Marjory Collins “Italian girls watching US Army parade on Mott Street, New York” Aug 1942

The financial world caught behind the oil curve: they listen only to Yellen.

• The Federal Reserve’s Language Lessons (Reuters)

“Will they or won’t they?” is the question on investors’ minds as the Federal Reserve policy-setting committee meets next week for the last time this year. Markets have followed Fed speakers closely in recent weeks for clues on whether the U.S. central bank will change key language in its post-meeting statement regarding how long it will keep benchmark interest rates near zero. Some expect the Fed to remove the reference to “considerable time” when setting a time frame for near-zero rates and maybe replace it, as it did ahead of the 2004-2005 monetary policy tightening cycle, with a nod to being “patient”. But that belief has been complicated somewhat by the slump in oil prices that has pulled inflation expectations lower and caused the S&P stock index to post its first negative week in eight on Friday.

The expectation of lower inflation could prevent the Fed from changing its current stance. Client notes from Goldman Sachs, Citi and Bank of America/Merrill Lynch this week deal with expectations for the removal of the wording, roughly agreeing that however close the call is, it is more likely than not that the phrase will go away. “They are going to remove it; I don’t think (Fed Chair Janet Yellen) is going to keep it in there just because of what we are seeing with the energy sector,” said Sean McCarthy, regional chief investment officer for Wells Fargo Private Bank in Scottsdale, Arizona. “All the other data has been strong, whether you are looking at construction, at the ISM numbers, and especially the jobs data that she cares about most.”

Indeed, recent statements from Fed officials suggest the language could be changed. Goldman Sachs, in a note, pointed to “widespread use of the word ‘patient'” as a signal that “some participants would prefer to revise the current language.” The lack of consensus on the Fed’s move all but guarantees that whatever the Federal Open Market Committee’s statement says on Wednesday the stock market will be volatile, as it usually is on Fed decision days. “The goal,” said the BofA/Merrill note, “will be to smooth the market’s reaction. The Fed does not intend to signal a fundamental shift in policy, and we expect chair Yellen’s press conference remarks to reinforce this point.”

While Americans are not just behind the curve, they positively confirm a top has been reached. If ever you needed a sign, this is it: “Their expectations run quite counter to recent price data.”

• After Years Of Doubts, Americans Turn More Bullish On Economy (Reuters)

Pessimism and doubt have dominated how Americans see the economy for many years. Now, in a hopeful sign for the economic outlook, confidence is suddenly perking up. Expectations for a better job market helped power the Thomson Reuters/University of Michigan index of consumer sentiment to a near eight-year high in December, according to data released on Friday. U.S. consumers also saw sharp drops in gasoline prices as a shot in the arm, and the survey added heft to strong November retail sales data that has showed Americans getting into the holiday shopping season with gusto. “Surging expectations signal very strong consumption over the next few months,” said Ian Shepherdson, an economist at Pantheon Macroeconomics.

While improvements in sentiment haven’t always translated into similar spending growth, consumers at the very least are feeling the warmth of several months of robust hiring, including 321,000 new jobs created in November. When asked in the survey about recent economic developments, more consumers volunteered good news than bad news than in any month since 1984, said the poll’s director, Richard Curtin. Moreover, half of all consumers expected the economy to avoid a recession over the next five years, the most favorable reading in a decade, Curtin said. The data bolsters the view that the U.S. economy is turning a corner and that worker wages could begin to rise more quickly, laying the groundwork for the Federal Reserve to begin hiking its benchmark interest rate to keep inflation from eventually rising above the Fed’s 2% target.

Overall, the sentiment index rose to a higher-than-expected 93.8, mirroring levels seen in boom years like 1996 and 2004. Many investors see the Fed raising rates in mid-2015, and policymakers will likely debate at a meeting next week whether to keep a pledge that borrowing costs will stay at rock bottom for a “considerable time.” Consumers see faster inflation ahead. Over the next year, they expect a 2.9% increase in prices, up from 2.8% in November, according to the sentiment survey. Their expectations run quite counter to recent price data. The Labor Department said separately its producer price index dropped 0.2% last month, brought lower by falling gasoline prices. Prices were soft even excluding the drag from gasoline.

“The market hasn’t seen the response they’re looking for on the supply side yet ..”

• Oil Seen Dropping to $55 ($45?) Next Week as Price Rout Deepens (Bloomberg)

Benchmark U.S. oil prices are poised to test $55 a barrel after a six-month rout pushed crude to the lowest in five years. West Texas Intermediate crude ended below $58 today for the first time since May 2009 after the International Energy Agency cut its global demand forecast for the fourth time in five months. Prices are down 46% from this year’s highest close of $107.26 on June 20. “By taking out $58, oil is moving towards the next target $55,” said Phil Flynn, senior market analyst at Price Futures. “It’s such an emotional selloff, and the even numbers are going to be the magic numbers.” WTI for January delivery dropped $2.14, or 3.6%, to $57.81 a barrel today on the New York Mercantile Exchange. Brent slid $1.83 to $61.85 on the London-based ICE Futures Europe exchange, the lowest since July 2009.

