Albert Fenn for OWI “New York. Negro taxi driver” 1942

I was going to write a nice piece on how the trusts and trust companies in China’s shadow banking industry are really no different from what we had 7+ years ago for instance in the hedge funds Bear Stearns had set up, and which they initially tried to save with $3.2 billion when they went awry, even though they had first put only $50 million or so in them.

The Chinese trust companies are exactly like these hedge funds, they were probably set up by the same people too, and the trusts they offer for people to invest in are like the SIVs and CDOs western banks offered to investors: opaque boxes filled with often very questionable paper, which was sliced and diced and tranched to make it magically transform from questionable to AAA. The Chinese have simply copied the entire set-up and nobody ever raised their voices. And that means we know where this is going, simply because we’ve seen it before, at the end of 2007.

China’s version has copied the whole thing, and that includes the great awe-inspiring and faith-inducing names the products have. Now, I said I was going to write a nice piece, but I can’t; I have a bout of the flu that has my skin shivering and my nose running and all my energy hiding somewhere I can’t touch it. So I’ll have to leave you with just those names, and the Two Johns video the topic made me think of.

They identified two of the Bear Stearns vehicles as the ‘High-Grade Structured Credit Strategies Fund’ and the ‘High-Grade Structured Credit Enhanced Leverage Fund’, and rightly remark how good those names sound (“I’d buy anything that says ‘enhanced'”). That video is from way before the Lehman crisis, late 2007 or January 2008. Just like The Automatic Earth.

The first Chinese fund that went down a few weeks ago – and was then saved by a mystery guest – was of course ‘Credit Equals Gold’, a name that has so many different layers of meaning, non-meaning and sheer obfuscation that I’m not even going to go there (but think about it: what does that mean, are they not polar opposites?).

The second one, which missed a $126 million payment the other day, could have been a brainchild of Bear Stearns’ China branche (and for all we know was): “Songhua River #77 Shanxi Opulent Blessing Project”.

I’m well aware that many people claim Beijing can, and will, make sure the trusts system won’t collapse. But if it’s anything like the Bear Stearns SIVs, which were, as per the numbers we know, leveraged at least 60-1, that may not be so easy.

Anyway, it’s the couch for me now, tea, honey, lemon, rum, aspirin and sleep.

• Fear and loathing in China’s trust industry (Reuters)

China’s trust sector is the financial system’s enfant terrible. It’s a 10.9 trillion yuan ($1.8 trillion) industry built on taking short-term funding and channeling it into longer-term investments. That mismatch has already led some trust products to unravel, and more will follow. What causes concern isn’t so much trusts failing as them being foolishly rescued.

Trusts are essentially financial boxes. Anything can go inside, from loans to property or stocks and bonds. Trust companies build the box, fill it and slice the financial exposure into securities, known as trust products, which are sold to wealthy investors. The company takes a fee of around 0.7%, but in theory has no duty to compensate investors if what is in the box goes wrong.

Two recent trust products have put that to the test. One, called “Credit Equals Gold”, came close to default in January, only to be bailed out by an unnamed investor at the eleventh hour. Another, evocatively named “Songhua River #77 Shanxi Opulent Blessing Project”, has missed a $126 million payday, according to China Securities News.

Demand for trusts has grown prodigiously, because they typically pay more than double the 3.3% maximum one-year deposit rate that savers get from banks. Trust assets under management have increased by an average of 53% a year for the past three years. While the pace has slowed recently, the $1.8 trillion trusts had under management at the end of 2013 was still 8% more than the end of September.

Not all trusts are equally worrisome. Only 45% of their assets are categorised as loans – although others may be loans disguised as equity. Meanwhile, just a quarter of assets belong to “collective” trusts, which are sold to multiple investors. This type, amounting to $450 billion, is the most vulnerable to messy public wrangling over who owes what to whom.

There are three reasons trusts inspire mistrust. The biggest is the potentially dangerous mismatch between short-term funds and longer-term investments. Many trust products last for two or three years. But for miners or infrastructure developers looking for financing, that can be the blink of an eye.

