DPC Main Street, Buffalo, NY 1900

Stupid circus.

• The Bank of Japan May Overshadow the Fed on Super Wednesday (CNBC)

In Super Wednesday’s central bank double-header, the Federal Reserve’s show may be an afterthought to the Bank of Japan’s performance. In a case of unusual timing, both the BOJ and the Fed will announce the outcomes of their monetary policy meetings on Wednesday. [..] Analyst predictions for the BOJ’s next move varied widely, from expectations that the central bank would cut interest rates deeper into negative territory, to changing the size or make up of its quantitative easing asset purchases, to trying to steepen the yield curve or to doing nothing at all. “The BOJ has a propensity to surprise, although most of the time, the surprises are negative,” Lam said. The market certainly took a negative view of the BOJ’s late January surprise move to introduce a negative interest rate policy, when the central bank cut the rate it pays on certain deposits to negative 0.1%.

That counterintuitively sent the yen sharply higher, frustrating policymakers who had hoped a weaker currency would help the BOJ reach its long-delayed 2% inflation target by increasing the cost of imports and spurring more consumption. Indeed, the yen may become the bellwether of how the markets view the twin central bank meetings. “Dollar-yen has fallen pretty much every time we’ve had an FOMC and BOJ meeting week this year,” David Forrester at Credit Agricole told CNBC’s “Street Signs” on Monday. He expected that the BOJ would aim to steepen Japan’s bond yield curve and if that move “impressed” the Nikkei stock index, then the yen might weaken. Forrester also noted that if the Fed sounded more hawkish in its statement, that would push up the dollar, and by extension, weaken the yen.

At least $42 trillion worth.

• Italy PM Renzi Tells Bundesbank To Solve German Banks’ Derivatives Problem (R.)

Italian Prime Minister Matteo Renzi said on Monday that Germany’s central bank chief Jens Weidmann should concentrate on fixing the problems of his own country’s banks, after Weidmann had urged Italy to cut its huge public debt. Renzi told reporters in New York that Weidmann needed to solve the problem of German banks which had “hundreds and hundreds and hundreds of billions of euros of derivatives” on their books. Renzi, who has staked his career on a referendum on constitutional reform this autumn, has repeatedly criticized other European leaders in the last few days over what he sees as an inadequate European Union response to the problems of the economy and immigration. In an interview with daily La Stampa published on Monday, Weidmann said Italy needed to consolidate its budget to avoid doubts emerging about the sustainability of its public debt.

How to kill a city, Chapter 26.

• Housing Crisis Is Driving A “Geographic Wedge” Between Generations (Ind.)

The housing crisis is driving a “geographic wedge” between the generations, weakening the bond between different age groups, according to new research. The study found that the rise in “age segregation”, caused by the lack of affordable housing for younger people, is damaging our society. Across England and Wales, the number of neighbourhoods in which half the population is aged over 50 has risen rapidly since 1991, the research from the Intergenerational Foundation (IF) found. In 1991 there were just 65 such neighbourhoods. This had risen to 485 by 2014, 60% of which were rural. But within urban areas, older people, children and young adults are also living increasingly separately.

“The housing crisis is driving a geographic wedge between the generations,” the research said. “It means that older and younger generations are increasingly living apart.” Since 1991, the median average age of neighbourhoods near the centre of cities has generally fallen by between five and 10 years, the report said. The report identified Cardiff, with its large student population, as “the most age segregated city in England and Wales”. Brighton, Leeds, Nottingham, Sheffield and Southampton were also identified by the report as age segregation “hotspots”. In Cardiff and Brighton, nearly a quarter of the population would need to move home in order to eliminate age segregation.

Surging house prices and a lack of choice for buyers have meant many people in the younger generation have had to move to find affordable housing close to employment. Younger generations are more likely rent than own, but older generations also face a “last-time buying crisis” due to a general lack of supply and a lack of affordable suitable accommodation to downsize into, the report said. Living apart in this way is making it harder for younger and older generations to look after each other, putting a bigger strain on the NHS. Age segregation also reduces people’s opportunities to find work and makes it harder for people to see different generations’ perspectives, it said.

