DPC The steamer Cincinnati off Manhattan 1900

All that’s wrong, put in just a few words: “We want to make sure that when there’s an announcement, that it’s as large as what the market’s expecting.” The ECB should do what’s good for people, not what markets expect. That’s insiduous.

• IMF Lowers Global Growth Forecast by Most in Three Years (Bloomberg)

The IMF made the steepest cut to its global-growth outlook in three years, with diminished expectations almost everywhere except the U.S. more than offsetting the boost to expansion from lower oil prices. The world economy will grow 3.5% in 2015, down from the 3.8% pace projected in October, the IMF said in its quarterly global outlook released late Monday. The lender also cut its estimate for growth next year to 3.7%, compared with 4% in October. The weakness, along with prolonged below-target inflation, is challenging policy makers across Europe and Asia to come up with fresh ways to stimulate demand more than six years after the global financial crisis.

“The world economy is facing strong and complex cross currents,” Olivier Blanchard, the IMF’s chief economist, said in the text of remarks at a press briefing Tuesday in Beijing. “On the one hand, major economies are benefiting from the decline in the price of oil. On the other, in many parts of the world, lower long-run prospects adversely affect demand, resulting in a strong undertow.” The IMF cut its outlook for consumer-price gains in advanced economies almost in half to 1% for 2015. Developing economies will see inflation this year of 5.7%, a 0.1 percentage point markup from October’s projections, the fund said. The growth-forecast reduction was the biggest since January 2012, when the fund lowered its estimate for expansion that year to 3.3% from 4% amid forecasts of a recession in Europe.

The IMF marked down 2015 estimates for places including the euro area, Japan, China and Latin America. The deepest reductions were in places suffering from crises, such as Russia, or for oil exporters including Saudi Arabia. IMF Managing Director Christine Lagarde outlined the sobering outlook in her first speech of the year last week, saying that oil prices and U.S. growth “are not a cure for deep-seated weaknesses elsewhere.” The U.S. is the exception. The IMF upgraded its forecast for the world’s largest economy to 3.6% growth in 2015, up from 3.1% in October. Cheap oil, more moderate fiscal tightening and still-loose monetary policy will offset the effects of a gradual increase in interest rates and the curb on exports from a stronger dollar, the fund said.

In Europe, weaker investment will overshadow the benefits of low oil prices, a cheaper currency and the European Central Bank’s anticipated move to expand monetary stimulus by buying sovereign bonds, according to the IMF. The fund lowered its forecast for the 19-nation euro area to 1.2% this year, down from 1.3% in October. The ECB should go “all in” in its bond-buying program, Blanchard said on Bloomberg TV. “We want to make sure that when there’s an announcement, that it’s as large as what the market’s expecting.”

Why anyone would believe numbers like these is beyond me.

• Chinese Growth at 7.4% Is the Slowest Since 1990 (Bloomberg)

China’s stimulus efforts began kicking in late last year, boosting industrial production and retail sales, and helping full-year economic growth come close to the government’s target. Gross domestic product rose 7.3% in the three months through December from a year earlier, compared with the median estimate of 7.2% in a Bloomberg News survey. GDP expanded 7.4% in 2014, the slowest pace since 1990 and in line with the government’s target of about 7.5%. The yuan and local stocks advanced after the release. A soft landing for China would help a global economy contending with weakness that spurred the IMF’s steepest cut to its world growth outlook in three years.

China’s central bank cut interest rates for the first time in two years in November and has added liquidity in targeted steps to buoy demand. “The economy’s performance in 2014 stands out against the widespread hard-landing fears that prevailed early last year,” said Tim Condon at ING in Singapore. “That the authorities were able to sustain close-to-target growth and increase the tempo of economic reforms –- shadow banking, local government finances -– and sustain the property-cooling measures demonstrates the effectiveness of the targeted measures.” “Markets should breathe a sigh of relief as the economy enters 2015 in a better shape than had been expected,” said Dariusz Kowalczyk at Credit Agricole in Hong Kong.

“The data lowers the need for further stimulus, but there remains some room for easing as risks are skewed to the downside.” [..] Quarter-on-quarter, China’s performance was less robust, slowing to 1.5% growth in the three months through December from 1.9% in the third quarter. “Growth momentum eased in the fourth quarter from the previous three months due to property-related weakness,” said Wang Tao, chief China economist at UBS Group AG in Hong Kong. “Property starts deepened their decline, which also dragged down heavy industry and related investment. Property will continue to drag down growth this year.”

China imitates the west: “Funds aren’t flowing into economic activities on the ground. Instead, people are adding leverage to speculate.”

• China’s $20 Trillion Headache Underscored by Stock Swings (Bloomberg)

For China’s central bank, the 36% stock market rally through Jan. 16 spurred in part by a surprise November interest-rate cut is the latest reminder that it’s easier to unleash money than to guide it to the right places. Since Zhou Xiaochuan became People’s Bank of China governor in late 2002, the broad money supply base has expanded almost seven times to 122.8 trillion yuan ($20 trillion) while the economy has grown about five times. That translates to a M2/GDP ratio of about 200% versus about 70% in the U.S. That liquidity springs up like a jack-in-the-box, driving property prices, then shifting to stocks, before moving on to whatever may be next. Such sprees help explain the PBOC’s reluctance to cut banks’ required reserve ratios even as the economy slows. Instead, it’s trying targeted tools to guide money to preferred areas such as farming and small business.

