DPC “Steamer loading grain from floating elevator, New Orleans 1906

“There is only so much cost-cutting companies can do to compensate for absent demand.”

• Global Economy On The Verge Of A Once-in-a-Generation Transformation (Telegraph)

Few things illustrate the 35-year boom in Western asset prices better than the cost of a London house. In 1980, according to Nationwide data, you could have bought the average home for little more than £30,000. Today, the same property would set you back £407,000, or more than 13 times as much. Even adjusting for inflation, the gains are spectacular. Relative to average earnings – which are themselves up by a lot more than ordinary inflation – house prices have doubled. But it is not just residential property. Equities, bonds, agricultural land, even personalised number plates – virtually all asset prices have sky-rocketed. There have been ups and downs, admittedly, but the direction of travel has been clear. It is as if all the inflation that used to go into consumer prices has been diverted into financial assets and real estate instead.

All this, however, may be about to change – for we could be on the cusp of one of those seminal, once-in-a-generation shifts that completely alters the way we experience, and respond to, the world around us. For the past three and a half decades, the balance of advantage has resided unambiguously with capital. Now, it may be turning back to labour. Such a change has been predicted many times before, only for those prophecies to be proved wrong. It could be that past trends continue for a while longer yet. But a unique array of unfamiliar factors is fast coming into play. So here are the five primary reasons for believing that the long boom in asset prices – on many measures, the biggest the world has ever seen – may finally be drawing to a close. First, low inflation in Europe. The eurozone this week confirmed that it has essentially lost the battle against deflation (in truth, it never really bothered to fight it), with the headline rate turning negative in December.

It is true that “core inflation” – excluding fluctuating costs such as energy and food – remains positive. But even this is very low by historic standards, and has been for a long time now. Companies perform best when inflation is predictable and steady, which is what we had during the “Great Moderation” of the pre-crisis period. Static or falling prices, on the other hand, are always extremely bad for corporate profits in the long term. There is only so much cost-cutting companies can do to compensate for absent demand. In this low-inflation environment, business models that have relied for decades on rising prices begin to look highly vulnerable. New forms of retail competition, both online and physical, have been a blessing for consumers, but for corporate profits they are a nemesis. In a deflationary environment, equities and property will inevitably perform badly: only fixed-interest sovereign bonds, the least risky form of investment, do well.

“Derivatives can tie a financial instrument to another financial instrument or a financial derivative can be tied to an oil derivative.” “This is just a flavor of how complicated these mathematical equations really are, and no one really knows the risk in them.”

• Oil Derivatives Explosion Double 2008 Sub-Prime Crisis (ETF Daily News)

Precious metals expert David Morgan says the plunge in oil prices is not good news for big Wall Street banks. Morgan explains, “The amount of debt that is carried by the fracking industry at large is about double what the sub-prime was in the real estate fiasco in 2008.” “In summary, we’re looking at an explosion in potential that is greater than the sub-prime market of 2008 because, number one, oil and energy are the most important sectors out there.” “Number two, the derivative exposure is at least double what it was in 2008. Number three, the banking sector is really more fragile and we have less ability to weather the storm.” Morgan, who is also “a big-picture macroeconomist,” says oil derivatives could take down the system just like mortgage-backed securities back in the last financial meltdown.”

“The Fed said the sub-prime crisis would be “contained.” It was not. So, could oil derivatives take down other derivatives in a daisy chain type of collapse? Morgan says, “Absolutely, there is no question about it. The main problem is the overleverage of the system as a whole.” “Warren Buffett calls derivatives weapons of financial mass destruction, which is a true statement. Secondly, look at how derivatives are interconnected. Derivatives can tie a financial instrument to another financial instrument or a financial derivative can be tied to an oil derivative.” “This is just a flavor of how complicated these mathematical equations really are, and no one really knows the risk in them.” So, underwater oil derivatives in one bank could bring down the financial system?” “Morgan says, “Absolutely, because it is all tied together, all the banks are interconnected.”

“.. deeper losses are likely to surface down the road, when companies report first-quarter or second-quarter earnings.“

• Energy Stocks Brace For Many Quarters Of Earnings Pressure (MarketWatch)

Wall Street is bracing for a 20% decline in energy companies’ earnings in the fourth quarter — and that’s the good news. “This quarter is not going to be the trough of profitability,” said Pavel Molchanov, an analyst with Raymond James. Rather, deeper losses are likely to surface down the road, when companies report first-quarter or second-quarter earnings. Perhaps more than the sheer numbers, investors will want to hear about belt-tightening measures at companies exposed to the rout in oil prices over the last few months. The giant oil companies will report at the tail end of this earnings season, in the last days of January and the first days of February (Metals manufacturer Alcoa kicks off earnings season on Monday).

