Jack Delano Chicago & North Western Railroad locomotive shops 1942

“..China’s “credit to GDP gap” has reached 30.1, the highest to date and in a different league altogether from any other major country tracked by the institution”

• BIS Flashes Red Alert For a Banking Crisis in China (AEP)

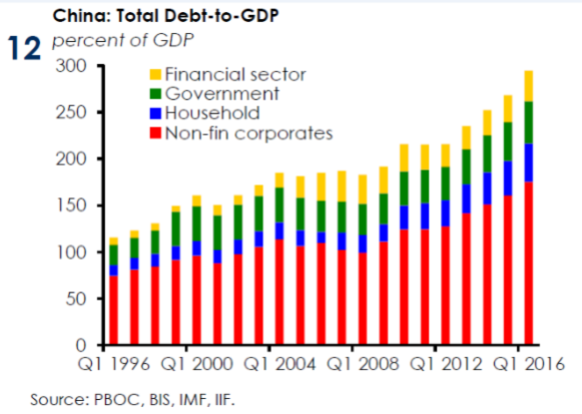

China has failed to curb excesses in its credit system and faces mounting risks of a full-blown banking crisis, according to early warning indicators released by the world’s top financial watchdog. A key gauge of credit vulnerability is now three times over the danger threshold and has continued to deteriorate, despite pledges by Chinese premier Li Keqiang to wean the economy off debt-driven growth before it is too late. The Bank for International Settlements warned in its quarterly report that China’s “credit to GDP gap” has reached 30.1, the highest to date and in a different league altogether from any other major country tracked by the institution. It is also significantly higher than the scores in East Asia’s speculative boom on 1997 or in the US subprime bubble before the Lehman crisis.

Studies of earlier banking crises around the world over the last sixty years suggest that any score above ten requires careful monitoring. The credit to GDP gap measures deviations from normal patterns within any one country and therefore strips out cultural differences. It is based on work the US economist Hyman Minsky and has proved to be the best single gauge of banking risk, although the final denouement can often take longer than assumed. Indicators for what would happen to debt service costs if interest rates rose 250 basis points are also well over the safety line. China’s total credit reached 255pc of GDP at the end of last year, a jump of 107 percentage points over eight years. This is an extremely high level for a developing economy and is still rising fast.

Outstanding loans have reached $28 trillion, as much as the commercial banking systems of the US and Japan combined. The scale is enough to threaten a worldwide shock if China ever loses control. Corporate debt alone has reached 171pc of GDP, and it is this that is keeping global regulators awake at night. The BIS said there are ample reasons to worry about the health of world’s financial system. Zero interest rates and bond purchases by central banks have left markets acutely sensitive to the slightest shift in monetary policy, or even a hint of a shift. “There has been a distinctly mixed feel to the recent rally – more stick than carrot, more push than pull,” said Claudio Borio, the BIS’s chief economist. “This explains the nagging question of whether market prices fully reflect the risks ahead.”

really? “..the state’s control of the financial system and limited levels of overseas debt may mitigate against the risk of a banking crisis.”

• BIS Warning Indicator for China Banking Stress Climbs to Record (BBG)

A warning indicator for banking stress rose to a record in China in the first quarter, underscoring risks to the nation and the world from a rapid build-up of Chinese corporate debt. China’s credit-to-GDP “gap” stood at 30.1%, the highest for the nation in data stretching back to 1995, according to the Basel-based Bank for International Settlements. Readings above 10% signal elevated risks of banking strains, according to the BIS, which released the latest data on Sunday. The gap is the difference between the credit-to-GDP ratio and its long-term trend. A blow-out in the number can signal that credit growth is excessive and a financial bust may be looming. Some analysts argue that China will need to recapitalise its banks in coming years because of bad loans that may be higher than the official numbers.

At the same time, the state’s control of the financial system and limited levels of overseas debt may mitigate against the risk of a banking crisis. In a financial stability report published in June, China’s central bank said lenders would be able to maintain relatively high capital levels even if hit by severe shocks. While the BIS says that credit-to-GDP gaps exceeded 10% in the three years preceding the majority of financial crises, China has remained above that threshold for most of the period since mid-2009, with no crisis so far. In the first quarter, China’s gap exceeded the levels of 41 other nations and the euro area. In the U.S., readings exceeded 10% in the lead up to the global financial crisis.