“The central bank will continue to face structural challenges in 2015 and beyond,” said Shen Jianguang at Mizuho. “Funds aren’t flowing into economic activities on the ground. Instead, people are adding leverage to speculate.” China’s benchmark stock index plunged the most in six years on Monday in Shanghai, led by brokerages, after regulatory efforts to rein in record margin lending sparked concern that speculative traders will pull back from the world’s best-performing stock market in 2014. The move to control margin lending was to “pave the way for more monetary easing,” according to Zhu Haibin at JPMorgan in Hong Kong. The action was to stop future monetary easing from flowing into the stock market, Zhu said in an interview with Bloomberg Television today.

“If we want to help governments that are in trouble let’s do it – but let the parliaments decide rather than this technocratic body, the ECB council.”

• Warning! Volatility May Await If ECB Launches QE (CNBC)

One of Europe’s most influential economists has warned that the quantitative easing measures seen being unveiled by the ECB this week could create deep market volatility, akin to what was seen after the Swiss National Bank abandoned its currency peg. “There was so much capital flight in anticipation of the QE to Switzerland, that the Swiss central bank was unable to stem the tide, and there will be more effects of that sort,” the President of Germany’s Ifo Institute for Economic Research, Hans-Werner Sinn, told CNBC on Monday. This week, the ECB holds its two-day policy meeting and is widely seen unveiling a U.S. Federal Reserve-type government bond-purchasing program, known as quantitative easing or QE. Sinn, a fierce critic of QE, said the launch of such a program would bring more market volatility, of the kind seen on Thursday after the Swiss National Bank abandoned its euro/Swiss franc floor.

“He (ECB President Mario Draghi) will do it, and what will the markets do, they will happy to be able to sell the government bonds, which they consider as partly toxic and they will have a lot of cash. What will they do – they will buy real estate, there could be a revival of the real estate market but they will primarily try to take it abroad. And they have already begun doing that – what you see in Switzerland,” Sinn told CNBC. Sinn said that a ECB government bond-buying program would make markets “happy”, but that it was not the right way to go about bailing out the euro zone. “If we want to help governments that are in trouble let’s do it – but let the parliaments decide rather than this technocratic body, the ECB council. All these (QE) measures go way beyond monetary policy – these are bailout operations to help banks and states which are unable to cope with normal rates of interest,” Sinn told CNBC.

What an incredible mess even before it’s been announced.

• Draghi Weighs QE Compromise Showcasing Unity Shortfall (Bloomberg)

Mario Draghi is weighing how much a compromise on euro-area stimulus would reveal about the currency bloc’s fault lines. As the European Central Bank president and his Executive Board sit down today to formulate a bond-buying proposal to fend off deflation, one option is to ring-fence the risks by country. While that may win over some of Draghi’s opponents when the Governing Council meets on Jan. 22, it might also shine a spotlight on the lack of unity within the union. “An absence of risk-sharing could be taken as a bad signal by the market with respect to the singleness of monetary policy and could be self-defeating,” said Nick Matthews at Nomura. “However, it may prove to be a necessary compromise to make the design of QE more palatable for Governing Council members, and is preferable to having to limit the size of the program.”

Investors are banking on Draghi to announce quantitative easing at his press conference after the council meets, with economists in a Bloomberg survey estimating the package at €550 billion euros. What remains unclear is how far he’ll go to mollify critics who say unelected central-bank officials are transferring risk from weaker nations to stronger ones. The tension surfaced again yesterday at a conference in Dublin. Irish Finance Minister Michael Noonan said having national central banks buy government bonds would be “ineffective,” drawing a response from ECB Executive Board member Benoit Coeure.

“The discussion is how to design it in a way that works, in a way that makes sense,” Coeure said. “If this is a discussion about how best to pool sovereign risk in Europe, and how to make the pooling of sovereign risk take a step forward in an environment where the governments themselves have decided not to do it, then this is not the right discussion.” Klaas Knot, the Dutch central-bank governor, told Der Spiegel last week that “we have to avoid that decisions are taken through the back door of the ECB.”

“Studies show that the business cycle was less volatile before the Federal Reserve was born. The presence of the Fed means that the implicit backing of the Fed allows excess leverage..”

• Endgame for Central Bankers (Steen Jakobsen)

The SNB suddenly abandoning the CHF ceiling had wide consequences last week as we were all taken by surprise. The fact that it would and should happen eventually was not lost on the market, but the SNB was, as late as last weekend, talking tough and telling the market that the floor was an integral part of Swiss monetary policy. Then suddenly it was not. I fully understand the rationale for the move but, like most of the market, I remain extremely disappointed in the SNB’s communication and handling of the issue. But isn’t the bigger lesson or bigger question: Why is it that most people trust or bother to listen to central banks? Major centrals banks claim to be independent, but they are all ultimately under the control of politicians.

Many developed countries have tried to anchor an independent central bank to offset pressure from politicians and that’s well and good in principle until an economy or the effects of a monetary policy decision beginning spinning out of control. At zero bound for growth and for interest rates, politicians and central banks switch to survival mode, where rules are bent or even broken to fit an agenda of buying more time. Just look at the Eurozone crisis over the past eight years: every single criteria of the EU treaty has been violated, in spirit of not strictly according to the letter of the law, all for the overarching aim of “keeping the show on the road”. No, the conclusion has to be that are no independent central banks anywhere! There are some who pretend to be, but none operates in a political vacuum. That’s the reality of the moment.

I would not be surprised to find that the Swiss Government overruled the SNB last week and the interesting question for this week of course will be if the German government will overrule the Bundesbank on QE to save face for the Euro Zone? Likely…. The most intense focus for the last few years in central banking policy-making has been on “communication policy”, which boiled down to its essentials is merely an appeal to “believe us and act accordingly”, often without any real policy action. Look at the Federal Reserve’s forward guidance: They are constantly too optimistic on growth and inflation. Constantly. The joke being to get the proper GDP and inflation forecast you merely take the Fed’s own forecasts and deduct 100-150 bps from both growth and inflation targets and Voila! You have the best track record over time.