Second, trusts can be misused by banks eager to shuffle loans they’re not supposed to make off their balance sheets. So-called bank-trust co-operation has shrunk to 20% of total trust assets, but banks still sometimes advise on what goes in a product.

Finally, trust companies aren’t well understood. They’re regulated by the China Banking Regulatory Commission, which allows regulators to claim they don’t count as “shadow banking”. But capital buffers are thin. Even though they’re not on the hook, trust companies don’t want to see products fail: their business relies on selling more in future, often to the same investors.

• More gloom for China’s factories (CNN)

China’s factories continued their skid in February, with manufacturing activity falling to a seven-month low amid concerns about rapid credit growth in the country. HSBC said that its “flash” measure of sentiment among manufacturing purchasing managers fell to 48.3 in February from 49.5 in January. February’s reading raises a red flag, as any number under 50 indicates a deceleration in the manufacturing sector.

Some improvement was seen in new export orders. Almost all other index components — including output, employment and domestic orders — worsened. If factory activity continues to lag in the coming months, it could be ominous for China’s economy and pose an even greater challenge for the government’s plans to enforce economic reforms. “The below 50 readings of the past two months leave little doubt that conditions in the manufacturing sector are downbeat,” said Julian Evans-Pritchard of Capital Economics.

But don’t hit the panic button just yet. Economic data from China is difficult to interpret during the months around the Lunar New Year holiday, when many workers return home for the holidays. Other labor market indicators have remained healthy despite the manufacturing slowdown. Evans-Pritchard said that the factory slowdown is unlikely to prompt a change in direction at the People’s Bank of China. The central bank is hoping to rein in credit growth, and is unlikely to loosen policy in a bid to support the flagging manufacturing sector.

“[Current policy] will help to contain China’s medium term credit risks, but it will also continue to weigh on the performance of the manufacturing sector,” Evans-Pritchard said. HSBC’s final manufacturing reading will be released on March 3. The Chinese government will announce official data March 1.

• Japan Trade Deficit Swells to Record as Import Costs Surge 25% (Bloomberg)

Japan’s trade deficit widened to a record in January as surging import costs weigh on Prime Minister Shinzo Abe’s campaign to drive a sustained recovery. The 2.79 trillion yen ($27.3 billion) shortfall reported by the Ministry of Finance in Tokyo today exceeded the 2.49 trillion yen median estimate in a Bloomberg News survey of 28 economists. Imports rose 25% from a year earlier and outbound shipments gained 9.5%.

Declines in the yen are driving up import costs as the nation’s nuclear reactors remain shuttered, while exports have seen only limited gains from the currency’s slide of more than 20% against the dollar in the past two years. The trade deficit contributed to Japan’s economy growing a less-than-forecast 1% in the fourth quarter, underscoring the risk that Abenomics may falter after a sales-tax increase in April. “Japan is paying the price for the transformation of its energy policy,” said Naohiro Niimura, a partner at Market Risk Advisory Co. in Tokyo. “This trend in Japan’s trade balance will continue for a while, eroding the strength of the economy little by little.”

The trade deficit with China was the widest in comparable data back to 1979. The lunar New Year may have weighed on exports to China and other Asian nations in January, an official said in a briefing after the release.

• Japan’s Penny-Pinching Beer Drinkers Show Challenge to Abenomics (Bloomberg)

While Prime Minister Shinzo Abe’s policies help manufacturers such as Toyota rack up record profit, challenges to his reforms are showing up in a more mundane spot: the outlook for beer. Brewers in Japan face an April sales tax increase, stagnant wages and an aging population, the same challenges Abe’s monetary easing and stimulus spending must overcome to sustain a recovery.

Kirin, Japan’s biggest beverage maker and competitor Asahi forecast 2014 net income that was at least 13% less than analysts estimated. Both blamed the sales tax set to rise to 8% from 5%, a sign they lack confidence that Abenomics will offset the increasing levy. [..]

