Alfred Palmer Nose section of B-17F “Flying Fortress”, Douglas Aircraft, Long Beach, CA. October 1942

That’s how I feel these days, or I should say these years. Since the name of this site comes from Paul Simon’s song by that title, it comes easily. Funny enough, I watched one of the Making of Graceland docs on Sunday night, and then on Monday morning read that the grand small 70-year old songwriter has been arrested because his wife’s mother had called 911 for a domestic disturbance situation. Given that Edie Brickell is about a foot taller than Simon, that made me smile. All the more so because in the documentary he’s talking about how he’s not good at writing angry songs, and that’s why Graceland came out the way it did, instead of being filled with loud protests against the injustices of South Africa. But, he said, outside of my songs, I’m very capable of expressing my anger, and I do get angry. Got ya, Paul.

Personally, I perhaps find it harder to not get angry all the time, and try to channel it into expressing amazement at what I see around me in this bubble I find myself in. For instance, I’ve seen more than one person claim this week alone that London real estate is not in a bubble – because there’s just so much demand -. And then I read that the average price of a 3-bedroom house in London’s plushest neighborhoods has gone up in “value” by $8000 per week, $1150 per day, over the past year, which represents a 20% rise overall. But I’m supposed to believe that that’s not a bubble. That all those buyers who owe their fortunes to Russia’s energy bubble and China’s $14 trillion stimulus bubble somehow represent the new normal. Let’s see what lifelong Londoners have to say about that who are getting pushed out ever further from the city center.

And in the US, to my utter bewilderment, there’s a second Enron, 12 years after the demise of the first one. the ghost of Kenny-Boy haunts the hallways of Wall Street. I’d say there were quite a few faces outside of Kenny Lay and Jeffrey Skilling, like amongst regulators, who should have been looked at at the end of 2001. But to let it happen again?! TXU slash Energy Future Holdings goes broke with a $40 billion debt. And Bernie Madoff is still in jail?! It’s not always easy to define what exactly is wrong with America, but whatever it is, it’s huge. The largest leveraged buy-out in history gambled on gas prices, and they lost. Investors thought they’d make a killing and got killed. Check your pension fund, I’d say. If only because Energy Future CEO John Young had this comment: “We are pleased to have the support of our key financial stakeholders for a consensual restructuring .. [..] We fully expect to continue normal business operations during the reorganization.” These guys lost $40 billion at the crap table, and they’re allowed to restructure, stiff junior investors, and get more loans? Where’s this going?

In the energy corner, there’s shale. Automatic Earth readers have known for a long time what shale is really about: land speculation. But how many other people realize that? The entire industry runs on junk debt, and you know what the collateral is? Land. Which is supposed to deliver enormous profits through the resources underneath it. But never quite does. I’ve asked it before: why do you think Shell and Exxon quit shale to the extent that they did, two companies who would kill their CEO’s grandma’s for some proven reserves? Bloomberg spells it out neatly:

Shale Drillers Feast on Junk Debt to Stay on Treadmill (Bloomberg)

The U.S. drive for energy independence is backed by a surge in junk-rated borrowing that’s been as vital as the technological breakthroughs that enabled the drilling spree. While the high-yield debt market has doubled in size since the end of 2004, the amount issued by exploration and production companies has grown nine-fold, according to Barclays.

That’s what keeps the shale revolution going even as companies spend money faster than they make it. “There’s a lot of Kool-Aid that’s being drunk now by investors,” said Tim Gramatovich, who helps manage more than $800 million as chief investment officer of Peritus Asset Management.

“People lose their discipline. They stop doing the math. They stop doing the accounting. They’re just dreaming the dream, and that’s what’s happening with the shale boom.” Rice Energy was able to borrow so easily because of the quality of its assets, which are in some of the best areas of the Marcellus, a shale formation beneath western Pennsylvania and West Virginia, and the company’s drilling success there, said Gray Lisenby, Rice’s chief financial officer. [..]

“Who can, or will want to, fund the drilling of millions of acres and hundreds of thousands of wells at an ongoing loss?” Ivan Sandrea, a research associate at the Oxford Institute for Energy Studies in England, wrote in a report last month. “The benevolence of the U.S. capital markets cannot last forever.” The spending never stops, said Virendra Chauhan, an oil analyst with Energy Aspects in London. Since output from shale wells drops sharply in the first year, producers have to keep drilling more and more wells to maintain production. That means selling off assets and borrowing more money. “The whole boom in shale is really a treadmill of capital spending and debt,” Chauhan said.

“It’s a perfect set-up for investors to lose a lot of money,” Gramatovich said. “The model is unsustainable.”

Not a bubble? I’m not a vindictive person, but sometimes I think people deserve what they get. Serves them right for not reading The Automatic Earth. Shell has written off billions in its investments in shale, this morning it announced a drop in net profit of -45%, and you still think Shell wouldn’t be all over this if it could find a way to make a buck? At least you must admit this article makes the claims of exporting US oil and gas look even funnier than they already did. And like with Enron and TXU, you should wonder who the people in government are that allow for this kind of trickery to happen.

