring it to national parliaments. The Dutch parliament was assured it would have a chance to weigh in on the treaty. But perhaps most worryingly for the EU, senior ministers in Germany, the bloc’s reluctant hegemon, are advocating shrinking the executive Commission, trimming its powers, and bypassing common European institutions to take more decisions by intergovernmental agreement. A call from veteran German Finance Minister Wolfgang Schaeuble, long an advocate of closer integration, to shift more policy decision-making to governments for expediency’s sake was among the most striking indicators of the mood around Europe.

“If the Commission doesn’t get involved, then we should take the matter into our own hands and solve problems between governments,” Schaeuble told Welt am Sonntag newspaper, saying now was a time for pragmatism. “This intergovernmental approach proved successful during the euro zone crisis,” he added.

Renzi, in trying to save his career, becomes a danger to Brussels.

• Draghi Should Have Done More To Help Italian Banks In 90’S, Says PM Renzi (R.)

Italian Prime Minister Matteo Renzi criticized ECB Governor Mario Draghi for not having done more to resolve Italy’s banking woes when he held a key Treasury job in Rome in the 1990s. Renzi’s rare public criticism of Draghi came on the day Italy’s third-largest lender, Banca Monte dei Paschi di Siena (BMPS.MI), said that the ECB had asked it to cut its bad debts by 40% within three years, heaping more pressure on Rome to stabilize its banking system. After taking power in 2014, Renzi’s government introduced reforms aimed at strengthening the country’s cooperative banks, but several are struggling to stay afloat and a bailout fund took control of Veneto Banca last week after the ECB said it had to raise capital or close.

“If the measures concerning the cooperatives had not been taken by us but by the centre-left government that first put them forward, but was not strong enough to enact them in 1998 … then we would not have this problem,” Renzi said. The prime minister said that Draghi was director general of the Treasury at that time, with Carlo Azeglio Ciampi serving as economy minister. “And if people had the strength and intelligence to keep politics out of the banking system a bit before we did it … we would not have had cases like Monte dei Paschi di Siena,” Renzi told a meeting of his centre-left Democratic Party (PD).

How things are seldom what they seem. Or people, for that matter.

• Did a Fear of Slave Revolts Drive American Independence? (NY Times)

For more than two centuries, we have been reading the Declaration of Independence wrong. Or rather, we’ve been celebrating the Declaration as people in the 19th and 20th centuries have told us we should, but not the Declaration as Thomas Jefferson, Benjamin Franklin and John Adams wrote it. To them, separation from Britain was as much, if not more, about racial fear and exclusion as it was about inalienable rights. The Declaration’s beautiful preamble distracts us from the heart of the document, the 27 accusations against King George III over which its authors wrangled and debated, trying to get the wording just right. The very last one — the ultimate deal-breaker — was the most important for them, and it is for us:

“He has excited domestic insurrections amongst us, and has endeavored to bring on the inhabitants of our frontiers, the merciless Indian savages, whose known rule of warfare is an undistinguished destruction of all ages, sexes and conditions.” In the context of the 18th century, “domestic insurrections” refers to rebellious slaves. “Merciless Indian savages” doesn’t need much explanation. In fact, Jefferson had originally included an extended attack on the king for forcing slavery upon unwitting colonists. Had it stood, it would have been the patriots’ most powerful critique of slavery. The Continental Congress cut out all references to slavery as “piratical warfare” and an “assemblage of horrors,” and left only the sentiment that King George was “now exciting those very people to rise in arms among us.”

The Declaration could have been what we yearn for it to be, a statement of universal rights, but it wasn’t. What became the official version was one marked by division. Upon hearing the news that the Congress had just declared American independence, a group of people gathered in the tiny village of Huntington, N.Y., to observe the occasion by creating an effigy of King George. But before torching the tyrant, the Long Islanders did something odd, at least to us. According to a report in a New York City newspaper, first they blackened his face, and then, alongside his wooden crown, they stuck his head “full of feathers” like “savages,” wrapped his body in the Union Jack, lined it with gunpowder and then set it ablaze.

Reflecting on Lady Liberty’s right foot.

