Harris&Ewing Goat team, Washington, DC 1917

Virtual money economy.

• Silicon Valley May Get Hit By China’s ‘Virtual Reality’ Economy (CNBC)

“Japan 25 years ago and China now were both debt [and] currency fueled flood of cash into U.S. assets inflating both valuations and fears,” Josh Wolfe, co-founder and managing partner of Lux Capital, a $700 million venture capital firm, told CNBC via email this week. Like other skeptical investors, Wolfe believes there are “really two Chinas: A high growth tech and biotech driven economy conflated with a levered old asset state owned influenced burden of very bad decision making and governance.” China’s high debt, slowing growth and appetite for U.S. assets—the country already owns trillions in U.S. Treasuries and dollars—raises the stakes for tech companies if the country’s fortunes should suddenly reverse.

Of the nearly $60 billion that the National Venture Capital Association says was invested in U.S. startups last year, about a quarter of those flows came from one destination: China. Along with art and high end real estate, tech ventures have been the primary recipient of China’s largesse. Meanwhile, 2016 has already exceeded last year’s record flow of Chinese capital, according to recent figures from The Rhodium Group. Wolfe told CNBC that Chinese investors “are fleeing a virtual reality economy in China and funding virtual reality startups in the U.S. They seem to be choosing illiquidity and uncertainty, denominated in dollars over liquidity and certainty of devaluation denominated in yuan.”

China’s slowing economy has reverberated across the globe, sending commodities reeling and giving investors fright. That pain is far from over: The IMF warned on Friday that China’s real GDP could sink below 6% in 2020. If Chinese interest rates rise or liquidity tightens, the flood of money threatens to do “what all excesses do: reverse or stop,” said Lux Capital’s Wolfe. “As the China bubble pops, it has been commodities and commodity exporting countries in the first wave, then banks and non-performing loans, then it will be the assets they financed or were secured by.”

Yuan+Junk=Yunk.

• High-Risk ‘Shadow’ Credit in China Put at $2.9 Trillion by IMF (BBG)

IMF staff said that 19 trillion yuan ($2.9 trillion) of Chinese “shadow” credit products are high-risk compared with corporate loans and highlighted the danger that defaults could lead to liquidity shocks. The investment products are structured by the likes of trust and securities companies and based on equities or on debt – typically loans – that isn’t traded, staff members John Caparusso and Kai Yan said in a report released Friday. The commentary highlighted the potential for risks bigger to the nation’s financial stability than from companies’ loan defaults. While loan losses can be realized gradually, defaults on the shadow products could trigger risk aversion that’s harder to manage, the report said.

The “high-risk” products offer yields of 11% to 14%, compared with 6% on loans and 3% to 4% on bonds, the commentary said. The lowest-quality of these products are based on “nonstandard credit assets,” typically loans, it said. In a separate document in a bundle released by the IMF, the Chinese banking regulator was cited as saying that banks’ exposures to “nonstandard credit assets” were a key concern, with moves already made to require higher provisioning against such exposures than for regular loans.

“Foreign buying of US assets very often reaches record highs prior to major financial accidents.”

• Insanity, Oddities and Dark Clouds in Credit-Land (AM)

Bond markets are certainly displaying a lot of enthusiasm at the moment – and it doesn’t matter which bonds one looks at, as the famous “hunt for yield” continues to obliterate interest returns across the board like a steamroller. Corporate and government debt have been soaring for years, but investor appetite for such debt has evidently grown even more. A huge mountain of interest-free risk has accumulated in investor portfolios and on bank balance sheets. Globally, more than $13 trillion in sovereign bonds trade at negative yields to maturity. In spite of soaring defaults, junk bond yields have collapsed again as well. In short, insanity rules in the bond markets. A recent article in the FT informs us of “a wave of foreign demand for US corporate debt”:

“Record-low interest rates are no barrier for US companies finding buyers for their debt thanks to a relentless global quest for fixed returns that shows little sign of easing. The pace of US corporate debt sales – which has not been fast enough to quench investor demand – is expected to continue unabated driven by foreign buyers in a world where roughly $13tn of sovereign and corporate debt trades in negative territory. “It is a low return world,” says Ed Campbell, a portfolio manager with asset manager QMA. “You don’t have a lot of asset classes that are attractive and there is a flight to quality where the US is outperforming.” More than $2.3tn of dollar-denominated debt has been issued by companies and banks since the year began, including three of the ten largest corporate bond sales on record, Dealogic data show.”