Meanwhile, Schlumberger on Thursday will be the first among oil-field services companies to report, while other companies, such as machinery maker Caterpillar, which reports on Jan. 27, are also expected to report pain from falling oil prices. Of course, all the fourth-quarter numbers will reflect the days when New York-traded WTI and London’s Brent, the global crude benchmarks, averaged $73 a barrel and $76 a barrel, respectively. The picture has only worsened. On Friday, Brent crude fell under $50 a barrel, while New York-traded oil struggled to keep above $48 a barrel. With the world awash in oil at least through the first half of the year and no indication that OPEC is even contemplating a production cut in the face of weak global demand, Wall Street has braced for more declines in the price of crude, and therefore gloomy outlooks from energy-related plays.

Falling oil prices, of course, are bound to help some companies — be it airlines, through lower fuel costs, or retailers, as consumers have more in their wallets for other items. Burt White, chief investment office for LPL Financial, said in a note Friday he expects “another good earnings season overall” despite the drag from the energy sector. Consensus estimates call for a 4% year-over-year increase in S&P 500 earnings per share for the quarter, even while absorbing the expected 20% decline in energy-sector earnings, he said.

The casino goes full steam.

• Don’t Bank on Oil Rebound Says Fund That Foresaw Collapse (Bloomberg)

A hedge fund that returned almost 60% last year by betting on oil’s collapse says the slump may have further to run. Crude may drop below $40 a barrel in the next few months without a substantial slowdown of production growth in the U.S. and Canada, said Doug King, London-based chief investment officer of Merchant Commodity Fund. Bearish oil wagers in the second half of 2014 helped the $260 million fund gain 59.3%, the best performance since its June 2004 start. Brent futures lost 48% last year, the most since 2008, as OPEC resisted calls to cut output.

The U.S. is pumping the most crude in more than three decades as horizontal drilling and hydraulic fracturing unlock shale reserves, adding to a global supply glut that Qatar estimates at 2 million barrels a day. “Unless we see real slowdown in production growth in the U.S. and Canada, there’s no point in trying to bottom fish as you are getting no help from the fundamental picture,” King said in an interview in Singapore on Jan. 8. “I wouldn’t be surprised to see the 2008 low of $35 to $30.” Merchant made 19.5% in December by forecasting a slump in crude and coal prices, King said. Brent fell 18% last month, while benchmark European thermal coal for next-year delivery lost 8.4%, according to broker data compiled by Bloomberg.

Floating casino’s.

• Oil Glut Spurs Top Traders To Book Supertankers For Storage At Sea (Reuters)

Some of the world’s largest oil traders have this week hired supertankers to store crude at sea, marking a milestone in the build-up of the global glut. Trading firms including Vitol, Trafigura and energy major Shell have all booked crude tankers for up to 12 months, freight brokers and shipping sources told Reuters. They said the flurry of long-term bookings was unusual and suggested traders could use the vessels to store excess crude at sea until prices rebound, repeating a popular 2009 trading gambit when prices last crashed. The more than 50% fall in spot prices now allows traders to make money by storing the crude for delivery months down the line, when prices are expected to recover.

The price of Brent crude is now around $8 a barrel higher for delivery at the end of 2015, with its premium rising sharply over spot prices this week due to forecasts for a large surplus in the first half of this year, in a market structure known as contango. Brent hit a 5 1/2-year low of $49.66 a barrel on Wednesday. It was trading around $51 a barrel on Thursday. While major energy traders will often hire vessels for long periods as part of their day-to-day operations, industry sources said the fixtures booked in the last week had the option to hold oil in storage. Some could still be used for conventional oil transportation. Vitol, the world’s largest independent oil trader, has booked the TI Oceania Ultra Large Crude Carrier, a 3 million barrel capacity mega-ship that is one of the biggest ocean going vessels in the world by dead weight tonnage (DWT).

Time lag.

• The Oil Industry Still Managed To Add Jobs In December (MarketWatch)

It wasn’t by much, but oil and gas explorers expanded their workforce in December even as energy prices tumbled, according to government data released Friday. The oil and gas extraction industry added roughly 400 positions in December. That is the lowest monthly showing since August, for an industry that employs some 216,000. The industry added 12,000 jobs last year. With crude-oil prices tumbling — down roughly half from a July high — job losses may well be in store.

