DPC Sidewalk newsstand NY 1900

Steve tackles two issues at once: austerity doesn’t work, and Greek debts were not nearly as bad as we were told.

• It’s All The Greeks’ Fault (Steve Keen)

If the polls are right, then this Sunday Greece will elect Syriza, the left-wing coalition party (its name is actually a Greek acronym for “Coalition of the Radical Left”). This will bring to power the first staunchly anti-austerity party in the EU, and the first element in their policy document is to “Write-off the greater part of public debt”. That is likely to lead to some fractious negotiations with the EU, and possibly even a messy exit from the Euro. Before that happens, there will be some messy commentary in the media as well, and I fully expect most commentators to take a line like that in my title. After all, it’s common knowledge that the Greeks lied about their levels of public debt to appear to qualify for the EU’s entry criteria, which include that aggregate public debt should be below 60% of GDP.

Though there’s an argument that Goldman Sachs, many of whose ex-staff are now leading Central Bankers, helped the Greeks make this alleged lie, the responsibility for it will be shafted home to the Greeks, and that in turn will be used to argue that the Greeks deserve to suffer. The story, in other words, will be that the Greeks were architects of their own dilemma, and that therefore they should pay for it, rather than making the rest of the world suffer through a write-down of their debts. Emotion will rule the debate rather than logic. So to cast a logical eye over this forthcoming debate, I’m going to consider who is really to blame for the Greek dilemma by considering another country entirely: Spain.

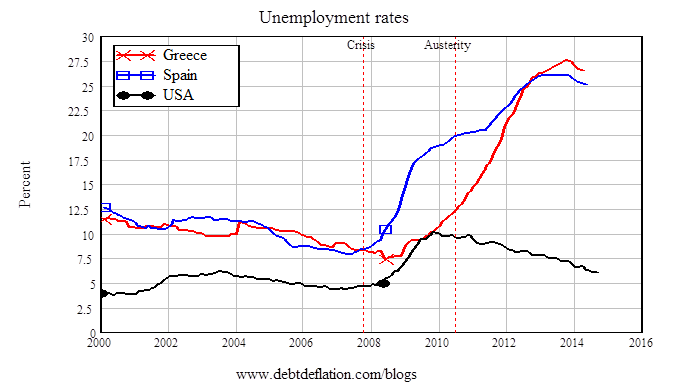

Spain’s situation lets us get away from Greece’s emotional baggage. Today, Greece and Spain are in very similar situations, with unemployment rates of well over 25%—higher than the worst the USA recorded during the Great Depression (see Figure 1). But unlike Greece, Spain before the crisis was doing everything right, according to the EU. More importantly still, Spain’s government debt when the EU imposed its austerity regime (mid-2010) was still well below America’s, even though both had risen substantially since the crisis. Spain’s government debt ratio was 65% of GDP then, versus 78% for the USA.

The whole purpose of the EU’s austerity program was to reduce government debt levels. Reducing government debt was the political topic du jour in America as well from 2010 on, but the various attempts to impose austerity came to naught: instead, after shooting up because of deliberate policy at the time of the crisis America’s budget deficit merely responded to the state of the economy. Politically paralyzed Washington talked austerity, but never actually imposed it. So who was more successful: the deliberate, policy-driven EU attempt to reduce government debt, or the “muddle through” USA? [..] muddle through was a hands-down winner: the USA’s government debt to GDP ratio has stabilized at 90% of GDP, while Spain’s has sailed past 100%.

“The European policy towards Greece has been determined by the will to experiment with the feasibility of shock therapies.”

• Is Greece About To Call Time On Five Punishing Years Of Austerity? (Observer)

For Professor Constantine Tsoukalas, Greece’s pre-eminent sociologist, there is no question that, come Monday, Europe will have reached a watershed. I first met Tsoukalas in January 2009, in his lofty, book-lined apartment in Kolonaki. For several weeks Athens had been shaken by riots triggered by the police shooting of a teenage boy. The violence was tumultuous and prolonged. Looking back, it is clear that this was the start of the crisis – a cry for help by a dislocated youth robbed of hope as a result of surging unemployment and enraged by a system that, corrupt and inefficient, favoured the few. Tsoukalas knew that this was “the beginning of something” although he could not tell what. But with great prescience he spoke of the degeneration of politics – both inside and outside Greece – the rise of moral indignation, and the emptiness of a globalised market “that was supposed to put an end to ideology but, in crisis, has instead created this moment of great ideological tension”.

