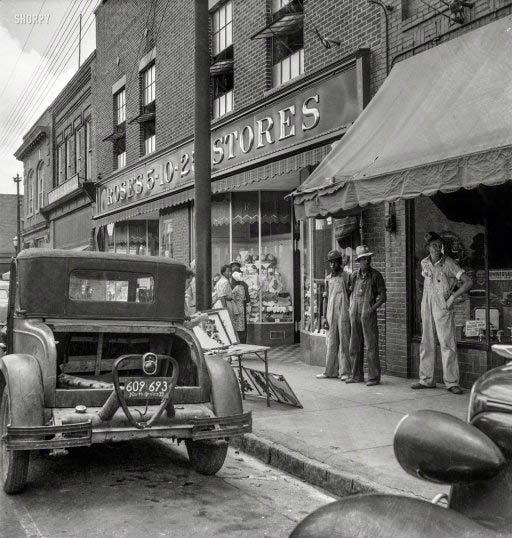

Dorothea Lange Saturday afternoon. 10 cent store, Siler City, North Carolina July 1939

Well, it’s not as if nothing ever happens. One government and one parliament down, all in one day. One planned, the other not so much.

Ukraine president Poroshenko dissolved parliament so he can have sole control for the next two months. And smile with a smirk at Putin when they meet tomorrow. Wonder what ‘progress’ they’ll make. Judging from all the accusations thrown around just today, and the plans announced, they’re not going to be short of material.

RT has the rebels claim they have thousands of Ukraine soldiers cornered, Kiev claims Russian tanks have entered the country on their way to Mariupol on the Azov Sea. A city where Ukraine did some unpalatable things earlier this year, by the way.

But the Ukraine battle is going to go on long enough to get back to on some other day, it’s not even close to being over. France is the potentially more interesting situation in today’s news.

French prime minister Manuel Valls has offered the resignation of his 4 month old (young?!) government. President François Hollande has accepted (after first insisting he’d do it) and ordered him to form a new one as soon as tomorrow. All this came after a hefty weekend in which Hollande and Valls’ policies were criticized by their own economy minister, Arnaud Montebourg.

The cabinet shuffle is aimed at getting rid of him, and of education minister Benoît Hamon and culture minister Aurélie Filippetti, who openly agreed with Montebourg’s criticisms.

Whether the shuffle would have taken place if Montebourg wouldn’t have included Germany in his tirade will probably remain an open question. What is sure is that Angela Merkel and the Bundesbank will, certainly in France, come under increasing fire for their insistence that all of Europe obey the harsh austerity measures Berlin has hammered into the EU and ECB.

And it’s not an easy position Hollande has maneuvered himself into. It may even be hopeless. It’s by no means sure that the new cabinet Valls is set to unveil tomorrow will be accepted by the French parliament. And that may be the end of that parliament too, and new elections. Which Marine Le Pen’s right wing Front National has already called for anyway.

And with Hollande’s approval rating at 17%, a more than 50-year low for a French president, that could mean big changes. Valls’ approval is at 36%, not sparkly either.

The critical voices are all part of Hollande’s own Socialist party, they’re just more left than he is. And that left is still a strong voice in France. Seeing it split into multiple factions cannot possibly be good for a president with that sort of ratings. He’ll soon be in single digits.

Then again, the right is growing stronger too. France is becoming a vastly more polarized nation, at a time when the truth about its economy is seeping through the cracks of the political system.

The options on the table are: Hollande and Valls stay in power, and continue to adhere to the Berlin/Brussels austerity model. If, and only if, they can guide a new cabinet through the National Assembly tomorrow. But they’ve now lost the far left wing of their own party, which is opposed to more austerity, though it does want the EU.

Option no. 2 is the far left gets the power, where it would have to either get Brussels to do a 180º on austerity or flip it the bird and start spending no matter what. Not an easy thing to when your central bank effectively resides in Frankfurt.

Option no. 3 is new elections, and the very real risk of Marine Le Pen and the Front National coming out on top. They want out of the euro and out of the EU.

Those new elections may well be written in stone already. The left has failed its constituents, because France is in the doldrums economically and there’s really no way out other than through means that will lead to mass protest. Which the French are very good at.

The left could try to save the very large entitlement programs, but that would mean ever more debt, and a potential rift with Germany and Brussels. The right would certainly tell everyone who’s not French to go stuff themselves, but it would still have to deal with millions upon millions of people who officially have jobs but in reality live off the state. Not to mention the workers, still organized in strong unions.

Does Le Pen want a civil war, or a revolution and counter revolution? She may think her party’s strong enough to do any of the above. Plenty of French will listen to a message that says Berlin should not dictate Paris, especially when it means poverty for the French people.

Can Brussels conjure up an autocrat, like they did in Italy, Greece, Portugal? That looks quite a bit harder to do in France. But we shouldn’t ignore the ruling classes under the surface, which have governed the country for a very long time, the landowners and industrialists who’ve all attended the same schools for generations. And who now, no doubt, start feeling the crisis too, even though its true numbers haven’t even been published yet.

France is a very proud nation. It’s also very large in the European context. Without it there is no EU, and no euro. We might just have seen the beginning of the end for both.