And then, timely ahead of Fed announcements later today, David Stockman tells it like it is:

The Fed Is Fueling The Century’s ‘Greatest Bubble’

The Fed is “a posse of academic zealots and unreconstructed Keynesians who think debt is the magic elixir, and they won’t stop printing money and putting their foot on the floorboard until they really blow something up …” At this point, his biggest concern is the impact that the Fed’s stimulative policies have had on equities. “I think the Fed is now inflating the greatest and third bubble yet of this century [..] The Russell 2000, even though it’s come off a little bit, is still trading at 80 time trailing earnings. That’s crazy, and you can say that about many other sectors of the market.” “What we need to do is get the Fed out of there, free interest rates, let the money market find the natural balance and purge some of this enormous speculation …”

There are people who know a bubble when they see one. But not everyone does, and it’s not in everyone’s interest either. Politicians can be made to look good inside a bubble, and businessmen can make a lot of money off the public purse. And you yourself get to feel for a fleeting moment in time as if you’re richer than you actually are. Because make no mistake about it, when this bubble bursts, it’s going to hurt. A lot worse than the last one. A comment in the Guardian on the “benefits” of austerity said: “… how does the logic of austerity sound in Britain? The country is richer, but its people are poorer. This now counts as a recovery.” That is a nice way to put it. Except that the country, too, will be poorer after the bubble pops, and a lot. And that will, of course, make the people poorer too. A lot.

There are lots of you, probably most, who like to live in a bubble. As long as you don’t feel forced to see it for what it is. It’s like the Truman Show. Exactly like that. But I know full well I live in a bubble. And I want to get out. It’s suffocating. Because I know what’s going to happen once it bursts, and it will, and the longer that takes, the worse the outcome will be. For the man in the street. Who I care more for than for those who seek only money or power. That, after all, is why there’s an Automatic Earth. Unlike the original boy in the bubble, you and I are not going to drop dead as soon as the bubble bursts. But just like him, the bubble keeps us from experiencing real human contact. That’s a huge price to pay. It’s not all that great to be a boy in a bubble. I should know.

• Biggest LBO Ends in Bankruptcy That Ranks With Enron’s Collapse (Bloomberg)

Energy Future Holdings, the Texas power company Henry Kravis and David Bonderman took private in 2007 with Goldman Sachs in the biggest-ever leveraged buyout, filed for bankruptcy after reaching a deal to cut billions in debt. Today’s filing in Delaware is the result of months of wrangling among creditors, owners and management, and represents the failure of a bet that natural-gas prices would rise enough to justify the company’s $48 billion price. Instead, the financial crisis, coupled with booming shale production, sent gas prices down starting in 2008. “We are pleased to have the support of our key financial stakeholders for a consensual restructuring,” Chief Executive Officer John Young said in a statement. “We fully expect to continue normal business operations during the reorganization.”

Energy Future said it seeks to exit bankruptcy in 11 months. The Dallas-based company, formerly known as TXU Corp., also said it has commitments for financing totaling more than $11 billion, including $7.3 billion for Energy Future Intermediate Holding. The bankruptcy ranks with Enron’s $48.9 billion collapse in 2001. Billionaire Warren Buffett called his $2 billion investment in Energy Future bonds “a big mistake.” Today’s petition listed assets of $36.4 billion and debt of of $49.7 billion. Texas’s largest electricity provider traces its roots to a business that first powered electric lights in Dallas in 1882. The 2007 going-private deal, coming at the peak of a three-year boom in leveraged buyouts, turned into a big loss for Kravis’s KKR, as well as Bonderman’s TPG Capital and Lloyd Blankfein’s Goldman Sachs, which loaded the company with debt.

• Energy Future Junior Creditors Test Bid for Fast Bankruptcy Deal (Bloomberg)

Energy Future Holdings Corp., the Texas power company that plans to leave bankruptcy in less than a year, can’t reduce its $50 billion in debt without fighting junior creditors who face losing their investment. The Dallas-based electricity provider, taken private seven years ago by Henry Kravis and David Bonderman in a record leveraged buyout, filed for bankruptcy yesterday in Wilmington, Delaware, after months of wrangling among creditors, owners and management yielded a restructuring proposal. Second-lien noteholders owed about $1.6 billion say they were shut out of those talks and want court permission to probe what they call management’s “disabling conflicts of interest.” They also want the case moved to Texas.

Managers artificially drove down the true value of Energy Future “to allow the senior lenders and management to print cheap reorganized equity and wipe out billions in legitimate creditor claims,” the trustee representing the junior creditors said in court papers filed minutes after the Chapter 11 petition. Under the proposal announced yesterday, the company’s deregulated Texas Competitive Electric Holdings unit would separate from Energy Future. The plan would hand ownership of Texas Competitive to creditors in exchange for eliminating $23 billion in debt. That deal could give senior lenders “recoveries in excess of their claim,” the trustee for the junior creditors said in its filing.

Bubble? What bubble? Why work, right?

