DPC Sloss City furnaces, Birmingham, Alabama 1906

Bringing the dollar home!

• Foreign Ownership Of US Equities Hits 69-Year High

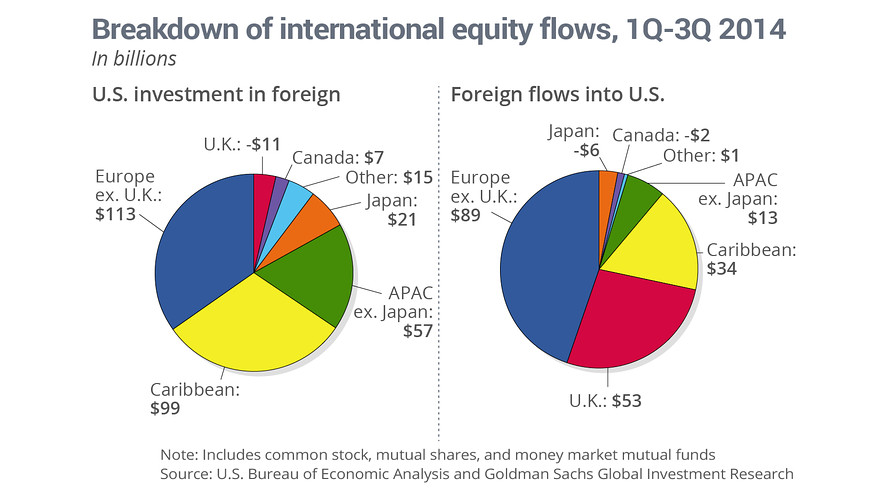

The U.S. stock markets are globalizing, and the British and Canadians are leading the charge. Foreign ownership of U.S. stocks totaled 16% in 2014, the highest in 69 years since such records have been kept, according to a Goldman Sachs report. The equity markets’ global diversification trend is expected remain intact in 2015, said Goldman’s Amanda Sneider. She didn’t elaborate on specific numbers. Britons and Canadians were the biggest foreign investors in U.S. stocks, each accounting for 12%, while Japanese investors checked in at 6%. Another one-third were from tax havens such as Luxembourg, Switzerland, and the Cayman Islands.

In 2015, net foreign inflow of funds into U.S. equity is expected to hit $125 billion, up from net $103 billion in 2014. That compares to total net equity inflow of $220 billion projected for 2015 versus $178 billion last year. U.S. investors are also likely to step up investment in foreign stocks to the tune of $250 billion this year versus $231 billion in 2014. Americans favored European (excluding the U.K.) and Caribbean securities. Among domestic players, corporations will continue to dominate the market with net purchases of $450 billion, equivalent to 2% of market capitalization. Inflow from equity-linked exchange-traded fund will total $170 billion and mutual funds will account for $125 billion.

““The economy is looking stellar ..”

• US Retakes the Helm of the Global Economy (Bloomberg)

The U.S. is back in the driver’s seat of the global economy after 15 years of watching China and emerging markets take the lead. The world’s biggest economy will expand by 3.2% or more this year, its best performance since at least 2005, as an improving job market leads to stepped-up consumer spending, according to economists at JPMorgan, Deutsche Bank and BNP Paribas. That outcome would be about what each foresees for the world economy as a whole and would be the first time since 1999 that America hasn’t lagged behind global growth, based on data from the International Monetary Fund. “The U.S. is again the engine of global growth,” said Allen Sinai, chief executive officer of Decision Economics in New York. “The economy is looking stellar and is in its best shape since the 1990s.”

In the latest sign of America’s resurgence, the Labor Department reported on Jan. 9 that payrolls rose 252,000 in December as the unemployment rate dropped to 5.6%, its lowest level since June 2008. Job growth last month was highlighted by the biggest gain in construction employment in almost a year. Factories, health-care providers and business services also kept adding to their payrolls. About 3 million more Americans found work in 2014, the most in 15 years and a sign companies are optimistic U.S. demand will persist even as overseas markets struggle. U.S. government securities rose after the report as investors focused on a surprise drop in hourly wages last month. “We are still waiting to see the kind of strengthening of wage numbers we would expect to be consistent with what we are seeing elsewhere in terms of growth and the absolute jobs numbers,” Federal Reserve Bank of Atlanta President Dennis Lockhart said in a Jan. 9 interview.

The Fed continues to reinforce the narrative of dissent.

