NPC KKK services, Capital Horse Show grounds, Arlington 1938

How obvious does it have to get?

• Globalization and its New Discontents (Stiglitz)

Fifteen years ago, I wrote a little book, entitled Globalization and its Discontents, describing growing opposition in the developing world to globalizing reforms. It seemed a mystery: people in developing countries had been told that globalization would increase overall wellbeing. So why had so many people become so hostile to it? Now, globalization’s opponents in the emerging markets and developing countries have been joined by tens of millions in the advanced countries. Opinion polls, including a careful study by Stanley Greenberg and his associates for the Roosevelt Institute, show that trade is among the major sources of discontent for a large share of Americans. Similar views are apparent in Europe.

How can something that our political leaders – and many an economist – said would make everyone better off be so reviled? One answer occasionally heard from the neoliberal economists who advocated for these policies is that people are better off. They just don’t know it. Their discontent is a matter for psychiatrists, not economists. But income data suggest that it is the neoliberals who may benefit from therapy. Large segments of the population in advanced countries have not been doing well: in the US, the bottom 90% has endured income stagnation for a third of a century. Median income for full-time male workers is actually lower in real (inflation-adjusted) terms than it was 42 years ago. At the bottom, real wages are comparable to their level 60 years ago.

The effects of the economic pain and dislocation that many Americans are experiencing are even showing up in health statistics. For example, the economists Anne Case and Angus Deaton, this year’s Nobel laureate, have shown that life expectancy among segments of white Americans is declining. Things are a little better in Europe – but only a little better. [..] .. if globalization is to benefit most members of society, strong social-protection measures must be in place. The Scandinavians figured this out long ago; it was part of the social contract that maintained an open society – open to globalization and changes in technology. Neoliberals elsewhere have not – and now, in elections in the US and Europe, they are having their comeuppance.

And everyone was busy doing something else. They still are by the looks of it.

• Brexit: This Backlash Has Been A Long Time Coming (O’Rourke)

The main point of my 1999 book with Jeff Williamson was that globalisation produces both winners and losers, and that this can lead to an anti-globalisation backlash. We argued this based on late-19th century evidence. Then, the main losers from trade were European landowners, who found themselves competing with an elastic supply of cheap New World land. The result was that in Germany and France, Italy and Sweden, the move towards ever-freer trade that had been ongoing for several years was halted, and replaced by a shift towards protection that benefited not only agricultural interests, but industrial ones as well. Meanwhile, across the Atlantic, immigration restrictions were gradually tightened, as workers found themselves competing with European migrants coming from ever-poorer source countries.

While Jeff and I were firmly focused on economic history, we were writing with an eye on the ‘trade and wages’ debate that was raging during the 1990s. There was an obvious potential parallel between 19th-century European landowners, newly exposed to competition with elastic supplies of New World land, and late 20th-century OECD unskilled workers, newly exposed to competition with elastic supplies of Asian, and especially Chinese, labour. In our concluding chapter, we noted that economists who base their views of globalisation, convergence, inequality, and policy solely on the years since 1970 are making a great mistake. The globalisation experience of the Atlantic economy prior to the Great War speaks directly and eloquently to globalisation debates today – and the political lessons from this are sobering.

“Politicians, journalists, and market analysts have a tendency to extrapolate the immediate past into the indefinite future, and such thinking suggests that the world is irreversibly headed toward ever greater levels of economic integration. The historical record suggests the contrary.” “Unless politicians worry about who gains and who loses,î we continued, ìthey may be forced by the electorate to stop efforts to strengthen global economy links, and perhaps even to dismantle them … We hope that this book will help them to avoid that mistake – or remedy it.”

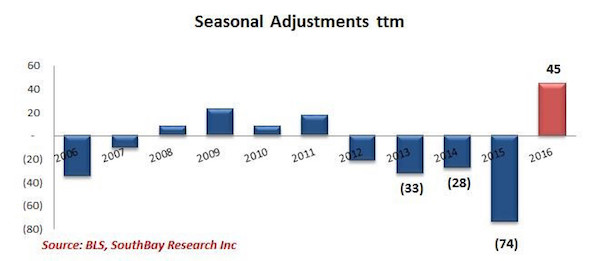

Yup, it’s seasonal adjustments again.

