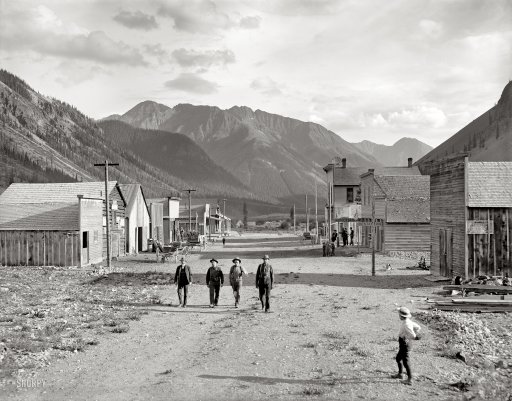

William Henry Jackson Eureka, Colorado 1900

I was going to start out saying yesterday was the saddest day in Europe in 50 years, or something like that, because of the insane and completely nonsensical largesse the ECB permits itself to launch, aimed at once again saving a banking system, but which will not only not help the European people, it will make things even much worse than they already are. Which is also, lest we overlook that ‘detail’, entirely thanks to the ECB/EU/IMF Troika,

I’ve said many times that the EU in its present form should be dismantled tomorrow morning (even though it’s not the same tomorrow morning anymore), and if Draghi’s $1.1 million x million ‘stimulus’ should make anything clear, it’s that the dismantling gets more urgent by the day.

But calling it the saddest day in Europe in 50 years would show far too little respect for the people who died in former Yugoslavia, and in eastern Ukraine. It’s still a very sad day, though. And I was already thinking about that even before I read Theopi Skarlatos’ article for the BBC; that really made me want to cry.

When you read about female doctors(!) feeling forced to prostitute themselves to feed their children, about the number of miscarriages doubling, and about the overall sense of helplessness and destitution among the Greek population, especially the young, who see no way of even starting to build a family, then I can only say: Brussels is a bunch of criminals. And Draghi’s QE announcement is a criminal act. It’s a good thing the bond-buying doesn’t start until March, and that it’s on a monthly base: that means it can still be stopped.

I’ll get back to Skarlatos’ story in a minute. First the insanity of the ECB QE itself. The problem with Europe’s economy, what drives it into high unemployment and deflation, is that people are not spending. If QE would really be aimed at reviving the economy, or at battling deflation, it would need to assume that people will start borrowing on a massive scale just because Draghi buys bonds – and soon perhaps even stocks – from bankers. There simply is no logic in that. The stated goals, pro-growth and anti-deflation, are not true. It’s a sleight of hand.

In order to achieve the stated goals, money would have to reach the real economy. As it stands, the best Draghi can do is to ‘hope’ it will. That’s not enough by a mile. This is not about doubts over its effectiveness, that’s baloney, we know it’s not effective when it comes to the stated goals. It will still leave Europe with no growth, and deeper deflation, and now €1.1 trillion deeper in debt. While banks can grow their reserves.

And it’s not as if Draghi doesn’t understand. Draghi is Goldman. And neither is it as if this is the only option. Steve Keen’s modern version of a debt jubilee, in which money is given directly to the people, under the condition that they first use it to pay off debt if they have any, would be much more effective. But it would be far less profitable for the banks, and that’s why it’s not considered. China yesterday announced a third option: they will effectively raise salaries of government workers by 60%.

Not that I’m terrible in favor of that kind of plan; I think any stimulus plan in our time should focus on reorganizing economies in such a way that jobs are created. That must mean moving away from centralization, and the return of production of essentials to communities and societies themselves, instead of emphasizing the ‘benefit’ of hauling goods halfway across the world, or an entire continent. It’s incredibly stupid that for instance most of our furniture and clothing is made in China.

We can produce those things at home, and give people jobs doing it. And China can focus on its domestic market too. And we can swap gadgets and other sheer luxuries, but not food or tables or shirts. Because we need to make those ourselves to keep our people employed.

Back to QE, or Draghi’s big swindle. I think Simon Jenkins at the Guardian had as good a go at it this morning as anyone:

QE For The Eurozone Is A Gigantic Confidence Trick. It Should Fool No One

The former BBC economic pundit Stephanie Flanders told the world it was “Santa Claus time”; the ECB has ridden to the rescue. No it has not.

Europe’s great and good, partying on the slopes of Davos, are blinded by snow and celebrities. Santa Claus gives presents to people; the ECB gives presents to its banks. It is merely tipping large sums of money into the vaults of precisely the institutions whose crazy lending caused the crash of 2008, and which have been failing Europe’s economy ever since. There is absolutely no requirement on these banks to release this money into private or commercial bank accounts.

