Harris&Ewing US Navy Yard, Washington. Sight shop, big gun section 1917

Good and long interview with Macquarie strategist Victor Shvets.

• ‘It’s Easier To Start A War Than To Forgive Debt’ (ET)

Shvets says the world should have actually delevered or paid down the debt to return initiative to the private sector, but thinks people could not accept the levels of pain associated with it. “You could eliminate the impact of the overcapacity through deflation. Nobody is prepared to accept that we might have to wipe out decades of growth just to eliminate leverage. Banks go, there are defaults, bankruptcies, layoffs,” he said. He thinks the Biblical debt jubilee, where slaves would be freed and debt would be forgiven every 50 years is a nice idea that would also work today if it weren’t for entrenched special interests. “The debt is not spread evenly, we still live in a tribal world, and it’s easier to start a war than to forgive debt,” Shvets said.

Global central banks with their easy money policies of negative interest rates and quantitative easing are working against a debt deflation scenario, with limited success, according to Shvets. “That was the entire idea of aggressive monetary policies: Stimulate investment and consumption. None of that works, there is no evidence. It can impact asset prices, but they don’t flow into the real economy,” he said. “Remember, the people at the Fed and the Bank of England are not supermen, they are people with an above average IQ trying to do a very difficult job in a highly complex environment.” Both overleveraging, easy money policies, and technological shifts are responsible for increasing levels of income inequality across the globe, another hallmark of the previous two industrial revolutions. Fewer people control more of the wealth.

So far it’s all just talk.

• Mobius: Helicopter Money Will Be Japan’s Next Big Experiment, And Soon (BBG)

The Federal Reserve signals a reluctance to raise interest rates. The yen strengthens to 90 per dollar. Haruhiko Kuroda decides to act. Helicopter money is coming, says Mark Mobius, even as soon as next month. The 80-year-old investment veteran is outlining how he expects central banks to respond to sluggish economic growth. For Mobius, executive chairman of Templeton Emerging Markets Group, traditional easing measures have just made people save instead of spend or borrow. Combined with a stronger yen, he says that’s going to force the Bank of Japan governor to contemplate a policy he’s repeatedly ruled out. “They’re really beginning to think what ammunition they have,” he said in an interview on a visit to a typhoon-struck Tokyo this week.

“The first reaction is to say, OK, let’s go for helicopter money, let’s get money directly into the hands of consumers,” he said. “I think that would probably be the next step.” Central bankers have flooded their economies with monetary stimulus in the eight years since the global financial crisis, driving up asset prices – including the stock markets that Mobius invests in – while struggling to kickstart global growth. A foray into negative interest rates in Japan has been met with the yen surging to about 100 per dollar, falling stocks and dwindling bank profits.

Party time.

• Central Bankers Eye Public Spending To Plug $1 Trillion Investment Gap (R.)

While markets wait for Janet Yellen’s latest message about the direction of monetary policy, the Federal Reserve chief and her colleagues already have one for politicians: the U.S. economy needs more public spending to shift into higher gear. In the past few weeks, Yellen and three of the Fed’s other four Washington-based governors have called in speeches and Congressional hearings for government infrastructure spending and other efforts to counter weak growth, sagging productivity improvements, and lagging business investment. The fifth member has supported the idea in the past. The Fed has no direct influence over fiscal policy and its officials traditionally refrain from discussing it in detail.

Having its top officials – from Yellen to former investment banker and Bush administration official Jerome Powell – speak in one voice sends a strong signal to the next president and Congress about the limits they face in setting monetary policy and what is needed to improve the economy’s prospects. The Fed’s annual conference in Jackson Hole, Wyoming, where Yellen speaks on Friday, is due to focus on how to improve central banks’ “toolkit,” but the unanimous message from the Fed’s top policymakers is that those tools are not enough. “Monetary policy is not well equipped to address long-term issues like the slowdown in productivity growth,” Fed vice chair Stanley Fischer said on Sunday. He said it was up to the administration to invest more in infrastructure and education.

