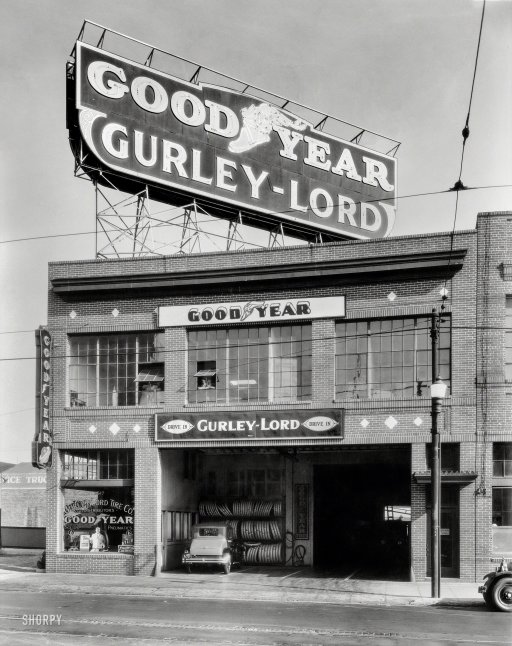

Unknown Gurley-Lord service station, San Francisco 1929

The Swiss have unleashed a pretty wild storm in financial markets. All sorts of companies and people today are licking their wounds, and quite a few will simply have to fold. It’s no exception to be so leveraged in foreign exchange wagers that a move of a few percent can wipe you out, let alone one of 30%. Leverage makes sure that right off the bat a whole bunch of foreign exchange brokers, including FXCM, the biggest, are literally dead in the water – FXCM stock fell 90% -.

We’ll hear about the real losses in the days and weeks to come, but rest assured they’ll be very substantial. Banks like Goldman, Deutsche and Barclays were heavily short the franc, and therefor of course, so were their clients. Many private investors have lost everything and then some. As if the losses from oil’s jump off the cliff weren’t damaging enough yet to the realm of finance. But, you know, the CHF franc was pegged to the slumping euro, so what did everybody really expect? The timing may have been a surprise, but come on ..

There’s number of lessons in this, but I don’t feel confident that they will be learned. If only because we’ve gotten so used to living in an upside down world that it has become a solid new normal, especially for those who’ve made a killing off of it. But everything, says physics, tends back to equilibrium. And we were many miles removed from that.

The world of finance decries the fact that the Swiss central bank didn’t ‘telegraph’ beforehand that they were going to get rid of the euro peg. And that’s completely upside down, right there. Even apart from the fact that the SNB move wouldn’t have worked if it had indicated it beforehand, what’s the idea behind central banks having to tell you anything at all? Just look at this from Bloomberg:

SNB Officials Eating Words Risk Lasting Investor Aches

Switzerland’s central bank officials have just eaten their words, risking lingering indigestion in financial markets. Just three days after Swiss National Bank (SNBN) Vice President Jean-Pierre Danthine called the franc cap a “pillar” of monetary policy, the SNB yesterday dropped the minimum exchange rate of 1.20 per euro. The shock abandonment of the SNB’s primary policy of the past three years may now leave investors warier of taking officials’ words at face value, according to economists including Karsten Junius, chief economist at Bank J. Safra Sarasin. By scrapping one tool, the franc cap, SNB President Thomas Jordan risks blunting the effects of another. “The SNB’s credibility has suffered a bit,” said Junius, a former economist at the International Monetary Fund.

“Statements will get read in the future with a bit more caution. Verbal interventions will hardly work any more.” The central bank’s regular pledge to defend the franc cap with “utmost determination” had become part of the institution’s brand, not least because of the success of that policy in protecting the country’s domestic economy. “They’ve lost part of their credibility, I think, ”Han De Jong, chief economist at ABN Amro told Angie Lau on Bloomberg TV. “Whatever they will say, markets will not trust them very much.” George Buckley at Deutsche also argues the SNB’s words are hard to reconcile with the SNB’s new policy stance. “Their commentary now means nothing,” he said. “This is not utmost determination, is it?”

Bank of England Governor Mark Carney has suffered similar criticism. He was labeled an “unreliable boyfriend” by one U.K. lawmaker last year for giving conflicting messages on the possible timing of interest-rate increases in the U.K. SNB President Jordan yesterday defended his surprise move, saying that a tool like the cap would always need to be abandoned unexpectedly. Anatoli Annenkov at SocGen agrees. “It’s something we aren’t used to anymore because most central banks are talking about warning markets, improving communication, not surprising anymore,” Annenkov said by phone from London. “But in such circumstances, there’s basically no other way to do this. Markets would have speculated, positioned themselves beforehand.”

