Harris&Ewing Balancing act, John “Jammie” Reynolds, Washington DC 1917

Finally, something happened. But still: there are no markets, there’s only a faint surrogate of a market left. And that has consequences, none of which are positive.

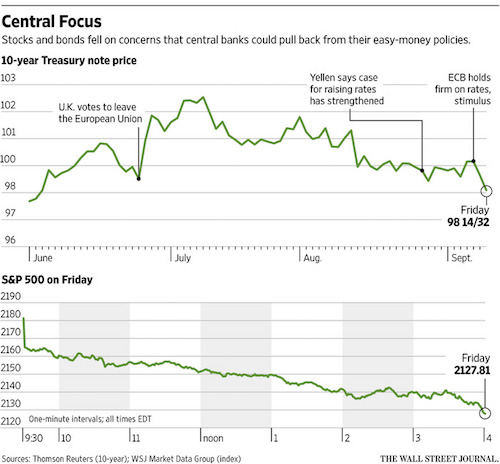

• Rate-Rise Fears Trip Up Markets (WSJ)

Major markets had one of their worst days in months, as doubts over central banks’ willingness or ability to stimulate economic growth sent stocks and bonds tumbling. The Dow Jones Industrial Average fell nearly 400 points, and sinking bond prices pushed yields on government debt to their highest levels since early summer. The yield on Germany’s 10-year bund, which had been negative almost without exception since Brexit on June 23, popped into positive territory Friday. The wave of selling shattered weeks of summer torpor and was a reminder of the extent to which long-running rallies in stocks and bonds are reliant upon continued support from central banks.

The ECB damped market sentiment on Thursday by deciding to leave its bond-buying and interest-rate policies unchanged, rather than expanding them as some investors had hoped. An official with the Federal Reserve deepened concerns by suggesting Friday that the Fed still might raise interest rates even after a week of relatively weak U.S. economic data. “A reasonable case can be made for continuing to pursue a gradual normalization of monetary policy,” Federal Reserve Bank of Boston President Eric Rosengren said in a speech. [..] Mr. Rosengren, who has tended to support keeping rates low in the past, helped push markets into a deeper rout.

The Dow industrials plunged 394.46 points, or 2.1%, to 18085.45. The S&P 500 declined 53.49 points, or 2.5%, to 2127.81. The percentage drop was the biggest for both indexes since June 24. The Nasdaq Composite Index lost 133.57 points, or 2.5%, to 5125.91. Yields on 10-year Treasury notes jumped to 1.671%, their highest level since June 23. Bond yields rise as prices fall. “Once the snowball starts rolling down the hill, everybody jumps on board,” said Jonathan Corpina, senior managing partner at Meridian Equity Partners.

“[Fed] Governor Lael Brainard will be delivering a previously unannounced speech Monday..”

• Surprise Fed Speech Throws Markets For A Loop (CNBC)

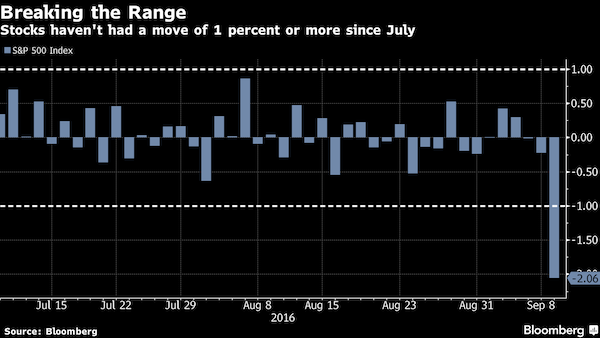

Those figuring that the Fed still might hike rates in September are getting one more bite at the apple. As the week drew to a close and the Fed’s “quiet period” before meetings was about to settle in, investors recoiled over news that the central bank’s most dovish official, Governor Lael Brainard, will be delivering a previously unannounced speech Monday at The Chicago Council on Global Affairs. The news sent a chill through markets Friday, with major stock market averages taking a beating and short-term government bond yields and the U.S. dollar moving higher, and it set off yet another round of speculation over whether the Fed is ready to come off its historically loose monetary policy. The S&P 500 was down more than 1% Friday afternoon, on track to close with its biggest percentage move since July 8.