Stagnating wages are one reason Japanese are drinking less beer, making breweries a bellwether for the kind of broader recovery Abenomics-watchers have yet to see. Monthly wages excluding overtime and bonus payments fell 0.6% in December from a year earlier, extending a decline to 19 months, according to labor ministry data. The central bank projects consumer prices excluding fresh food will rise 1.9% in the 12 months starting April 1, 2015, excluding the effects of a higher consumption levy.

Domestic shipments of regular, low-malt and alternative beers dropped 1% in 2013, a ninth straight yearly decline, industry data show. “We will start seeing the impact of the tax increase in July or August,” said Makoto Kikuchi, the Tokyo-based chief executive officer for Myojo Asset Management Co. “People will realize stimulus measures aren’t doing anything and the reality is tougher than they had expected.”

Abe has vowed to revive growth using policies described as three arrows: monetary easing, stimulus spending and deregulation. He’s yet to implement the third arrow, prompting speculation the coming year will reflect only the first two. Brewers and consumer staples producers also face the prospect of a second planned tax increase in 2015 to 10%. Abe has said the economy’s growth pace will determine whether the government goes ahead with that higher levy.

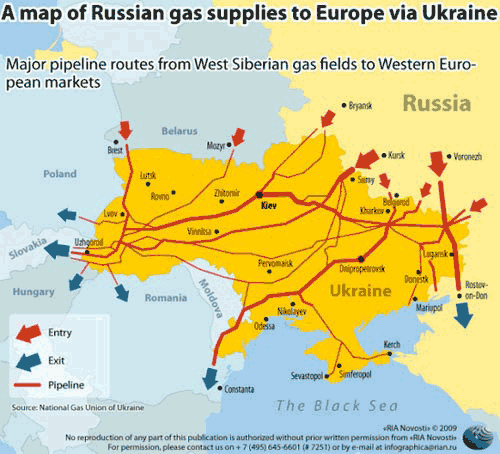

• Kiev Chaos Jumps Borders as Markets Teeter (Bloomberg)

Markets from Hungary to Poland and Russia are suffering contagion from the violence rocking Ukraine’s capital, sending bond yields higher and currencies lower as the turbulence afflicting developing nations deepens.

Russia’s ruble slid to an all-time low yesterday, Hungary’s forint declined the most in more than a week and the yield on Poland’s 10-year bond rose for the first time in four days. The rate on Ukraine’s debt due in June jumped 19 percentage points to a record 42%.While European officials called for sanctions against Ukraine’s government after the bloodiest clashes in a three-month standoff with activists in Kiev’s Independence Square, investors recoiling from the mayhem sold assets across the region as the conflict spread in the nation. Russia canceled a bond auction for the third time in less than a month as the ruble slid and yields climbed.

“We are already seeing spillover from Ukraine to Russia and Poland in currencies and bonds,” Richard Segal, a strategist at Jefferies International Ltd. in London, said by e-mail yesterday. “If Ukraine truly collapses, Russia could feel forced to pick up the pieces, which would be expensive.”

• Turkey spoils emerging market story as politics go haywire (AEP)

Turkey is the first big domino to fall in emerging markets, a cautionary tale for investment tourists who came late to the party and skipped the political fine print. Its catch-up growth model reached exhaustion in 2007. The consumption boom that followed has been driven by inflows of hot money, all too like the earlier bubbles in Ireland and Spain.

Its showcase Muslim democracy came off the rails when police opened fire last June on demonstrators in Istanbul’s Taksim Square and cities across the country, killing six and injuring 8,000. Amnesty International accused the government of human rights violations on a “huge scale”.

Matters have since gone from bad to worse. European diplomats say premier Recep Tayyip Erdogan is in such clear breach of the EU’s Copenhagen Criteria on democracy and the rule of law that Turkey’s accession bid is in doubt, and with it the implicit assumption that underpins foreign investment in the country.

No country so rudely exposes the illusions behind the $8 trillion stampede into emerging markets, though Ukraine must be ahead on points by now. Investors came to believe that all humanity is moving in the same direction, that free markets and open societies are ineluctable, that we really are seeing the “End of History” on liberal terms. “The West should wake up,” said Kemal Kilicdaroglu, Turkey’s opposition leader.

