Wyland Stanley Marmon touring car at Yosemite 1919

There’s a hole in the bucket, dear Shinzo.

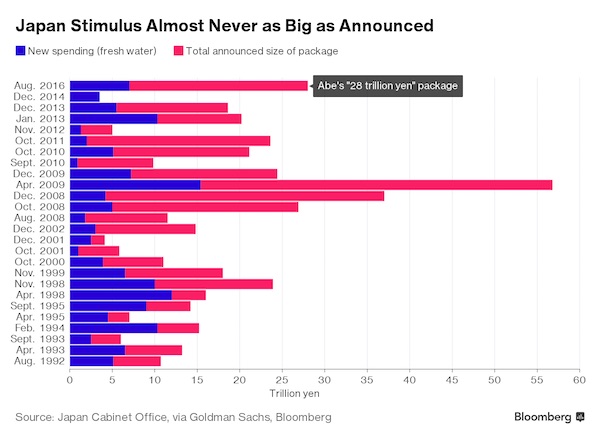

• Abe’s Fiscal Plan Follows a Long Road of Packages That Failed (BBG)

Prime Minister Shinzo Abe’s “bold” plan to revive the economy with a $273 billion package leaves him traveling down a well-trod path: it marks the 26th dose of fiscal stimulus since the country’s epic markets crash in 1990, in a warning for its effectiveness. The nation has had extra budgets every year since at least 1993, and even with that extra spending, it has still had six recessions, an entrenched period of deflation, soaring debt and a rapidly aging population that has left the world’s third-largest economy still struggling to get off the floor. While some analysts say the latest round of spending may buy the economy time, few are convinced it will be enough to dramatically change the course.

First off, much of the 28 trillion yen announced by Abe last week won’t be spending, but lending. And if previous episodes are any guide, an initial sugar hit to markets and growth will quickly fade amid a realization that extra spending does little to cure the economy’s underlying problems. A Goldman Sachs study found that markets gave up their gains in the first month after the cabinet approved the stimulus in 18 of the 25 packages it studied since 1990. Skeptics of Abe’s latest plan aren’t hard to find. Instead of adding to a debt pile already more than twice the economy’s size, more should be done to tackle thorny structural problems such as a declining labor force and protected industries, according to Naoyuki Shinohara, a former Japanese finance ministry official.

“Looking at the history of the Japanese economy, there have been lots of fiscal stimulus packages,” according to Shinohara, who was a top official at the IMF until last year. “But the end result is that it didn’t have much impact on the potential growth rate.”

A lot of seemingly contradictory reports today. Manufacturing PMI down, but services PMI up.

• China July Factory Activity Unexpectedly Dips (R.)

Activity in China’s manufacturing sector eased unexpectedly in July as orders cooled and flooding disrupted business, an official survey showed, adding to fears the economy will slow in coming months unless the government steps up a huge spending spree. While a similar private survey showed business picked up for the first time in 17 months, the increase was only slight and the much larger official survey on Monday suggested China’s overall industrial activity remains sluggish at best. Both surveys showed persistently weak demand at home and abroad were forcing companies to continue to shed jobs, even as Beijing vows to shut more industrial overcapacity that could lead to larger layoffs.

And other readings on Monday pointed to signs of cooling in both the construction industry and real estate, which were key drivers behind better-than-expected economic growth in the second quarter. The official Purchasing Managers’ Index (PMI) eased to 49.9 in July from the previous month’s 50.0 and below the 50-point mark that separates growth from contraction on a monthly basis. While the July reading showed only a slight loss of momentum, Nomura’s chief China economist Yang Zhao said it may be a sign that the impact of stimulus measures earlier this year may already be wearing off. That has created a dilemma for Beijing as the Communist Party seeks to deliver on official targets, even as concerns grow about the risks of prolonged, debt-fueled stimulus.

“The government has realized the downward pressure is great but they’ve also realized that stimulus to stimulate the economy continuously is not a good idea and they want to continue to focus on reform and deleveraging,” Zhao said.

Monopoly money running out.