That’s particularly worrying, because these positions, which include geoscientists, engineers and laborers, pay above-average wages. In November, workers in this sector earned $40.59 per hour, compared to the national average that’s under $25. It’s also a sector that’s been aggressively adding jobs. There’s been jobs growth of 39% over the last five years, compared to 8% for the U.S. overall. The rapid growth in the energy industry — driven by techniques like fracking that have ratcheted up growth in places like North Dakota — has also helped spill over into other sectors, like construction.

And there go the jobs.

• Oil-Price Drop Takes Shine Off Steel Town (WSJ)

Lorain, Ohio—The collapse of oil prices in the past six months is threatening to end a recent industrial revival in manufacturing centers like this town of 64,000 people on the banks of Lake Erie. The U.S. shale-drilling boom lifted Midwest manufacturing economies, enriched property owners with mineral rights and even brought back the fat blue-collar paychecks that once were harder to find. But as drilling and exploration for new oil and gas slow with the drop in energy prices, cutbacks at heavy-industry companies are cropping up. The U.S. Steel Corp. plant here, which depends heavily on oil and gas companies to buy its steel pipe and tubes, warned on Monday it might have to idle the plant in March and lay off 614 of the plant’s 700 workers. The company also said it could temporarily end work at a plant in Houston, affecting 142 workers.

The Pittsburgh-based steelmaker, the second-biggest employer in Lorain after Mercy Regional Medical Center, had recently invested $95 million in a plant upgrade. When energy prices were high and orders robust, workers received generous overtime, sometimes pushing annual salaries into six figures. “We thought this time the going was going to be good for a while,” said Chase Ritenauer, the town’s 30-year-old mayor. “But now Lorain is going to feel the impact of the global economy.” U.S. Steel bet heavily on the energy industry. The company invested $215 million in capital expenditure in its so-called tubular division over the past three years, compared with $113 million in the five years before that. U.S. Steel is trying to get back in the black after five straight unprofitable years, including a $1.7 billion loss last year.

“Right now, there’s somewhat of a state of emergency in the oil industry – some would call it a panic ..”

• Oil Losses Force Norway to Consider Measures to Back Economy (Bloomberg)

Norway is considering tapping reserve funds to shield western Europe’s biggest oil producer from the worst slump in crude prices in more than half a decade. Prime Minister Erna Solberg said the government is now “on alert” to respond to the rout. “If the economic situation requires it, we can react quickly,” she said yesterday at a conference in Oslo organized by Norway’s confederation of industry. A 56% plunge in the price of Brent crude since a June high has undermined Norway’s currency and beaten back its stock market. The krone has lost 20% against the dollar over the period. Norway’s benchmark equity index is down 9%. Oil producers including the country’s biggest, Statoil, and service companies have already cut thousands of jobs to adjust and unions are calling for government measures to protect the industry.

“The decline has been stronger and gone faster than we had expected,” Eldar Saetre, chief executive officer of state-backed Statoil, said yesterday in an interview. “The development we’re seeing is a reminder that we’re in a cyclical industry, and that we need to have a cost level in this industry that can sustain these types of cycles and let us be competitive over time.” Scandinavia’s richest economy is now facing the flipside of an oil reliance that has supported an economic boom over the past decade. Though successive governments have sought to avoid overheating by channeling oil income into the country’s $840 billion sovereign wealth fund, Norway’s plight now shows those efforts weren’t enough to wean it off oil.

“Right now, there’s somewhat of a state of emergency in the oil industry – some would call it a panic,” Walter Qvam, CEO of Kongsberg, a Norwegian defense and oil services company, said in an interview. “Norway needs this reminder, and it’s very good that we’re getting it now. We’re going to stay an oil nation, but we now need to create the next version of Norway, because the version we’ve been living in for the past 35 years is on the wane.” Solberg said her government is working on models that will help the $510 billion economy speed up its shift away from fossil fuels and over to other industries.

The war on Russia continues: “It will be very difficult to escape being junked.”