Muharrem Yılmaz, the head of Turkey’s industry lobby Tusiad, issued an astonishing cry of alarm three weeks ago. “A country where the rule of law is ignored, where the independence of regulatory institutions is tainted, where companies are pressured through tax penalties and other punishments, where rules on tenders are changed regularly, is not a fit country for foreign capital.” For this he was accused of “treason” by the prime minister.

The new twist – the “events of December 17” – is the eruption of a bare-knuckled power-struggle within Mr Erdogan’s Islamist movement. It was triggered by corruption probes against party elites, including four cabinet ministers, but nothing is what it seems in Turkey.

Mr Erdogan retaliated with a purge of judges, prosecutors and police, as well as banking and TV regulators. Court orders were torn up. He claimed that a “parallel state” led by the Gulenist brotherhood – a sort of Islamist Opus Dei that runs elite schools and nurtures rising leaders – was trying to overturn democracy.

“Claims of a judicial coup cut no ice with us,” said one EU diplomat. “The prime minister is circling the wagons to protect the new establishment. Anybody not considered sufficiently loyal is being forced out.” “There are no credible parliamentary balances to hold the executive to account. Erdogan cannot roll up democratic institutions like this. He was told in no uncertain terms in Brussels in January that these are persistent breaches of the Copenhagen Criteria, and imperil Turkey’s accession process,” said the official.

• January Fed minutes show officials debated raising interest rates (Guardian)

Federal Reserve officials started to debate raising interest rates in January, with some arguing they might need to move sooner than expected, minutes of the meeting revealed on Wednesday. The Fed has kept interest rates at close to zero since the end of the financial crisis in 2008. According to minutes of the 28-29 January meeting, released after the customary three-week lag: “A few participants raised the possibility that it might be appropriate to increase the federal funds rate relatively soon.” The officials were concerned about inflation but others argued inflation was too low.

Any rise is unlikely in the short term. Most Fed officials continued to believe it would not be appropriate to raise short-term rates until 2015 or later, according to economic projections officials submitted at their December meeting. They also argued that standard policy tools did not apply, as the US economy continues to feel the impact of the recession.

The Fed had previously suggested any rise in interest rates would be linked to the unemployment rate falling below 6.5%. Last month unemployment dipped to 6.6%, but problems remain in the jobs market. The percentage of people no longer seeking work is at 30-year highs. Long-term and youth unemployment are also high, as are the jobless rates for African Americans and hispanics.

The Fed open markets committee (FOMC) minutes show the central bank is now assessing what to do when unemployment hits its former target. “Participants agreed that, with the unemployment rate approaching 6.5%, it would soon be appropriate for the Committee to change its forward guidance in order to provide information about its decisions regarding the federal funds rate after that threshold was crossed,” the minutes state. The Fed was not specific about what those changes would be.

The news came as the Fed appeared to largely shrug off disappointing monthly jobs reports from the Labor Department; in December the US added just 74,000 new jobs. A report published after the Fed meeting showed continued weakness in January, with the US adding just 113,000 jobs for the month, well below recent monthly gains. “A number of participants indicated that the December payrolls figure may have been an anomaly, perhaps importantly reflecting bad weather, and it was noted that the initial readings on payrolls in recent years had subsequently tended to be revised up,” the minutes state.

• IMF Urges ECB To Mull Cutting Interest Rates Below Zero (Guardian)

The International Monetary Fund has urged the European Central Bank to consider cutting interest rates to below zero as it warned that deflation in the eurozone was a key new risk facing the world economy.

In its assessment of global prospects published ahead of the meeting of G20 finance ministers in Sydney, the IMF said recovery from the deep global recession had been disappointingly weak and urged stronger co-operation between developed and developing countries to promote growth and financial stability. “A new risk stems from very low inflation in the euro area, where long-term inflation expectations might drift down, raising deflation risks in the event of a serious adverse shock to activity,” the Fund said.