Both benchmarks have collapsed about 20% since Nov. 26, the day before OPEC agreed to leave its production limit unchanged at 30 million barrels a day. U.S. output, already at a three-decade high, will continue to rise in 2015, according to the IEA, which reduced its estimate for oil demand growth in 2015 by 230,000 barrels a day. “We could definitely see $55 next week,” said Tariq Zahir, commodity fund manager at Tyche Capital. “We are probably going to see some violent trading.” Skip York, vice president of energy research at Wood Mackenzie, said the next price target is $45. “The market hasn’t seen the response they’re looking for on the supply side yet,” York said. “We’re now in this environment where I think prices are going to keep drifting down until the market is convinced, until the signal that production growth needs to slow has been received and acted on by operators.”

“At first it was just oversupply of oil. But now it’s that, plus fear of a world economy that’s growing too slow.”

• US Stocks Tumble to Cap Dow’s Worst Week Since 2011 (Bloomberg)

U.S. stocks sank, with the Dow Jones Industrial Average capping its biggest weekly drop in three years, as oil continued to slide and Chinese industrial data raised concern over a global economic slowdown. Materials stocks declined the most in the Standard & Poor’s 500 Index, losing 2.9% as a group, while energy shares dropped 2.2%. IBM, DuPont and Exxon Mobil sank at least 2.9% to lead declines in all 30 Dow stocks. The S&P 500 lost 1.6% to 2,002.33 at 4 p.m. in New York, extending losses in the final hour to cap a weekly drop of 3.5%. The Dow sank 315.51 points, or 1.8%, to 17,280.83. The Dow slid 3.8% for the week, its biggest decline since November 2011. “Clearly the oil situation is driving things,” Randy Warren at Warren Financial said. “At first it was just oversupply of oil. But now it’s that, plus fear of a world economy that’s growing too slow. Those fears are definitely outweighing the positive signs we’re seeing domestically.”

The selloff picked up speed in the final hour as the Dow average plunged more than 100 points and the S&P 500 ended about 2 points above its average price for the last 50 days, a level monitored by technical analysts. At about 2:50 p.m., March futures on the benchmark gauge for U.S. equities slipped below 2,000 for the first time since Nov. 4. More than $1 trillion was erased from the value of global equities this week as oil prices tumbled, raising concern over the strength of the global economy. Oil extended losses today amid speculation that OPEC’s biggest members will defend market share against U.S. shale producers. The IEA cut its forecast for global oil demand for the fourth time in five months.

“Everyone is trying to squeeze through a very small door.”

• Oil Rot Spreading in Credit (Bloomberg)

Credit investors are preparing for the worst. They’re cleaning up their portfolios, selling riskier debt that’s harder to trade in bad times and hoarding longer-term government bonds that do best in souring markets. While investors have pruned energy-related holdings in particular as oil prices plunge, they’re also getting rid of other types of corporate bonds, causing yields to surge to the highest in more than a year. “We believe the pervasive nature of the sell-off is more reflective of overall liquidity concerns in the cash market than of fundamental deterioration,” Barclays analysts Jeffrey Meli and Bradley Rogoff wrote in a report today. “The weakness, while certainly most pronounced in the energy sector, has been broad based.”

Rather than waiting around for a trigger to escalate this month’s selloff, investors are pulling out of dollar-denominated corporate debt now, causing a 0.8% decline in the notes this month, according to a Bank of America Merrill Lynch index that includes investment-grade and junk-rated securities. This would be the first month of losses since September. Yields on the debt have surged to 2.21 percentage points more than benchmark rates, the highest premium in 14 months. While the biggest driver of the selling is plummeting oil prices, the selling extends beyond just energy. Bonds of wireless provider Verizon have fallen 1% this month and debt of HCA, a hospital operator, has dropped 1.2%, Bank of America Merrill Lynch index data show.

Even though the global speculative-grade default rate is less than half its historical average at 2.2%, investors are getting ready for sentiment to turn. When that happens, it may be all the more difficult to get out as hoards of other investors try to sell in a market where trading hasn’t kept pace with the growth of outstanding debt. There’s “very little liquidity” in corporate bonds, especially in lower-rated debt, Bill Gross, who joined Janus Capital in September, said today in a Bloomberg Surveillance interview with Tom Keene. “Everyone is trying to squeeze through a very small door.”

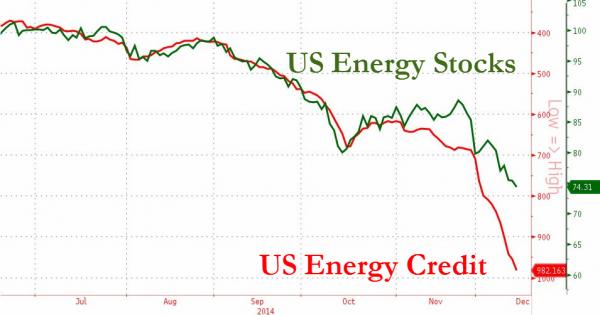

Just take one look at that energy junk bond chart.