• French Government Dissolved Amid Row Over Economy (RTE)

France has been thrown into fresh crisis after President Francois Hollande told his prime minister to form a new government. This followed a much-criticised show of insubordination by the country’s firebrand economy minister. Mr Hollande ordered Prime Minister Manuel Valls to form a new cabinet “consistent with the direction he has set for the country”, the presidency said in a statement. It did not give any reasons, but the move came after Economy Minister Arnaud Montebourg bad-mouthed the country’s economic direction and ally Germany at the weekend in a move that angered Mr Valls. This morning, Mr Valls offered the resignation of his government. Mr Valls was asked by President Francois Hollande to form a new team only four months ago but has continually had to reconcile policy differences between leftists such as Mr Montebourg and more centrist members of his Socialist-led government.

President Hollande’s office said in a statement a new government would be formed on Tuesday in line with the “direction he (the president) has defined for our country.” Mr Montebourg at the weekend said deficit-reduction measures carried out since the 2008 financial crisis were crippling the eurozone’s economies and urged governments to change course or lose their voters to populist and extremist parties. Finance Minister Michel Sapin acknowledged this month that weak growth would mean France missing its deficit-reduction target for this year but stressed the government would continue cutting the deficit “at an appropriate pace”. The weakness of the economy was a major factor in Mr Valls seeing his approval rating drop to a new low of 36% this month, while Mr Hollande remained the most unpopular president in more than half a century, an Ifop poll showed on Sunday. Mr Valls was appointed to lead the government in a cabinet reshuffle in March, after the ruling Socialists suffered a bruising defeat in local elections.

• French Ministers Criticize Economic Austerity Policies (WSJ)

Senior French ministers called for changes to President François Hollande’s tax and spending cuts plan over the weekend, saying alternatives are possible and attacking austerity policies in France and the euro zone. In interviews with the French press and speeches at a Socialist gathering Sunday, Economy Minister Arnaud Montebourg and Education Minister Benoît Hamon said forcibly reducing budget deficits as the economy wilts is driving up unemployment, fueling political extremism and risks tipping the economy into recession. “The priority must be exiting crisis and the dogmatic reduction of deficits should come second,” Mr. Montebourg said in an interview with Le Monde published ahead of the annual Fête de la Rose meeting of Socialist Party activists at Frangy-en-Bresse in eastern France.

The minister also turned on Germany: “We need to raise the tone. Germany is caught in the trap of austerity that it is imposing across Europe.” Mr. Hamon joined Mr. Montebourg’s call for a change of course. He said the Socialist government needs to reconnect with its electorate and boost demand by increasing tax cuts for households after defeats in local and European elections this year . “The worst thing would be to think of French people as children who haven’t understood,” Mr. Hamon said, speaking after Mr. Montebourg at the Socialist meeting. This isn’t the first time the Mr. Montebourg has attacked French government policy. In July, he proposed a string of measures to boost domestic demand and advocated handing more tax cuts to consumers.

But the criticism comes at a difficult moment for the French president, who said earlier this week he will push ahead with a three-year plan to cut public spending to fund tax cuts for business even as the economy stagnates. Businesses continued cutting investment in the second quarter despite receiving the first payouts from labor-tax reductions. Critics of Mr. Hollande’s plans have seized on the economy’s disappointing performance in the first half of the year to argue the Socialist leader needs to rethink the balance of cuts. “Promising to get the economy going again, on the path to growth and full employment, hasn’t worked. Honesty obliges us to acknowledge this,” Mr. Montebourg said in a speech to supporters. “The role of the economy minister and any statesman in his place is to confront the truth—even it is cruel—and propose alternative solutions,” he added.

And everything lese.

• Fears Of Slowdown As German Business Morale Drops (CNBC)

Fears of a German economic slowdown were further heightened on Monday, as a key business survey fell short of analyst expectations. The Ifo Business Climate index, which measures German business sentiment, showed signs of continued weakness in August, falling for the fourth consecutive month. The index slipped to 106.3 in August, down from 108.0 in July and missing analyst expectations of 107.0 “The German economy continues to lose steam,” Hans-Werner Sinn, the president of the Ifo Institute, said in a statement, adding that this month’s reading marked the index’s lowest level since July 2013. Ifo economist and deputy director Klaus Wohlrabe told Reuters that domestic consumption in the country remained solid, but warned that the Ukraine crisis was a “burdensome factor” for the country’s economy.

Germany is the European country with the highest exposure to Russia, and Wohlrabe added that German firms with business ties to Russia were “more pessimistic”. The weak number follows disappointing gross domestic product (GDP) data for the country earlier this month. The figures showed that the economy in Germany – often referred to as Europe’s growth engine – had contracted for the first time in over a year in the second quarter. It showed a marked slowdown from the January to March period, when the economy grew strongly. Wohlrabe told Reuters that Ifo was now likely to reduce its GDP forecast for the country to 1.5% growth, down from the 2% predicted.

Yeah right.