“When a market is quiet, it’s susceptible to rumors, whether we’re talking about a path to freeze oil production or whether the Fed is going to raise rates in September,” said Quincy Krosby at Prudential Financial. “This may be a market that has too much time on its hands right now.” Indeed, the guessing game over whether the Fed might enact its first rate rise since December and only its second tightening in more than a decade has set off a fever pitch of horse trading. At one point Friday morning, markets put the chance of a hike later this month as high as 30% before backing off. The probability had been reduced amid a week’s worth of poor economic data, including the worst services reading in six years, a contraction in manufacturing and a weaker-than-expected nonfarm payrolls report.

You can’t keep ‘markets’ at a completely fake level forever.

• Stocks Sink With Bonds, Dollar Rallies as Complacency Broken (BBG)

Tranquility that has enveloped global markets for more than two months was upended as central banks start to question the benefits of further monetary easing, sending government debt, stocks and emerging-market assets to the biggest declines since June. The dollar jumped. The S&P 500 Index, global equities and emerging-market assets tumbled at least 2% in the biggest rout since Brexit. The yield on the 10-year Treasury note jumped to the highest since June and the greenback almost erased a weekly slide as a Federal Reserve official warned waiting too long to raise rates threatened to overheat the economy. German 10-year yields rose above zero for the first time since July after the ECB downplayed the need for more stimulus.

Fed Bank of Boston President Eric Rosengren’s comments moved him firmly into the hawkish camp, sending the odds for a rate hike this year above 60%. He spoke a day after ECB President Mario Draghi played down the prospect of an increase in asset purchases, while DoubleLine Capital Chief Investment Officer Jeffrey Gundlach said it’s time to prepare for higher rates. “Dovish Fed members getting called up to bat for a hike is putting people on edge,” Yousef Abbasi, a global market strategist at JonesTrading, said by phone. “The more hawkish-leaning investors are grabbing onto that and it’s certainly one of those days where people are positioning for that September hike being back on the table.”

Calm had dominated financial markets in late summer with equity volatility and bond yields near historic lows and measures of cross-asset correlation at the highest levels since at least the financial crisis. The rise in the influence of different markets on each other has been attributed to the growing impact of central bank policy on prices, and rising concern that the era of easing may be nearing an end roiled assets from bonds to currencies and stocks on Friday.

It will take years for people to realize what central banks and their incompetence have done to fixed income.

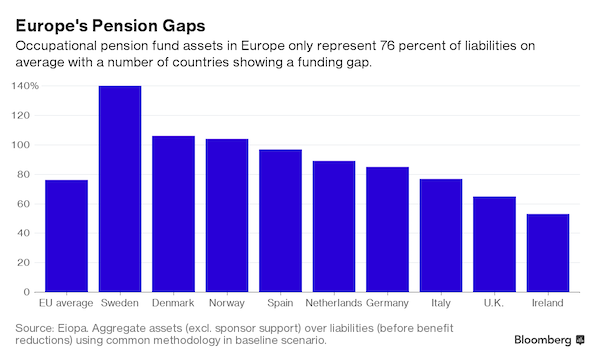

• Draghi Asset Buying Deepens the Hole in Europe’s Pension Funds (BBG)

As he tries to jump start the economies of today, ECB President Mario Draghi is punching holes in the retirements of tomorrow. Draghi on Thursday said the ECB may continue asset buying beyond March 2017 until it sees inflation consistent with its targets. The purchases, along with low and negative interest rates from the ECB and the region’s national banks, are pushing more and more bond yields below zero, hurting European pension managers that are already struggling to fund retirement plans. “Pension funds can’t meet their future obligations if interest rates remain as low as they currently are,” said Olaf Stotz at the Frankfurt School of Finance and Management. “Some sponsors will have no choice but to add more capital” to their pension plans.