Six years later, following the longest recession on record, he is in little doubt that anger has fuelled the rise of Syriza. On the back of rage over austerity, the leftists have seen their popularity soar from 5% before the crisis to as high as 35% – more than the combined total of New Democracy and left-leaning Pasok, the two parties that have alternated in power since the restoration of democracy in 1974. Neo-Nazi Golden Dawn, the group that has been the other beneficiary of despair – but whose support has dropped amid revelations of criminal activity – may yet surprise if it succeeds in coming in third. “The European policy towards Greece, to a large extent, has been determined by the will to experiment with the feasibility of shock therapies,” says Tsoukalas. “It worked, but the reaction is going to be a leftwing government. Europe cannot survive as it is. The rise of fascism … should be sufficient [evidence] to everyone that it has to change.”

If Greece’s rebellion was to occur in a coherent way, Tsoukalas, who is being fielded by Syriza as an honorary candidate, believes it would be only a matter of time before it was replicated in other parts of the continent. “These elections are important because they are a reminder to the people of Europe that there is another way out,” he insists. “That neoliberal orthodoxy is not an immovable problem.” The business community, no ally of the left in a nation where communists were hounded for much of the 20th century, is bracing itself for the inevitable. But it has found it hard to conceal its anxiety. With bailout funds guaranteed only until the end of February – and negotiations with creditors at the EU, ECB and IMF still stalled over the need for further austerity – there are fears of a bank run, or worse.

Nice math.

• Draghi’s QE Promise To Greece Depends On Debt-Market Math (Bloomberg)

Greece’s inclusion in the European Central Bank’s bond-buying plan this year doesn’t just depend on its new government sticking to a bailout program. It also relies on some debt-market arithmetic. When ECB President Mario Draghi presented his quantitative- easing program on Jan. 22 in Frankfurt, he offered Greece the prospect of eligibility as existing securities roll off in the middle of the year. Those redemptions, he said, would bring the Mediterranean nation back below the ECB’s cap at 33% of an issuer’s debt, which the central bank imposed as Draghi presented initial guidelines. Even after debt matures in July and August, the institution’s share of Greek bonds won’t drop below 33% for the whole of 2015, assuming no new securities are issued, according to calculations based on data compiled by Bloomberg.

It takes the inclusion of treasury bills to bring the ECB’s holdings below the cap. It currently owns just under 33% of the entire Greek debt market, and that would fall further, creating room for QE purchases, once the 2015 bonds owned by the ECB mature. That calculation is based on the supply of bills, or short-term money-market securities, remaining constant. The ECB has yet to say precisely what will be included in its calculations on the allowance for its purchases and an ECB spokesman declined to comment on the calculations. The ECB and euro-area central banks currently own about €27 billion ($30.4 billion) of Greek bonds, according to data compiled by Bloomberg, comprising 40% of the total outstanding market of about €67.5 billion.

At the end of this year, by which time €6.6 billion of bonds held by the ECB and in euro-area central banks’ investment portfolios under the Securities Markets Program are due to have been repaid, it would own €20.4 billion out of a total €60.5 billion. That equates to about 34%, still exceeding the limit set by Draghi. If the stock of bills remain the same and are included in the calculation, the ECB’s holdings would drop to 30% by the end of July and 27% by the end of the year. [..] “There are obviously some conditions before we can buy Greek bonds,” Draghi said Jan. 22 in Frankfurt. “There is a waiver that has to remain in place, has to be a program. And then there is this 33% issuer limit, which means that, if all the other conditions are in place, we could buy bonds in, I believe, July, because by then there will be some large redemptions of SMP bonds and therefore we would be within the limit.”