• Russia Cut to One Step Above Junk by Fitch on Oil, Sanctions (Bloomberg)

Russia’s credit rating was cut to the lowest investment grade by Fitch Ratings after plummeting oil prices and the conflict over Ukraine triggered the worst currency crisis since the country’s 1998 default. Fitch, which last downgraded Russia in 2009, cut the sovereign one step to BBB-, according to a statement issued Friday in New York. The grade, on par with India and Turkey, has a negative outlook. “The economic outlook has deteriorated significantly since mid-2014 following sharp falls in the oil price and the ruble, coupled with a steep rise in interest rates,” Fitch said in the statement. “Plunging oil prices have exposed the close link between growth and oil.” The world’s biggest energy exporter is on the brink of a recession after crude fell more than 50% since June and the U.S. and its allies imposed sanctions following President Vladimir Putin’s annexation of Crimea from Ukraine in March.

The penalties have locked Russian corporate borrowers out of international debt markets and curbed investor appetite for the ruble, stocks and bonds. The downgrade by Fitch puts it in line with the nation’s assessment by Standard & Poor’s, which cut Russia to BBB- in April. Authorities have responded to the currency crisis with emergency moves that included the biggest interest-rate increase since 1998, a 1 trillion-ruble ($17 billion) bank recapitalization plan and measures to force exporters to convert more of their foreign revenue into rubles. “This decision is showing Russia is now caught in a vicious cycle in which the plunge in oil prices, the much harsher sanctions regime, the uncertainty about the entire policy regime and the depth of the recession are all feeding on each other,” Nicholas Spiro, managing director at Spiro Sovereign Strategy, said in a telephone interview from London. “It will be very difficult to escape being junked.”

“We won’t survive the coming years if someone loses their nerve in this overheated situation ..”

• Gorbachev Warns Of Major War In Europe Over Ukraine (Reuters)

Former Soviet leader Mikhail Gorbachev warned that tensions between Russia and European powers over the Ukraine crisis could result in a major conflict or even nuclear war, in an interview to appear in a German news magazine on Saturday. “A war of this kind would unavoidably lead to a nuclear war,” the 1990 Nobel Peace Prize winner told Der Spiegel news magazine, according to excerpts released on Friday. “We won’t survive the coming years if someone loses their nerve in this overheated situation,” added Gorbachev, 83. “This is not something I’m saying thoughtlessly. I am extremely concerned.” Tensions between Russia and Western powers rose after pro-Russian separatists took control of large parts of eastern Ukraine and Russia annexed Crimea in early 2014. The United States, NATO and the European Union accuse Russia of sending troops and weapons to support the separatist uprising, and have imposed sanctions on Moscow.

Russia denies providing the rebels with military support and fends off Western criticism of its annexation of Crimea, saying the Crimean people voted for it in a referendum. Gorbachev, who is widely admired in Germany for his role in opening the Berlin Wall and steps that led to Germany’s reunification in 1990, warned against Western intervention in the Ukraine crisis. “The new Germany wants to intervene everywhere,” he said in the interview. “In Germany evidently there are a lot of people who want to help create a new division in Europe.” The elder statesman, whose “perestroika” (restructuring) policy helped end the Cold War, has previously warned of a new cold war and potentially dire consequences if tensions were not reduced over the Ukraine crisis. The diplomatic standoff over Ukraine is the worst between Moscow and the West since the Cold war ended more than two decades ago.

h/t @PhenomTriune

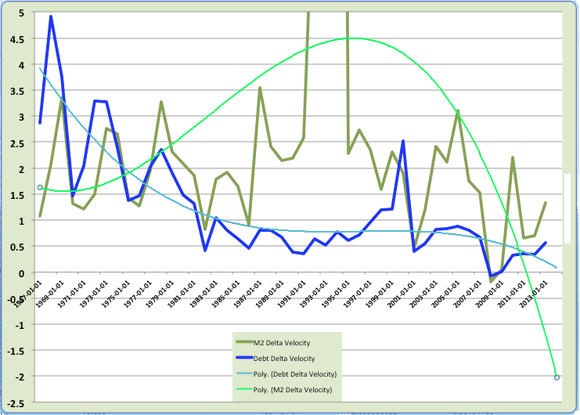

Crucial topic. The turning point in debt fueled economies is when additional debt can no longer produce growth.

• Empirical Proof of the Giant Con (Beversdorf)

[..] it is important then that we ensure our debt is being allocated effectively so as to avoid devastation. But how do we do that? How do we know debt is being effectively put to work in the economy so that it actually returns both principal and some additional positive return at least sufficient to cover the interest payment on the principal borrowed? Well, I’ve put together a chart. The chart depicts something I’m calling Debt Delta Velocity and M2 Delta Velocity. All I’ve done is used the change in GDP and money stock to get the delta velocity. That is, for each dollar we ve added to money supply in a given period (and I used annual periods) we gauge how much additional output was generated. So then it s change in GDP divided by change in M2 Stock (whereas M2 Velocity is total GDP/total M2).