Funds that supply retirement income of millions of European workers face a growing gap between the money they have and what they must pay out. To make up the shortfalls, they may have to tap their sponsoring companies or institutions, reduce or delay payouts or try to boost returns by investing in riskier assets. That mirrors the dilemma faced by pension managers from the U.S. to Japan who are also being affected by central bank monetary policy. Low yields force funds to buy a greater variety of bonds or diversify their investments to generate a long-term income for their retirees. While some are profiting now by selling bonds purchased at lower prices in the past, they will struggle to get the same kind of returns from any new bonds they purchase.

Occupational funds in Europe currently have resources to pay only about 76% of their commitments on average, according to the European insurance and pensions regulator Eiopa. “Pension funds are more liberal in their investment decisions than insurers,” said Martin Eling at the University of St. Gallen in Switzerland. “Regulators will need to closely watch them as they are driven into higher-return assets such as corporate bonds and emerging markets investments.” EU regulations on the industry “might underestimate the risks,” Eiopa said by e-mail. It recommends measures including improved public disclosure so more beneficiaries know how their funds are investing. While pension systems and controls differ from country to country in Europe, regulators typically approve a pension plan’s design and set limits for certain investments.

They also can intervene to make sure a fund can meet its obligations.] Eiopa’s first stress test of the industry in Europe, published earlier this year, showed that occupational pension fund assets were 24% short of liabilities, a deficit of €428 billion ($484 billion) even before applying a shock scenario. Central banks in Europe and Japan are relying on stimulus packages that include negative deposit rates to fuel inflation and revive the economy. That has pushed yields in countries such as Germany and Japan below zero, bringing the global pile of bonds with negative yields to about $8.9 trillion. Pension liabilities for the 30 members of the benchmark DAX Index in Germany rose by about €65 billion this year to a record €426 billion as interest rates declined, according to consulting firm Mercer.

“Traders have started dumping government bonds, leading to the biggest rout in Japanese debt in 13 years…”

• Gundlach Puts His Finger On Bond Market Inflection Point (BBG)

DoubleLine’s Jeffrey Gundlach indicated in a webcast on Thursday that financial markets are on the brink of turmoil, saying “this is a big, big moment.” He’s right. It is. The mood has shifted suddenly. Investors are losing faith in the efficacy of monetary stimulus, and it appears that perhaps central bankers may be, too. The BOJ and ECB have refrained from committing to additional rounds of stimulus and are quickly running out of bonds to buy under their existing programs. The BOJ may run out of bonds within the next 18 months, while the ECB may run into a wall sooner than that, according to analysts cited by the WSJ and the FT.

The Federal Reserve, meanwhile, is still planning to raise benchmark interest rates despite underwhelming economic data. This is in large part because policy makers are increasingly concerned about the threats to longer-term financial stability by keeping rates so low. Meanwhile, inflation expectations are rising on bets that government officials will embark on spending plans to stimulate growth. This multifaceted dynamic is a game changer, and markets have taken note. Traders have started dumping government bonds, leading to the biggest rout in Japanese debt in 13 years. [..] “Interest rates have bottomed,” Gundlach said in the webcast. “They may not rise in the near term as I’ve talked about for years. But I think it’s the beginning of something, and you’re supposed to be defensive.”

So VW guys will be thrown in jail but bankers will not.