Studies show that the business cycle was less volatile before the Federal Reserve was born. The presence of the Fed means that the implicit backing of the Fed allows excess leverage (gearing), and this has resulted in bigger and bigger collapses in financial markets as each collapse triggers yet another central bank “put” that then enables the next bubble to inflate. And the trend of major crashes has been increasing in frequency: 1987 stock crash, 1992 ERM crisis, 1994 Mexico “Tequila crisis”, 1998 Asian crisis and Russian default, 2000 NASDAQ bubble, 2008 stock market crash, and now 2015 SNB, ECB QE, Russia and China, which will lead to what? I don’t know, but clearly the world of finance and the flow of money is increasing in velocity, meaning considerably more volatility.

“Denmark’s three-decades-old peg is backed by the ECB, unlike the SNB’s former currency regime..” And that’s supposed to make us feel better?

• Denmark Strikes Back at Speculators and Burnishes Peg Defenses (Bloomberg)

Denmark is trying to silence currency speculators as the government and central bank insist the Nordic country won’t follow Switzerland in severing its euro ties. “Circumstances significantly different from Denmark’s” were behind the Swiss National Bank’s decision, Danish Economy Minister Morten Oestergaard said in a phone interview. “Any comparison between Denmark and Switzerland is impossible.” The comments followed yesterday’s surprise decision by the Danish central bank to cut its deposit rate by 15 basis points to minus 0.2%, matching a record low last seen during the darkest hours of Europe’s debt crisis in 2012. Like the Swiss, the Danes lowered rates after interventions in the market proved insufficient.

Denmark will probably deliver another rate cut on Jan. 22 as krone “appreciation pressure prevails” with the European Central Bank set to present details of its bond-purchase program, Danske Bank reiterated today. Danske, Denmark’s biggest bank, says it’s been inundated by calls from offshore investors and several hedge funds seeking advice on how to profit from the latest developments in currency markets. SEB, Scandinavia’s largest currency trader, says it’s fielded similar calls. Their response has been to tell investors that Denmark’s three-decades-old peg is backed by the ECB, unlike the SNB’s former currency regime. Denmark has “a long-lasting and politically firmly anchored fixed-currency policy,” Oestergaard said. “This situation should not be overly dramatized.”

To underline the point, the central bank yesterday sought to reassure investors that its monetary policy arsenal is big enough should speculators try to test its resolve. “We have the necessary tools” to defend the peg,Karsten Biltoft, head of communications at the central bank, said by phone. Asked whether Denmark could ever consider abandoning its currency peg, he said, “Of course not.” Biltoft described as “somewhat off” any attempt to draw parallels between the Danish and Swiss currency pegs. “I don’t think you can make a comparison between the two cases,” he said. Yet the speculation is proving hard to put to rest. Defending Denmark’s euro peg “might be easier said than done in the current environment,” Ken Wattret at BNP Paribas, said. “The next test will of course be the upcoming ECB policy announcement on Thursday.” Given BNP’s estimate that the ECB will purchase €600 billion ($697 billion) in sovereign bonds, “further upward pressure on the DKK is likely,” he said.

As if they have a choice.

• Denmark Should Cut Loose From Euro (Bloomberg)

Europe’s currency war is picking up speed. On Monday, with the Danish krone appreciating against the euro, the Danish central bank sought to make the currency less attractive to safe-haven investors by cutting the deposit rate to -0.2% and the lending rate to 0.05%. After the Swiss National Bank abandoned its peg to the euro and cut interest rates, bankers and traders wondered which country would be the next to follow suit. No sooner had the franc zoomed upward than the Danish central bank prepared for an onslaught. Defending the krone’s peg to the euro could get a lot harder once the ECB begins its government bond-buying program, widely expected on Thursday. Yet maintaining the peg is an act of faith in Denmark.

The central bank should rethink its commitment. With a more flexible monetary policy, it could have done more to stimulate the economy since the global financial crisis, just as it could have prevented some of the overheating that took place in the years running up to the crisis. The krone has been pegged to the euro since 1999, and to the deutschemark before that. It’s allowed to fluctuate no more than 2.25% from 7.46038 to the euro. In practice, the central bank tries to keep the fluctuations within 0.5%. It also marches to the ECB’s monetary drum, including changing interest rates on the same day as ECB decisions, or in response to exceptional pressures on the euro-krone exchange rate. The peg was put in place to stabilize Danish monetary policy after a period of high inflation, which peaked at 12.3% in 1980.

It’s not clear that the peg is a good idea now. Unlike Sweden, which has a floating currency and until 2010 had a more sensible monetary policy, Denmark hasn’t fully recovered from the global economic crisis. Real gross domestic product per capita is still more than 7% below the pre-crisis peak. The desirability of the peg, however, is beyond debate in political and economic policy circles. When a prominent economist and former Danish government economic adviser was asked to compare the performance of the Danish economy with Sweden’s in December 2013, he was unable to name any area of economic policy where the Swedes did better. Monetary policy wasn’t mentioned at all; only structural reforms such as marginal tax rates and labor market policies were.

Poland and especially Hungary have huge amounts of mortgages denominated in Swiss francs.

• Swiss Upending Polish Mortgages Unnerves Bank Bondholders (Bloomberg)

Among the victims of last week’s shock surge in the Swiss franc are bond investors in Polish banks, which hold $35 billion in mortgages denominated in the currency. Yields on Eurobonds for lenders including Bank Polski and MBank jumped to five- and nine-month highs after the Swiss National Bank unexpectedly ditched its currency cap. The move sent the zloty tumbling against the franc on concern more Poles will fall behind on repaying franc-denominated home loans. JPMorgan said the nation’s banks may need to make additional provisions for non-performing mortgages in the currency, whose value is equivalent to 6.7% of gross domestic product.. While the zloty plunged 20% against the franc following the SNB action, Polish lenders have adequate capital to withstand a drop of more than twice that, the financial markets regulator said last week, citing results of October stress tests.