It added that the eurozone was “turning the corner” from recession to a recovery that was uneven and fragile. Low inflation added to the problems of the troubled countries on the fringes of the euro area, where it would increase the real burden of already high levels of public debt. “In the euro area, more monetary easing is needed to raise the prospects of achieving the ECB’s inflation objective, including by supporting demand, given the weak and fragile growth, large output gaps and very low inflation,” said the Washington-based IMF.

It said further ECB action could include cheap loan schemes, possibly targeted at small and medium sized firms, and “further rate cuts, including mildly negative deposit rates, to support demand and reduce fragmentation” The Fund urged the US to consult with other members of the G20 – a group of leading advanced and emerging nations – about its plans to withdraw gradually the stimulus provided to the American economy. “Concerns about the withdrawal of unconventional monetary policy [the bond buying programme known as quantitative easing] in the US have already provoked sharp price movements in emerging markets”, the Fund said.

• Do American auto workers have an inferiority complex? (Guardian)

Do American auto workers have an inferiority complex? Do they suffer from such low self esteem that they believe they should be paid significantly less than their counterparts in other countries who build the same cars for the same company? Would they really prefer to have no say whatsoever in how their companies are run, even when their employers are keen to offer them a seat at the table?

Sadly, these are questions that need to be asked in the wake of last week’s decision by auto workers at a Volkswagen (VW) plant in Chattanooga, Tennessee to reject an effort by the United Automobile Workers (UAW) to unionize the German owned factory. The no vote came as a pretty big surprise to UAW organizers, not least because a majority of the workers had reportedly signed cards favoring the union’s representation in creating a German-style works council at the plant.

There was also no opposition from VW management, who agreed to remain neutral in the process and had even invited UAW representatives onto the factory floor to explain the benefits of organizing. Still, even though their jobs were not under threat and their employers were supportive, a majority of the workers (712 to 626) voted against unionization. Much of the blame for the no vote is being assigned to the right-wing groups and Republican lawmakers in the state, who mounted a relentless, if predictable, anti-union campaign. While this blame is well deserved, the apparent willingness of so many workers to act against their own interests needs to be called into question also.

Unlike most of the VW facilities worldwide, the Chattanooga plant does not have a works council, which brings workers together with management to establish the company’s policies and procedures. (Under US law, union representation is a pre-requisite to having a works council, which is why the UAW vote was necessary.) As things stand Chattanooga workers have no say in the company’s decision-making process or in any negotiations surrounding pay or work conditions. It should come as no surprise then that workers at this plant get paid considerably less than workers at other VW plants around the world who do have a say.

In Germany, for instance, auto workers at VW plants get paid an average of $67.14 an hour. That’s more than double the average hourly rate for an established unionized worker in Detroit, and it’s more than three times what the non unionized workers in Chattanooga can hope to earn. According to a company spokesperson, new hires at Chattanooga start at $14.50 an hour, a rate that gradually increases to $19.50 an hour after three years on the job.

This brings me back to my original question – do American workers have an inferiority complex that makes them willing to accept an lower salary than they deserve, and, if so, why? According to reports from the ground, one of the reasons many workers cited for opposing the unionization plans was that they were satisfied with their job and felt they were well paid. It’s true that with Tennessee being a so called “right to work” state, where wages are generally low and poverty is high, $19.50 an hour probably seems like a pretty good salary. But when their European counterparts, working for the same employers, doing the same work, make more than three times what they do, shouldn’t these workers be feeling less satisfied than screwed?

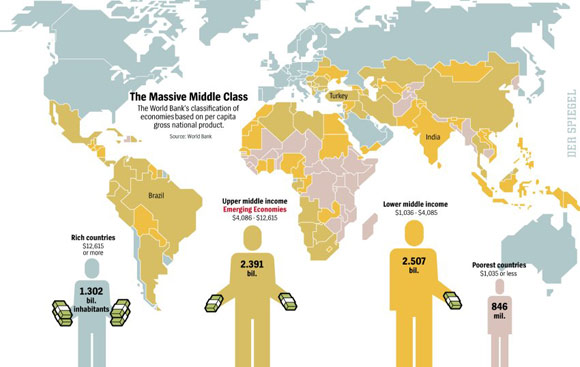

• Emerging Nations Demand Western Support (Spiegel)

At the G-20 finance ministers’ meeting in Sydney, emerging economies will push for joint action to halt rising interest rates. But the industrialized nations want nothing to do with it and are instead arguing that each country should solve its own problems.