• We Have Just Escaped The Earth’s Gravity And Are Now In Space Orbit (Zero Hedge)

Houston, we have a serious problem… With only 20% of US Shale regions remaining economic at these oil price levels, it should not be surprising that the credit risk of the US Energy sector is exploding to near 1000bps… and contagiously infecting the broad HY market… Credit risk in the energy sector is starting to infect the broad HY market – HYG at 2-year yield highs and HYCDX near 15-month wides…

Which signals considerable pain to come for US Energy stocks..

“It’s starting ..”

• U.S. Oil Rigs Drop Most in Two Years, Baker Hughes Says (Bloomberg)

U.S. oil drillers idled the most rigs in almost two years as they face oil trading below $60 a barrel and escalating competition from suppliers abroad. Rigs targeting oil dropped by 29 this week to 1,546, the lowest level since June and the biggest decline since December 2012, services company Baker Hughes said on its website yesterday. As OPEC resists calls to cut output, U.S. producers including ConocoPhillips and Oasis Petroleum have curbed spending. Chevron put its annual capital spending plan on hold until next year. Rigs targeting U.S. oil are sliding from a record 1,609 after a $50-a-barrel drop in global prices, threatening to slow the shale-drilling boom that has propelled domestic production to the highest level in three decades.

“It’s starting,” Robert Mackenzie, oilfield services analyst at Iberia Capital, said. “We knew this day was going to come. It was only a matter of time before the rig count was going to respond. The holiday is upon us and oil prices are falling through the floor.” ConocoPhillips said Dec. 8 that would cut spending next year by about 20%. The Houston-based company is deferring investment in North American plays including the Permian Basin of Texas and New Mexico and the Niobrara formation in Colorado. Oasis, an exploration and production company based in Houston, said Dec. 10 that it’s cutting 2015 spending 44%.

“Our capex will be lower,” Roger Jenkins, chief executive officer of Murphy Oil, an Arkansas-based exploration company, said during a presentation Dec. 10. “I think this idea of lowering capex around 20% is going to be pretty common in the industry.” Even as producers cut budgets and lay down rigs, domestic production is surging, with the yield from new wells in shale formations including North Dakota’s Bakken and Texas’s Eagle Ford projected to reach records next month, Energy Information Administration data show. Oil output climbed to 9.12 million barrels a day in the week ended Dec. 5, the highest in EIA data going back to 1983, and is projected to increase to 9.3 million barrels a day next year.

“I won’t express my own opinion…”

• Don’t Vote ‘Wrong’ Way, EU’s Juncker Urges Greeks (Reuters)

The European Union’s chief executive has given Greeks a stark and unusual warning of major problems if they vote the “wrong” way and radicals win an early parliamentary election. Jean-Claude Juncker, the president of the European Commission, stressed in remarks carried late on Thursday by Austrian broadcaster ORF that he was not trying to insert himself into the Greek political process. In general, EU officials take pains to avoid accusations of interference and Juncker’s remarks went beyond the normal reticence. As the government in Athens faces a possible election and defeat by an untried left-wing party that opposes the terms the EU has set on Greece’s financial bailout, Juncker said he was not averse to seeing “familiar faces” remaining in charge. Prime Minister Antonis Samaras said on Thursday that Greece risked a “catastrophic” return to financial crisis if his government fell as a result of a parliamentary vote he has called for this month to elect a head of state.

Juncker, who was closely involved in managing the euro zone debt crisis when he was prime minister of Luxembourg, said he was sure Greek voters understood the risks of an election that polls show could bring to power the left-wing Syriza party. “I assume that the Greeks – who don’t have an easy life, above all the many poor people – know very well what a wrong election result would mean for Greece and the euro zone,” he said. “I won’t express my own opinion. I just wouldn’t like extremist forces to take the wheel. “I would like Greece to be governed by people with an eye on and a heart for the many little people in Greece – and there are many – and also understand the necessity of European processes.” He said he did not view market ructions in Greece of late as a sign that a new Greek crisis was breaking out.

“.. the euro zone cannot withstand another full scale recession and will ultimately fracture despite the best efforts of the ECB.”

• Albert Edwards: China Deflation Risks Sparking A Eurozone Break-Up (CNBC)

Societe Generale’s uber-bearish strategist Albert Edwards believes that investors are slowly waking up to the idea that the Chinese have a “major deflation problem” and its transition into a more consumer-led economy won’t be a smooth one. Traditionally the country is known for its cheap exports that compete strongly with domestically produced goods around the world. That model is unlikely to change soon, according to Edwards. “The realization that China will be exporting more deflation helps to explain why U.S. inflation expectations continue to plunge despite recent stronger than expected real economy data,” he said in a note on Thursday.

He continues to warn that weakness in emerging markets could seriously impact Germany, the traditional powerhouse for the euro bloc. Germany sees China as one of the biggest buyers of its goods. Edwards said that Germany will eventually have to “walk the walk” and aggressively cut spending as it falls into recession next year. “My own view is that the euro zone cannot withstand another full scale recession and will ultimately fracture despite the best efforts of the ECB,” he said.

“I am just not perceiving the global economy on the verge of a boom…the risks look to the downside – especially as the effects of lower oil are factored in.”

