Earl Theisen Walt Disney oiling scale model locomotive at home in LA Sep 1951

Anything could blow now.

• Swiss Mess Could Make Oil Plunge Seem Like Minor Hiccup (MarketWatch)

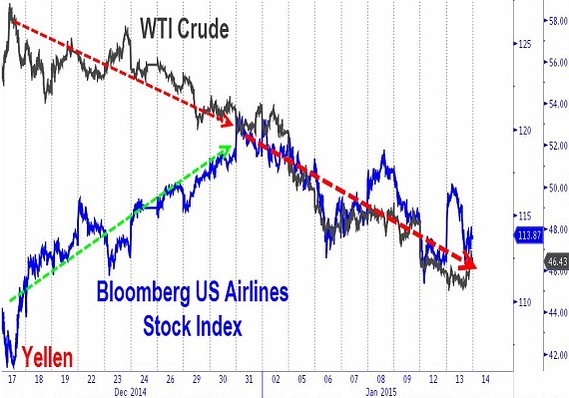

One day, it’s gold. The next, it’s equities. Most days, it’s crude. On Wednesday, it was copper. On Thursday it was the Swiss franc and Swiss stocks. And the move in those two makes those others look like minor-league hiccups. While you were sleeping, all hell broke loose in Switzerland, as the central bank ditched its currency cap against the euro after four years and slashed interest rates to negative 0.75%. The Swiss franc is rallying wildly, while the Swiss stock market is cratering and U.S. stock futures are mostly on the losing side as investors figure out this latest shock to the markets Meanwhile, collapsing oil is claiming its next batch of victims. Apache just became the first, and certainly not the last, big-name oil producer to cut a notable number of jobs. And Calgary is suffering through it’s worst decline in home prices in almost two years. Airlines stocks aren’t even benefiting anymore.

So where’s that cheap oil upside? Perhaps, it’s in the opportunity created in solar stocks. The best thing that can be said about oil at this point is that, hey, at least it’s not bitcoin. Or the ruble. More fallout to come if $50 does, indeed, turn out to be a ceiling and if, as Goldman Sachs says, prices fall below the bank’s $39 target.

Ambrose gets it right: deflation.

• World Deflationary Forces Have Swept Away Switzerland’s Defences (AEP)

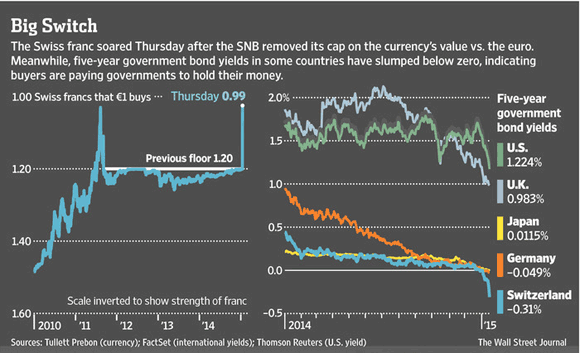

The Swiss National Bank has lost control. It is the latest in a list of venerable central banks to be overwhelmed by deflationary forces and global economic disorder. The country is already in deflation. The Swiss franc ended Thursday 13% higher after the SNB abandoned its three-year efforts to defend a currency floor of 1.20 to the euro. “We have a free exchange rate once again,” said the SNB’s president, Thomas Jordan. Indeed, but nobody is fooled by the SNB’s attempt to spin this as benign. “This is a huge hit to their credibility,” said Deutsche Bank. The official statement claimed that the exchange floor is no longer needed and that “overvaluation has decreased as a whole since the introduction of the minimum exchange rate”. This is eyewash. “They have had to throw in the towel. They couldn’t hold the line anymore,” said David Owen, from Jefferies Fixed Income.

“This is going to cause extreme pain for parts of the Swiss economy but SNB are trapped.” The franc has been level over the past year on a trade-weighted basis. Even before Thursday morning’s events, the exchange rate was 25% above its decade-long average. It is now 40% higher. Just one month ago the SNB argued in its quarterly report that currency floor was imperative to stop Switzerland relapsing back into deflation. “In view of heightened deflation risks, the minimum exchange rate remains the key instrument for ensuring appropriate monetary conditions. A further appreciation of the Swiss franc would have a major impact on salary and price structures. Companies in Switzerland would be forced to cut costs drastically again to remain competitive.” The statement was true then. The threat is much greater now, made all too clear by the howls of protest this morning from the Swiss export sector.

Nick Hayek, head of Swatch Group, said the collapse of the floor would cause havoc. “Words fail me. Today’s SNB action is a tsunami; for the export industry and for tourism, and for the entire country,” he said. The Swiss economy has been muddling through over the past year but the output gap is still -1% of GDP, inflation is negative and the KOF index of business sentiment has been slipping lower for two years. On top of this, the country now has to grapple with the likely hangover from its own domestic credit bubble. The SNB’s Mr Jordan said the end of an exchange floor inevitably requires subterfuge. “You can only end a policy like this by surprise. It is not something you can debate for weeks,” he said. That may be true. Less justifiable is the failure to come clean after the event and explain exactly why the SNB now judges the damage of eternal currency intervention to be even more dangerous than the threat of a systemic deflationary shock. We are left guessing.

It was always but an illusion, though.

• Switzerland Shows The Era Of Central Bank Omnipotence Is Over (Krasting)

I wrote about the Swiss National Bank being forced to abandon its currency peg to the Euro on 12/3/14, 12/8/14 and 1/11/15. That said, I’m blown away that this has happened today. Thomas Jordan, the head of the SNB has repeatedly said that the Franc peg would last forever, and that he would be willing to intervene in “Unlimited Amounts” in support of the peg. Jordan has folded on his promise like a cheap suit in the rain. When push came to shove, Jordan failed to deliver. The Swiss economy will rapidly fall into recession as a result of the SNB move. The Swiss stock market has been blasted, the currency is now nearly 20% higher than it was a day before. Someone will have to fall on the sword, the arrows are pointing at Jordan.