• The Statue Of Liberty Was Built To Welcome Immigrants (Eggers)

Though she is the most recognisable symbol of the American experiment, there is something about the Statue of Liberty that goes largely unnoticed. And that is that she is moving. The torch in her right hand, symbolising enlightenment, cannot be ignored and is never overlooked. The book in her left hand, with 4 July carved in roman numerals, is not likely to be missed. Nor are the seven spikes of her crown, matching the world’s seven continents and seven seas. And though, if pressed, we remember that she is wearing sandals, we forget, if we ever knew, that the Statue of Liberty is on the go. Take the ferry to Liberty Island. As your boat rises and falls on the rough waters of New York Harbor, you will see, with undeniable clarity, that her right foot is striding forward.

And around her feet are chains, broken, which sculptor Frédéric Auguste Bartholdi meant to symbolise the breaking of the chains of bondage and tyranny. She is caught, forever, in the moment of becoming free. The 305ft statue is a marvel of artistry and engineering, and there are many details to admire, but none is more important than her right leg, which is stepping forward, and stepping forward not casually but with great striding purpose. This right foot, though largely unheralded, might be its most important feature. For what would it mean if the symbol of liberty were standing still? That would imply that freedom is static, that once established, it’s a settled thing. But freedom is not a settled thing.

It would imply that once the first few million immigrants arrived on American shores, fleeing religious bigotry or political violence or ethnic persecution, then the United States should or could close its gates. It would imply that the welcoming of new arrivals, the poor and tired and struggling to be free, was a temporary thing, that the welcoming of the world’s oppressed was a thing of the past. But the welcoming of the world’s oppressed is not a thing of the past. We live in a moment when shrill voices tell us that not only should immigration be stifled, but that millions of current residents should be deported, returned to their country of origin, no matter the consequences for their souls or our consciences. These fearful voices put forth a direct repudiation of the origin and elemental purpose of this country, and to the meaning of the statue that we accept as our talisman.

The coup against Corbyn is also linked to Tony Blair’s possible indictment, and the risks that brings for those in the party who are linked to him.

• The Elites Hate Momentum and The Corbynites – I’ll Tell You Why (Graeber)

As the rolling catastrophe of what’s already being called the “chicken coup” against the Labour leadership winds down, pretty much all the commentary has focused on the personal qualities, real or imagined, of the principal players. Yet such an approach misses out on almost everything that’s really at stake here. The real battle is not over the personality of one man, or even a couple of hundred politicians. If the opposition to Jeremy Corbyn for the past nine months has been so fierce, and so bitter, it is because his existence as head of a major political party is an assault on the very notion that politics should be primarily about the personal qualities of politicians. It’s an attempt to change the rules of the game, and those who object most violently to the Labour leadership are precisely those who would lose the most personal power were it to be successful: sitting politicians and political commentators.

If you talk to Corbyn’s most ardent supporters, it’s not the man himself but the project of democratising the party that really sets their eyes alight. The Labour party, they emphasise, was founded not by politicians but by a social movement. Over the past century it has gradually become like all the other political parties – personality (and of course, money) based, but the Corbyn project is first and foremost to make the party a voice for social movements once again, dedicated to popular democracy (as trades unions themselves once were). This is the immediate aim. The ultimate aim is the democratisation not just of the party but of local government, workplaces, society itself.

In a nutshell: “..One reason for the aggressive tactics is that the state depends on Wall Street investors to finance student loans..”

• In New Jersey Student Loan Program, Even Death May Not Bring a Reprieve (NYT)

New Jersey’s loans, which currently total $1.9 billion, are unlike those of any other government lending program for students in the country. They come with extraordinarily stringent rules that can easily lead to financial ruin. Repayments cannot be adjusted based on income, and borrowers who are unemployed or facing other financial hardships are given few breaks. The loans also carry higher interest rates than similar federal programs. Most significant, New Jersey’s loans come with a cudgel that even the most predatory for-profit players cannot wield: the power of the state. New Jersey can garnish wages, rescind state income tax refunds, revoke professional licenses, even take away lottery winnings — all without having to get court approval.

