Detroit Publishing Co. “Manhattan from the Brooklyn Bridge” 1907

There’s a lot more to the Ukraine situation than meets the eye. The country was already on the verge of bankruptcy before the protests started three months ago, and seems dead set on default now. Russia seemed willing to help, but the protests against Yanukovych are protests against Putin too. Moreover, Russian banks have substantial holdings of Ukrainian bonds.

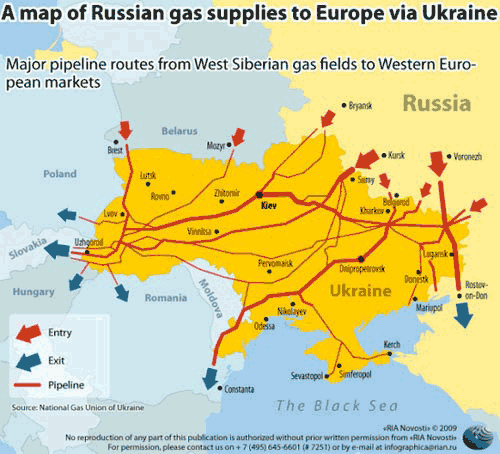

Then, there’s of course the energy question. Ukraine relies on Russian gas and oil. It’s also where Russia’s pipelines for Europe are located:

One thing is obvious from this map: Russia and Ukraine have a very tight relationship whether they want it or not. And Putin may not like the EU trying to improve its ties with Ukraine, but if your man in Kiev’s a guy who has elite snipers shoot his country’s young men straight through the heart by the dozen, you may need to rethink your position. Because Putin can’t send in his troops to Kiev anymore, those days are gone.

I can’t really work again yet, too sick still, zero energy, but I’ll give you a series of quotes from various news sources today that make what goes on in and with Ukraine much clearer:

Ambrose Evans-Pritchard

Regis Chatellier, from Societe Generale, said there is a “high risk” that Ukraine will be pushed into default on its €60 billion sovereign debt, triggering a credit shock for Russian banks. Sberbank and VTB are both large holders of Ukrainian bonds. Global emerging market bond funds hold 3% of their portfolio in Ukrainian debt.

Ukraine’s foreign reserves are down to survival levels. Russia has so far kept the country afloat with a $3 billion loan, the first tranche of a $15 billion bailout, but further payments are in doubt. Russia faces the choice of large losses from a default or the ever rising costs of propping up Ukraine’s economy.

Russia is already near recession itself. Industrial output has contracted over the past year and fixed investment has fallen by 7%. “We think Russia is the most exposed. The current account surplus has fallen very sharply,” said Liza Ermolenko, from Capital Economics. Russia has nearly $500 billion of foreign reserves – the world’s third largest – but this cannot easily be deployed in an economic slump. The country learned the hard way in 2008-2009 that such action has a side-effect of monetary tightening. The central bank burned through $200 billion propping up the ruble, but in the process destroyed part of the Russian banking system.

Russia largely escaped the first wave of the emerging market crisis – mostly directed against those, like Turkey, South Africa and Brazil, with large current account deficits – but is now at the epicentre as worries switch to geopolitics. The ruble has fallen 10% against the dollar this year.

Russia has never fully recovered from the post-Lehman crash in 2008-2009. It is a textbook case of the “Dutch Disease”, over-reliant on oil and gas at the expense of manufacturing. It requires crude prices above $110 to balance the budget

Bloomberg

Putin has pledged $15 billion in aid to pry the former Soviet republic away from a potential pact with the European Union after he oversaw spending on Sochi that soared to $43 billion from an initial $12 billion.

“The meddling with Ukraine certainly hurts Russia’s image as an investment destination,” David Hauner, a fixed-income and currency strategist at Bank of America Corp., said in a telephone interview from London. “It is not going to bankrupt Russia, but $15 billion can turn out to be $50 billion, and Russia will have to plug the holes for a couple years.”

The tumble in Ukrainian debt prices triggered by the violence signals Russia is already suffering losses in the market value of the $3 billion of bonds it bought in the aid package’s first installment.