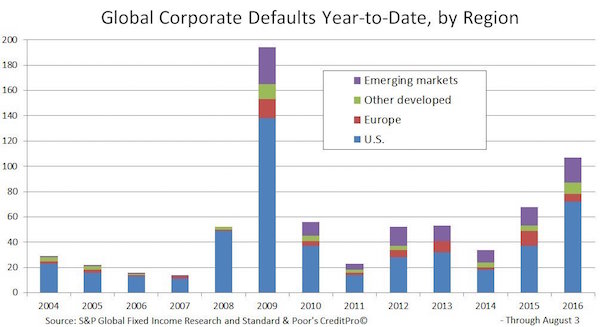

This not only shows that “investors” (we use the term loosely) are insane, it also happens to be a contrary indicator. Foreign buying of US assets very often reaches record highs prior to major financial accidents. Is this really a “flight to quality?” Corporate defaults are currently at the highest level since 2009, with US defaults clearly leading the pack:

And what should(s)he do for everyone else who’s in trouble? Can’t very well help only students.

• The Next President Should Forgive All Student Loans (TIME)

If Hillary Clinton is to win this November, she needs to motivate the electorate to come out to vote for something more than a justified aversion to Donald Trump. Particularly for younger voters and voters with families, she has to capture their imaginations with a bold, simple, and common sense proposal to address one of the most critical financial and social problems currently facing a generation: the student loan crisis. And she needs to do so in a way that can do the most immediate good for the nation at large. First, all outstanding student loan debt should be forgiven. Second, a new loan program should be created that is tied to incentives for college graduates to choose careers in public service and which indexes repayment to income.

Current outstanding student loans amount to 1.3 trillion dollars, roughly 10% of all household debt. Student loan debt is larger than either car loans or credit card debt. Forty-two million Americans hold student loan debt. Student debt has been a drag on younger generations’ incomes and has contributed to the stagnation in middle class earnings. The average debt at graduation has skyrocketed from $10,000 in 1993 to more than $35,000 in 2016. Furthermore, the federal government has set interest rates on student loans at twice the current market rate of other types of loans. Going to college should not be a profit center for Wall Street and the federal government.

By forgiving student loan debt—which is largely held by the government—a tremendous economic stimulus would be generated, whose beneficiaries are people, not banks. The cost is comparable to the stimulus program created in the wake of the financial crisis of 2008, and, in this case, Main Street and not Wall Street will benefit. Quickly, more than two generations of Americans would be able to invest in homes and develop and support families. And the Americans who benefit are those who have obtained education and skills, but whose careers have been hobbled by an inordinate amount of debt.

Private debt sinks societies. For no good reason. Make forgiving student debt part of a modern jubilee?!

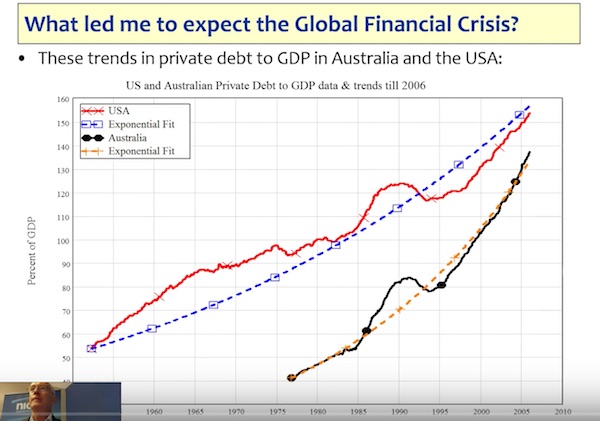

• The Big Idea about Private Debt (Steve Keen)

This is a talk I gave to the Northern Ireland Big Ideas Event organised by NICVA: the “Northern Ireland Council for Voluntary Action” (https://www.nicva.org/event/big-ideas-…). Unfortunately I ran out of time to finish my presentation on why a “Modern Debt Jubilee” is needed to escape from the current economic state of credit stagnation, but I covered why it is this–and not “secular stagnation” that explains the prevalence of low rates of economic growth globally.

True but not strong.