And so in order to measure the effectiveness of our debt utilization I take change in GDP divided by change in debt. Now the issue with debt is that it needs to be paid back. And so if we are generating anything less than the principle + real interest rate we are actually losing money on each dollar of debt despite official total GDP increasing due to the inclusion of debt principal. So let’s have a look at the chart.

And so what we see is M2 Delta Velocity (green line) showing a positive trend from the late 1960s through the late 1990s at which point it goes into a nose dive that continues today. This means that we re being forced to print proportionately more dollars to generate the same amount of output. But one dollar of additional supply is still generating more than a dollar of output. However that does not appear to be the case with debt delta velocity. The Debt Delta Velocity (blue line) is the change in GDP/ (change in debt + cumulative change in annual interest payments). The idea is that the cost is not only the additional principal debt but the annual interest payment as well. And so even a linear accumulation of debt results in an exponential growth in obligations requiring significantly more GDP growth than does M2 Delta Velocity to generate positive returns. The significance of this chart is that it shows us for every dollar of debt we take on we are generating less than a dollar of GDP.

“Reality is now setting in for America and for that matter for most of the world. The piper will get his due even if “the children” have to suffer.”

• Inner City Turmoil And Other Crises: My Predictions For 2015 (Ron Paul)

If Americans were honest with themselves they would acknowledge that the Republic is no more. We now live in a police state. If we do not recognize and resist this development, freedom and prosperity for all Americans will continue to deteriorate. All liberties in America today are under siege. It didn’t happen overnight. It took many years of neglect for our liberties to be given away so casually for a promise of security from the politicians. The tragic part is that the more security was promised — physical and economic — the less liberty was protected. With cradle-to-grave welfare protecting all citizens from any mistakes and a perpetual global war on terrorism, which a majority of Americans were convinced was absolutely necessary for our survival, our security and prosperity has been sacrificed. It was all based on lies and ignorance. Many came to believe that their best interests were served by giving up a little freedom now and then to gain a better life. The trap was set.

At the beginning of a cycle that systematically undermines liberty with delusions of easy prosperity, the change may actually seem to be beneficial to a few. But to me that’s like excusing embezzlement as a road to leisure and wealth — eventually payment and punishment always come due. One cannot escape the fact that a society’s wealth cannot be sustained or increased without work and productive effort. Yes, some criminal elements can benefit for a while, but reality always sets in. Reality is now setting in for America and for that matter for most of the world. The piper will get his due even if “the children” have to suffer. The deception of promising “success” has lasted for quite a while. It was accomplished by ever-increasing taxes, deficits, borrowing, and printing press money. In the meantime the policing powers of the federal government were systematically and significantly expanded. No one cared much, as there seemed to be enough “gravy” for the rich, the poor, the politicians, and the bureaucrats.

As the size of government grew and cracks in the system became readily apparent, a federal police force was needed to regulate our lives and the economy, as well as to protect us from ourselves and make sure the redistribution of a shrinking economic pie was “fair” to all. Central economic planning requires an economic police force to monitor every transaction of all Americans. Special interests were quick to get governments to regulate everything we put in our bodies: food, medications, and even politically correct ideas. IRS employees soon needed to carry guns to maximize revenue collections. The global commitment to perpetual war, though present for decades, exploded in size and scope after 9/11. If there weren’t enough economic reasons to monitor everything we did, fanatics used the excuse of national security to condition the American people to accept total surveillance of all by the NSA, the TSA, FISA courts, the CIA, and the FBI. The people even became sympathetic to our government’s policy of torture.

“Holding to a budget balance goal is really a key point in our strategy, as it gives us the possibility to negotiate from a strong position.”

• Greece’s Leftist Candidate: ‘Markets Won’t Be Rooting for Us’ (Bloomberg)

Greek anti-austerity Syriza party leader Alexis Tsipras isn’t “frightened” by possible market turmoil in case of victory at the Jan. 25 general election. “We know markets certainly won’t be rooting for us and there’s a chance that initially they will show some aggressiveness toward a left government,” he said, according to excerpts of “Alexis Tsipras, My Left,” a book scheduled to be published in Italy next week. “The more you need money, the higher is the interest markets require.” Prime Minister Antonis Samaras was forced to ask for snap elections on Dec. 29 after failing to get enough lawmakers to support his candidate for the country’s ceremonial presidency.