• China’s Love Affair With U.S. Real Estate Fades (BBG)

For David Wong, the business of selling homes isn’t as good this year as it was in 2015, and he’s blaming that on a decline in customers from China. “The residential-property market here, especially for those priced between $2.5 million to $3 million, has been affected by China’s measures to control capital flight,” said the New York City-based Keller Williams Realty Landmark broker. “You need to cut the price, or it may take a real long time.” Wong is not the only one who has felt the cooling in the U.S. real estate market for foreign buyers. Total sales to Chinese buyers in the 12 months through March fell for the first time since 2011, to $27.3 billion from $28.6 billion a year earlier, according to an annual research report released by the National Association of Realtors.

The number of properties purchased by Chinese also declined to 29,195 units from 34,327 units. While the total international sales saw its first decline in three years, the 1.25% pace is slower than 4.5% recorded for Chinese buying. In terms of U.S. dollar value, the total share of Chinese buying of international sales dropped from 27.5% to 26.7%. [..] The yuan began plummeting in August, driving the Chinese currency to a five-year low versus the U.S. dollar. The Chinese authorities have been compelled to increasingly tighten the noose on cross-border capital flows to defend the yuan and to slow down the burnout of the nation’s foreign-exchange reserves since then. This includes increasing scrutiny of transfers overseas, to closely check whether individuals send money abroad by breaking up foreign-currency purchases into smaller transactions.

This is why I recently wrote that a basic income should replace old-age provisions.

• For Social Security “Time’s Up – The Pain Must Begin Now” (CH)

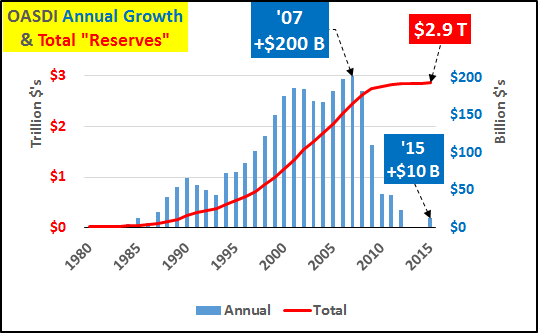

In 2010, Social Security (OASDI) unofficially went bankrupt. For the first time since the enactment of the SS amendments of 1983, annual outlays for the program exceeded receipts (excluding interest credited to the trust funds). The deficit has grown every year since 2010 and is now up to 8% annually and is projected to be 31% in 2026 and 44% by ’46. The chart below highlights the OASDI annual surplus growth (blue columns) and total surplus (red line). This chart includes interest payments to the trust funds and thus looks a little better than the unvarnished reality. For a little perspective, the program pays more than 60 million beneficiaries (almost 1 in 5 Americans), OASDI (Old Age, Survivors, Disability Insurance) represents 25% of all annual federal spending, and for more than half of these beneficiaries these benefits represent their sole or primary source of income.

The good news is since SS’s inception in 1935, the program collected $2.9 trillion more than it paid out. The bad news is that the $2.9 trillion has already been spent. But by law, Social Security is allowed to pretend that the “trust fund” money is still there and continue paying out full benefits until that fictitious $2.9 trillion is burned through. To do this, the Treasury will issue another $2.9 trillion over the next 13 years to be sold as marketable debt so it may again be spent (just moving the liability from one side of the ledger, the Intergovernmental, to the other, public marketable). However, according to the CBO, Social Security will have burnt through the pretend trust fund money (that wasn’t there to begin with) by 2029.