• How to Break the Power of Money (Korten)

Our current political chaos has a simple explanation. The economic system is driving environmental collapse, economic desperation, political corruption, and financial instability. And it isn’t working for the vast majority of people. It serves mainly the interests of a financial oligarchy that in the United States dominates the establishment wings of both the Republican and Democratic parties. So voters are rebelling against those wings of both parties—and for good reason. As a society we confront a simple truth. An economic system based on the false idea that money is wealth—and the false promise that maximizing financial returns to the holders of financial assets will maximize the well-being of all—inevitably does exactly what it is designed to do:

1. Those who have financial assets and benefit from Wall Street’s financial games get steadily richer and more powerful. 2. The winners use the power of their financial assets to buy political favor and to hold government hostage by threatening to move jobs and tax revenue to friendlier states and countries. 3. The winners then use this political power to extract public subsidies, avoid taxes, and externalize environmental, labor, health, and safety costs to further increase their financial returns and buy more political power. This results in a vicious cycle of an ever greater concentration of wealth and power in the hands of those who demonstrate the least regard for the health and well-being of others and the living Earth, on which all depend.

Fewer and fewer people have more and more power and society pays the price. A different result requires a different system, and the leadership for change is coming, as it must, from those for whom the current system does not work.

“The agreements make global corporations immune to laws and regulations that can be said to adversely impact their profits.”

• TTIP: The Suicide of Nations (PCR)

The TransAtlantic and TransPacific “partnerships” are the economic and financial counterpart to Washington’s military and foreign policy push for world hegemony. TTIP and TPP are neither partnerships nor trade agreements. They are instruments of financial imperialism that, if they come into effect, subordinate the sovereignty of countries to the profits of global corporations. The reason the “partnerships” are negotiated in secrecy without public discussions and the participation of the national legislatures is that the so-called agreements cannot stand the light of day. The reason is simple. The agreements make global corporations immune to laws and regulations that can be said to adversely impact their profits.

It makes no difference whether the laws protect the environment, the safety of food and workers or are part of the social fabric. If the laws impose costs that reduce profits, corporations can sue the governments in “corporate tribunals” in which the corporations themselves serve as judge and jury. This is no joke. Public Citizen reports that the agreements would greatly expand the privileges given to foreign corporations by the North American Free Trade Agreement under which $350 million has been paid out by governments to corporations because of costs of complying with toxic waste and logging rules, with $13 billion in claims pending.

Economist Michael Hudson cites a British study that public provision of health care, such as the UK’s National Health Service, is a TTIP target on the grounds that not only health care regulations but also public provision of health care harms the commercial interests of corporations. TTIP and TPP are tools for disenfranchising electorates and overturning democratic outcomes and for looting taxpayers via damage suits against governments for the costs of complying with health, safety, environmental, and social laws and regulations. The agreements place corporations above the laws of countries. The agreements have the potential of producing a worldwide sweatshop with starvation wages devoid of environmental and safety legislation.

Curious ideas when coming from the Wall Street Journal.

• How Global Elites Forsake Their Countrymen (Noonan)

On Wall Street, where they used to make statesmen, they now barely make citizens. CEOs are consumed with short-term thinking, stock prices, quarterly profits. They don’t really believe that they have to be involved with “America” now; they see their job as thinking globally and meeting shareholder expectations. In Silicon Valley the idea of “the national interest” is not much discussed. They adhere to higher, more abstract, more global values. They’re not about America, they’re about … well, I suppose they’d say the future. In Hollywood the wealthy protect their own children from cultural decay, from the sick images they create for all the screens, but they don’t mind if poor, unparented children from broken-up families get those messages and, in the way of things, act on them down the road.

From what I’ve seen of those in power throughout business and politics now, the people of your country are not your countrymen, they’re aliens whose bizarre emotions you must attempt occasionally to anticipate and manage. In Manhattan, my little island off the continent, I see the children of the global business elite marry each other and settle in London or New York or Mumbai. They send their children to the same schools and are alert to all class markers. And those elites, of Mumbai and Manhattan, do not often identify with, or see a connection to or an obligation toward, the rough, struggling people who live at the bottom in their countries. In fact, they fear them, and often devise ways, when home, of not having their wealth and worldly success fully noticed.

Affluence detaches, power adds distance to experience. I don’t have it fully right in my mind but something big is happening here with this division between the leaders and the led. It is very much a feature of our age. But it is odd that our elites have abandoned or are abandoning the idea that they belong to a country, that they have ties that bring responsibilities, that they should feel loyalty to their people or, at the very least, a grounded respect.

“Did they think they can separate me from my kids without a fight? I fight corrupt US empire clowns all day, every day. Not even tired.”

• Megaupload’s Dotcom To Seek A Review Of US Court’s Forfeiture Ruling (R.)