• Price Of 3-Bedroom House In Prime London Areas ‘Rises $1100 A Day’ (Guardian)

The average price of a three-bedroom home in London’s most expensive neighbourhoods has increased by £729 ($1150) a day over the past year, according to estate agent Marsh & Parsons. The firm said the price rise of 19% since April 2013, to an average of £1.6m was equivalent to £5,120 a week – or eight times the £658-a-week median salary for Londoners. Overall, the agent said the cost of homes in upmarket London areas including Chelsea, Kensington, Notting Hill, Clapham and Fulham was up by 12.9% in the last year and by 4.3% in the last quarter, to £1.5m, and if growth continued at the current rate the average would reach £2m by 2016.

Marsh & Parsons said it had seen “a huge surge” in the number of UK buyers purchasing prime London property in the last three months, with this group making up 78% of the market. In areas including Kensington & Chelsea, typically a stronghold for overseas buyers, the proportion of purchases by overseas and foreign nationality buyers had fallen to a two-year low of 21%. During 2012 and 2013, overseas and foreign nationality buyers accounted for around 40% of all purchases.

Peter Rollings, chief executive of Marsh & Parsons, said these were “extraordinary times” for the prime London property market. “It’s always difficult to call the ‘top’ of the market. But while comparisons are being drawn with 2007, the current conditions are actually remarkably different,” he said. “It’s difficult to see how prices can fall while demand for property remains so high. Compared to the same point last year, we have seen a 20% increase in demand and a 25% fall in the supply of property. Prime London is still a strong sellers’ market and jackpot prices are fast becoming the norm.”

Short and to the point.

• Fed Fueling Century’s ‘Greatest Bubble’: David Stockman (CNBC)

The Federal Reserve will release its next policy statement on Wednesday, and it is broadly expected to announce an addition $10 billion reduction in quantitative easing. But for David Stockman, who memorably served as director of the Office of Management and Budget under President Ronald Reagan, the Fed’s reduction in accommodative policies is coming far too late. “I don’t have any expectations at all” for what the Fed is set to announce “because I think the Fed is hopelessly lost and completely incompetent, if you want to put it starkly,” as Stockman certainly did on Tuesday’s episode of “Futures Now.”

The Fed is “a posse of academic zealots and unreconstructed Keynesians who think debt is the magic elixir, and they won’t stop printing money and putting their foot on the floorboard until they really blow something up,” Stockman said. At this point, his biggest concern is the impact that the Fed’s stimulative policies have had on equities. “I think the Fed is now inflating the greatest and third bubble yet of this century,” Stockman said. “The Russell 2000, even though it’s come off a little bit, is still trading at 80 time trailing earnings. That’s crazy, and you can say that about many other sectors of the market.” So what’s his preferred course of action now? “What we need to do is get the Fed out of there, free interest rates, let the money market find the natural balance and purge some of this enormous speculation,” he said.

• Royal Dutch Shell Net Profit Falls 45% (WSJ)

Royal Dutch Shell on Wednesday reported a fall in first-quarter profit after taking a $2.86 billion impairment charge largely on its refineries in Asia and Europe. The oil major also raised its dividend and said it is considering the sale of certain marketing assets in Norway. The results were the first for the oil giant under the leadership of Ben van Beurden, who took over as chief executive in January. “The impairments we have announced today in downstream reflect Shell’s updated views on the outlook for refining margins,” Mr. van Beurden said. Shell first-quarter profit on a current cost of supplies basis—a figure that factors out the impact of inventories, making it equivalent to the net profit reported by U.S. oil companies—fell 44% to $4.47 billion.

First-quarter revenue fell to $109.66 billion in the quarter, from $112.81 billion a year earlier, while net profit fell to $4.51 billion, compared with $8.18 billion. Oil and gas production during the quarter was 3.25 billion barrels of oil equivalent a day, 4% below the first quarter of 2013. Shell has declared a dividend of $0.47 per ordinary share, in line with its previous guidance of $0.47 a share and 4% above last year’s $0.45. Shell, like other big, integrated oil companies, has seen costs jump over the past few years as the refining business has grown more difficult, dragging down profits. Shell’s cash flow last year was less than its spending on capital projects, acquisitions and dividends, and the company in January issued its first profit warning in a decade.

• Shale Drillers Feast on Junk Debt to Stay on Treadmill (Bloomberg)

Rice Energy Inc., a natural gas producer with risky credit, raised $900 million in three days this month, $150 million more than it originally sought. Not bad for the Canonsburg, Pennsylvania company’s first bond issue after going public in January. Especially since it has lost money three years in a row, has drilled fewer than 50 wells and said it will spend $4.09 for every $1 it earns in 2014. The U.S. drive for energy independence is backed by a surge in junk-rated borrowing that’s been as vital as the technological breakthroughs that enabled the drilling spree. While the high-yield debt market has doubled in size since the end of 2004, the amount issued by exploration and production companies has grown nine-fold, according to Barclays.

That’s what keeps the shale revolution going even as companies spend money faster than they make it. “There’s a lot of Kool-Aid that’s being drunk now by investors,” Tim Gramatovich, who helps manage more than $800 million as chief investment officer of Peritus Asset Management. “People lose their discipline. They stop doing the math. They stop doing the accounting. They’re just dreaming the dream, and that’s what’s happening with the shale boom.” Rice Energy was able to borrow so easily because of the quality of its assets, which are in some of the best areas of the Marcellus, a shale formation beneath western Pennsylvania and West Virginia, and the company’s drilling success there, said Gray Lisenby, Rice’s chief financial officer.