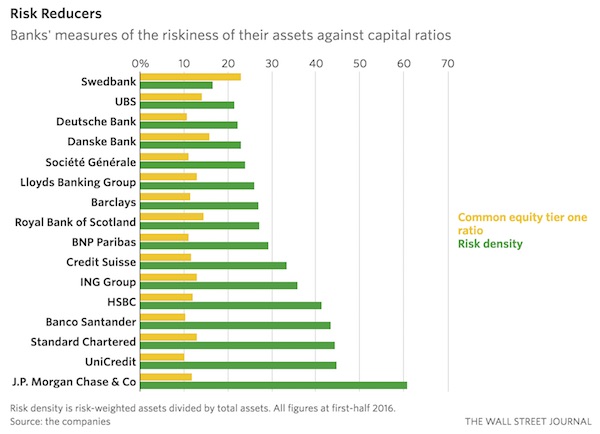

It is really simple: “..every euro of loans or securities they own is worth less than 30 cents in risk-weighted assets..”

• Global Regulators See Risks in European Banks (WSJ)

Global rule makers think some banks are too clever by half. They want to limit the capital benefits those banks get from sophisticated risk models because they worry that these create a level of accuracy and detail as seductive as it is fallible. The Basel Committee, which sets global banking rules, wants to rein in the outliers: Those banks whose models produce the lowest-risk weightings and create most benefits in reducing their capital requirements. This will disproportionately affect European banks versus U.S. peers because Europeans have long designed their businesses around a risk-based approach to capital, while U.S. banks historically were governed by simpler leverage ratios that use plain asset measures.

It is quite easy to see which banks in Europe face the biggest potential impact from the changes currently being designed and debated by the rule makers who should complete them by the year’s end. Deutsche Bank, Société Générale, Barclays and BNP Paribas all have a relatively low-risk density, which is a measure of how little risk a bank assigns to the assets on its books. Each has a risk density of less than 30%, which means that every euro of loans or securities they own is worth less than 30 cents in risk-weighted assets. And it is risk-weighted assets that determines a bank’s capital requirement. For comparison, J.P. Morgan has a risk density of 61%.

The answer to all problems with the euro(-zone): more euro.

• Shore Up The Euro Before It’s Too Late (R.)

Will the euro survive the next big crisis? A new report inspired by Jacques Delors, one of the architects of the single currency, says it probably won’t and urges policymakers to pursue immediate changes to Europe’s troubled monetary union to ward off the inevitable collapse. The report, entitled “Repair and Prepare – Growth and the Euro after Brexit”, comes at a time when even the most ardent defenders of the euro are cautioning against closer integration in the aftermath of Britain’s vote to leave the European Union. Pressing ahead, they worry, would deepen public resentment towards Europe after years of economic crisis that has pushed up unemployment and sent populist, eurosceptic parties surging in opinion polls.

The authors, a group of academics, think tankers and former policymakers from across Europe, acknowledge the obstacles but argue that politicians cannot afford to wait. They have put together a three-pronged plan for shoring up the euro that they believe is politically feasible despite the troubling backdrop. “Reforming the euro might not be popular. But it is essential and urgent: at some point in the future, Europe will be hit by a new economic crisis,” the report says. “We do not know whether this will be in six weeks, six months or six years. But in its current set-up the euro is unlikely to survive that coming crisis.”

[..] In a first stage to shore up the single currency, they recommend “quick fixes” that include a reinforcement of the euro zone’s rescue mechanism, the ESM, a strengthening of banking union and improved economic policy coordination that does not require changes to the EU treaty. This would be followed by a north-south quid pro quo on structural reforms and investments. In a third stage, the euro zone would move to a more federal structure, with risk and sovereignty sharing. This final stage, the most controversial, could take a decade or more to realize and is described as important but optional.