• The US LOST 1,030 Million Jobs in July -Teachers’ Summer Break- (Sanders)

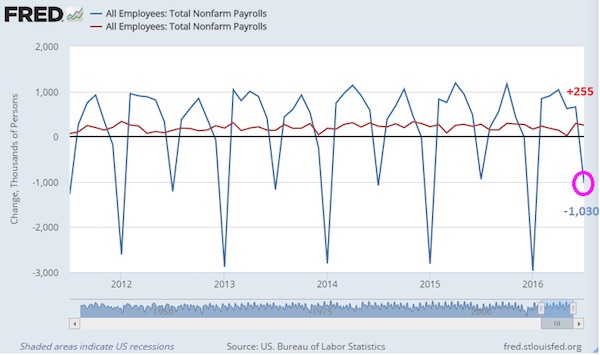

To better understand the July Jobs report, one has to understand the seasonal adjustments that the Bureau of Labor Statistics employs. Nonfarm payroll jobs added in July on a seasonally adjusted basis were +255,000 in July. But the raw or NON seasonally adjusted numbers were -1,030,000 jobs. Or 1.03 million jobs lost.

Notice in the above chart that you get big downward dips in the nonfarm payroll numbers in January and July. And it repeats every year. For January, this is the release of seasonal employment for the holidays. For July, this is the transformation to summertime employment, mostly for teachers. Local government education NSA fell by -1,093,000 in July. Total PRIVATE jobs added amounted to +85,000. So, the BLS smoothes the data using Seasonal Adjustments since January temporary workers being terminated or teachers not working during the summer is hardly newsworthy or surprising. Food and drinking services actually fell by -35,000 jobs added. Bartender blues. The bottom line is that the July jobs report was all about teachers going on summer break and low wage jobs being added.

The real interesting question is what channels are now used to get money out.

• China’s July Forex Reserves Fall To $3.20 Trillion (R.)

China’s foreign exchange reserves fell to $3.20 trillion in July, central bank data showed on Sunday, in line with analyst expectations. Economists polled by Reuters had predicted reserves would fall to $3.20 trillion from $3.21 trillion at the end of June. China’s reserves, the largest in the world, fell by $4.10 billion in July. The reserves rose $13.4 billion in June, rebounding from a 5-year low in May. China’s gold reserves rose to $78.89 billion at the end of July, up from $77.43 billion at end-June, data published on the People’s Bank of China website showed. Net foreign exchange sales by the People’s Bank of China in June jumped to their highest in three months, as the central bank sought to shield the yuan from market volatility caused by Brexit.

China’s foreign exchange regulator recently said China would be able to keep cross-border capital flows steady given its relatively sound economic fundamentals, solid current account surplus and ample foreign exchange reserves. China’s foreign reserves fell by a record $513 billion last year after it devalued the yuan currency in August, sparking a flood of capital outflows that alarmed global markets. The yuan has eased another 2% this year and is hovering near six-year lows, but official data suggests speculative capital flight is under control for now, thanks to tighter capital controls and currency trading regulations. However, economists are divided over how much money is still flowing out of the country via other channels, with opaque policymaking and some inconsistency in the data raising suspicions that the fall in the yuan may be masking capital outflow pressure.

When will the whole thing be declared a failure?

• Bitcoin’s Latest Economic Problem – (Worstall)

[..] And that’s where Bitcoin has the problem, in that very existence of the blockchain: The first relates to the ongoing legal recourse rights of Bitfinex victims. Even though they may have lost their right to pursue Bitfinex for compensation, they are still going to be entitled to track the funds across the blockchain to seek recourse from whomsoever receives the bitcoins in their accounts. That’s good news for victims, but mostly likely very bad news for bitcoin’s fungible state and thus its status as a medium of exchange.

Just one successful claim by a victim who tracks his funds to an identifiable third party, and the precedent is set. Any exchanges dealing with bitcoin in a legitimate capacity would from then on be inclined to do much stronger due diligence on whether the bitcoins being deposited in their system were connected to ill-gotten gains. This in turn would open the door to the black-listing of funds that can not prove they were originated honestly via legitimate earnings. Of course, people should not steal things. And yet for a currency to work it has to be possible to take the currency at its face value. Thus it may well be that the bank robber paid you for his beer with stolen money but you got it fair and square and thus the bank doesn’t get it back as an when they find out.