The ECB will buy €60 billion of public and private securities a month, starting in March, Draghi said, adding that the central bank will buy bonds due between two- and 30-years. About €45 billion probably would be sovereign debt, according to a central bank official. ECB buying will be carried out in proportion to each euro- area country’s contribution to the central bank’s capital, Draghi said. Adjusted for non-euro-region central banks, that works out as a 2.9% share for Greece, according to calculations based on data on the ECB’s website, equating to a pace of about €1.3 billion a month, if all other conditions are met.

One more technocrat needs to go.

• Spain’s Rajoy on the Defensive as New Generation Seeks Power (Bloomberg)

Mariano Rajoy is struggling to convince Spaniards he can lead the country into a new period of prosperity as a younger generation of politicians challenges his grip on power. The 60-year-old prime minister has been eclipsed in recent surveys by Pablo Iglesias, 36, the leader of the newly created anti-austerity party Podemos, while the 42-year-old Socialist leader Pedro Sanchez says Rajoy is out-of-date. Even within the government, 43-year-old Deputy Prime Minister Soraya Saenz de Santamaria’s approval rating was 11%age points higher than her bosses, in a Metroscopia poll for El Pais newspaper released last month. Spanish voters are desperate for change after a seven-year economic slump pushed unemployment to a record 26% in 2013.

While Rajoy has stabilized the economy and forecasts the fastest growth in seven years for 2015, his support has plunged amid a series of corruption scandals. “Youth is not a political asset in itself, but Rajoy looks very old,” Podemos founder and executive committee member Juan Carlos Monedero, 51, said in an interview. “He would look like a member of the soviet old guard if he was sat round a table with Sanchez and Iglesias.” The prime minister will kick off his battle to prove his enduring relevance to Spaniards Friday in Madrid when his People’s Party begins its national conference. That will mark the beginning of a year of campaigning which will include local and regional elections in May and a ballot in Catalonia in September before a general election due around the end of year.

Rajoy appointed 33-year-old lawmaker Pablo Casado spokesman for the local election campaign Jan. 12. While the official agenda will be focused on PP plans to nurture the economy and boost living standards, talk on the sidelines may be dominated by the release on bail last night of the party’s former treasurer, Luis Barcenas. Barcenas told the National Court in 2013 that he helped manage a secret party slush fund over 20 years. He named Rajoy among the beneficiaries and gave the court handwritten ledgers showing the payments. Rajoy has repeatedly denied any wrongdoing. Prosecutors are seeking a 42 1/2-year jail term for Barcenas for his role in the scheme.

“..even the benefits to those who stand to gain the most from QE are only temporary. Because the same asset prices which rise thanks to money printing are only transitory, and ultimately mean reverting.”

• 8 Ways ECB’s QE Will Hurt Everyone But The Wealthy (Zero Hedge)

Over the past 48 hours, the world has been bombarded with a relentless array of soundbites, originating either at the ECB, or – inexplicably – out of Greece, the place which has been explicitly isolated by Frankfurt, that the European Central Bank’s QE will benefit everyone. Setting the record straight: it won’t, and not just in our own words which most are familiar with as we have been repeating them since 2009, but those of JPM’s Nikolaos Panigirtzoglou, who just said what has been painfully clear to all but the 99% ever since the start of QE, namely this: “The wealth effects that come with QE are not evenly distributing. The boost in equity and housing wealth is mostly benefiting their major owners, i.e. the wealthy.” Thank you JPM. Now if only the central banks will also admit what we have been saying for 6 years, then there will be one less reason for us to continue existing.

And of course, even the benefits to those who stand to gain the most from QE are only temporary. Because the same asset prices which rise thanks to money printing are only transitory, and ultimately mean reverting. To wit: “It potentially creates asset bubbles by lowering asset yields by so much relative to historical norms, that an eventual return to normality will be accompanied with sharp price declines.” So enjoy your music while it lasts dear 0.1%. Collateral eligible for monetization is becoming increasingly scarce and by our calculations there is about 2 years worth of runway left for G3 assets before central bank interventions in the private market result in a complete paralysis of virtually every asset class, and the end of capital markets as we know them. As for everyone else, here is a list of 8 ways that the ECB’s QE will hurt, not help, by way of JP Morgan.