There’s this sense of entitlement seeping through from this that makes you want to, I don’t know, shout, puke? Traders and journalists that chide a central bank for not giving them what they want, when they want it? On what logical basis? That Greenspan and Bernanke did it for years, and so screwed up the entire US financial system? That information from central banks is now some god-given right for traders and bankers? Are you nuts? Are we all? We now know the Swiss are not, or let’s say that for whatever reason they did what they did, they’re not completely off their rockers.

So how about other central bankers? Everyone seems to be sure now that Draghi at the ECB has more reason than ever, after the SNB move, to launch full tilt QE. And I’m thinking, I don’t know kiddos, perhaps he has less reason now, because the markets’ faith in central banks has taken a jolt, because the effectiveness of that QE, which has been in the works forever, has already been priced in by those markets, and because the Germans are sure to contest it all throughout their court system(s). What use would a Draghi QE be at this point? Close to zero. He might still do it, but that would just expose him as a tool. And he can resign and become Italy’s new president right after. And it’s not just Draghi:

The Swiss Just Made Japan’s Job Harder

Haruhiko Kuroda’s monetary “bazooka” just got outgunned by the Swiss. Since April 2013, Japan’s central banker has been pumping trillions of dollars into the economy in an attempt to generate 2% inflation. But in a mature, aging economy like Japan’s, the effort is 95% about confidence. In order to “drastically convert the deflationary mindset,” as Kuroda puts it, the Bank of Japan must transform sentiment among households and businesses. Kuroda’s massive bond purchases mean little if the Japanese don’t trust that better days lay ahead. The Swiss National Bank’s move to abandon the franc’s cap against the euro may have blown a hole in Kuroda’s strategy.

By reneging on a promise made time and time again that he wouldn’t ditch the policy, SNB President Thomas Jordan “has undermined the credibility of central banks,” says Simon Grose-Hodge of LGT. Now, at central banks around the globe, he adds, “the unthinkable is entirely possible. You can’t rule anything out.” Even if the BOJ issues another blast of quantitative-easing after its two-day policy meeting next week, the question is how effective the move would be. Kuroda’s Oct. 31 shock-and-awe stimulus announcement worked for a time by bolstering perceptions that steady inflation was within reach. But this time, with even Economy Minister Akira Amari admitting “it will probably be difficult” for the BOJ to succeed, markets are likely to be more skeptical of the bank’s staying power.

It’s not really the Swiss, central bank credibility was already shot through the past decade, if not more. You have no credibility as a central banker if you serve the interests of one particular niche. Like traders. You need to serve the interests of the entire nation you ‘serve’, or your time will come. No matter how much Draghi, Kuroda or Bernanke were tempted by the omnipotence narrative, deep down they must have known it wouldn’t last.

And now they have to face a new world, one they’re not used to at all. One in which their credibility is shot. I’m guessing that means they understand their ‘normal’ course of action, QE up the wazoo, no longer works. So what then?

Look, Draghi may well come up with that QE of his, but it’ll be stillborn. It’ll only be yet another transfer of money from the public to the private sector. Let’s buy a trillion worth of bonds! Yeah, that worked great for everyone else… But can Draghi still do that? Yes, it’ll bring down the euro for a bit, but the euro is going down no matter what he does. This is turning into a game of whodunnit. And then, of course, there’s the Fed:

Yellen Signals She Won’t Babysit Markets in Turmoil

Janet Yellen is leaving the Greenspan “put” behind as she charts the first interest-rate increase since 2006 amid growing financial-market volatility. The Federal Reserve chair has signaled she wants to place the economic outlook at the center of policy making, while looking past short-term market fluctuations.

To succeed, she must wean investors from the notion, which gained currency under predecessor Alan Greenspan, that the Fed will bail them out if their bets go bad – just as a put option protects against a drop in stock prices. “The succession of Fed puts over the years has led to a wide range of distortions in financial markets,” said Lawrence Goodman at the Center for Financial Stability. “There have been swollen asset values followed by sharp declines. This is a very good time for the Fed to move away.”

We’re getting back to normal, and though normal’s going to hurt – and far more than you realize yet-, it’s hugely preferable to upside down; you hang uprise down long enough, it makes your brain explode. The price of oil was the first thing to go, central banks are the next. And then the whole edifice follows suit. The Fed has been setting up its yes-no narrative for months now, and that’s not without a reason.

But everyone’s still convinced there won’t be a rate hike until well into this new year. And the Swiss central bank said, a few days before it did, that it wouldn’t. And then it did anyway. The financial sectors’ trust in central banks is gone forever. And none too soon. Now they’ll have to cover their own bets. If anything spells deflation, it’s got to be that. But not even one man in a thousand understands what deflation is.

We have a ways to go before we solve this puzzle. But we are, at least and at last, on our way.

Home › Forums › Central Banks Upside Down