• IMF Chief Lagarde: Germany Should Drive Economic Recovery In Europe (AFP)

IMF chief Christine Lagarde wants Germany to play a bigger role in propelling economic recovery in Europe, she hinted in an interview broadcast on Monday, suggesting that German wages should rise. Part of her remarks may be interpreted by personalities on the left of French politics as going in the same direction as criticism of French, German and European Union austerity policies by French Economy Minister Arnaud Montebourg at the weekend. Montebourg’s attack on the thrust of the French Socialist government’s policy caused a crisis on Monday when President Francois Hollande told Prime Minister Manuel Valls to form a new government. Lagarde told Swiss public broadcaster RTS: “What I think is very important for Germany is to participate in the recovery movement in a very intense way. It has the means to do so.”

Describing the European economic recovery as “labourious”, the head of the International Monetary Fund stressed that the continent’s economic powerhouse had “room for manoeuvre”, as seen in recent wage negotiations. “That leeway has been disclosed in the salary negotiations between the unions and the employers’ organisations,” she said, adding that “hopefully that movement will be amplified and will help propel the European recovery.” Last month, Bundesbank chief Jens Weidmann said that German wages had scope to rise by up to to three% because “we are practically in a situation of full employment”. But this runs counter to many on the German right, including Chancellor Angela Merkel, who believe that low-wage policy has given the country its competitive edge.

A disgrace.

• Over 50% Of Americans On Welfare Or Other Government Assistance (Mish)

As a result of Obamacare Medicaid expansion coupled with means-tested Obamacare assistance, I estimate welfare rolls expanded from 35.4% of the population in 2012 to about 40% in 2014. Let’s go through the math to see how I make that estimate. The latest welfare statistics are from year-end 2012. Those figures show 35.4%] 109,631,000 on Welfare.

109,631,000 living in households taking federal welfare benefits as of the end of 2012, according to the Census Bureau, equaled 35.4% of all 309,467,000 people living in the United States at that time.

When those receiving benefits from non-means-tested federal programs — such as Social Security, Medicare, unemployment and veterans benefits — were added to those taking welfare benefits, it turned out that 153,323,000 people were getting federal benefits of some type at the end of 2012. Subtract the 3,297,000 who were receiving veterans’ benefits from the total, and that leaves 150,026,000 people receiving non-veterans’ benefits. The 153,323,000 total benefit-takers at the end of 2012, said the Census Bureau, equaled 49.5% of the population. The 150,026,000 taking benefits other than veterans’ benefits equaled about 48.5% of the population. In 2012, according to the Census Bureau, there were 103,087,000 full-time year-round workers in the United States (including 16,606,000 full-time year-round government workers). Thus, the welfare-takers outnumbered full-time year-round workers by 6,544,000.

• Fewer Economists Believe US Policy On Right Track (CNBC)

The Federal Reserve’s monetary policy is headed in the right direction, but the U.S. also needs to enact structural policies in order to stimulate stronger economic growth, according to a new survey released Monday. The National Association for Business Economics’ economic policy survey found 53% believe U.S. monetary policy is on the right track, that’s down slightly compared with 57% in February 2014. And 39% felt that the current economic policy was too stimulative. When asked how policy makers should address deficit problems and their impact on gross domestic product, 36% of respondents said the U.S. should enact structural policies to spur stronger GDP. Last year, only 20% supported this approach. According to the survey, a majority of economists were less concerned about fiscal policy uncertainty in comparison to earlier polls. “While there is no clear consensus on current fiscal policy, the share expressing approval has increased markedly to 42% compared to just 31% one year ago,” says NABE president Jack Kleinhenz.

“Over this same period, the panel’s approval of Federal Reserve policy has edged downward.” The semiannual survey of 257 members was conducted between July 22 and August 4, around the same time as the Fed’s most recent policy meeting—which concluded on July 30. The Federal Open Market Committee intends to end its monthly asset purchases by October, but the plan hinges on whether the economy improves as it expects. However, the Fed will continue to reinvest principal payments of Treasury debt and agency mortgage-backed securities. Some 30% of panelists said the Fed should stop such reinvestment by the end of 2014, but only 7% expect it to do so by then. Over half of the respondents, 54%, said they expect the Fed to stop in 2015, while nearly a quarter, 23%, expect it to stop in 2016 or later. Similar to the results of the previous survey, nearly 70% consider the Fed’s quantitative easing a success.

S&P broke 2000.

• ‘Groundbreaking’ Draghi Brings Cheer To Markets (CNBC)

European markets cheered dovish words by Mario Draghi at the start of the week, after the president of the European Central Bank (ECB) delivered a wide-ranging speech which many deemed to mark a key turning point in rhetoric. Draghi’s comments, at the Jackson Hole meeting of central bankers in Wyoming on Friday, raised expectations of further policy easing by the central bank. Hopes of further stimulus pushed stocks in Europe higher on Monday. The euro, meanwhile, stumbled to 1.3189 against the dollar – a level not seen since September 2013. German sovereign bond yields also eased lower amid expectations that the ECB could begin a major asset-buying program. “This could actually go down as one of the major speeches by Draghi, signaling another potential policy shift that is in the making,” Christoph Rieger, head of fixed-income strategy at Commerzbank, told CNBC on Monday morning. Taking the stage after U.S. Federal Reserve Chair Janet Yellen on Friday, Draghi’s words on weak inflation in the region were of particular interest to analysts.