• VW Engineer Pleads Guilty in US Criminal Case Over Diesel Emissions (NYT)

A Volkswagen engineer pleaded guilty on Friday to conspiring to defraud regulators and car owners, in the first criminal charges stemming from the American investigation into the German carmaker’s emissions deception. The plea by the engineer, James Robert Liang, a Volkswagen veteran, suggests that the Justice Department is trying to build a larger criminal case and pursue charges against other higher-level executives at the carmaker. Mr. Liang was central in the development of software that Volkswagen used to cheat pollution tests in the United States, which the company admitted last year to installing in more than 11 million diesels vehicles worldwide. He was also part of the cover-up, lying to regulators when they started asking questions about discrepancies in emissions.

Mr. Liang’s admissions, made in the United States District Court for the Eastern District of Michigan, portray a broader conspiracy by executives, making Mr. Liang a potentially valuable resource for the developing criminal investigation. The Justice Department said Mr. Liang, who faces a maximum sentence of five years in prison, would cooperate. The Volkswagen case comes at a time when the government is trying to get tough on white-collar crime and hold more individuals responsible. After being criticized for going soft on executives, the Justice Department introduced new policies last year that emphasized the prosecution of individual employees. And the Volkswagen case provides one of the first real tests of the government’s commitment.

The Volkswagen case has escalated quickly. In June, the Justice Department and other agencies secured a record $15 billion settlement in a civil suit with the company. At the time, officials were quick to note that the settlement was just a first step, saying they would aggressively pursue a criminal case against the company and individuals. “There’s considerable pressure on the Department of Justice to see how far up the chain of management the knowledge goes,” said Daniel Riesel, a principal at the New York-based environmental law firm Sive, Paget & Riesel. One way for investigators to do that was “to indict and cut deals with lower-level people,” he added. Mr. Liang is “a high enough official who is culpable on his own right, and maybe in a position to start unraveling this chain of responsibility.”

Good on them! Still, while they do this, they still persist in terrorizing Assange for the US.

• Sweden Says No to NATO (BBG)

Sweden’s government affirmed its military neutrality even as a government-commissioned report broadly sided with those in favor of joining the North Atlantic Treaty Organization amid rising tensions with Russia. “Our non-alignment policy serves us well,” Foreign Minister Margot Wallstroem said in Stockholm Friday after receiving the report. Joining NATO “would expose Sweden to risks, both political and otherwise, and we don’t think that’s the right direction.” The country has been forging closer ties with the military alliance, taking part in joint military exercises that have angered authorities in Moscow.

A stable, geographically strategic democracy such as Sweden would be a welcome addition for NATO as it struggles to contain a more assertive Russia on its eastern flank. The review released on Friday in Stockholm refrained from making a formal recommendation. While NATO membership would “increase common conflict-deterrent capabilities,” it would also spark a political crisis with Russia and possibly lead to a regional arms race, the review concluded. And although Russian attacks on Sweden or its Baltic neighbors are considered “unlikely,” being a part of NATO would help “remove uncertainty in case of conflict.”

Zero Hedge has an interesting ‘alternative’ view from Norway. Tyler calls it a view of Trump, but it’s definitely wider than that.

• One “Lifelong Socialist” Norwegian’s Perspective on America (Nordmann)

I find it interesting that the very wealthy are suddenly vocal, vigorously opposing Donald J Trump’s presidency. Mark Cuban, Warren Buffet, Bill Gates and George Soros have all made statements against “The Donald.” Buffet, Gates, and Soros are avid supporters of Hillary Clinton. Goldman Sachs top management are not allowed to donate to Trump’s campaign. As an average seventy-something Norwegian farmer, looking at American from the outside, I find the vigorous billionaire opposition “interesting.” Moreover, this is amplified by CNN (which we get here in Norway as part of our standard cable package). CNN used to be fact based news only. Now they morphed into the Clinton News Network, attempting to shape public opinion, garnering support for globalism.