• Would Global Deflation Really Be That Bad? (CNBC)

The collapse in oil process may only be a few months old, but economists are already debating its long-term effects: will the world be gripped in growth-sapping Japanese-style deflation or will the world economy benefit from a period of lower prices? Deflation is classed as when consumer prices turn negative with the theory being that buyers would hold off from making purchases in the hope of further falls. This raises the fear of a prolonged deflationary spiral with the slump becoming so entrenched that it impacts growth and does little for the potential of wage increases. The price of oil has seen a dramatic 40% fall since June and has weighed on headline inflation figures and is likely to continue to do so next year. Consultancy Capital Economics estimate that the energy component of inflation in advanced economies will fall temporarily to around minus 10% next year. Some consumers see little price reductions at the pump as their governments subsidize the commodity, but in the U.S. many have been cheering the drop in oil which has put more money in their pocket.

Bill Blain, a fixed income strategist at Mint Partners argues that lower oil prices does not necessarily translate into growth, however. “Oil price declines are initially hailed as positive growth drivers – but in an already recessionary environment, perhaps they have become a soporific too far?,” he said in a morning note on Friday. “I am just not perceiving the global economy on the verge of a boom…the risks look to the downside – especially as the effects of lower oil are factored in.” Consumer prices in November rose 0.3% for the euro zone, compared to the year before, and the European Central Bank has regularly downgraded its prospects for the next year as 2015 approaches. In the U.S., annual inflation still remains below the 2% goal given by the Federal Reserve. The Bank of England is expecting the U.K.’s inflation rate to fall below 1% next year and China’s number currently sits at a five-year low.

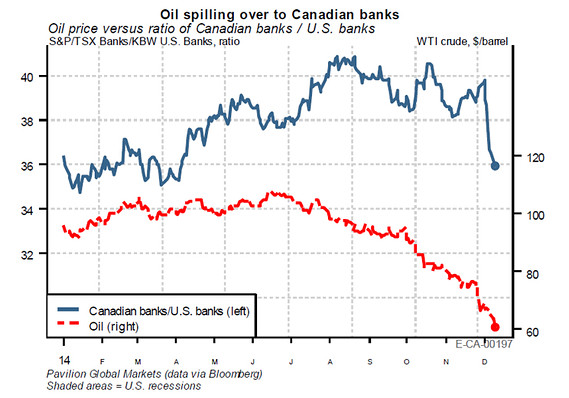

“In this context, the risk to Canadian banks doesn’t stem necessarily from a narrow view of loans to oil companies, but more from a broad macro risk perspective.”

• Falling Oil Threatens Canada’s Bulletproof Banking System (MarketWatch)

While the U.S. financial system – as well as many international banks – has gotten hopped up on a wide assortment of financial opiates and stumbled through more than a dozen bank-fueled crises through the decades, Canada boasts a stellar track record of banking sobriety. However, a spectacular death spiral in crude-oil futures – West Texas Intermediate settled Thursday at $59.95, a more than five-year low – threatens to deliver a serious shock to the banking system of the U.S.’s northern neighbor, according a research note published Thursday by Pavilion Global Markets. Canada ranks as one the world’s five largest energy producers and a net exporter of oil, according to the U.S. Energy Information Administration. So, a big drop in oil would pose several risks to Canada’s oil-dependent economy.

“The drop in oil prices, as mentioned above, will have wide-ranging implications on the Canadian economy,” Pavilion strategists Pierre Lapointe and Alex Bellefleur said in the note. It’s not just that Canada’s banks will find themselves saddled with souring loans from underwater energy producers. The problem, Pavilion argues, is that Canada’s employment rate could suffer as oil-related businesses are forced to close. Here’s how they put it: “In this context, the risk to Canadian banks doesn’t stem necessarily from a narrow view of loans to oil companies, but more from a broad macro risk perspective. As employment in the oil industry declines, a negative income and wealth shock to many households will take place, impacting a variety of loans (credit card, mortgage) on Canadian bank balance sheets.”

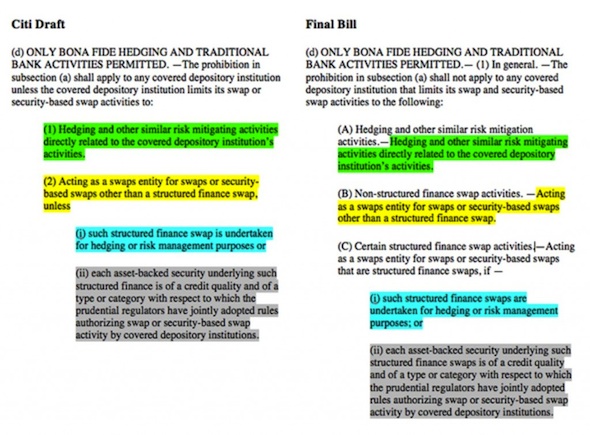

It’s insane what goes on here. Banks get to write laws, and now out in the open.