The dust has not settled on this development as of this morning. I will stick my neck out and say that the failure to hold the minimum rate will result in a one time loss for the SNB of close to $100B. That’s a huge amount of money. It comes to 20% of the Swiss GDP! If this type of loss were incurred by the US Fed it would result in a loss in excess of $2 Trillion! In the coming days and weeks there will be more fallout from the SNB disaster. There will be reports of big losses and gains from today’s events. But that is a side show to the real story. We have just witnesses the collapse of a promise by a major central bank. The Fed, Bank of Japan, ECB, SNB and other Central Banks have repeatedly made the same promises over the past half decade:

Don’t worry! We are here. We will do anything it takes to achieve the stability we desire. We are stronger than the markets. We can overwhelm all forces. We will never let go – just trust us!

I never believed in these promises, but the vast majority of those who are active in financial markets did. The entire world has signed onto the notion that Central Banks are all powerful. We now have evidence that they are not. Anyone who continues to believes in the All Powerful CB after today is a fool. Those who believed in Jordan’s promises now have red ink on their hands – lots of it! The next central bank that will come into the market’s cross hairs is the ECB. Mario Draghi has made promises that he would “Do anything – in any amount”. Like I said, you would be a fool to continue to believe in that promise as of this morning. We’ve just taken a huge leap into chaos. The linchpin of the capital markets has been the trust in the CBs. The market’s anchors have now been tossed overboard.

“Where a client cannot cover this loss, it is passed on to us. This has forced Alpari (UK) Limited to confirm…that it has entered into insolvency ..”

• Swiss Franc Move Cripples, Wipes Out Currency Brokers (WSJ)

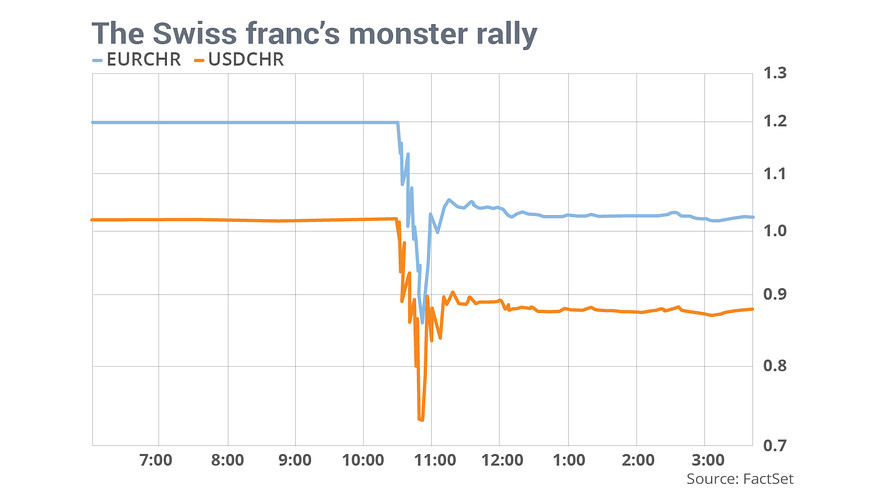

A major U.S. currency broker warned its equity was wiped out, a U.K. retail broker entered insolvency and a global foreign-exchange trading house failed after suffering big losses sparked by the Swiss central bank’s move to free up its currency. On Friday, regulators in Japan, Hong Kong, Singapore and New Zealand sought information from brokers about what happened. In Japan, the Finance Ministry was checking on trading firms after industry sources said the country’s army of mom-and-pop foreign exchange traders suffered big losses. The losses were caused when liquidity dried up and volatility spiked in the debt-driven foreign exchange market, making it impossible for brokers to execute trades as losses spiraled. Many of these brokers offer 100-to-1 leverage, meaning a 1% loss can wipe a client out.

The Swiss franc jumped 30% against the euro in minutes on Thursday, after the Swiss National Bank stopped capping the rise their nation’s currency against the euro. The surprise move sent the Swiss franc soaring and caused big losses for traders who had bet against the currency. FXCM, the biggest retail foreign-exchange broker in the U.S. and Asia, said in a statement that because of unprecedented volatility in the euro against the Swiss franc, its losses left it with a negative equity balance of about $225 million and that it was trying to shore up its capital. FXCM was operating normally in Hong Kong on Friday with employees trying to sort out trading positions and answer questions from clients about their trading losses. “As a result of these debit balances, the company may be in breach of some regulatory capital requirements.

We are actively discussing alternatives to return our capital to levels prior to today’s events and discussing the matter with our regulators,” the company, which has a market capitalization of about $701.3 million, said in a statement. Shares of the company fell 15% in U.S. trading and tumbled another 12% after hours. In the U.K., retail broker Alpari entered insolvency after racking up losses amid the currency turmoil following the SNB’s decision. Alpari said in a statement on its website that a majority of its clients sustained losses exceeding the equity in their accounts. “Where a client cannot cover this loss, it is passed on to us. This has forced Alpari (UK) Limited to confirm…that it has entered into insolvency,” the firm said.

““We expect that few risk-management algorithms in G-20 currencies were prepared for greater than 20% moves in a currency pair ..”