“Who can, or will want to, fund the drilling of millions of acres and hundreds of thousands of wells at an ongoing loss?” Ivan Sandrea, a research associate at the Oxford Institute for Energy Studies in England, wrote in a report last month. “The benevolence of the U.S. capital markets cannot last forever.” The spending never stops, said Virendra Chauhan, an oil analyst with Energy Aspects in London. Since output from shale wells drops sharply in the first year, producers have to keep drilling more and more wells to maintain production. That means selling off assets and borrowing more money. “The whole boom in shale is really a treadmill of capital spending and debt,” Chauhan said.

“… how does the logic of austerity sound in Britain? The country is richer, but its people are poorer. This now counts as a recovery.”

• Any Talk Of Economic Recovery Is Pure Fiction (Guardian)

Down is up. Sick is healthy. The RMS Titanic is seaworthy. Topsy-turvy logic is a speciality of the austerity brigade, and here they come dishing up a third helping. First, in 2010-11, they pledged that making historic cuts amid a global slump would definitely, absolutely secure a strong recovery. Then things went predictably belly-up, forcing Cameron and Osborne to dump their deficit-reduction plans and the eurocrats to make more bailouts. Yet these reversals were, naturally, “sticking to the course”. Now things don’t look quite as awful as they did a couple of years ago – and this somehow gets chalked up as a miraculous rebound. Only a prude would expect their politicians not to exaggerate. But getting to such upside-down conclusions requires more than that: it requires fictionalising and even lying.

Let’s have a look at two examples from the past few days, one in Britain the other in Greece. Athens was declared last week to have passed a big milestone. Officials in Brussels certified that Antonis Samaras and his government had racked up a primary budget surplus in 2013. Cue much celebration by Greek ministers: not only had they climbed a couple of rungs on the ladder of fiscal probity, they now also qualified for easier terms on their outstanding debt. The prime minister must have known well in advance that the European seal of approval was coming his way, because he was peacocking for days beforehand.

Take last week’s boast: “We don’t need more money. We have no fiscal gap.” Of course, saying this even while petitioning for easier repayment on Greece’s mountain of debt is just another example of austerity’s topsy-turvyism. In any case, it’s rubbish. For a country to have a primary surplus means that its income covers its spending – once you set aside previous borrowing. Imagine ignoring a person’s credit-card debt and just looking at whether his or her wages exceed their outgoings: if so, that’s a primary surplus. And that’s what Greece doesn’t have. The only way Athens gets to a primary surplus is by the European Commission ignoring all sorts of things the country does have to pay for, the biggest of all being the bailout of its banks.

Recovery can mean anything you want it to.

• Low Wage Jobs Dominate The US Economic Recovery (Yahoo!)

It’s no secret that the bulk of new jobs created since the Great Recession ended pay low wages, but the extent of the gap between low and high-paying jobs may surprise you. The National Employment Law Project reports that that low wage industries employ 1.85 million MORE workers now than at the start of the recession while mid-and higher-wage industries employ 1.83 million LESS. Low wage industries account for 44% of employment growth over the past four years but only 22% of job losses during the recession. As a result of this imbalance, the take home pay for households has fallen, averaging $51,000 in 2012, or 8% less than the average $55,000 in 2007, adjusted for inflation, according to the NELP.

“The average American continues to lose ground while the wealthiest … continue to do phenomenally well,” says The Daily Ticker’s Aaron Task. “People are saying there’s a problem not because that guy’s getting rich but because (they’re) falling behind.” [..] And in Washington this week, the Senate is expected to vote this week on raising the minimum wage to $10.10 by 2016, as President Obama has proposed. But whether or not the bill passes the Senate it’s not expected to pass the House–and may not even come to a vote there.

“I hate the idea that it has to be mandated,” Henry Blodget says about raising the minimum wage. “But until we can convince the owners of companies…to take some of that profit and share it with the folks who are creating that value … we need a higher minimum wage.” And companies can afford to pay it, says Blodget. Companies today now “are more profitable than they have ever been,” he says. “They should reward the workers who have created that increased value. Instead, he says “people working full time for McDonalds, Starbucks and Walmart are still poor.”

In the days when the biggest banks are too big to fail, every stress teast is a joke.

• Nul Points For EU Stress-Test Comedy (AEP)

Be careful if you are planning to buy a house in France. The EU stress test for banks released this morning expects French property to fall 1.6% this year and another 1% in 2015 even if things go well. The “adverse scenario” is a cumulative drop of 31% by the end of 2016. This reflects the worries of French regulators who fed the data to the European Banking Authority. Romania competes for horror. Italians deem their country less volatile. Property prices fall 3.4% this year and 0.7% next if all goes well, but only drop 16% in a rout by 2016.