• Fed’s Lockhart Says Jobs Report No Reason to Raise Rates Sooner (Bloomberg)

Federal Reserve Bank of Atlanta President Dennis Lockhart said today’s strong jobs report is no reason to speed up the timing of an interest-rate increase that he sees occurring in the middle of the year or later. “I don’t see a reason yet to accelerate my assumption of when a policy move might be appropriate,” Lockhart, who votes on monetary policy this year, said in a telephone interview from Atlanta. At the same time, “clearly this added to accumulated progress with very healthy numbers.” Employment rose more than forecast in December, and the jobless rate declined to 5.6%, capping the best year for the labor market since 1999, a Labor Department report showed today.

The Fed last month said it would be “patient” in raising rates from close to zero, with Chair Janet Yellen saying an increase was unlikely before late April. “The report confirms my sense of how the economy is progressing,” said Lockhart, 67, who has been a consistent supporter of record stimulus. “If the committee is to err on the side of being a little late as viewed by history writers or maybe a little early, I prefer to take the risk of being a little bit late.” A lack of wage growth suggests slack remains in the labor market, Lockhart said. “All the wage measures remain well below historical norms, and I think I would have to say they are not consistent yet with particularly tight labor markets,” he said.

He called a monthly decline in average hourly earnings in December “potentially noise” and inconsistent with other data on compensation. Average hourly earnings for all employees dropped by 0.2% in December from the prior month, the biggest decline since comparable records began in 2006, today’s Labor Department report showed. Earnings increased 1.7% over the 12 months ended in December, the smallest gain since October 2012. “We are still waiting to see the kind of strengthening of wage numbers we would expect to be consistent with what we are seeing elsewhere in terms of growth and the absolute jobs numbers,” Lockhart said.

Will the ECB dare pre-empt court decisions?

• Legal Challenge Shows Rocky Path To ECB Money-Printing (Reuters)

A landmark legal opinion this week will remind the European Central Bank of the limits it faces as it advances towards money printing, while a tumbling oil price saps inflation in debt-strained Europe. With expectations high that the ECB is on the verge of buying government bonds with new money to shore up the economy, an influential adviser to Europe’s top court will give his view on Jan. 14 about an earlier unused bond-buying scheme. It is the latest chapter in a long-running and increasingly bitter dispute about QE between the ECB and Germany, the largest member of the 19-country bloc, that is likely to limit the size or scope of such a program. As the debate continues, the euro zone economy is all but grinding to a halt. Germany is expected to announce modest growth on Jan. 15 for last year.

In the United States, fresh data on rising employment as well as retail sales is set to show just how much its recovery has overtaken Europe. “The global economy is at a precarious point,” said Jacob Kirkegaard of Washington think tank, the Peterson Institute. “The falling oil price is a huge shot in the arm. Nonetheless, it is clear that the ECB will have to do something. There is no growth and the debt burden is too high. The world will be flying on one engine, the U.S., for quite some time.” [..] Low price inflation, a symptom of the global slowdown, has led some to question the rule of thumb for measuring economic health, namely that there should be a steady up-tick in prices.

British inflation will be watched on Tuesday, with analysts betting it will hit a fresh 12-year low below 1%. Those looking for respite elsewhere may be disappointed. The People’s Bank of China cut the cost of borrowing in November and loosened loan restrictions to encourage lending. It is expected to take further such steps, as the country’s property market downturn continues and local governments and companies grapple with heavy debts. Bank lending data and a readout on economic output in the final three months of last year are likely to paint a glum picture. Hopeful eyes are turning to the ECB. But German opposition to money printing could put a fly in the ointment. Its Bundesbank has warned that buying bonds issued by euro zone governments – including politically brittle Greece – could leave it on the hook for losses.

Next week, an adviser to Europe’s top court will give his opinion on a challenge by a group of Germans to an earlier ECB bond-buying program. If he shares any of the concerns of Germany’s constitutional court, which referred the case to European judges, it would be significant. Alain Durre, an economist with Goldman Sachs, said this could lead to the ECB setting a fixed limit on its bond-buying plans or to take priority over other investors when it buys state bonds. Whatever the outcome, the German protest is likely to get louder. “The ECB has stepped beyond its remit. The European court should forbid the ECB from doing this,” said Dietrich Murswiek, a lawyer representing one of the plaintiffs. “You can draw parallels with quantitative easing. From my point of view, QE is also beyond its remit. This can also lead to legal action.”

If only the PIIGS would unite.