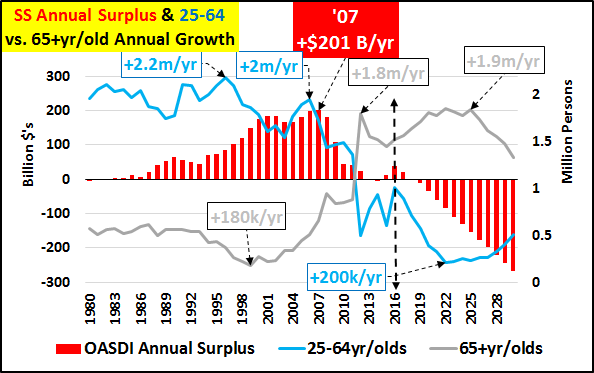

Below, the annual OASDI surplus (in red) peaking in 2007, matched against the annual growth of the 25-64yr/old (in blue) and 65+yr/old (grey) populations. The impact of the collapse of the growth among the working age population and swelling elderly population is plain to see. And it will get far worse before it eventually gets better. [..] Americans turning 67 in 2030 will be told that after being mandated to pay their full share of SS taxation throughout their working lifetime, they will not see anything near their full benefits in their latter years. However, those in retirement now and those retiring between now and 2029 are being paid in full despite the shortfall in revenue. They will be paid in full until this arbitrary “trust fund” is theoretically drained.

I have no intention of funding, in full, current retirees benefits with my tax dollars only to know I will hit the finish line with a 30%+ reduction that will only worsen over time. My goal is to pay it forward to my kids and then do my best to never to be a burden to them. The SS (OASDI) benefits must be cut now to be in line with revenues. Raise taxes, lower benefits…your choice. But I’m not about to make the old whole so I can then subsequently see my generation go bankrupt in my latter years.

Perfect fit for a basic income. But it won’t come. Austerity as controlled poverty is a power(ful) tool.

• Impact Of Poverty Costs The UK £78 Billion A Year (G.)

Dealing with the effects of poverty costs the public purse £78bn a year, or £1,200 for every person in the UK, according to the first wide-ranging report into the impact of deprivation on Britain’s finances. The Joseph Rowntree Foundation (JRF) estimates that the impact and cost of poverty accounts for £1 in every £5 spent on public services. The biggest chunk of the £78bn figure comes from treating health conditions associated with poverty, which amounts to £29bn, while the costs for schools and police are also significant. A further £9bn is linked to the cost of benefits and lost tax revenues. The research, carried out for JRF by Heriot-Watt and Loughborough universities, is designed to highlight the economic case, on top of the social arguments, for tackling poverty in the UK.

The prime minister, Theresa May, has made cutting inequality a central pledge. Julia Unwin, the chief executive of the foundation, said: “It is unacceptable that in the 21st century, so many people in our country are being held back by poverty. But poverty doesn’t just hold individuals back, it holds back our economy too. “Taking real action to tackle the causes of poverty would bring down the huge £78bn yearly cost of dealing with its effects, and mean more money to create better public services and support the economy. UK poverty is a problem that can be solved if government, businesses, employers and individuals work together.”

“But did anyone tell you that Germany from 2009 onwards bailed out its failing banks with public money? Banks, that is, with holes in their balance sheets visible from the Moon.”

• Did Germany Just Blink? (DQ)

Put simply, the EU is a half-way house with too much democracy and nothing in the way of transfer union. “There are too many moving parts in the electoral politics of 28 nation states, and too many conceivable random-like events that could push political and economic developments in one direction or another, with impossible-to-predict consequences and timelines,” the agency added. The perfect case in point is Italy’s banking crisis. If the country’s struggling banks are not saved with a combination of public and private money — a process that, to all intents and purposes, began on Friday with the announcement of Monte dei Paschi’s suspension of the ECB’s stress test as well as a €5 billion capital expansion later this year — the resulting carnage could unleash not only a tsunami of financial contagion but also an unstoppable groundswell of political opposition to the EU.

For a taste of just how disastrous the political fallout would be for Italy’s embattled premier, Matteo Renzi, here’s an excerpt from a furious tirade given by Italian financial journalist Paolo Barnard on prime-time TV, addressing Renzi directly:

“You went to meet Mrs. Merkel to ask for a minor public funded bail-out of Italian banks and you got a sharp NO. But did anyone tell you that Germany from 2009 onwards bailed out its failing banks with public money? “Banks, that is, with holes in their balance sheets visible from the Moon.

