Lewis Wickes Hine Newsies in St. Louis 1910

“.. if they follow the current trends they’re on, we’re going to hit a recession sometime in the second half of next year.”

• Bank of America Has A Recession Warning That’s Downright ‘Scary’ (CNBC)

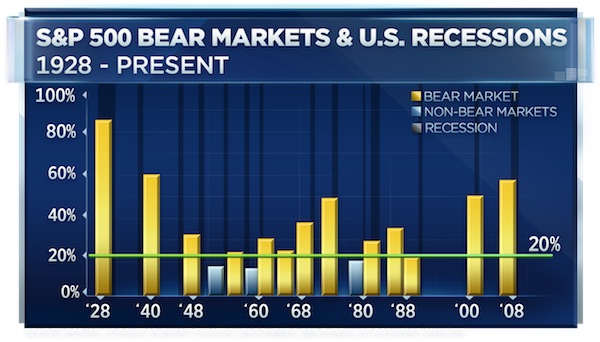

There’s a chilling trend in the market, and it could wreak havoc on your portfolio, a top market watcher said. “We are seven years into a full-fledged, all out, central bankers doing everything they can to stimulate demand,” Bank of America-Merrill Lynch’s head of U.S. equity and quantitative strategy Savita Subramanian recently warned on CNBC’s “Fast Money.” “We looked at all of these indicators that have been pretty good at forecasting recessions and we extrapolated that if they follow the current trends they’re on, we’re going to hit a recession sometime in the second half of next year.” The most unsettling thing is that this recession risk isn’t discounted into the market at these levels, according to Subramanian.

The S&P is 1.8% away from its intraday all-time high of 2,193.81, hit on August 15. Subramanian’s year-end 2016 S&P 500 price target is 2000, about seven% lower than where it’s trading today. And, if she’s right, it’s about to get a lot worse next year. “What scares me is the market been so fragile. So, remember what happened in January? We got a whiff of bad news and all of the sudden the market is at 1800,” she said—a move that augured poorly for the near-term. “I think that speaks to the reaction function of the market. There are a lot of itchy trigger fingers. There’s lot of violent trades that can really roil a fairly complacent environment.”

Nice metaphor. Could be used for Trump and Hillary too.

• The Truly Scary Clowns: Central Bankers (Forsyth)

At a Grant’s Interest Rate Observer conference last week, Jeffrey Gundlach, DoubleLine’s CEO, commented on the growing belief that interest rates will “never” rise. When it’s said that something can “never” happen, it’s about to happen, he argued. Zero or negative interest rates are doing more harm than good, he continued, with the long decline in the stock of Deutsche Bank being an example. You can’t help the economy by bankrupting the banks, he contended, which is the effect of shrinking their net interest earnings. For these and other reasons, Gundlach suggested, the lows in bond yields were seen in the post-Brexit plunge in the 10-year Treasury to 1.36%, a hair under the nadir of 1.38% touched in 2012. (Some data providers have slightly different numbers, but they’re as close as “damn it” is to swearing.)

The more important inference is that major trend changes are at hand. As described by Bank of America Merrill Lynch global investment strategists led by Michael Hartnett, we may be witnessing “peak liquidity.” That is, the era of excess liquidity from central banks is ending, which is consistent with shifts in ECB and BOJ policies, the U.K. Prime Minister May’s criticism of QE, and the likelihood of a Fed interest-rate hike in December. In addition, the BofA ML strategists also point to “peak inequality,” which would spur fiscal actions, such as greater spending and income redistribution. Finally, they see “peak globalization,” as populism counters the “disinflationary free movement of capital, trade and labor.”

The sum is “peak returns” from financial assets, the BofA ML team concludes. In that scenario, they recommend “Main Street over Wall Street” for 2017, including small-capitalization stocks and commodities, real assets (including collectibles and real estate) over financial ones, and banks over capital markets. In particular, they suggest a shift from bond proxies, including utilities, telecoms, real estate investment trusts, and low-volatility stocks. These sectors, it should be noted, had tough times last week. Investors who have tilted strongly toward these investments, which have benefited from historically low interest rates, have been laughing all the way to the bank. In the future, they may be spooked by those creepy clowns, otherwise known as less-friendly central bankers.