“This is clearly negative and increases the risks in the banking sector, which may or may not materialize,” Marta Jezewska-Wasilewska at Wood & Co., wrote in a research note Jan. 15. “Polish banks have managed to deal with the FX mortgage issue relatively well since 2008.” The yield on PKO’s 2019 euro-denominated bonds rose 40 basis points in the last three days to 1.56%, the highest since Aug. 22. The rate on similar-maturity MBank debt soared 83 basis points to 2.34% in the same period. The currency swing pushed banking stocks on the Warsaw Stock Exchange down by the most in more than three years, with Getin Noble Bank, owned by billionaire Leszek Czarnecki, leading declines after a 16% drop on Jan. 15. Getin’s Swiss-franc loans accounted for “slightly” above 20% of total loans at the end of last year, spokesman Wojciech Sury said in an e-mail last week. The bank sees no threat its liquidity levels will fall below the required minimum and is “ready for different scenarios,” he said.

“They are not subject to an OPEC quota at the moment, and could flood the market”.

• Iraq Back From The Brink With Largest Oil Output Since 1979 (CNBC)

In spite of still struggling to recover from the 2003 war and the continuing Islamic State (IS) insurgency, Iraq produced a record amount of oil last month, the country’s oil minister announced at the weekend. Unveiling production of 4 million barrels of crude per day in December, Adel Abdel Mehdi told reporters that the total was ” a historical figure, and the first time Iraq has achieved this.” Speaking at a joint press conference with his Turkish counterpart Taner Yildiz in Baghdad, the Iraqi minister added the production increase would “make up” for the recent slump in oil prices. Iraq, where lawmakers are now looking at a 2015 draft budget based on an average of $60 dollars a barrel, depends on crude exports to generate over 90% of government revenues. The barrel export count, if confirmed, also trumps estimates of 3.7 million b/d by the International Energy Agency (IEA) published last week.

The agency’s report also identified Iraq as the main driver behind a rise in OPEC supply in December by 80,000 b/d to 30.48 million b/d. Iraq has not pumped as much crude oil since 1979, when the previous record was set with 3.56 million b/d . The December total would make Iraq OPEC’s second largest producer, behind Saudi Arabia at around 7 million b/d and ahead of Iran, the United Arab Emirates and Kuwait which each produce 2.7 b/d. “It’s quite a significant increase, but in-line with all the investment that was done over the last 10 years,” Samir Kasmi at Dubai-based advisory firm CT&F, told CNBC. “They are not subject to an OPEC quota at the moment, and could flood the market”. Abdel Mehdi explained production in the region of Kirkuk, which was held by IS troops last year before being liberated in June, would reach 375,000 b/d for the first three months of 2015. Production would eventually rise to 600,000 b/d by April.

10% of US production.

• Price Collapse Hits Scavengers Who Scrape the Bottom of Big Oil (Bloomberg)

In the $1.6 trillion-a-year oil business, there are global titans like Exxon Mobil that wield more economic might than most of the nations on Earth, and scores of wildcatters scouring land and sea for the next treasure troves of crude. Then there are the strippers. For these canaries in the proverbial coal mine, the journey keeps going deeper and darker. Strippers are scavengers who make a living by resuscitating once-prolific oil fields to coax as little as a bathtub full of crude a day from each well. Collectively, the strippers operate almost half-a-million oil wells that produced more than 730,000 barrels a day in 2012, the most recent year for which figures were available.

That’s one of every 10 barrels produced in the U.S. – equivalent to the entire output of Qatar, or half the crude Shell, Europe’s largest energy company, pumps worldwide every day. With oil prices down 57% since June, these smallest of producers will be the first to succumb to the Great Oil Bust of 2015. “This is killing us,” said Todd Shulman, a University of Colorado-trained geologist who ran fracking crews in the Rocky Mountains before returning to Vandalia, Illinois, in 1984 to help run the family’s stripper well business. Stripper wells – an inglorious moniker for 2-inch-wide holes that produce trickles of crude with the aid of iconic pumping machines known as nodding donkeys – were a vital contributor to U.S. oil production long before the shale revolution.

Though a far cry from the booming shale gushers that have pushed American crude production to the highest in a generation, stripper wells are a defining image of the oil business, scattered throughout rural backwaters abandoned by the world’s oil titans decades ago. With the price of crude dipping so low, there’s no way Shulman will be able to drill a new well that regulators have already permitted. Nor is he even going to turn on a well finished last month that’s ready to start production. It would be foolhardy to harvest crude from wells that won’t pay for themselves, said Shulman, who scrapes remnants from old Texaco (CVX) and Shell fields 310 miles south of Chicago, in the heart of what had been a booming oil region in the 1930s. He’ll wait for prices to rebound.

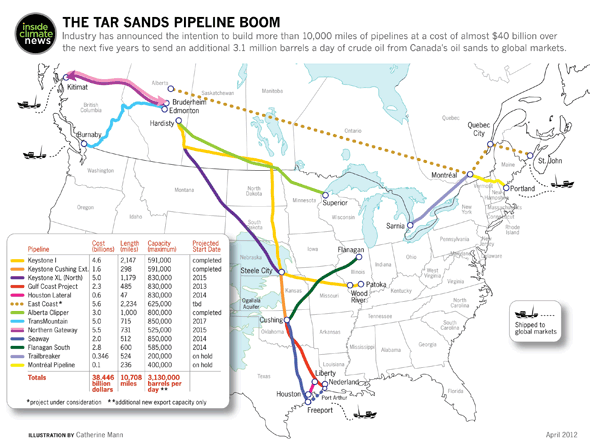

“The crude Keystone XL delivers will make no difference to US crude imports; it will simply displace crude imports from elsewhere.”