Another way to put this is that the crime dies with the criminal. And yet the blockchain upends all of that. Because every transaction which any one bitcoin has been involved in is traceable. I’ve said before that bitcoin has significant economic problems associated with it. The most important being that it is a deliberately deflationary currency which is a really, really, terrible idea. But the more we wander through the actual use in the real world of this idea the more we find other problems with it. As here, that blockchain, the basic defining point of bitcoin in the first place, making it something which isn’t going to work well as a currency over time. Because that very blockchain means that we’ll not be able to make the necessary compromises about justice in favour of efficiency in the event of crime.

Will a bunch of unknowns, likely Bitfinex insiders, get away with stealing $60 million?

• Theft And Mayhem In The Bitcoin World (Coppola)

The schadenfreude of Bitcoin enthusiasts over Ethereum’s recent troubles ended abruptly last week. A major Bitcoin exchange, Bitfinex, was hacked and nearly 120,000 BTC (around $60m) was stolen. The price of Bitcoin promptly crashed, and Bitfinex was forced to suspend trading. Suddenly, Ethereum was not the only basket case cryptocurrency around. It appears that Bitfinex’s security was seriously compromised. Customer coins were held in individual wallets secured with a 2 of 3 multisig arrangement: keys were held by Bitfinex itself and Bitgo, a professional custodian and signatory, with a third (backup) key held in secure offline storage. Customers could not withdraw funds from the wallets until any borrowings had been cleared. It was, if you like, a form of escrow. And it should have been secure.

But it wasn’t. Somehow, the hacker managed to gain access to hundreds of customer wallets. Not only did the hacker gain access to the wallets, he/she also overrode Bitgo’s withdrawal limits. It was a well-planned and comprehensive security breach by someone who knew exactly what they were doing. Funds were moved to thousands of addresses over a short period of time. Bitfinex, it seems, was powerless to stop it. This is one of the largest Bitcoin heists ever, dwarfed only by Mt. Gox in 2014. It is comparable in size to Ethereum’s DAO theft only a couple of weeks ago. And it is going to result in a lot of people losing a lot of money. All of Bitfinex’s customers, in fact. The company has announced a haircut of 36.067% across the board:

“After much thought, analysis, and consultation, we have arrived at the conclusion that losses must be generalized across all accounts and assets. This is the closest approximation to what would happen in a liquidation context. Upon logging into the platform, customers will see that they have experienced a generalized loss percentage of 36.067%. In a later announcement we will explain in full detail the methodology used to compute these losses.” Although the loss is estimated as the amount the customers would receive if the company were liquidated, this is a bail-in. Bitfinex has no plans to cease trading: “We intend to come online within 24-48 hours with limited platform functionality. Additional announcements will be made as we progressively enable more platform features and return to full operations.”

Club 106.

• Over 100 Americans Are Rich Enough to Buy the Election Outright (I’Cept)

Two billion dollars, the estimated cost of this year’s presidential election, is big money, but it is not huge money. Two billion is one-tenth of NASA’s annual budget, one-twentieth of the Harvard endowment, one-thirtieth of the personal wealth of Warren Buffett. Buffett is number two on the 2015 Forbes list of 106 Americans who hold personal fortunes of $5 billion or more, the Club of 106. These billionaires are rich enough to pay for the campaigns of both Hillary Clinton and Donald Trump and still have $3 billion left over. A lot of the money in Club 106 is family money. The Club includes two Kochs, four Waltons, three Marses, two Newhouses, and three Ziffs. Donald Trump was also born into big money. With a supposed net worth of $4.5 billion, he is brushing up against the velvet rope outside of Club 106.

The Clintons, both born to families with ordinary incomes, are now worth around $110 million, which puts them way off from Club 106 and pretty far from you and me as well. In the political off-season the Clintons have borrowed private jets from friends and relied on book advances and speaking fees to maintain two residences, to summer in East Hampton, and reportedly to help their daughter and son-in-law purchase a $10 million Manhattan apartment. The Obamas will soon be devising their own approach to making their way in a billionaire’s world with a mere $20 million. At least four of the members of Club 106 (Buffett, the Kochs, Bloomberg) have openly voiced their thoughts on who should be president.

