G. G. Bain Asbury Park, Jersey Shore 1914

“..people are still very keen to buy and the lenders are keen to lend..”

• British House-Buyers Dance With the Devil (BBG)

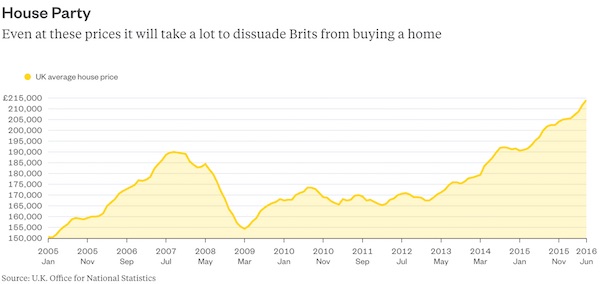

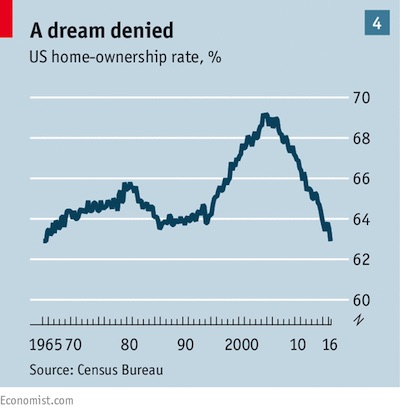

What will it take to halt the U.K. housing market? Maybe not the Brexit vote. British builder Persimmon became the latest to challenge the “Brexit is bearish for building” thesis on Tuesday when it said home reservation rates are 17% higher since July 1 compared to the same period a year ago. Customer site visits are buoyant too. To outsiders, this property obsession seems a kind of collective madness. Yes, British house prices are expected to fall 1% next year, according to economists at Countrywide, but they believe they’ll restart the upward march in 2018. Brits’ appetite for houses at inflated prices (see chart below) brings to mind former Citigroup boss Chuck Prince’s infamous 2007 assertion that “as long as the music is playing [in terms of liquidity], you’ve got to get up and dance”.

Wavering prospective home-buyers are enticed by ultra-cheap mortgages, bolstered by the Bank of England cutting rates after the Brexit vote. So buying is still often cheaper than renting. And while falling interest rates raise big questions about company pension promises, buying a home at least gives you somewhere to live in retirement. Persimmon CEO Jeff Fairburn told Bloomberg that “people are still very keen to buy and the lenders are keen to lend”.Brits aren’t mad, they’re just trapped: prisoners of a system that conspires to keep prices high and houses in short supply. They know their government will do almost anything to prevent house prices collapsing. Buyers can already obtain loans from the government to help get on the housing ladder, a policy that will further inflate prices for those lucky enough to own property already.

Desperately trying to keep the bubble afloat.

• How America Accidentally Nationalised Its Mortgage Market (Economist)

The most dramatic moment of the global financial crisis of the late 2000s was the collapse of Lehman Brothers on September 15th 2008. The point at which the drama became inevitable, though—the crossroads on the way to Thebes—came two years earlier, in the summer of 2006. That August house prices in America, which had been rising almost without interruption for as long as anyone could remember, began to fall—a fall that went on for 31 months. In early 2007 mortgage defaults spiked and a mounting panic gripped Wall Street. The money markets dried up as banks became too scared to lend to each other. The lenders with the largest losses and smallest capital buffers began to topple. Thebes fell to the plague.

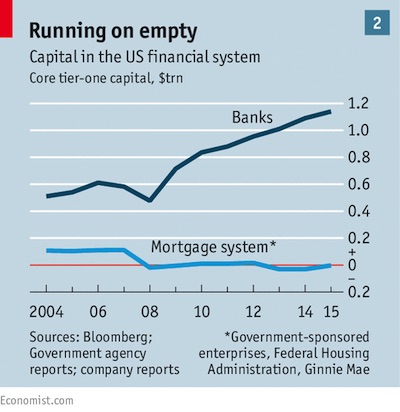

Ten years on, and America’s banks have been remade to withstand such disasters. When Jamie Dimon, the boss of JPMorgan Chase, talks of its “fortress” balance-sheet, he has a point. The banking industry’s core capital is now $1.2 trillion, more than double its pre-crisis level. In order to grind out enough profits to satisfy their shareholders, banks have slashed costs and increased prices; their return on equity has edged back towards 10%. America’s lenders are still widely despised, but they are now in reasonable shape: highly capitalised, fairly profitable, in private hands and subject to market discipline. The trouble is that, in America, the banks are only part of the picture.