Notably, the ECB President bulked out his speech and drifted away from pre-prepared comments. Draghi cited the risks of a further drop in euro zone inflation, which stood at just 0.4% in July, and said the bank would use all available instruments within its mandate to ensure price stability over the medium term. He also highlighted that market-based long-term inflation expectations had recently fallen. Philippe Gudin, an economist at Barclays, called Draghi’s speech a “major breakthrough”, and said his comments on inflation were a sign the bank could be readying additional easing measures in the near term, such as a quantitative easing (QE) program. “This speech represents a significant breakthrough in the ECB rhetoric and will probably have significant implications regarding the debate just about to start between European governments on policies that need to be deployed to avoid a ‘triple-dip recession’ and a fall in outright deflation,” he said in a research note on Sunday evening.

• There’s A Big Problem With The Dow (CNBC)

If you follow the Dow Jones industrial average, you may be wasting your time. And if you invested in the Dow instead of the S&P 500 this year, you’ve actually missed out on a lot of gains. Despite a 1% rally on Monday, the Dow is up just 1.6% since the start of 2014. Meanwhile, the S&P 500 has gained 6.7%. So what explains the discrepancy? “For at least the past decade, if not longer, [the Dow] really is too concentrated, too focused on large caps,” said Erin Gibbs, equity chief investment officer at S&P Capital IQ. “Inherently, [it] has some problems with it being representative of the overall market.” While the Dow is composed of just 30 stocks, the S&P 500 index is a market capitalization-weighted index of 500 companies. The funny thing is that both are among the 830,000 indexes administered by S&P Dow Jones Indices.

“The S&P 500 really just has a much more diverse and broad array of industries and sectors you can have exposure to,” said Gibbs. “So our preference is heavily the S&P 500, but mainly because of the valuations and the growth when you look at the two indexes.” According to Gibbs , the outperformance may continue. The S&P 500 is valued at roughly 15.6 times the next 12 months’ earnings, while the Dow is at 16.2 times its forward earnings. Ari Wald, head of technical analysis at Oppenheimer, agrees with Gibbs. “I don’t think the Dow is a great reflection of the market anymore,” Wald said. “It only covers 30 stocks. It also puts too much emphasis on the price rather than a market’s capitalization.”

It’s not as if anyone else does.

• Russia Plans to Send Second Aid Convoy to Eastern Ukraine (Bloomberg)

Russia plans to send a second convoy loaded with humanitarian aid to eastern Ukraine, Foreign Minister Sergei Lavrov said, days after the first delivery sparked international condemnation by crossing its neighbor’s border without authorization. The government in Moscow has informed Ukraine of plans to dispatch another column of trucks this week, with the convoy taking the same route through rebel-held territory as the lorries that returned to Russia two days ago, Lavrov told reporters in Moscow today. Lavrov said Russia hoped for no delays and called on the Red Cross and Ukraine to help with the delivery as the humanitarian situation continues to deteriorate in the war-torn regions.

Speaking a day before the leaders of Russia and Ukraine meet in the Belarus capital of Minsk, Lavrov said the talks between President Vladimir Putin and his Ukrainian counterpart Petro Poroshenko will focus on economic ties, the humanitarian crisis and the prospects for a political resolution in Ukraine. The armed conflict with pro-Russian rebels has shown no signs of abating since the insurrection started after Putin’s takeover of the Crimean peninsula in March. All of about 280 trucks that carried what Russia says is humanitarian aid have returned on Aug. 23, according to the Foreign Ministry in Moscow. The U.S. and the European Union condemned the decision to send the convoy, which the government in Kiev called an “invasion.”

• Russia Asks If US Still Fit To Help Solve International Problems (Zero Hedge)

Yesterday it was China slamming America’s superpower status (and thus dollar reserve currency status) when in Sina News it stated the following:

Their various reconnaissance aircraft have been wandering around foreign airspace for decades and watching the military secrets of other countries like a disgusting thief spying over his neighbor’s fence. However, when the neighbor comes back with a big stick, the thief will turn tail and run away, blaming the neighbor. [..] When you show people weakness, they will bully you. When you show people strength, they will respect you. [..] We [the newspaper] believe the Chinese Air Force and Naval aviation should maintain a high level of vigilence and morale in southeast coastal region to prevent the further US action. America has lost face and does not want to show the world they are sick. They have been lording over other countries for so long, and they will never let it go after they eat this loss.

Now it is Russia’s turn, whose Ministry of Foreign Affairs issued a statement on Friday, following the UN’s delay in adopting a statement calling for a ceasefire in Ukraine after the US once again opposed Russia, which claimed among other things that “if the US opposes an absolutely non-confrontational, reconciliatory text, there can be no doubts that Washington intends to have the armed confrontation in Ukraine continued. It could be seen only as an attempt to ‘undermine’ the humanitarian mission.” A mission which Russia greenlighted despite stern US opposition, and also concluded without incident as we reported yesterday, when the convoy returned to Russia after a brief stay in east Ukraine. Moscow believes that such policy is hypocritical, the ministry added. Of course, if indeed the Ukraine economic crisis is the direct result of US and CIA meddling as the Victoria Nuland intercepted recording validates, then Russia has every right to such an opinion. The punchline:

“Cynical disregard for the fate of civilians and ‘couldn’t care less’ attitude toward the international humanitarian law when it comes to geopolitical interests, becomes the core of the policy of the United States and its European satellites regarding Ukrainian,” the statement read. [..] “More and more questions are being raised about the ability of the current US administration to participate in the development of realistic and pragmatic approaches to international problems, to adequately assess the situation in the various regions of the world,” the Russia Foreign Ministry noted.