So there!

• Theresa May Outs Herself as Wall Street’s Poodle in Brexit Talks (NC)

The only elements that differentiate Theresa May’s latest move from a Monty Python skit is her lack of a pith helmet and safari jacket. The British Prime Minister, per the Financial Times, plans to visit with top executives of major Wall Street firms to “canvass” them on “how Britain should structure its departure from the EU to reassure them that Brexit will not damage their UK business.” Mind you, she is not making this kiss-the-ring trip to New York to “reassure” the financial behemoths. That would mean the UK has a plan and is making the rounds to sell it and perhaps make cosmetic changes around the margins to make them feel important. Nor is it “consult,” which is diplo-speak for, “We’ll listen to your concerns but are making no commitment as to how much if any well take under advisement.”

No, “canvass” means they are a valued constituency she intends to win over and is seeking their input for real. This “canvass” is yet more proof of how out of its depth the UK government is in handling the supposedly still on Brexit. There’s a decent likelihood that May is running to the US because her team is short on staff and ideas and those clever conniving Americans might have some useful ideas up their sleeves. After all, they don’t want to go through the bother of getting more licenses and moving some staff to the Continent or Dublin. It’s much simpler to keep everything in London, particularly since top New York execs might face a tour of duty there, and the housing, shopping and schools are much more to their liking. Mind you, most financial services would remain in London with a Brexit, but Euroclearing will require a restructuring (that will have to be done out of an EU entity).

The embarrassing part is that May is apparently having to solicit input, when the big issue is obvious and binary: will the UK keep passporting rights for banking? This is binary and not hard to understand. If not, UK and US banks will need to obtain EU licenses to do certain types of business and some customer-facing personnel will need to be domiciled in the EU, not the UK. Numerous estimates have been bandied about, and they vary widely. Note that many important operations, like foreign exchange trading, were centered in the UK long before it entered the EU, are not regulated, and are conducted by phone and electronically, so there’s no reason to think they will need to migrate.

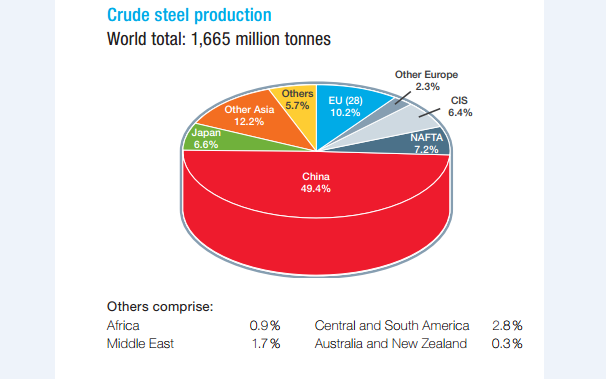

China wa never going to restructure steel. It’s a strategic industry.

• China Creates Global Steel Champion As Doubts Deepen On Output Cuts (AEP)

China has backed the creation of a giant national steel champion with continental reach, calling into question the country’s pledge at the G20 summit to slash over-production.Caixin Magazine said regulators have approved the merger of Baosteel and the loss-making group Wuhan Iron and Steel, calling it the birth of a strategic “behemoth” with a capacity of over 60 million tonnes a year. The move is touted as part of a restructuring plan to slash 100-150 million tonnes of excess capacity in China by 2020, with the loss of 180,000 steel jobs. But the evidence so far shows that output is still rising. An internal document from the German steel federation Stahl alleges that China has added 9m tonnes of extra capacity so far this year and there is no chance whatsoever that the country will meet its commitment to eliminate 45m tonnes of plant in 2016.