• Voices Join Greek Left’s Call for a New Deal on Debt (NY Times)

The concern now is that Mr. Tsipras, in challenging Europe on these thorny issues, will force Greece into default and perhaps a messy exit from the euro — an event that could unleash a new wave of investor contagion. Some analysts, however, are advancing an alternate view: that a radical new Greek government would not be that radical after all. Jens Bastian, a financial analyst based in Athens, notes that Mr. Tsipras’s core argument — that Greece’s onerous debt is not sustainable and should be reduced — has also been put forward by one of Greece’s larger creditors: the IMF. “It was the I.M.F. that kick-started the idea of restructuring Greece’s debt with Europe,” Mr. Bastian said.

“Mr. Tsipras can say we are in line with the IMF — we just want to talk to our European partners about the debt.” This is hardly a radical notion, Mr. Bastian argues. Perhaps. But that also means that European taxpayers — particularly those in Germany — will have to absorb the full brunt of the haircut as the IMF, by tradition, does not allow its debts to be restructured. Greece’s official creditors in the eurozone hold 65% of the country’s debt load of €317 billion. Private sector investors, whose bonds were restructured in 2012, hold just 15%. These investors range from mutual funds like Putnam Investments and Capital Group, which own the restructured bonds, to vulture funds that did not participate in the bond swap. The I.M.F. and the European Central Bank make up the rest.

Yanis Varoufakis, an economist and adviser to Mr. Tsipras, says that a Tsipras-led government would not make a private sector haircut a priority — an outcome that many foreign investors now fear. Instead, Mr. Varoufakis proposes a grand bargain of sorts by which Europe agrees to exchange its current obligations for new Greek bonds that are linked directly to Greece’s economy. If the economy grows, as it is expected to this year, bondholders receive a nice return; if it does not, the bonds pay nothing. “We are turning Europe into a partner for growth as opposed to a partner for austerity,” Mr. Varoufakis said in a recent interview. “This fiscal waterboarding has to end.”

“Before the crisis we probably had excessively high growth expectations. Now it is the opposite.”

• Anxiety Rises Over Eurozone’s Falling Prices (Observer)

Consumers who believe that prices are going to continue falling tend to sit on their hands, postponing spending in the belief that their money will go further in the future. This weak demand can cause businesses to cut back on investment and stint on wages and a vicious spiral sets in. This is particularly dangerous for heavily indebted countries, as deflation increases the real value of their debts. In Japan, policymakers have spent more than two decades trying to jolt the economy out of just this kind of deflationary trap: the country’s debt-to-GDP ratio has rocketed to well over 200%. HSBC’s Henry warns that some in the eurozone are already responding to the uncertain climate and the prospect of declining prices. “For companies in particular, there’s already evidence of deflationary behaviour. Why are they going to invest if they think things are going to be even cheaper tomorrow?”

Peter Praet, the ECB’s chief economist, said in an interview last month: “What we are increasingly worried about … is the high risk that after seven years of crisis and poor economic performance in the euro area, businesses and households are reducing their long-term growth expectations and adapting to weak growth and low inflation. To some extent this risk is already materialising: companies are starting to adjust to a 1% growth/1% inflation economy.” Behavioural changes like these are notoriously hard to forecast: the impact on workers’ pay of their employers’ chastened mood will depend partly on the specifics of wage-bargaining, for example.

But if the onset of deflation adds to the downbeat mood, it may take a long time to shift. As Praet put it: “Before the crisis we probably had excessively high growth expectations. Now it is the opposite. The big risk is that this growth pessimism perpetuates the current situation.” Danny Gabay of Fathom Consulting, warns that in some ways, the situation in the eurozone is worse than Japan’s at the start of what used to be known as its “lost decade” – before the 10-year stretch became 20 years and more. “Japan didn’t fall into deflation with debts of 100% of GDP, unemployment in double digits and recession,” he said. “It started from a pretty good point compared with Europe.” Average unemployment across the eurozone is 11.5%, more than twice Japan’s historical maximum.

“Visitors from London and Sydney can barely believe how little they pay, comparatively, for a decent meal and a few drinks in Tokyo.”

• Spectre Of Deflation Horrifies Bankers, But Japan Has A Taste For It (Observer)

Europeans wondering what life might be like under sustained deflation need look no further than a bowl of gyudon – the Japanese comfort food of rice topped with beef and onions. The price of gyudon has become an unofficial bellwether for the health of the world’s third biggest economy, which has been beleaguered by more than two “lost decades” of stagnation as consumers have resolutely refused to start spending and lift their economy out of trouble. Which is why last month’s decision by Yoshinoya, Japan’s largest chain of gyudon restaurants, to raise the price of a standard-size dish by a whopping 27% is not all it seems. Far from heralding a new era of inflation, the price rise, to a still very affordable ¥380 (about £2.11), simply highlights the deflationary depths into which Japan has sunk: this, after all, was the first gyudon price hike for almost a quarter of a century. If Japan’s experience is any indication, living in a deflationary spiral can be complicated.

