Arthur Rothstein Family leaving South Dakota drought for Oregon Jul 1936

Shoppers are confident enough to not shop. Absolutely brilliant spin attempts, but the whole thing oozes desperation.

• US Consumers Reduce Spending By 11% Over Thanksgiving Weekend (Bloomberg)

Even after doling out discounts on electronics and clothes, retailers struggled to entice shoppers to Black Friday sales events, putting pressure on the industry as it heads into the final weeks of the holiday season. Spending tumbled an estimated 11% over the weekend, the Washington-based National Retail Federation said yesterday. And more than 6 million shoppers who had been expected to hit stores never showed up. Consumers were unmoved by retailers’ aggressive discounts and longer Thanksgiving hours, raising concern that signs of recovery in recent months won’t endure.

The NRF had predicted a 4.1% sales gain for November and December – the best performance since 2011. Still, the trade group cast the latest numbers in a positive light, saying it showed shoppers were confident enough to skip the initial rush for discounts. “The holiday season and the weekend are a marathon, not a sprint,” NRF Chief Executive Officer Matthew Shay said on a conference call. “This is going to continue to be a very competitive season.” Consumer spending fell to $50.9 billion over the past four days, down from $57.4 billion in 2013, according to the NRF. It was the second year in a row that sales declined during the post-Thanksgiving Black Friday weekend, which had long been famous for long lines and frenzied crowds.

How about them apples?

• Stocks Have Been More Overvalued Only ONCE in the Last 100 Years (Phoenix)

Stocks today are overvalued by any reasonable valuation metric. If you look at the CAPE (cyclical adjusted price to earnings) the market is registers a reading of 27 (anything over 15 is overvalued). We’re now as overvalued as we were in 2007. The only times in history that the market has been more overvalued was during the 1929 bubble and the Tech bubble. Please note that both occasions were “bubbles” that were followed by massive collapses in stock prices.

Source: https://www.multpl.com/shiller-pe/

Then there is total stock market cap to GDP, a metric that Warren Buffett’s calls tge “single best measure” of stock market value. Today this metric stands at roughly 130%. It’s the highest reading since the DOTCOM bubble (which was 153%). Put another way, stocks are even more overvalued than they were in 2007 and have only been more overvalued during the Tech Bubble: the single biggest stock market bubble in 100 years.

Source: Advisorperspectives.com

1) Investor sentiment is back to super bullish autumn 2007 levels.

2) Insider selling to buying ratios are back to autumn 2007 levels (insiders are selling the farm).

3) Money market fund assets are at 2007 levels (indicating that investors have gone “all in” with stocks).

4) Mutual fund cash levels are at a historic low (again investors are “all in” with stocks).

5) Margin debt (money borrowed to buy stocks) is near record highs.In plain terms, the market is overvalued, overbought, overextended, and over leveraged. This is a recipe for a correction if not a collapse.

This is exactly what I’ve been warning about for more than a week now. Oil is big enough as an industry to drag the whole market down.

• The Imploding Energy Sector Is Responsible For A Third Of S&P 500 Capex (ZH)

We have previously discussed the implications that tumbling crude oil prices will have not only on some of the most levered companies with exposure to Brent prices, namely the vast majority of the US energy space with outstanding junk bonds which, as we explained before, should WTI drop to $60, it would “Trigger A Broader HY Market Default Cycle” (based on a Deutsche Bank analysis) leading to pain across the entire credit market (and in the process impairing the stock-buyback machinery which companies aggressively use to artificially boost their stock price), as well as on oil-exporting nations, whose economies are assured to grind to a halt leading to broad social unrest or worse, and lastly, on global asset liquidity, which is set to contract even more now that for the first time in over a decade, the net flow of Petrodollars will be an outflow (as explained in How The Petrodollar Quietly Died, And Nobody Noticed).

And while much has been said about the “benefits” the US economy is poised to reap as a result of the plunge in gas prices, which has been compared to a major tax cut (whatever happened to the core Keynesian tenet that “deflation” is the worst thing that can possibly happen) on the US consumer, almost nothing has been said about the adverse impact on US GDP as a result of tumbling fixed investment spending and CapEx. The reason, clearly, is that the collapse in new investment will more than offset the boost from incremental household spending. Here are the facts, per Deutsche Bank:

US private investment spending is usually ~15% of US GDP or $2.8trn now. This investment consists of $1.6trn spent annually on equipment and software, $700bn on non-residential construction and a bit over $500bn on residential. Equipment and software is 35% technology and communications, 25-30% is industrial equipment for energy, utilities and agriculture, 15% is transportation equipment, with remaining 20-25% related to other industries or intangibles. Non-residential construction is 20% oil and gas producing structures and 30% is energy related in total. We estimate global investment spending is 20% of S&P EPS or 12% from US. The Energy sector is responsible for a third of S&P 500 capex. 35% of S&P EPS from investment and commodity spend, 15-20% US.

