G. G. Bain At Casino, Belmar, Sunday, NJ 1910

Warning against vulture funds. Then again, isn’t the IMF one of them too?

• Private Lenders Increase the Risk of a Global Debt Crisis (TeleSur)

Private creditors have replaced the public sector as lead borrower to developing countries, which has contributed to a new borrowing and lending boom. Private financial institutions are responsible for prompting a potential “new wave” of debt crises among developing nations, according to a new report carried out by European Think Tank Eurodad. Public debt in developing countries is increasingly being borrowed from private lenders, which the authors argue has meant that an increasing portion of credit is not effectively monitored or regulated. “Private borrowers, in particular private corporations, have used this regulation gap to throw a big borrowing party, a debt party, and thus have contributed disproportionately to the external debt burden that developing countries carry now,” the report warned.

As part of its findings, the authors of the report concluded that, “while relative debt burdens decreased between 2000 and 2010, these trends have reversed in 2011. Since then debt is on an upward path, also when measured in relative terms.” Developing countries total external debt burden reached US$5.4 trillion in 2014 and over half of this amount is now owed by private debtors, according to data from the report titled,“The Evolving Nature of Developing Country Debt and Solutions for Change.” The study attributed the recent increase in private creditors to the heavy public borrowing that took place during the 1980’s and 1990’s, which prompted sharper restrictions on public lending institutions such as the International Monetary Fund.

Remember affordable housing?

• US Homeownership Dips to Lowest Rate Since 1960 (RCM)

The US homeownership rate, as recently reported by the Census Bureau, dropped to 62.9% in the second quarter of 2016, a rate about equal to the rate of 61.9% reported over a half century ago for 1960. This stagnation compares unfavorably to 1900 to 1960 when the non-farm homeownership rate increased from 36.5% to 61%.-a period encompassing rampant urbanization, immigration, and population growth. For example, the non-farm population quadrupled from about 42 million to 166 million, yet the non-farm homeownership rate increased by 67%. Except for the interruption caused by the Great Depression, the rate of increase was moderate to strong throughout the period.

How can this be? Isn’t there an alphabet soup of federal agencies-FHA, HUD, FNMA, FHLMC, GNMA, RHS, FHLBs-all with the goal of increasing homeownership by making it more “affordable”? Don’t these agencies fund or insure countless trillions of dollars in home loan lending–most with very liberal loan terms? Could it be the federal government massive liberalization of mortgage terms creates demand pressure leading to higher prices? Could it be federal, state, and local governments’ implement land use policies that constrain supply and drive prices up even further? Could it be government housing policies have made homeownership less, not more affordable or accessible?

The answer is an unequivocal yes. Since the mid-1950, liberalized federal lending policies have fueled a massive and dangerous increase in leverage-one that continues to this day. For example, in 1954 FHA loans had an average loan term of 22 years vs. 29.5 years today, an average loan-to-value of 80% vs. 97.5%, average housing debt-to-income ratio of 15% vs. 28%. Only the average borrowing cost in 1954 of 4.5% is the same as it is today. The result is today’s FHA borrower can purchase a home selling for twice as much as one with the underwriting standards in place in 1954-but without a dollar’s increase in income!

It’s all a big rip-off. Get the government out of housing once and for all.

• The Next Huge American Housing Bailout Could Be Coming (TAM)

The failures of government intervention in the economy have made headlines yet again. Recent stress tests by the Federal Housing Finance Agency found something sinister brewing under the surface at notorious mortgage giants Fannie Mae and Freddie Mac. The results show that these puppet companies could need up to a $126 billion bailout if the economy continues to deteriorate. That’s right — the two companies that were taken over by the government and that sucked $187 billion from the treasury could be entitled to more taxpayer money. The toxic home loans bought during the last crisis coupled with a lack of liquidity have suddenly become serious risk factors.

The so-called “recovery” that has been trumpeted for years by countless politicians and economists is falling apart in plain view. The media will do just about anything to assure the public that this is all isolated and overblown, but the canary in the coal mine has just dropped dead. The tests ran a scenario eerily similar to warnings we’ve heard about what the economic future might hold: “The global market shock involves large and immediate changes in asset prices, interest rates, and spreads caused by general market dislocation and uncertainty in the global economy.” In the throes of the 2008 crisis, the government took many unprecedented actions, but one of the most notable was seizing control of the two largest mortgage loan holders in the country.