RT

Russia’s GDP growth turned negative in January, with the lowest investment since 2010. Analysts say uncertainty surrounding the ruble, which hit its all-time low against the euro on Wednesday, is weighing on the economy and could drag it into recession. Russia’s GDP shrank during the first month of 2014, though so far there are no exact numbers, a source told the Vedomosti newspaper. Inward investment slid 7% year on year in January, as real income was down 1.5% and wages grew the slowest since 2009, according to Wednesday’s report by Russia’s statistics service Rosstat. Retail growth also slowed to a four-year low at 2.4%.

Currency operations have become more attractive for Russians than economic activity, as the Russian ruble is being extremely volatile, explains Natalia Orlova from Alfa-Bank. This is a bad signal, as similar things were happening between the autumn of 2008 and the start of 2009, Orlova said. “Everybody has stopped dead, nobody knows what will happen with the ruble,” agrees Valery Mironov from the development center of the Highest School of Economics.

S&P

We now believe it is likely that Ukraine will default in the absence of significantly favorable changes in circumstances, which we do not anticipate.

… continued Russian support up to the committed $15 billion is increasingly uncertain. Should Russian financial support fall short of Russia’s commitments, we expect the government of Ukraine to default on its foreign-currency obligations.

We estimate that the government, National Bank of Ukraine (NBU; the central bank), and state-owned gas company Naftogaz have about $13 billion in foreign currency debt service to make in 2014. Ukraine’s international reserves fell to $17.8 billion in January 2014 from $20.4 billion in December 2013. At the same time, Ukraine’s large current account deficit, at about 9% of GDP in 2013, and elevated household demand for foreign currency will also put pressure on Ukraine’s foreign currency reserves.

The NBU spent $1.7 billion of foreign currency reserves in January alone to defend the currency.

FT

Russian-backed bonds are starting to dry up. Ukraine cancelled its planned issue of 5-year eurobonds worth $2 billion late on Thursday, according to a statement to the Irish Stock Exchange. The money – at 5% not even remotely close to the market yield on Ukraine bonds – was part of the $15 billion Russian bailout.

The knock-on effects are starting to kick in too – The Russian ruble has fallen nearly 2% in the last week, one of the worst emerging markets performers, while according to Bloomberg, demand for local bonds has dried up, pushing benchmark yields to a record high and prompting the government to cancel its third debt auction in four weeks.

Where will it end? Any chance of avoiding default means Ukraine has to take Russian or EU/IMF money – with corresponding pain in the form of sanctions or other measures from the other side. As SocGen’s Régis Chatellier put it: “The only scenarios where a default could be avoided would still mean a substantial deterioration of the economic situation for Ukraine.”

• Financial crisis threatens Russia as Ukraine spins out of control (AEP)

The dramatic escalation of Ukraine’s civil conflict and fears of Russian military intervention have sent financial tremors across Eastern Europe, turning the region into the new fulcrum of the emerging market crisis. “This has suddenly gone from a domestic Ukrainian story into a geopolitical clash,” said Lars Christensen, from Danske Bank. The Russian ruble has fallen to a record low against the euro, with contagion reaching Poland, Hungary and Romania in recent days. “The moves in Russia are very like the events during the war in Georgia in 2008. Markets are pricing in the risk of Russian intervention,” he said.

Any deployment of Russian troops to stiffen the Ukrainian governmment – even if invited by President Viktor Yanukovich – could spiral out of control, leading to an East-West stand-off not seen since the Cold War. It might even been seen as replay of Russian intervention in Hungary in 1956 to prevent the country slipping out of the Soviet sphere. German foreign minister Frank-Walter Steinmeier called Ukraine a “powder keg” as the death toll rose to 70, while Poland’s premier Donald Tusk warned of civil war.

Russian foreign minister Sergei Lavrov called the demonstrators fascists bent on a 1930-style “Brown Revolution”. Moscow has accused the EU of instigating a coup d’etat by mob violence. Regis Chatellier, from Societe Generale, said there is a “high risk” that Ukraine will be pushed into default on its €60 billion sovereign debt, triggering a credit shock for Russian banks. Sberbank and VTB are both large holders of Ukrainian bonds. Global emerging market bond funds hold 3% of their portfolio in Ukrainian debt. “The spillover effect of a Ukrainian default would be significant, but not systemic,” he said.

The decision by the Ukrainian nationalist stronghold of Lvov this week to declare “independence” from Kiev has upped the ante, creating a volatile climate in which the Ukrainian army may be forced to intervene to head off civil war. “Ukraine is on the verge of splitting into two countries. We’re looking at events that we have not seen in Europe since the break-up of Yugoslavia,” said one City economist with links to Lvov. “When you have this level of hatred and mistrust, anything can happen.”