In short, while nobody knows just how many tens of billions in US economic “growth”, i.e., GDP, will be eliminated now that energy companies are not only not investing in growth spending or even maintenance, being forced to shut down unprofitable drilling operations and entering spending hibernation territory, the guaranteed outcome is that US GDP is set to slide as the CapEx cliff resulting from Brent prices dropping below the $75/bbl red line under which shale is broadly no longer profitable will offset any GDP benefit unleashed from the “supposed” increase in consumer spending (supposed because according to the latest NRF numbers, Thanksgiving spending was not only well below last year (with the average consumer spending $380.95 over Thanksgiving compared to $407.02 a year ago) but below even our worst case forecasts. So just where are all those external benefits to US retailers as a result of crashing gas prices?

Rhetorical questions aside, the real question is just how much will said GDP slide ultimately be? Sadly, this too will be one question the BEA will never answer, as instead the upcoming GDP plunge will be blamed once again on inclement weather as opposed to actually analyzing what is truly happening as America’s transformation to an oil-producing (and maybe exporting) powerhouse, is so rudely interrupted.

The doomiest view of all made me also laugh out loud.

• Good Money After Bad: The Big Sell-Off of 2015 (Steen Jakobsen)

The big selloff in 2015 will come from housing and housing-related investments as the marginal cost of capital rises through regulation and through “margin calls” on banks as their profit-to-GDP ratios grow too high for the economy to function properly. The dividend society is here and the true manifestation of Japanisation is not a future event but a thing we are living in right now… From a tactical point of view, I live in a very simple world:

[..] No, if there is any reality left in the world the market will realize — by its mistaken support for long USDJPY positions — that productivity gains and competitive edges are driven by the “need” to change… not from isolation but from cause and effect (but that’s also a 2015 story). In closing I have very little positions — the stock market is on a mission to kill the shorts (which will probably succeed), the FX market believes in Santa Japan and the ECB continues to do nothing but talk… but for now it’s enough to sell the product, which is risk-on at all costs.

The correction will be deeper and deeper as the market is dislocated through zero interest rates and an investing crowd that is rewarded for throwing all conservative risk rules overboard in a year where we again have double digit gains on… low interest rates. Let’s hope the ECB plays ball for the market to buy some more time; for now we are playing musical chairs, and when the music stops, more than one chair will be missing… How bad are things? Well, let me give you my starting slide from a presentation done in November:

“”We’re seeing a lot of traders being forced into the market, a lot of hedges, because the prices have been so volatile toward the downside .. ”

• Can Oil Fall All The Way To $40? (CNBC)

As oil prices drop to more than four-year lows, analysts are slashing their forecasts, with some predicting it could plunge as much as 40% to around $40 a barrel. “There is a possibility that if this price war becomes unmanageable, [we could] see prices down to about $40 a barrel [for WTI],” Jonathan Barratt, chief investment officer of Ayers Alliance Securities, told CNBC. But for oil to get all the way down to $40 a barrel would take “a massive lack of confidence in the economies, also a lack of pricing power,” Barratt said. Brent and WTI crude each fell more than 2% to as low as $67.90 and $64.10 a barrel respectively during Asian trade on Monday, levels last seen in 2010, as the European credit crisis was heating up. Global oil prices have plunged since peaking in June.

From around $115 a barrel, Brent crude has lost around a third of its price. Weak demand, a strong U.S. dollar and booming U.S. oil production are the three main reasons behind the fall, according to the IEA, which warned of a “new chapter” for oil markets, which could even affect the social stability of some countries. Saudi Arabia sparked talk of an oil price war as it has cut its official selling prices for some customers for four consecutive months through November. Part of oil’s drop has to do with supply conditions. Increased U.S. oil production has added to a glut in the world oil market. The U.S. now produces about 8.9 million barrels a day, while Saudi Arabia, the world’s largest producer, pumps about 9.6 million barrels a day.

But Barratt believes much of the price drop has to do with financial traders, citing the speed of the drop over the past few trading sessions amid relatively low volumes during the holiday period. “We’re seeing a lot of traders being forced into the market, a lot of hedges, because the prices have been so volatile toward the downside,” Barratt said. He isn’t alone in predicting oil could plunge to $40 a barrel – levels not seen in more than 10 years. Murray Edwards, chairman of Canadian Natural Resources, one of Canada’s biggest oil investors, predicted oil could fall as low as $30 a barrel before stabilizing at around $70-$75, according to a Financial Post article. While Forbes contributor Jesse Colombo, admittedly a perma-bear, said in an article that technical analysis suggests that if oil prices fall below $60 a barrel, $40 is the next major support.

OPEC have turned into the proverbial cats in a sack.

• Oil at $40 Possible as Market Transforms Caracas to Iran (Bloomberg)

Oil’s decline is proving to be the worst since the collapse of the financial system in 2008 and threatening to have the same global impact of falling prices three decades ago that led to the Mexican debt crisis and the end of the Soviet Union. Russia, the world’s largest producer, can no longer rely on the same oil revenues to rescue an economy suffering from European and U.S. sanctions. Iran, also reeling from similar sanctions, will need to reduce subsidies that have partly insulated its growing population. Nigeria, fighting an Islamic insurgency, and Venezuela, crippled by failing political and economic policies, also rank among the biggest losers from the decision by the Organization of Petroleum Exporting Countries last week to let the force of the market determine what some experts say will be the first free-fall in decades.