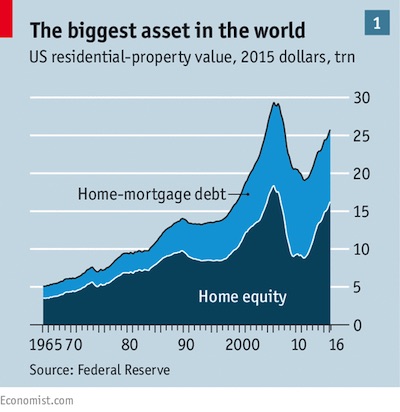

There is a huge, parallel structure that exists outside the banks and which creates almost as much credit as they do: the mortgage system. In stark contrast to the banks it is very badly capitalised (see chart 2). It is also barely profitable, largely nationalised and subject to administrative control. That matters. At $26 trillion America’s housing stock is the largest asset class in the world, worth a little more than the country’s stockmarket. America’s mortgage-finance system, with $11 trillion of debt, is probably the biggest concentration of financial risk to be found anywhere. It is still closely linked to the global financial system, with $1 trillion of mortgage debt owned abroad. It has not gone unreformed in the ten years since it set off the most severe recession of modern times. But it remains fundamentally flawed.

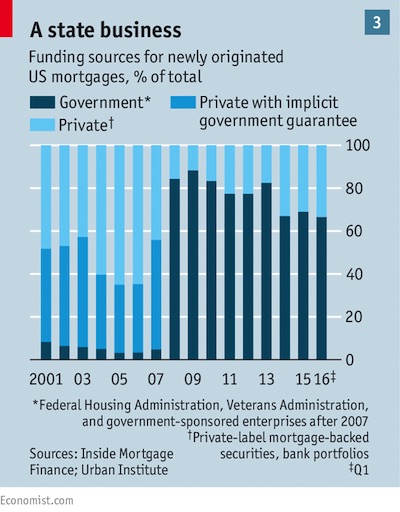

The strange path the mortgage machine has taken has implications for ordinary people, as well as for financiers. The supply of mortgages in America has an air of distinctly socialist command-and-control about it. Some 65-80% of all new home loans are repackaged by organs of the state. The structure of these loans, their volume and the risks they entail are controlled not by markets but by administrative fiat. No one is keen to make transparent the subsidies and dangers involved, the risks of which are in effect borne by taxpayers. But an analysis by The Economist suggests that the subsidy for housing debt is running at about $150 billion a year, or roughly 1% of GDP. A crisis as bad as last time would cost taxpayers 2-4% of GDP, not far off the bail-out of the banks in 2008-12.

My bet is they’re too scared.

• Fed Going Out To Jackson Hole To Get Divorce From Markets (MW)

Like celebrities who went to Las Vegas in the 1950s to get quick divorces, the Federal Reserve could be going to Jackson Hole this week to prepare to divorce policy from financial markets. In a way, the Fed’s relationship with the markets can be boiled down to a simple rule: the U.S. central bank is happy to surprise markets when it is easing policy but has never surprised the market with a rate hike. But the Fed may be preparing to end this relationship, especially given the recent behavior of financial markets with interest rates so low. Despite some fairly clear warnings that September is a “live” meeting. the market continues to see only a 24% probability of a rate hike in September, according to the CME’s Fed Watch tool.

New York Fed President William Dudley, San Francisco Fed President John Williams, and Atlanta Fed President Dennis Lockhart have pointed to a possible September move. Even Fed Vice Chairman Stanley Fischer chimed in with some broadly hawkish comments. In the wake of these developments, Carl Tannenbaum, chief economist at Northern Trust in Chicago, said he did not understand why rate hike probabilities remain so low. “I am mystified at what the short-term futures market is looking at,” he said. One thing the financial markets are clearly not looking at is a mirror. If they did they might see that their behavior is a big reason the Fed wants to hike rates in the first place.