One wonders if based on his recent track record in the international arena, the president of the US wouldn’t agree.

How wrong is he?

• ‘Russia Seems Only Party Still Interested In MH17 Investigation’ (RT)

Russian Foreign Minister Sergey Lavrov has announced plans for a second humanitarian convoy to be sent to eastern Ukraine, urging all foreign actors and agencies to participate. Failure to do so would constitute a violation of international law, he warned. “Anyone in need of aid shall receive it,” the FM said, stressing that it is important to learn from the mistakes of the first attempt and to look forward to closer cooperation with the Ukrainian authorities this time around. He stressed that as the indiscriminate shelling of areas such as Lugansk continues, the humanitarian need for water and food grows. This has been acknowledged by humanitarian agencies and itnernational actors at large. The distribution of aid is currently underway, and is headed by the ICRC. The FM also added that the shelling of schools, hospitals, kindergartens and other vulnerable institutions and structures can no longer be excused by claims of “wrongful shooting” or be written off as “accidental.”

Minister Lavrov emphasized that Russia is willing and ready to participate in full in any type of negotiations on ending hostilities in the east, and expressed hope that Tuesday’s meeting in Minsk will include a focus on the crisis in Ukraine. “We certainly expect that tomorrow’s meeting in Minsk will feature a discussion on the humanitarian crisis,” Lavrov said. “We express hope that all participants will urge for the removal of any obstacles to smooth aid delivery to those who are most in need of it,” he added. The upcoming gathering will be attended by the Customs Union, the Ukrainian authorities and members of the EU. Sergey Lavrov was asked a wide range of questions on the situations in Ukraine, including the claims that Russian arms were crossing the border. Allegations of Russian attempts to smuggle military equipment into Ukraine are false and are the latest in a string of bad information that has been circulating in recent days, the minister said. No one, including Ukraine’s special services, could confirm those suspicions.

Lavrov went on to stress that reports of Russian forces crossing into Ukraine have not been confirmed by the OSCE, which is evidenced in their report. He further mentioned OSCE concerns that indiscriminate arrests carried out by the militias are beginning to resemble a “witch hunt.” The people migrating into the west are not being taken in, nor are their children being given places in schools, he stressed. If this is the sort of national unity Klichko, Tyangibok and Yatsenyuk spoke of, they lied to their own people, he said, referring to national unity agenda promoted by the leaders of opposition to former president Viktor Yanukovich. The minister was dismayed at the ongoing investigation into the downing of flight MH17 over eastern Ukraine, which aroused much controversy and finger-pointing. He said that at this point it would appear that Russia “seems to be the only interested party in giving this serious issue any further attention.”

• War In East Ukraine Leaves Economy In Ashes. Who Will Pay For Recovery? (RT)

The turmoil in eastern Ukraine has devastated the economy, putting the International Monetary Fund (IMF) and other Western backers under pressure to save the sinking financial wreck. “If the conflict lingers for another few months in its current form the cost to the Ukrainian economy would be huge,” Vitaly Vavryshchuk, an analyst at Kiev-based SP Advisors, told the Financial Times. The MF has delayed Ukraine’s second $1.4 billion aid installment, and now Kiev is asking to combine the third and fourth tranche into a $2.2 billion package, according to Ukraine’s Finance Minister Oleksandr Shlapak. In order for the loans to be disbursed, the IMF has to confirm the multi-billion dollar debt restructuring plan is sustainable, which it may not be at present. Gabriel Sterne of Oxford Economics predicts that Ukraine’s GDP-to-debt ratio is on the rise, and by 2018 could hit 87%. “We think the Ukraine economy and the IMF program face such difficulties that a default is likely, possibly imminent,” Sterne wrote in an August report.

“It could take the form of a ’precautionary’ default in which debt falling due over the next three years is forcibly rolled over. If there is a full-blown Russian invasion then deeper haircuts may be required,” Sterne wrote. The IMF approved a two-year $17 billion loan package in April, and the first disbursement of $3.2 billion was delivered in May. If the IMF program falls apart, the country faces default, which would further discredit the lending institution after its failed efforts in Greece and other debt-ridden economies. Before, the IMF money was a sure thing; now many analysts predicted Ukraine could default by the end of the year. Another looming financial burden hanging over Kiev is the $3 billion in Eurobonds issued from Russia in December 2013. Moscow can demand repayment before the bonds are due in 2015 if Ukraine’s debt-to-GDP surpasses 60%, which at present, seems likely. [..]