• Wall Street Is Bracing For Shock Waves From Swiss Franc Move (MarketWatch)

Don’t be too quick to look past the turmoil that swept global financial markets after Switzerland’s central bank unexpectedly scrapped a cap on the value of its currency versus the euro. While European and U.S. equities largely regained their footing after a panicky round of selling in the wake of the decision, dangers may still lurk in some corners of the market. Here are the potential shock waves to look out for:

Needless to say, the Swiss franc, which had long been held down by the Swiss National Bank’s controversial cap, exploded to the upside. The euro is down 15% and the U.S. dollar remains down nearly 14% versus the so-called Swissie after having plunged even further in the immediate aftermath of the move. See: Swiss stunner sends euro to 11-year low against buck. Since the Swiss National Bank had given no indication it was set to move — indeed, it had previously said it would defend the euro/Swiss franc currency floor with the “utmost determination” — investors were holding large dollar/Swiss franc and euro/Swiss franc long positions, noted George Saravelos, currency strategist at Deutsche Bank, in a note. As a result, the moves Thursday likely resulted in some big losses on investor portfolios holding those positions, he said.

“This effectively serves as a large VaR [value-at-risk] shock to the market, at a time when investors were already sensitive to poor [profit-and-loss] performance for the year,” Saravelos wrote. The Wall Street Journal reported that Goldman Sachs on Thursday closed what had previously been one of its top trade recommendations for 2015: shorting the Swiss franc versus the Swedish krona after the franc jumped as much as 14% on the day versus its Swedish counterpart. Douglas Borthwick, managing director at Chapdelaine Foreign Exchange, said forex participants are bracing for aftershocks. “We expect that few risk-management algorithms in G-20 currencies were prepared for greater than 20% moves in a currency pair, for this reason the chance of a binary outcome is significant,” he said, in a note. “Either participants gained or lost considerable amounts.”

“It’s normal for ruble to do this kind of thing, but we’re talking about Swiss franc ..”

• Franc’s Surge Ranks Among Largest Ever in Foreign Exchange (Bloomberg)

The Swiss franc’s 41% surge after the central bank unexpectedly lifted its cap against the euro is one of the biggest moves among major currencies since the collapse of the Bretton Woods system in 1971. Unlike previous foreign-exchange upheavals, today’s action occurred to one of the most-traded currencies that is considered a haven in tumultuous times, and few saw the move coming. “It’s normal for ruble to do this kind of thing, but we’re talking about Swiss franc,” Axel Merk, president and founder of Merk Investments, who has 20 years of experience in the currency market. “That’s quite extraordinary and unheard of.” A history of some of the biggest moves in the now $5.3 trillion a day market:

• Mexico Tequila Crisis, December 1994: U.S. interest-rate increases helped spark a peso devaluation and fueled capital flight across Latin America. The peso lost 53% in three months. The recession the following year, when the economy contracted 6.2%, was among the worst since the 1930s.

• Thai baht, July 1997: The currency fell 48% over the second half of the year after the central bank devalued its the baht in an attempt to revive its slumping economy, marking one of the biggest shifts in Asian currency policy since the country last devalued its currency in 1984.

• Japanese yen, October 1998: During the Asian Financial Crisis, the Japanese currency rallied as much as 7.2% in a day as hedge funds rushed to unwind carry trades by repaying the yen that they borrowed to invest in higher-yielding currencies such as the Thai baht and Russia’s ruble. The yen surged 16% that week.

• Turkish lira, 2001: A spat between then-President Ahmet Necdet Sezer and Prime Minister Bulent Ecevit led to an exodus of foreign capital, pushed up government debt and throwing more than 20 banks into bankruptcy. The currency lost 54% in value that year and inflation jumped to 69% by December.

• Argentine peso, June 2002: Argentina started struggling to finance its debt in 1999 as the one-to-one peg to a rising dollar squeezed exporters and Brazil, the country’s largest trading partner, devalued the real. Interim President Adolfo Rodriguez Saa announced to default on $95 billion debts in December 2001. Within weeks, the central bank abandoned the peg, allowing the peso to fall 74% by June 2002.

• Russian Ruble, December 2014: The currency plummeted 34% in three weeks through mid-December as plunging oil prices and international sanctions pushed Russia toward a recession. The central bank has spent $95 billion of foreign reserves over the past year to shore up the ruble and boosted interest rate five times. While the efforts helped quell volatility, the ruble remains within 5% of the record low set on Dec. 16.

Not too crazy so far.

• Swiss Bankers Are Accelerating the Euro’s Slide (Bloomberg)

The euro is shaping up as the biggest casualty of Switzerland’s decision to scrap its currency cap. Soon after the Swiss National Bank unexpectedly decided yesterday to end its three-year policy of keeping the franc from appreciating beyond 1.20 per euro, bearish bets on Europe’s common currency soared. While setting a record low versus the franc, the euro also plunged 3.5% against a basket of 10 developed-nation peers, the most since its 1999 debut. The SNB’s decision removes a key pillar of support for the euro, boosting the odds that its recent slide will accelerate. Companies from Goldman Sachs to Pimco have in recent days talked about the increasing chance the euro falls to parity with the dollar, which would represent a 14% decline from its current level.

“It adds fuel to the fire,” Atul Lele, the chief investment officer of Deltec International Group, who manages $1.9 billion, said by phone from Nassau, Bahamas. “This move out of Switzerland certainly exacerbates the trade-weighted euro weakness that we expect to see.” The difference in the cost of options to sell Europe’s common currency against the dollar, over those allowing for purchases, jumped by the most in almost two years yesterday. The euro dropped 1.3% to $1.1633 yesterday. In defending its cap on the franc, the SNB almost doubled its holdings of the 19-nation currency to 174.3 billion euros ($203 billion) since September 2011.