Conventional wisdom tells us deflation is bad for jobs and growth, and that it causes the debt burden to weigh more heavily on households, companies and governments. But for the average Japanese person, life under two decades of falling prices has had its compensations. Having seen so many false dawns, consumers have reached their own accommodation, of sorts, with the scourge that is now threatening the eurozone. First, it has shattered Tokyo’s undeserved reputation as a prohibitively expensive city. It wasn’t so long ago that McDonald’s there was selling a ¥100 hamburger (that’s about 56p), and clothing retailer Uniqlo has built a global empire on selling cheap, no-fuss garments. Expensive hostess clubs, harking back to Japan’s 1980s bubble era, still exist, but they share premises with izakayas (pubs) where a glass of beer costs a paltry ¥180 (£1). Visitors from London and Sydney can barely believe how little they pay, comparatively, for a decent meal and a few drinks in Tokyo.

Great video.

• Princes of the Yen: Central Banks and the Transformation of the Economy

“Princes of the Yen” reveals how Japanese society was transformed to suit the agenda and desire of powerful interest groups, and how citizens were kept entirely in the dark about this. Based on a book by Professor Richard Werner, a visiting researcher at the Bank of Japan during the 90s crash, during which the stock market dropped by 80% and house prices by up to 84%. The film uncovers the real cause of this extraordinary period in recent Japanese history.

Making extensive use of archival footage and TV appearances of Richard Werner from the time, the viewer is guided to a new understanding of what makes the world tick. And discovers that what happened in Japan almost 25 years ago is again repeating itself in Europe. To understand how, why and by whom, watch this film. “Princes of the Yen” is an unprecedented challenge to today’s dominant ideological belief system, and the control levers that underpin it. Piece by piece, reality is deconstructed to reveal the world as it is, not as those in power would like us to believe that it is. “Because only power that is hidden is power that endures.”

“Central bank interest rate repression either encourages households to supplement income based spending with incremental borrowings— or it has no direct impact on measured GDP.”

• Here They Go Again: Subprime Delinquencies Rising In Autoland (David Stockman)

Yesterday’s WSJ article on rising auto loan delinquencies had a familiar ring. It focused on sub-prime borrowers who were missing payments within a few months of the vehicle purchase. Needless to say, that’s exactly the manner in which early signs of the subprime mortgage crisis appeared in late 2006 and early 2007.

More than 8.4% of borrowers with weak credit scores who took out loans in the first quarter of 2014 had missed payments by November, according to the Moody’s analysis of Equifax credit-reporting data. That was the highest level since 2008, when early delinquencies for subprime borrowers rose above 9%.

To be sure, subprime auto will never have the sweeping impact that came from the mortgage crisis. The entire auto loan market is less than $1 trillion compared to a mortgage market of more than $10 trillion at the time of the crisis. Yet the salient point is the same.The apparent macro-economic recovery and prosperity of 2004-2008 rested on the illusion of an unsustainable debt fueled housing boom; this time its the auto sector. Indeed, delete the auto sector from the phony 5% GDP SAAR of Q3 2014 and you get an economy inching forward on its own capitalist hind legs. Q3 real GDP less motor vehicles was up just 2.3% from the prior year (LTM); and that’s the same LTM rate as recorded in Q3 2013, and slightly lower than the 2.4% growth rate posted in Q3 2012. Aside from autos, there has been no acceleration, no escape velocity.

Furthermore, the 2%+/- growth in the 94% balance of the economy after the 2008-09 plunge has nothing to do with the Fed’s maniacal money printing stimulus and the booster shot from cheap credit that is supposed to provide. The reason is straight forward. There is no such thing as Keynesian monetary magic. Central bank interest rate repression either encourages households to supplement income based spending with incremental borrowings— or it has no direct impact on measured GDP. The fact is, outside of autos and student loans, households have reached peak debt. That is after a 30-year spree of getting deeper and deeper into hock, middle class households stopped adding to leverage on their wage and salary incomes at the time of the financial crisis; and since then they have actually deleveraged slightly—albeit at levels that are still way off the historical charts.

Overblown expectations.