Ukraine’s foreign reserves are down to survival levels. Russia has so far kept the country afloat with a $3 billion loan, the first tranche of a $15 billion bailout, but further payments are in doubt. Russia faces the choice of large losses from a default or the ever rising costs of propping up Ukraine’s economy. Military intervention to subjugate the rebels in the Catholic strongholds of Western Ukraine orbit could lead to a quagmire.

Russia is already near recession itself. Industrial output has contracted over the past year and fixed investment has fallen by 7%. “We think Russia is the most exposed. The current account surplus has fallen very sharply,” said Liza Ermolenko, from Capital Economics. Russia has nearly $500 billion of foreign reserves – the world’s third largest – but this cannot easily be deployed in an economic slump. The country learned the hard way in 2008-2009 that such action has a side-effect of monetary tightening. The central bank burned through $200 billion propping up the ruble, but in the process destroyed part of the Russian banking system.

The central bank has been intervening gingerly in the exchange markets over recent weeks, but may feel tempted to go further if the ruble buckles. “We think such a defence could become very costly for the Russian economy,” said Danske Bank. Russia largely escaped the first wave of the emerging market crisis – mostly directed against those, like Turkey, South Africa and Brazil, with large current account deficits – but is now at the epicentre as worries switch to geopolitics. The ruble has fallen 10% against the dollar this year.

Russia has never fully recovered from the post-Lehman crash in 2008-2009. It is a textbook case of the “Dutch Disease”, over-reliant on oil and gas at the expense of manufacturing. It requires crude prices above $110 to balance the budget, leaving it acutely vulnerable if a flood of oil from Iran, Iraq and Libya this year leads to a sharp fall in prices.

• Ruble Wilts as Kiev Burns With Sochi Overshadowed (Bloomberg)

For Russian President Vladimir Putin, the deadly clashes in neighboring Ukraine couldn’t have come at a worse time. The violence that threatens to topple a government propped up by his financial aid is taking investors’ attention away from the Olympic games in Sochi that he sought to use as a showcase for how far Russia has come since its 1998 default. The ruble sank 1.7% this week, the worst rout in emerging markets, while demand for local bonds dried up, pushing benchmark yields to a record high and prompting the government to cancel its third debt auction in four weeks.

While Ukraine, with a population of 45 million, is too small to drag the world’s ninth-biggest economy into crisis, the country is Russia’s fourth-largest trade partner and home to a gas pipeline that state-controlled OAO Gazprom uses for more than half its European exports. What’s more, Putin has pledged $15 billion in aid to pry the former Soviet republic away from a potential pact with the European Union after he oversaw spending on Sochi that soared to $43 billion from an initial $12 billion.

“The meddling with Ukraine certainly hurts Russia’s image as an investment destination,” David Hauner, a fixed-income and currency strategist at Bank of America Corp., said in a telephone interview from London. “It is not going to bankrupt Russia, but $15 billion can turn out to be $50 billion, and Russia will have to plug the holes for a couple years.”

The tumble in Ukrainian debt prices triggered by the violence signals Russia is already suffering losses in the market value of the $3 billion of bonds it bought in the aid package’s first installment.

• Sliding ruble to drag Russian economy into recession (RT)

Russia’s GDP growth turned negative in January, with the lowest investment since 2010. Analysts say uncertainty surrounding the ruble, which hit its all-time low against the euro on Wednesday, is weighing on the economy and could drag it into recession. Russia’s GDP shrank during the first month of 2014, though so far there are no exact numbers, a source told the Vedomosti newspaper. Inward investment slid 7% year on year in January, as real income was down 1.5% and wages grew the slowest since 2009, according to Wednesday’s report by Russia’s statistics service Rosstat. Retail growth also slowed to a four-year low at 2.4%.

The investment slump, slowdown in consumer demand and a real fall in personal income is all very alarming, said Alexander Morozov from HSBC. “Even if we don’t fall into recession, we shouldn’t account for an economic recovery,” Morozov said. Though a recession is now a real threat for Russia, it’s too early to make any far–reaching conclusions, as technically it is defined as two quarters of economic contraction, the HSBC analyst explained. “My forecast for investment was extremely pessimistic – minus 2%. And given such a sharp slowdown in retail, I don’t exclude that the economy is de-facto in recession,” says Evgeny Nadorshin, an economist from AFK Sistema.