Speculation the European Central Bank is only days away from announcing a government-bond purchase program, or quantitative easing, at its Jan. 22 meeting had already weakened the euro against its major peers. The euro also sank below parity with the franc yesterday to an all-time low of 85.17 centimes, before recovering to 1.0096 per euro today. Deltec’s Lele said he sees it falling an additional 5% to 10%. “The euro can’t find a friend for love nor money,” said London-based Kit Juckes, a strategist at Societe Generale SA, which predicts a decline to $1.14 by year-end. When one of the biggest buyers of euros “leaves the building,” losses are inevitable, he said.

Stockman addresses the same issue, the return of price discovery, that I did yesterday in The End Of Fed QE Didn’t Start Market Madness, It Ended It.

• In Praise Of Price Discovery – The Market Is Off Its Lithium (David Stockman)

This morning’s market is more erratic than Claire Danes off her lithium. Gold is soaring, the euro’s plunging, US treasury yields are in free fall, junk bonds are faltering, copper is bouncing, oil has rolled over, the Russell 2000 momos are getting mauled, the swissie has shot the moon, the Dow is knee-jerking down, correlations are failing……and the robo traders are flat-out lost. All praise the god of price discovery! For six years financial markets have been drugged into zombiedom by maniacal central bankers who have violated every known rule of sound money and financial market honesty. In expanding their collective balance sheets from $5 trillion to $16 trillion over the past decade, for instance, they have midwifed a planet-wide fiscal fraud.

Politicians have been enabled to spend and borrow like never before because central banks have swapped trillions of public debt for electronic cash confected from nothing. Likewise, never have carry traders and gamblers been so egregiously pleasured by the state. After 73 straight months of ZIRP they are still pinching themselves, wondering if such stupendous largesse is real. They have bought anything with a yield and everything with prospect of gain, financed it for nothing and collected the arb – while being swaddled in the Fed’s guarantee that it would never surprise them or perturb their trades with unannounced money market rate changes. And so they wallowed in their windfalls, proclaiming their own genius.

Does a pompous dandy like Bill Ackman end up purchasing an absurdly priced $90 million Manhattan condo just “for fun” because markets operate on the level? Do his petulant brawls with other grand “activist” speculators like Carl Icahn mark investment genius or the machinery of honest capitalism at work? No they don’t. There is absolutely nothing honest, productive or fair about the central bank dominated casinos which have morphed out of what used to be legitimate money and capital markets. Indeed, all the requisites of stability, efficiency and honest price discovery have been destroyed by the monetary central planners. The short sellers have been eradicated. Downside insurance against a broad market swoon has become dirt cheap. Momo traders have thereby been enabled to earn unconscionable returns because their carry costs have been negligible and their hedging expenses nearly nothing.

“Saudi Arabia, the biggest producer, is probably assuming $80 ..”

• Iran Lowers Oil Price for Budget to $40 After Collapse (Bloomberg)

Iran, its oil exports curbed by sanctions, is lowering the crude price for this year’s budget to $40 a barrel as the energy slump affects governments and industry. The government is revising its draft budget to assume a base price of $40, from $72, the state-run Fars News Agency reported Finance and Economy Minister Ali Tayebnia as saying Jan. 15. The minister said some projects will have to be halted, according to Fars. Iran’s calendar year begins March 21. Prices of Brent, a benchmark for more than half the world’s oil, have dropped about 50% in the past year, forcing governments to reduce subsidies on diesel, natural gas and utilities and companies to cut billions from capital budgets. Qatar Petroleum and Shell called off plans to build a $6.5 billion petrochemical plant.

“Most Gulf countries are pricing $50 oil for 2015,” said Naeem Aslam, chief market analyst at Dublin-based Avatrade Ltd. in a phone interview from Dubai. “Creditors want to be sure they recoup their money so there could be hesitation to starting up new projects.” Iran President Hassan Rouhani presented a budget to lawmakers on Dec. 7 based on $72 oil. Since then, Brent crude has dropped about 30%. It budgeted $100 oil last year. [..] Iraq, the second-biggest member of OPEC, is using $60 in its budget. Saudi Arabia, the biggest producer, is probably assuming $80, according to John Sfakianakis, a former Saudi government economic adviser. Kuwait has propsed basing its 2015-16 budget on oil at $45.

Makes you wonder how BP itself will survive.

• BP Sees $50 Oil For Three Years (BBC)

BP’s job announcement later today, including a few hundred job losses in Aberdeen, is being made because it does not expect the oil price to bounce any time soon. The oil price has dropped around 60% since June, to $48 a barrel, and I understand that BP expects that it will stay in the range of $50 to $60 for two to three years. Although no oil company has a crystal ball, this matters – especially since it has a big impact on its investment and staffing ambitions. So plans that it had already initiated to reduce costs have taken on a new element, namely postponement of investments in new capacity that have not been started, and shelving of plans to extend the life of older fields where residual oil is more expensive to extract.

Aberdeen is an important centre for BP, and it employs around 4000 there. And it is in no sense withdrawing – it is continuing to invest in the Greater Clair and Quad 204 offshore properties. But the reduction of several hundred in the numbers it will henceforth employ in the Aberdeen area is symbolic of a city and industry that faces a severe recession. Hardest hit will be North Sea companies with stakes in older fields, where production costs are on a rising trend – and whose profitable life will be significantly shortened if the oil price does not recover soon. The reason BP expects the oil price to stay in the range of $50 to $60 for some years is for reasons you have read about here – it is persuaded that the Saudis, Emiratis and Kuwaitis are determined to recapture market share from US shale gas.

This means keeping the volume of oil production high enough such that the oil price remains low enough to wipe out the so-called froth from the shale industry – to bankrupt those high-cost frackers who have borrowed colossal sums to finance their investment. This does not simply require some US frackers to be bankrupted and put out of business, but also that enough banks and creditors are burned such that the supply of finance to the shale industry dries up. Only in that way could Saudi could be confident of reinvigorating its market power.