• The Keystone XL Pipeline Makes No Difference (Energy Matters)

Lobbyists are mobilizing to advance it. Environmentalists are mobilizing to stop it. The newly-elected Republican House has already voted to approve it. So has the newly elected Republican Senate. Obama has threatened a veto. The media are having a field day. What’s so important about Keystone XL? Well nothing, really. Keystone XL is basically just another pipeline; a little longer and larger than most, but not unusually so, and it goes nowhere pipelines don’t already go. All it does is increase the capacity of the existing Keystone pipeline system, which has already transported over 550 million barrels of Canadian heavy crude from Alberta to the US. The crude Keystone XL delivers will make no difference to US crude imports; it will simply displace crude imports from elsewhere.

And if Keystone XL doesn’t get built the crude it would have carried will go somewhere else, meaning that no CO2 emissions would be saved by not building it. (Although building it probably would save CO2 emissions because much of the Canadian crude that now moves south on trucks and rail tankers would pass through Keystone instead.) So what’s all the fuss about? What’s happened, of course, is that Keystone XL has been blown totally out of proportion, to the point where it’s become a cause célèbre. But how it got to this point is something for the psychologists, sociologists and political scientists to argue about. Here we will confine ourselves to the facts.

First, the purpose of Keystone XL. Its purpose is simply to supply more Canadian heavy crude to US Gulf Coast refineries that are facing potential feedstock shortages because of declining heavy crude production from Mexico and Venezuela, their main historic suppliers. This is a perfectly reasonable business proposition. Canada is motivated to sell, the refineries are motivated to buy and both will profit from the transaction. (Scotland has the same motivation in wishing to sell its surplus wind power to England. The difference is that Canada can deliver a product the client wants when the client wants it.) Second, the Canada-US pipeline system. There’s a perception that Keystone XL will be the first pipeline to bring Canadian crude to the US, but as shown in Figure 1 a substantial network of oil pipelines linking the two countries already exists. (Keystone XL is the blue line running northwest of Steele City):

“I call it a liquidity spiral. They’ll start burning right through cash.”

• A Huge Credit Line Reset Looms Over Oil Drillers (Bloomberg)

Oil and gas companies have April circled on their calendars. That’s when their lenders will recalculate the value of properties that energy companies staked as loan collateral. With those assets in decline along with oil prices, banks are preparing to cut the amount they’re willing to lend, crimping the ability of U.S. drillers to keep production growing. “This could start a downward spiral for some of these companies because liquidity will dry up,” said Thomas Watters, managing director of oil and gas research for Standard & Poors in New York. “I call it a liquidity spiral. They’ll start burning right through cash.” More than 20 U.S. exploration and production companies have used at least 60% of their credit lines, according to Bloomberg analyst Spencer Cutter. The energy industry is facing a cash squeeze after U.S. oil prices fell 60% since June.

Drillers have already cut spending to conserve cash. If credit lines are cut, the most indebted producers will be left scrambling to raise money elsewhere. New loans will be expensive – if they’re available at all. The credit lines, which typically are reset each spring and fall based on the value of borrowers’ petroleum reserves, operate like credit cards. To pay them off, companies have in the past sold off assets or issued bonds. The value of oil properties has declined at the same time that the borrowing environment for energy companies has gotten worse. At least one junk-rated company, Breitburn, has gotten an early jump on discussions with its lender. Breitburn’s credit limit was raised to $2.5 billion from $1.6 billion on Nov. 19 as a result of the acquisition of another energy company.

About three months ago, Los Angeles-based Breitburn attempted to sell $400 million of bonds to pay down its $2.5 billion credit line, but canceled the offering as oil falling below $90 a barrel roiled credit markets. The credit line is 88% drawn, according to regulatory filings. With the high-yield energy market still “challenged,” Breitburn is considering tapping the loan market, Jim Jackson, the oil producers’ chief financial officer, said in a phone interview. If its credit line is reduced to below what’s already been borrowed, “we would have six months to close that gap,” he said. “We’re being very pro-active.” Last week, S&P said it might downgrade Breitburn’s credit rating over concerns the company would face cash shortfalls if it couldn’t replace money from a reduced credit line.

“There is a point in time where disinflation turns into deflation and then you start worrying about that potential car crash..”

• Janjuah On 2015: Oil At $30; Bonds To Go Crazy (CNBC)

If you thought 2014 was volatile, hold on to your hats this year as the price of oil could hit $30 a barrel and the bond markets will outperform, according to Bob Janjuah, a closely-watched strategist from Nomura Securities. He told CNBC on Monday that there was little chance of Saudi Arabia changing its decision not to cut oil production, despite the 60% fall in prices since June 2014, and the cost of a barrel could head even lower. “Oil can go up in the short-term but I think actually that there’s some political motivations at play here and Saudi Arabia is at risk of losing its position as the marginal price-setter and I don’t think they want to lose that position,” Janjuah, co-head of cross-asset allocation strategy at Nomura, told CNBC Monday.

“I think the Saudis will potentially carry on (with their policy of not cutting production) and production will remain high but my head target is $30 – $35 as where we could get to. Where prices are now, I think a twenty dollar move is more difficult but I think that’s the risk and out there,” he told CNBC Europe’s “Squawk Box.” Janjuah believed that Saudi Arabia – the leading member of OPEC – would be content to maintain that pressure on the U.S. along with other major oil producers such as Russia. While some economies could benefit from lower oil prices, such as major importer Europe, Janjuah warned about the U.S. whose energy industry has grown thanks to its “fracking” of shale oil.