Greek 10-year government bond yields climbed back above 10% this week as Syriza’s lead in polls was confirmed less than three weeks before the ballot. Samaras has warned the election will determine Greece’s euro membership and raised the specter of default in case of a victory by Tsipras, who advocates higher wages and a write-off of some Greek debt. “Additionally, as to markets perception, the issue of debt negotiation is fundamentally important,” Tsipras told Teodoro Andreadis Synghellakis in the question-and-answer style book. Syriza vows to write down most of the nominal value of Greece’s debt once elected. “That’s what was done for Germany in 1953, it should be done for Greece in 2015,” Tsipras said in a speech in Athens Jan. 3.

“The solution is balanced budgets to strongly limit the need to borrow money,” Tsipras said in the book. “Holding to a budget balance goal is really a key point in our strategy, as it gives us the possibility to negotiate from a strong position. That said, we need to say that budget balance doesn’t mean resorting to austerity per se.” Stavros Theodorakis, leader of To Potami, which is polling in third place ahead of elections, said in an interview in Athens yesterday that he won’t support any coalition willing to gamble with the country’s place in the euro. “The goal is to create a majority of social forces where the Left can be the main actor that will be able to play a fundamental role in changing citizens condition,” Tsipras said, according to the transcripts.

Germany is losing much of its shine.

• Eurozone Hit By Germany’s Sliding Exports And Industrial Production (Ind.)

Germany’s faltering output and exports have capped a week of pain for the eurozone. Germany – which narrowly avoided a triple-dip recession last year – saw industrial output dip 0.1% in November, according to official figures, far weaker than the 0.4% advance pencilled in by pundits. In another blow, Germany’s exports to the rest of the world also tumbled 2.1% over the month. The fall was echoed by a 0.1% decline in the UK’s industrial production during November. Warm weather hit electricity demand, although manufacturers fared better, growing output 0.7%. Britain’s builders sank into reverse, however, as output dropped 2% over the month.

The fresh signs of weakness in the German economy – the eurozone’s biggest – come just days after the struggling single-currency bloc slid into deflation territory for the first time since 2009, heightening speculation that European Central Bank boss Mario Draghi will launch a full-scale, money-printing programme later this month. Germany’s exporters are struggling against a backdrop of Russian sanctions and a weaker Chinese economy. Meanwhile, Greece’s looming election and potential victory for the anti-austerity Syriza party is adding to the uncertainty, although the euro’s collapse to nine-year lows against the dollar should eventually help exporters.

“Today’s data provides further evidence that the German economy has not yet fully recovered from the soft spell of the summer. In fact, the German economy still counts its bruises. Nevertheless, in our view, the economy should gain more momentum in the coming months,” ING Bank’s Carsten Brzeski said. But German economist Alexander Krueger at Bankhaus Lampe added: “Things are certainly not rosy. The geopolitical situation, especially the Russia conflict and the related economic uncertainty, is limiting growth.”

All pensions funds should.

• Dutch Pension Fund Giant Drops Use Of Hedge Funds (Reuters)

The Netherlands’ PFZW has become the latest major pension fund to announce it will no longer use hedge funds to manage investments, citing excessive costs, complexity and a lack of performance. The fund, which represents around 2 million workers in the health care sector, had 156.3 billion euros ($184.7 billion) in assets under management as of September 2014. About 2.7% of the fund’s assets had been invested with hedge funds in the year 2013, but the pension fund said on Friday that it had “all but eradicated” their use by the end of 2014. “With hedge funds, you’re certain of the high costs, but uncertain about the return,” the company’s manger for investment policy Jan Willem van Oostveen said. He added that PFZW wanted to have greater control over of its investments, and that hedge funds’ methods were too complex because of their diverse investment strategies. In September, the $300 billion California Public Employees’ Retirement System said it had scrapped its hedge fund programme, pulling out about $4 billion.

“Disgusted and also shocked, we cannot fall to our knees. It is our responsibility to react ..”