Germany bailed them out to the tune of €704 billion. It was all paid for by European taxpayers’ money, public funds that is. “It was done through the EU Commission of Mr Barroso and by Mr Mario Draghi at the ECB. Didn’t you know that Mr Renzi? Couldn’t you have barked this right into Ms Merkel’s face?”

Barnard rounded off his rant with a rallying call for Italians to follow the UK’s example and demand an exit from the EU — a prospect that should be taken very seriously given that one of the manifesto pledges of Italy’s rising opposition party, the 5-Star Movement, is to call a referendum on Italy’s membership of the euro.

Ambrose has religion. He believes!

• US Shale Producers Weather Oil Price Storm (AEP)

Opec’s worst fears are coming true. Twenty months after Saudi Arabia took the fateful decision to flood world markets with oil, it has failed to break the back of the US shale industry. The Saudi-led Gulf states have certainly succeeded in killing off a string of global mega-projects in deep waters. Investment in upstream exploration from 2014 to 2020 will be $1.8 trillion less than previously assumed, according to consultants IHS. But this is an illusive victory. North America’s hydraulic frackers are cutting costs so fast that most can now produce at prices far below levels needed to fund the Saudi welfare state and its military machine, or to cover Opec budget deficits.

Scott Sheffield, the outgoing chief of Pioneer Natural Resources, threw down the gauntlet last week – with some poetic licence – claiming that his pre-tax production costs in the Permian Basin of West Texas have fallen to $2.25 a barrel. “Definitely we can compete with anything that Saudi Arabia has. We have the best rock,” he said. Revolutionary improvements in drilling technology and data analytics that have changed the cost calculus faster than most thought possible. The “decline rate” of production over the first four months of each well was 90pc a decade ago for US frackers. This dropped to 31pc in 2012. It is now 18pc. Drillers have learned how to extract more. Mr Sheffield said the Permian is as bountiful as the giant Ghawar field in Saudi Arabia and can expand from 2m to 5m barrels a day even if the price of oil never rises above $55.

His company has cut production costs by 26pc over the last year alone. Pioneer is now so efficient that it already adding five new rigs despite today’s depressed prices in the low $40s, and it is not alone. The Baker Hughes count of North America oil rigs has risen for seven out of the last eight weeks to 374, and this understates the effect. Multi-pad drilling means that three wells are now routinely drilled from the same rig, and sometimes six or more. Average well productivity has risen fivefold in the Permian since early 2012. Consultants Wood Mackenzie estimated in a recent report that full-cycle break-even costs have fallen to $37 at Wolfcamp and Bone Spring in the Permian, and to $35 in the South Central Oklahoma Oil Province. The majority of US shale fields are now viable at $60.

Once again: demand.

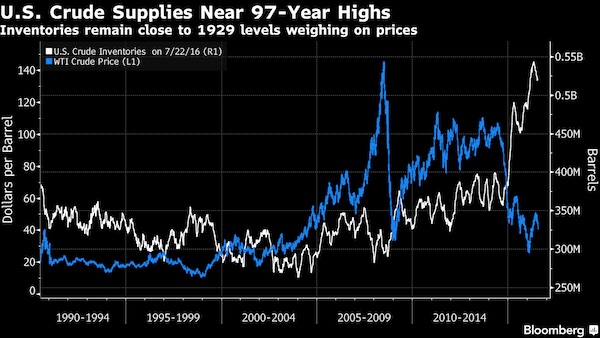

• Growing Oil Glut Shows Investors There’s Nowhere to Go But Down (BBG)

Money managers have never been more certain that oil prices will drop. They increased bets on falling crude by the most ever as stockpiles climbed to the highest seasonal levels in at least two decades, nudging prices toward a bear market. The excess supply hammered the second-quarter earnings of Exxon Mobil and Chevron. Inventories are near the 97-year high reached in April as oil drillers boosted rigs for a fifth consecutive week. “The rise in supplies will add more downward pressure,” said Michael Corcelli, chief investment officer at Alexander Alternative Capital, a Miami-based hedge fund. “It will be a long time before we can drain the excess.”