“If you look at the U.S. economy, the bulk of capital expenditure and jobs growth has been in and around the shale and energy-related sectors so if crude is down around the $30-$35 mark for a significant period of time I think you’re going to see a default cycle in the U.S. energy sector.” “I think disinflation is the key theme (this year) so you have to like bonds,” Janjuah said. “There is a point in time where disinflation turns into deflation and then you start worrying about that potential car crash where we start to worry about growth and earnings and how that hits the equity trade.”

Translation: frack on!

• U.S. Won’t Intervene in Oil Market (Bloomberg)

The U.S. won’t intervene in the oil market amid falling crude prices, according to Amos Hochstein, the U.S. State Department’s energy envoy. The U.S. will let “the market” decide what happens, Hochstein said in an interview at a conference in Abu Dhabi yesterday. Hochstein is special envoy and coordinator for international affairs at the State Department’s Bureau of Energy Resources. “When people ask the question ‘what will the U.S. do?,’ it’s really the market that’s going to have to decide what happens,” Hochstein said. “This is about a global market that is addressing the supply-demand curve.” Asked what the U.S. could do about falling prices and instability in oil markets, he said: “We do have mechanisms to work with our partners around the world if something extreme happens, but that’s not where I think we are and I think the markets so far can adjust themselves.”

Oil prices have dropped 53% in the past year as growing production from the U.S., Russia and OPEC overwhelmed demand. The International Energy said last week that the effects on U.S. production are so far “marginal.” “One of the most remarkable aspects of this recent period has been the resilience of the American energy market,” Hochstein said. U.S. oil production growth has swelled to its fastest pace in more than three decades, driven by output from shale deposits. Cheaper oil prices won’t stop development of alternative energy sources, he said. “We have really switched paradigms here where renewable energy really can continue to grow, even when there are low oil prices,” he said. “That’s true globally.”

Not politically, it can’t.

• Saudi Arabia Can Last Eight Years On Low Oil Prices (Guardian)

A former adviser to Saudi Arabia has said the country can withstand eight years or more of low oil prices as tensions over the price slump simmered between the world’s biggest oil exporter and Iran. Mohammad al-Sabban told the BBC that Saudi Arabia was concerned about the falling oil price but its cash reserves and planned budget cuts meant it could cope with a long period of depressed prices. “Saudi Arabia can sustain these low oil prices for at least eight years. First, we have huge financial reserves of about 3tn Saudi riyals (£527bn). Second, Saudi Arabia is embarking now on rationalising its expenditure, trying to take all the fat out of the budget. I think [Saudi Arabia] is worried but we [have to] wait for the full medicine that we have prescribed for ourself to take its course.”

Without cuts in spending on infrastructure, sports stadiums and new cities, Saudi Arabia can withstand low oil prices for at least four years, said Sabban, a former adviser to the Saudi minister for petroleum. He also suggested that lower oil prices could have long-term benefits for Saudi Arabia. Saudi Arabia has refused to cut production despite a more than 50% fall in the price of oil since last summer. “To shorten the cycle, you need to allow prices to go as low as possible to see those marginal producers move out of the market on the one hand, and also if there is any increase in demand that will be welcomed.” His comments were a further signal that Saudi Arabia was prepared to use its financial strength to ride out depressed oil prices now piling pressure on other producers, including Iran, which also faces western sanctions over its nuclear programme.

Thank you Brussels for bringing back extremism.

• Europe ‘Faces Political Earthquakes’ (BBC)

Political earthquakes could be in store for Europe in 2015, according to research by the Economist Intelligence Unit for the BBC’s Democracy Day. It says the rising appeal of populist parties could see some winning elections and mainstream parties forced into previously unthinkable alliances. Europe’s “crisis of democracy” is a gap between elites and voters, EIU says. There is “a gaping hole at the heart of European politics where big ideas should be”, it adds. Low turnouts at the polls and sharp falls in the membership of traditional parties are key factors in the phenomenon. The United Kingdom – going to the polls in May – is “on the cusp of a potentially prolonged period of political instability”, according to the Economist researchers.

They say there is a much higher than usual chance that the election will produce an unstable government – predicting that the populist UK Independence Party (UKIP) will take votes from both the Conservatives and Labour. The fragmentation of voters’ preferences combined with Britain’s first-past-the-post electoral system will, the EIU says, make it increasingly difficult to form the kind of single-party governments with a parliamentary majority that have been the norm. But the most immediate political challenge – and test of how far the growing populism translates into success at the polls – is in Greece. A snap general election takes place there on 25 January, triggered by parliament’s failure to choose a new president in December. Opinion polls suggest that the far left, populist Syriza could emerge as the strongest party. If it did and was able to form a government, the EIU says this would send shock waves through the European Union and act as a catalyst for political upheaval elsewhere.

“The election of a Syriza government would be highly destabilising, both domestically and regionally. It would almost certainly trigger a crisis in the relationship between Greece and its international creditors, as debt write-offs form one of the core planks of its policy platform,” the EIU says. “With similar anti-establishment parties gaining ground rapidly in a number of other countries scheduled to hold elections in 2015, the spill-over effects from a further period of Greek turmoil could be significant.” Other examples of European elections with potential for unpredictable results cited by EIU include polls in Denmark, Finland, Spain, France, Sweden, Germany and Ireland. “There is a common denominator in these countries: the rise of populist parties,” the EIU says, “Anti-establishment sentiment has surged across the eurozone (and the larger EU) and the risk of political disruption and potential crises is high.”