• How Elizabeth Warren Led The Great Swaps Rebellion of 2014 (Bloomberg)

John Carney couldn’t understand why the vote was so close. The Delaware congressman, a Democratic member of the House Financial Services Committee, had been there when a reform to the Dodd-Frank “swaps push-out” passed—in a 55-6 landslide. He’d joined a veto-proof majority, 292-122, to back the reform in a House bill that was throttled by the Democratic Senate. The bank-friendly Democrat had not expected the reform’s quiet return, as a rider in the must-pass “Cromnibus” spending package, to kick off a revolt. “This passed with nearly 300 votes,” said Carney on Thursday night, after the House had voted on the Cromnibus, and as legislators of both parties congratulated him or wished him Merry Christmas. “It would have been more than 300, like some of the other bills we’ve done, if there wasn’t this toxic description of what it might do. Unfortunately, the world we live in, the political world, is one of perception. I try to deal with the facts.”

“Sometimes that’s at odds with the way we do work here, where you get these political narratives that take on a larger than life part of the discussion.” Put it this way: Carney was not Ready for Warren. For the better part of two days, most of his fellow Democrats approached the Cromnibus—which did not de-fund the president’s immigration order, or the bulk of the Affordable Care Act—as a sell-out of cosmic proportion. This started when Massachusetts Senator Elizabeth Warren gave a Wednesday floor speech challenging her colleagues to restore swaps push-out, which prohibited banks from booking derivatives in their own subsidiaries. “The financial industry spent more than $1 million a day lobbying Congress on financial reform, and a lot of that money went to former elected officials and government employees,” said Warren. “And now we see the fruits of those investments. This provision is all about goosing the profits of the big banks.”

The backlash should have been predictable. As Carney recalled, the original bill to change the swaps rule lost some votes after critical media coverage. More specifically, the New York Times reporters Eric Lipton and Ben Protess noticed that Citigroup had practically written the swaps language; its “recommendations were reflected in more than 70 lines of the House committee’s 85-line bill.” Yet it didn’t become “toxic” until the fight over the “Cromnibus.” Warren made the swaps language infamous. In the House, she found an impromptu whip team led by Illinois Representative Jan Schakowsky and the party’s ranking member on the Financial Services Committee, California Representative Maxine Waters. She found an ally in the Minority Leader, California Representative Nancy Pelosi, who took the floor on Thursday to warn that the swaps rule was exactly the sort of time-bomb that could create another financial crisis in the pattern of 2008.

This rattled the Democrats’ appropriators, some of whom were heading for the exits. Virginia Representative Jim Moran spent a good part of Thursday telling reporters that Warren was “running for president” and drowning Democrats in her ambition. “She obviously has a lot of influence,” said Moran after the votes. “The media listens to everything she says.”

Here’s what Warren doesn’t like.

• $303 Trillion In Derivatives US Taxpayers Are Now On The Hook For (Zero Hedge)

Courtesy of the Cronybus(sic) last minute passage, government was provided a quid-pro-quo $1.1 trillion spending allowance with Wall Street’s blessing in exchange for assuring banks that taxpayers would be on the hook for yet another bailout, as a result of the swaps push-out provision, after incorporating explicit Citigroup language that allows financial institutions to trade certain financial derivatives from subsidiaries that are insured by the Federal Deposit Insurance Corp, explicitly putting taxpayers on the hook for losses caused by these contracts. Recall:

Five years after the Wall Street coup of 2008, it appears the U.S. House of Representatives is as bought and paid for as ever. We heard about the Citigroup crafted legislation currently being pushed through Congress back in May when Mother Jones reported on it. Fortunately, they included the following image in their article:

And the CIA once again thinks it’s in control of toppling a government.

• Venezuela’s Got $21 Billion. And Owes $21 Billion (Bloomberg)

Of all the financial barometers highlighting the crisis in Venezuela, this may be the one that unnerves investors the most as oil sinks: The country’s foreign reserves only cover two years of bond payments. The government and state-run oil company owe $21 billion on overseas bonds by the end of 2016, an amount equal to about 100% of reserves. Those figures explain why derivatives traders aren’t only betting that a default is almost certain but that it will most likely happen within a year. The 48% collapse in crude in the past six months stripped President Nicolas Maduro of the one thing – windfall profits for the country’s No. 1 export – that was preventing a full-blown crisis.

Even before oil started sinking, the OPEC member had depleted 30% of its international reserves in the past six years, the result of billions of dollars of capital flight triggered by the socialist push implemented by Maduro’s mentor and predecessor, the late Hugo Chavez. “These are panic capitulation levels,” Kathryn Rooney Vera, an economist at Bulltick Capital Markets, said in an e-mailed response to questions. “Oil’s continued price decline is ratcheting up risk aversion to exporters, and even more so for an economy already as distorted as that of Venezuela.” The cost to insure Venezuelan debt against non-payment over the next 12 months surged to about 6,928 basis points yesterday in New York, according to CMA data, widening the price gap over five-year protection to a record.

