Harris&Ewing No caption, Washington DC 1915

There’s only one solution: take away from central banks their current powers to manipulate markets and economies.

• Fed Dove Frets About Asset Bubbles, Wall Street Freaks Out (WS)

When Boston Fed governor Eric Rosengren, a voting member of the Federal Open Markets Committee, where monetary policy is decided, shared some aspects of his worries on Friday morning, markets tanked instantly. This came just after the ECB’s refusal to please the markets with promises of additional bond purchases. Instead, it stuck to the promises it had made previously. What a disappointment for markets running on nothing but central-bank mouth-wagging and money-printing! [..] In his speech, Rosengren discussed how the US economy has been “fairly resilient” and is near “reaching the Federal Reserve’s dual mandate from Congress (stable prices and maximum sustainable employment),” despite all the global headwinds, some of which he enumerated.

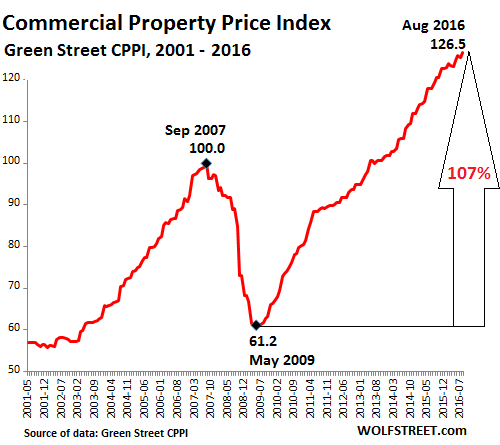

And so, he said, “a reasonable case can be made for continuing to pursue a gradual normalization of monetary policy.” Hence, rate increases, even though there were some “conflicting signals” in the economic data – “Clearly, the first two quarters did not live up to the forecasts,” he said. But “waiting too long to tighten” would expose the economy to two risks: First, the economy overheats – the belated tightening might “require more rapid increases in interest rates later in the cycle,” which will likely “result” in a recession, as it did “frequently” in the past. And second, asset bubbles – “that some asset markets become too ebullient.” He pointed at commercial real estate prices that “have risen quite rapidly over the past five years, particularly for multifamily properties.”

He added: Because commercial real estate is widely held in the portfolios of leveraged institutions, commercial real estate cycles can amplify the impact of economic downturns as financial institutions need to write down the value of loans and cut back on lending to maintain their capital ratios. And what a bubble it is. Over the past 12 months, prices have jumped only 6%, according to the Green Street Commercial Property Price Index, compared to the double-digit gains in prior years. “Equilibrium,” the report called it. The index has soared 107% from May 2009, and 26.5% from the peak of the totally crazy prior bubble that ended with such spectacular fireworks:

Excellent from Grant, fully in line with Nicole’s series the past week.

• Hostage to a Bull Market (Jim Grant)

If there is a curse between the covers of this thin, self-satisfied volume, it doesn’t have to do with cash, the title to the contrary notwithstanding. Freedom is rather the subject of the author’s malediction. He’s not against it in principle, only in practice. Ken Rogoff is a chaired Harvard economics professor, a one-time chief economist at the International Monetary Fund and (to boot) a chess grandmaster. He laid out his case against cash in a Saturday essay in this newspaper two weeks ago. By abolishing large-denomination bills, he said there, the government could strike a blow against sin and perfect the Federal Reserve’s control of interest rates. “The Curse of Cash,” the Rogoffian case in full, comes in two parts.

The first is a helping of monetary small bites: a little history (in which the gold standard gets the back of the author’s hand), a little central-banking practice, a little underground economy. It’s all in the service of showing where money came from and where it should be going. Terrorists traffic in cash, Mr. Rogoff observes. So do drug dealers and tax cheats. Good, compliant citizens rarely touch the $100 bills that constitute a sizable portion of the suspiciously immense volume of greenbacks outstanding—$4,200 per capita. Get rid of them is the author’s message. Then, again, one could legalize certain narcotics to discommode the drug dealers and adopt Steve Forbes’s flat tax to fill up the Treasury. Mr. Rogoff considers neither policy option. Government control is not only his preferred position.