Hedge funds pushed up their short position in West Texas Intermediate crude by 38,897 futures and options combined during the week ended July 26, according to the Commodity Futures Trading Commission. It was the biggest increase in data going back to 2006. WTI dropped 3.9% to $42.92 a barrel in the report week, and traded at $41.75 at 12:20 p.m. Singapore time. WTI fell by 14% in July, the biggest monthly decline in a year. It’s down by 19% since early June, bringing it close to the 20% drop that would characterize a bear market.

U.S. crude supplies rose by 1.67 million barrels to 521.1 million in the week ended July 22, according to U.S. Energy Information Administration data. Stockpiles reached 543.4 million barrels in the week ended April 29, the highest since 1929. Gasoline inventories expanded for a third week to 241.5 million barrels, the most since April. “The flow is solidly bearish,” said Tim Evans, an energy analyst at Citi Futures Perspective in New York. “It reflects a recognition that the market is, at least for the time being, oversupplied.”

Hinkley Point is about the worst British plan ever, and that’s saying something.

• Amid Britain Nuclear Debacle, China’s Xinhua Decries ‘Suspicion’ (R.)

China will not tolerate “unwanted accusations” about its investments in Britain, a country that cannot risk driving away other Chinese investors as it looks for post-Brexit trade deals, China’s official Xinhua news agency said on Monday. British Prime Minister Theresa May was concerned about the security implications of a planned Chinese investment in the Hinkley Point nuclear plant and intervened to delay the project, a former colleague and a source said on Saturday.The plan by France’s EDF to build two reactors with financial backing from a Chinese state-owned company was championed by May’s predecessor David Cameron as a sign of Britain’s openness to foreign investment.

But just hours before a signing ceremony was due to take place on Friday, May’s new government said it would review the project again, raising concern that Britain’s approach to infrastructure deals, energy supply and foreign investment may be changing. China General Nuclear Power, which would hold a stake of about a third in the project, said on Saturday it respected the decision of the new British government to take the time needed to familiarise itself with the program. Xinhua, in an English-language commentary, said China understood and respected Britain’s requirement for more time to think about the deal. “However, what China cannot understand is the ‘suspicious approach’ that comes from nowhere to Chinese investment in making the postponement,” it said.

The project will create thousands of jobs and create much needed energy following the closure of coal-fired power plants, Xinhua added, dismissing fears China would put “back-doors” into the project. “For a kingdom striving to pull itself out of the Brexit aftermath, openness is the key way out,” it said.

But please don’t think this means problems are over.

• Greece Eases Back On Capital Controls In Bid To Reverse Currency Flight (G.)

More than a year after they were imposed, capital controls in Greece will be substantially eased on Monday in a bid to lure back billions of euros spirited out of the country, or stuffed under mattresses, at the height of the eurozone crisis. The relaxation of restrictions, whose announcement sent shockwaves through markets and the single currency, is aimed squarely at boosting banking confidence in the eurozone’s weakest member. The Greek finance ministry estimates around €3bn-€4bn could soon be returned to a system depleted of more than €30bn in deposits in the run-up to Athens sealing a third bailout to save it from economic collapse last summer.

“The objective is to re-attract money back to the banking system which in turn will create more confidence in it,” said Prof George Pagoulatos who teaches European politics and economy at Athens University. “And there are several billion that can be returned. People just need to feel safe.” As such the loosening of measures initially seen as an aberration in the 19-strong bloc is being viewed as a test case: of the faith Greeks have in economic recovery and the ability of their leftist-led government to oversee it. New deposits will not be subject to capital controls; limits on withdrawals of money brought in from abroad will also be higher; and ATM withdrawals will be raised to €840 every two weeks in a reversal of the policy that allowed depositors to take out no more than €420 every week.