The end of major parts of the industry.

• $50 Oil Is The Ceiling For A Much Lower Trading Range (Anatole Kaletsky)

If one number determines the fate of the world economy, it is the price of a barrel of oil. Every global recession since 1970 has been preceded by at least a doubling of the oil price, and every time the oil price has fallen by half and stayed down for six months or so, a major acceleration of global growth has followed. Having fallen from $100 to $50, the oil price is now hovering at exactly this critical level. So should we expect $50 to be the floor or the ceiling of the new trading range for oil? Most analysts still see $50 as a floor – or even a springboard, because positioning in the futures market suggests expectations of a fairly quick rebound to $70 or $80. But economics and history suggest that today’s price should be viewed as a probable ceiling for a much lower trading range, which may stretch all the way down toward $20.

To see why, first consider the ideological irony at the heart of today’s energy economics. The oil market has always been marked by a struggle between monopoly and competition. But what most western commentators refuse to acknowledge is that the champion of competition nowadays is Saudi Arabia, while the freedom-loving oilmen of Texas are praying for OPEC to reassert its monopoly power. Now let’s turn to history – specifically, the history of inflation-adjusted oil prices since 1974, when OPEC first emerged. That history reveals two distinct pricing regimes. From 1974 to 1985, the US benchmark oil price fluctuated between $50 and $120 in today’s money. From 1986 to 2004, it ranged from $20 to $50 (apart from two brief aberrations after the 1990 invasion of Kuwait and the 1998 Russian devaluation).

Finally, from 2005 until 2014, oil again traded in the 1974-1985 range of roughly $50 to $120, apart from two very brief spikes during the 2008-09 financial crisis. In other words, the trading range of the past 10 years was similar to that of OPEC’s first decade, whereas the 19 years from 1986 to 2004 represented a totally different regime. It seems plausible that the difference between these two regimes can be explained by the breakdown of OPEC power in 1985, owing to North Sea and Alaskan oil development, causing a shift from monopolistic to competitive pricing. This period ended in 2005, when surging Chinese demand temporarily created a global oil shortage, allowing OPEC’s price “discipline” to be restored.

Just the start.

• Big Oil Gets Serious With Cost Cuts on Worst Slump Since 1986 (Bloomberg)

Major oil companies are awaking from their slumber and facing up to the magnitude of the crash in crude prices. From Shell canceling a $6.5 billion project in Qatar to Schlumberger firing about 9,000 people and Statoil giving up exploration in Greenland, the oil industry this week concluded that the slump is no blip. Top producers follow U.S. shale developers such as Continental in unraveling a boom that produced more oil and natural gas than the world is ready to buy. And there’s certainly more unwinding to come. For most of this month, crude oil has traded below $50 a barrel, a level few predicted even two months ago when OPEC signaled it wouldn’t cut production to defend prices.

If the market stays this depressed, global spending on exploration and production could fall more than 30%, the biggest drop since 1986, according to forecasts from Cowen. “Not too many people expected these levels of oil prices, not even the companies themselves,” said Dragan Trajkov, an analyst at Oriel in London. “Now they have to deal with this new situation and the first impact will be on new investments.” Shell, BP, Chevron and other top producers are preparing to present 2014 earnings to investors at the end of this month or early February and will signal plans for this year. Their chief executive officers are faced with the challenge of assuring shareholders they can see through the depression without cutting dividend payments. The direction of the oil market shows companies probably need to prepare for the worst.

Bank of America, noting the speed global oil inventories are building, forecast Thursday that Brent futures are set to fall to as low as $31 a barrel by the end of the first quarter from about $48 now. That’s even lower than the $36.30 seen during the depths of 2008’s financial crisis. Oil traded above $100 a barrel in July and analysts forecast prices would stay there for years to come. The scale and speed of the price drop has forced companies to start making significant decisions. Shell, Europe’s largest oil company, took the axe this week to a $6.5 billion petrochemicals plant it planned to build in Qatar in partnership with the state oil producer. The company, based in The Hague, said the project wasn’t economically feasible in the current price environment.

“Energy companies are expected to cut spending in the U.S. by as much as 35% this year ..”

• Schlumberger Cuts 9,000 Jobs as Oil Slump Portends Uncertainty (Bloomberg)

Schlumberger, the world’s biggest oilfield-services company, tackled the “uncertain environment” of plummeting crude prices head-on by cutting 9,000 jobs and lowering costs at a vessels unit. The 7.1% workforce cutback, along with the reduction and reassessment of its WesternGeco fleet, were among steps leading to a $1.77 billion fourth-quarter charge in anticipation of lower spending by customers in 2015, the Houston- and Paris-based company said in an earnings report Thursday. Energy companies, coping with oil worth less than half its price six months ago, are expected to cut spending in the U.S. by as much as 35% this year, according to Cowen. The number of onshore U.S. rigs could fall by as much as 750 this year, Wells Fargo said. That would be a 43% decline from the 1,744 in operation at the start of the year, according to Baker Hughes. The coming year “is looking like it’s gonna be pretty rough,” Rob Desai, an analyst at Edward Jones in St. Louis, said.

“With the potential for this to last some time, it’s in the best interest of the company to attack it aggressively.” Schlumberger, which had doubled its workforce in the past 10 years, said the one-time charges for the quarter also resulted from the devaluation of Venezuela’s currency and a lower value for production assets it owns in Texas. Net income dropped to $302 million, from $1.66 billion a year earlier. “In this uncertain environment, we continue to focus on what we can control,” Schlumberger Chief Executive Officer Paal Kibsgaard said in the earnings report. “We have already taken a number of actions to restructure and resize our organization.” Shares in oilfield-services companies, which help customers find and produce oil and natural gas, were the first to fall as crude prices declined. Service companies in the Standard & Poor’s Index dropped 20% in the quarter, more than the 18% decline for producers.