A relatively agreeable meeting is awaiting German Finance Minister Wolfgang Schäuble at the end of this week. The journey itself, to be sure, will be a taxing one; the flight from Berlin to Sydney will take almost 24 hours. But once he arrives, the greatest difficulty will already be behind him. Under the summer Australian sun, Schäuble will meet with his counterparts from industrialized and emerging economies as part of the G-20 meeting there. As always, the state of the global economy will be the main topic of conversation.

Schäuble and his colleagues from the euro zone, in contrast to previous years, can sit back and relax this time around. Nobody will be trying to force Germany, France or Italy to take immediate action to protect the world economy from turbulence in Europe. “The euro as such is no longer the focus of financial market attention as a source of concern,” Schäuble recently said with satisfaction. The euro crisis, much to the pleasure of European leaders, has gone dormant. This year, others will be in the spotlight, such as the Americans.

Representatives from India, Brazil and Turkey in particular accuse the US Federal Reserve, under the leadership of new head Janet Yellen, of having severely handicapped their economies by backing away from the crisis driven policies it has pursued in recent years. By reducing the number of US sovereign bonds it purchases, the Fed has triggered a rise in US interest rates, with the consequence that a flood of investors are now returning to the dollar from emerging economies.

To halt the decline of their currencies, India and Turkey were recently forced to raise their own interest rates, a move which, while propping up the exchange rate, also puts the brakes on economic growth. As such, they and similar countries want to use the meeting in Sydney to establish a common approach with the industrialized economies, particularly with the US. They want the developed world to pay closer attention to economies in Asia and Latin America.

The battle lines are familiar: emerging economies versus Europe and the US, just like at the beginning of the economic crisis. Back then, though, China, India and Co. were negotiating from a position of strength. Pointing to their own strong growth rates, they demanded that the Americans and Europeans — who they not illogically saw as having caused the crisis — do more to prevent a collapse of the global economy. Now, though, with growth in emerging economies having slowed, roles have been reversed.

• Crash of 2014: Like 1929, you’ll never hear it coming (Paul B. Farrell)

Early warnings of a crash are dismissed over and over (“just a temporary correction”). They gradually numb us about the inevitable. Time after time we forget history’s lessons. Until finally a big surprise catches us totally off-guard. Financial historian Niall Ferguson put it this way: Before the crash, our world seems almost stationary, deceptively so, balanced, at a set point. So that when the crash finally hits — as inevitably it will — everyone seems surprised. And our brains keep telling us it’s not time for a crash.

Till then, life just goes along quietly, hypnotizing us, making us vulnerable, till a shocker like Lehman Brothers upsets the balance. Then, says Ferguson, the crash is “accelerating suddenly, like a sports car … like a thief in the night.” It hits. Shocks us wide awake.

One moment we’re playing musical chairs, excited, in denial, convinced we can pocket a few more winnings before the inevitable. Convinced we know when, where, how to exit. Then the “thief in the night” suddenly attacks, catches us by surprise. Even then, in our denial, we may keep telling ourselves it’s just another short-term correction in a hot bull market. Until suddenly, it’s more than an accelerating sports car … it’s a Mack truck roaring loudly.

Both optimism and fear are inside jobs. But the early warnings come long and loud from outside us. But our brains are programmed, constantly choosing between this new information and our long-held beliefs, personal biases and ideologies. Which invariably override new information to the contrary. How else can we explain why just before the 2008 global banking collapse our own Treasury secretary, a long-time former CEO of Goldman Sachs, told Fortune that the economy was the best he had seen in his professional lifetime? It was not. But his belief wouldn’t let him be confused by the facts.