Currency operations have become more attractive for Russians than economic activity, as the Russian ruble is being extremely volatile, explains Natalia Orlova from Alfa-Bank. This is a bad signal, as similar things were happening between the autumn of 2008 and the start of 2009, Orlova said. “Everybody has stopped dead, nobody knows what will happen with the ruble,” agrees Valery Mironov from the development center of the Highest School of Economics.

• Ukraine Likely to Default, Credit Rating Cut to CCC, S&P Says (Bloomberg)

Ukraine is at risk of default after a political crisis “deteriorated substantially,” according to Standard & Poor’s. Fighting between police and anti-government protesters have claimed at least 77 lives this week. S&P cut Ukraine to CCC, eight levels below an investment rating, from CCC+ and kept its outlook negative, citing the increasing risk that President Victor Yanukovich’s government will fail to service its debt. “We now believe it is likely that Ukraine will default in the absence of significantly favorable changes in circumstances, which we do not anticipate,” S&P analysts said in the statement.

European Union governments imposed sanctions on Ukrainian officials, and the country’s parliament yesterday rejected Yanukovych’s crackdown following the deadliest day of protests in the capital Kiev. Diplomatic efforts in Kiev and Brussels to end three months of anti-government demonstrations left Yanukovych to consider mounting calls to step aside. Ukrainian markets rebounded yesterday as investors anticipated an endgame was at hand.

“In our view, the political situation in Ukraine has deteriorated substantially,” Standard & Poor’s said. “We believe that this puts the government’s capability to meet debt service at increasing risk, and raises uncertainty regarding the continued provision of Russian financial support over the course of 2014.”

• Ukraine and the ‘D’ word (FT)

Yup, default. Credit rating agency Standard & Poor’s raised the spectre of Ukraine not paying back its debt in a downgrade early on Friday. With protesters being killed and the country descending further into chaos, the question is now not whether Ukraine will default, but if it can possibly avoid it. The S&P statement pulled no punches. The agency lowered the credit rating from CCC+ to CCC, a symbolic rather than practical measure, given that Ukraine was firmly in junk territory and the yields on its benchmark bonds are already sky-high. Instead, it was the words, rather than rating, that caught the eye.

We now believe it is likely that Ukraine will default in the absence of significantly favorable changes in circumstances, which we do not anticipate.

S&P set out the funding problems – the full statement is worth a read, but here are the key parts (with our emphasis):

In our view, the expected financial support from Russia is becoming increasingly uncertain and dependent on the outcome of the deteriorating political situation in Ukraine. The clashes between protesters and security forces that began on Feb. 18 lead us to conclude that a conciliatory end to the political stand-off is now out of reach. We consider that the future of the current Ukrainian leadership is now more uncertain than at any time since the protests began in November 2013. We believe that the Russian government’s support for Ukraine is tied to the current leadership and its political orientation away from the EU and toward Russia. As a result of the intensifying political turmoil in Ukraine, we consider that continued Russian support up to the committed $15 billion is increasingly uncertain. Should Russian financial support fall short of Russia’s commitments, we expect the government of Ukraine to default on its foreign-currency obligations.

We estimate that the government, National Bank of Ukraine (NBU; the central bank), and state-owned gas company Naftogaz have about $13 billion in foreign currency debt service to make in 2014. Ukraine’s international reserves fell to $17.8 billion in January 2014 from $20.4 billion in December 2013. At the same time, Ukraine’s large current account deficit, at about 9% of GDP in 2013, and elevated household demand for foreign currency will also put pressure on Ukraine’s foreign currency reserves.

We had understood that the $15 billion of direct Russian financial support to Ukraine would be fully disbursed before the second half of 2014. This amount constitutes about 8% of Ukraine’s 2014 GDP, and $3 billion has been disbursed to date. However, the deterioration in the political situation in Ukraine, resulting in the loss of at least 25 lives, suggests to us that opposition to the Ukrainian government’s current financing arrangements–and to President Yanukovych remaining in power–could be sufficient to prevent Russia from providing the committed funding. In our view, this would result in the Ukrainian government being unable to meet its debt service in a timely manner. No alternative funding sources have yet been found. …

As a result of the political turmoil, the economic situation in Ukraine continues to deteriorate and, in our view, the likelihood of a forced devaluation of the Ukrainian hryvnia has significantly increased. With over half of the government’s debt denominated in foreign currency, a significant devaluation could further undermine the government’s debt service capabilities. The potential magnitude of this has also increased in light of the government’s defense of the exchange rate. The NBU spent $1.7 billion of foreign currency reserves in January alone to defend the currency. [..]