• Investors Put Their Hopes, and Money, in Modi (Reuters)

Global statesmen and business titans descended on the home state of Prime Minister Narendra Modi of India on Sunday to pay homage to the man they count on to unleash big-bang economic changes. Big business cheered Mr. Modi when he won India’s strongest election mandate in 30 years in May, and he has caught its attention with eye-catching initiatives like his Make in India campaign. Now, in his home state of Gujarat, he has turned the assembly he founded as the state’s chief minister in 2003, called Vibrant Gujarat, into a pitch to put his nation firmly on the investment map. “India is marching forward with a clear vision to become a global power, even as most of the world is struggling with low growth,” the country’s richest man, Mukesh Ambani, told an audience of hundreds of chief executives and politicians.

A roll call of world leaders – including the United Nations secretary general, Ban Ki-moon; the World Bank head Jim Yong Kim; and Secretary of State John Kerry – converged on Mr. Modi’s hometown, Gandhinagar, for Vibrant Gujarat, a three-day Davos-style meeting. President Obama will also visit India this month. Eight months into Mr. Modi’s rule, the failure of India to emerge from its longest growth slowdown in a generation is raising questions about how much substance there is behind the premier’s promise of “red carpet, not red tape.” The Make in India campaign has drawn comparisons to the manufacturing miracle that turned China into the world’s second-largest economy. But skeptics argue that India’s competitive strengths are not in making things, but in areas like information technology and business process outsourcing, in which it is a world leader.

Vibrant Gujarat, held every two years, has yielded billions of dollars in investment promises, but only a fraction of the deals announced have come to fruition. In keeping with tradition, Mr. Ambani said his conglomerate, Reliance Industries, would invest 1 trillion rupees, or $16 billion, in its home state of Gujarat over the next year to 18 months. “There is an air of optimism in the air of India,” said Sam Walsh, the chief executive of the global mining giant Rio Tinto, who flagged two potential projects: a $2 billion iron ore project in Odisha State and an investment in Madhya Pradesh that could employ 30,000 diamond cutters. Mr. Modi needs investors to fulfill their monetary commitments to end the stagnation in capital investment that has held India’s growth to 5.3%.

“Ukraine’s government will need an additional 15 billion dollars to remain afloat, but there is currently no-one who wants to provide the money.”

• Russia, Ukraine and Greece – Default Probabilities (Acting Man)

Currently there are a number of weak spots in the global financial edifice, in addition to the perennial problem children Argentina and Venezuela (we will take a closer look at these two next week in a separate post). There is on the one hand Greece, where an election victory of Syriza seems highly likely. We recentlyreported on the “Mexican standoff” between the EU and Alexis Tsipras. We want to point readers to some additional background information presented in an article assessing the political risk posed by Syriza that has recently appeared at the Brookings Institute. The article was written by Theodore Pelagidis, an observer who is close to the action in Greece. As Mr. Pelagidis notes, one should not make the mistake of underestimating the probability that Syriza will end up opting for default and a unilateral exit from the euro zone – since Mr. Tsipras may well prefer that option over political suicide.

Note by the way that the ECB has just begun to put pressure on Greek politicians by warning it will cut off funding to Greek banks unless the final bailout review in February is successfully concluded (i.e., to the troika’s satisfaction). The stakes for Greece are obviously quite high. There are two ways of looking at this: either the ECB provides an excuse for Syriza, which can now claim that it is essentially blackmailed into agreeing to the bailout conditions “for the time being”, or Mr. Tsipras and his colleagues may be enraged by what they will likely see as a blatant attempt at usurping what is left of Greek sovereignty, and by implication, their power.

We have already discussed Russia’s situation in some detail in recent weeks. As regards Ukraine, its economy is already doing what observers are merelyexpecting to happen with Russia’s economy in light of the recent decline in crude oil prices. In other words, It is no exaggeration to state that Ukraine’s economy is in total free-fall. The country’s foreign exchange reserves have declined precipitously, most of the central bank’s gold has been mysteriously “vaporized”, and what is left of it has turned out to be painted lead (no kidding, the central bank’s vault in Odessa was found to contain painted lead bars instead of gold bars – the thieves didn’t even bother with using tungsten).

Last year Ukraine’s GDP contracted by an official 7% and this year another contraction of 6% is expected. Ukraine’s government will need an additional 15 billion dollars to remain afloat, but there is currently no-one who wants to provide the money. The EU is itself short on funds, and JC Juncker let it be known that: “There is only a small margin of flexibility for additional financing next year. And if we fully use our margin for Ukraine, we will have nothing to address other needs that may arise over the next two years.” Somewhat earlier, the authorities in Kiev asked Brussels for a third program of macro-financial aid in the amount of €2 billion. European commissioner for neighborhood and enlargement policies, Johannes Hahn, said the EU was prepared to continue aid to Kiev but only in exchange for concrete results of reforms. Finland’s Prime Minister Alexander Stubb said the EU would not take any decisions on extra financial aid to Ukraine right now because the country had not implemented the essential structural reforms yet.”