Spain falls 4.3% this year, then starts to recover. The worst case is a 10.4% drop over the next two years with rebound by 2016 even in a crisis. The Spanish regulators are delightfully optimistic as usual, seemingly living in a parallel universe. So, if the EBA’s global shock were to occur – with a surge in 10-year US yields by 250 basis points this year, a further “tantrum” (the EBA’s word) in emerging markets that culminates in a “sudden stop”, and a fall in world trade – we are told that Spain could dodge the bullet deftly. This stretches credulity. Madrid consultants RR de Acuna say there is still an overhang of around 2m homes in Spain if you include the properties in foreclosure, on the books of banks, or yet to be finished.

What exactly is “extreme” about a 4% interest rate?

• Bank of England To Subject Biggest UK Banks To ‘Extreme’ Stress Test (Guardian)

The Bank of England is to subject the UK’s biggest banks and building societies to a series of stringent tests to see if they are strong enough to withstand the shock of a 35% crash in house prices, along with a jump in interest rates to 4% and soaring unemployment. Policymakers in Threadneedle Street will stress-test the UK’s eight largest financial firms with a set of hypothetical scenarios over a three-year period between 2014 and 2016. The exercise will assume that house prices fall back to levels last seen in 2002, unemployment would soar to 12% and interest rates increase eightfold from their record low of 0.5%. As a comparison, house prices fell by around 20% during the recent crisis and have never fallen by 35% in the past.

Under the scenario, which the Bank stresses is not a forecast, the economic downturn that occurred following the banking crisis would be followed by another severe downturn. “A cumulative contraction in activity to that implied by the stress scenario or larger has happened only in a single episode over the past 150 years – and that was in the immediate aftermath of the first world war,” the Bank said. An unemployment rate as high as 12% was last seen in the late 1980s and early 1990s while the subsequent marked downturn in economic activity would see GDP trough at about 3.5% below its 2013 fourth-quarter level.

• In 20% of American Families, No One Works (CNS)

In 20% of American families in 2013, according to new data released by the Bureau of Labor Statistics (BLS), not one member of the family worked. A family, as defined by the BLS, is a group of two or more people who live together and who are related by birth, adoption or marriage. In 2013, there were 80,445,000 families in the United States and in 16,127,000—or 20%–no one had a job. The BLS designates a person as “employed” if “during the survey reference week” they “(a) did any work at all as paid employees; (b) worked in their own business, profession, or on their own farm; (c) or worked 15 hours or more as unpaid workers in an enterprise operated by a member of the family.”

Members of the 16,127,000 families in which no one held jobs could have been either unemployed or not in the labor force. BLS designates a person as unemployed if they did not have a job but were actively seeking one. BLS designates someone as not in the labor force if they did not have a job and were not actively seeking one. (An elderly couple, in which both the husband and wife are retired, would count as a family in which no one held a job.)

Must read from investor Paul Singer on federal accountancy “standards” designed to hive reality.

• The Circularity Of Confidence In A Fragile System (Paul Singer)

The budget deficit for the latest fiscal year (which ended on September 30) was reported to be around $700 billion. However, this figure would be many times higher if the government’s unfunded entitlement programs were included. Even before taking into account liabilities stemming from the Affordable Care Act (ACA), which cannot even be calculated yet because so many of its assumptions are either erroneous or outright fabrications, and because many of its provisions keep getting delayed by the Administration for purposes of political advantage, the present value of the future obligations of the federal government is currently around $92 trillion. These obligations have been growing by over 10% per year since 2000, during which time nominal GDP has risen just 3.8% per year. At this rate, the federal government will owe an estimated $200 trillion on the entitlement programs by 2021 (again, excluding the effects of ACA) and $300 trillion by 2025.

These numbers are not fantasies. At present, there is no acknowledgement by a large portion of the American political establishment that this insolvency even exists. Nor have the leaders of this establishment made any concrete progress toward restoring solvency by taking up serious proposals to rein in unpayable promises. Quite the contrary: Politicians and policymakers continually tell people that such entitlement obligations will be met – a claim they must know cannot possibly be true.

Recently, we had a conversation with a mainstream economist who told us that the government is not actually insolvent because the long-term entitlements are not really liabilities that need to be counted, any more than the military budget for the year 2030 needs to be counted. This assertion is incorrect. Military spending, like any other form of discretionary spending, can be cut quickly and arbitrarily, as Washington recently made clear. And such spending is in exchange for goods and services delivered at the time the money is spent. In 2030, the government can buy many more tanks, or many fewer, than it is buying today. It has not promised to buy any amount.

In fact, aside from military entitlements such as veterans’ health care, there is no obligation to spend any money at all on the military in 2030. By contrast, entitlements represent concrete governmental promises that are being made today about future spending – promises on which people are being (falsely) told that they can rely. And at the time the money is scheduled to be delivered, the recipient is delivering no goods or services. Only someone who has never run a business could say with a straight face that such obligations are not really liabilities and need not be included in the accounting.

Tick tock, Drip, drop.