Stahl said China’s capacity has been increasing every year for the last four years, reaching 1,105m tonnes at a time when internal demand in China has slumped to 686m tonnes. Over-capacity has in effect doubled to 419m tonnes since 2012, more than twice the entire steel output of the EU. The Baosteel takeover of Wuhan is not necessarily a threat. Mergers can be part of the slow process of consolidation, and in this case the two state-owned companies have vowed to cut capacity by 13.4m tonnes between them. The nagging doubt is that steel is deemed a “strategic” industry by Beijing, a term with specific meaning in Communist Party ideology. The normal reflex of the authorities – especially regional party bosses – is to keep ailing steel mills alive by rolling over bad debts or forcing debt-equity swaps.

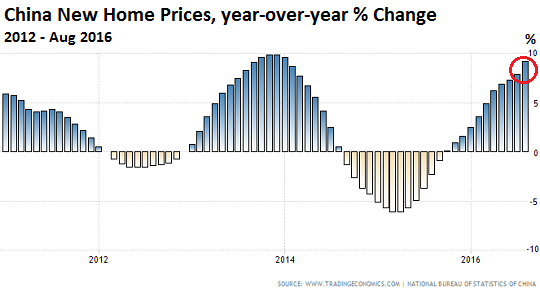

[..] For now the global steel crisis is in remission. The glut has been masked by China’s own policies over recent months, chiefly a fresh blast of infrastructure spending and a 20pc surge in new construction driven by easier credit. This looks like a cyclical bounce, now a routine feature of China’s stop-go economic management. The latest property boom is highly unstable. House prices rose 9.2pc in August from a year earlier, reaching 40pc in Hefei, 37pc in Shenzhen, 37pc in Nanjing, and 31pc in Shanghai. Once the new bubble deflates, a slowdown in building is likely to expose the immense scale of the steel glut once again.

See my article yesterday.

• China’s Property Bubble Keeps Getting Bigger (WSJ)

China’s attempts to contain property prices have been halfhearted. If anything, they may have made the bubble grow even bigger. Average new-home prices in August were up 1.3% from July, the government reported, the 17th straight increase and the biggest since at least January 2011. Prices declined in only four of the 70 cities surveyed. The latest leg of China’s property boom, which began last year in the biggest cities—such as Shenzhen and Shanghai—has recently spread to smaller cities, driving local governments to roll out tightening measures. Some specifically aim at capping land prices, which in some places exceed the price per square meter of already-built housing nearby. Shanghai has suspended land auctions while other cities, including Nanjing and Guangzhou, have capped land prices.

These measures, however, may have backfired by reducing supply, driving developers to acquire land in other ways. Sunac China, for example, said Sunday it would buy 42 property projects from Legend Holdings, the biggest shareholder of computer maker Lenovo, for 13.8 billion yuan ($2.1 billion). More important, tightening measures haven’t tackled the key factor of rising home prices—easy credit. As a%age of total loans, outstanding mortgage loans are at their highest since at least 2008. For developers, cheaper money available in the onshore bond market fuels aggressiveness. Sunac, for example, a company whose dollar-denominated bonds were yielding 10% just 17 months ago, raised 4 billion yuan last month with coupons of 3.44% to 4%—despite a doubling of its net debt in just the past year. With so many parties including banks and local governments all depending on real estate, it may not make sense for them to pop the bubble.

Until another stock bubble is blown. Beijing had better understand that game is largely up after it’s in the IMF basket. Then stability becomes much more important.

• Chinese Say Home Prices ‘High and Hard to Accept’ but Buying Frenzy Surges (WS)

Home prices in China are “high and hard to accept,” said 53.7% of the respondents in a survey by the People’s Bank of China, published today in the People’s Daily, the official paper of the Communist Party. Only 42.9% found them “acceptable.” And only 23.1% predicted that they would rise next quarter, while 11.9% expected them to fall. But that isn’t stopping people from wanting to participate in this frenzy: “Nevertheless, the ratio of residents who were prepared to buy a house within the next three months increased 1.3% from the third quarter to reach 16.3%.” That’s a lot of people “prepared to buy a house,” even with prices “high and hard to accept.”