Five members (Soros, Simons, Cohen, Ellison, Bloomberg) are among the top 25 donors to the outside groups that have poured tens of millions of dollars into the campaign. Seven members (Bezos, Zuckerberg, Page, Brin, Murdoch, the Newhouses, Bloomberg) own large media and internet companies — Amazon, the Washington Post, Facebook, Google, Fox News, the New York Post, the Wall Street Journal, Condé Nast, Bloomberg — with the power to shape public opinion. (By way of disclosure, an eighth member, Pierre Omidyar, founded The Intercept’s parent company, First Look Media.)

For the Club of 106, elections are a game they can easily afford to play.

From July 25, but interesting enough.

• Frozen Loans Trigger Australian Property Funding Crisis (AFR)

Off-the-plan buyers of Australian apartments are in crisis as tough new borrowing rules mean thousands of investors who have paid a deposit are struggling to complete their purchases, according to local and overseas mortgage brokers and financiers. Shanghai-based financiers claim their Chinese clients’ funding from Australian banks has been frozen and they face foreclosure – or usurious interest rates – from private financiers. Australian financiers claim their local clients, many of them Asian, have had their settlements deferred by three months to find alternative funding. “All the deals have been frozen,” said Mark Yin, an agent with Shanghai-based Home Tree Group, about his Shanghai clients’ funding with Australian banks. “We are now looking for finance all over the world.”

Mr Yin said this represented nearly 100 per cent of his clients who were waiting for properties to be completed in Australia and that most of the apartments were in the Melbourne CBD. Melbourne-based Marshall Condon, CEO of mortgage broker Neue Black and who also has off-shore and local Asian investors, added: “In the next three to 12 months, many investors will be applying for funding to complete their deals, however, they will be become increasingly concerned as they discover funding is limited.” Billions of dollars has been invested in tens-of-thousands of high-rise apartments that are reshaping the skylines of the nation’s major capitals, particularly Melbourne, Sydney and Brisbane. Most have been sold off-the-plan, which means purchasers buy off the blueprint with a deposit and complete when it is built, which requires a second valuation and financing commitment by the lender.

“..both men were not only influenced by but also took instructions from people, as yet unidentified, up until the attacks..”

• First Sept 11, Now Saudi Arabia Linked To German Terrorist Attacks (ZH)

Several weeks after the US government finally released a redacted version of the secret “28 pages”, which confirmed Saudi Arabia’s key role behind the September 11 attack, even as both the Obama administration and Saudi Arabia claimed no such connection exists (when it clearly did for anyone who actually read the disclosure), a trail has now emerged linking the recent surge in deadly terrorist attacks in Germany to Saudi Arabia. According to Der Spiegel, both the terrorist from the Wurzburg train axe attack, and the Ansbach suicide bomber who blew up an explosive-filled backpack, had multiple chat contacts with persons in Saudi Arabia.

As a result, Reuters adds, Saudi authorities are now in contact with their German colleagues, responding to these potentially explosive new findings which once again implicate the Saudi state with more state-sponsored terrirms, and show at least two attackers were in close contact via a chat conversation with possible Islamic State backers from Saudi Arabia. Traces of the chat, which investigators have been able to reconstruct, indicate that both men were not only influenced by but also took instructions from people, as yet unidentified, up until the attacks, the report said. It may not come as a surprise that the state exposed as facilitating and coordinating the September 11 terrorist attack, and which admitted to have created the Islamic States (with US knowledge), is now trying to provoke a terrorist backlash in Europe too.

Recall that after the Iraqi city of Mosul fell to a lightning Isis offensive in 2014, the late Prince Saud al-Faisal, then the Saudi foreign minister when speaking to John Kerry admitted that “Daesh [Isis] is our [Sunni] response to your support for the Da’wa” — the Tehran-aligned Shia Islamist ruling party of Iraq. One can only speculate what Saudi Arabia is “responding” to with the recent surge in European terrorist attacks. For now, however, the all too “generous” Saudi government has “offered to help German investigators find those behind Islamist bomb and ax attacks in July”, Spiegel adds. We can only imagine how accurate Saudi “findings” will be, especially if – like in the case of Sept 11 – those involved include members from the very top of Saudi power echelons.