Hit hard.

• Aberdeen, The Energy-Rich Town Counting The Cost Of The New Oil Shock (Guardian)

Billy Campbell’s three-year-old is spinning around in a Peppa Pig plastic rocket in the middle of Aberdeen’s Union Square shopping mall. It is not hard to believe that the wider Aberdonian population is in a similar spin given the crisis that has struck the Granite City’s key industry: oil and gas. Ed Davey, the energy secretary, and Nicola Sturgeon, Scotland’s first minister, have both rushed to Britain’s oil capital in the last 48 hours to reassure the city that they are aware of looming problems – problems that, the Bank of England governor warned on Wednesday, will deliver a “negative shock” to Scotland’s economy. Some experts think the oil price fall will wipe £6bn off the country’s GDP and Sturgeon is setting up a task force to try to preserve energy jobs.

[..] This is a very affluent city where unemployment is only a little over 2% and incomes are well above the Scottish average. In Aberdeenshire some 38% of households have an income of more than £30,000, compared to 28% across Scotland and just 19% in Glasgow. The Union Square car park is crammed with upmarket models and four-wheel drives – a survey last year by accountants UHY Hacker Young showed that Aberdeenshire has the highest sales of 4x4s in the UK. The car park is just yards away from the massive offshore support vessels that are waiting to load in the harbour beyond. But, away from the downtown bustle of the city centre, not everyone is quite so laid back.

Certainly not those at the sprawling business park at Dyce, close to the airport, where oil firms and the industry’s service companies are congregated. It was here that BP staff were just told that 300 jobs are to be lost from the North Sea business. These are just the latest staff cuts at major oil employers in the region. Shell has taken similar steps, as has Chevron. Companies such as the Wood Group and Petrofac that provide drilling and other support services to the big oil companies have also been cutting costs. Last year Wood slashed 10% off the rates it pays to its contractors, saying operating costs in the North Sea were unsustainable. And that was before the price of oil crashed over the last six months by 60% to its lowest level in six years.

Preparing for a bank run.

• Greek Systemic Banks Request Emergency Liquidity Assistance (Kathimerini)

Two Greek systemic banks submitted the first requests to the Bank of Greece for cash via the emergency liquidity assistance (ELA) system on Thursday, sources told Kathimerini. It is thought that requests from the remaining Greek banks will follow in the next few days. The move came in response to the pressing liquidity conditions resulting from the growing outflow of deposits as well as the acquisition of treasury bills forced onto them by the state. Banks usually resort to ELA when they face a cash crunch and do not have adequate collateral to draw liquidity from the European Central Bank, their main funding tool. ELA is particularly costly as it carries an interest rate of 1.55%, against just 0.05% for ECB funding.

The requests by the two lenders will be discussed by the ECB next Wednesday. Bank officials commented that lenders are resorting to ELA earlier than expected, which reflects the deteriorating liquidity conditions in the credit sector. Besides the decline in deposits, banks were dealt another blow on Thursday with the scrapping of the euro cap on the Swiss franc. Bank estimates put the impact of the euro’s drop on the local system’s cash flow at between €1.5 and €2 billion. Deposits recorded a decline of €3 billion in December – a month when they traditionally expand – while in the first couple of weeks of January the outflow continued, although banks say it is under control.

A major blow to the system’s liquidity has come from the repeated issue of T-bills: In November the state drew €2.75 billion in this way, in December it secured €3.25 billion, and it has already tapped another €2.7 billion in January. Of the above amounts, a significant share – amounting to €3 billion according to bank estimates – was in the hands of foreign investors who are not renewing their stakes, so Greek banks have to step in to buy them. Local lenders had also resorted to ELA in 2011 to cope with the outflow of deposits and consecutive credit rating downgrades of the state (and the banks) that made Greek paper insufficient for the supply of liquidity by the Eurosystem. In June 2012, due to the uncertainty of the twin elections at the time, the ELA being drawn by local banks to handle the unprecedented outflow of deposits reached a high of €135 billion. By May 2014, Greek banks had reduced their ELA financing to zero.

If politicians – like this guy – don’t understand what deflation is, and most have no clue, that can obviously cause trouble.

• No Risk Of ‘Deflation Spiral’ In Europe: German Minister (CNBC)

Despite data showing that the euro zone has slid into deflation, Germany’s deputy finance minister brushed off concerns that the region could enter a downward spiral of falling prices and lack of demand. “This is not what economists and textbooks describe as a deflation spiral, this is a modest price development,” Steffen Kampeter told CNBC Thursday. Data released last week showed that the 19-country single currency region had entered deflation territory in December. Prices in the euro zone fell 0.2% year-on-year in December, marking the first time since 2009 that prices have dipped into negative territory. The decline in prices has been largely attributed in the cost of oil, which has slipped over 60% since June 2014. However, core inflation, which strips out volatile factors like fuel and unprocessed food prices, was stable at 0.7% in December.

“I see the facts,” Kampeter said. “And the fact is that the core inflation is rising and we have a very moderate and negative price development, especially in energy and raw material.” Deflation concerns analysts because a decline in the price of goods can cause consumers to delay purchases in the hope of further price falls, putting pressure on the broader economy. The figures prompted widespread market speculation that the European Central Bank (ECB) could announce a full-scale quantitative easing program when it meets on January 22. The deputy finance minister wouldn’t comment on any forthcoming ECB action, however. As a German policymaker, Kampeter said he was tasked with looking at structural reforms in Germany and Europe as a whole, and was aiming to ensure that investment in Europe continued in order to keep the region competitive. The Germany economy – which is the largest in the euro zone – has staged something of a turnaround of late, after veering dangerously close to recession in 2014.