What happens in one way streets and dead alleys.

• Far From Stepping Back, Top Central Banks Are Set To Double Down (R.)

Central banks’ repeated warnings that there are limits to what they can do to bolster the sputtering world economy could suggest they are about to pull back and pass the baton to governments. But a steady flow of research and a new tone in the debate among policymakers and advisers points in a different direction: rather than retreat, central banks are preparing for the day they may need to do more, even at the risk of antagonizing politicians who argue they already have too much power. The shift can be seen in the acknowledgment by Federal Reserve policymakers that their massive $4 trillion balance sheet will not shrink anytime soon, or that asset buying may become a “recurrent” tool of future monetary policy.

It can be seen in the comments of Bank of England officials who talk of crisis-fighting tools as now semi-permanent fixtures, or in the Bank of Japan developing a new monetary policy framework, in this case targeting long-term market interest rates. Driving those developments is an emerging consensus among policymakers who now acknowledge that the global financial crisis has led to a fundamental shift toward low inflation, tepid growth, lagging productivity and interest rates stuck near zero. “We could be stuck in a new longer-run equilibrium characterized by sluggish growth and recurrent reliance on unconventional monetary policy,” Fed Vice Chair Stanley Fischer said last week.

For years, Federal reserve and other policymakers have discounted such a scenario, arguing that temporary factors were slowing the recovery and plotting a return to conventional pre-crisis policies. Over the past months, though, that optimism has given way to an admission that such a return is increasingly elusive. Interest rates are set to stay low far longer than thought only a year ago and jumbo balance sheets accumulated through crisis-era asset purchases are now cast as a possibly permanent tool. At the annual Jackson Hole Fed conference in August the discussion had shifted from the mechanics and timing of “normalization,” to how and whether to expand the central bank footprint yet again.

They don’t talk to people telling them that.

• The World Bank and the IMF Won’t Admit Their Policies Are The Problem (G.)

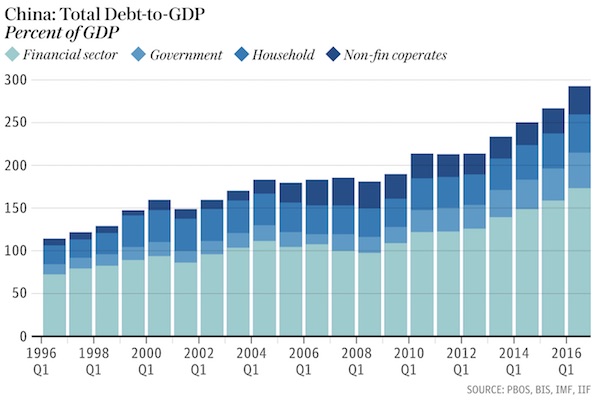

The World Bank, IMF and WTO can sense that they are sitting on the edge of a volcano that could blow at any time. They fear, rightly, that a second big crash within a decade would create a backlash leading to protectionism and the rise of dark political forces that would be difficult, if not impossible, to control. That there are ingredients for a fresh crisis became apparent at various stages last week. According to the IMF, global debt has risen to a record level of $152tn – more than double global GDP – at a time when activity is sluggish. Collapsing commodity prices and weak demand from the west has meant that growth in sub-Saharan Africa is running at half the level of population increases. Companies in the emerging world loaded up on debt during the commodity boom and are vulnerable to rising US interest rates and any softening of the world economy. China is the most egregious example of debt being used to boost activity artificially.