German tech entrepreneur and alleged internet pirate Kim Dotcom will seek a review of a Federal Court decision which rejected his bid to keep hold of millions of dollars in assets held in Hong Kong and New Zealand, his lawyer said. A three-judge panel of the 4th Circuit U.S. Court of Appeals ruled two to one on Friday that Dotcom could not recover his assets because by remaining outside the U.S., he was a fugitive, which disentitled him from using the resources to fight his case. Dotcom’s lawyer Ira P. Rothken said his client would seek a review of the decision in front of the full bench and, if necessary, petition the Supreme Court.

“This opinion has the effect of eviscerating Kim Dotcom’s treaty rights by saying if you lawfully oppose extradition in New Zealand, the U.S. will still call you a fugitive and take all of your assets,” Rothken said in an email to Reuters received on Sunday. Dotcom has been fighting extradition from New Zealand over charges of copyright infringement, racketeering and money laundering in the United States related to the Megaupload file-sharing site he founded in 2005. A New Zealand court ruled in December he could be extradited, but an appeal hearing has been set for later this month. Dotcom responded to the Federal Court ruling on Twitter. “Did they think they can separate me from my kids without a fight? I fight corrupt US empire clowns all day, every day. Not even tired.”

The writedowns total down the road keeps growing rapidly.

• A Year After The Crisis Was Declared Over, Greece Is Still Spiralling Down (G.)

In a side street in the heart of Athens, two siblings are hard at work. For the past year they have run their hairdressing business – an enterprise that was once located on a busy boulevard – out of a two-bedroom flat. The move was purely financial: last summer, as it became clear that Greeks would be hit by yet more austerity to foot the bill for saving their country from economic collapse, they realised their business would go bust if it continued operating legally. “We did our sums and understood that staying put made no sense at all,” says one sibling. “If we didn’t [offer] receipts, if we avoided taxes and social security contributions, we could just about make ends meet.”

They are far from being alone. A year after debt-stricken Greece received its third financial rescue in the form of international funding worth €86bn, such survival techniques have become commonplace. For a middle class eviscerated by relentless rounds of cuts and tax rises – the price of the country’s ongoing struggle to avert bankruptcy – the draconian conditions attached to the latest bailout are invariably invoked in their defence. Measures ranging from the overhaul of the pension system to indirect duties – slapped on beer, fuel and almost everything in between – and a controversial increase in VAT are similarly cited by Greeks now reneging on loan repayments, property taxes and energy bills.

Against a backdrop of monumental debt – €320bn, or 180% of GDP, the accumulation of decades of profligacy – fatalism is fast replacing pessimism on the streets. “Our country is doomed,” sighs Savvas Tzironis, summing up the mood. “Everything goes from bad to worse.” Close to half a million Greeks are believed to have migrated since the crisis begun, thanks to the searing effect of persistent unemployment (at just under 24%, the highest in Europe) and an economy that has shed more than a third of its total output over the past six years. The nation has been assigned some €326bn in bailout loans since May 2010 – the biggest rescue programme in global financial history. Yet the fear that it is locked in an economic death spiral was given further credence last week when Eurobank analysts announced that consumption and exports had also fallen, by 6.4% and 7.2%, in the second quarter of the year.

And why should Larry Elliott not call a spade a spade? What’s happening to Greece is not some ‘policy mistake’, all parties involved know exactly what they do.

• The Greek Crisis Will Flare Up Again. And Why Should It Not? (G.)

Greece has ceased to make headlines. A year ago, the TV cameras were trained on the protesters thronging the streets of Athens because there were fears that a crisis that had been steadily becoming more acute in the first half of 2015 could result in the single currency splintering. That threat was removed by a deal that involved a humiliating climbdown by the Syriza-led government. Greece received a bailout, but with harsh conditions attached. There were three obvious problems with that 2015 deal, which secured Greece its third bailout in five years. The first was that the new dose of austerity would make it more difficult for Greece to emerge from a slump just as severe as that which gripped the US in the 1930s.

The second was that Greece’s creditors were making unrealistic assumptions for growth and deficit reduction. The third was that sooner or later the Greek crisis would flare up again. It was a case of when, not if. It has not all been bad news over the past 12 months. Fears that yields on Greek bonds would soar after the UK’s Brexit vote did not materialise. Some of the tough capital controls that were imposed in the summer of 2015 to protect the banking system have been eased. There has been talk that by next summer it will be possible for the government in Athens to raise money in the world’s financial markets by selling Greek government bonds. All that said, though, the first two predictions have come true.