Behind Fischer’s statement lies a troubling feature of the recovery – business investment has fallen below levels in prior years and companies seem to have stopped responding to low borrowing costs. As a share of GDP, U.S. annual business investment since 2008 has averaged nearly a full percentage point below the previous decade’s average, government data shows. Reuters calculations indicate the investment shortfall has blown a hole in annual GDP that has grown to as much as one trillion dollars a year compared with what it would have been if the previous trend continued.

“A full decade of stagnation.”

• World Trade Falls for Second Quarter in a Row (WS)

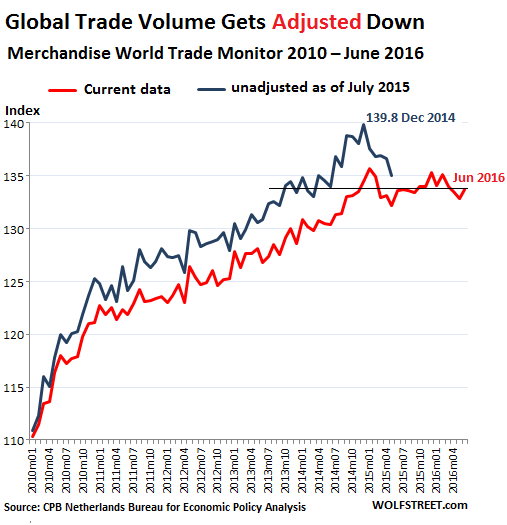

Adding to the picture of crummy demand for goods around the world, the CPB Netherlands Bureau for Economic Policy Analysis, a division of the Ministry of Economic Affairs, just released its preliminary data of its Merchandise World Trade Monitor for June. Trade volumes rose 0.7% in June from May, after falling 0.5% in May, but were about flat year-over-year, and below the volumes of December 2014! On a quarterly basis – it averages out the monthly ups and downs – world trade fell 0.8%, contracting for the second quarter in a row. The CPB recently adjusted its world trade data down, going back many years.

The new data now depicts a post-Financial Crisis recovery of global trade that was a lot weaker than the original data had indicated. These downward adjustments of 2% to 3% came in a world where economic growth, according to the IMF, is stuck at 3.1% in 2016. This chart of the CPB’s World Trade Monitor index shows the old data released as of July 2015 (blue line) and the newly adjusted data released today (red line). Note the 4.4% drop from the peak in global trade volumes in the original data for December 2014 and in the current data for June 2016!

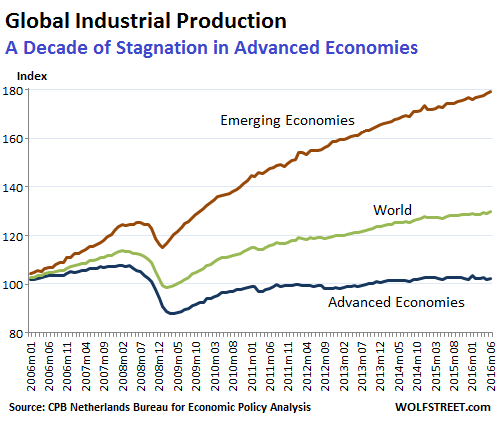

World trade is a reflection of the goods-producing economy. Services don’t get shipped around the world. Goods do. So industrial production, excluding construction, is key. And here the trend is awful for advanced economies. Global industrial production, excluding construction, rose 0.6% in June, after a 0.3% decline in May. The index for industrial production in advanced economies rose to 102.5, below where it had been in January (103.4), a level it had hit after the Financial Crisis in December 2012, but down from the glory days before the Financial Crisis when the index peaked in February 2008 (107.8). And here’s a tidbit: the first time that the index hit the current level had been in April 2006. A full decade of stagnation.

Industrial production has shifted to emerging economies (“cheap labor” economies) for many years, such as China, as companies in the US, decades ago, and eventually in Europe and Japan began outsourcing and offshoring production to emerging economies. Hence, industrial production in emerging economies has surged over this period. This was particularly the case after the Financial Crisis when companies in the US, Europe, and Japan redoubled their efforts to get production relocated offshore. This chart shows the CPB’s industrial production index globally (green line), and also separated by advanced economies (the dismally flat-ish blue line at the bottom) and emerging economies (brown line at the top):

Someone better restructure that entire industry, or ugly things will happen.