Given the fear of over-lending that regulators have struck into bank bosses since the collapse of Lehman Brothers, the money will simply build up reserves. That is exactly what has happened to quantitative easing in Britain since 2010: there has been no surge in bank lending, except into property investment. Quantitative easing is a gigantic confidence trick.

It was promised that it would yield new investment. It has not. It was promised that it would “pump money into the economy”. It has not. It was also feared that printing money would lead to hyper-inflation. It has not, for the simple reason that no one gets to spend the money. It is a bookkeeping transaction between a central bank and a commercial bank. It means nothing as long as banks are told to build up their reserves. Money in circulation matters. The whole of Europe, including Britain, is chronically short of demand, which is why deflation is such a menace.

If no one can afford to buy anything, no one will sell anything or invest money in making anything. The chronic imbalance between northern and southern states of the eurozone, previously ameliorated by selective devaluation, has bound poor and rich countries alike in a rictus of cash starvation. Collapsing demand drives down prices and profits; there is nothing for banks to invest in. The Chinese are laughing. Greece and some other Mediterranean economies are facing poverty not seen in half a century.

A return to normal growth means they must declare themselves bankrupt, restructure past debts, leave the eurozone and devalue. Don’t bury money in their banks. Bury it in their wallet. The eurozone may still look great from the top of a Swiss mountain; it looks terrible from the foot of the Acropolis.

I also liked ADMISI’s Marc Ostwald’s take right after Draghi did the announcement, courtesy of Tyler Durden:

Risk sharing is very limited, with national central banks taking 80% of the risk on sovereign bond purchases, and rather un-reassuring was Draghi’s comment that “most national central banks have adequate buffers to absorb a negative event” – most being how many.

Not good news for Greece, while it and Cyprus will be eligible for purchases of govt under a ‘waiver’ for (bail-out) ‘programme countries’, the ECB already has a very high volume of Greek bonds on it balance sheet from the SMP programme, and given a limit on total holdings for each sovereign issuer, it will not be eligible for purchases until it redeems debt in July and August.

It should be added that Italy and Spain and other bail-out countries will implicitly also have a lower available volume of total purchases, until SMP holdings are redeemed.

Draghi is going the save German banks, not weaker eurozone nations. Their banks maybe.

BUT perhaps the key aspect relates to the limits on the 25% limit on purchases of a single issue, which ensures that the ECB adheres to the ECJ’s ruling about the ECB ensuring that is does not interfere with “price formation”. So here’s the key aspect, there are some $12.0 trillion of FX reserves in the world, of which roughly a quarter are held in Euros.

Operating on the traditional metric that roughly half of those will be invested in Govt Bills and Bonds, this means that FX reserve managers will have to be involved in the process of establishing prices for whatever is purchased under the Govt bond QE programme. Eminently anything that is sold by central banks will not find its way into the private financial sector, therefore that €60 billion figure may often overstate what is being injected into the market.

Last but not least, the expanded programme does not start until March 15, so “Mr Market” now has a very long waiting period to sit on holdings of EUR debt before selling to the ECB, and with plenty of event risk in the world, starting with the Greek election, and an imminent Ukrainian default. Sort this under an uncomfortably long period before the QE ‘party’ gets started.

And in case you’re still wondering whether QE works and/or how effective it is, this graph also comes from Durden:

And that doesn’t even yet include stock markets and bank reserves at the Fed. What is obvious is that the Fed’s QE3 has been a mind-boggling failure for the American people, and a smashing success for the Davos crowd.

What’s wrong in Europe is not just Draghi, it’s the entire EU. If you join into a union with other nations, you can’t let some of them sink into despair, and worse, while others sit pretty. And I know the answer from Brussels will be that what is needed is a stronger and closer union, fiscal, political, but I think that if you already let your fellow union members plunge this deep into misery in the early stages of a union, a country like Greece would be out of its mind if not outright suicidal to sign on to a closer union. Northern Europe survives by sucking the lifeblood out of the South. It’s a really simple story that nobody will tell you.

Let’s return to Theopi Skarlatos for the BBC. This is heart rendering. How can the people of Germany, Holland, France, ever have let it get this far? What could possibly be their excuse? That their media never informed them? You have the most pervasive media in history, and you didn’t know? What are you going to do? Blame the lazy Greeks? Who need to ‘reform’ their societies?

Greece was not nearly this poor before it joined the EU. And we’ve seen above that Draghi’s QE won’t do anything to relieve their misery, nothing at all. If you’re going to spend 1.1 million times a million euros, shouldn’t that go towards doing something for Greece, instead of a group of banks and their shareholders?