By last summer, Greece had suffered a five-year slump that was on a par with the damage caused to the US economy in the Great Depression. Yet the country’s creditors thought it was a good idea to suck even more demand out of the economy through spending cuts and tax increases. The result has been depressingly predictable. Far from there being a resumption of growth, the economy has continued to contract. Greece’s national output was 1.4% lower in the first three months of 2016 than it was a year earlier. Consumer spending was down by 1.3%. Nor, with confidence at rock bottom, is there much prospect of better times. Greece remains deep in recession.

[..] The IMF says that without debt relief, Greece’s debt could hit 250% of GDP by the middle of the century. Germany would prefer those discussions to be delayed until after its election in autumn next year. But the chances are that Greece will be back in the headlines before then.

Oh, irony. Just a few days after I wrote about Greece’s 15 minutes of fame in Meanwhile in Greece.., both the Guardian and the NY Times happen to notice the same thing. “..ceased to make headlines..” , “..Attention dwindling..”

• Aid and Attention Dwindling, Migrant Crisis Intensifies in Greece (NYT)

Seven months after the EU shut the doors to large numbers of newcomers, Greece remains Europe’s de facto holding pen for 57,000 people trapped amid the chaos. Many are living in a distressing limbo in sordid refugee camps on the mainland and on Greek islands near Turkey. A year after the world was riveted by scenes of desperate men, women and children streaming through Europe, international attention to their plight has waned now that the borders have been closed and they are largely confined to camps. Anti-immigrant sentiment has surged since last year in many countries, especially as people who entered Europe with the migrant flow are linked to crimes and, in a few cases, attacks planned or inspired by the Islamic State or other radical groups.

Neither the prosperous nations of Western and Northern Europe, where the refugees want to settle, nor Turkey, their point of departure for the Continent, are living up to their promises of help. [..] The ranks of those in limbo are most likely to grow despite a deal to resolve the crisis that took effect March 20 between the EU and Turkey. While the number of migrants entering Greece has dwindled from nearly 5,000 a day last year, hundreds have started crossing the Aegean Sea again after the July 15 coup attempt in Turkey. Few of the resources pledged by the EU to assist the asylum seekers and process their applications have actually come through, leaving the Greek authorities struggling to cope with a daunting humanitarian and logistical challenge that has fallen from view in the rest of Europe.

European Union member states have sent just 27 of the 400 asylum specialists and 24 of the 400 interpreters they had agreed to provide to process claims for refugees like Mrs. Madran. So far, 21,000 migrants have been registered for asylum; 36,000 have not. A union plan to ease Greece’s burden by relocating tens of thousands of asylum seekers to the Continent has also fizzled, with European countries taking less than 2,300 people.

The bottlenecks have overwhelmed many of the camps, especially on the Greek islands, where migrants arriving after the March 20 deal are supposed to be held until being deported to Turkey. That program has stalled because of legal challenges and because Greece must process each asylum application first. So far, 468 of the more than 10,000 people who have arrived since the deal took effect have been returned. Turkish monitors assigned to assist were fired by President Recep Tayyip Erdogan of Turkey after the coup attempt against him.

“The cost for Greece since the beginning of the Refugee Crisis “is more than €2 billion, the EU has allocated so far €330million – not to the Greek government but to NGOs, mostly NGOs from abroad..” Makes you wonder how much of that €330million has actually been used to help refugees, and how much on NGO operating costs.

• Germany To Send 3,000 Refugees Back To Greece (KTG)

I thought, EU members states were supposed to take 6,000 refugees per month from Greece – according to some forgotten EU Deal signed the European Commission and the EU member states. Reality teaches us, the deal will work the other way around. Member states will send refugees back to …Greece. Blame the Dublin III Agreement. Germany decided to send to Greece and specifically to Crete more than 3,000 refugees in first phase. Berlin considers that this number is “redundant” in its territory. According to local media ekriti.gr, the Greek government has adopted this German decision, while Migration Minister Yiannis Mouzalas chaired a revelant meeting in Herakleion recently and announced the transfer.

The refugees will start coming by plane initially in Heraklion and Chania in December. Mouzalas had said that they will come after the tourist season. Independent MEP Notis Marias also confirmed the transfer in an interview with Radio Kriti. The cost for Greece since the beginning of the Refugee Crisis “is more than two billion euro, the EU has allocated so far €330million – not to the Greek government but to NGOs, mostly NGOs from abroad,” ekriti notes. Meanwhile the influx from Turkey started to increase again, more than 650 refugees and migrants arrived last week. Athens is worried that Ankara will draw back from the EU-Turkey deal in October.

Home › Forums › Debt Rattle August 14 2016