If Russian funding dries up – which S&P thinks will happen without Yanukovitch in power – then an IMF deal is the only way out. This is the “best case”, according to [Timothy Ash, economist at Standard Bank], but would require early elections and a new government put in place quickly with support from the EU and IMF, which would remove Russia from the picture.

And the Russian-backed bonds are starting to dry up. Ukraine cancelled its planned issue of 5-year eurobonds worth $2 billion late on Thursday, according to a statement to the Irish Stock Exchange. The money – at 5% not even remotely close to the market yield on Ukraine bonds – was part of the $15 billion Russian bailout.

The knock-on effects are starting to kick in too – The Russian ruble has fallen nearly 2% in the last week, one of the worst emerging markets performers, while according to Bloomberg, demand for local bonds has dried up, pushing benchmark yields to a record high and prompting the government to cancel its third debt auction in four weeks.

Where will it end? Any chance of avoiding default means Ukraine has to take Russian or EU/IMF money – with corresponding pain in the form of sanctions or other measures from the other side. As SocGen’s Régis Chatellier put it: “The only scenarios where a default could be avoided would still mean a substantial deterioration of the economic situation for Ukraine.”

• Ukraine on thin ice as bond sale canceled (CNN)

Ukraine has canceled plans to raise $2 billion by selling bonds to Russia, increasing the risk that it won’t be able to pay its debts. Ukraine has to repay as much as $13 billion in debt this year but three months of political turmoil have left the country dangerously short of foreign currency reserves. Russia was expected to buy the bonds as part of a $15 billion financial aid package agreed in December.

Rating agency S&P lowered its rating on Ukraine Friday to CCC, saying it believed Ukraine would default “in the absence of significantly favorable changes in circumstances, which we do not anticipate.” Without external financial support, Ukraine will struggle to service its debt and finance its imports, including gas from Russia.

• France is looking straight down the barrel of a deflation shock (AEP)

French President François Hollande must now pay the price for kowtowing to the contraction polices of the eurozone. His country is sliding into deflation. French prices fell 0.6% in January from a month earlier, and would have fallen even further without one-off tax rises. Manufactured goods fell 3%, and clothing fell 15.4% as retailers slashed prices to offload stock.

France’s core prices have been dropping for months, even if the core CPI index is still just positive at 0.1% on a year-to-year basis. This outcome is exactly what the Observatoire Economique predicted a year ago would happen under the eurozone’s contractionary policy structure, that is to say under a triple squeeze of fiscal austerity, passive monetary tightening, and draconian bank deleveraging.

Surprise, surprise, the eurozone M3 money supply has been contracting since March. People laughed at the Observatoire. Nobody is laughing any more. As the IMF said last night, Europe is one external shock away from a lurch into outright deflation.

“A new risk to activity stems from very low inflation in advanced economies, especially the euro area, which, if below target for an extended period, could de-anchor longer-term inflation expectations. Low inflation raises the likelihood of a deflation in case of a serious adverse shock to activity. In the euro area, low inflation also complicates the task in the periphery where the real burden of both public and private debt would rise as real interest rates increased.”

It is no mystery where that shock might come from. The Fed and the Chinese central bank are tightening into an emerging market storm that is turning more serious by the day. A long list of countries are having to raise interest rates to defend their currencies, creating a further tightening bias. Some of these countries are coming off the rails altogether.

Optimists have a touching faith in the German locomotive that is supposed to pull the eurozone out of the swamp, but the latest data shows that German wages fell 0.2% in 2013. Germany too is in wage deflation. Which raises the question: how on earth are France, Italy, Spain, Portugal, and Greece supposed to claw back lost labour competitiveness against Germany by means of “internal devaluations” if German wages are falling?