How to predict a crash? The secret is programmed in your brain, your genes, your psychological personality profile. You’ll do what you always do. Look within. You’ll keep playing your own version of musical chairs, either naturally bullish or naturally bearish, timing your exit strategy to suit your risk tolerance, your judgments, your beliefs, biases, ideologies, not the data.

• The Iron Lady’s Poisonous Free-Market Legacy Lives On (RT)

Despite the undeniable devastation caused by late PM Margaret Thatcher and the free market fundamentalist ideology that bears her name, Thatcherism continues to dominate British society politically, economically and socially. The way in which the British political establishment fawned over Thatcher upon her death split the country between those who considered her political legacy a poisonous one (this writer included) and those who believed that she changed Britain for the better.

As if any more evidence were needed that the former opinion of the Iron Lady’s legacy is the more credible of the two, the results of a recent study by a group of British academics makes the case inarguable. Sourcing data from over 70 pre-existing research papers into Thatcher’s decade as prime minister reveals that the “unnecessary unemployment, welfare cuts, and damaging housing polices” of the first-ever British female PM’s reign caused “the unnecessary and unjust premature death of many British citizens, together with a substantial and continuing burden of suffering and loss of well-being.”

Alex Scott-Samuel, one of the authors of the report, said of the findings: “Towards the end of the 1980s we were seeing around 500 excess deaths each year from chronic liver disease and cirrhosis. We also know that there were 2,500 excess deaths per year as a result of unemployment caused by Thatcher’s policies. And these premature deaths represent just the tip of an immense iceberg of sickness and suffering resulting from Thatcherism.”

Another damning indictment of Thatcher’s policies contained in the report is the huge rise in inequality which she presided over. In 1978, the year before she became prime minister, the wealthiest 0.01% in Britain earned 28 times more than the average income. In 1990 that ratio had climbed to an outrageous 70 times. Poverty meanwhile rose from 6.7% in 1975 to 12% in 1985.

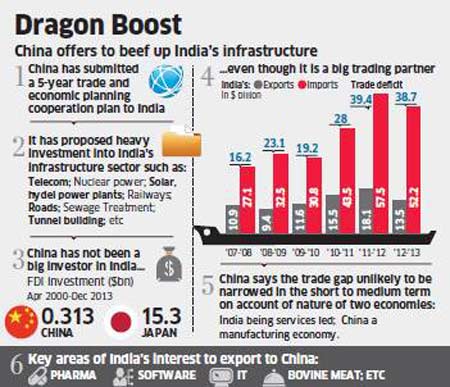

• China offers to finance 30% of India’s infrastructure development plan (ET)

China wants to fund a big chunk of India’s infrastructure development even though previous attempts have been rebuffed by a government nervous about allowing its neighbour to enter critical areas such as telecom or power over security worries. But that hasn’t discouraged the Chinese from making a concerted bid that envisages its companies and workers getting deeply involved in upgrading India’s decrepit rail, road and power infrastructure besides telecom.

A Chinese working group submitted a five-year trade and economic planning cooperation plan to the Indian government in the first week of February, offering to finance as much as 30 per cent of the $1trillion targeted investment in infrastructure during the 12th Five-Year Plan (2012-17) to the tune of about $300 billion.

That’s the biggest such offer by any one country, exceeding the funds contributed by Japan, which has traditionally financed some of India’s most ambitious projects. The commerce department is likely to hold an inter-ministerial meeting next week to discuss the investment proposal by China to identify sectors of India’s interest, a government official familiar with developments told ET.

China has more than $3.8 trillion in reserves — which keeps rising thanks to trade surpluses with other countries — that it needs to deploy effectively. And, having already invested huge sums in its own infrastructure, Beijing has been looking further afield.

• A high price for ignoring the risks of catastrophe (FT)

After a catastrophic financial crisis plunged the world into recession five years ago, financial economists were pilloried for using complex models with flawed assumptions to value subprime mortgages. It took only a few years to expose the error, with drastic consequences. But similar flaws lurk in economic models of a far greater threat – climate change – that also underestimate our peril.