Since then, Fannie Mae and Freddie Mac have been converted from subsidized private organizations into some of the biggest government-sponsored enterprises ever created. These institutions have been used to prop up the entire real estate market by purchasing trillions of dollars in home loans from other banks to keep prices elevated. Without Fannie and Freddie, the supply of houses on the market would have far exceeded the number of buyers. This glut in supply and low demand would have forced sellers to lower prices until a deal was made. Instead, these wards of the state were able to buy up properties at artificially high prices using government-issued blank checks, allowing for the manipulation of home values back up to desired levels.

Debt at work.

• China’s Stimulus Efforts Show ‘Malinvestment Is Still Hard at Work’ (BBG)

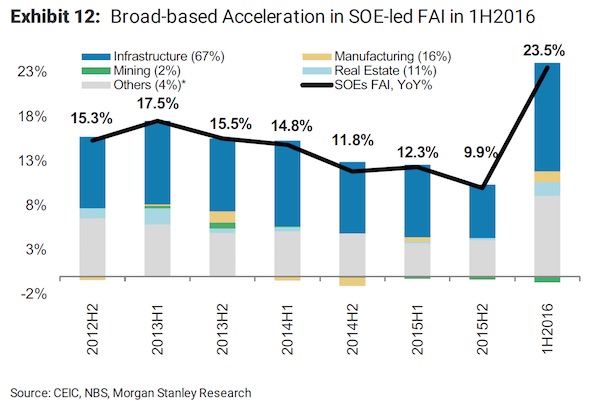

It was supposed to be different this time. Ahead of looming fiscal stimulus from China, analysts were quick to emphasize that this would be a leaner, smarter government spending program. There would be a new method of financing to try to keep the debt burdens for local governments from becoming too onerous. And, above all, it would be targeted to avoid exacerbating the excess capacity that’s abundant in many industries. While the scale of the expenditures certainly pales in comparison to those that followed the Great Recession, the story remains the same. A Morgan Stanley team, led by Chief China Economist Robin Xing, noted that fixed-asset investment growth among state-owned enterprises (or SOEs) has accelerated across the board in 2016, with the exception of mining.

This same trend also holds for investment in services sectors, Xing observed. These data suggest that stimulus efforts have not been as targeted as proponents hoped, belie the narrative of rotation of growth from credit-driven infrastructure projects to activity linked to domestic demand, and raise the specter of further malinvestment in the world’s second largest economy. “We know a) in real terms rebalancing isn’t advancing as much as the government protests citing nominal data and b) the restimulation this last year of investment via credit and fiscal policies will certainly have slowed it down further,” writes George Magnus, senior economic adviser at UBS. “Capital accumulation isn’t all or always wrong but if it’s largely debt financed and SOE provided, I’d say that malinvestment is still hard at work.”

Lest we forget: There is no market. There is only distortion.

• The UK Is the New Engine of Bond-Market Distortion (WSJ)

Britain has taken over from Japan as the world’s wildest bond market, raising new questions about the distortions being caused by central banks. The soaring price (and so plunging yield) of the 30-year gilt means it has now returned the same 31% over the past 12 months as the Japanese 30-year note, even as some of the excess in long-dated Japanese bonds falls away. The race into gilts partly anticipated and was accelerated by the Bank of England’s resumption of bond purchases this week, part of a package of monetary easing designed to offset damage to the economy from June’s Brexit vote. Lower gilt yields are in turn contributing to demand for global bonds, helping keep U.S. Treasury yields depressed even as other market moves suggest a revival of hopes for growth and inflation.

This again raises a long-running problem for investors. Should they regard low yields as a sign of how grim a future is in store for the world economy? Or are central banks distorting the signal so much through bond purchases that yields no longer carry much information about the economy? The rally in gilts has been extraordinary, with the yield on the U.K.’s longest-dated bond, the 2068 maturity, almost halving from 2% on the day of the referendum to 1.06% on Thursday. The price of the bond is up 53% this year, the sort of gains usually produced by risky stocks, not rock-solid government paper.

Consolation: it happens everywhere.