“Ukraine, indeed, has violated the terms of the loan, namely because its national debt exceeds 60% of its GDP ..”

• Russia May Demand Early Repayment Of $3 Billion Loan To Ukraine (RT)

Ukraine has violated the terms of the $3 billion Russian loan by allowing its national debt to exceed 60% of its GDP. This makes Moscow eligible to demand an early repayment of the debt, Anton Siluanov, Russia’s finance minister, said. “Ukraine, indeed, has violated the terms of the loan, namely because its national debt exceeds 60% of its GDP,” Siluanov said, commenting on earlier media reports of Kiev’s loan violation. The minister stressed that now Russia has “every reason” to demand an early repayment of the debt, but added, “at the moment, a decision to do so hasn’t been made.” “It’s also surprising that the federal budget of Ukraine doesn’t foresee the settlement of the $3 billion obligations [to Russia]. But Ukraine is fulfilling and will keep fulfilling its obligations to other borrowers, including the IMF,” Siluanov is cited as saying by TASS.

Viktor Suslov, who was Ukraine’s finance minister from 1997 to 1998, confirmed to RIA Novosti that Moscow is, in fact, eligible to demand repayment from Kiev. “Yes, in accordance with the terms of the loan, they may demand it or they may not demand it. However, in late 2014 the Russian authorities said that they won’t be pushing for an early repayment,” Suslov said. In December 2013, Vladimir Putin and then president of Ukraine, Viktor Yanukovich, agreed that Moscow would provide Kiev financial assistance of $15 billion. However, only the first tranche of $3 billion was forwarded, with Russia buying out Ukrainian Eurobonds, which had a maturing date in 2015 and a coupon rate of 5% per annum.

“Today every member of the GOP controlling the Senate, House and their state governors are all de facto mutant capitalists ..”

• Creationism Vs. Evolution: Whose God Is Making America Richer? Paul B. Farrell

The defining war of this century is being waged by “mutant capitalists, whose obsession with perpetual growth and material wealth, is destroying the planet’s ecosystem, will end our civilization.” Jack Bogle warned us of this virus in his classic, “The Battle for the Soul of Capitalism.” Now, a decade later, mutant capitalism is mutating further, becoming a pandemic among conservative politicians. Today every member of the GOP controlling the Senate, House and their state governors are all de facto mutant capitalists, thanks to big money donations, and like robots all linked to one master machine that renders them incapable of independent thinking when it comes to their lockstep march as climate-science deniers.

Yes, they’re mindless robots at odds with over 2,500 scientists who now warn, after more than two decades of research, that they are 97% “certain humans are causing climate change, that the damage is accelerating 10 times faster than the past 65 million years and soon we will self-destruct our civilization and disappear like dinosaurs, forever.” Bill Nye “the science guy” is the new warrior challenging antiscience robotic senators like the GOP’s James Inhofe, who’ll soon be chairman of the Senate Environment and Public Works Committee. Nye says America needs a new generation of leaders savvy in science and technology. Inhofe and fellow Republicans are Luddites trapped in a 19th century Wild West time warp. Fortunately Bill Nye, “the science guy” believes that while deniers are a lost cause, too incapable of rational thinking, their kids are not.

Nye’s “biggest concern is about creationist kids” whose parents are science deniers. “They’re compelled to suppress their common sense, to suppress their critical-thinking skills at a time in human history,” Nye recently told New York Times reviewer Jeffery DelViscio about his new book, “Undeniable: Evolution and the Science of Creation.” So Nye’s just stepped into the science denialism war zone, and on a rigid ideological land mine. Maybe Nye and his 2,500 “science guy” friends on the UN Intergovernmental Panel on Climate Change are worried about the education of the next generation of creation kids. But unfortunately, the fact is that 42% of all Americans don’t agree with Bill Nye when it comes to science. So Nye, Pope Francis and all climate-science believers have an enormous fight on their hands with the parents, teachers and their state education officials of these creation kids.