Perhaps the billionaire’s enterprises benefit from bloated government spending (this is speculation and worthy of investigation)? These Billionaires are so rich that the interest earned on their idle cash and investments amounts to tens of thousands of dollars per day. What do they have to lose either way? Why is this so important to them? Maybe it’s to their advantage that the ladder (better known as the American Dream), where people can ascend through the rungs, achieving different levels of success through hard work, is broken? Don’t Americans find it strange, despite technological advancements and increased productivity, that medical care, education, and housing costs are rising. I thought technology was supposed to make things cheaper, easier and more abundant.

Remember when people went from horse and buggy to the Ford Model T – what happened? (A middle mobile middle class was born). Based on what I read about American life, it seems like now, when there is a new technology or innovation to make life easier, things get worse. Jobs become less stable than decades earlier. People are working longer hours for less. The housing standard is now a cramped condo instead of a house with a yard. It appears a lot of people are on edge. American’s need to ask themselves, reflecting back one generation (20 years), how billionaires have made their lives better? Billionaires have substantially increased their wealth in the past 20 years, have you? American’s have a history of being rebellious, unpredictable, self-reliant and wild, rooting for the underdog. In this case, the underdog is Trump.

Europe’s core will take this out on the periphery.

• Eurozone Woes Continue: German Exports Plunge, French Industry Weakens (Tel.)

German exports fell at the fastest pace in more than a year in July as French industrial production shrank for a third straight month, fuelling fears of a wider eurozone slowdown. Exports in Germany fell 2.6pc in July compared with June, according to Destatis. This was the biggest fall since August 2015, and compares with expectations for a 0.4pc rise. The decline was driven by a drop in sales outside the EU, including China and the US, while demand from the UK also fell. June’s month-on-month rise of 0.3pc was also revised down to 0.2pc. Separate data showed French industrial production declined by 0.6pc in July on a monthly basis. Analysts had expected French production to bounce back following declines in May and June when activity was hit by strike action.

Chantana Sam, an economist at HSBC, said: “This is a bad sign for the prospects of a rebound in business investment. Recent manufacturing surveys also point to a deteriorating outlook and persistent weak demand. “All in all, this bad start to the third quarter of industrial production and puts some downside risks on our expectations for a rebound in GDP growth in the third quarter, after flat growth in the second quarter.” Wolfgang Schaeuble, the German finance minister, said Europe’s largest economy had no intention of reining in export growth. Critics, including ECB chief Mario Draghi, say the country’s current account surplus, which includes trade, has contributed to imbalances and hindered growth in the 19 nation bloc. “Even before the ECB decided its policies of unusual monetary policy, which also led to the euro exchange rate falling significantly, I said that we will increase German export surplus,” Mr Schaueble told reporters.

Love mish, but I’ll write an article on where he goes off the rails on the issue.

• Why the Eurozone Will Destruct (Mish)

No discussion of eurozone problems would be complete without a discussion of Target2, an abomination created by the eurozone founders and one of the fundamental flaws of the euro. Target2 stands for Trans-European Automated Real-time Gross Settlement System. It is a reflection of capital flight from the “Club-Med” countries in Southern Europe (Greece, Spain, and Italy) to banks in Northern Europe. Pater Tenebrarum at the Acting Man blog provides this easy to understand example: “Spain imports German goods, but no Spanish goods or capital have been acquired by any private party in Germany in return. The only thing that has been ‘acquired’ is an IOU issued by the Spanish commercial bank to the Bank of Spain in return for funding the payment.”

Monetary policy can help external balances but it cannot fix internal target2 balances. Germany will pay one way or another for the massive imbalances between the creditor and debtor Eurozone countries. Eventually Spain, Greece, or Italy will realize it is impossible for them to pay back what is owed. Once that realization sets in, some country will default on their euro-denominated liabilities. Beppe Grillo’s Five Star Movement in Italy is on board with that idea already. There are only three possible paths at this point: 1) Germany and the creditor nations forgive enough debt for Europe to grow; 2) Permanently high unemployment and slow growth in Spain, Greece, Italy, with stagnation elsewhere in Europe; 3) Breakup of the eurozone.