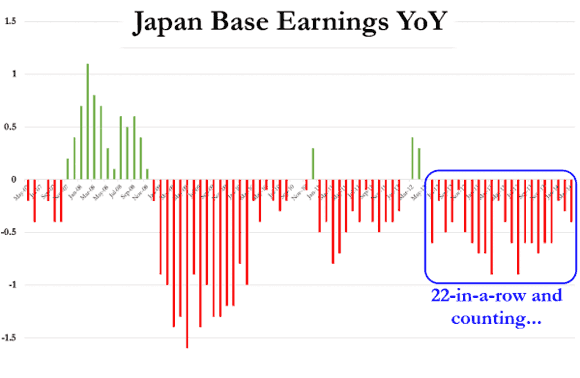

• Japan Base Wages Fall For 22nd Consecutive Month (Zero Hedge)

As we noted previously, for the past year Abenomics has had the “get out of a jail free” card because while the plunging yen was crushing Japanese purchasing power, and sending nominal regular wages ever lower, at least the stock market was higher – so (some of the) locals could delude themselves they are getting richer, if only on paper. However, following the most recent 15% correction in the Nikkei which may soon become an all out rout if the 102 level in the USDJPY is ever “allowed” to break, all Japan suddenly has left, is the shock of soaring food and energy prices, and the hangover of declining wages that refuse to stop dropping. Case in point, tonight the Japan labor ministry reported that monthly wages excluding overtime and bonus payments fell 0.4% in March from a year earlier (the biggest drop in 2014), a series of declines which has now stretched to 22 consecutive months.

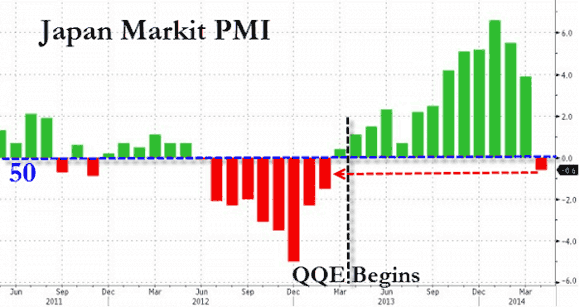

• Japan Manufacturing PMI Collapses At Fastest Pace On Record (Zero Hedge)

Not much to add to this total and utter disaster… Markit’s Japan Manufacturing PMI plunged from 53.9 to 49.4 – it’s first contractionary print since Feb 2013 and its biggest MoM drop on record. Under the surface the picture is just as bad with output falling at the fastest pace since December 2012 and New orders also down. The blame for all this – the tax hike… hhm (well, it’s better than the weather we guess). Both prices charged and input prices rose in April with some panellists attributing inflation to an increase in raw material prices (stunned?). And if you think this terrible news is great news (because more QQE), forget it – Kuroda already say no and inflation is near the BoJ’s target.

This is how many see the global environment: “ … not just the best opportunity of our generation, but of the last 12,000 years.”

• Diamonds to Oil Bring Gold Rush Dreams to Melting Arctic (Bloomberg)

Hugh Short wants you to invest in an emerging economy with few people, fewer buildings, and which is melting at the fastest pace in millennia. He’s talking about the Arctic, which Scott Minerd, the chief investment officer of Guggenheim Partners LLC, calls “not just the best opportunity of our generation, but of the last 12,000 years.” Short, a native of Alaska, said Pt Capital LLC, which he co-founded last year, is the first and only U.S. private-equity firm dedicated to investing in the Arctic. Short, 41, is attempting to raise $250 million for the firm’s first fund by year-end. The ex-mayor of the frontier town of Bethel and former head of Alaska’s state investment arm plans to leverage his local connections and financial experience to develop the Arctic’s resources for the people who live there.

Investors are wary while environmental groups warn of risks from oil spills and mining that would ravage the landscape. “Unlike most of the planet, the Arctic still contains uncharted mysteries,” Santa Monica, California-based Minerd, whose firm is considering investing with Pt Capital, said in an e-mailed response to questions on April 7. “With a great deal of the development still in the planning stages, few investors are fully aware of just how great the opportunities are.” Climate change is making the Arctic’s natural resources accessible for the first time, including about 22% of the world’s undiscovered oil and natural gas, the U.S. Geological Survey estimates. The region, about 5.5 million square miles (14.5 million square kilometers) comprising parts of the U.S., Canada, Greenland, Iceland, Norway, Finland, Sweden and Russia, is also home to deposits of gold, silver, copper, zinc and diamonds.

• Exxon’s $900 Billion Arctic Prize at Risk After Ukraine (Bloomberg)

Exxon Mobil’s dream of drilling in the Russian Arctic may risk running aground on the politics of Ukraine. The company plans to start drilling in August in the Arctic’s remote Kara Sea – the centerpiece of Exxon’s global alliance with Russian state-controlled OAO Rosneft. The partnership, which includes shale exploration in Siberia and joint venture fields in Texas, will come under greater scrutiny after the U.S. placed sanctions on Rosneft’s Chief Executive Officer Igor Sechin. “With Sechin being sanctioned it may complicate relations for Rosneft with Western companies,” said Mattias Westman, who oversees about $3.3 billion in Russia assets as CEO of Prosperity Capital.

“Maybe some transactions will be threatened as a result and perhaps Russia will counter and they will be less keen for American companies to work on Arctic projects.” Patrick McGinn, a spokesman for Exxon’s exploration arm, said on April 25 that the company’s Kara Sea project was on schedule. He declined to make any additional comment after the U.S. extended the reach of sanctions yesterday. Rosneft assures its “shareholders and partners, including those in America,” that cooperation won’t be hurt by sanctions, Sechin said in a statement yesterday. “Our cooperation won’t suffer.”