It is the only position that seems to cross his mind. Which brings us to the business end of this production. Come the next recession, the book’s second part contends, the Fed should have the latitude to drive interest rates below zero. Mr. Rogoff lays the blame for America’s lamentable post-financial-crisis economic record not on the Obama administration’s suffocating tax and regulatory policies. The problem is rather the Fed’s inability to put its main interest rate, the federal funds rate, where it has never been before. In a deep recession, Mr. Rogoff proposes, the Fed ought not to stop cutting rates when it comes to zero. It should plunge right ahead, to minus 1%, minus 2%, minus 3% and so forth.

At one negative rate or another, the theory goes, despoiled bank depositors will stop saving and start spending. According to the worldview of the people who constitute what Mr. Rogoff fraternally calls the “policy community” (who elected them?), the spending will buttress “aggregate demand,” thus restore prosperity. You may doubt this. Mr. Rogoff himself sees difficulties. For him, the problem is cash. The ungrateful objects of the policy community’s statecraft will stockpile it. What would you do if your bank docked you, say, 3% a year for the privilege of holding your money? Why, you might convert your deposit into $100 bills, rent a safe deposit box and count yourself a shrewd investor. Hence the shooting war against currency.

Historians will see us as too deluded to be true.

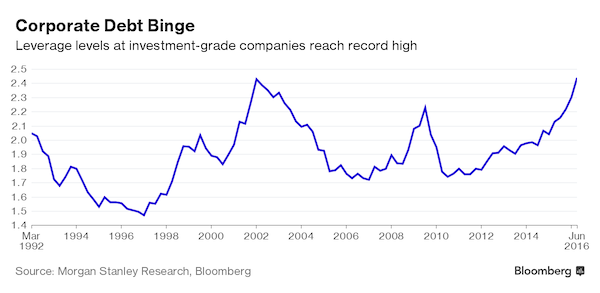

• Leverage Soars to New Heights as Corporate Bond Deluge Rolls On (BBG)

Here’s a gut check for bond investors: corporate America is now more leveraged than ever. As this year’s corporate bond sales raced past $1 trillion on Wednesday – marking the fifth consecutive year of trillion-plus issuance – Morgan Stanley published a report Friday highlighting the growing strains on company balance sheets. The report, which estimated US companies’ collective debt at a record 2.4 times their collective earnings as of June, comes at a time of growing angst in global bond markets “The investment-grade ‘safe’ part of the market is becoming the most dangerous,” said Ashish Shah, CIO at AllianceBernstein. “There are so little returns out there. People are crowding into whatever they can.”

The debt metric, which doesn’t include banks and other financial companies, has climbed for five straight quarters as corporate profits decline at the same time companies load up on the increasingly cheap borrowings, Morgan Stanley analysts led by Adam Richmond wrote in a note to clients. In 2010, when the U.S. economy started recovering from the longest recession since the Great Depression, the ratio fell to 1.7 times. But what has the analysts uneasy isn’t just the speed at which leverage is climbing, but that it’s happening while the economy continues to grow. “Leverage tends to rise most in a recession – so the fact that it is this high in a ‘healthy economy’ is even more concerning,” the analysts wrote. In other words, they said, “mistakes are both more likely and more costly.”

The analysts’ assessment wasn’t totally worrisome. Years of near-zero interest rates have made it a lot easier to service those debt loads. The typical company’s annual earnings before interest, taxes, depreciation and amortization, known as Ebitda, is still almost 10 times its interest payments, Morgan Stanley’s data shows. Even that number has been declining, though, as earnings slump.

“Today, consumption can only increase if someone hands out money. This money cannot be earned by companies, because consumers are unable to buy additional products.”