“The audit revealed that between 2007 and 2008 the Federal Reserve loaned over $16 trillion — more than four times the annual budget of the United States — to foreign central banks and politically-influential private companies.”

• If The Fed Has Nothing To Hide, It Has Nothing To Fear (Ron Paul)

Since the creation of the Federal Reserve in 1913, the dollar has lost over 97% of its purchasing power, the US economy has been subjected to a series of painful Federal Reserve-created recessions and depressions, and government has grown to dangerous levels thanks to the Fed’s policy of monetizing the debt. Yet the Federal Reserve still operates under a congressionally-created shroud of secrecy. No wonder almost 75% of the American public supports legislation to audit the Federal Reserve. The new Senate leadership has pledged to finally hold a vote on the audit bill this year, but, despite overwhelming public support, passage of this legislation is by no means assured. The reason it may be difficult to pass this bill is that the 25% of Americans who oppose it represent some of the most powerful interests in American politics.

These interests are working behind the scenes to kill the bill or replace it with a meaningless “compromise.” This “compromise” may provide limited transparency, but it would still keep the American people from learning the full truth about the Fed’s conduct of monetary policy. Some opponents of the bill say an audit would somehow compromise the Fed’s independence. Those who make this claim cannot point to anything in the text of the bill giving Congress any new authority over the Fed’s conduct of monetary policy. More importantly, the idea that the Federal Reserve is somehow independent of political considerations is laughable. Economists often refer to the political business cycle, where the Fed adjusts its policies to help or hurt incumbent politicians.

Former Federal Reserve Chairman Arthur Burns exposed the truth behind the propaganda regarding Federal Reserve independence when he said, if the chairman didn’t do what the president wanted, the Federal Reserve “would lose its independence.” Perhaps the real reason the Fed opposes an audit can be found by looking at what has been revealed about the Fed’s operations in recent years. In 2010, as part of the Dodd-Frank bill, Congress authorized a one-time audit of the Federal Reserve’s activities during the financial crisis of 2008. The audit revealed that between 2007 and 2008 the Federal Reserve loaned over $16 trillion — more than four times the annual budget of the United States — to foreign central banks and politically-influential private companies.

”Next time around, the federals are going to have to confiscate stuff, break promises, take away things, and rough some people up.”

• A Solemn Pause (Jim Kunstler)

Events are moving faster than brains now. Isn’t it marvelous that gasoline at the pump is a buck cheaper than it was a year ago? A lot of short-sighted idiots are celebrating, unaware that the low oil price is destroying the capacity to deliver future oil at any price. The shale oil wells in North Dakota and Texas, the Tar Sand operations of Alberta, and the deep-water rigs here and abroad just don’t pencil-out economically at $45-a-barrel. So the shale oil wells that are up-and-running will produce for a year and there will be no new ones drilled when they peter out — which is at least 50% the first year and all gone after four years.

Anyway, the financial structure of the shale play was suicidal from the get-go. You finance the drilling and fracking with high-yield “junk bonds,” that is, money borrowed from “investors.” You drill like mad and you produce a lot of oil, but even at $105-a-barrel you can’t make profit, meaning you can’t really pay back the investors who loaned you all that money, a lot of it obtained via Too Big To Fail bank carry-trades, levered-up on ”margin,” which allowed said investors to pretend they were risking more money than they had. And then all those levered-up investments — i.e. bets — get hedged in a ghostly underworld of unregulated derivatives contracts that pretend to act as insurance against bad bets with funny money, but in reality can never pay out because the money is not there (and never was.) And then come the margin calls. Uh Oh….

In short, enjoy the $2.50-a-gallon fill-ups while you can, grasshoppers, because when the current crop of fast-depleting shale oil wells dries up, that will be all she wrote. When all those bonds held up on their skyhook derivative hedges go south, there will be no more financing available for the entire shale oil project. No more high-yield bonds will be issued because the previous issues defaulted. Very few new wells (if any) will be drilled. American oil production will not return to its secondary highs (after the 1970 all-time high) of 2014-15. The wish of American energy independence will be steaming over the horizon on the garbage barge of broken promises. And all, that, of course, is only one part of the story, because there is the social and political fallout to follow.

“Production can only be maintained through relentless drilling, and that relentless drilling has now stopped.”

Over the course of 2014 the prices the world pays for crude oil have tumbled from over $125 per barrel to around $45 per barrel now, and could easily drop further before heading much higher before collapsing again before spiking again. You get the idea. In the end, the wild whipsawing of the oil market, and the even wilder whipsawing of financial markets, currencies and the rolling bankruptcies of energy companies, then the entities that financed them, then national defaults of the countries that backed these entities, will in due course cause industrial economies to collapse. And without a functioning industrial economy crude oil would be reclassified as toxic waste. But that is still two or three decades off in the future.

In the meantime, the much lower prices of oil have priced most of the producers of unconventional oil out of the market. Recall that conventional oil (the cheap-to-produce kind that comes gushing out of vertical wells drilled not too deep down into dry ground) peaked in 2005 and has been declining ever since. The production of unconventional oil, including offshore drilling, tar sands, hydrofracturing to produce shale oil and other expensive techniques, was lavishly financed in order to make up for the shortfall. But at the moment most unconventional oil costs more to produce than it can be sold for. This means that entire countries, including Venezuela’s heavy oil (which requires upgrading before it will flow), offshore production in the Gulf of Mexico (Mexico and US), Norway and Nigeria, Canadian tar sands and, of course, shale oil in the US.