Germany will not allow #1. It is unreasonable to expect #2 to last forever. The only door left open is door #3. The best move would be for Germany to leave the eurozone. Germany is in the best shape to suffer the consequences. Unfortunately, the most likely outcome is still a destructive breakup of the eurozone, starting in Italy or Greece.

Any ‘subversive’ moves from the south will be crushed by the north.

• EU’s Poor Nations Plot Next Move As North-South Divide Erupts (CNBC)

In order to tame the euro zone sovereign debt crisis over the last seven years, the richer countries of Northern Europe have called for austerity measures and budget cuts, coupled with stronger EU sanctions for countries that do not adhere to this policy. In practice, this economic recipe, led by Germany, proved economically and politically disastrous, as it fueled the recession and nourished populism. In some cases it has become increasingly difficult for political parties to pursue an economic agenda that deviates from these fiscal norms without questioning EU membership. Tspiras and his colleagues believe the current situation in southern Europe makes this a good time to address austerity issues and its effect on long-term growth throughout the region.

The stars may be aligning, considering in Italy a referendum on constitutional reform will take place between Nov. 15 and Dec. 5 and the first round of the presidential election in France next April. This may help the Greek prime minister’s cause, which is to convince its lenders that the targeted 3.5 percent primary surplus for 2018 is too high and would negatively affect crisis-stricken Greeks. Terms of the Greek bailout program assumed that tax revenues would exceed program spending, ex-interest on outstanding debt. But within the southern EU bloc, many believe this is an unrealistic target for an aching economy that for seven years has been in a recession and austerity mode. Tsipras does not want to give the impression that he does not respect the agreements with Greece’s creditors.

In an informal government meeting held on September 6, Tsipras asked his ministers to progress rapidly with the fiscal and structural measures that Greece’s lenders set as a prerequisite last June. This effort comes ahead of a mandated second review of its current international bailout, which the Greek government is expected to start in October and which includes controversial reforms. In turn, lenders have promised that the European Stability Mechanism, the EU’s bailout fund, will outline how it will offer Greece debt-relief measures. The austerity measures in southern European nations create the conditions for dividing the EU further, as the Germans and their northern allies insist on tight budgets, despite the persistent deflation in the region and weak growth.

This is the craziest European idea yet. Merkel suspended Dublin, and now she wants to flood already severely overburdened Greece with the people she invited to Germany last year? Note: Greece is overburdened because Europe refuses to help out.

• Greece Rejects Return Of EU’s Dublin Regulation On Reverse Migration Flow (AP)

The Greek government is adamantly opposing the revival of a European Union rule that would allow the forcible return to its territory of asylum-seekers who entered the bloc via Greece – a path followed by more than a million people in the past two years. Immigration is high on the agenda of a meeting Friday in Athens of southern European leaders. The group includes Italian Prime Minister Matteo Renzi, whose country, with Greece, is Europe’s main immigration gateway. Ahead of the talks, a government spokesman on immigration said Athens rejects reactivation of the so-called Dublin Regulation, which would allow other EU members to send asylum-seekers back to Greece.

“A country such as Greece which receives a large number of refugees from Turkey, and also hosts a large number of refugees – practically without any outside help – cannot be asked to receive refugees from other European countries,” Giorgos Kyritsis told The Associated Press. “That would be outrageous.” The Dublin Regulation that governs the Schengen passport-free area stipulates that people wishing to apply for asylum must do so in the first member country they arrive in. In most cases that was Greece, whose eastern islands were overwhelmed last year by migrants packed into smugglers boats from Turkey. But even before last year’s migration crisis, many of its EU partners had stopped enforcing the rule because Greece’s asylum and migrant reception systems were below standard.

Now, however, both Germany and the EU executive are pressing for the rule to be restored, with EU officials saying that Greece must meet the Dublin standards by the end of this year.

Home › Forums › Debt Rattle September 10 2016