• #OpCharlieHebdo: Anonymous Declares War On Terrorist Websites (RT)

Hacktivist group Anonymous has threatened to avenge the recent terrorist attacks in France by tracking and bringing down jihadist websites. The group’s YouTube message directly confronts Al-Qaeda and Islamic State on the Charlie Hebdo massacre. “We are declaring war against you, the terrorists,” says a figure wearing the symbolic Guy Fawkes mask in a new online clip, released with a statement. The hashtag #OpCharlieHebdo is visible in the video that dedicates the message to: “Al-Qaeda, the Islamic State and other terrorists.” It says that the hacktivist group will be going after and shutting down all terrorist accounts on social media in a mission to avenge those killed in the Charlie Hebdo attacks. The video was uploaded to the group’s Belgian YouTube account.

Earlier, Anonymous posted a statement on Pastebin, titled: “Message to the enemy of the freedom of speech.” “Freedom of speech has suffered an inhuman assault … Disgusted and also shocked, we cannot fall to our knees. It is our responsibility to react,” the statement says. The group has successfully attacked many websites in the past, including government, military, religious, and commercial pages. Anonymous’ signature move is to overwhelm the servers with traffic by sending out distributed denial-of-service (DDoS) attacks, which knocks out the websites.

Can we learn?

• What Radicalized The Charlie Hebdo Terrorists – Try Abu Ghraib (Ray McGovern)

First, a hat tip to Elias Groll, assistant editor at Foreign Policy, whose report just a few hours after the killings on Wednesday at the French satirical magazine Charlie Hebdo, included this key piece of background on the younger of the two brother suspects: “Carif Kouachi was previously known to the authorities, as he was convicted by a French court in 2008 of trying to travel to Iraq to fight in that country’s insurgent movement. Kouachi told the court that he wished to fight the American occupation after viewing images of detainee abuse at Abu Ghraib prison.” The next morning, Amy Goodman of Democracynow.org and Juan Cole also carried this highly instructive aspect of the story of the unconscionable terrorist attack, noting that the brothers were well known to French intelligence; that the younger brother, Cherif, had been sentenced to three years in prison for his role in a network involved in sending volunteer fighters to Iraq to fight alongside al-Qaeda; and that he said he had been motivated by seeing the images of atrocities by U.S. troops at Abu Ghraib.

An article in the Christian Science Monitor added: “During Cherif Kouachi’s 2008 trial, he told the court, ‘I really believed in the idea’ of fighting the U.S.-led coalition in Iraq.” But one would look in vain for any allusion to Abu Ghraib or U.S. torture in coverage by the Wall Street Journal or Washington Post. If you read to the end of a New York Times article, you would find in paragraph 10 of 10 a brief (CYA?) reference to Abu Ghraib. So I guess we’ll have to try to do their work for them. Would it be unpatriotic to suggest that a war of aggression and part of its “accumulated evil” – torture – as well as other kinds of state terrorism like drone killings are principal catalysts for this kind of non-state terrorism? Do any Parisians yet see blowback from France’s Siamese-twin relationship with the U.S. on war in the Middle East and the Mahgreb, together with their government’s failure to speak out against torture by Americans? Might this fit some sort of pattern?

Well, duh. Not that this realization should be anything new. In an interview on Dec. 3, 2008, Amy Goodman posed some highly relevant questions to a former U.S. Air Force Major who uses the pseudonym Matthew Alexander, who personally conducted more than 300 interrogations in Iraq and supervised more than a thousand. AMY GOODMAN: “I want to go to some larger issues, this very important point that you make that you believe that more than 3,000 U.S. soldiers were killed in Iraq — I mean, this is a huge number — because of torture, because of U.S. practices of torture. Explain what you mean.” MATTHEW ALEXANDER: “Well, you know, when I was in Iraq, we routinely handled foreign fighters, who we would capture. Many of — several of them had been scheduled to be suicide bombers, and we had captured them before they carried out their missions.

“They came from all over the area. They came from Yemen. They came from northern Africa. They came from Saudi. All over the place. And the number one reason these foreign fighters gave for coming to Iraq was routinely because of Abu Ghraib, because of Guantanamo Bay, because of torture practices. “In their eyes, they see us as not living up to the ideals that we have subscribed to. You know, we say that we represent freedom, liberty and justice. But when we torture people, we’re not living up to those ideals. And it’s a huge incentive for them to join al-Qaeda.

Wow.