“The big question for us now is about liquidity cycles that come from fund managers that don’t have leverage. It’s $35 trillion of mutual funds that invest in relatively illiquid securities..”

• Carney Warns Of Liquidity Storm As Global Currency System Turns Upside Down (AEP)

The Governor of the Bank of England has warned markets to brace for possible trouble in 2015 as the US Fed tightens monetary policy and liquidity evaporates, fearing that the new financial order has yet to face its first real test. Mark Carney said diverging monetary policies in the US, Britain, Europe, and Japan may set off further currency turbulence and “test capital flows across the global economy, including to emerging markets.” It is the latest sign that officials at Threadneedle Street are worried about the global fall-out from the rising dollar, which poses a mounting threat to companies in the developing world that have borrowed up to $9 trillion in US dollars. Mr Carney said regulators have cleaned up the banks and tried to prepare for the tectonic shift taking place in the international currency structure but major risks remain.

“This will test the resilience of that new financial system. It has a potential feedback and we have to be aware of that,” he told an elite group of central bankers at the World Economic Forum. “We are particularly concerned about an illusion of liquidity that has existed in a number of financial markets. I would say that illusion of liquidity is gradually being disabused,” he said, adding that the so-called ‘flash crash’ in the US Treasury market last October was a wake-up call even if the “bouts of losses” have been small so far. Mr Carney said the global authorities have clamped down on excess leverage and the sort of behaviour by banks that caused the financial crisis seven years ago, but new worries have emerged. “The big question for us now is about liquidity cycles that come from fund managers that don’t have leverage. It’s $35 trillion of mutual funds that invest in relatively illiquid securities,” he said.

Global watchdogs say the scale is so large – and subject to “clustering” and crowd psychology – that these funds may all rush for the exits at the same time in a crisis and amplify the effects. The concerns were echoed by Benoît Cœuré, board member of the ECB. “The system is untested. We had a wave of new financial regulation, which has mostly focussed on banks, so we’re pretty sure that banks are much safer,” he said. Mr Cœuré said the ECB was forced to throw caution to the winds and launch a €60bn blitz of bond purchases on Thursday, given that inflation expectations in the eurozone have collapsed, with outright deflation in December. “It was pretty clear we had to do something. The only discussion was how to do it,” he said.”Being patient is a risk that we just don’t want to take. We need growth in Europe. With entrenched unemployment, people are being forced out of the labour market, and we are seeing the whole foundation of the European project being weakened. This cannot last for too long,” he said.

“Arguably Draghi is only reacting to the US and UK, which printed money to devalue the dollar and sterling immediately after the Lehman collapse, and the Japanese, who have halved the cost of their exports to the US in the last year..”

• Devaluation And Discord As The World’s Currencies Quietly Go To War (Observer)

There is every sign that the European Central Bank’s €1.1 trillion stimulus package is going to unleash a long period of beggar-thy-neighbour currency wars. Maybe not quite in the way that wrecked the global economy in the 1930s – triggering retaliatory trade tariffs and sending industrial production spiralling downwards. But enough to dampen the enthusiasm of exporting companies which might be thinking of expanding output. This is a war that pits the central banks of the world’s major trading blocs against each other and, as currencies yo-yo in value, creates a nervousness and caution among investors that can create years of stagnation. Two economists who warned of a looming credit crunch in 2007 are now warning about the onset of competitive devaluations driven by central bank policies.

Before Davos, William White, a senior OECD official and a former chief economist to the Bank for International Settlements (BIS), told the Daily Telegraph: “We’re seeing true currency wars and everybody is doing it, and I have no idea where this is going to end.” In the Guardian before Christmas, Nouriel Roubini, the economist known as Dr Doom for his prescient predictions of calamity, warned that while it was possible for one or two small nations to quietly devalue, a look around the world revealed almost every country devaluing against the dollar and each other. The euro has fallen almost 20% against the dollar over the past seven months and is destined to take another dive following the announcement last Thursday of the ECB’s QE scheme. Who knows, the euro could be below $1 in a few months’ time.