• On Nov. 8 Americans Decide To Either Rescue The Banks Or The Consumer (RI)

Recently, the Fed decided not to change interest rates. Various reasons were given, but as we know, there are two “parties” in the US, one which favors monetary easing, and the other, tightening, and each has arguments for their case. Economists are divided on how to proceed. They disagree on precisely this: which economic policies can facilitate growth in our times? A brief look at the last 50 years provides some context. In the 70s, household incomes fell, most of all from 1972-73, and with them, spending. Starting in 1981, (Reaganomics!), spending began to rise, but income, hardly at all. Economic growth was due to increased consumption driven by a rise in household debt, and from 2008 on, in government debt. If we look at real disposable household income, it is the same today as it was in the early 60s.

Today, average household debt is 120% of annual income, whereas up until 1981 it never exceeded 65%. Note too, that in 1981, the discount rate was 19%, whereas today it is practically zero. Today, consumption can only increase if someone hands out money. This money cannot be earned by companies, because consumers are unable to buy additional products. So the only way is to increase debt. But lowering interest rates is impossible because they are already at zero. So there are two options: 1) print money and hand it out to people through the banks, with the understanding that this money will not be returned, or 2) restructure the existing debt, both personal and corporate, in the hopes that then people will start to consume.

In order to do this, interest rates would have to be raised to at least 3-4%, with the banks taking a major hit, because their customers cannot service their loans at those rates… Voila the collision of interests between the people and the banks. Unsurprisingly, the two US candidates disagree on this issue. Clinton is for option 1, i.e. more monetary easing (helping the banks), and Trump is for tightening (helping the people). The choice, of course, lies with the American voter.

And nobody in management noticed a thing?

• Wells Fargo Opened a Couple Million Fake Accounts (BBG)

[..] Wells Fargo was fined $185 million by various regulators for opening customer accounts without the customers’ permission, and that is bad, but there is also something almost heroic about it. There’s a standard story in most bank scandals, in which small groups of highly paid traders gleefully and ungrammatically conspire to rip-off customers and make a lot of money for themselves and their bank. This isn’t that. This looks more like a vast uprising of low-paid and ill-treated Wells Fargo employees against their bosses. The Consumer Financial Protection Bureau, which fined Wells Fargo $100 million, reports that about 5,300 employees have been fired for signing customers up for fake accounts since 2011. You’d have a tough time organizing 5,300 people into a conspiracy, which makes me think that this was less a conspiracy and more a spontaneous revolt.

“Wells Fargo’s punishment comes to only 0.9% of the $22.9 billion that the bank earned last year..”

• It’s Business As Usual At Wells Fargo After Record Fine (MW)

“The fine is a rounding error, and I don’t see any unintended consequences.” So said FBR analyst Paul Miller, describing the $185 million in fines and penalties, plus another $5 million for “customer remediation,” that Wells Fargo agreed to pay. Wells Fargo’s punishment comes to only 0.9% of the $22.9 billion that the bank earned last year. The Consumer Financial Protection Bureau (CFPB) found “widespread unlawful practices” at the third-largest U.S. bank by assets, including the opening of “hundreds of thousands” of accounts by employees without customers’ knowledge so employees could hit lofty sales targets. The fine was the largest levied since the CFPB’s founding in 2011.

Shares of San Francisco-based Wells Fargo fell 2.4% at the close of regular trading Friday, in line with the benchmark S&P 500 suggesting a low level of worry among investors. But there could be longer-term consequences for the bank’s reputation, as Federal Reserve Gov. Daniel Tarullo said during a CNBC interview that criminal charges against bank officers should be pursued. In Wells Fargo’s more than 6,000 retail branches, there has long been a culture of cross-selling as many products to customers as possible, which has been a big part of the bank’s success for decades, according to Marty Mosby, director of bank and equity strategies at Memphis, Tenn.-based broker-dealer Vining Sparks.

I’m afraid the walls will have to come crumbling down before Kiwis accept their reality.

• New Zealand Prepares for the Party to End (Hickey)

Should we all celebrate? Or sink into a great depression, or run for the nearest bunker? It’s hard to know how to react to the news Auckland’s average house value rose over $1 million in August. Auckland’s homeowners should in theory be celebrating their good fortune and voting for more of the same. Anyone who invested just over $53,000 of their money in 2011 to buy an average Auckland house with a 90% mortgage would now be sitting on tax-free capital gains of $486,000. Indeed, some are celebrating. New car sales are at record highs and spending in Auckland’s cafes, bars and restaurants is growing at double-digit rates. But it’s not the sort of go-for-broke debt-fuelled spending binge like the one we saw from 2002-07 when mortgage lending grew at an annual rate of 15%.