Funny how that goes.

• The Real Casualty Of Brexit: Reputations Of Economists Who Predicted Doom (MW)

Did you hear the one about the economist who drove into a swimming pool and broke his neck? He forgot to seasonally adjust. Have you seen the version of Trivial Pursuit designed by an economist? It has 3,000 questions and 10,000 answers. There has always been a thriving, if niche, market in jokes about the dismal science, and its equally gloomy practitioners. And no doubt, there will soon be plenty to add to the list about Brexit. What‘s the difference between an economist predicting a Brexit-triggered recession and a confused and senile old man? The economist is the one with a calculator. And so on.

Over the spring, there were a lot of predictions about who would suffer the most damage if the British decided to vote to leave the European Union. The U.K. economy would be plunged into recession, we were told. The banking system would go down. The eurozone would take a terrible hit. And yet the real casualty turns out to be something quite different: The reputation of professional economists. With a very few exceptions, they forecast the U.K. would go straight into recession as a result of Brexit. As it turns out, however, Britain is doing just fine, and so is the rest of Europe. That is surely a calamity for which the profession deserves a beating – and at the very least should start asking itself some serious questions.

If you rewind a few weeks, and listened seriously to some of the predictions made about the likely consequences of Brexit, you would imagine that the U.K., and indeed the rest of the world, would be sliding into recession by now. In the immediate aftermath of the vote, number-crunchers from all the main investment banks, and from the policy and regulatory authorities, were unanimous in forecasting that the slowdown in economic activity would be sharp and sudden.

Dividends are why people hold stocks. Yeah, that’s short-termism.

• Companies Must Sort Pension Black Holes Before Paying Out Dividends (Tel.)

British companies are slashing their dividends, which, if you own their shares, either directly or through your pension scheme, is bad news. With companies like Wm Morrison, Anglo American and Standard Chartered cutting their payouts, underlying UK dividends fell 3.3pc year-on-year in the second quarter – the worst performance among the world’s seven richest economies. But here is another, possibly more staggering, statistic: UK companies threw five times as much cash at their shareholders as they did at their pension deficits last year. I would wager that the first stat (which comes courtesy of Henderson Global Investors) will be more worrisome to most investors, especially at a time of evaporating yield in the fixed income market and question marks hovering over property.

But I would argue that the second (from the actuarial consultants Lane Clark & Peacock) should give them greater pause for thought. Because, although the search for yield (and the lack thereof) has become one of the defining issues in the investment landscape, the pensions crisis is posing an almost existential question for corporate Britain. Many of the big corporate stories over the summer – BHS, Tata Steel, BT and Openreach – have been united by a single theme: pensions. And, with negative yields on many government (and some corporate) bonds blowing blackholes in schemes, expect the pain to get worse before it gets better. And yet many companies are still hosing their shareholders down with dividends.

Even if you know damn well you can’t make anywhere near 7.5%, please keep pretending.

• Illinois Governor’s Office Warns Of Crippling Pension Payment Hike (R.)

Potential action this week by Illinois’ biggest public pension fund could put a big dent in the state’s already fragile finances, Governor Bruce Rauner’s administration warned. A Monday memo from a top Rauner aide said the Teachers’ Retirement System (TRS) board could decide at its meeting this week to lower the assumed investment return rate, a move that would automatically boost Illinois’ annual pension payment. “If the (TRS) board were to approve a lower assumed rate of return taxpayers will be automatically and immediately on the hook for potentially hundreds of millions of dollars in higher taxes or reduced services,” Michael Mahoney, Rauner’s senior advisor for revenue and pensions, wrote to the governor’s chief of staff, Richard Goldberg.

When TRS lowered the investment return rate to 7.5% from 8% in 2014 the state’s pension payment increased by more than $200 million, according to the memo. Illinois’ fiscal 2017 pension payment to its five retirement systems was estimated at $7.9 billion, up from $7.617 billion in fiscal 2016 and $6.9 billion in fiscal 2015, according to a March report by a bipartisan legislative commission. The country’s fifth-largest state’s unfunded pension liability stood at $111 billion at the end of fiscal 2015, with TRS accounting for more than 55% of that gap. The funded ratio was a weak 41.9%.