The upfront cost of one-year contracts implies a 65% probability of default by December 2015. Swaps prices show a 94% chance of non-payment by 2019. Venezuela’s benchmark bonds due 2027 have fallen for seven straight days, reaching 41.22 cents on the dollar as of 12:02 p.m. in New York today, the lowest in 16 years. Maduro said Dec. 10 that the government is doing everything it can to boost the price of oil, which he says should be about $100 a barrel. The country advocated unsuccessfully for production cuts at November’s meeting of members OPEC. Yesterday, Maduro said the country could export cement to bring more dollars into the country.

” .. there is no evidence or honest economic logic to support the proposition that – over any reasonable period of time – a nation can become richer by making its people poorer ..”

• Japan’s Lemmings March Toward The Cliff Chanting “Abenomics” (David Stockman)

According to Takahiro Mitani, trashing your currency, destroying your bond market and gutting the real wages of domestic citizens is a sure fire ticket to economic success. Yes, that’s what the man says, “I have no doubt that the economy is in a recovery trend if you look at the long run….” After two years of hoopla and running the BOJ’s printing presses red hot, however, there is not a shred of evidence that Abenomics will lead to any such thing. In fact, after the recent markdown of Q3 GDP even deeper into negative territory, Japan’s real GDP is no higher now than it was the day Abenomics was launched in early 2013; and, in fact, is no higher than it was on the eve of the global financial crisis way back in 2007.

In the meanwhile, the Yen has lost 40% of its value and teeters on the brink of an uncontrolled free fall. Currency depreciation, of course, is supposedly the heart of the primitive Keynesian cure on which Abenomics is predicated, but there is no evidence or honest economic logic to support the proposition that – over any reasonable period of time – a nation can become richer by making its people poorer. That’s especially true in the case at hand, which is to say, a Pacific archipelago of barren rocks. Japan imports virtually 100% of every BTU and every ton of metals and other raw materials consumed by its advanced $5 trillion industrial economy.

Yet thanks to the mad money printer who Prime Minister Abe seconded to the BOJ, Hiroki Kuroda, import prices are up by a staggering 30% since 2012. Even with oil prices now collapsing, the yen price of crude oil imports is still higher than it was two years back. Not surprisingly, input costs for Japan’s legions of small businesses have soared, and the cost of living faced by its legendary salary men has risen far faster than wages. Accordingly, domestic businesses that supply the home market—and that is the overwhelming share of Japan’s output—are being driven to the wall, bankruptcies are at record highs and the real incomes of Japan’s households have now shrunk for 16 consecutive months and are down by 6% compared to 2 years ago.

A view of Russia we don’t often see here in the west.

• Putin 2000 – 2014, Midterm Interim Economic Results (Awara)

A study released today by Awara Group, a Russia-based consulting firm, shows that Russia’s economy is not as dependent on oil and gas as is commonly claimed. Having researched the development of key indicators of the economy from 2000 to 2013, the authors of the study want to debunk the media story that Russia’s governments under Putin have been supposedly exclusively relying on an economic model based on oil and gas rents while neglecting the need to modernize and diversify the economy. It turns out that quite the opposite is true.

The crisis-torn economy battered by years of robber capitalism and anarchy of the 1990’s, which Putin inherited in 2000, has now reached sufficient maturity to justify a belief that Russia can make the industrial breakthrough that the President has announced. “The Russian economy is much more diversified and modernized than critics claim. The contention that it is only about oil and gas is total nonsense”, says Jon Hellevig, chief researcher for the study. “This is why Russia will not only stay afloat under the conditions of sanctions, but actually will make the industrial breakthrough that President Putin has announced”, Hellevig continues. The study reveals a range of impressive indicators on the development of the economy between 2000 and 2013 and the health of the Russian economy:

- The share of natural resources rents in GDP (oil, gas, coal, mineral, and forest rents) more than halved between 2000 to 2012 from 44.5% to 18.7%. The actual share of oil and gas was 16%.

- Russian industrial production has grown more than 50% while having undergone a total modernization at the same time.

- Production of food has grown by 100% in 2000 – 2013.

- Production of cars has more than doubled at the same time that all the production has been totally remodeled.

- Russian exports have grown by almost 400%, outdoing all major Western countries.

- Growth of exports of non-oil & gas goods has been 250%.

- Russia’s export growth has more than doubled compared with the competing Western powers.

- Oil & gas does not count for over 50% of state revenues as has been claimed, but only 27.4%. Top revenue source is instead payroll taxes.

- Russia’s total tax rate at 29.5% is among lowest of developed countries, non-oil & gas total tax rate is half that of the Western countries.

- Russia’s GDP has grown more than tenfold from 1999 to 2012.

- Public sector share of employment in Russia is not high in comparison with developed economies. State officials make up 17.7% of Russia’s total work force, which situates it in the middle of the pack with global economies.

- Russia’s labor productivity is not 40% of the Western standards as is frequently claimed, but rather about 80%.

Far from “relying” on oil & gas, the Russian government is engaged in massive investments in all sectors of the economy, biggest investments going to aviation, shipbuilding, and manufacturing of high-value machinery and technological equipment. Totally contrary to these facts, the Western media, financial analysts, and even leaders such as U.S. President Obama keep parroting the refrain that “Russia only relies on oil and gas” and “Russia does not produce anything”. Clearly, Barack Obama has not been analyzing the Russian economy, so this must mean that those whose job it is to do so are misleading the President.