Mortgage debt grew 9% in the last year and most people think it has peaked, given the Reserve Bank’s latest restrictions on low deposit lending and a limit on debt to income multiples expected next year. Most Aucklanders don’t believe the manna from the great housing gods in the heavens is real enough to go withdrawing from their household ATMs, which is why the lending growth is relatively subdued. They can also feel in their bones that house prices at 10 times incomes are hyper≠ventilated, if not downright over-valued. New Zealand’s house-price-to-income multiple is the second-most-expensive relative to long run averages in the OECD (behind Belgium), and is the most expensive relative to rents in the OECD. That overvaluation has grown more than any other country in the OECD over the past six years.

This is not the sort of world champion tag we want. The $1m milestone is clearly a moment of despair for those young Aucklanders aspiring to own a home and start a family, particularly those whose parents were also renters. The combination of the price rises and the new LVR rules mean they face decades of saving for a deposit, let along being able to borrow the hundreds and hundreds of thousands to buy a home. All they can hope for is to win Lotto or to marry into a rich family. Another response is to hunker down and prepare for an implosion, which means saving madly to repay debt ahead of the housing market end-times and to diversify into other types of assets. This isn’t so much a celebration as a preparing for the party to be shut down.

Really?

• Italy’s Renzi: At Last Hollande Is With Us, We Can Cause A Stir (Kath.)

After the EU-Mediterranean summit in Athens on Friday, Italian Prime Minister Matteo Renzi expressed his satisfaction that French President Francois Hollande joined Alexis Tsipras’s initiative to form a front against austerity, Italy’s Corriere della Sera newspaper reported on Saturday. “At last, Hollande is with us, he got over his indecisiveness,” the paper quoted Renzi as saying. “Now we can take action.” On the flight back to Rome from Athens, Renzi appeared more than satisfied with the outcome of the summit, the paper reported. Renzi is said to have expressed relief, in comments to journalists, that Hollande signed a declaration embracing the policies that Italy and other southern European countries are promoting. “Now we are many, we can cause a stir,” Renzi is reported to have said, adding that he expected that “in the future the balance of power will change.”

Much as I appreciate Yanis, I’m afraid I have to agree with much of this article. Reforming the EU is akin to reforming the mob. Why not put your energy into an organization that exists ‘parallel’ to the EU?

• Yanis Varoufakis’s Fantasy Politics (Jacobin)

To his credit, Varoufakis at least recognizes that progressives “have no alternative” but a “head-on clash with the EU establishment,” since the European Union simply cannot be reformed to make it more democratic. But, he nonetheless insists, leftists must not support referenda to leave the EU. He offers two confused reasons for this. First, since exit referenda are “movements that have been devised and led primarily by the Right,” it is “unlikely” that joining them “will help the Left block their opponents’ political ascendancy.” This left defeatism is simply a self-fulfilling prophecy. If the Left refuses to lead exit referenda campaigns, of course the running will be left to the Right. And since the Left cannot convincingly defend the European Union, that leaves the Right to benefit.

Secondly, Varoufakis suggests that restoring national democracy will mean the end of the free movement of “workers.” “Given that the EU has established free movement, Lexit involves acquiescence to – if not actual support for – the reestablishment of national border controls, complete with barbed wire and armed guards.” Leaving aside the fact that left-wing leadership could theoretically persuade an electorate to accept open borders, this defence of the EU is simply bizarre. The European Union is very far from “borderless” (his word). It has created free movement not for “workers,” but for EU citizens, albeit limited for the citizens from accession countries.