This forces these countries to go into even steeper wage deflation to narrow the gap, and that in turn causes debt dynamics to spin out of control as the denominator effect does its worst. There is a technical solution to this. It is called QE. The European Central Bank can lift the entire EMU system off the reefs by launching a monetary blitz to meet its own M3 growth target of 4.5%. Unfortunately, the German constitutional court has just raised the political bar for QE to such a high level that the ECB will have to wait until the shock hits before reacting, and by then it will be too late.

Contrary to widespread belief, there is no treaty prohibition against QE. Mario Draghi has said explicitly that it is “not illegal” and remains an option in extremis. Maastricht prohibits the financing of budgets but not open market operations (QE) needed to maintain monetary stability. The alleged constraint is entirely political and ideological, and driven by fear that German Eurosceptics will fight it in the courts. So we have an impasse. What now happens if the damp kindling wood of eurozone recovery fails yet again? It has Japanisation written all over it.

• Greece has first current account surplus in 66 years (RT)

For the first time since official data begun in 1948 Greece posted a current account surplus of $1.65 billion last year. The money flow changed direction, as revenues from tourism jumped 15% and imports slumped to a long term low. It’s the equivalent of around 0.7% of national gross domestic product, says a Bank of Greece (BOG) press release. A big part of the gain came from tourism, which in 2013 brought in a record $16 billion, a 15% jump from the year before.

The shift from deficit to surplus came as imports fell by 4.5% for all products, and exports rose 2.3%. A reduction in salaries promoted Greek companies’ competitiveness, strengthening non-fuel exports by 2.1% or $19.6 billion in 2013. The contribution of foods and beverages and non-metallic mineral products was also significant, according to the BOG.

The account deficits have been a burden for the Greek economy for decades , compensated by borrowing and capital investment from abroad. The 2012 country’s deficit stood at €4.6 billion, while in 2011 the shortfall was €20.6 billion, according to figures from the country’s central bank.

Economists predict further current account surplus in Greece this year. “For 2014 we expect the current account to stay in surplus as imports will remain weak alongside improving tourism and exports,” Reuters quotes Platon Monokroussos, an economist at Eurobank. nHowever he considers it’s too early to call Greece an export-driven, competitive economy. “Sustaining the surplus in the longer term will depend on whether the economy maintains its competitiveness and on its capacity to increase import substitution with domestic production.”

Government officials planned to emerge from recession in 2014, however the country still faces economic challenges. In November 2013 the unemployment rate reached a record high of 28%, while the austerity measures have eroded about a quarter of the Greek economy in four years.

• UK productivity gap with developed nations now widest for 20 years (Guardian)

Output per hour worked in UK 21% below average for G7, figures from Office for National Statistics reveal

Britain’s productivity gap with its main developed country rivals is at its widest in 20 years, following the flat-lining of the economy after the deep recession of 2008-09. International comparisons released by the Office for National Statistics (ONS) show that output per hour worked in the UK is 21% lower than the average for the other six members of the G7 – the US, Germany, France, Italy, Japan and Canada. The ONS said this was the biggest productivity shortfall since 1992, and that on an alternative measure – output per worker – the gap was 25%.

Poor productivity has been blamed for the lack of earnings growth and the squeeze on real incomes in Britain over the past five years, though the Bank of England is expecting output per worker to pick up during 2014. John Philpott, director of the consultancy the Jobs Economist, said: “We know UK labour productivity has been dire since the start of the recession. We now know our relative performance is even direr than first thought.”

During the 1990s and 2000s, Britain closed the gap with the other G7 nations to less than 10%, but in the years since the 2007 financial crisis weak output and a smaller loss of jobs than in previous recessions has led to a marked worsening in Britain’s productivity record. The ONS said the UK productivity deficit was most pronounced in comparison with the US, Germany and France, where the gap was now more than 30%. By contrast, British workers produced 11% more per hour than their Japanese counterparts and lagged behind those in Canada and Italy by five and 11 points respectively.

Productivity tends to increase over time as new technology and better skills make economies more efficient. But the ONS said output per worker in 2012 was 3% lower than it had been five years earlier and 16% below the level that might have been expected, had its previous upward trend not been interrupted by the most severe slump of the postwar era. Moreover, even though the UK economy has recovered since 2012, there is no evidence to suggest that the productivity gap is likely to have narrowed, leaving the UK still staring up the international productivity league table.