There are several remarkable things in this survey: the worried tone in terms of the soaring prices, the increased desire to buy because, or despite, of the soaring prices, and the fact that this survey came via the official party organ from the PBOC which has been publicly fretting about the housing bubble, the debt bubble that comes along with it, and what it might do when it deflates. And what a bubble it is! The average new home price in 70 Chinese cities soared 9.2% in August year-over-year, after having jumped 7.9% in July, the eleventh month in a row of year-over-year gains, according to the China Housing Index, reported by the National Bureau of Statistics. In Tier 1 cities, prices skyrocketed: in Beijing, by 23.5% and in Shanghai by 31.2%!

Prices increased in 64 of the 70 cities, up from 51 in July. They fell in only four cities and remained flat in two. This chart by tradingeconomics.com shows the year-over-year percentage change in new home prices, the boom and bust cycles, and the stage of the boom where prices are at the moment:

Beijing will have to give up a substantial part of the control it’s used to having over the yuan. That will not be a smooth process.

• Yuan Funding Crunch Shows Risks in Reserve Currency Ranking (BBG)

China’s desire to stabilize the yuan risks undermining its future as a global reserve currency. For the second time this year, the overnight cost to borrow the offshore currency in Hong Kong surged above 20% amid speculation the People’s Bank of China is mopping up liquidity to boost the exchange rate. The volatility comes less than two weeks before the yuan’s inclusion in the IMF’s Special Drawing Rights – an event seen as a validation of President Xi Jinping’s efforts to promote its standing on the world stage. “This is not the sort of behavior you would expect from an SDR currency,” said Sue Trinh at Royal Bank of Canada in Hong Kong. “You can’t have funding for a reserve currency blowing up or moving in such a volatile fashion; it would be a nightmare for short-term portfolio management.”

Any use of borrowing rates to shake down bears risks eroding authorities’ pledges to give markets more sway in the world’s second-largest economy and undercutting Hong Kong’s position as the biggest offshore yuan trading center. The yuan’s funding costs at home and abroad have been more volatile than the four existing currencies in the IMF’s reserve basket over the past three years, data compiled by Bloomberg show. The offshore yuan funding cost, known as Hibor, jumped 15.7 percentage points to 23.7% on Monday, the second-largest increase on record, before falling to 12.4% on Tuesday. The rate previously surged to a high of 66.8% in January as China’s policy makers battled to restore control over the currency after a series of weaker fixings.

Traders are growing used to China’s policy makers intervening before key events, said Hao Hong at Bocom International in Hong Kong. “The central bank has done this before.” Still, the move is underscoring the greater volatility in China’s money markets compared with other reserve currencies. While the overnight Shanghai Interbank Offered Rate surged to 13% during a credit crunch in 2013, similar funding costs for the dollar, yen, euro and pound all traded within a 100 basis-point range in the past three years, according to data compiled by Bloomberg.

Those Auckland homes are turning into ATMs.

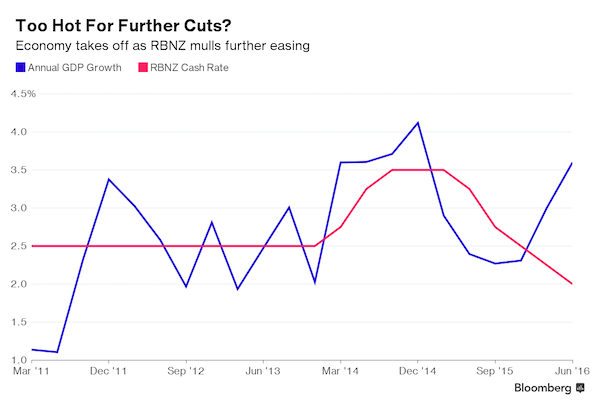

• New Zealand’s Sizzling Economy Sees Goldman Go Out On a Limb Over Rates (BBG)