[..] From 2008, the year before the country’s debt crisis erupted, until the end of 2015, an estimated 244,700 small- and medium-sized businesses have closed with many more expected to declare bankruptcy this year. The latest move, which follows easing of transactions abroad, is directed at small entrepreneurs, for years the lifeline of the Greek economy, and individual depositors. But while economists are calling the easing of restrictions a significant step to normalisation, Greek finances are far from repaired. Challenges for the prime minister, Alexis Tsipras, are expected to peak – along with social discontent – in the autumn when his fragile two-party coalition is forced to meet more milestones and creditor demands, starting with the potentially explosive issue of labour reform. Further disbursement of aid – €2.8bn – will depend exclusively on the painful measures being passed.

The Great Deflation.

• Building a Progressive International (YV)

Politics in the advanced economies of the West is in the throes of a political shakeup unseen since the 1930s. The Great Deflation now gripping both sides of the Atlantic is reviving political forces that had lain dormant since the end of World War II. Passion is returning to politics, but not in the manner many of us had hoped it would. The right has become animated by an anti-establishment fervor that was, until recently, the preserve of the left. In the United States, Donald Trump, the Republican presidential nominee, is taking Hillary Clinton, his Democratic opponent, to task – quite credibly – for her close ties to Wall Street, eagerness to invade foreign lands, and readiness to embrace free-trade agreements that have undermined millions of workers’ living standards.

In the United Kingdom, Brexit has cast ardent Thatcherites in the role of enthusiastic defenders of the National Health Service. This shift is not unprecedented. The populist right has traditionally adopted quasi-leftist rhetoric in times of deflation. Anyone who can stomach revisiting the speeches of leading fascists and Nazis of the 1920s and 1930s will find appeals – Benito Mussolini’s paeans to social security or Joseph Goebbels’ stinging criticism of the financial sector – that seem, at first glance, indistinguishable from progressive goals.

What we are experiencing today is the natural repercussion of the implosion of centrist politics, owing to a crisis of global capitalism in which a financial crash led to a Great Recession and then to today’s Great Deflation.The right is simply repeating its old trick of drawing upon the righteous anger and frustrated aspirations of the victims to advance its own repugnant agenda. It all began with the death of the international monetary system established at Bretton Woods in 1944, which had forged a post-war political consensus based on a “mixed” economy, limits on inequality, and strong financial regulation. That “golden era” ended with the so-called Nixon shock in 1971, when America lost the surpluses that, recycled internationally, kept global capitalism stable.

What a crazy story.

• India Rescues 10,000 Starving Workers In Saudi Arabia (Sky)

The Indian government has come to the rescue of more than 10,000 of their starving citizens in Saudi Arabia. Some 16,000 kg of food was distributed on Saturday night by the consulate to penniless workers who’ve lost their jobs and not been paid. The issue came to light when a man tweeted India’s foreign minister Sushma Swaraj saying around 800 Indians had not eaten for three days in Jeddah, asking her to intervene. Investigations found that there were thousands starving across Saudi Arabia and Kuwait. Ms Swaraj instructed the consulate to make sure no unemployed worker is to go without food, and is said to have monitored the situation on an hourly basis.

She tweeted: “Large number of Indians have lost their jobs in Saudi Arabia and Kuwait. The employers have not paid wages, closed down their factories. “The number of Indian workers facing food crisis in Saudi Arabia is over ten thousand.” Many workers in Saudi Arabia and Kuwait have been living in inhumane conditions after losing their jobs. Hundreds have been laid off without being paid their wages. Indian newspapers reported that one firm – the Saudi Oger company – did not pay wages for seven months. Of its 50,000 employees, 4,000 were Indians. India’s Consul General Mohammad Noor Rehman Sheikh, told a news agency: “For the last seven months these Indian workers of Saudi Oger were not getting their salaries and the company had also stopped providing food to these workers.”

[..] India’s junior foreign minister VK Singh has been tasked to travel to Saudi Arabia to put in place an evacuation process which is due to begin soon. He had successfully led the evacuation of a large number of Indians from war-torn Yemen and most recently from South Sudan. There are more than three million Indians living and working in Saudi Arabia and more than 800,000 in Kuwait. Falling oil prices have hit the economy of Saudi Arabia and other Gulf countries.

Home › Forums › Debt Rattle August 1 2016