Last year it was worth almost $1.40. ECB president Mario Draghi says the value of the euro is not an official target. Yet he has talked at previous meetings about his concern that the currency is out of step with the poorly performing eurozone economy. He hoped currency traders would do his work for him. In the end he has been forced to print money, and lots of it, to drive down the euro’s value. Arguably Draghi is only reacting to the US and UK, which printed money to devalue the dollar and sterling immediately after the Lehman collapse, and the Japanese, who have halved the cost of their exports to the US in the last year by doing the same. In November, Japan’s central bank cranked up the printing presses further, saying it planned to increase QE asset purchases to $700bn a year. Ask Tokyo officials about the policy and they will say it is legitimate as a short-term fix while deeper structural reforms are pushed through. How long is the short term? Prime minister Shinzo Abe won’t say.

Could? “Wells Fargo and JPMorgan have both been bookrunners on almost $100 billion [of leveraged oil and gas loans] since the start of 2011..”

• Oil Collapse Could Trigger Billions In Bank Losses (Telegraph)

British banks including RBS and Barclays may be sitting on billions in losses from the collapse in oil prices after a surge in junk loans to the industry. UK banks have been behind more than $50bn of leveraged loans – high-yield, non-investment grade debt – to the oil and gas industry in the past four years, according to data from Dealogic. Although British lenders are not the most exposed to the oil collapse, with most debt issuance arranged by US and Canadian institutions, leveraged loans arranged by UK lenders have more than doubled since 2011 amid the North American shale boom. While low prices are likely to give a shot in the arm to consumers and manufacturers, many oil producers, particularly in America’s shale gas fields, are likely to be driven out of business. A lengthy period of cheap crude is likely to trigger widespread defaults and many oil and gas loans are now changing hands for well below their face value as investors fear they will not get their money back.

Banks will offload many of the loans and hedge their losses, and some will have stricter lending standards for high-yield loans than others. Losses will also depend on how long the oil price stays low, so it is unclear precisely how exposed the banks are to the energy industry’s woes. Some lenders have privately indicated that they consider the oil price fall to have a positive impact, with the wider economic benefits offsetting the loans they are writing off. However, significant losses are seen as inevitable if prices fail to rebound. Chirantan Barua at Bernstein Research has estimated that the combined losses of Barclays, RBS, HSBC and Standard Chartered from falling oil prices could amount to $3.4bn. “Someone is feeling the pain,” said Mr Barua. “When you see [this much] high-yield issuance in a sector that has been levering up across the supply chain, any shocks in the underlying business will have risk ripples across the financial system.”

According to Dealogic’s data, RBS has arranged $14.3bn of leveraged oil and gas loans in the past four years, making it the biggest UK player in the high-yield space. This compares to $10.5bn for Barclays and $4.7bn for HSBC, but is far less than the biggest Wall Street players. Wells Fargo and JPMorgan have both been bookrunners on almost $100bn since the start of 2011. Leveraged loans to the industry hit a record high of $72.7bn in the second quarter of last year, before crude’s collapse. They then fell to $53.4bn in the third quarter and $47.8bn in the fourth quarter of 2014.

“The juicy yields that were around during the aftermath of the crisis are gone, and some investors, it would appear, are opting to just hang onto their cash instead.”

• Dalio’s Call for Doom Borne Out in Mom and Pop Fleeing Junk Debt (Bloomberg)

The promise of yet another trillion-dollar cash infusion from a central bank isn’t enough to bring individual investors back into the market for risky corporate debt. In fact, they keep bailing. Investors pulled $523 million from global high-yield bond mutual and exchange-traded funds in the week ended Jan. 21, according to data compiled by EPFR Global. They withdrew $868 million from funds that buy U.S. speculative-grade loans, bringing their total assets below $100 billion for the first time since September 2013, Wells Fargo data show. The goal of the European Central Bank’s new 1.1 trillion ($1.3 trillion) euro bond-buying program announced Thursday is to push investors into less-creditworthy notes for bigger – or even just positive – returns.