“This is a big shock in Caracas, it’s a shock in Tehran, it’s a shock in Abuja,” Daniel Yergin, vice chairman of Englewood, Colorado-based consultant IHS Inc. and author of a Pulitzer Prize-winning history of oil, told Bloomberg Radio. “There’s a change in psychology. There’s going to be a higher degree of uncertainty.” A world already unsettled by Russian-inspired insurrection in Ukraine to the onslaught of Islamic State in the Middle East is about be roiled further as crude prices plunge. Global energy markets have been upended by an unprecedented North American oil boom brought on by hydraulic fracturing, the process of blasting shale rocks to release oil and gas.

Few expected the extent or speed of the U.S. oil resurgence. As wildcatters unlocked new energy supplies, some oil exporters abroad failed to invest in diversifying their economies. Coddled by years of $100 crude, governments instead spent that windfall subsidizing everything from 5 cents-per-gallon gasoline to cheap housing that kept a growing population of underemployed citizens content. Those handouts are now at risk. “If the governments aren’t able to spend to keep the kids off the streets they will go back to the streets, and we could start to see political disruption and upheaval,” said Paul Stevens, distinguished fellow for energy, environment and resources at Chatham House in London, a U.K. policy group. “The majority of members of OPEC need well over $100 a barrel to balance their budgets. If they start cutting expenditure, this is likely to cause problems.”

” The International Energy Agency says we could soon hit “peak oil demand”, due to cheaper fuel alternatives, environmental concerns, and improving oil efficiency.” But no slowdown anywhere!

• ‘We Are Entering A New Oil Normal’ (Jawad Mian)

Everyone believes that the oil-price decline is temporary. It is assumed that once oil prices plummet, the process is much more likely to be self-stabilizing than destabilizing. As the theory goes, once demand drops, price follows, and leveraged high-cost producers shut production. Eventually, supply falls to match demand and price stabilizes. When demand recovers, so does price, and marginal production returns to meet rising demand. Prices then stabilize at a higher level as supply and demand become more balanced. For the classic model to hold true in oil’s case, the market must correctly anticipate the equilibrating role of price in the presence of supply/demand imbalances.

By 2020, we see oil demand realistically rising to no more than 96 million barrels a day. North American oil consumption has been in a structural decline, whereas the European economy is expected to remain lacklustre. Risks to the Chinese economy are tilted to the downside and we find no reason to anticipate a positive growth surprise. This limits the potential for growth in oil demand and leads us to believe global oil prices will struggle to rebound to their previous levels. The International Energy Agency says we could soon hit “peak oil demand”, due to cheaper fuel alternatives, environmental concerns, and improving oil efficiency. The oil market will remain well supplied, even at lower prices. We believe incremental oil demand through 2020 can be met with rising output in Libya, Iraq and Iran.

We expect production in Libya to return to the level prior to the civil war, adding at least 600,000 barrels a day to world supply. Big investments in Iraq’s oil industry should pay-off too with production rising an extra 1.5-2 million barrels a day over the next five years. We also believe the American-Iranian détente is serious, and that sooner or later both parties will agree to terms and reach a definitive agreement. This will eventually lead to more oil supply coming to the market from Iran, further depressing prices in the “new oil normal”. [..] Our analysis leads us to conclude that the price of oil is unlikely to average $100 again for the remaining decade. We will use an oil rebound to gradually adjust our portfolio to reflect this new reality.

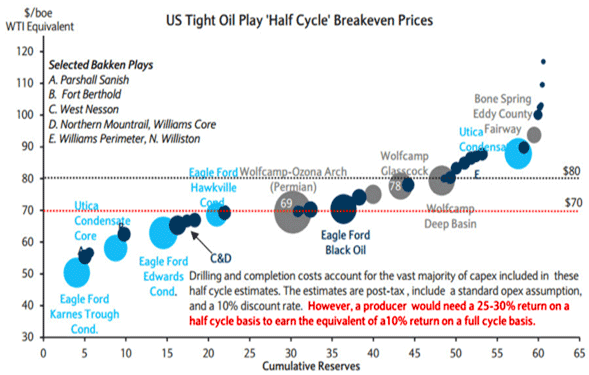

Ambrose in July 2014: “A large chunk of US investment is going into shale gas ventures that are either underwater or barely breaking even, victims of their own success in creating a supply glut. One chief executive acidly told the TPH Global Shale conference that the only time his shale company ever had cash-flow above zero was the day he sold it – to a gullible foreigner. [..] … the low-hanging fruit has been picked and the costs are ratcheting up. Three Forks McKenzie in Montana has a break-even price of $91. [..]”