New Zealand’s sizzling economy has prompted Goldman Sachs to go out on a limb and call an end to the country’s easing cycle. Data last week showed GDP expanded 3.6% in the year through June, putting New Zealand among the fastest-growing economies in the developed world and suggesting inflation should finally start to gather pace. The Kiwi economy is “too strong to justify further rate cuts,” Tim Toohey, chief economist at Goldman Sachs Australia, wrote in a note to clients. He cancelled the two rate reductions he’d been forecasting and said the Reserve Bank of New Zealand will now hold its official cash rate at 2% through 2017. That’s a bold call after RBNZ Governor Graeme Wheeler all but committed himself to at least one more cut as he struggles to return inflation to target.

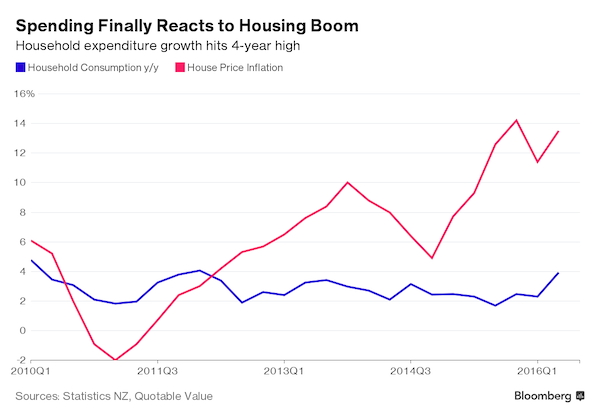

While 16 other economists surveyed by Bloomberg expect Wheeler to keep borrowing costs on hold at Thursday’s policy decision, they all predict he’ll lower them in November and some forecast another cut early next year. New Zealand’s strong dollar is damping the price of imports, meaning Wheeler has to crank up domestic price pressures to get inflation back into his 1-3% target band. He’s worried the longer the gauge stays low – it’s currently at 0.4% and forecast to slow further – the greater the risk inflation expectations will drop and create a deflationary spiral. Goldman may be on to something though. The GDP data showed a surge in household spending growth to a four-year high, suggesting inflation may be just around the corner. Spending was led by categories such as furniture, carpets and audio equipment.

Craziness. Not a crisis goes to waste.

• Alabama Selling Bonds Backed by Deepwater Horizon Settlement (BBG)

The 2010 Deepwater Horizon oil-rig disaster, featured in a major-motion picture opening next week, may soon help Alabama rebuild its reserves, pay Medicaid expenses and fund road projects. Alabama plans to use annual payments from a $1 billion settlement with U.K. oil producer BP to back bonds issued within the next two months, said Bill Newton, the state’s acting director of finance, who also sits on the Alabama Economic Settlement Authority, which was created to handle the debt issue. The state will receive the payments under the settlement for 18 years.

State lawmakers earlier this month approved the bond sale and authorized creation of the six-member authority, which had its first meeting Monday. Under the legislation about $400 million of the bond proceeds will go to repay money the state loaned itself from reserve funds in prior years to balance budgets, with the rest going to fund Medicaid expenses and road work in the southern part of the state. The amount issued will depend on interest rates when the debt is sold. “We started the process to issue the bonds within the next two months,” said Newton. “We’ll see what the market brings.”

Wise words: “They can organize ten-acre farms instead of cell phone game app companies. They can do physical labor instead of watching television. They can build compact walkable towns instead of suburban wastelands….”

• Slowly, Then All at Once (Jim Kunstler)

As is usually the case with troubled, over-ripe societies, these elites have begun to resort to magic to prop up failing living arrangements. This is why the Federal Reserve, once an obscure institution deep in the background of normal life, has come downstage front and center, holding the rest of us literally spellbound with its incantations against the intractable ravages of debt deflation. One way out of this quandary would be to substitute the word “activity” for “growth.” A society of human beings can choose different activities that would produce different effects than the techno-industrial model of behavior.