“.. the importance of the property sector to China’s overall economic health, posed a challenge. It contributes up to one-third of GDP..”

• China Relies on Housing Bubble to Keep GDP Numbers Elevated (CNBC)

Policymakers in China were facing the dilemma of driving growth while preventing the property market from overheating, an economist said Monday as prices in the world’s second largest economy jumped in August. Average new home prices in China’s 70 major cities rose 9.2% in August from a year earlier, accelerating from a 7.9% increase in July, an official survey from the National Bureau of Statistics showed Monday. Home prices rose 1.5% from July. But according to Donna Kwok, senior China economist at UBS, the importance of the property sector to China’s overall economic health, posed a challenge. It contributes up to one-third of GDP as its effects filter through to related businesses such as heavy industries and raw materials.

“On the one hand, they need to temper the signs of froth that we are seeing in the higher-tier cities. On the other hand, they are still having to rely on the (market’s) contribution to headline GDP growth that property investment as the whole—which is still reliant on the lower-tier city recovery—generates…so that 6.5 to 7% annual growth target is still met for this year,” Kwok told CNBC’s “Street Signs.” The data showed prices in the first-tier cities of Shanghai and Beijing prices rose 31.2% and 23.5%, respectively. Home prices in the second tier cities of Xiamen and Hefei saw the larges price gains, rising 43.8 percent and 40.3 percent respectively, from a year ago.

Liquidity.

• Chinese Yuan Borrowing Rate Hits Second Highest Level On Record (R.)

Hong Kong’s overnight yuan borrowing rate was fixed at the highest level in eight months on Monday after the long holiday weekend. China’s financial markets were closed from Thursday for the Mid-Autumn Festival, and Hong Kong’s markets were shut on Friday. The CNH Hong Kong Interbank Offered Rate benchmark (CNH Hibor), set by the city’s Treasury Markets Association (TMA), was fixed at 23.683% for overnight contracts, the highest level since Jan. 12. Traders said the elevated offshore yuan borrowing rates in the past week were due to tight liquidity in the market and rumors that China took action to raise the cost of shorting its currency.

“Normal lenders of the yuan, like Chinese banks, have refrained from injecting liquidity into the market recently due to speculation that the yuan will depreciate toward certain levels like 6.68, 6.7 per dollar,” said a trader in a local bank in Hong Kong. “(The yuan’s) inclusion into the SDR basket nears, so the central bank would like to maintain the offshore yuan near the stronger side,” said the trader, adding that seasonal reasons including national holidays and caution near the quarter-end also drains yuan liquidity from the market. The U.S. dollar traded near a two-week high against a basket of major currencies on Monday after U.S. consumer prices rose more than expected in August, bolstering expectations the Federal Reserve will raise interest rates this year.

Really, it’s about demand.

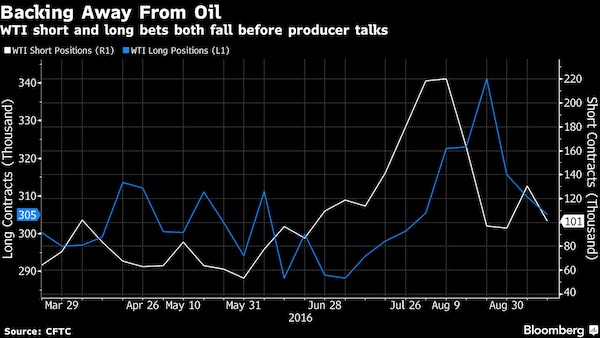

• Oil Investors Flee as OPEC Freeze Hopes Face Supply Reality (BBG)

Oil speculators headed for the sidelines as OPEC members prepare to discuss freezing output in the face of signs the supply glut will linger. Money managers cut wagers on both falling and rising crude prices before talks between OPEC and other producers later this month. The meeting comes after the International Energy Agency said that the global oversupply will last longer than previously thought as demand growth slows and output proves resilient. “It’s a cliff trade right here,” said John Kilduff, partner at Again Capita, a New York hedge fund focused on energy. “There’s more uncertainty than usual in the market because of the upcoming meeting. People are waiting for the outcome and a number think this is a good time to stand on the sidelines.”