The argument that rising debt is fine, because on the other side of ledger is an asset increasing in value, is specious. The only reason the assets are rising in price is because investors are taking on more debt to buy them. At some point, the asset bubble bursts, leaving borrowers with a major problem. This was the lesson of the sub-prime crisis and it is remarkable that memories are so short. The next big one could come from anywhere and it is good that the World Bank and IMF are aware of the risks. Even so, there was an air of unreality about the discussions in Washington last week. The reason was simple: there was not the slightest hint from the IMF or World Bank that the policies they advocated during the heyday of the so-called Washington consensus – austerity, privatisation and financial liberalisation – have contributed to weak and unequal growth, with all the political discontent that this has caused.

Even worse, Lagarde and Kim seemed oblivious to the fact that the Washington consensus approach is alive and well within their organisations. The IMF’s remedy for Greece and Portugal during the eurozone crisis has been straight out of the structural adjustment playbook: reduce public spending, cut salaries and benefits, insist that state-owned enterprises return to the private sector, reduce minimum wages and restrict collective bargaining. Between them, the IMF and the European authorities are turning Greece into a developing country. It would be fascinating to see what sort of response Lagarde would get if she tried talking about inclusive growth to homeless people huddled on the streets of Athens.

The IMF will pressure China now it’s in the basket. New meaning to ‘basket case’.

• China Must Wean Itself Off Debt Addiction To Avoid Financial Calamity-IMF (Tel.)

China is edging towards “financial calamity” and must wean itself off its debt addiction and reform if it is to avoid a crisis, the IMF has warned. Markus Rodlauer, deputy director of the IMF’s Asia-Pacific department, said the world’s second largest economy was approaching a tipping point where its rapidly growing financial sector and surge in shadow credit could undermine the state’s ability to contain the fallout from a crash. “The level of financial and corporate debt and the complexity of the financial system and rapid growth in shadow banking is on an unsustainable path,” he said. “While still manageable in its size given the size of the public assets under public control, the trend is dangerous and if it’s not corrected it will lead to a correction.

“The longer it lasts … the more serious the disturbance and the disruption might be. [The reaction could range] from a mild growth slowdown, to a sharp slowdown in growth to potentially a financial crisis.” Data show credit and financial sector leverage in China has continued to rise much faster than economic growth. The IMF’s latest World Economic Outlook said debt in China was rising at a “dangerous pace”, while its Financial Stability Report showed small Chinese banks were heavily exposed to shadow credit as a share of capital buffers, with exposure reaching nearly 600pc at some banks. Mr Rodlauer, who served as the IMF’s China’s mission chief for five years, said stronger trade ties and financial linkages between China and other countries meant the impact of a hard landing on the global economy could also be huge.

Been in the SDR basket for 10 days, and already there’s this.

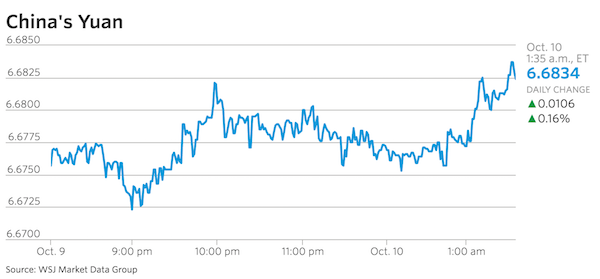

• China Fixes Yuan at Six-Year Low Against the US Dollar (WSJ)

The Chinese yuan was guided toward a six-year low against the U.S. dollar on Monday, as the country’s markets returned after a weeklong holiday. In onshore trading, the currency was on track for its biggest one-day loss against the U.S. dollar since the Brexit in June. The yuan entered the basket of currencies backing the IMF’s special drawing rights, an international reserve currency, on Oct. 1. The PBOC set its daily reference rate for the yuan at 6.7008 against the U.S. dollar, a depreciation of 0.3% from its last fixing of 6.6778 on Sept. 30, before the National Day holiday. Monday’s fixing was the weakest level for the currency since September 2010.