They can organize ten-acre farms instead of cell phone game app companies. They can do physical labor instead of watching television. They can build compact walkable towns instead of suburban wastelands (probably even out of the salvaged detritus of those wastelands). They can put on plays, concerts, sing-alongs, and puppet shows instead of Super Bowl halftime shows and Internet porn videos. They can make things of quality by hand instead of stamping out a million things guaranteed to fall apart next week. None of these alt-activities would be classifiable as “growth” in the current mode. In fact, they are consistent with the reality of contraction. And they could produce a workable and satisfying living arrangement.

The rackets and swindles unleashed in our futile quest to keep up appearances have disabled the financial operating system that the regime depends on. It’s all an illusion sustained by accounting fraud to conceal promises that won’t be kept. All the mighty efforts of central bank authorities to borrow “wealth” from the future in the form of “money” – to “paper over” the absence of growth – will not conceal the impossibility of paying that borrowed money back. The future’s revenge for these empty promises will be the disclosure that the supposed wealth is not really there – especially as represented in currencies, stock shares, bonds, and other ephemeral “instruments” designed to be storage vehicles for wealth. The stocks are not worth what they pretend. The bonds will never be paid off. The currencies will not store value. How did this happen? Slowly, then all at once.

Renzi has everyhting to lose with his referendum coming before the new year.

• Italy ‘Ready To Go It Alone On Migrants’ (ANSA)

Italian Premier Matteo Renzi on Monday reiterated his disappointment at Friday’s EU summit in Bratislava, which concluded with him openly coming out against Germany’s and France’s stance on migrants and economic growth for the bloc’s post-Brexit future. “If Europe continues like this, we’ll have to get organised and act autonomously on immigration,” Renzi said. “This is the only new development to come from Bratislava, where there were so many words, but we weren’t capable to saying anything clear about the issue of Africa. “That’s why, to use a euphemism, we didn’t take it well. ” Juncker says lots of wonderful things, but we don’t see actions. “This is one of Europe’s problems. Italy will go it alone. “It is capable of doing it, but this is a problem for the EU”

The camp is basically gone. The poor just got a whole lot more desperate. Why the EU should no longer exist.

• Thousands Flee As Blaze Sweeps Through Moria Refugee Camp In Lesbos (G.)

Thousands of refugees detained at one of Greece’s biggest camps, on the island of Lesbos, have fled the facility amid scenes of mayhem after some reportedly set fire to it, local police have said. Up to 4,000 panic-stricken men, women and children rushed out of the barbed-wire-fenced installation following rumours of mass deportations to Turkey. “Between 3,000 and 4000 migrants have fled the camp of Moria,” a police source said, attributing the exodus to fires that rapidly swept through the facility because of high winds. Approximately 150 unaccompanied children, controversially housed at the camp, had been evacuated to a childrens’ village, the police source added. No one was reported to have been injured in the blaze.

But damage was widespread and with tents and prefabricated housing units going up in flames, the Greek channel Skai TV, described the site as “a war zone”. The disturbances, it reported, had been fuelled by frustration over the notoriously slow pace with which asylum requests were being processed. A rumour, earlier in the day, that Greek authorities were preparing to send possibly hundreds back to Turkey – in a bid to placate mounting frustration in Germany over the long delays – was enough to spark the protests. [..] The increase in arrivals in recent months from Turkey – the launching pad for more than a million Europe-bound refugees last year – has added to the pressure on Greek authorities.

On Monday, the government announced that 60,352 refugees and migrants were registered in the country, essentially ensnared by the closure of borders along the Balkan corridor into Europe. Some 13,536 were detained on Aegean islands, including Lesbos which has borne the brunt of the influx. The detention centre at Moria has a capacity to house no more than 3,000 but is now said to be holding almost twice that number ..

Home › Forums › Debt Rattle September 20 2016