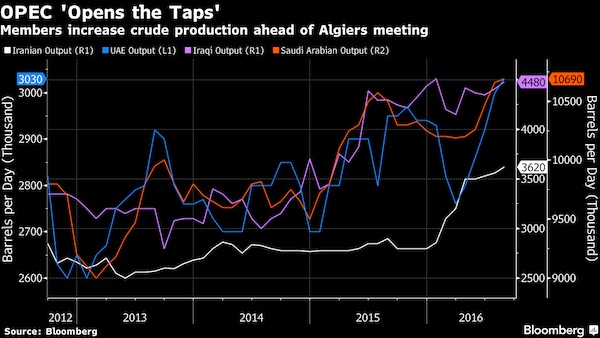

OPEC plans to hold an informal meeting with competitor Russia in Algiers Sept. 27, fanning speculation the producers may agree on an output cap to shore up prices. Oil climbed 7.5% in August after OPEC announced talks in the Algerian capital. [..] World oil stockpiles will continue to accumulate into late 2017, a fourth consecutive year of oversupply, according to the IEA. Just last month, the agency predicted the market would start returning to equilibrium this year. OPEC production rose last month as Middle East producers opened the taps, the IEA said. Saudi Arabia, Kuwait and the UAE pumped at or near record levels and Iraq pushed output higher, according to the agency. “OPEC is out of bullets,” said Stephen Schork, president of the Schork Group. “Even if they agree on a production freeze it will be at such a high level that it will be meaningless.”

“..the energy companies producing shale oil in the Bakken are in the hole for $32 billion. ”

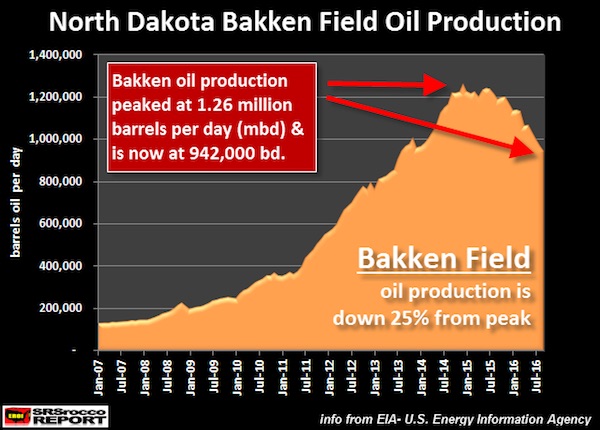

• The Death Of The Bakken Field Has Begun (SRSrocco)

The Death of the Great Bakken Oil Field has begun and very few Americans understand the significance. Just a few years ago, the U.S. Energy Industry and Mainstream media were gloating that the United States was on its way to “Energy Independence.” Unfortunately for most Americans, they believed the hype and are now back to driving BIG SUV’s and trucks that get lousy fuel mileage. And why not? Americans now think the price of gasoline will continue to decline because the U.S. oil industry is able to produce its “supposed” massive shale oil reserves for a fraction of the cost, due to the new wonders of technological improvement. [..] they have no clue that the Great Bakken Oil Field is now down a stunning 25% from its peak just a little more than a year and half ago:

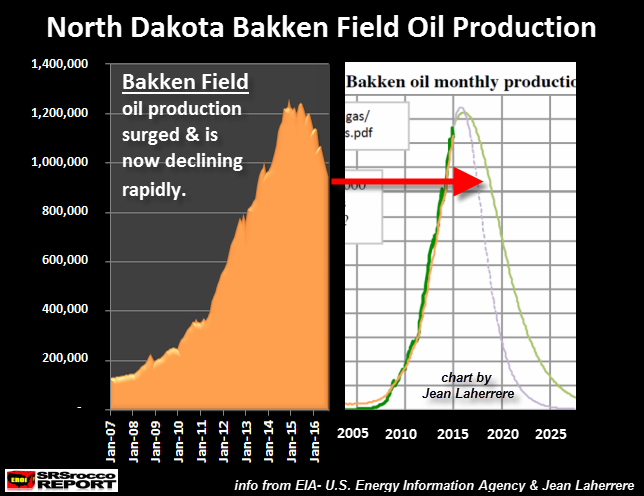

Some folks believe the reason for the decline in oil production at the Bakken was due to low oil prices. While this was part of the reason, the Bakken was going to peak and decline in 2016-2017 regardless of the price. This was forecasted by peak oil analyst Jean Laherrere. [..] I took Jean Laherrere’s chart and placed it next to the current actual Bakken oil field production:

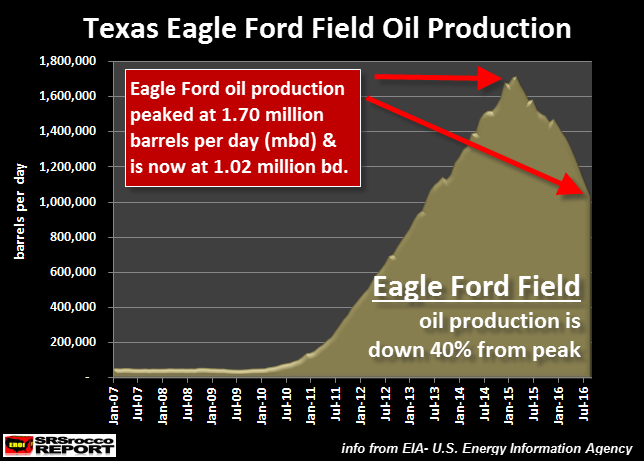

As we can see in the chart above, the rise and fall of Bakken oil production is very close to what Jean Laherrere forecasted several years ago (shown by the red arrow). According to Laherrere’s chart, the Bakken will be producing a lot less oil by 2020 and very little by 2025. This would also be true for the Eagle Ford Field in Texas. According to the most recent EIA Drilling Productivity Report [8], the Eagle Ford Shale Oil Field in Texas will be producing an estimated 1,026,000 barrels of oil per day in September, down from a peak of 1,708,000 barrels per day in May 2015. Thus, Eagle Ford oil production is slated to be down a stunning 40% since its peak last year.

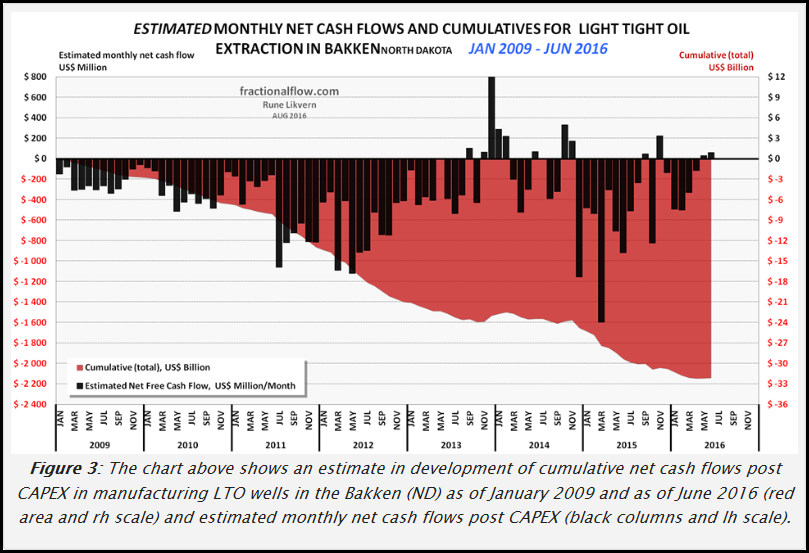

Do you folks see the writing on the wall here? The Bakken down 25% and the Eagle Ford down 40%. These are not subtle declines. This is much quicker than the U.S. Oil Industry or the Mainstream Media realize. And… it’s much worse than that. The U.S. Oil Industry Hasn’t Made a RED CENT Producing Shale. Rune Likvern of Fractional Flow has done a wonderful job providing data on the Bakken Shale Oil Field. Here is his excellent chart showing the cumulative FREE CASH FLOW from producing oil in the Bakken: [..] the BLACK BARS are estimates of the monthly Free Cash flow from producing oil in the Bakken since 2009, while the RED AREA is the cumulative negative free cash flow. [..] Furthermore, the red area shows that the approximate negative free cash flow (deducting CAPEX- capital expenditures) is $32 billion. So, with all the effort and high oil prices from 2011-2014 (first half of 2014), the energy companies producing shale oil in the Bakken are in the hole for $32 billion. Well done…. hat’s off to the new wonderful fracking technology.