More stress tests.

• China Test Shows Bad Loan Surge Would Hurt Banks’ Capital (Bloomberg)

China’s systemically important banks may see their capital adequacy ratio fall to 10.5% in the event bad loans surge fivefold, according to a stress test by the nation’s central bank. The average capital adequacy ratio of the 17 banks, which account for 61% of China’s banking assets, may fall to 10.5% from the end-2013 level of 11.98% should nonperforming loans increase 400% in the worst-case scenario, the People’s Bank of China said in its annual financial stability report yesterday. China introduced stricter capital requirements for banks in January 2013, posing a challenge for an industry facing slower loan growth and rising bad debts amid more competition and interest-rate deregulation.

Industrial & Commercial Bank of China Ltd. and its three closest rivals will face a capital shortfall of $87 billion under the new rules by 2019, according to an estimate by Mizuho Securities Asia. The government is requiring the biggest Chinese banks to have a minimum common equity Tier-1 ratio of 8.5% and total buffer of 11.5% by the end of 2018. Banks’ bad loans increased for a ninth straight quarter as of December to the highest level since 2008, data from the China Banking Regulatory Commission show. The stress test also examined the effect of changes in economic growth, bond yields and foreign exchange rate. The results show that “Chinese banks’ asset quality and capital adequacy level are relatively high,” the central bank said in the report. “The banking system, as represented by the 17 banks, has relatively strong absorbent capacity.”

Yawn.

• China Set to Overtake U.S. as Biggest Economy Using PPP Measure (Bloomberg)

China is poised to overtake the U.S. as the world’s biggest economy, while India has vaulted into third place, ahead of Japan, using calculations that take exchange rates into account. China’s economy was 87% of the size of that of the U.S. in 2011, assessed according to so-called purchasing power parity, the International Comparison Program said in a statement in Washington yesterday. The program, which involves organizations including the World Bank and United Nations, had put the figure at 43% in 2005. Changes in methodology contributed to the speed of China’s rise and India jumping to third-biggest in 2011 from 10th in 2005. Purchasing power parity seeks to compare how far money goes in each country. Using market rates, U.S. gross domestic product was $16.2 trillion in 2012, compared with China’s $8.2 trillion.

China keeps deteriorating.

• China Developer Default Risk to Slow Sales: Moody’s (Bloomberg)

Moody’s Investors Service said the risk more Chinese property developers will default, after the collapse of Zhejiang Xingrun Real Estate Co., will make it harder for them to raise funds just as apartment sales cool. The builders have issued $500 million of offshore yuan or dollar bonds this month, compared with $1.6 billion in the same period last year and a record $9.2 billion in the first quarter, data compiled by Moody’s show. Notes in Bank of America Merrill Lynch’s emerging markets index of Chinese corporates including property companies returned 0.8% in the past year. That compares with a 1.5% total gain for bonds globally, according to Bank of America.

“Investors are concerned certain developers will go into more defaults,” Franco Leung, an analyst at Moody’s said in an interview on April 23, predicting a drop in developers’ offshore debt issuance in the coming six months. “While China’s economy is slowing, there will be stress on companies with weaker credit profiles.” The world’s second-largest economy expanded 7.4% in the first three months, the weakest pace in six quarters, spurring speculation that the government will be forced to ease curbs on real-estate investment. Property sales in the period fell 5.2% from a year earlier and the floor space of new property construction dropped 25.2%, statistics bureau data showed on April 16.

• “EU ‘should be ashamed’ after sanctions on Russia” (RT)

The Russian Foreign Ministry responded with a scathing statement to the EU’s new round of sanctions against Russia, saying Europe apparently has no insight into the political situation in Ukraine. “Instead of forcing the Kiev clique to sit down with south-eastern Ukraine to negotiate the country’s future political system, our partners are toeing Washington’s line to take more unfriendly gestures towards Russia,” the statement declared. “If somebody in Brussels hopes to stabilize the situation in Ukraine by this, it is evidence of a total lack of understanding of the internal political situation in that country and invites local neo-Nazis to continue their lawlessness and thuggery towards the peaceful civilians of the south-east,” the statement said. “Are you not ashamed?”

” … he is quite incorrect that the general conditions we enjoy at this moment in history will continue a whole lot longer – for instance the organization of giant nation-states and their ability to control populations.”

• Piketty Dikitty Rikitty (Jim Kunstler)

Piketty and his fans assume that the industrial orgy will continue one way or another, in other words that some mysterious “they” will “come up with innovative new technologies” to obviate the need for fossil fuels and that the volume of wealth generated will more or less continue to increase. This notion is childish, idiotic, and wrong. Energy and technology are not substitutable with each other. If you run out of the former, you can’t replace it with the latter (and by “run out” I mean get it at a return of energy investment that makes sense). The techno-narcissist Jeremy Rifkins and Ray Kurzweils among us propound magical something-for-nothing workarounds for our predicament, but they are just blowing smoke up the collective fundament of a credulous ruling plutocracy.