85 donors contributed $156 million. Plus 16 foreign governments donated another $170 million.

• Many Donors To Clinton Foundation Met With Her At State Department (AP)

More than half the people outside the government who met with Hillary Clinton while she was secretary of state gave money — either personally or through companies or groups — to the Clinton Foundation. It’s an extraordinary proportion indicating her possible ethics challenges if elected president. At least 85 of 154 people from private interests who met or had phone conversations scheduled with Clinton while she led the State Department donated to her family charity or pledged commitments to its international programs, according to a review of State Department calendars released so far to The Associated Press. Combined, the 85 donors contributed as much as $156 million. At least 40 donated more than $100,000 each, and 20 gave more than $1 million.

Donors who were granted time with Clinton included an internationally known economist who asked for her help as the Bangladesh government pressured him to resign from a nonprofit bank he ran; a Wall Street executive who sought Clinton’s help with a visa problem; and Estee Lauder executives who were listed as meeting with Clinton while her department worked with the firm’s corporate charity to counter gender-based violence in South Africa. The meetings between the Democratic presidential nominee and foundation donors do not appear to violate legal agreements Clinton and former president Bill Clinton signed before she joined the State Department in 2009.

But the frequency of the overlaps shows the intermingling of access and donations, and fuels perceptions that giving the foundation money was a price of admission for face time with Clinton. Her calendars and emails released as recently as this week describe scores of contacts she and her top aides had with foundation donors. The AP’s findings represent the first systematic effort to calculate the scope of the intersecting interests of Clinton Foundation donors and people who met personally with Clinton or spoke to her by phone about their needs. The 154 did not include U.S. federal employees or foreign government representatives. Clinton met with representatives of at least 16 foreign governments that donated as much as $170 million to the Clinton charity, but they were not included in AP’s calculations because such meetings would presumably have been part of her diplomatic duties.

Don’t act surprised!

• ECB Secretly Hands Cash to Select Corporations (DQ)

In June, the ECB began buying the bonds of some of the most powerful companies in Europe as well as the European subsidiaries of foreign multinationals. This pushed the average yield on euro investment-grade corporate debt to 0.65%. Large quantities of highly rated corporate debt with shorter maturities are trading at negative yields, where brainwashed investors engage in the absurdity of paying for the privilege of lending money to corporations. By August 12, the ECB had handed out over €16 billion in freshly printed money in exchange for corporate bonds. Throughout, the public was given to understand that the ECB was buying already-issued bonds trading in secondary markets. But the public has been fooled.

Now it has been revealed by The Wall Street Journal that the ECB has also secretly been buying bonds directly from companies, thus handing them directly its freshly printed money. It has been doing so via “private placements.” These debt sales are not open to the broader market. There’s no need for a prospectus. Only a small number of institutional investors participate. It allows companies to raise cash quickly, without jumping through the normal hoops. Private placements are not unusual. What’s new is that the ECB used them to buy bonds. There have been two of these secretive private placements. And Morgan Stanley arranged them. The Wall Street Journal determined this by analyzing data from Dealogic and national central banks.

The two companies involved were the Spanish energy giants Repsol and Iberdrola. The Bank of Spain, now no more than a local branch of the ECB, was among the select buyers of a €500 million bond issued by Repsol. It is also the owner of part of a €200 million bond issued by Iberdrola. Among the advantages of issuing debt in a private placement is that it allows companies to raise cash quickly. According to Apostolos Gkoutzinis, head of European capital markets at law firm Shearman & Sterling, cited by The Wall Street Journal: because there is no prospectus or the other formalities required in a normal bond offering, “there won’t be any transparency, there won’t be a press release. It’s all done discreetly.”

Stone. Squeeze. “Plans [..] that will see foreclosures and auctions for 55% of debtors are already in progress.”

• Troika Prompts Greece To Tighten Debt Repayments (Kath.)

The Greek government’s plans for allowing taxpayers to make debt repayments to the state in 100 installments has been halted by the country’s lenders, who are refusing to consent to the scheme on the grounds that it will inflate debts to the state coffers. Alternate Finance Minister Tryfon Alexiadis told Skai there will be no new regulation for the reypayments, and called on debtors either to service their debts or make use of the existing framework of 12 or 24 installments. Greece’s lenders had been increasing the pressure recently to make the debt repayment process for those who owe money to the state more rigorous.