Today’s episode of The Dog Ate My Homework.

• UK Retailers ‘Throttled’ By Black Friday (Daily Mail)

It’s the American import that has played havoc with Christmas retail sales. Black Friday, where US shops slash their prices on the day after Thanksgiving, has joined the school prom as a stars-and-stripes tradition that has invaded our islands. For UK retailers, it has proved an unwelcome arrival. Far from boosting net sales it has proved a festive nightmare, denting Christmas trading, causing websites to crash, and sparking delivery chaos. Shoppers spent an estimated £810m on Black Friday on November 28 – making it the biggest ever day for UK online sales. But consumers more than made up for their spree by tightening their belts later on, in the run-up to Christmas.

Retailers suffered their slowest December growth in six years as Black Friday disrupted the timing and rhythm of festive sales. Several chains have lined up to blame the event for their lacklustre performance, with Argos owner Home Retail Group claiming to be the latest victim. The company, which fell short of City forecasts, accused Black Friday of fostering ‘a discount mentality’ in the run-up to Christmas, a time of year when shoppers are usually prepared to pay full price for gifts. Marks & Spencer said that it had caused systems at its Castle Donington warehouse to collapse, and Game Digital blamed it for Monday’s profit warning. Home Retail Group’s new chief executive John Walden said: ‘This year’s adoption of ‘Black Friday’ promotional events generally by the UK market significantly impacted the shape of Argos sales over its peak trading period.’

But China can make the numbers up as it goes along.

• Warning: China May Trigger Fresh Rout In Commodities (CNBC)

Commodities just can’t catch a break – and China’s GDP release on January 20 could throw another punch at the beleaguered asset class should it underperform expectations, warn analysts. “We are days from the release of China’s Q4 GDP and copper is the best barometer of growth. The rout gives me reason to believe China’s growth is not only moderating but is slowing faster than estimated,” Evan Lucas, market strategist at IG wrote in a note. “If China disappoints next Tuesday, brace for a real rout in commodities,” he said. Copper, regarded as an important indicator of economic health, joined the selloff in commodities Wednesday after the World Bank downgraded its growth outlook for the global economy. The global economy is forecast to expand by 3% this year,the Washington-based lender said in its Global Economic Prospects report released on Tuesday, a notch lower than its previous forecast of 3.4% made in June, but up from an estimated 2.6% in 2014.

The red metal suffered its biggest one-day slide in more than three years on Wednesday, with three-month copper on the London Metal Exchange falling more than 8% at one point to $5,353 a tonne before settling around $5,655 on Thursday. The World Bank expects China’s gradual pace of deceleration to continue,forecasting growth in the world’s second largest economy to slow to 7.1% this year from an estimated 7.4% last year. China plays a dominant role in the commodities market because it’s the world’s largest consumer of energy and metals, including copper. “In our view, the significant pressure on copper price lately indicates either a noticeable slow-down in demand [out of China] or troubles in the shadow banking sector, or both,” said David Cui, strategist at Bank of America Merrill Lynch.

“.. shadow bank credit exceeded new yuan-denominated loans for the first time in 2014.”

• China Shadow Banking Surge Chills Stimulus Hopes (CNBC)

Two months ago calls for broad-based stimulus in China were all the rage, but a sudden spike in shadow banking has led analysts to revise their expectations for looser monetary policy. Aggregate social financing, a measure of credit that covers bank lending and shadow banking activity, hit one-year high of 1.69 trillion yuan ($273 billion) in December, up from 1.15 trillion yuan the previous month, official data showed on Thursday. “A surge in shadow bank credit – entrusted loans, trust loans, banker’s acceptances, corporate bonds and non-financial enterprises’ domestic equity – was responsible for December’s considerably larger than expected increase in aggregate financing,” said Tim Condon, head of Asia research at ING in a note on Friday, noting that shadow bank credit exceeded new yuan-denominated loans for the first time in 2014.

China’s central bank surprised markets by cutting interest rates for the first time in two years in November, sparking expectations for further policy easing via interest rate or reserve ratio requirements (RRR) cuts. Tight funding conditions also fuelled hopes for RRR cuts late last year. The seven-day repo rate, a closely-watched measure of interbank lending costs, spiked suddenly to an over one-year high in mid-December, prompting speculation for central bank action to boost liquidity. But Thursday’s data reduce the likelihood that the People’s Bank of China will cut the RRR for lenders, Condon said: “We are reviewing our forecast of 100 basis-points of RRR cuts in the first half of the year for downward revision.” Shadow banking was fairly stable last year after Beijing introduced regulatory measures to clampdown on the sector, such as stricter financing rules for trust companies.

During the July-September period, the shadow banking sector of China’s total social financing contracted for the first time on quarter since the global financial crisis. However, those tightening measures may be the very reason for December’s surge, according to Barclays. “We suspect that borrowers including local government financing vehicles (LGFVs) could have accelerated their financing activities through shadow banking channels, since they might experience difficulties in accessing bond market for new issuance as a result of tightening regulations/declining support from provincial government on new debt,” analysts said in a note on Friday. The sudden spike in shadow banking credit leaves the central bank in a catch-22 situation, Gavin Parry at Parry International Trading said. “Here is the issue for the PBoC; it is facing rampant speculation bubbling in the economy like the stock market, while also facing weaker loan demand, local government funding needs and deflationary forces,” he said.

Logical step.