Gaping holes in Ukraine’s state budget and foreign reserves, and instability in financial markets have brought havoc to Ukraine’s macroeconomic situation. Ukraine’s Economy Minister Pavel Sheremeta resigned on Thursday frustrated with the slow pace of economic reform. Sheremeta, who was appointed soon after the ousting of President Viktor Yanukovich in February, said on his Facebook page that he no longer wanted to “fight against yesterday’s system.” Fitch Ratings predicts the economy will contract by 5% in 2014, a pretty conservative estimate compared to other analysis, which predict a 6.5% drop (IMF) or even 8% (Oxford Economics). In 2013, GDP growth was zero.

Sanctions? Not us.

• Russian Oil Company Rosneft To Take 30% Stake In Norwegian Driller (RT)

Russia’s biggest oil company Rosneft has agreed to purchase a stake in Norway’s North Atlantic Drilling (NADL) through an asset swap, which appears to show businesses remain undeterred by political sanctions. Rosneft has agreed to take a 30% of North Atlantic in return for 150 onshore drilling assets in Russia, and some cash. The final terms of the deal, including the amount of investments in the Norwegian company, will be set after it passes due diligence, which is expected to be done by the end of the year, Rosneft said in a statement Friday. Rune Magnus Lundetrae, Chief Financial Officer of Seadrill, which owns 70% of North Atlantic, told Bloomberg Rosneft would also buy 100 million new shares at $9.25 apiece. The deal comes amidst sanctions tension between Russia and the West and shows that foreign businesses still want to cooperate with Russia, leaving politics aside. “We’re very pleased with the execution of this important transaction and welcome Rosneft as an equity partner and to our board of directors,” Alf Ragnar Lovdal, CEO of North Atlantic, said in a statement.

“We’re not very worried” that the sanctions will affect any part of these deals, Lundetrae told Bloomberg by phone. “Rosneft is a very good and constructive partner for us.” Friday’s deal marks the second step under a framework agreement signed in May. Last month, just days before the EU imposed tighter economic sanctions against Russia; the two companies completed the lease of offshore rigs. Under the July agreement, Rosneft and NADL will cooperate in shelf drilling, with the Norwegian company providing Rosneft with six sea drilling units till 2022 to conduct shelf drilling in harsh weather conditions. ExxonMobil and Norway’s Statoil have also confirmed they would continue offshore Arctic drilling with Rosneft, despite politicians in the EU and the US seeking to make Russia change its policy over Ukraine by putting on economic pressure. On Thursday, the Financial Times reported Vitol, the world’s largest independent oil trader, was shelving its $2 billion deal with Rosneft.

• Is China About To Step On Stimulus Pedal Again? (CNBC)

As China’s fragile economic recovery loses momentum, expectations are growing that Beijing will unleash fresh stimulus to ensure delivery on its growth target of 7.5%. The last month has seen a slew of disappointing economic data – from manufacturing to credit growth – raising concerns that the world’s second-largest economy may be headed into a renewed soft patch. HSBC’s preliminary reading of China’s manufacturing purchasing managers’ index (PMI) for the month of August dipped to 50.3 from July’s 18-month high of 51.7, missing forecasts for 51.5. Meanwhile, lending unexpectedly slowed in July. A broad measure of new credit stood at 273.1 billion yuan ($44.3 billion) the lowest monthly total since October 2008. Policymakers appear more nervous, particularly on the back of the weak credit growth, and will roll out more measures to bolster the economy, said Dariusz Kowalczyk, senior economist and strategist, Asia ex-Japan at Credit Agricole. He expects a re-acceleration of fiscal spending, expansion of the pledged supplementary lending program and a relaxation of the window guidance for bank lending.

Last Thursday, he raised his estimate on the likelihood of a system-wide reserve requirement ratio (RRR) cut in the second-half to 35% from 25%. In June, the People’s Bank of China cut the level of reserves banks must hold for certain banks that have sizable loans to the farming sector and small- and medium-sized firms. “July will prove to be a bump on the road rather than the beginning of a serious downturn. Perhaps second half will be more difficult than first half was, but China will still achieve its growth target of ‘about 7.5%’,” he said. So far this year, the government has implemented targeted measures to support growth including accelerating spending on railways and other infrastructure projects and lowering tax rates for smaller companies, refraining from big-bang stimulus. Jiang Chang, China economist at Barclays agrees more policy easing is unavoidable. “The government faces a trade-off between ‘tolerating lower growth’ and ‘rolling out more stimulus’ amid a property market correction and uncertain external demand,” Chang wrote in a note published on Thursday.

One trick pony.

• Western Australia State Stripped of Top Credit Rating by Moody’s (Bloomberg)

Western Australia was stripped of its top credit rating by Moody’s Investors Service as the state’s increasing reliance on resource royalties threatens efforts to repair its finances. Moody’s lowered the state’s ranking to Aa1 from Aaa and changed its outlook to stable from negative, according to a statement today. The government’s assumptions for mining royalties are based on a “fairly optimistic forecast” for iron ore prices, while the state faces spending pressures due to rapid population growth, the ratings company said. “Western Australia’s debt burden has risen sharply in recent years,” Moody’s said. “The state will be hard pressed to meet its very low spending growth targets, unless the government’s fiscal resolve strengthens and new measures are identified.”