So, why aren’t junk bonds getting a serious boost? Individual investors are either leaving a seemingly indefatigable party in risky debt too early, or their sentiment is a harbinger of a deeper, more worrisome idea: That policy makers’ main tool to ignite growth isn’t working so well anymore. With yields so low, “the transmission of the monetary policy mechanism will be less effective,” said Ray Dalio, the US hedge fund manager. “We have a deflationary set of circumstances,” which makes it appealing to just stuff your money under a mattress, he said at a panel discussion in Davos, Switzerland, this week. The $2 trillion market for global high-yield bonds was one of the biggest beneficiaries of the Federal Reserve’s record stimulus in recent years.

The debt gained an annual 16.4% on average in the six years after 2008, with yields shrinking to 7% from a peak of 23% at the height of the credit crisis, according to Bank of America Merrill Lynch index data. Average borrowing costs are up from a low of 5.6% last year on concern that plunging oil prices will leave speculative-grade energy companies unable to meet their obligations. While the Fed successfully got individuals to chase these risky credits, the ECB may now have a harder time doing the same. The juicy yields that were around during the aftermath of the crisis are gone, and some investors, it would appear, are opting to just hang onto their cash instead.

Thing is, it wouldn’t make any difference. The dollar will continue to travel home no matter what they do.

• Get Ready For Negative Interest Rates In The US (Mises.ca)

I predict that the Fed will start charging negative interest rates on bank reserve accounts, which will ripple through the markets and result in negative interest rates on savings at banks. I make this prediction only because it is the logical action of the Keynesian managers of our economy and monetary policy. Our exporters will scream that they can’t sell goods overseas, due to the stronger dollar. So, what is the Fed’s option? Follow the lead of Switzerland and Denmark and impose negative interest rates in order to drive down the foreign exchange rate of the dollar. It is the final tool in the war on savings and wealth in order to spur the Keynesian goal of increasing “aggregate demand”. If savers won’t spend their money, the government will take it from them.

Not just pennies either. Ford $800 million, Kimberly-Clark $462 million in pre-tax charges.

• Venezuela Currency Woes An Increasing Threat To US Corporate Profits (Reuters)

Venezuela’s deepening economic troubles, and in particular the weakness of the bolivar and restrictive currency controls, have hurt U.S. corporate profits for the fourth quarter of 2014 and are set to inflict further pain this year. In a likely sign of things to come from a number of companies this results reporting season, Ford on Friday said it was taking a pre-tax charge of $800 million for its Venezuela business. It blamed Venezuelan exchange control regulations that have restricted the ability of its operations in the country to pay dividends and obligations in U.S. dollars. Ford also said that it was unable to maintain normal production in Venezuela with the availability of vehicle parts constrained.

Also on Friday, diaper and tissue maker Kimberly-Clark said it took a fourth-quarter charge of $462 million for its Venezuelan business. That was after it concluded that the appropriate rate at which it should be measuring its bolivar-denominated monetary assets should be a Venezuelan government floating exchange rate – currently at around 50 bolivars to the dollar – rather than a fixed official rate of 6.3 to the dollar that it had previously been using. Kimberly-Clark blamed increased uncertainty and lack of liquidity in Venezuela for the move.

Venezuela President Nicolas Maduro said on Wednesday he was shaking up the complex currency controls in the socialist-run country, where dollars are sold on the black market for about 184 bolivars to the U.S. dollar instead of the country’s three-tiered exchange rate system that has ranged from the 6.3 official rate to two other rates, currently at about 12 and the one at around 50. Those latter two tiers of the system would be merged, he said, though it is not immediately known at what rate that would happen. Maduro also announced that another new rate would be introduced into the system to offer dollars via private brokers to vie with the black market rate.

“Her analysis of Chinese data suggests growth is actually considerably slower than official figures suggest.”

• Hard Times Return As China Bids To Bring Its Economic Miracle To An End (Observer)

China’s president, Xi Jinping, calls it the “new normal” – but strikes are increasing, wages going unpaid and businesses are struggling to survive as the vast economy adjusts to a more sedate pace of growth after more than a decade of explosive expansion. Official figures published last week showed that China’s GDP expanded by 7.4% in 2014. That was a significant drop from the 7.7% seen in 2013, and the weakest rate of growth since 1990, when the country was grappling with international sanctions in the wake of the Tiananmen Square massacre. And while the government has spun the downturn as a good thing, as it deliberately shifts from an unsustainable, export-led boom to relying on demand at home to fuel economic growth, people across the country are feeling the heat.