All of these producers are now burning money as well as much of the oil they produce, and if the low oil prices persist, will be forced to shut down. An additional problem is the very high depletion rate of “fracked” shale oil wells in the US. Currently, the shale oil producers are pumping flat out and setting new production records, but the drilling rate is collapsing fast. Shale oil wells deplete very fast: flow rates go down by half in just a few months, and are negligible after a couple of years. Production can only be maintained through relentless drilling, and that relentless drilling has now stopped. Thus, we have just a few months of glut left. After that, the whole shale oil revolution, which some bobbleheads thought would refashion the US into a new Saudi Arabia, will be over.

New Zealand PM does hollow propaganda.

• Why New Zealand Can Handle Europe, Oil Troubles (CNBC)

New Zealand’s exports may face headwinds from the decline in oil price and strengthening of its currency against the euro, but the country’s prime minister told CNBC that the “Kiwi economy” is set to carry on booming. The New Zealand dollar has appreciated just over 8% against the euro since in the last three months as expectations have risen that the European Central Bank (ECB) will announce a full-blown quantitative easing program when it meets this Thursday. The kiwi dollar, as it is known, strengthened further to a record high against the euro on Friday after the Swiss National Bank made a surprise policy move to abandon its minimum exchange rate against the euro. New Zealand Prime Minister John Key told CNBC that a stronger currency would not hinder the economy, one that is currently outperforming many developed nations.

“Obviously it’s had an impact as it’s pushed up the kiwi-euro rate and that makes it a little bit more difficult for our exporters but overall our economy is still very strong. We think we’ll grow 3.25% every year for the next three years, so about ten% over the next three years so we’re still confident we can get there, even with a higher exchange rate.” In December, Statistics New Zealand said the economy was growing faster than expected and had accelerated in the third quarter. Gross domestic product increased 1% in the third quarter from the previous quarter, according to the statistics body. Key said that the New Zealand economy was being helped by economic activity in the U.S. and he brushed aside concerns over a slowdown in growth in Asia. Europe was another matter, however.

“The U.S. is much stronger than people think now, we see a lot of activity out of the U.S. both in terms of tourists coming and the buying activity. Asia is still quite strident and there is some concern that China is going to fall over but I don’t think that’s going to happen. It’s still Europe that’s got to deal with its fundamental issues.” New Zealand’s third-quarter growth was driven by its primary industries, including the dairy industry and oil and gas exploration and extraction, which grew by 5.8%. After dairy, meat and wood, oil is the fourth-largest export for New Zealand and, as such, the steep decline in global oil prices could hit the country’s economy. Indeed, exploration companies like New Zealand Oil and Gas, TEG Oil and Key Petroleum are all looking to defer projects in the region.

Thank ZIRP.

• Bleak Future For Retirees As Savings Slashed (CNBC)

Millions of workers around the world could enter retirement with savings diminished by a fifth or more after getting into debt or financial difficulty, HSBC warned in a new report. According to the bank, the impact of the global economic downturn could be felt for decades by the vast number of people who raided their retirement funds and accumulated debt during the financial crisis. In a study of 16,000 people into global retirement trends, HSBC found that two in five workers stopped or reduced their savings for retirement during the downturn that began in 2007. The situation is particularly bad in the U.K. and Canada, the bank warned, where retirement savings have been nearly halved as a result of debts or financial constraints.

“Despite the fact that close to 70% of people feel like they will run out of money or not have enough to live on day-to-day in retirement, 40% of people today are either not saving for retirement or significantly reduced their savings for retirement,” Michael Schweitzer, head of sales and distribution for group wealth management at HSBC, told CNBC on Monday. “And that is going to cause a shortfall for millions of people – as much as a fifth when they do get to retirement.” Even with a recovery in the global economy, which the International Monetary Fund expects to grow 3.8% this year from 3.3% in 2014, debt accumulated during the financial crisis will continue to weigh on workers’ ability to save, HSBC said. According to the study, this gloom is being felt across the globe, with almost a quarter of working-age people anticipating living standards in retirement to be worse than they are today.

Did anyone realize this?: “Wild honey bees can no longer be found in England or Wales ..”

• Disease Threat To Wild Bees from Commercial Bees (BBC)

The trade in bees used for honey or to pollinate crops could have a devastating impact on wild bees and other insects, say scientists. New measures are needed to stop diseases carried by commercial bees spilling over into the wild, says a University of Exeter team. Evidence suggests bees bred in captivity can carry diseases that could be a risk to native species. Bees are used commercially to pollinate crops such as peppers and oilseed rape. Species of bees used for this purpose, or in commercial hives, are known to suffer from parasite infections and more than 20 viruses. Many of these can also infect wild bumble bees, wasps, ants and hoverflies.

The study, published in the Journal of Applied Ecology, reviewed data from existing studies to look at the potential for diseases to jump from commercial bees to insects in the wild. “Our study highlights the importance of preventing the release of diseased commercial pollinators into the wild,” said lead researcher Dr Lena Wilfert. “The diseases carried by commercial species affect a wide range of wild pollinators but their spread can be avoided by improved monitoring and management practices. “Commercial honey beekeepers have a responsibility to protect ecologically and economically important wild pollinator communities from disease.”

Several diseases of honey bee colonies are known. They include a parasite called the Varroa mite and a virus that leads to deformed wings, which has also been found in wild bumble bees. Vanessa Amaral-Rogers of the charity, Buglife, said the results of the study showed an urgent need for changes in how the government regulates the importation of bees. “Wild honey bees can no longer be found in England or Wales, thought to have been wiped out by disease,” she told BBC News. “Now these studies show how diseases can be transmitted between managed honey bees and commercial bumble bees, and could have potentially drastic impacts on the rest of our wild pollinators. “

Home › Forums › Debt Rattle January 20 2015