The spot price of iron ore, the state’s largest export, has dropped 33% since Dec. 31 to $90.10 a ton, according to The Steel Index. While Western Australia has based its spending plans on the price averaging $122.70 a ton this fiscal year, analysts surveyed by Bloomberg predict the steelmaking material will hold closer to current levels through 2018. The downgrade by Moody’s follows Standard & Poor’s decision to remove its top credit grade last September. The state’s operating surplus for the current period was forecast at just A$175 million ($163 million) and the iron-ore plunge means inflows could be trailing estimates, according to revenue sensitivities provided in the state’s May budget. The government’s plans to address its fiscal problems “are positive steps but are not expected to lead to significant improvements in the near term,” Moody’s said. “Minimal improvement is expected in the financial performance in” the current financial year.

Oh, great!

• Microplastic Contaminates Found In Sydney Harbor Threat To Food Chain (ABC)

The bottom of Sydney Harbour has been contaminated by widespread microplastic pollution which could be entering the food chain, scientists say. Professor Emma Johnston from the Sydney Institute of Marine Science said the microplastics, or fragments of plastic less than five millimetres long, represented the “emergence of new contaminants in our harbours and waterways”. In the first study of its kind, 27 sites were tested across the harbour, with researchers discovering up to 60 microplastics per 100 milligrams of sediment. The environmental effects of the contaminants are largely unknown, but there have been moves to ban their use in products overseas. Professor Johnston said some of the microplastic contamination was coming directly into the harbour. “For example when we wash our fleecy jackets in the washing machine, lots of particles of microplastics, thin threads, come off and enter our waterways,” she said. “But there are also microplastics from facial scrubs and there are breakdown products from macro debris, like plastic bags or plastic bottles.”

A PhD candidate at the University of New South Wales, Vivian Sim, said several hotspots were identified and the worst-affected area was in the pristine-looking waters of Middle Harbour. “Something interesting is going on here, but we’re not sure what,” she said. In Middle Harbour, microplastic threads were more common than flakes or balls, but it was unclear where they came from. “We should be worried about it,” Ms Sim said. “We actually managed to pull up a sipunculid worm today. “It’s got sand going through all of it, so you can see that it’s ingesting it. “So if your microplastic fragments are as small as a sand grain, then [the worm] is going to take up the plastics and contaminants, and then if something else comes along and eats that worm it’s going to go further up the food chain.” It was not clear what impact microplastics were having on the organisms that were eating them, but Professor Johnston said some contained materials such as flame retardants.

Lots of areas where it’s hard to keep track of what goes on. And densely populated.

• British Ebola Victim Flown Home As Epidemic Spreads To Congo (Reuters)

A British medical worker was flown home from West Africa on Sunday after becoming the first Briton infected in an Ebola epidemic, and a separate new outbreak of the disease was detected in Democratic Republic of Congo. A specially adapted Royal Air Force cargo plane picked up the male healthcare worker in Sierra Leone on Sunday after British Foreign Secretary Philip Hammond authorized his repatriation for treatment. The Department of Health said the patient – whose identity has not been disclosed – was “not currently seriously unwell”. The man will be transported to an isolation unit at the Royal Free Hospital in London.

The hemorrhagic fever has killed at least 1,427 people, mostly in Sierra Leone, Liberia and neighboring Guinea, the deadliest outbreak of the disease to date. The disease also has a toehold in Nigeria, where it has killed five people. In Democratic Republic of Congo, Health Minister Felix Kabange Numbi said an Ebola outbreak had been confirmed in the remote northern Equateur province – 1,200 km (750 miles) from the capital Kinshasa – but it was a different strain of the virus from the West African one. There have been six outbreaks of Ebola in Democratic Republic of Congo since the disease was discovered there in 1976, with a total of more than 760 deaths. The World Health Organization (WHO) has said that more than 225 health workers have fallen ill and nearly 130 have lost their lives to Ebola since the West African outbreak was detected in the jungles of southeast Guinea in March.

• Sierra Leone ‘Hero’ Doctor’s Death Exposes Slow Ebola Response (Reuters)

When two American aid workers recovered from Ebola after being treated with an experimental drug, the grieving family of Sierra Leone’s most famous doctor wondered why he had been denied the same treatment before he died from the deadly virus. Sheik Umar Khan was a hero in his small West African country for leading the fight against the worst ever outbreak of the highly contagious hemorrhagic fever, which has killed 1,427 people mostly in Sierra Leone, Liberia and Guinea. When Khan fell sick in late July, he was rushed to a treatment unit run by Medecins Sans Frontieres (MSF) where doctors debated whether to give him ZMapp, a drug tested on laboratory animals but never before used on humans. Staff agonised over the ethics of favouring one individual over hundreds of others and the risk of a popular backlash if the untried treatment was perceived as killing a national hero. In the end, they decided against using ZMapp. Khan died on 29 July, plunging his country into mourning.