In fact, we’re faced with an unprecedented contraction of wealth, and a shocking loss of ability to produce new wealth. That‘s the real “game-changer,” not the delusions about shale oil and the robotic “industrial renaissance” and all the related fantasies circulating among a leadership that checked its brains at the Microsoft window. Of course, even in a general contraction wealth will still exist, and Piketty is certainly right that it will tend to remain concentrated (where it isn’t washed away in the deluge of broken promises to pay this and that obligation). But he is quite incorrect that the general conditions we enjoy at this moment in history will continue a whole lot longer – for instance the organization of giant nation-states and their ability to control populations.

• How The ECB Will Force The Euro Lower (MarketWatch)

There will be a three-part campaign to get the euro down, and it will play out like this. First, plenty of talk. Expect to hear a lot more from the likes of Noyer over the next few weeks about how the euro is too strong. Currency traders listen to this stuff, and if they think that a central bank is determined to push a currency lower they will get out before the carnage begins. You can’t usually talk a currency a lot lower, but you can often get it down a bit.

Second, direct intervention in the markets. It was a long time ago, but the ECB has been willing to intervene in the market when it needs to. It last moved back in November 2000 when the newly launched currency was plunging on the markets, and briefly managed to get it rising again, although over the month as a whole the operation was not a success. If it has done it once, it can do it again. There is nothing to stop the ECB selling euros for dollars or yen, and that would have a big and immediate impact.

Finally, start printing money. There is already a long list of reasons for starting up euro-zone quantitative easing. A flat lining economy and falling prices are two good ones. But it is also one of the best ways of getting a currency down. The dollar has remained weak despite the strengthening U.S. economy because the Federal Reserve is still printing money. The yen has been forced lower by massive QE. So was the British pound. A full-scale blitz of QE from the ECB — and its program is likely to out-gun even the Fed — will send the euro tumbling. European assets have been among the best performing in the world over the past twelve months, with stocks and bonds all sharply higher. But if the currency starts to fall, that will change — and it would be better to get out now while there is still time.

• BNP Warns US Fine May ‘Far Exceed’ $1.1 Billion Provision (Reuters)

French bank BNP Paribas has warned it might be hit with a U.S. fine far in excess of the $1.1 billion that it set aside last year to cover litigation costs linked to potential breaches of U.S. sanctions on countries including Iran. The warning from France’s biggest bank comes as the global banking industry faces mounting legal woes due to investigations into a string of alleged misdeeds, including fixing benchmark interest rates and manipulating foreign-exchange markets. A big U.S. fine could have ramifications for BNP beyond the immediate financial hit, as the bank is targeting expansion in North America as a key plank of a new strategy to grow revenue and profits outside traditional European markets.

“There is uncertainty with respect to the amount and the nature of penalties the U.S. will impose,” Chief Financial Officer Lars Machenil told Reuters Insider television. “It’s not impossible that the fine is far in excess of the ($1.1 billion) provision.” U.S. federal prosecutors are considering criminal charges against BNP for doing business with countries subject to U.S. sanctions, such as Iran, Sudan and Cuba, a person with knowledge of the matter has said. Regulators may consider suspending the bank’s ability to conduct dollar clearing in New York – the process by which transactions are quickly settled and cleared within the banking system – and are looking at possible penalties for individual employees, the person said.

Do we want it to be?

• Can Industry’s Wastelands Be Made Workable Again? (Guardian)

Thirty years after the year-long miners’ strike, councillors, MPs and trade unionists from former coalfields will today gather at Westminster to endorse a 10-point plan aimed at reviving Britain’s old industrial heartlands. Far from being a hand-wringing event, mired in nostalgia, this, hopefully, could prove a wake-up call to those who believe Britain has turned the corner from recession to expansion with an improving economy delivering new jobs, whether real or imagined. Away from a largely house-price fuelled upturn in London and the south-east, another nation lurks behind the veneer of prosperity portrayed by senior ministers talking up recovery. [..]

The scars of the ruthless pit closure programme, representing de-industrialisation on a scale never experienced in Britain, still remain. Fothergill says many areas have still not recovered from the “crucifying blow” of large-scale job losses, with hidden unemployment still dragging down many communities – and masking the real scale of social and economic disparities. Welfare reform has further widened the rich-poor gap; a report last year from Sheffield Hallam University showed that older industrial areas, seaside towns and some London boroughs had been hit the hardest – with Blackpool losing £900 for every working age adult, and other places not far behind.

The 10-point revival plan, Rebuilding the Economy of Britain’s Industrial Communities, launched today, calls for co-ordinated social, education, training and employment schemes – tied to a job creation programme – to turn round the fortunes of these seemingly forgotten former pit communities and older industrial towns. With the scrapping of eight English regional development agencies three years ago – effectively ending a regional policy which began earlier in the last century – England’s former industrial heartlands have been cast adrift. True, some remnants of a once-successful national coalfields programme, aimed at clearing derelict sites and creating jobs – often through the regional agencies – remain. But the impetus has gone.

Home › Forums › Debt Rattle Apr 30 2014: The Boy In The Bubble