Onshore, where the yuan is allowed to trade within 2% of the PBOC’s central reference point, the currency traded 0.5% weaker at 6.7032 in early trade. Offshore, the yuan traded 0.1% weaker at 6.7106. Many markets in Asia, including the largest offshore-yuan trading center in Hong Kong, are closed for a holiday Monday. The past week was characterized by volatility in foreign-exchange markets, including a flash crash in the British pound that saw it lose more than 6% shortly after 7 a.m. Hong Kong time Friday before recovering later in the trading day. The U.S. dollar, which accounts for about a quarter of the value of the basket of currencies the yuan tracks, has strengthened during the period.

The U.S. dollar index, which tracks its strength against a basket of six currencies, is up 1.1% so far this month. The weakness in the yuan fix reflects data released during the past week, including a faster-than-expected drawdown of $18.79 billion in China’s foreign-currency reserves during September, said Alex Wijaya, senior sales trader at CMC Markets. “For the past year, the Chinese government has been intervening in the currency and this has depleted some of its foreign-exchange reserves, and this could be one of the main contributions to the weakness in the yuan,” he said. “The U.S. dollar has been strengthening as well.”

Unlike the rest of the western world, Iceland had no austerity, but it did introduce capital controls and it did go after bankers.

• Iceland, Where Bad Bankers Go to Jail, Finds Nine Guilty in Historic Case (CD)

Iceland, which became a gold standard for corporate accountability in the wake of its 2008-2011 financial crisis, has found nine bankers guilty for market manipulation in one of the biggest cases of its kind in the country’s history. The verdict from Iceland’s Supreme Court, issued Thursday, overturns a June 2015 decision by the Reykjavik District Court, which found seven of the nine defendants guilty and acquitted two. No punishment has been handed down yet, although sentencing is set to come. The defendants worked at the major international firm Kaupthing Bank until it was taken over by the Icelandic government during the crash.

The bank’s former director Hreidar Mar Sigurdsson, who had been sentenced to five and a half years in 2013 in a separate Kaupthing case, had his punishment extended by six months in response to the verdict. The acquittals were overturned for former Kaupthing credit representative Björk Poraninsdottir and former Kaupthing Luxembourg CEO Magnuse Gudmondson, although no penalties have been meted out for them. According to the Iceland Monitor, the decision found that “[b]y fully financing share purchases with no other surety than the shares themselves, the bankers were accused of giving a false and misleading impression of demand for Kaupthing shares by means of deception and pretense.”

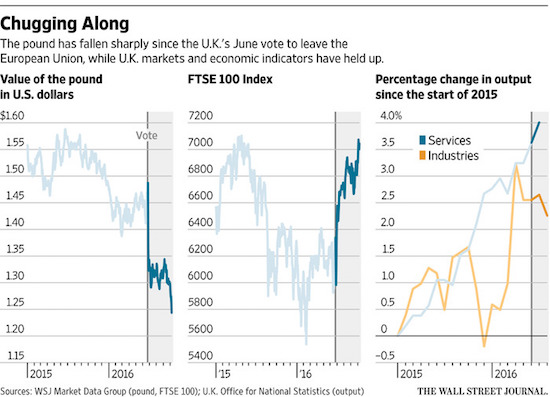

“..suffering Brexit’s pain through the currency may be more comfortable than through higher unemployment or other ills..”

• Pound’s Pounding Helped UK Absorb Brexit Shock (WSJ)

When the U.K. voted to leave the European Union in June, the pound took its worst beating in half a century. Many economists saw that as a good thing. Despite the shock of Brexit, more than three months later there are few tangible signs of economic distress in Britain: Employment is steady. The stock market has held up. Government bonds are strong. Houses are still being bought and sold. Consumers are still consuming. Credit, say economists, goes in large part to the decline of the British pound, which has acted as a giant shock absorber against Brexit. It fell 11% against the dollar in two trading days after the vote, and after another sudden slump last week is now down 16%. Seen from abroad, British people are one-sixth poorer and their economy is one-sixth smaller.