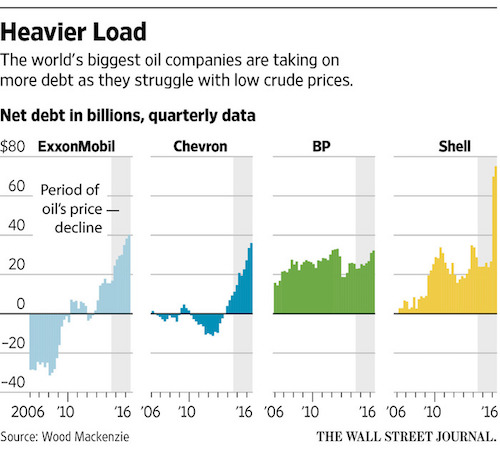

• Largest Oil Companies’ Debts Hit Record High (WSJ)

Some of the world’s largest energy companies are saddled with their highest debt levels ever as they struggle with low crude prices, raising worries about their ability to pay dividends and find new barrels. Exxon Mobil, Shell, BP and Chevron hold a combined net debt of $184 billion—more than double their debt levels in 2014, when oil prices began a steep descent that eventually bottomed out at $27 a barrel earlier this year. Crude prices have rebounded since, but still hover near $50 a barrel. The soaring debt levels are a fresh reminder of the toll the two-year price slump has taken on the oil industry. Just a decade ago, these four companies were hauled before Congress to explain “windfall profits” but now can’t cover expenses with normal cash flow.

Executives at BP, Shell, Exxon and Chevron have assured investors that they will generate enough cash in 2017 to pay for new investments and dividends, but some shareholders are skeptical. In the first half of 2015, the companies fell short of that goal by $40 billion, according to a Wall Street Journal analysis of their numbers. “Eventually something will give,” said Michael Hulme, manager of the $550 million Carmignac Commodities Fund, which holds stakes in Shell and Exxon. “These companies won’t be able to maintain the current dividends at $50 to $60 oil—it’s unsustainable.” BP has said it expects to be able to pay for its operations, make new investments and meet its dividend at an oil price of between $50 and $55 a barrel next year.

The debt is piling up despite cuts of billions of dollars on new projects and current operations. Repaying the loans could weigh the companies down for years, crimping their ability to make investments elsewhere and keep pumping ever more oil and gas. “They are just not spending enough to boost production,” said Jonathan Waghorn at Guinness Atkinson Asset Management.

As graphs go…

• This is What’s Wrong with US Oil (WS)

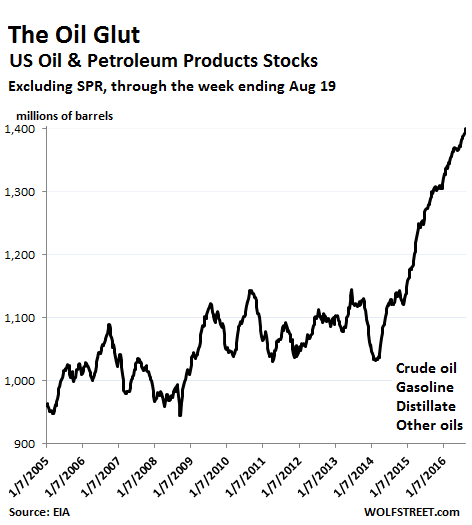

Soothsayers out there have been prophesying time and again, for over a year, that very soon, in fact next week, the supply glut will start to unwind; that production in the US is already coming down sharply, that demand is up, or whatever…. In the end, a glut comes down to whether inventories are rising, particularly during a time of the year when they’re supposed to be falling (glut gets worse), or whether they’re falling (glut stabilizes or abates). It’s not just crude oil, but also the products that crude oil gets refined into for eventual use. And these stocks of petroleum products have been a doozie, particularly gasoline.