And today: “The International Energy Agency said most of North Dakota’s vast Bakken field “remains profitable at or below $42 per barrel. The break-even price in McKenzie County, the most productive county in the state, is only $28 per barrel.“

• Saudis Risk Playing With Fire In Shale-Price Showdown As Crude Crashes (AEP)

Saudi Arabia and the core OPEC states are taking an immense political gamble by letting crude oil prices crash to $66 a barrel, if their aim is to shake out the weakest shale producers in the US. A deep slump in prices might equally heighten geostrategic turmoil across the broader Middle East and boomerang against the Gulf’s petro-sheikhdoms before it inflicts a knock-out blow on US rivals. Caliphate leader Abu Bakr al-Baghdadi has already opened a “second front” in North Africa, targeting Algeria and Libya – two states that live off energy exports – as well as Egypt and the Sahel as far as northern Nigeria. “The resilience of US shale may prove greater than the resilience of OPEC,” said Alistair Newton, head of political risk at Nomura. Chris Skrebowski, former editor of Petroleum Review, said the Saudis want to cut the annual growth rate of US shale output from 1m barrels per day (bpd) to 500,000 bpd to bring the market closer to balance. “They want to unnerve the shale oil model and undermine financial confidence, but they won’t stop the growth altogether,” he said.

There is no question that the US has entirely changed the global energy landscape and poses an existential threat to OPEC. America has cut its net oil imports by 8.7m bpd since 2006, equal to the combined oil exports of Saudi Arabia and Nigeria. The country had a trade deficit of $354bn in oil and gas as recently as 2011. Citigroup said this will return to balance by 2018, one of the most extraordinary turnarounds in modern economic history. “When it comes to crude and other hydrocarbons, the US is bursting at the seams,” said Edward Morse, Citigroup’s commodities chief. “This situation is unlikely to stop, even if prevailing prices for oil fall significantly. The US should become a net exporter of crude oil and petroleum products combined by 2019, if not 2018.” OPEC has misjudged the threat. As late as last year, it was dismissing US shale as a flash in the pan. Abdalla El-Badri, the group’s secretary-general, still insists that half of all US shale output is vulnerable below $85.

This is bravado. US producers have locked in higher prices through derivatives contracts. Noble Energy and Devon Energy have both hedged over three-quarters of their output for 2015. Pioneer Natural Resources said it has options through 2016 covering two- thirds of its likely production. “We can produce down to $50 a barrel,” said Harold Hamm, from Continental Resources. The International Energy Agency said most of North Dakota’s vast Bakken field “remains profitable at or below $42 per barrel. The break-even price in McKenzie County, the most productive county in the state, is only $28 per barrel.”

” .. if the industrial commodities that have fed China’s prodigious economic rise are taken as a guide, there is little need for debate: There has already been a hard landing ..”

• China Plays Big Role In Oil’s Slide (MarketWatch)

All eyes have been on OPEC after its failure to agree to a production cut triggered the latest dramatic slide in the price of crude oil. But if you want to understand why the demand side of oil has been unraveling — and why it could continue — look no further than China. Opinion over the state of the world’s second-largest economy is typically divided between whether it is merely undergoing a rebalancing or a more painful slowdown after years of excessive credit growth. But if the industrial commodities that have fed China’s prodigious economic rise are taken as a guide, there is little need for debate: There has already been a hard landing, as all the prices of these resources have collapsed to multi-year lows. Now oil is falling in line as it too adjusts to a world where China is no longer bidding prices ever higher. Granted, oil is different from steel, iron ore and coal, where China is the world’s largest consumer (The U.S. still consumes almost twice as much oil as China). Yet Chinese demand is still pivotal.

China became the dominant source of growth in crude-oil demand as it joined the world economy in recent decades. Indeed, Société Générale comments China’s opening to world trade was responsible for lifting the oil price from around $20 a barrel to around $100. This price move approximately correlates with China joining the World Trade Organization at the beginning of the last decade, a period in which the nation, by itself, added the equivalent of Japanese and U.K. total oil consumption. The oil market is unlikely to find another country, or even a continent, that can take over this degree of heavy lifting in demand growth. Meanwhile, longer-term forecasts that China can maintain anything close to its recent pace of growth increasingly look misplaced. Until recently, many economists had assumed that it was only a matter of time before China’s appetite for oil would surpass that of the U.S. But there are a number of reasons to question such bullish forecasts. For one, we can expect the Chinese investment cycle to be in for a prolonged adjustment as it digests past excesses.

There is widespread evidence of industrial overcapacity, and last week researchers at China’s National Development Commission became the latest to highlight this issue. In a new report, they estimated $6.8 trillion of “ineffective investment” had been wasted. There are other signs that China’s thirst for oil is coming up against capacity constraints. After surpassing the U.S. as the biggest automobile market in the world in 2010, recent years have seen traffic jams and pollution become recurring problems. This has forced authorities to use administrative measures to rein in growth. We should also expect China’s future demand for oil to be more price-sensitive. In the past, demand appeared inelastic as growth continued even as crude prices reached triple-digits. But this period coincided with state-funded industry being the dominant driver, whereas demand for gasoline for cars can be expected to be dependent on the income growth of the middle class.