We strongly believe that everyone benefits from knowing the true state of Russia’s economy, its real track record over the past decade, and its true potential. Having knowledge of the actual state of affairs is equally useful for the friends and foes of Russia, for investors, for the Russian population – and indeed for its government, which has not been very vocal in telling about the real progress. I think there is a great need for accurate data on Russia, especially among the leaders of its geopolitical foes. Correct data will help investors to make a profit. And correct data will help political leaders to maintain peace. Knowing that Russia is not the economic basket case that it is portrayed to be would help to steer the foes from the collision course with Russia they have embarked on.

Translation: we’re about to go broke.

• Only ‘Minimal’ Risk Of Default: Ukrainian Official (CNBC)

Ukraine is at “minimal” risk of defaulting on its debt repayments, according to an official in the country’s recently-appointed government, despite a currency in freefall and an apparent $15-billion black hole in its bailout from the IMF. “We do have economic difficulties, but that is something that is going into the debate with the IMF,” Dmytro Shymkiv, deputy head of presidential administration, told CNBC. “The risk of default is minimal,” he added, arguing that 95% of the country was not suffering as a result of the military conflict in the east of Ukraine. A further $15 billion may be needed to bailout the struggling country, on top of the $17-billion loan package the IMF worked out for the troubled country, and Prime Minister Arseny Yatseniuk appealed for Western help to stop a default on Thursday.

Ukraine’s currency, the hryvnia, has lost over 90% of its value against the U.S. dollar to date this year, as conflict raged on its borders. Inflation is spiralling, and the country is facing a future without cheap gas supplies from neighbor Russia, after their fallout over the deposition of former Ukrainian President Viktor Yanukovych and subsequent emergence of a more pro-European government in Ukraine. The economies of Donetsk and Luhansk, the areas where fighting between the Ukrainian army and pro-Russian separatists is worst, have ground to a halt – but these account for close-to a fifth of the country’s economy, according to Yatseniuk.

There is some hope that negotiations to resolve the conflict may re-open soon, with President Petro Poroshenko saying Friday morning that the country had experienced its first 24 hours of proper ceasefire in seven months. Shymkiv, the former head of Microsoft Ukraine who is now tasked with implementing much-needed administrative, social and economic reforms in the country, said: “We’re trying to bring our knowledge and experience to the development of the country. That’s the only way we can bring it out of the mis-development of the economy.” Asked about potential conflict between Yatseniuk and Poroshenko, he said: “There aren’t conflicts between President and Prime Minister. We have no time to have disputes.”

He didn’t say he was willing to take any losses …

• Ukraine’s Chocolate King President Not Sweet On Keeping Promise (Reuters)

The Chocolate King is finding it difficult to relinquish his throne. Petro Poroshenko, one of Ukraine’s richest men and owner of a sweets empire, made an unusual promise last spring while campaigning to be president – if elected, he would sell most of his business assets. “As president of Ukraine, I only want to concern myself with the good of the country and that is what I will do,” he told an interviewer. Poroshenko won the election, but he hasn’t succeeded yet at keeping his campaign promise. With his country at war with Russian-backed separatists in the east, the economy faltering and its currency weakening, Ukraine’s 49-year-old president hasn’t sold any of his assets, including his most valuable one: a majority stake in Roshen Confectionery Corp, Ukraine’s biggest sweets maker. His promise appears to be a victim of the very problems that face him as president.

Executives at the two financial firms that Poroshenko has hired to help sell his assets caution that deals, particularly in former Soviet republics and eastern Europe, can often take a year or more. But they also concede that their client’s timing is terrible. “It’s clearly not a good time to sell,” said Giovanni Salvetti, managing director of Rothschild CIS, which is trying to sell Roshen. “I hope the situation will improve in the first or second quarter” of 2015. Makar Paseniuk, a managing director at ICU in Kiev, which acts as Poroshenko’s financial adviser, said there is an agreement to sell one of his other assets. He declined to identify it but said the deal has not closed and it’s not clear when or if it will. Besides Roshen, Poroshenko’s portfolio includes numerous other assets, including real estate and investments in a bank, an insurance company and a shipyard in Crimea. He also owns a Ukrainian television station that he has said he will keep.

Nice little history lesson. Must read, certainly if you don’t know what a ute is.

• Australia’s Once-Vibrant Auto Industry Crashes in Slow Motion (NY Times)

There has been a car industry in Australia for about as long as there have been cars. But within two or three years, the last of the continent’s auto plants will go dark. At the turn of the 20th century, while visionaries in the United States and Europe labored on horseless carriages, Australians were also creating them. In 1896 in Melbourne, Herbert Thomson built a steam car for sale using Dunlop pneumatic tires made in Australia. In 1901, Harley Tarrant began selling cars made mostly from Australian parts. Over the next century, American automakers including General Motors, Ford and Chrysler came to dominate the market, turning out cars from factories set up in nearly every Australian state. Toyota, Nissan and Mitsubishi later joined them.