Gasoline stocks were essentially unchanged for the week, at 232.7 million barrels, a record for this time of the year, and up 8.5% from the already elevated inventory levels last year. Distillate fuels rose by 200,000 barrels to 153.3 million barrels. And “all other oils” jumped by a total of 3.9 million barrels to 490.6 million barrels. So total petroleum products stocks rose by 6.6 million barrels during the week, or 0.5%. Once again, this small-ish number, but over the period of the oil bust, total petroleum products stocks have soared by 30% and now exceed for the first time ever another huge milestone: 1.4 billion barrels. This chart shows what a truly relentless glut looks like:

No independence then?!

• Scotland North Sea Oil Revenues Collapse 97% (Ind.)

Scotland’s revenues from North Sea oil have collapsed by 97% in the past year as oil prices have plummeted, reigniting a fierce debate over whether an independent Scotland could finance itself. Scottish Liberal Democrat leader Willie Rennie said: “The nationalists’ case for independence has been swallowed up by a £14bn black hole.” Taxes collected from oil production fell from £1.8bn in 2015 to just £60m in 2016. The gap between tax revenues and what Scotland spends is now 9.5%, or £14.8bn, compared to a 4% deficit for the UK as a whole. Scotland’s public sector now spends £12,800 per person, but collects just £10,000 each, the figures reveal. In 2008-9, as oil peaked at almost $150 per barrel, the Scottish government brought in a record £11.6bn from North Sea fields.

Funny. Here’s what I wrote on April 8, 2015: Russia’s Central Bank Governor Is Way Smarter Than Ours

• The Woman Who Revived Russia’s Markets (WSJ)

Russian markets are red hot again. Two years after plunging oil prices and Western economic sanctions fueled an investor exodus, the Micex stock index on Tuesday hit an all-time high. It is up 25% this year in dollar terms, making Russia the sixth-best performer among 23 emerging countries tracked by MSCI Inc. The ruble has gained 13% against the dollar this year, ranking third among all emerging currencies. Russia’s local-currency bonds rank third this year in performance out of 15 countries tracked by JP Morgan Chase. Many investors credit central-bank chief Elvira Nabiullina for Russia’s resurgence. They cite her surprise decision to end the ruble’s peg to the dollar in November 2014 and then sharply raise interest rates to combat capital flight and knock down inflation.

The moves were painful for Russia’s economy, which went into a sharp recession as the value of the ruble slumped, reducing consumer and business purchasing power. But over time they have helped to restore some international-investor faith in a country still shadowed by its 1998 default. “The correct steps taken by the Russian central bank have restored confidence in the ruble and its macroeconomic policy,” said Andrey Kutuzov, an associate portfolio manager of the Wasatch Emerging Markets Small Cap fund. Global investors this year have added $1.3 billion to funds that invest in Russian bonds and stocks, according to EPFR Global. The share of foreigners among government bondholders rose to 24.5% as of June 1, its highest level since late 2012, according to the Russian central bank.

“..loans for weddings, guaranteed against the cash gifts that couples expect to receive..”

• China Imposes Caps on P2P Loans to Curb Shadow-Banking Risks (BBG)

China imposed limits on lending by peer-to-peer platforms to individuals and companies in an effort to curb risks in one part of the loosely-regulated shadow-banking sector. An individual can borrow as much as 1 million yuan ($150,000) from P2P sites, including a maximum of 200,000 yuan from any one site, the China Banking Regulatory Commission said in Beijing on Wednesday. Corporate borrowers are capped at five times those levels. Tighter regulation may encourage consolidation that aids the industry long-term, said Wei Hou at Sanford C. Bernstein in Hong Kong. China’s authorities are concerned about defaults and fraud among the nation’s 2,349 online lenders. In December, the country’s biggest Ponzi scheme was exposed after Internet lender Ezubo allegedly defrauded more than 900,000 people out of the equivalent of $7.6 billion.

The nation has 1778 “problematic” online lenders, according to the CBRC. The P2P lenders are barred from taking public deposits or selling wealth-management products and must appoint qualified banks as custodians and improve information disclosure, the regulator said. [..] China’s P2P industry brokered 982 billion yuan of loans in 2015, almost quadruple the amount in 2014 and an approximately 10-fold increase from 2013, according to Yingcan. P2P firms attracted more than 3.4 million investors and 1.15 million borrowers in July, with loans extended at an average interest rate of 10.3%, according to Yingcan. Products offered by P2P platforms in China can include anything from loans for weddings, guaranteed against the cash gifts that couples expect to receive, to high-yield lending for risky property or mining projects.