It’s close to contraction, and that’s a a long way away from 7.5% growth.

• China Factory Gauge Drops as Shutdowns Add to Slowdown (Bloomberg)

A Chinese manufacturing gauge fell as factory shutdowns aggravated a pullback in the economy, raising pressure on the central bank to ease policy further after it lowered interest rates for the first time in two years. The government’s Purchasing Managers’ Index (PMI) fell to an eight-month low of 50.3 in November, compared with the 50.5 median estimate of analysts in a Bloomberg survey and October’s 50.8. Readings above 50 indicate expansion. The government ordered factories in Beijing and surrounding regions to shut down during the Asia-Pacific Economic Cooperation forum to curb pollution. China’s central bank cut interest rates last month as the economy heads for its slowest full-year expansion since 1990.

“Today’s official PMI reading points to continued downward pressure on manufacturing activity,” said Julian Evans-Pritchard, China analyst in Singapore at Capital Economics Ltd. “The recent cut in the benchmark rate will do little to boost economic activity unless followed by a loosening of quantitative controls on lending, which policymakers will remain cautious about given concerns over mounting credit risk.” The official PMI is released by the National Bureau of Statistics and China Federation of Logistics and Purchasing in Beijing. The index is based on responses to surveys sent to purchasing executives at 3,000 companies. The final reading of another manufacturing PMI for November from HSBC Holdings Plc and Markit Economics was 50.0. It was unchanged from a preliminary reading.

Iron, steel, oil, it’s all under huge pressure. All the producers have gambled on continuing growth. And there’s more: “Meanwhile, the biggest mining companies say they are still committed to plans to keep topping production records.”

• China’s Slowdown Hits Iron-Ore Prices (MarketWatch)

China’s hunger for minerals to build skyscrapers, cars and bridges produced a decadelong surge in the price and production of key commodities. Now, exporting nations are feeling the hit as the China-fueled boom slows. Topping the list are big commodity players Australia and Brazil, but also smaller resource-rich countries, such as Guinea, Indonesia and Mongolia, where minerals make up a disproportionate share of the economy and employment. In countries specializing in crucial commodities, such as iron ore and coal, sluggish demand and falling commodity prices are reducing government tax revenue, increasing trade deficits and affecting currency values. The Australian dollar reached a four-year low in November against the U.S. dollar due in part to sliding raw-material prices and slowing Chinese demand growth for those commodities. J.P. Morgan this month cut its forecast for 2015 Australian economic growth to 2.8% from 3.3%, and Brazil recently halved its own growth forecast for 2014 to 0.9% from 1.8%.

Mining profits as a share of the economy in both countries more than doubled during the past 15 years, according to the World Bank. The longer-term impact of a collapse in commodity prices could be even more profound, hurting the economies of producing countries and boosting buying power in Western consumer economies. “The impact of oversupply could be a mess,” says Lourenco Goncalves, CEO of Cliffs Natural Resources, a midsize miner that laid off workers in Australia. Meanwhile, the biggest mining companies say they are still committed to plans to keep topping production records. Rio Tinto and BHP Billiton have been shipping cargoes from Australia’s remote northwest at record rates. For smaller countries, the growing dependence on mining is even more apparent. In Guinea, the share of mining profits as a percentage of GDP more than tripled to 18.3% between 2000 and 2012, the latest data available, according to the World Bank. And in Mongolia, it nearly doubled to 11.9%.

All the news about a China slowdown, and then this?! I don’t believe the numbers presented here for a minute.

• China Winning in OPEC Price War as Hoarding Accelerates (Bloomberg)

China is emerging as the winner from OPEC’s battle with rival oil producers as the world’s biggest energy consumer stockpiles crude. The nation’s efforts to boost reserves may increase its imports by as much as 700,000 barrels a day in 2015, according to London-based Energy Aspects. That’s more than half the global glut forecast by Citigroup Inc. after the Organization of Petroleum Exporting Countries refrained from cutting output at its meeting last week. Brent crude has slumped 41% from its peak in June. The dwindling number of investors still betting on a rebound in prices can at least count on Chinese demand.

OPEC decided to maintain output targets even as a shale boom boosts U.S. production to the highest in more than three decades and causes a global supply glut. As crude extends its slump to the lowest level in more than four years, China is seeking to build a strategic petroleum reserve. “This is a golden time window to acquire more strategic oil stockpiles at lower costs,” Gordon Kwan, the Hong Kong-based head of regional oil and gas research at Nomura Holdings Inc., wrote in an e-mail Nov. 28. China will be “a big beneficiary” from the OPEC decision, he said.

“We’ll get more pressure on gold. The overall outlook is not looking great.”