• RBS agrees to $275 million mortgage-debt settlement (Reuters)

Royal Bank of Scotland has agreed to pay $275 million to resolve a U.S. lawsuit accusing it of misleading investors in mortgage-backed securities, lawyers for the plaintiffs said on Wednesday. The accord, which must be approved by a federal judge in New York, is the third-largest settlement in a U.S. class action against banks that packaged and sold mortgage securities that were at the heart of the 2008 financial crisis. “To get a settlement like this, we think it’s a solid result,” said Steven Toll, a lawyer for the plaintiffs at Cohen Milstein Sellers & Toll.

RBS in a statement said it had already provisioned for the settlement, adding that the result “should not be seen as indicative” of how other mortgage-backed securities cases against it may resolve. RBS last month said it had set aside £3.1 billion (about US $5.2 billion) to cover legal claims against it, including £1.9 billion to resolve claims primarily related to mortgage-backed securities. The U.K. government is RBS’ largest shareholder, owning about 80% following a £45 billion (US $75 billion) government rescue in 2008.

The settlement announced Wednesday came in a 2008 lawsuit led by New Jersey Carpenters Health Fund and the Boilermaker Blacksmith Pension Trust, which had sued over soured mortgage securities issued in 2006 and 2007. The lawsuit accused RBS and other defendants of violating U.S. securities law in packaging and selling an estimated $25.39 billion of securities in 14 offerings of mortgage-backed securities linked to the Harborview Mortgage Loan Trusts. RBS was accused of concealing that the mortgage loans did not meet underwriting guidelines. These securities ultimately sank to junk status, which investors said reflected how their investments were “impaired from the outset.”

• RBS to shed up to 30,000 jobs, shrink investment bank (Reuters)

Royal Bank of Scotland is to shrink its investment banking and international operations in a revamp in which the group could shed up to a quarter of its 120,000 workforce, sources familiar with the matter said. The part-nationalised bank has given in to demands from politicians that it focuses on lending to British households and businesses and maintains only a downsized investment banking business to service corporate clients, one source said.

RBS, which is 81% owned by the British government, could reduce its headcount by up to 30,000 as part of the reorganisation, according to sources familiar with the matter. But that figure includes previously announced plans to sell its U.S. retail business Citizens, which accounts for 18,300 jobs, and a UK retail business, Williams & Glyn, which employs 4,500.

RBS was rescued by a £45.5 billion ($75.80 billion) government bailout during the 2008 financial crisis. Since then, the future of its investment bank and Citizens has been a source of friction between RBS’s management and Britain’s finance ministry. Finance Minister George Osborne wants RBS to be more like state-backed rival Lloyds Banking Group, which has minimal investment banking operations and concentrates on domestic lending. Lloyds is expected to return fully to private ownership in the next 12 months while RBS is three to five years away.

Former RBS CEO Stephen Hester clashed with politicians over their desire to see RBS’s investment bank scaled back and this contributed to his departure last year. Ross McEwan, who replaced him, will unveil the outcome of a strategic review of the business alongside the bank’s full-year results next Thursday. Numis analyst Mike Trippitt said the plans were a positive development subject to restructuring costs and the impact on the bank’s capital position. “It has been clear for some time that the government has wanted RBS to retrench to a UK focused retail and commercial bank,” he said.

If ever there was a reason to win a hockey game……

The stakes are high for Friday’s semifinal hockey game between Canada and the U.S. at the Sochi Olympics. Not only is a spot in the gold-medal game on the line, but fans on the web appear willing to wager national ownership of pop star-turned-brat Justin Bieber.

The hashtag #LoserKeepsBieber was trending on Twitter Thursday, with puck-heads on both sides of the border willing to up the ante on the highly-anticipated matchup. The idea picked up even more steam after a Chicago-based company that operates an electronic billboard created a sign that shows an image of the 19-year-old from Stratford, Ont., in between Canadian centre Jonathan Toews and U.S. winger Patrick Kane – both teammates on the NHL’s Blackhawks – with the caption ‘Loser Keeps Bieber’.

This article addresses just one of the many issues discussed in Nicole Foss’ new video presentation, Facing the Future, co-presented with Laurence Boomert and available from the Automatic Earth Store. Get your copy now, be much better prepared for 2014, and support The Automatic Earth in the process!

Home › Forums › Debt Rattle Feb 21 2014: Broke, Bruised And Battered