“It’s state-sanctioned loan-sharking,” Daniel Frischberg, a bankruptcy lawyer, said. “The New Jersey program is set up so that you fail.” The authority, which boasts in brochures that its “singular focus has always been to benefit the students we serve,” has become even more aggressive in recent years. Interviews with dozens of borrowers, who were among the tens of thousands who have turned to the program, show how the loans have unraveled lives. The program’s regulations have destroyed families’ credit and forced them to forfeit their salaries. One college graduate declared bankruptcy at age 26 after struggling to repay his debt. The agency filed four simultaneous lawsuits against a 31-year-old paralegal after she fell behind on her payments.

Another borrower, Chris Gonzalez, could not keep up with his loans after he got non-Hodgkin’s lymphoma and was laid off by Goldman Sachs. While the federal government allowed him to suspend his payments because of hardship, New Jersey sued him, seeking $266,000 in payments, and seized a state tax refund he was owed. One reason for the aggressive tactics is that the state depends on Wall Street investors to finance student loans through tax-exempt bonds and needs to satisfy those investors by keeping losses to a minimum. Loan revenues also cover about half of the agency’s administrative budget.

How to kill a city.

• Sydney Home Prices Just Keep On Rising (BBG)

Sydney home prices resumed their upward march as dwindling supply outweighs tighter loan approvals by lenders. Dwelling values climbed 1.2% in June, taking gains for the second quarter to 6.8%, according to data from CoreLogic. The market is getting a leg up after a slowdown at the end of last year in Australia’s largest city, as new listings fell more than 16% from a year earlier to the lowest in five months in June, according to the data.

How to kill a country: “..it is financed by grants from the Australian Department of Defence, the Australian Army, the Australian Federal Police, the Dutch Foreign Ministry, and the Japanese Government; plus Raytheon, Northrup Grumman, Lockheed Martin, and Boeing..”

• How Australia Is Sold Into Waging War In Ukraine (Helmer)

Among Turnbull’s last-minute ploys to attract votes, one was the leak last month of Australian cabinet plans for an Australian Army force to fight in eastern Ukraine, alongside Dutch and other NATO units, to destroy the Donetsk and Lugansk rebellion against the regime in Kiev. Turnbull’s leak had suggested that Tony Abbott, the prime minister Turnbull had pushed aside to take the job, dreamed up the plan of Australian war at the Russian frontier by himself. The new report by Dibb now corroborates the idea of an Australian military expedition against Russia, in exchange for improved American commitments to defend Australia from the Chinese closer to home, in the Pacific.

“How things work out in Europe,” Dibb claims, “will affect Washington’s ability to reassure allies and partners everywhere, including those in our region who must contend with increasing coercion by China.” Unless Australia does more fighting with the Americans on the Russian front, he concludes, “China will take advantage of this, and allies and partners of the US in the region -including Australia- would be subject to further uncertainty about American military commitments to Asia.” Combating “Russia’s aggressive military behaviour “is necessary because, otherwise, “both Moscow and Beijing will be seen as getting away with it.” The 40-page Dibb report is entitled “Why Russia is a threat to the international order”. Read it in full. The publisher is a think-tank headquartered in Sydney called the Australian Strategic Policy Institute (ASPI).

It says “ASPI was established, and is partially funded, by the Australian Government as an independent, non-partisan policy institute.” The institute’s financial reports reveal it is financed by grants from the Australian Department of Defence, the Australian Army, the Australian Federal Police, the Dutch Foreign Ministry, and the Japanese Government; plus Raytheon, Northrup Grumman, Lockheed Martin, and Boeing — the leading arms-exporting corporations of the US. European arms builders also funding ASPI include the European missile-maker MBDA, BAE Systems, ThyssenKrupp Marine Systems, Rheinmetall, Airbus, and Navantia, the Spanish state shipbuilder. When Australians march into the field against the Russians, these suppliers aim to provide the best kit Australian money can buy.

Tsipras might have done well to pay some more attention.

• US Economist Galbraith Sheds Light On Varoufakis ‘Plan X’ (Kath.)