• Swiss Vote Against Gold Deals Blow to Investors Hurt by Slump (Bloomberg)

With no chance that the Swiss central bank will be the next big buyer of gold, it’s one more reason for investors to be bearish. Voters today rejected a referendum requiring the Swiss National Bank hold at least 20% of its 520-billion-franc ($540 billion) balance sheet in gold. Had it been approved, it would have led to purchases of at least 1,500 metric tons over five years. With lower oil prices reducing costs for consumers and the U.S. considering raising interest rates, demand is fading for hedges against inflation such as gold. Gold has lost 16% since peaking in March and investor holdings of exchange-traded products are near a five-year low. While prices probably won’t be affected too much by the “no” vote of the initiative called “Save Our Swiss Gold,” approval would have improved sentiment and increased prices by as much as $50 an ounce, HSBC estimated in November.

“Gold had received some support in the last couple of weeks” before the vote, Georgette Boele, an analyst at ABN Amro Bank, said by phone. “We’ll get more pressure on gold. The overall outlook is not looking great.” The proposal stipulating the SNB raise the portion of its assets held in gold from about 8% now was voted down by 77% to 23%. The initiative would have also prohibited the SNB from ever selling any of its bullion and required the 30% currently stored in Canada and the U.K. to be repatriated. Polls forecast the initiative’s rejection. Approval would have probably made Switzerland the world’s third-biggest holder by country of the metal. Analysts had said purchases would have been at least 1,500 tons over five years. Adding 300 tons a year would equal about 7% of annual global consumption. SNB policy makers had a higher estimate, forecasting 70 billion francs worth of gold, or about 1,932 tons.

Proponents of the initiative said boosting bullion holdings would help preserve national wealth. The SNB and national government had argued that approving the measure could undermine efforts to prevent the franc from surging against the euro and erode the bank’s annual dividend distribution to regional governments.

“The starting point is that the SNB cannot let the floor go. They will fight for it. They will do whatever it takes to defend the floor ..”

• Swiss Headache To Continue Beyond Gold Vote (WSJ)

A Swiss vote on whether the country’s central bank should drastically ramp up its gold holdings — forever– happens this Sunday. The result is likely to be a no if the latest polls are accurate. But even in case of a negative outcome the pressure on the Swiss National Bank to cut interest rates below zero will not go away. The franc has been flying high of late, in part because the market has sniffed the possibility that forcing the SNB to buy lots and lots of gold (that’s what the vote’s all about) could cause problems for the central bank’s efforts to hold the currency down. The Swiss central bank keeps a floor on the currency, which controls how strong it gets against the euro, to protect the country’s exporters from an overly strong franc, which would damage them at international level. In order to do this, it buys euros which are added to its balance sheet.

With the new requirement in place, the SNB would have to match euro purchases with equal amounts of gold, which would not only be costly, but also permanent as it would be banned from selling it. Many have suggested that negative interest rates might be a useful tool for the central bank to deflect buying of the franc in the case the Swiss vote for the bank to ramp up its gold holdings to 20% by buying 1500 tons of gold over a period of five years. After all, the SNB has repeatedly said it’s open to the idea of negative rates. Since opinion polls started to point more clearly to a no vote, the franc has backed down a little. But the market’s bet on negative rates has not subsided.

Libor three month futures on the Swiss franc suggest that the market is pricing 0.11 percentage point in cuts by the end of next year, or a 45% probability of a 0.25 percentage point cut by the end of 2015, said a trader at SocGen. “The market is expecting rate cuts in the future and in the Swiss case, negative rates, to follow in the ECB footsteps. ”That’s the rub: the European Central Bank cut its deposit rate below zero in June, and it’s still firmly in easing mode. This has weakened the euro against all currencies, including against the franc, with the euro trading just above the level set by the central bank. “The starting point is that the SNB cannot let the floor go. They will fight for it. They will do whatever it takes to defend the floor,” said Samy Char, investment strategist at Swiss asset manager Lombard Odier. Negative rates may be part of that mix, investors and analysts add.

Abenomics is a colossal failure that was entirely foreseeable. And still the Krugmans of the world call for Europe to do what Japan did.

• Moody’s Downgrades Japan As Concerns Grow (CNBC)

Fears over the future of Japan’s economy are growing – and Moody’s, the credit ratings agency, reflected this on Monday by cutting its credit rating to A1 from AA3. The news came just after the country’s main stock market, the Nikkei, closed at a seven-year high. Increased “uncertainty” over whether Japan Prime Minister Shinzo Abe can achieve his deficit-cutting goals, and “the timing and effectiveness of growth enhancing policy measures” have made Japanese government debt riskier in the medium term, analysts at Moody’s said in a release. They added that the outlook for the rating was stable.

Abe swept into power two years ago, and was hailed as a savior because of his plan to reinvigorate Japan’s moribund economy – known as “Abenomics”. The three main pillars of Abenomics are: a large fiscal stimulus, more aggressive monetary easing from the Bank of Japan, and structural reforms to the country’s economy. Japan has been in a deflationary spiral for two decades, and it remains to be seen whether Abenomics can shake it out. Abe has called a snap election for December 14, in an effort to secure another four years to see his policies through. However, his popularity seems to be in decline. Japan’s economy is now back in recession after GDP shrank by 0.4% in the third three months of the year, on a quarter-on-quarter basis.

How crazy is it that Abe is still set to win the December 14 snap election?