Biggest debts must be with shadow banks, and they don’t hang up posters.

• Runaway Bosses Fleeing Debts A Symptom Of China’s Economic Slowdown (SCMP)

Wanted posters for fugitive debtors, not commercials, are the main images that flash up on a big electronic screen in downtown Yixing, in the heart of the faltering Chinese industrial powerhouse that is the Yangtze River Delta. The posters, from the local courts, show the identity card numbers and pictures of dozens of people who have fled unpaid debts. Rewards ranging from 20,000 yuan (HK$23,000) to 330,000 yuan are offered to anyone reporting their whereabouts. But Hengsheng Square is the glitziest part of Yixing – with the most luxury stores, the brightest lights and the priciest office buildings – and few passers-by, their attention directed elsewhere, heed the wanted posters. They have little novelty value in any case, with the “runaway debtor” phenomenon now just part of daily life in the small city as economic growth slows.

In many ways, the square stands as a metaphor for the overall health of the Chinese economy. Under a prosperous surface, deep cracks have begun to emerge in its investment-led model, casting a shadow over the country’s economic growth prospects and even giving rise to doubts about the fundamental soundness of the world’s second-biggest economy. “The economic dynamics are waning,” said Professor Hu Xingdou, an economist at Beijing Institute of Technology. “China’s economic growth in recent years was powered by massive money printing, which is dangerous and unsustainable.”

Holding up Spain as a success story while it has 20-25% unemployment never seemed terribly credible. It still doesn’t.

• Real World Shows Economics Has a Deflation Problem (BBG)

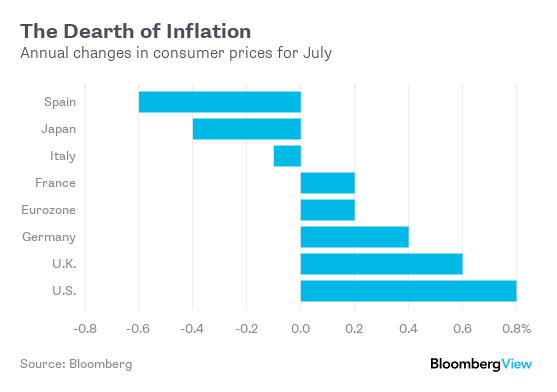

Jacob Rothschild, the billionaire scion of arguably Europe’s greatest banking dynasty says we’re living through “the greatest experiment in monetary policy in the history of the world.” There’s a major flaw in the experiment, though: the real world isn’t responding to policy in the way that the textbooks say it should. Moreover, it seems increasingly evident that the fears that led to zero interest rates and quantitative easing were at best overblown, if not entirely unjustified. The economic quandary is easy to parse. Central banks almost everywhere have sanctioned a 2% inflation target as signifying financial Nirvana. But, as the table below shows, consumer prices in the world’s major economies are rising much slower than that arbitrary ideal:

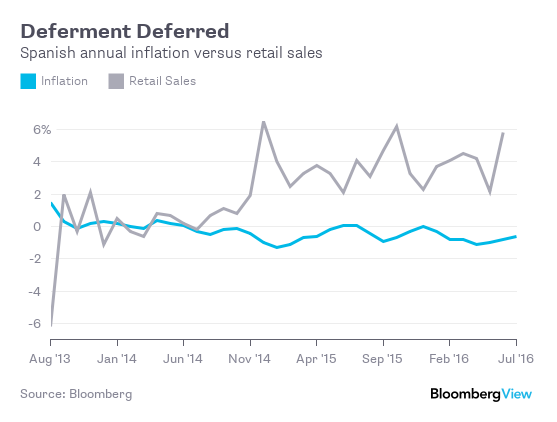

Spain has emerged as the poster child for deflation. Prices fell by 0.6% in July, the country’s 12th consecutive month with no increase in inflation. The textbooks suggest that when there’s a prolonged period of falling prices – the definition of deflation – the economy can quickly find itself in a tailspin. Businesses and consumers will defer purchases in the expectation that goods and services will be even cheaper in the future. So if Spain has had an average inflation rate of -0.4% since the end of 2013, and has seen lower prices in 23 of the past 30 months, consumers will have responded by shunning the shops and curtailing their spending, right? Wrong:

Heed that warning.