Lofty.

• Canada To Impose Nationwide Carbon Price (R.)

Canada will impose a carbon price on provinces that do not adequately regulate emissions by themselves, Environment Minister Catherine McKenna said on Sunday without giving details on how the Liberal government will do so. Speaking on the CTV broadcaster’s “Question Period,” a national politics talk show, McKenna said the new emissions regime will be in place sometime in October, before a federal-provincial meeting on the matter. She only said the government will have a “backstop” for provinces that do not comply, but did not address questions on penalties for defiance. Canada’s 10 provinces, which enjoy significant jurisdiction over the environment, have been wary of Ottawa’s intentions and have said they should be allowed to cut carbon emissions their own way.

Prime Minister Justin Trudeau persuaded the provinces in March to accept a compromise deal that acknowledged the concept of putting a price on carbon emissions, but agreed the specific details, which would take into account provinces’ individual circumstances, could be worked out later. Canada’s four largest provinces, British Columbia, Alberta, Ontario and Quebec, currently have either a tax on carbon or a cap-and-trade emissions-limiting system. But Brad Wall, the right-leaning premier of the western energy-producing province of Saskatchewan, has long been resistant to federal emissions-limiting plans. McKenna said provinces such as Saskatchewan can design a system in which emissions revenues go back to companies through tax cuts, which would dampen the impact of the extra cost brought by the carbon price.

“Lower Saxony, home state to Volkswagen doesn’t offer electronic filing for civil litigation.”

• 1000s of VW Lawsuits To Be Filed By The End Of Monday, All in Print (BBG)

There was one thing Andreas Tilp and Klaus Nieding needed most for taking a wave of Volkswagen investor cases to court: a pickup truck. Nieding had a load of 5,000 suits sent Friday from his office in Frankfurt to Braunschweig, about 350 kilometers (218 miles) away. Tilp’s 1,000 or so complaints will arrive in a transport vehicle Monday, traveling more than 500 kilometers from his office in the southern German city of Kirchentellinsfurt. There was no other way to do it: Lower Saxony, home state to Volkswagen doesn’t offer electronic filing for civil litigation. The court in Braunschweig, the legal district that includes VW’s Wolfsburg headquarters, is expecting thousands of cases by the end of the day.

Investors are lining up to sue in Germany, where VW shares lost more than a third of their value in the first two trading days after the Sept. 18 disclosure of the emissions scandal by U.S. regulators. Monday is the first business day after the anniversary of the scandal and investors fear they have to sue within a year of the company’s admission that it had equipped about 11 million diesel vehicles with software to cheat pollution tests. The lawsuits disclosed so far are seeking 10.7 billion euros ($11.9 billion). The Braunschweig court has said it will release the total number this week. Volkswagen has consistently argued that it has followed all capital-markets rules and properly disclosed emissions issues in a timely fashion.

The super-sized filing is yet another example of the sheer scale of the scandal that’s haunted VW for a year. It forced the German carmaker into the biggest recall in its history to fix the cars or get them off the road entirely, the fines already levied are among the steepest against any manufacturer, and the carmaker has built up massive provisions to absorb the hit.

What are the odds VW sponsored the report?

• Many Car Brands Emit More Pollution Than Volkswagen (G.)

A year on from the “Dieselgate” scandal that engulfed Volkswagen, damning new research reveals that all major diesel car brands, including Fiat, Vauxhall and Suzuki, are selling models that emit far higher levels of pollution than the shamed German carmaker. The car industry has faced fierce scrutiny since the US government ordered Volkswagen to recall almost 500,000 cars in 2015 after discovering it had installed illegal software on its diesel vehicles to cheat emissions tests. But a new in-depth study by campaign group Transport & Environment (T&E) found not one brand complies with the latest “Euro 6” air pollution limits when driven on the road and that Volkswagen is far from being the worst offender.