• In Fading Japan Hinterland, Skeptics Doubt “Abenomics” Will Cure Ills (Reuters)

Mihoko Asaka wants to know how candidates in this month’s election in Japan will create jobs and halt the drastic population decline that is bleeding her home region of youth and vitality, but has little hope they will offer real solutions. Like many of his age group, her 25-year-old son left the largely rural prefecture of Akita in northeastern Japan to find work after graduating from college. “I’m interested to see how much they are listening to the voices from this region,” said Asaka, 57, waiting for a bus in Akita City, the prefecture’s capital. “But I don’t think our voices are being heard. They talk about money being thrown around, but we can’t see where it goes.” Critics say Prime Minister Shinzo Abe’s policies to end deflation and generate growth have helped mainly big cities, large companies and the rich by boosting share prices and exporters’ profits with a hyper-easy monetary policy that has slashed the value of the yen and sent asset prices higher.

All too aware of the criticism, Abe has made spreading the benefits of his “Abenomics” agenda to “every nook and cranny” of Japan a key plank of his Liberal Democratic Party (LDP) platform for the Dec. 14 lower house election. The LDP-led ruling coalition is expected to keep its lower house majority, so interest is focused on whether and to what extent its grip on two-thirds of the chamber erodes. Akita prefecture, with the dubious distinction of having Japan’s highest suicide rate and fastest-shrinking population, definitely needs a boost. Already, about 30% of its population is aged 65 and over compared to 25% nationwide, with the ratio predicted to rise to more than 40% by 2040, when Akita’s total population will have fallen by more than a third to 700,000.

TEXT

• Eurozone Manufacturing Falls As Germany Contracts (CNBC)

Euro zone manufacturing activity missed forecasts and slowed in November, with German activity contracting — hitting hopes of a pick-up in the bloc’s largest economy. Markit’s euro zone manufacturing PMI was nearly flat at 50.1 in November, missing analysts’ forecasts of 50.4. This was a fall from the 50.6 recorded in October. The latest figures will raise concerns among policymakers at the European Central Bank (ECB) who are battling extremely low inflation in the single currency bloc. Three of the euro zone’s largest economies – Germany, France and Italy – saw manufacturing activity contract in October. Germany’s November manufacturing PMI came in at 49.5, France’s reading was 48.4, and Italy’s figure was at 49, all below the 50 mark that signifies growth.

“With the final PMI coming in below the flash reading, the situation in euro area manufacturing is worse than previously thought. Not only is the performance of the sector the worst seen since mid-2013, there is a risk that renewed rot is spreading across the region from the core,” Chris Williamson, chief economist at Markit, said in a press release. “The sector has more or less stagnated since August, but we are now seeing, for the first time in nearly one-and-a-half years, the three largest economies all suffering manufacturing downturns.” The near-stagnant euro zone-wide PMI figure was driven by falling levels of new business and lackluster export orders, Markit said, alongside signs of slowing global growth. The fall in manufacturing growth also came amid continued price pressures with factories continuing to cut prices.

“I am sure shareholders would trade an executive or two for a few billion less in regulator fines.”

• So Banks Are Too Big To Fail. Are They Also Too Big To Regulate? (Guardian)

The broken culture of high street banking will take a generation to fix, according to a report this week. The thinktank New City Agenda calculated that over the past 15 years banks had incurred £38.5bn in fines and redress for the mistreatment of customers. Bank boards and their regulators acknowledge the need for change, and by all accounts this is a massive problem. So why should it take so long – and how can we force things to move faster? A few months ago, a dealer in old wine was given a 10-year sentence for misrepresenting the quality of the contents. A banker who misrepresented his or her product would not face anything like this penalty. Despite scandal after scandal, the absence of personal accountability persists.

The size of penalties varies by regulator, but the unwillingness to punish the individual perpetrator does not. The message being sent from the regulators to the banks is: “Here’s the deal: we fine you a ton of money; no one goes to jail; no individual is named; and the best part – you can settle the bill with your shareholders’ dough!” True, in Britain the government is proposing new laws to make criminal behaviour a crime. But tools already in place remain untouched. The UK has long had an “approved persons” regime administered initially by the Financial Services Authority, and now by the Prudential Regulatory Authority. The PRA determines who is fit and proper to hold key positions in finance. Most of the focus has been on who is approved and how. But prior authorisations can be revoked. One wonders why they haven’t.

Surely there is no shortage of scandal-linked wrongdoers. Who would not want them to act? Think about the list of those who have a stake in the matter. Banks serve multiple stakeholders. These include society, clients, shareholders, employees and executives. We have already mentioned society’s outrage and clients’ dismay. Both have been clamouring for justice. What about the others? Surely shareholders should want the unfit to be identified and punished. After all, the depth, breadth and persistence of the wrongdoing shows that either management were complicit in their subordinates’ actions, or they were too incompetent to prevent it. Take your pick, but both are cases for being banned as unfit for such responsibilities. I am sure shareholders would trade an executive or two for a few billion less in regulator fines.