• S&P: Increased Risk Of ‘Sharp Correction In New Zealand Property Prices’ (Int.)

International credit rating agency S&P Global Ratings has warned of the increasing risks facing New Zealand banks as a result of the continuing rise in house prices. In a new report, S&P has downgraded its Banking Industry Country Risk Assessment (BICRA) for NZ’s banks by a notch, dropping it from 3 to 4, on a scale where 1 is the lowest risk and 10 is the highest risk. However it has not changed the individual credit ratings of any New Zealand banks. [..] .. our ratings on all the financial institutions operating in New Zealand remain unchanged. “This reflects our expectation that despite some weakening in the capital levels of all these financial institutions, their stand alone credit profiles (SACPs) would remain unchanged.

However S&P did downgrade the SACPs of ASB and Rabobank by one notch each, although it did not downgrade the two banks’ credit ratings, “… reflecting our assessment of timely financial support from their respective parents, if needed,” S&P said. S&P said the increased risks to this country’s banking sector had been driven by “…continued strong growth in residential property prices nationally, coupled with an increase in private sector credit growth.” “We believe the risk of a sharp correction in property prices has further increased and, if it were to occur – with about 56% of registered banks’ lending assets secured by residential home loans – the impact on financial institutions would be amplified by the New Zealand economy’s external weaknesses, in particular its persistent current account deficit and high level of external debt.”

This is just plain funny.

• Treasury to EU: Back Off On Tax Probes Of US Companies (CNBC)

There’s a giant pot of corporate gold sitting outside the United States, and the U.S. Treasury and the European Commission are squabbling over how to get their hands on it. American multinational corporations have stashed more than $2 trillion in profits and assets outside to avoid paying what many companies argue are unduly high U.S. corporate tax rates. Over the past few years, the European Commission has opened investigations into a handful of those companies, including Apple, Starbucks and Amazon, to determine whether they owe taxes to European countries. But the Treasury Department, in a “white paper” released Wednesday, said those investigations have gone too far.

The paper attacked the legal approach the EU is using to determine tax liabilities on American companies, saying it targets “income that (European) Member States have no right to tax under well-established international tax standards.” The paper also argued that taxes collected by European countries could, in effect, come right out of the pockets of American taxpayers. That’s because taxes collected by European countries could be deducted from any future payments to the Treasury. “That outcome is deeply troubling, as it would effectively constitute a transfer of revenue to the EU from the U.S. government and its taxpayers,” the paper said. The report urged the European Commission to “return to the system and practice of international tax cooperation that has long fostered cross-border investment between the United States and EU Member States.”

France will demand the hollowing out of the EU. Decentralization. Inevitable when economies shrink.

• French Support For The EU Project Is Crumbling On The Left And Right (AEP)

The drama of Brexit may soon be matched or eclipsed by crystallizing events in France, where the Long Slump is at last taking its political toll. A democracy can endure deflation policies for only so long. The attrition has wasted the French centre-right and the centre-left by turns, and now threatens the Fifth Republic itself. The maturing crisis has echoes of 1936, when the French people tired of ‘deflation decrees’ and turned to the once unthinkable Front Populaire, smashing what remained of the Gold Standard. Former Gaulliste president Nicolas Sarkozy has caught the headlines this week, launching a come-back bid with a package of hard-Right policies unseen in a western European democracy in modern times.

But the uproar on the Left is just as revealing. Arnaud Montebourg, the enfant terrible of the Socialist movement, has launched his own bid for the Socialist Party with a critique of such ferocity that it bears examination. The former economy minister says France voted for a left-wing French manifesto four years ago and ended up with a “right-wing German policy regime”. This is objectively true. The vote was meaningless. “I believe that we have reached the end of road for the EU, and that France no longer has any interest in it. The EU has left us mired in crisis long after the rest of the world has moved on,” he said. Mr Montebourg stops short of ‘Frexit’ but calls for the unilateral suspension of EU labour laws. “As far as I am concerned, the current treaties have elapsed.