Here’s a profile of the everyday world their creation kids live and learn in:

• Gallup says 42% of Americans believe in creationism

• And 76% believe climate is not a major national priority

• Half of Americans say climate change is a “sign of the Apocalypse”

• Those who do believe will pay only about $5 to stop global warmingCheck the facts: According to Gallup polling, “more than four in 10 Americans continue to believe that God created humans in their present form 10,000 years ago, a view that has changed little over the past three decades. Half of Americans believe humans evolved, with the majority of these saying God guided the evolutionary process.” Moreover, another Gallup poll says only 24% of Americans think “climate change” is a problem, put it near the bottom of 15 national problems polled. So today, 76% of Americans (that’s about 235 million!), say climate change, global warming and the environment are not the nation’s top priority. What is? Social Security, jobs, immigration, crime, big government, etc. But not overheating the planet.

“.. there are six major conflicts in Muslim countries between India and the Tunisian border that provide fertile ground for fanatical Sunni al-Qaeda type groups to take root and flourish.”

• Paris Attacks: Don’t Blame These Atrocities On Security Failures (Cockburn)

Will France make the same mistake the US did, when the Bush administration, the neo-conservatives and state security agencies exploited 9/11 to increase their power and implement their agendas? It could easily happen. Former President Nicolas Sarkozy has already spoken twice about the “war of civilisations” that sounds suspiciously like a French version of Bush’s “war on terror”, which in present circumstances is the sort of demagoguery that will be music to the ears of jihadis. There is already a potential constituency for jihadism among France’s 6 million Muslims, who have been pushed to the margins and see themselves as the victims of old-fashioned racism disguised as a confrontation between progressive secularism and medieval Islamic practices. War exposes and exacerbates such divisions in any country but France is especially vulnerable, because of the legacy of hatred stemming from the Algerian war of independence.

Some of the rhetoric immediately after the Paris massacre included melodramatic slogans such as “France is at war”. Again this echoes President Bush over a decade ago. And, of course, France is not at war, but, while the slogan is untrue as it stands, it does lead the way to an important but little appreciated truth about French security that applies equally to the rest of Europe. France may not be at war but it is suffering from the effects at a distance of the four wars now raging in the wider Middle East. Three of these – Syria, Libya and Yemen – have started since 2011, and a fourth in Iraq has massively escalated since that time. In addition, there are continuing wars in Afghanistan and Somalia, which means that there are six major conflicts in Muslim countries between India and the Tunisian border that provide fertile ground for fanatical Sunni al-Qaeda type groups to take root and flourish.

In the wake of the Paris killings there is much speculation about what links there may have been with foreign jihadis in the shape of Isis or al-Qaeda in Yemen. But this rather misses the point. Attacks on civilians require weapons, ammunition and the ability to use them, but no great level of combat training. What is really driving these attacks in Europe, and will go on doing so, is the collapse of so many Muslim states into violence and anarchy providing an ideal environment for Sunni jihadism to grow. Unsurprisingly, extreme fanatical Sunni jihadis, whom sympathisers might see as “holy warriors” and one Afghan journalist described as “holy fascists”, do well in wartime conditions. The Isis, in particular, relates to the world around it almost solely through acts of violence.

How much choice did they have, though?

• Curious Charlie Carnage (StealthFlation)

Just a few random thoughts on Charlie. I never can quite understand why these crack S.W.A.T teams don’t strategically hold off for 24-48 hours so as to exhaust the terrorists and attempt to gas them out, or at the very least, equipped with the latest military grade night vision, aim to catch them off guard overnight. Instead, they choose to impetuously storm the building by barging and charging, which virtually assures that hostages are also killed during the ensuing mayhem. One would assume the pros know what they’re doing, but it sure as hell seems questionable. C’mon now, slowly mechanically raising a shop’s street level security gate, are you kidding me??? You can’t be serious! Whatever happened to the element of surprise, isn’t that like terrorist manhunt school 101?

Don’t get me wrong, it’s just that I would much rather see these crazed craven characters professionally tortured, effectively interrogated and only then summarily executed, so that at least we stand a fighting chance to find out who and what was really behind them………and certainly the hostages spared at all costs. I mean once they have them completely cornered with thousands of expert anti terrorist police surrounding the perimeter, what’s the big rush to go in there guns a blazing…… Seriously, these crazed undisciplined young terrorist couldn’t stay awake for days on end, yet the expert S.W.A.T teams can, as they would rotate shifts. Just seems so ill-considered and outright reckless when hostages are involved.

It would be surprising not to see more of this.