As of July 1, the legal framework was tightened for those with debts to the state. As a result, those who were already in the 100-installment scheme learned they would have to pay any debts incurred after that date no later than 15 days after the deadline. If they have not paid after 15 days, they are thrown out of the 100-installment scheme and will face the same penalties as anyone else. From January 1, 2018, the precondition for the continuation of the arrangement will be that they have repaid any new debts by the date they were due. According to figures from the Ministry of Finance, debts to the state are growing at a rate of €1 billion per month. In the first half of the year, the amount of new taxpayer debt to the state came to €6.8 billion.

In order to reduce the growth rate of the debt and increase state revenues, the government, in agreement with its creditors, has moved to coercive measures against state debtors. Plans by the General Secretariat of Public Revenue that will see foreclosures and auctions for 55% of debtors are already in progress.

What if complying is prohibitively expensive?

• Investors Controlling $13 Trillion Want G20 Leaders To Ratify Paris Deal (G.)

A group of 130 institutions that control US$13tn of investments have called on G20 nations to ratify the Paris agreement this year and accelerate investment in clean energy and forced disclosure of climate-related financial risk. Countries that ratified the Paris agreement early would benefit from better policy certainty and would attract investment in low-carbon technology, the signatories said in a letter before the G20 heads of government meeting in September. They called for strong carbon pricing to be implemented, as well as regulations that encouraged energy efficiency and renewable energy. Plans for how to phase out fossil fuels also needed to be developed, they said.

Financial regulators needed to force companies to disclose how climate change, and climate-related policies, would impact their bottom line, the group said. “So investors are asking companies: tell us what the implementation of the Paris agreement means for your business so that we can price that risk and invest accordingly,” said Emma Herd, the chief executive of the Investor Group on Climate Change (IGCC) – one of the six organisations that represent the 130 investors on the letter. Herd said that required not only mandatory reporting but also for that reporting to be standardised so that investors can compare between companies and between industries.

The signatories of the letter wrote: “The Paris agreement on climate change provides a clear signal to investors that the transition to the low-carbon, clean energy economy is inevitable and already under way. “Governments have a responsibility to work with the private sector to ensure that this transition happens fast enough to catalyse the significant investment required to achieve the Paris agreement’s goals.”

“..the US has squandered a fantastic sum of money fattening up its notoriously corrupt defense establishment ..”

• A Thousand Balls of Flame (Dmitry Orlov)

“Russia is ready to respond to any provocation, but the last thing the Russians want is another war. And that, if you like good news, is the best news you are going to hear.”

[..] There is exactly one nation in the world that nukes other countries, and that would be the United States. It gratuitously nuked Japan, which was ready to surrender anyway, just because it could. It prepared to nuke Russia at the start of the Cold War, but was prevented from doing so by a lack of a sufficiently large number of nuclear bombs at the time. And it attempted to render Russia defenseless against nuclear attack, abandoning the Anti-Ballistic Missile Treaty in 2002, but has been prevented from doing so by Russia’s new weapons. These include, among others, long-range supersonic cruise missiles (Kalibr), and suborbital intercontinental missiles carrying multiple nuclear payloads capable of evasive maneuvers as they approach their targets (Sarmat).

All of these new weapons are impossible to intercept using any conceivable defensive technology. At the same time, Russia has also developed its own defensive capabilities, and its latest S-500 system will effectively seal off Russia’s airspace, being able to intercept targets both close to the ground and in low Earth orbit.mIn the meantime, the US has squandered a fantastic sum of money fattening up its notoriously corrupt defense establishment with various versions of “Star Wars,” but none of that money has been particularly well spent. The two installations in Europe of Aegis Ashore (completed in Romania, planned in Poland) won’t help against Kalibr missiles launched from submarines or small ships in the Pacific or the Atlantic, close to US shores, or against intercontinental missiles that can fly around them. The THAAD installation currently going into South Korea (which the locals are currently protesting by shaving their heads) won’t change the picture either.

Home › Forums › Debt Rattle August 24 2016