“I’m pretty tired, as Forrest Gump would say .. ”

• Tired’ Grillo Overhauls Leadership Of Italy’s 5-Star Movement (Reuters)

Beppe Grillo, the unruly comic who built Italy’s 5-Star Movement into one of the most potent anti-establishment forces in Europe, is struggling to stop a steady slide following months of infighting and electoral setbacks. After a week that saw two local election defeats and two parliamentary members expelled from the party, Grillo announced his movement needed a more formal leadership structure. A five-member committee, approved by an online poll, will take over much day-to-day running with the aim of strengthening foundations for the future. The 66-year-old Grillo said he would remain as “guarantor” but what that means is unclear. “I’m pretty tired, as Forrest Gump would say,” he wrote in his blog beneath a mock-up of himself as the movie character, telling a band of followers that he is ending a marathon run across the country.

One of the most successful of the anti-system parties that have blossomed in Europe during the financial crisis, Grillo’s movement is fueled by anger at a corrupt and inefficient political class. It remains Italy’s second-biggest party but after its triumph in the 2013 elections, when it won 25% of the vote, it has struggled in parliament. In the latest of a string of disputes over issues including whether members may appear on television, two deputies were thrown out this week, accused of failing to repay state funding as party rules demand. The latest expulsions left the 5-Star Movement with 143 seats in parliament, compared with the 163 it won last year. It has done poorly in recent local elections, taking only 13% and 5% respectively last week in the regions of Emilia-Romagna and Calabria.

In its place, the anti-immigrant Northern League, which shares Grillo’s hostility to the euro, is capturing more of the protest vote, coming second in Emilia-Romagna, a traditional stronghold of the left. Even Silvio Berlusconi, fighting to regain influence following a conviction for tax fraud, has re-emerged. In an opinion poll last week, he beat Grillo’s personal approval rating for the first time in months. “Grillo’s tired. I’m in better form than ever,” he said on Saturday. Marco Travaglio, a prominent columnist for Il Fatto Quotidiano, a newspaper generally sympathetic to Grillo’s movement, wrote that the disputes were “suicidal” and would only strengthen Prime Minister Matteo Renzi, “who, with adversaries like this, can stay 100 years.”

Wouldn’t that be something?

• Commercial Seafood Set to Disappear from Oceans in 2048 (Alternet)

A prominent marine research ecologist says that commercial seafood could disappear from our oceans within the next three decades if humans don’t take action immediately. Boris Worm of Dalhousie University in Halifax, Canada said the oceans are quickly losing biodiversity and that nearly 30% of seafood species humans consume are already too small to harvest. If the long-term trend continues, there will be little or no seafood available for a sustainable harvest by 2048. Dr. Worm’s study was recently published in the journal Science and is an update of a study published in 2006. Importantly, the study is about the collapse of commercial catches, not species extinction. Catch collapse means that fish are caught at 10% or less of the rate they had been caught historically. Several media outlets have incorrectly stated that the study warns all seafood will be gone from the oceans.

CBS News, for example, reported that “the apocalypse has a new date: 2048” and that the oceans would be empty of fish at that time. To our knowledge, the television network has not issued a retraction. “We never said that,” says Dr. Worm. “We never talked about extinction. We talked about the collapse of the commercial catches.” Still, Worm and his international team of scientists and economists say that catch collapses paint a grim picture for the ocean and for human health. The accelerated loss of biodiversity, they say, is imperiled by overfishing, pollution, habitat loss and climate change. Saltwater ecosystems, including human populations that depend on it for survival, can be adversely affected by dwindling populations. Harmful algae blooms, coastal flooding and poor water quality can be the results of reduced fish populations. “Biodiversity is a finite resource, and we are going to end up with nothing left…if nothing changes,” says Worm.

Still not going well at all. New warnings are iddues about the threat of ebola spreading.

• Ebola Death Toll in 3 West African Countries Most Affected Nears 7,000 (WSJ)

Nearly 7,000 people have died from the Ebola virus disease in the three West African countries most affected by the current outbreak, according to new data from the World Health Organization. In an update, the United Nations health agency said 16,169 confirmed, suspected or probable cases of Ebola had been reported in Guinea, Liberia and Sierra Leone. The three countries are at the epicenter of the current outbreak. A total of 6,928 people have died of Ebola in the three countries since the outbreak began, the WHO said. Liberia reported the biggest rise in deaths; more than 1,000 since WHO data released on Wednesday The agency, which recently changed the format it uses for reporting Ebola data, provided no commentary as to why the death toll jumped.

However, a spokesman said via email that the increase was caused by previously unreported deaths now being counted in the official statistics, rather than a rash of new fatalities. The WHO has previously said some local authorities have had difficulty processing paperwork quickly. The agency has said its count may greatly underestimate the toll, and the U.S. Centers for Disease Control and Prevention has said it believes the actual count could be between two and four times the WHO numbers. Ebola causes high fever and internal bleeding. The disease spreads via bodily fluids and the corpses of its victims can be contagious.

Home › Forums › Debt Rattle December 1 2014