The Plan B for Greece that was drafted by former Greek Finance Minister Yanis Varoufakis foresaw the declaring of a state of emergency, the immediate nationalization of the Bank of Greece, the transformation of bank deposits into a New Drachma and emergency public order measures, according to a book by American economist James Galbraith, Varoufakis’s chief coordinator for the plan. In the book, “Welcome to the Poisoned Chalice: The Destruction of Greece and the Future of Europe,” which has been translated into Greek, Galbraith describes in detail Varoufakis’s plan for moving Greece to a parallel banking system last year.

Those privy to the Plan B – or Plan X as Varoufakis is said to have called it – would meet in conditions of high secrecy involving secure communications and the depositing of cell phones in hotel refrigerators. According to Galbraith, during the transition phase, the ministries of Defense and the Interior would have been responsible for public order, fuel supplies would be controlled, while employees at important public institutions (schools, hospitals, police) would be mobilized. Even though there was a high-level meeting about the plan, Galbraith said the prime minister did not ask to be briefed, so work on the endeavor ended with the submission of an extensive memo in May.

At some point, indictment or not, enough people will realize that Clinton is too much of a risk for the credibility of the entire American political system.

• Wikileaks Publishes More Than 1,000 Hillary Clinton War Emails (Ind.)

WikiLeaks, the anti-secrecy website, has released more than 1,000 emails from Hillary Clinton’s private email server pertaining to the Iraq War. The website tweeted a link to 1,258 emails on Monday that Clinton sent during her time as secretary of state. According to the release, the emails were obtained from the US State Department after they issued a Freedom of Information Act request. However, it’s unclear if any of the information is classified. WikiLeaks founder Julian Assange previously claimed that his website obtained enough proof for the FBI to indict the presumptive Democratic nominee for president.

“We could proceed to an indictment, but if Loretta Lynch is the head of the DOJ in the United States, she’s not going to indict Hillary Clinton,” Assange told ITV. “That’s not possible that could happen.” The newly released information will likely only serve as political fodder for the presumptive Republican nominee Donald Trump, as Clinton met with FBI investigators over the weekend wrapping up the lengthy investigation. Sources close to the probe recently told CNN that the bureau will announce no charges against Clinton in the weeks to come.

Ha! Funny! But I think Lynch’s involvement is far more insidious than this.

• Who The F**k Is Charlotte? (Jim Kunstler)

The mighty Shakespeare in his direst night sweats could not have conjured up the Clinton family in all their sharp angles and dark corners, but we can try to reconstruct the scene last week on Loretta Lynch’s plane out on the Phoenix airport tarmac.

Former president Bill steps aboard:

• Loretta: What the fuck are you doing here?

• Bill: I just had to tell you what Charlotte did last week.

• Loretta: Who the fuck is Charlotte?

• Bill: Our grand-kid. She’s turning into a good little earner.

• Loretta: We can’t meet like this. We’re about to depose your wife.

• Bill: Charlotte gave a speech to the whole Citibank C-suite.

• Loretta: I don’t give a fuck. Get off my plane right now!

• Bill: Well, I don’t know if ‘speech’ is the right word. She gurgles nice.

• Loretta: I guess you didn’t hear me.

• Bill: She pulled in fifty grand for that. Of course it was 100% remitted to the foundation. Well, bye now. (Exits plane).I have a theory about the Clinton family dynamic. Bill does not want Hillary to win because he doesn’t want to live in the White House again. For sure he does not want to live with The Flying Reptile, but he especially doesn’t want to be on display in that fishbowl where folks pretty much can see what you’re up to 24/7. For one thing, “The Energizer” can’t discreetly come and go. But he certainly doesn’t want to concern himself as “First Husband” or “First Gentleman” (title TBD) with deciding which fabric to choose in replacing the East Room draperies. So Bill decided to fix things for sure with that innocent visit to the US Attorney General’s airplane to talk about grand-kids.

It seems to be working. If there was any question that Loretta Lynch could just sit on her hands about Hillary’s email investigation through the November election, it went up in a vapor last week. It also left the FBI director on the hot seat because now he will have to either cough up a referral to Justice Department prosecutors, or he’ll have some ‘splainin to do in the heat of a presidential election campaign. If you thought Watergate was a ripe peach, this one is beginning to look like a stinking durian (Durio zibethinus).

Home › Forums › Debt Rattle July 5 2016