• ‘Bent Time’ Tips Pulsar Out Of View (BBC)

A pulsar, one of deep space’s spinning “lighthouses”, has faded from view because a warp in space-time tilted its beams away from Earth. The tiny, heavy pulsar is locked in a fiercely tight orbit with another star. The gravity between them is so extreme that it is thought to emit waves and to bend space – making the pulsar wobble. By tracking its motion closely for five years, astronomers determined the pulsar’s weight and also quantified the gravitational disturbance. Then, the pulsar vanished. Its wheeling beams of radio waves now pass us by, and the researchers have calculated that this can be explained by “precession”: the dying star wobbling into the dip in space-time that its own orbit created. A pulsar is a small but improbably dense neutron star – the collapsed remnant of a supernova.

“They pack more mass than our Sun has in a sphere that’s only 10 miles across,” said the study’s lead author Joeri van Leeuwen, from the Netherlands Institute for Radio Astronomy (Astron). When they occur as binaries, neutron stars come hard up against Einstein’s theory of general relativity, and should generate space-time ripples called gravitational waves, which astronomers hope one day to detect. This particular specimen, Pulsar J1906, popped up unexpectedly during a survey Dr van Leeuwen and colleagues were conducting at the Arecibo Observatory, Puerto Rico. “That was a real Eureka moment that night,” he told journalists at the conference. “It was strange, because that part of the sky’s been surveyed lots of times – and then something really bright and new appears.” They soon discovered the pulsar had a companion star, and that it was pushing the boundaries of what astronomers know of these bizarre systems.

The pair circle each other in just four hours – the second fastest such orbit ever seen – and the pulsar spins seven times per second, sweeping its two beams of radio waves across space to Earth. Dr van Leeuwen’s team set about monitoring those waves, nearly every night for the next five years, using the world’s five biggest radio telescopes. All told, they clocked one billion rotations of the pulsar. “By precisely tracking the motion of the pulsar, we were able to measure the gravitational interaction between the two highly compact stars with extreme accuracy,” said co-author Prof Ingrid Stairs of the University of British Columbia, Canada. Each is approximately 1.3 times heavier than our Sun, but they are only separated by about one solar diameter.“The resulting extreme gravity causes many remarkable effects,” Prof Stairs said. Chief among those is the time-space warp and the wobble that has now caused J1906 to shine its light elsewhere – for the time being.

About as off-topic as I could find.

• Would You Be Beautiful In The Ancient World? (BBC)

In ancient Greece the rules of beauty were all important. Things were good for men who were buff and glossy. And for women, fuller-figured redheads were in favour – but they had to contend with an ominous undercurrent, historian Bettany Hughes explains. A full-lipped, cheek-chiselled man in Ancient Greece knew two things – that his beauty was a blessing (a gift of the gods no less) and that his perfect exterior hid an inner perfection. For the Greeks a beautiful body was considered direct evidence of a beautiful mind. They even had a word for it – kaloskagathos – which meant being gorgeous to look at, and hence being a good person. Not very politically correct, I know, but the horrible truth is that pretty Greek boys would have swaggered around convinced they were triply blessed – beautiful, brainy and god-beloved.

So what made them fit? For years, classical Greek sculpture was believed to be a perfectionist fantasy – an impossible ideal, but we now think a number of the exquisite statues from the 5th to the 3rd Centuries BC were in fact cast from life – a real person was covered with plaster, and the mould created was then used to make the sculpture. Those with leisure time could spend up to eight hours a day in the gym. An average Athenian or Spartan citizen would have been seriously ripped – thin-waisted, small-penised, oiled from his “glistening lovelocks” down to his ideally slim toes. A rather different story though when it comes to the female of the species. Hesiod – an 8th/7th Century BC author whose works were as close as the Greeks got to a bible – described the first created woman simply as kalon kakon – “the beautiful-evil thing”. She was evil because she was beautiful, and beautiful because she was evil. Being a good-looking man was fundamentally good news. Being a handsome woman, by definition, spelt trouble.

And if that wasn’t bad enough, beauty was frequently a competitive sport. Beauty contests – kallisteia – were a regular fixture in the training grounds of the Olympics at Elis and on the islands of Tenedos and Lesbos, where women were judged as they walked to and fro. Triumphant men had ribbons tied around winning features – a particularly pulchritudinous calf-muscle or bicep. My favourite has to be the contest in honour of Aphrodite Kallipugos – Aphrodite of the beautiful buttocks. The story goes that when deliberating on where to found a temple to the goddess in Sicily it was decided an exemplar of human beauty should make the choice. Two amply-portioned farmer’s daughters battled it out. The best endowed was given the honour of choosing the site for Aphrodite’s shrine. Fat-bottomed girls clearly had a hotline to the goddess of love.

Home › Forums › Debt Rattle January 10 2015