Floods in England and drought in California have brought another round of sterile arguments about whether climate change is to blame. Just as models of collateralised debt obligations all but assumed the impossibility of default, however, models of climate change all but assume it cannot have a catastrophic effect on the economy, no matter how bad global warming becomes. Far from exaggerating the threat, economists tend to understate it.

The financial crisis – and growing scientific evidence that there are small but real risks of extreme climate change – suggest a way forward. Rather than try to price the unknowable with precision, we should consider the uncertain odds but terrifyingly high costs of a catastrophe, then ask what we will pay for insurance against it. That might even be an easier way to sell stalled action on carbon emissions.

The judgment from academics on their existing models is damning. So-called integrated assessment models of climate change come “close to assuming directly that the impacts and costs will be modest, and close to excluding the possibility of catastrophic outcomes”, writes Nicholas Stern. According to Robert Pindyck of the Massachusetts Institute of Technology: “The bottom line here is that the damage functions in most IAMs are completely made up, with no theoretical or empirical foundation.”

These models matter. They lie behind the estimates that carbon has a social cost of $36 a tonne the Obama administration is using to regulate coal. Admittedly, that is better than nothing, and the world’s determination to ignore climate change means a higher estimate would not have much immediate impact. Lobbyists have already lined up to claim $36 is too much. But the lessons of the financial crisis are clear: economists should strive to tell it like it is, then let fools, knaves and politicians try to justify inaction as best they may. History will judge harshly anyone who underplays the price of global warming.

• New 100 metric tons radioactive water leak at Fukushima (CNN)

A large amount of radioactive water has leaked from a holding tank at Japan’s troubled Fukushima Daiichi nuclear power plant, its operator said Thursday. The leak of an estimated 100 metric tons of highly contaminated water was discovered late Wednesday, Tokyo Electric Power Company (TEPCO) said in a statement.

The tainted water flowed over a barrier around the tank and is being absorbed into the ground, TEPCO said. The plant has shut off the inflow of water into the tank and the leaking has stopped, it added. The company doesn’t believe that there was any leakage of the radioactive water into the nearby Pacific Ocean.

Since the massive earthquake and tsunami that hit northeastern Japan in March 2011 set off meltdowns at three of the reactors at the nuclear plant, TEPCO has been storing the enormous volumes of water contaminated at the site in a steadily growing collection of containers. The company has struggled to manage the vast amounts of radioactive water, with a number of leaks reported last year.

• Diseases in managed honeybee colonies spreading to wild bees (UPI)

Diseases common in managed honeybee colonies are now spreading to wild pollinators in Britain including bumblebees, a study found. “Wild and managed bees are in decline at national and global scales,” biologist Mathias Fuerst of Royal Holloway University of London said. “Given their central role in pollinating wildflowers and crops, it is essential that we understand what lies behind these declines.”

Two common honeybee diseases — deformed wing virus and the fungal parasite Nosema ceranae — have been found to be infecting wild worker bumblebees, the researchers reported in the journal Nature. “Our results suggest that emerging diseases, spread from managed bees, may be an important cause of wild bee decline,” Furst said.

The findings suggest it is vital for beekeepers across the world to ensure honeybee management supports wild bee populations, the researchers said. “National societies and agencies, both in the United Kingdom and globally, currently manage so-called honeybee diseases on the basis that they are a threat only to honeybees,” Royal Holloway scientist Mark Brown said.

“While they are doing great work, our research shows that this premise is not true, and that the picture is much more complex,” he said. “Policies to manage these diseases need to take into account threats to wild pollinators and be designed to reduce the impact of these diseases not just on managed honeybees, but on our wild bumblebees too.”

This article addresses just one of the many issues discussed in Nicole Foss’ new video presentation, Facing the Future, co-presented with Laurence Boomert and available from the Automatic Earth Store. Get your copy now, be much better prepared for 2014, and support The Automatic Earth in the process!

Home › Forums › Debt Rattle Feb 20 2014: The Opulent Blessing Project