• German Paper Target Of Arson Attack After Printing Charlie Hebdo Cartoons (DW)

A German newspaper in the northern city of Hamburg that reprinted Prophet Muhammad cartoons from French paper Charlie Hebdo has been the target of an apparent arson attack. Authorities said no one was injured. Police said “rocks and then a burning object” were thrown through rear court-yard windows into archive rooms of Hamburg’s daily newspaper, the Hamburger Morgenpost around 0200 a.m. local time (0100 UTC). Two people seen acting suspiciously in the area had been taken into custody, as authorities investigated further, police added, refusing to give more information about those detained. The investigation had been handed to Hamburg city state’s protection service.

The Hamburger Morgenpost had printed three Charlie Hebdo cartoons following last Wednesday’s massacre in Paris. The Morgenpost headline on Thursday had read, “this much freedom must be possible.” The “key question” authorities said early on Sunday was whether there was a connection between with the reprinting of the caricatures, adding that it is “too soon” to confirm such speculation. “Thick smoke is still hanging in the air, the police are looking for clues,” the Hamburger Morgenpost wrote briefly in its online edition early on Sunday. The German news agency DPA reported that contents in the newspaper’s archive rooms were destroyed in the apparent attack. No one had been injured in the incident. Two rooms on the lower floors were damaged but the fire was put out quickly,” police said.

“While almost everyone is Charlie when it comes to defending the fundamental values of the French republic, there is less unity when it comes to dealing with threats to those values.”

• French Unity Against Terrorism May Not Last Far Beyond Paris March (Observer)

Je suis Charlie. Nous sommes Charlie. La France est Charlie. Under the banner Tous Unis! (All United), France’s Socialist government has called for a show of national unity after three days of bloodshed that were seen as a direct blow to the republican values of liberté, égalité and fraternité. On Sunday, David Cameron and Angela Merkel, as well as the Ukrainian president Petro Poroshenko, Matteo Renzi, prime minister of Italy, and the Spanish premier, Mariano Rajoy – among 30 world leaders in all – will take part in one of the most significant public occasions in the history of postwar France. Behind what is sure to be an impressive, emotional show of solidarity, however, cracks have already appeared, suggesting political unity in France is unlikely to hold out much beyond the three-kilometre march from Place de la République to Place de la Nation. While almost everyone is Charlie when it comes to defending the fundamental values of the French republic, there is less unity when it comes to dealing with threats to those values.

It was almost inevitable that the far-right Front National – which has linked immigration from France’s former north African colonies to Islamist terrorism – was the first to break ranks. The party’s leader, Marine Le Pen, complained of being banned, or at least not formally invited to Sunday’s march. And her father, Jean-Marie, the provocative former paratrooper and the FN’s honorary president, showed that, at 86, he is still spoiling for a scrap. “Keep Calm and Vote Le Pen,” he tweeted. Later he told journalists: “National unity my arse, we [FN] have been sidelined. I deplore the deaths of 12 French people, but I’m not Charlie at all. I’m Charlie Martel, if you know what I mean.” The reference to the first-century Frankish leader Charles Martel, who is credited with halting the Islamic advance into Christian western Europe at the Battle of Tours in 732, was picked up by other far-right supporters.

“We vomit on all these people who suddenly say they are our friends.” Holtrop refused extra protection.

• Charlie Hebdo Cartoonist Slams Hypocritical ‘New Friends’ Of Magazine (AFP)

A prominent Dutch cartoonist at Charlie Hebdo heaped scorn on the French satirical weekly’s “new friends” since the massacre at its Paris offices, in particular far-right National Front leader Marine Le Pen. “We have a lot of new friends, like the pope, Queen Elizabeth and (Russian President Vladimir) Putin. It really makes me laugh,” Bernard Holtrop, whose pen name is Willem, told the Dutch center-left daily Volkskrant. “Marine Le Pen is delighted when the Islamists start shooting all over the place,” said Willem, 73, a longtime Paris resident who also draws for the French leftist daily Liberation. He added: “We vomit on all these people who suddenly say they are our friends.”

Commenting on the global outpouring of support for the weekly, Willem scoffed: “They’ve never seen Charlie Hebdo.” “A few years ago, thousands of people took to the streets in Pakistan to demonstrate against Charlie Hebdo. They didn’t know what it was. Now it’s the opposite, but if people are protesting to defend freedom of speech, naturally that’s a good thing.” Willem was on a train between northwestern Lorient and Paris when he learned of Wednesday’s attack by two Islamist gunmen as the paper was holding its weekly editorial meeting. He told Liberation: “I never come to the editorial meetings because I don’t like them. I guess that saved my life.” Willem stressed that Charlie Hebdo must continue to publish. “Otherwise, (the Islamists) have won.”

Home › Forums › Debt Rattle January 11 2015