• A Really Vicious Circle Is Threatening UK Pension Pots (BBG)

As the Bank of England seeks to ease Brexit angst by injecting money into the U.K. economy, pension managers and insurers are finding themselves caught up in a vicious circle. Britain’s new quantitative-easing program, combined with monetary easing around the world, is crushing yields, leaving these long-term investors ever more desperate to hold on to their 20-, 30- and 50-year bonds to meet return targets and liabilities. That forces protagonists like the BOE, which is buying 60 billion pounds ($78 billion) of government debt over six months, to bid higher prices – driving yields down even further.

This may explain the crunch this week, when the central bank failed to find enough investors to sell it longer-maturity gilts, the part of the debt market dominated by pensions and insurers. While the revival of QE is intended to reduce the risk of a Brexit-fueled slump, the shortfall raises the question of whether debt purchases with newly created money are becoming part of the problem as well as the solution. “We recognize the Bank’s concern and the need to protect the economy,” said Helen Forrest Hall, defined-benefit policy lead at the Pensions and Lifetime Savings Association in London. “But the challenge we have is that the QE programs do have an impact on pension funds’ liabilities.”

Yeah, can’t risk bank profits, can we?

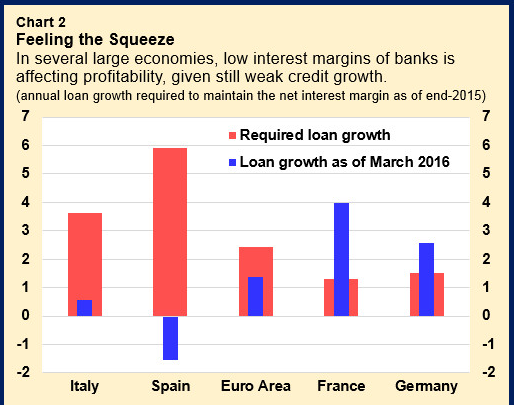

• IMF to ECB: Forget Negative Rates, Or You’ll Do More Harm Than Good (MW)

Economists at the IMF are urging the ECB to stop yanking interest rates further into negative territory, warning it will take a toll on the region’s already struggling banks and reduce lending to businesses and households. In a blog post on the IMF website, economists Andy Jobst and Huidan Lin say any additional cuts that would push rates further below zero will encounter diminishing returns and threaten, at this point, to do more harm than good. “Further policy rate cuts could bring into focus the potential trade-off between effective monetary transmission and bank profitability. Lower bank profitability and equity prices could pressure banks with slender capital buffers to reduce lending, especially those with high levels of troubled loans,” the analysts said on the blog.

“The prospect of prolonged low policy rates has clouded the earnings outlook for most banks, suggesting that the benefits from a negative interest rate policy might diminish over time,” they said. The warning comes as expectations are rising the central bank will announce fresh stimulus at its September meeting to offset the negative impact on the eurozone from the U.K.’s Brexit vote on June 23. At its July meeting, ECB boss Mario Draghi stopped short of pledging more measures, saying the policy makers will reassess in September when it will have fresh economic forecasts that factor in the impact of the U.K.’s referendum on ending its EU membership.

New normal: Profit falls 90%, shares up 5.3%.

• Global Shipping Giant Moller-Maersk Reports 90% Fall In Net Profit (CNBC/R.)

Moller-Maersk kept its downbeat 2016 profit forecast on Friday as the Danish shipping and oil giant reported net profit way under expectations as it struggles to cope with a shipping recession and tough oil markets. The Danish shipping and oil group said net profit fell to $101 million in April-June, lagging a forecast of $196 million. It was also around 90% lower than the $1.069 billion reported for the same period last year. The company maintained its outlook for an underlying profit for the full year significantly below last years $3.1 billion. Shares of the group were up 5.3% Friday morning.

Trond Westlie, chief financial officer of Maersk Group, told CNBC on Friday that the shipping industry faced turbulent times as a result of the “very difficult” oil market and decline in freight rates. “When we look at the overall market and when we look at supply and demand and the growth in the world, we still think it’s going to be low-growth and volatile.” “For us, like always, we have a view on a couple of weeks or a four weeks’ indication on where the market is going but after that it’s very opaque for us as well.”

Home › Forums › Debt Rattle August 12 2016