Coal and copper prices are down owing to lack of demand; strikes and protests are becoming increasingly common. The prospect of weaker demand from China has also been a key factor behind plunging global oil prices. “From an industry point of view, obviously the hardest hit are the miners and the upstream players – the iron ore industry, steel, refineries, they’re all being really squeezed,” said Andrew Polk, a senior economist at research group The Conference Board. “China’s consumption has held up relatively well so far, but [the slowdown] looks to be finally feeding through to the consumption side as well.” And while the downturn is, on one level, intentional, policymakers face a tough challenge in engineering a slowdown while maintaining enough control over the financial system to prevent a crash.

Growth is expected to slow further over the next three years, as officials act to control the sliding property market and rein in excessive borrowing by local government — the International Monetary Fund has projected a 2015 growth rate of 6.8%. “The financial crisis dealt a mortal blow to the export-led growth model, for two reasons,” said Diana Choyleva, an expert on China at consultancy Lombard Street Research. “One was the slowdown in global demand, and the other was the adjustment of the yuan against the dollar. Not only has the size of the pie reduced, but their ability to carve out ever-larger parts of it has diminished.” Her analysis of Chinese data suggests growth is actually considerably slower than official figures suggest.

Note: the finance team in Kiev is now made up of Americans.

• Ukraine Stiffs China for Billions Owed (RINF)

China paid Ukraine $3 billion two years ago for grain still not delivered, now demands refund. Another $3.6 billion that’s owed to China will probably also default. Russia’s RIA Novosti News Agency reported, on January 17th, that China is demanding refund of $1.5 billion in cash and of an additional $1.5 billion in Chinese goods that were paid in advance by China (in 2013), for a 2012 Chinese order of grain from Ukraine, which goods still have not been supplied to China. According to RIAN, “State Food and Grain Corporation of Ukraine supplied grain in 2013, elsewhere, but not to China. The new Kiev authorities had an opportunity to fix the short-sighted actions ‘of the [previous] Yanukovych regime,’ and to present a positive economic image to the Chinese.” But it didn’t happen.

Furthermore: “Prior to the Presidency of Yanukovych [which started in 2010], China’s leadership had simply refused to do business with the pre-Yanukovych Administration’s Yulia Tymoshenko, and they planned to wait until Yanukovych became President. He then came, and since has been ousted, and yet still only $153 million of grain has been delivered.” (None of the $1.5 billion cash that China advanced to Ukraine to pay for growing and shipping grain has been returned to China, but only the $153M that had essentially been swapped: Chinese goods for Ukrainian grain.) This $153 million was approximately as much as the interest that would be due on China’s prepayment, and so Ukraine still owes China the full $3 billion ($1.5 billion in cash, + $1.5 billion that China supplied in goods).

The RIAN report goes on to quote Alex Luponosov, a Ukrainian authority on Ukraine’s banking system, who says, “Ukraine won’t be able to supply the grain to China, because we don’t have it.” The reason he gives is that “there is a big shortage of technicians: combiners, adjusters, mechanics, farm-machinery operators — all of them were taken by the army.” Those men are being required to fight in Ukraine’s ‘ATO’ or ‘Anti Terrorist Operation,’ that’s occurring in Ukraine’s former Donbass region (the far-eastern tip of Ukraine), the place where the residents don’t accept the new Ukrainian Government’s legitimacy, and they are therefore being called ‘Terrorists’ by this new Government, which is thus bombing them, supposedly in order to convince them that this new Government’s authority over them is legitimate (even though the residents there never participated in its selection, and have been cut off even from Ukraine’s social-security payments).

The policy may be a good idea, but the timing is unashamedly intended to buy votes.” Actually, the policy is toxic.