But for non-EU workers, the European Union has established Fortress Europe: “barbed wire and armed guards” surround the continent, resulting in thousands of dead Africans and Asians in the Mediterranean Sea, and hundreds of thousands more languishing in squalid conditions in southeast Europe (including Varoufakis’s own home country, Greece) and Turkey. Moreover, the migration crisis has led to the restoration of “barbed wire and armed guards” across the continent. The idea that the European Union safeguards some sort of workers’ paradise of open borders against right-wing revanchism is ludicrous.

Growth is a pipedream wih half your young people long term unemployed (which kills economic activity), wages as low as €100 a week, and pensions at €380 a month (both of which kill consumption).

• Greek PM Tsipras Pledges Growth Amid Protests, Austerity Plans (AP)

Greece’s prime minister promised Saturday to deliver economic growth to a country hammered by years of economic hardship, as thousands gathered in protest at more planned austerity measures. About 15,000 protesters – beating drums, waving black flags and holding helium balloons bearing anti-government slogans – took part in demonstrations, marching through the center of Greece’s second-largest city, Thessaloniki, where Prime Minister Alexis Tsipras spoke on the state of the nation’s economy. “In five disastrous years … a quarter of our national wealth was destroyed, disposable income fell by 40%, unemployment soared to 28% and the level of poverty rose to 38%,” Tsipras told an audience of politicians and business leaders, referring to governments before he took office in early 2015.

“Now, all the indications are that this chapter is closing…Finally, we are going from a negative direction to a positive one.” As expected Tsipras said that €246 million, the proceeds of a recent auction of TV licenses, would go toward the “needs of the welfare state.” He promised 10,000 new jobs at state hospitals, thousands more free meals at schools, more kindergarten places and a program aimed at bringing back young Greeks who left the country due to the crisis. “Every last euro of the €246 million will go the people,” he said. He also heralded a 5-year action plan – “a realistic road map for the recovery of the economy and reduction of burdens” – that would bring about a “new Greece” by 2021 and promised to freeze the social security contributions of self-employed Greeks as well as reducing taxes in two years time.

I had to read 5-6 versions of this, in order to find where the money would be going. Turns out, as I feared, that it goes not to the Greeks but to -mostly- international NGOs, who’ve done a far from stellar job. Give a fraction of the €115 million to Konstantinos and his O Allos Anthropos ‘movement’ that we support, and many more people get help. That this is still needed despite the 100s of millions of euros doled out to those NGOs says more than enough. International NGOs are way too expensive and inefficient. So please click that link and help The Automatic Earth help where it counts.

• EU Adds €115 Million In Aid For Migrants In Greece (DW)

The European Union will provide humanitarian organizations in Greece an additional €115 million on top of €83 million from earlier this year, the European Commission said on Saturday. “The European Commission continues to put solidarity into action to better manage the refugee crisis, in close cooperation with the Greek Government,” Humanitarian Aid Commissioner Christos Stylianides said. “The new funding has the key aim to improve conditions for refugees in Greece, and make a difference ahead of the upcoming winter.”

About 60,000 refugees and migrants are stranded in Greece due to border closures implemented earlier this year in the Balkans. Rights organizations have documented poor conditions in overcrowded camps. The new funding will help improve existing shelters and build new ones, pay for a voucher system for migrants, and provide education and other support to unaccompanied minors. It will be channelled via humanitarian organizations. The EU’s emergency support aid is in addition to financial assistance given under other funding programmes.

A routine day.

• Rescuers Bring 2,300 Migrants To Safety From Mediterranean on Saturday (R.)

Rescuers pulled 2,300 migrants to safety on Saturday in 18 separate rescue operations in the Mediterranean coordinated by the Italian coast guard. A Spanish boat belonging to an EU naval force, an Irish navy vessel and boats of four non-governmental organizations were involved in the rescue operations, the coast guard said in a statement. It did not say where the migrants, who were traveling in 17 rubber vessel and one small boat, originally came from. Since moves to stop people crossing from Turkey to Greece, Europe’s worst migrant crisis since World War Two is now focused on Italy, where some 115,000 people had arrived by the end of August, according to the United Nations refugee agency UNHCR.

Home › Forums › Debt Rattle September 11 2016