In the past week, figures from the IMF suggest, Britain has slid from the world’s fifth-largest economy to sixth, behind its millennium-old rival France. But suffering Brexit’s pain through the currency may be more comfortable than through higher unemployment or other ills—a luxury that wasn’t available to eurozone countries during the currency bloc’s debt crisis. Over the longer term, economic wisdom holds that a weaker currency will boost a nation’s sales abroad, so what the economy loses in the form of lower consumption—because consumers are poorer—will be recovered through higher exports. “It is important that you have a live release valve like this,” said Tim Haywood, an investment director at GAM Holding.

Italy pre-referendum.

• A Mile-High House Of Cards (IM)

According to Webster’s Dictionary, an economic depression is “a period of time in which there is little economic activity and many people do not have jobs.” Italy has had virtually no productive growth since it joined the euro in 1999. Today, the Italian economy (real GDP per person) is smaller than it was at the turn of the century. That’s almost two decades of economic stagnation. The economy today is 10% smaller than it was before its peak prior to the 2008 financial crisis. More than 25% of Italy’s industry has been lost since then. Unemployment is around 12%. Youth unemployment is around 36%. And these are only the official government statistics, which almost certainly understate the true numbers.

The IMF predicts it will take at least until 2025 for the Italian economy to return to its 2008 peak. Since nobody can accurately predict what’s going to happen next year, let alone nine years from now, the IMF is basically saying it has no idea how or when the Italian economy could ever recover. The mass media and establishment economists don’t dare call it a depression. But a depression it is. Italy’s populist Five Star Movement—or M5S, as it’s known by its Italian acronym—is now the country’s most popular political party. M5S blames Italy’s economic malaise squarely on the euro. I’d say a large plurality of Italians agree, and they have a point. They claim that, under the euro, Italian industry and exports have become uncompetitive. M5S believes a return to the lira could be the remedy.

Prior to joining the euro, Italy would regularly post large trade surpluses with Germany. Since joining, it has posted large trade deficits. Because of Italy’s structural economic problems, it should have a significantly weaker currency. But since Italy is wrapped in the euro straightjacket, it gets monetary conditions that are far too tight than appropriate for the country. [..] The Italian economy is made up of many small and medium-sized businesses. Those businesses have taken out loans from Italian banks. But as the economy is in a depression, many of those loans have gone bad or will go bad. This has created a crisis in the Italian banking system. It took years to build up, but now the situation is coming to a head. The Italian banking system is insolvent, and now everyone knows it. Shares of Italian banks have plummeted more than 50% so far this year.

No need to doubt: rest assured it’s not going to happen.

• Oil Prices Fall Over Doubts That Non-OPEC Producers Will Cut Output (R.)

Oil prices fell on Monday over doubts that an OPEC-led plan to cut output would rein in a global oversupply that has dogged markets for over two years. Brent crude futures were trading at $51.53 per barrel at 0511 GMT, down 40 cents or 0.77%, from their last settlement. WTI futures were down 44 cents or 0.88%, at $49.37 a barrel. OPEC plans to agree on an output cut by the time it meets in late November. The targeted range is to cut production to a range of 32.50 million barrels per day (bpd) to 33.0 million bpd. OPEC’s current output stands at a record 33.6 million bpd. To achieve such an agreement among its members, some of which like Saudi Arabia and Iran are political rivals, OPEC officials are embarking on a flurry of meetings in the next six weeks, starting in Istanbul this week.

However, analysts cautioned about too high expectations about the Istanbul talks this week. “A meeting between OPEC and non-OPEC producers (namely Russia) will add to oil headlines this week. Don’t expect a firm agreement from Russia, but headlines about cooperation are likely,” Morgan Stanley said on Monday. “It’s also worth noting that Iraq and Iran oil ministers will not be in attendance,” the U.S. bank added. Even if a deal is reached, analysts are unconvinced it would result in much higher prices, as doubts run high over the feasibility of a cut among rivaling members, a Reuters poll showed on Friday. Pouring cold water on expectations, OPEC’s second biggest producer Iraq said over the weekend that it wants to raise output further in 2017.