• Fears Of Pension Chaos In Runup To UK Election (Observer)

Ministers have warned people who will be 55 or over this spring to delay exercising new rights to cash in their pension pots in April, amid rising fears that the industry will not be able to cope and that insufficient advice systems are in place. The cautionary message, issued by pensions minister Steve Webb, reflects growing nervousness in government that the pensions revolution of the chancellor, George Osborne – which he said would give people the right to “choose what they do with their money” from April – could turn into a fiasco in the runup to the 7 May general election. Leading pension providers and industry experts, although supporting the government’s objective of giving people greater access to their pensions savings, told the Observer that pensions companies face being swamped by demands for cash after 6 April, before the industry is ready, or customer advice networks have been established.

Tom McPhail, head of pensions research at leading pensions company Hargreaves Lansdown, said the government had tried to force through the changes at “reckless” speed in what seemed a clear attempt to make people feel richer before election day. “There is widespread support for these reforms, both from the pensions industry and from investors,” McPhail said. “The problem is the reckless pace with which the changes are being introduced. “There’s a pretty transparent political agenda to unlock billions of pounds of pension money just a month before the general election. The policy may be a good idea, but the timing is unashamedly intended to buy votes.” He added: “With such radical and profound reforms as these, under normal circumstances you’d expect to take at least another year before implementing them, in order to make sure all the various players involved were ready. Unfortunately the industry does not have that luxury and as a result many pension providers will be woefully unprepared on 6 April.”

Good argument.

• You Don’t Understand How People Get Poor? You’re Probably A Sociopath (Guardian)

I don’t understand how the people in charge of us all don’t understand. If you are genuinely unable to apply your imagination and extend your empathy far enough – and you don’t have to do it all at once; little by little will suffice, but you must get there – then you are a sociopath, and we should all be protected from your actions. If you are in fact able and choose not to, then you’re something quite a lot worse. So, these are the questions I’d like to see pursued once the televised prime ministerial debates begin (if enough speakers agree to turn up, natch): have you ever had a bad day? Have you ever been really, really tired? Have you ever been alone, or frightened, or not had a choice about something? If yes, was your response unique among man? If no, are you a madman or a liar? Do tell. Do tell.

Big fan. Billie and Callas.

• The Hunting of Billie Holiday (Politico)

One night, in 1939, Billie Holiday stood on stage in New York City and sang a song that was unlike anything anyone had heard before. ‘Strange Fruit’ was a musical lament against lynching. It imagined black bodies hanging from trees as a dark fruit native to the South. Here was a black woman, before a mixed audience, grieving for the racist murders in the United States. Immediately after, Billie Holiday received her first threat from the Federal Bureau of Narcotics. Harry had heard whispers that she was using heroin, and—after she flatly refused to be silent about racism—he assigned an agent named Jimmy Fletcher to track her every move. Harry hated to hire black agents, but if he sent white guys into Harlem and Baltimore, they stood out straight away. Jimmy Fletcher was the answer.

His job was to bust his own people, but Anslinger was insistent that no black man in his Bureau could ever become a white man’s boss. Jimmy was allowed through the door at the Bureau, but never up the stairs. He was and would remain an “archive man”—a street agent whose job was to figure out who was selling, who was supplying and who should be busted. He would carry large amounts of drugs with him, and he was allowed to deal drugs himself so he could gain the confidence of the people he was secretly plotting to arrest. Many agents in this position would shoot heroin with their clients, to “prove” they weren’t cops. We don’t know whether Jimmy joined in, but we do know he had no pity for addicts: “I never knew a victim,” he said. “You victimize yourself by becoming a junkie.”

He first saw Billie in her brother-in-law’s apartment, where she was drinking enough booze to stun a horse and hoovering up vast quantities of cocaine. The next time he saw her, it was in a brothel in Harlem, doing exactly the same. Billie’s greatest talent, after singing, was swearing—if she called you a “motherfucker,” it was a great compliment. We don’t know the first time Billie called Jimmy a motherfucker, but she soon spotted this man who was hanging around, watching her, and she grew to like him. When Jimmy was sent to raid her, he knocked at the door pretending he had a telegram to deliver. Her biographers Julia Blackburn and Donald Clark studied the only remaining interview with Jimmy Fletcher—now lost by the archives handling it—and they wrote about what he remembered in detail.

Home › Forums › Debt Rattle January 25 2015