• New Russian/Chinese Credit Rating Agencies To ‘Balance Big Three’ (RT)

The creation of a joint Russian-Chinese credit rating agency will balance the global outlook and give the world an alternative view on how credit ratings should be done, Chinese international relations expert Victor Gao told RT. “Traditionally credit rating is mostly done by Western credit rating agencies. They sometimes may not fully understand the dynamics of the economics of any particular company or the sovereign borrower,” he said, adding that the agency won’t pursue a goal of replacing traditional Western credit rating agencies like S&P and Moody’s. “It will give the whole world another perspective of how risks are analyzed and how credit rating should be done,” he said. Gao believes Western rating agencies claim to be independent and professional, but in fact they turn out to be biased when it comes to issues of geopolitical importance.

“During the global financial crisis the Western rating agencies did not react as quickly as possible,” he said. “In terms of the rating of the sovereign debt of the US for example, or even for Japan, they’ve actually displayed much more flexibility in rating these countries compared with many other countries.” The announcement of a rating could actually make a situation even worse rather than help stabilize it, he added. Credit rating agencies are very much at the top of the international financial system and they’re not only active domestically in one particular country but in many cases they are active across national boundaries.

Gao said that China has its own credit rating agency Dagong which is actively operating in the country and abroad, increasingly estimating other countries’ and companies’ credit rating. The analyst believes the global economy is changing and going through an important transformation as the emerging markets are growing and their portion in the global economy is increasing despite a significant turmoil in the international financial, economic and energy sectors. Creating a joint credit rating agency of Russia and China is significant but it’s high time the world’s most important developing economies united and came up with their own credit rating agency, as in case of establishing the BRICS Development Bank, he said.

Up to 60 years old, women up to 50.

• Ukraine President Poroshenko Signs Decree To Mobilize Up To 100,000 (TASS)

Ukrainian President Petro Poroshenko has signed a decree on another mobilization. He put his signature to the document at a meeting with the heads of regional authorities. “I have handed it over to parliament, because it requires approval by the national legislature,” Poroshenko said. Under a decision by the National Security and Defense Council of December 20, 2014, a fourth mobilization wave is beginning on January 20, and two more will be held in April and June.

Some categories of reservists will be exempt from mobilization: men with poor health, university and post-graduate students, clerics, parents having three or more children, and those resident in the territories uncontrolled by the Ukrainian authorities. On January 8, Defense Minister Stepan Poltorak said that in 2015 about 104,000 men may be mobilized, if need be. Ukrainian General Staff spokesman Volodymyr Talalai said that women aged 25 through 50 might be drafted into the army, if necessary.

There needs to be far more protest against TTIP, or it’ll be pushed through.

• ‘Corporate Wolves’ Will Exploit TTIP Trade Deal, MPs Warned (Guardian)

The controversial TTIP trade deal between Europe and the US could depress workers’ wages by £3,000 a year and allow “corporate wolves” to sue the government for loss of profit, MPs have heard. The claims were made in a highly-charged House of Commons debate, with many Conservative MPs defending the proposed Transatlantic Trade and Investment Partnership free trade deal and opposition MPs warning that it risks giving too much power to big US corporations. Anti-TTIP campaigners claim one million people have signed a petition against the deal, mainly because of worries that it could open the door to US health companies running parts of the NHS. This has been firmly denied by the UK government and the European commission, who have said public services are explicitly excluded. However, Labour is still worried that the proposals not do enough to protect the public interest.

Many MPs have particular concerns about the investor-state dispute settlement clauses, which would give private companies the right to sue the government in international tribunals for loss of profit arising from policy decisions. Labour MP Geraint Davies, who called the debate, urged negotiators to drop controversial clauses, insisting the judicial system in each country was sufficient protection in mature democracies. His motion called for the UK parliament to play a role in scrutinising any eventual deal, instead of it being passed exclusively by Brussels. “The harsh reality is this deal is being stitched up behind closed doors by negotiators with the influence of big corporations and the dark arts of corporate lawyers – stitching up laws that will be quite outside contract law and common law, outside the shining light of democracy, to in fact give powers to multinationals to sue governments over laws designed to protect their citizens.”

“My view is we should pull the teeth of the corporate wolves scratching at the door of TTIP by scrapping the investor-state dispute settlement rules altogether and so we can get on with the trade agreement without this threat over our shoulder.” Caroline Lucas, the former Green party leader and MP for Brighton Pavilion, said she believed TTIP amounted to a corporate takeover and cited independent research from Tuft University suggesting workers’ wages could suffer by £3,000 a year. “Countries like the Czech Republic, Slovakia and Poland who are in trade agreements which include this kind of investor-state relationship have been sued 127 times and lost the equivalent money that could have employed 300,000 nurses for a year,” she said. “The idea this isn’t a problem is patently wrong; this is about a corporate takeover and that is why it is right to oppose this particular mechanism.”

Good man.

• Pope Francis Says Freedom Of Speech Has Limits (BBC)

Pope Francis has defended freedom of expression following last week’s attack on French satirical magazine Charlie Hebdo – but also stressed its limits. The pontiff said religions had to be treated with respect, so that people’s faiths were not insulted or ridiculed. To illustrate his point, he told journalists that his assistant could expect a punch if he cursed his mother. [..] Speaking to journalists flying with him to the Philippines, Pope Francis said last week’s attacks were an “aberration”, and such horrific violence in God’s name could not be justified. He staunchly defended freedom of expression, but then he said there were limits, especially when people mocked religion. “If my good friend Doctor Gasparri [who organises the Pope’s trips] speaks badly of my mother, he can expect to get punched,” he said, throwing a pretend punch at the doctor, who was standing beside him. “You cannot provoke. You cannot insult the faith of others. You cannot make fun of the faith of others. There is a limit.”

Home › Forums › Debt Rattle January 16 2015