A few days later, the California-manufactured pharmaceutical was administered to US aid workers Kent Brantly and Nancy Writebol who contracted Ebola in Liberia and were flown home for treatment. It is not clear what role ZMapp played in their recovery but the two left hospital in Atlanta last week. Khan is among nearly 100 African healthcare workers to have paid the ultimate price for fighting Ebola, as the region’s medical systems have been overwhelmed by an epidemic which many say could have been contained if the world had acted quicker. In their village of Mahera, in northern Sierra Leone, Khan’s elderly parents and siblings asked why he did not get the treatment. Khan saved hundreds of lives during a decade battling Lassa fever – a disease similar to Ebola – at his clinic in Kenema and was Sierra Leone’s only expert on haemorrhagic fever. “If it was good enough for Americans, it should have been good enough for my brother,” said C-Ray, his elder brother, as he sat on the porch of the family home. “It’s not logical that it wasn’t used. He had nothing to lose if it hadn’t worked.”

Cascading dominoes.

• 500 Methane Vents Detected On Ocean Floor Off US East Coast (BBC)

Researchers say they have found more than 500 bubbling methane vents on the seafloor off the US east coast. The unexpected discovery indicates there are large volumes of the gas contained in a type of sludgy ice called methane hydrate. There are concerns that these new seeps could be making a hitherto unnoticed contribution to global warming. The scientists say there could be about 30,000 of these hidden methane vents worldwide. Previous surveys along the Atlantic seaboard have shown only three seep areas beyond the edge of the US continental shelf. The team behind the new findings studied what is termed the continental margin, the region of the ocean floor that stands between the coast and the deep ocean. In an area between North Carolina and Massachusetts, they have now found at least 570 seeps at varying depths between 50m and 1,700m.

Their findings came as a bit of a surprise. “It is the first time we have seen this level of seepage outside the Arctic that is not associated with features like oil or gas reservoirs or active tectonic margins,” said Prof Adam Skarke from Mississippi State University, who led the study. The scientists have observed streams of bubbles but they have not yet sampled the gas within them. However, they believe there is an abundance of circumstantial evidence pointing to methane. Most of the seeping vents were located around 500m down, which is just the right temperature and pressure to create a sludgy confection of ice and gas called methane hydrate, or clathrate. The scientists say that the warming of ocean temperatures might be causing these hydrates to send bubbles of gas drifting through the water column. They do not appear to be reaching the surface. “The methane is dissolving into the ocean at depths of hundreds of metres and being oxidised to CO2,” said Prof Skarke.

Flaring, though it’s not mentioned in the article, is a very polluting “acitivity”.

• Inside North Dakota’s Latest Fracking Problem (CNBC)

From his driveway, Tom Wheeler’s view of North Dakota’s sprawling grasslands seems endless. Fields of soy, wheat and canola stretch to the horizon in all directions. But as drillers flock to the state to cash in on North Dakota’s booming shale play, that horizon has become increasingly marked by natural gas flares. Wheeler, 59, owns 3,000 acres of farmland in Ray, the heart of the state’s oil-rich Bakken Basin, one of the world’s largest shale formations. Shale gas is natural gas, which is found trapped within shale formations. Still farming the land his grandfather homesteaded in 1902, Wheeler can give a first-hand account of the oil industry’s boom and bust cycles in North Dakota, sometimes known as the “Roughrider State.” During the area’s last boom in the ’70s, Wheeler spent his winters working on an oil rig. And while he knows just how much an energy surge can change a community, he’s never experienced one that’s transformed the landscape quite like the recent boom. “In the ’70s we had so many dry holes that you never noticed the flares,” Wheeler said.

“But now every well is productive—and the flares are everywhere.” In the Bakken, flaring has become synonymous with drilling. The prairies—once dotted only with cattle and an occasional lazy oil derrick—are now marked by thousands of flares, open pits or steel pipes burning off excess natural gas, a byproduct of the rapid rise in oil drilling. New wells are coming online so quickly that the pipeline infrastructure for natural gas has not been able to keep pace. Hydraulic fracturing, or fracking, forces natural gas and crude oil out of shale buried deep below the earth by using highly pressurized and treated water. Drillers seek out valuable crude oil, but natural gas comes out of the ground, too. Flaring is the burning of natural gas that can’t be processed or sold.All those flares, meanwhile, are adding up. They burn so brightly that NASA astronauts have taken pictures of their glow from space. Many oil drillers are unable to direct the flow of natural gas coming off wells into existing pipelines, which already are at full capacity.

Now regulators are cracking down. North Dakota passed new flaring standards, with the goal of capturing more natural gas. Energy companies are scrambling to meet the rules and curb flaring—some with creative technologies. In Ray, Hess has a gas compression station bordering Wheeler’s property. Natural gas is pumped from several surrounding oil wells, before being transported to a larger processing facility in Tioga. A four-burner flare sounds like a jet engine, and the 20-foot flame, sitting atop the 30-foot torch, can be seen for miles. “It’s not just a waste to the landowner or the tax collector, it’s a waste of the land’s natural product,” Wheeler said. “When I was growing up, we were taught not to waste anything.” Every day, drillers in the Bakken burn off about 350 million cubic feet of natural gas. That comes to more than $100 million worth of gas burned off each month – a figure that makes the state’s mineral rights holders’ unhappy. There are at least 12 class-action law suits filed against the drillers by mineral rights holders seeking lost revenue.

Home › Forums › Debt Rattle Aug 25 2014: Is France About To Kill The Eurozone?