Love In A Time Of Crisis In Greece

As Greeks prepare to vote in Sunday’s general election, anti-austerity party Syriza is ahead in the polls and campaigning under the slogan, “Hope is on its way”. The average wage has fallen to €600 (£450: $690) a month; half of all young people are unemployed and the economy is barely emerging from six years of recession. But Greeks remain determined to maintain their hold on normality. “We don’t have much else,” they say, “we may as well enjoy our freddo cappuccinos.”

But despite the drinking, flirting and dating, since the onset of financial disaster, a fundamental change has taken place in Greek society. Deejay Tommy paints a sad picture of young Greeks waking up every day without a job. “Things have lost a little bit of their romanticism,” he says. “The crisis has forced love to become a secondary priority. There are other things to worry about. I see many women looking for someone who will have money to take them out, who’ll take them on holidays. I see this quite a lot and it saddens me.”

Down the road along the shoreline, the Bouzoukia clubs ring with live renditions of popular Greek love songs. Crowds sipping on vodka throw the singers red carnations and sing along to lyrics of heartbreak and pain. “We save up to come once every few months and we look forward to it,” says Katerina Fotopoulou, 30, at a table with her friends. “We don’t have the money to do much any more. We’re always talking about future plans, going on holiday, but no-one ever does anything.” Living at home, Katerina describes herself as an adult forced to live as a teenager, her life put on hold.

Compared with other Europeans, Greeks are still fairly traditional. For many young women, it is awkward bringing a boyfriend through the front door to meet the parents. And that poses a problem, considering the high numbers unable to afford a place of their own. “Relationships are complicated these days,” says Katerina. “No-one is even thinking about getting married or having children.”

Indeed, Greece’s population is shrinking at an increasing pace according to data released by the Hellenic Statistical Authority (Elstat). Since Greece first signed its EU-IMF bailout agreement the number of births has declined rapidly. In 2010 there were 114,766 live births, and by 2013 that number had declined by almost 20,000 (94,134). Obstetrician Leonidas Papadopoulos says miscarriages at the Leto maternity hospital have doubled over the past year. “Maybe it’s down to stress,” he says. “There is no proof, but you can see it in the eyes of the people, there is stress and fear for the future.”

He describes how a woman he had been treating with IVF came to him one day crying because she was pregnant. She had lost her job and demanded an abortion. But he felt he could not perform the procedure. “Soon,” says Dr Papadopoulos, “the population will be halved and there won’t be any young people to work and pay for the pensions of the elderly. All the social problems will rise up in front of us.”

Some who have children and are struggling to support them have turned to sex work, to put food on the table. Further north, in Larissa, Soula Alevridou, who owns a legal brothel, says the number of married women coming to her looking for work has doubled in the last five years. “They plead and plead but as a legal brothel we cannot employ married women,” she says. “It’s illegal. So eventually they end up as prostitutes on the streets.”

A doctor, Georgia, explains how she also works as an escort in the sex industry to support her family. Her private clinic currently treats three patients a week, but the peak summer season in the sex industry enables her to keep up with the rental payments on her family’s home and the healthcare bills for her elderly parents. “I live a double life and only I can know about it,” she says. “I have applied for jobs in medicine abroad and wait every day in hope of a reply.”

For journalist Elini Lazarou, having a baby was not something she was prepared to put on hold while waiting for a change in the political or economic climate. “Love in the time of crisis can function as a painkiller, with which someone can forget the problems they’re facing, or as a source from which someone can draw strength, energy and optimism,” she says.

On a wall in downtown Athens, a simple message is daubed that reads “Love or nothing”. It strikes a defiant tone amid the blighted lives hidden behind pure economics.

And against that backdrop Brussels and Frankfurt ‘heroically’ decide to prop up the banks with another €1.1 trillion. They should be dragged before judges, but what they do is presently legal (guess who makes the laws). So it’s up to the people of not just Greece in this weekend’s election, but to everyone who lives in the European Union. It’s up to the Dutch and the Germans and the Finns to end this monstrosity.

The troika is creating third world nations within the EU, and you guys are just sitting there watching them do it, and hoping that more money for your banks will mean your own petty little lives will be secure and safe, while Greek doctors are forced to prostitute themselves.

Please Syriza, please Tsipras, win the elections and fight this bunch of criminals. And please all of Europe, get up from your couches and refuse for this to be committed in your name. If not, you’re accomplices, whether anyone calls you on it or not. Shame on you, you’re a disgrace to mankind.

Home › Forums › Bunch of Criminals!