But the end is nigh. Auto plants have been closing, one by one, over five decades. The three remaining carmakers here — Toyota, Ford and the Holden subsidiary of G.M. — are shutting their manufacturing operations over the next few years. Government policy has played a large role in the contraction; the Australian market has gone from one of the world’s most protected to possibly the least-protected among auto-manufacturing nations. The Australian car industry had always benefited from barriers to imported vehicles. Those who bought early Thomson steam cars and gasoline-powered Tarrants were industrialists, wealthy ranchers, bankers and politicians who saw merit in protecting the home industry.

So early adopters in the 1900s who wanted foreign-made cars, and there were plenty of them, could only import the chassis complete with engine, transmission, axles and wheels — and the hood and the grille. The rest of the car had to be manufactured, mostly by hand, by body builders who generally evolved from outfits that had made coaches and buggies for the horse trade. Holden started in the leatherwork and saddlery business in 1856, but by the early 20th century was making motorcycle sidecars and car bodies for chassis from G.M. In 1931, G.M. bought Holden Motor Builders and plans were laid for a distinctly Australian car, which finally arrived after World War II, in 1948.

If confirmed, this is the biggest discovery in eons.

• Did A European Spacecraft Detect Dark Matter? (Christian Science Monitor)

Astronomers may finally have detected a signal of dark matter, the mysterious and elusive stuff thought to make up most of the material universe. While poring over data collected by the European Space Agency’s XMM-Newton spacecraft, a team of researchers spotted an odd spike in X-ray emissions coming from two different celestial objects – the Andromeda galaxy and the Perseus galaxy cluster. The signal corresponds to no known particle or atom and thus may have been produced by dark matter, researchers said. “The signal’s distribution within the galaxy corresponds exactly to what we were expecting with dark matter – that is, concentrated and intense in the center of objects and weaker and diffuse on the edges,” study co-author Oleg Ruchayskiy, of the École Polytechnique Fédérale de Lausanne (EPFL) in Switzerland, said in a statement.

“With the goal of verifying our findings, we then looked at data from our own galaxy, the Milky Way, and made the same observations,” added lead author Alexey Boyarsky, of EPFL and Leiden University in the Netherlands. Dark matter is so named because it neither absorbs nor emits light and therefore cannot be directly observed. But astronomers know dark matter exists because it interacts gravitationally with the “normal” matter we can see and touch. And there is apparently a lot of dark matter out there: Observations of star motion and galaxy dynamics suggest that about 80% of all matter in the universe is “dark,” exerting a gravitational force but not interacting with light.

Researchers have proposed a number of different exotic particles as the constituents of dark matter, including weakly interacting massive particles (WIMPs), axions and sterile neutrinos, hypothetical cousins of “ordinary” neutrinos (confirmed particles that resemble electrons but lack an electrical charge). The decay of sterile neutrinos is thought to produce X-rays, so the research team suspects these may be the dark matter particles responsible for the mysterious signal coming from Andromeda and the Perseus cluster. If the results — which will be published next week in the journal Physical Review Letters — hold up, they could usher in a new era in astronomy, study team members said. “Confirmation of this discovery may lead to construction of new telescopes specially designed for studying the signals from dark matter particles,” Boyarsky said. “We will know where to look in order to trace dark structures in space and will be able to reconstruct how the universe has formed.”

Weird. Just plain weird.

• The Chinese Mystery Of Vanishing Foreign Brides (FT)

Police in central China have launched an investigation into the disappearance of more than 100 Vietnamese women who married local bachelors and had been living in villages around the city of Handan. The women all disappeared at the same time in late November, along with a Vietnamese woman who married a local villager 20 years ago and had introduced most of the brides to local men in recent months in exchange for a fee. Faced with severe gender imbalances as a result of China’s decades-old one-child policy and a traditional preference for male children, many Chinese men are unable to find suitable brides and resort to paying for wives from poorer Asian countries such as Vietnam.

Particularly in more traditional rural parts of China, marriage is highly transactional and men are increasingly expected to provide a house, car, electrical appliances and a steady income before a woman or their family will consider him eligible for marriage. For those who cannot afford the expensive requirements of Chinese brides, paying for a bride from Vietnam or elsewhere in the region can be a much cheaper option. As a consequence of the demand for cheap foreign brides, China has an enormous problem with human trafficking. “My brother worked outside the village and was too poor to afford a local wife so my family paid Rmb100,000 to get a wife from Vietnam through that old Vietnamese woman who came here 20 years ago,” said the brother of Bai Baoxing, a local man whose Vietnamese wife disappeared with the others barely a month after they were married.

Mr Bai’s brother said the new bride spoke decent Mandarin Chinese and he and his family were now wondering whether she was even Vietnamese. Chinese media reports identified the absconded Vietnamese marriage broker as Wu Meiyu. After living in a village on the outskirts of Handan for 20 years, she started offering introductions to Vietnamese brides for a fee at the start of this year. An officer in the local Handan city police office told the Financial Times that provincial police were now handling the case and they could not comment on the ongoing investigation. Chinese media are filled with cases of women from poor rural areas who are abducted and sold into marriage, as well as cases involving foreign brides.

Home › Forums › Debt Rattle December 13 2014