“We’ve had this focus on Volkswagen as a ‘dirty carmaker’ but when you look at the emissions of other manufacturers you find there are no really clean carmakers,” says Greg Archer, clean vehicles director at T&E. “Volkswagen is not the carmaker producing the diesel cars with highest nitrogen oxides emissions and the failure to investigate other companies brings disgrace on the European regulatory system.” T&E analysed emissions test data from around 230 diesel car models to rank the worst performing car brands based on their emissions in real-world driving conditions. Fiat and Suzuki (which use Fiat engines) top the list with their newest diesels, designed to meet Euro 6 requirements, spewing out 15 times the NOx limit; while Renault-Nissan vehicle emissions were judged to be more than 14 times higher. General Motors’ brands Opel-Vauxhall also fared badly with emissions found to be 10 times higher than permitted levels.

Exposed. But too late.

• The Ongoing Collapse of Economics (Caswell)

If we accept the rapidly growing body of evidence and authority suggesting that many of the core concepts of conventional macroeconomics are bollox, and that economists don’t really know what they’re doing, then the important question becomes ‘What next?’ As conventional macroeconomic theory crumbles in the face of facts, what will replace it? One of the primary contenders is Modern Monetary Theory, which focuses on money itself (something which, believe it or not, conventional macroeconomic theory doesn’t do). Another possibility is that macroeconomics will learn from complexity and systems theory, and that its models (and, hopefully, their predictive ability) will become more like those used in meteorology and climate science.

Anti-economist Steve Keen is working in this direction, influenced by the Financial Instability Hypothesis (FIH) of Hyman Minsky, whatever that is. But wherever macroeconomics is going, it’s clear that the old order is collapsing. The theoretical orthodoxy that has guided the highest level of economic management for many decades is crumbling. Either economics is an objective science or it’s not. And if economics is not an objective science, then we quickly need an economics that is. Countless livelihoods and lives will be deeply affected by the revolution we are witnessing in theoretical macroeconomics. It may be dry, it may be boring, it may be theoretical, and it may seem incomprehensible. But it’s hard to think of any discussion that’s more important.

Not looking good.

• WaPo 1st Paper to Call for Prosecution of its Own Source -After Pulitzer- (GG)

Three of the four media outlets which received and published large numbers of secret NSA documents provided by Edward Snowden – The Guardian, The New York Times and The Intercept – have called for the U.S. Government to allow the NSA whistleblower to return to the U.S. with no charges. That’s the normal course for a newspaper, which owes its sources duties of protection, and which – by virtue of accepting the source’s materials and then publishing them – implicitly declares the source’s information to be in the public interest. But not The Washington Post.

In the face of a growing ACLU-and-Amnesty-led campaign to secure a pardon for Snowden, timed to this weekend’s release of the Oliver Stone biopic “Snowden,” the Post Editorial Page not only argued today in opposition to a pardon, but explicitly demanded that Snowden – their paper’s own source – stand trial on espionage charges or, as a “second-best solution,” “accept [] a measure of criminal responsibility for his excesses and the U.S. government offers a measure of leniency.” In doing so, The Washington Post has achieved an ignominious feat in U.S. media history: the first-ever paper to explicitly editorialize for the criminal prosecution of its own paper’s source – one on whose back the paper won and eagerly accepted a Pulitzer Prize for Public Service. But even more staggering than this act of journalistic treachery against their paper’s own source are the claims made to justify it.

The Post Editors concede that one – and only one – of the programs which Snowden enabled to be revealed was justifiably exposed – namely, the domestic metadata program, because it “was a stretch, if not an outright violation, of federal surveillance law, and posed risks to privacy.” Regarding the “corrective legislation” that followed its exposure, the Post acknowledges: “we owe these necessary reforms to Mr. Snowden.” But that metadata program wasn’t revealed by the Post, but rather by the Guardian.

Soon one of many.