“The CDs were encoded to open the videos on RealPlayer software that connects to the Internet when it runs. It would issue an IP address that could then be tracked by US intelligence. ”

• Pentagon Spent Half a Billion On Fake Al-Qaeda Propaganda Videos (Ind.)

A former contractor for a UK-based public relations firm says that the Pentagon paid more than half a billion dollars for the production and dissemination of fake Al-Qaeda videos that portrayed the insurgent group in a negative light. The Bureau of Investigative Journalism reported that the PR firm, Bell Pottinger, worked alongside top US military officials at Camp Victory in Baghdad at the height of the Iraq War. The agency was tasked with crafting TV segments in the style of unbiased Arabic news reports, videos of Al-Qaeda bombings that appeared to be filmed by insurgents, and anti-insurgent commercials – and those who watched the videos could be tracked by US forces.

The report of Bell Pottinger’s involvement in the video hearkens back to more than 10 years ago, when the Washington-based PR firm Lincoln Group was revealed to have produced print news stories and placed them in Iraqi newspapers. According to the Los Angeles Times, who obtained the 2005 documents, the stories were intended to tout the US-led efforts in Iraq and denounce insurgent groups. Bell Pottinger was first tasked by the interim Iraqi government in 2004 to promote democratic elections. They received $540m between May 2007 and December 2011, but could have earned as much as $120m from the US in 2006. Lord Tim Bell, a former Bell Pottinger chairman, confirmed the existence of the contract with the Sunday Times.

The Pentagon also confirmed that the agency was contracted under the Information Operations Task Force, but insisted that all material distributed was “truthful”. However, former video editor Martin Wells, who worked on the IOTF contract with Bell Pottinger, said they were given very specific instructions on how to produce the fake Al-Qaeda propaganda films. “We need to make this style of video and we’ve got to use Al-Qaeda’s footage,” Mr Wells told the Bureau, recalling the instructions he received. “We need it to be 10 minutes long, and it needs to be in this file format, and we need to encode it in this manner.” According to Mr Wells’ account, US Marines would then take CDs containing the videos while on patrol, then plant them at sites during raids. “If they’re raiding a house and they’re going to make a mess of it looking for stuff anyway, they’d just drop an odd CD there,” he said.

Russis will not back down.

• Russia Says US Actions Threaten Its National Security (R.)

Russian Foreign Minister Sergei Lavrov said on Sunday he had detected increasing U.S. hostility towards Moscow and complained about what he said was a series of aggressive U.S. steps that threatened Russia’s national security. In an interview with Russian state TV likely to worsen already poor relations with Washington, Lavrov made it clear he blamed the Obama administration for what he described as a sharp deterioration in U.S.-Russia ties. “We have witnessed a fundamental change of circumstances when it comes to the aggressive Russophobia that now lies at the heart of U.S. policy towards Russia,” Lavrov told Russian state TV’s First Channel. “It’s not just a rhetorical Russophobia, but aggressive steps that really hurt our national interests and pose a threat to our security.”

With relations between Moscow and Washington strained over issues from Syria to Ukraine, Lavrov reeled off a long list of Russian grievances against the United States which he said helped contribute to an atmosphere of mistrust that was in some ways more dangerous and unpredictable than the Cold War. He complained that NATO had been steadily moving military infrastructure closer to Russia’s borders and lashed out at Western sanctions imposed over Moscow’s role in the Ukraine crisis. He also said he had heard that some policy makers in Washington were suggesting that President Barack Obama sanction the carpet bombing of the Syrian government’s military air fields to ground its air force. “This is a very dangerous game given that Russia, being in Syria at the invitation of the legitimate government of this country and having two bases there, has got air defense systems there to protect its assets,” said Lavrov.

Home › Forums › Debt Rattle October 10 2016