I will be inspired by the General de Gaulle’s policy of the ’empty chair’, a strike against the EU. I am not in favour of a French Brexit, but we can longer accept a Europe like that,” he said. In other words, he wishes to leave from within – as Poland, and Hungary are doing – without actually triggering any legal or technical clause. Mr Montebourg is unlikely to progress far but his indictment of president François Hollande is devastating. The party leadership was warned repeatedly and emphatically that contractionary policies would inevitably lead to another million jobless but the economic was swept aside. “They never budged from their Catechism and their false certitudes,” he said.

“..the first post on social media to change the course of European history..”

• ‘It Took On A Life Of Its Own’: How One Rogue Tweet Led Syrians To Germany (G.)

The tweet was sent by Germany’s ministry for migration and refugees a year ago today. “The #Dublin procedure for Syrian citizens is at this point in time effectively no longer being adhered to,” the message read. With 175 retweets and 165 likes, it doesn’t look like classic viral content. But in Germany it is being spoken of as the first post on social media to change the course of European history. Referring to an EU law determined at a convention in Dublin in 1990, the tweet was widely interpreted as a de facto suspension of the rule that the country in Europe where a refugee first arrives is responsible for handling his or her asylum application.

By this point in 2015, more than 300,000 asylum seekers had reached Europe by boat – a figure that was already 50% higher than even the record-breaking number of arrivals in 2014. Although the German ministry’s intervention certainly did not start the crisis, it did make Germany the first-choice destination for Syrians who previously might have aimed for other countries in Europe, such as Sweden, which at the time offered indefinite asylum to Syrians. It also created an impression of confusion and loss of political control, from which Angela Merkel’s government has at times struggled to recover. Twelve months on, politicians and officials at the centre of Berlin’s bureaucratic machine are still trying to figure out how the tweet came about.

Four days previously, Angelika Wenzl, the executive senior government official at the refugee ministry, which in Germany is known as BAMF, had emailed out an internal memo titled “Rules for the suspension of the Dublin convention for Syrian citizens” to its 36 field bureaux around the country, stating that Syrians who applied for asylum in Germany would no longer be sent back to the country where they had first stepped on European soil. [..] By channels that officials and journalists have so far failed to pinpoint, Wenzl’s internal memo was leaked to the press.

I forget who said it, but it’s still an interesting take: ”Nature developed mankind to get rid of a carbon imbalance”.

• We’ve Been Wrecking The Planet A Lot Longer Than You Think (SMH)

When Charles Dickens, the English novelist, was detailing the “soft black drizzle” of pollution over London, he might inadvertently have been chronicling the early signs of global warming. New research led by Australian scientists has pegged back the timing of when humans had clearly begun to change the climate to the 1830s. An international research project has found human-induced climate change is first detectable in the Arctic and tropical oceans around the 1830s, earlier than expected. That’s about half a century before the first comprehensive instrumental records began – and about the time Dickens began his novels depicting Victorian Britain’s rush to industrialise.

The findings, published on Thursday in the journal Nature, were based on natural records of climate variation in the world’s oceans and continents, including those found in corals, ice cores, tree rings and the changing chemistry of stalagmites in caves. Helen McGregor, an ARC future fellow at the University of Wollongong and one of the paper’s lead authors, said it was “quite a surprise” the international research teams of dozens of scientists had been able to detect a signal of climate change emerging in the tropical oceans and the Arctic from the 1830s. “Nailing down the timing in different regions was something we hadn’t expected to be able to do,” Dr McGregor told Fairfax Media.

Interestingly, the change comes sooner to northern climes, with regions such as Australasia not experiencing a clear warming signal until the early 1900s. Nerilie Abram, another of the lead authors and an associate professor at the Australian National University’s Research School of Earth Sciences, said greenhouse gas levels rose from about 280 parts per million in the 1830s to about 295 ppm by the end of that century. They now exceed 400 ppm.

Home › Forums › Debt Rattle August 25 2016