• ‘People’s Candidate’ Le Pen Vows To Free France From EU Yoke (AFP)

French far-right National Front leader Marine Le Pen on Sunday vowed to give her country back control over its laws, currency and borders if elected president next year on an anti-EU, anti-immigration platform. Addressing around 3,000 party faithful in the town of Frejus on the Cote d’Azur, Le Pen aimed to set the tone for her campaign, declaring in her speech: “The time of the nation state has come again.” The FN leader, who has pledged to hold a referendum on France’s future in the EU if elected and bring back the French franc, said she was closely watching developments in Britain since it voted to leave the bloc. “We too are keen on winning back our freedom…. We want a free France that is the master of its own laws and currency and the guardian of its borders.”

Polls consistently show Le Pen among the top two candidates in the two-stage presidential elections to take place in April and May. But while the polls show her easily winning a place in the run-off they also show the French rallying around her as-yet-unknown conservative opponent in order to block her victory in the final duel. In Frejus, Le Pen sought to sanitise her image, continuing a process of “de-demonisation” that has paid off handsomely at the ballot box since she took over the FN leadership from her ex-paratrooper father Jean-Marie Le Pen in 2011. “I am the candidate of the people and I want to talk to you about France, because that is what unites us,” the 48-year-old politician said in a speech that avoided any reference to the FN which is seen as more taboo than its leader.

What would happen if she decides not to run next year?

• Merkel Suffers Drubbing In Berlin Vote Due To Migrant Angst (R.)

Chancellor Angela Merkel’s conservatives suffered their second electoral blow in two weeks on Sunday, with support for her Christian Democrats (CDU) plunging to a post-reunification low in a Berlin state vote due to unease with her migrant policy. The anti-immigrant Alternative for Germany (AfD) polled 11.5%, gaining from a popular backlash over Merkel’s decision a year ago to keep borders open for refugees, an exit poll by public broadcaster ARD showed. The result means the AfD will enter a 10th state assembly, out of 16 in total.

Merkel’s CDU polled 18%, down from 23.3% at the last election in 2011, with the centre-left Social Democrats (SPD) remaining the largest party on 23%. The SPD may now ditch the CDU from their coalition in the German capital. The blow to the CDU came two weeks after they suffered heavy losses in the eastern state of Mecklenburg-Vorpommern. The setbacks have raised questions about whether Merkel will stand for a fourth term next year, but her party has few good alternatives so she still looks like the most likely candidate.

Perhaps there’s a contradiction hiding in realizing that globalization is moving in reverse, but still expecting global responses to crises.

• Why Won’t The World Tackle The Refugee Crisis? (Observer)

It is now the greatest movement of the uprooted that the world has ever known. Some 65 million people have been displaced from their homes, 21.3 million of them refugees for whom flight is virtually compulsory – involuntary victims of politics, war or natural catastrophe. With just less than 1% of the world’s population homeless and seeking a better, safer life, a global crisis is under way, exacerbated by a lack of political cooperation – and several states, including the United Kingdom, are flouting international agreements designed to deal with the crisis. This week’s two major summits in New York, called by the United Nations general assembly and by President Barack Obama, are coming under intense criticism before the first world leaders have even taken their seats.

Amnesty, Human Rights Watch and refugee charities are among those accusing both summits of being “toothless” and saying that the declaration expected to be ratified by the UN on Monday imposes no obligations on the 193 general assembly nations to resettle refugees. The Obama-led summit, meanwhile, which follows on Tuesday, is designed to extract pledges of funding which critics say too often fail to materialise. Steve Symonds, refugee programme director at Amnesty, said: “Funding is great and very much needed, but it’s not going to tackle the central point of some sharing of responsibility. The scale of imbalance there is growing, and growing with disastrous consequences.”

He said nations were sabotaging agreements through self-interest. “It’s very, very difficult to feel any optimism about this summit or what it will do for people looking for a safe place for them and their families right at this moment, nor tackle the awful actions of countries who are now thinking, ‘If other countries won’t help take responsibility, then why should we?’ and are now driving back desperate people. “Compelling refugees to go back to countries where there is conflict and instability doesn’t help this awful merry-go-round going on and on.”

Home › Forums › Debt Rattle September 19 2016