“A campaign that began two years ago this Sunday has now, 50,000 bombs and 25,000 dead ISIS fighters later, expanded to a whole new continent.”

• Obama Expands ISIS Bombing to 4th Country, the Media Barely Notice (Nation)

The Obama administration announced on Monday the beginning of US air strikes in Libya against ISIS targets, marking the fourth country the United States is currently bombing with the goal of “degrading and destroying” the terror group. A campaign that began two years ago this Sunday has now, 50,000 bombs and 25,000 dead ISIS fighters later, expanded to a whole new continent. You’d hardly notice, however, if you followed US media. While the air strikes themselves were reported by most major outlets, they were done so in a matter-of-fact way, and only graced the front pages of major American newspapers for one day.

[..] The question pundits should be asking themselves is this: Had Obama announced on August 7, 2014, that he planned on bombing four countries and deploying troops to two of them to fight a war with “no end point,” would the American public have gone along with it? Probably not. To authorize his perma-campaign, Obama’s administration has dubiously invoked the 15-year-old, one-page Authorization for Use of Military Force, passed three days after 9/11. The president has to do this, the White House and friendly media claim, because Congress “refuses” to act to authorize the war (notice that’s a rubber-stamp question of when, not if). But such apologism largely rests on a tautology: Congress doesn’t have a sense of urgency to authorize the war because the public doesn’t, and the public doesn’t because the media have yawned with each new iteration.

What’s lacking is what screenwriters call “an inciting incident.” There’s no clear-cut moment the war is launched, it just gradually expands, and because media are driven by Hollywood narratives, they are victims to the absence of a clear first act. This was, to a lesser extent, the problem with the last bombing of Libya, in 2011. What was pitched to the American public then was a limited, UN-mandated no-fly zone to protect civilians (that even the likes of Noam Chomsky backed), which quickly morphed, unceremoniously, into all-out, NATO-led regime change three weeks later. Then, as now, there was no public debate, no media coming-to-Jesus moment. Obama just asserted the escalation as the obvious next step, and almost everyone just sort of went along—an ethos summed up in Eric Posner’s hot take at Slate the day after Obama expanded the ISIS war to Syria: “Obama Can Bomb Pretty Much Anything He Wants To.”

“Is it possible that Washington did not want to clear ISIL out of Iraq because Washington intended to use ISIL to clear Assad out of Syria?”

• Behold, a Pale Horse and its Rider’s Name Was Death (PCR)

I just listened to Obama give Washington’s account of the situation with ISIL in Iraq and Syria. In Obama’s account, Washington is defeating ISIL in Iraq, but Russia and Assad are defeating the Syrian people in Syria. Obama denounced Russia and the Syrian government—but not ISIL—as barbaric. The message was clear: Washington still intends to overthrow Assad and turn Syria into another Libya and another Iraq, formerly stable and prosperous countries where war now rages continually. It sickens me to hear the President of the United States lie and construct a false reality, so I turned off the broadcast. I believe it was a press conference, and I am confident that no meaningful questions were asked.

If Helen Thomas were still there, she would ask the Liar-in-Chief what went wrong with Washington’s policy in Iraq. We were promised that a low-cost “cakewalk” war of three or six weeks duration would bring “freedom and democracy” to Iraq. Why is it that 13 years later Iraq is a hellhole of war and destruction? What happened to the “freedom and democracy?” And the “Cakewalk”? You can bet your life that no presstitute asked Obama this question. No one asked the Liar-in-Chief why the Russians and Syrians could clear ISIL out of most of Syria in a couple of months, but Washington has been struggling for several years to clear ISIL out of Iraq. Is it possible that Washington did not want to clear ISIL out of Iraq because Washington intended to use ISIL to clear Assad out of Syria?

No one asked the Liar-in-Chief why Washington sent ISIL to Syria and Iraq in the first place, or why the Syrians and Russians keep finding US weapons In ISIL’s military depots, or why Washington’s allies were funding ISIL by purchasing the oil ISIL is stealing from Iraq. It seems to be the case that ISIL originated in the mercenaries that Washington organized to overthrow Gaddafi in Libya and were sent to Syria to overthrow Assad when the UK Parliament refused to participate in Washington’s invasion of Syria and the Russians put a stop to it.

Home › Forums › Debt Rattle August 7 2016