Harris&Ewing “Pennsylvania Avenue with snow, Washington, DC” 1918

Mother of all bubbles.

• Commodity Prices Collapse To Lowest In 12 Years (Telegraph)

The world’s leading index of commodity prices has slumped to its lowest level in more than 12 years as China slows and America hints at tightening monetary policy. The Bloomberg Commodity index, which tracks the prices of 22 different commodity prices such as gold, natural gas and oil, fell 0.3pc to 99.84 in early trading, the lowest point since August 2002. The recent bout of weakness in commodity prices came as the US Federal Reserve issued an upbeat view on the state of US economy. Minutes from the Federal Open Market Committee’s December meeting said the US economy is expanding at a solid rate with strong job gains, a signal that the central bank remains on track with plans to raise interest rates.

Commodities, like all asset classes, have benefited from America’s loose monetary policy. The upbeat view from the US economy came after another sign of a slowdown in China, with official figures showing profits from the industrial sector fell 8pc in December from a year earlier. Last year, China’s annual economic growth slowed to 7.4pc—its slowest pace in nearly a quarter of a century—as the property crisis in the country holds back the economy, and there is rising debt and slower demand for its products at home and abroad. Most economists expect Beijing to set an annual-growth target for 2015 of 7pc.

“Demand was so high that the company more than doubled the size of the offering. The debt is now trading for less than 50 cents on the dollar..”

• Cheap Oil Burns $390 Billion Hole in Investors’ Pockets (Bloomberg)

Investors have a message for suffering U.S. oil drillers: We feel your pain. They’ve pumped more than $1.4 trillion into the oil and gas industry the past five years as oil prices averaged more than $91 a barrel. The cash infusion helped push U.S. crude production to the highest in more than 30 years, according to data compiled by Bloomberg. Now that oil prices have fallen below $45, any euphoria over cheaper energy will be tempered by losses that are starting to show up in investment funds, retirement accounts and bank balance sheets. The bear market has wiped out a total of $393 billion since June – $353 billion from the shares of 76 companies in the Bloomberg North America Exploration & Production index, and almost $40 billion from high-yield energy bonds, issued by many shale drillers.

“The only thing people are noticing now is that gas prices are dropping,” said Sean Wheeler at law firm Latham & Watkins. “People haven’t noticed yet that it’s also hitting their portfolios.” The money flowing into oil and gas companies around the world in the last five years came from a variety of sources. The industry completed $286 billion in joint ventures, investments and spinoffs, raised $353 billion in initial public offerings and follow-on share sales, and borrowed $786 billion in bonds and loans. The crash caught investors and lenders by surprise. Eight months ago, oil producer Energy XXI sold $650 million in bonds. Demand was so high that the company more than doubled the size of the offering, company records show. The debt is now trading for less than 50 cents on the dollar, and the stock has declined 88%.

Energy XXI, which has more than $3.8 billion in debt, is one of more than 80 oil and gas companies whose bonds have fallen to distressed levels, meaning their yields are more than 10percentage points above Treasury debt, as investors bet the obligations won’t be repaid, according to data compiled by Bloomberg. The stocks and bonds of Energy XXI and other struggling energy firms have been bought up by pension funds, insurance companies and savings plans that are the mainstays of Americans’ retirement accounts. Institutional investors had more than $963 billion tied up in energy stocks as of the end of September, according to Peter Laurelli at analytics firm eVestment, that gathers data on about $22 trillion of institutional strategies.

Mother of all bubbles’ younger sister.

• China Shadow Banking Trusts Fuel Stocks With 28% Jump in Investment (Bloomberg)

China’s trusts, part of the shadow-banking industry, fueled a stock-market rally by boosting their investments in equities by a record 122 billion yuan ($19.5 billion) in the fourth quarter. The increase, reported by the China Trustee Association on Friday, was the biggest by value in data starting in 2010. The 28% gain was the largest since the third quarter of 2010. China’s capital controls and weakness in the property market have helped to channel money into stocks, driving a 35% surge in the Shanghai Composite Index over three months. Trusts’ assets under management grew at the fastest pace in six quarters, gaining almost 8% to 13.98 trillion yuan. Investment in equities totaled 552 billion yuan. So-called umbrella trusts, which allow more leverage than broker financing, have played a role in the stock boom. At the end of last year, China had 369 “risky” trust products valued at 78.1 billion yuan, the statement showed, down from 82.4 billion yuan three months earlier.

Mother of all bubbles’ elder sister.

• Europe Stocks Head for Best January Since 1989 (Bloomberg)

European stocks were little changed, with the Stoxx Europe 600 Index heading for its best start to a year since 1989. The Stoxx 600 added less than 0.1% to 368.85 at 9:53 a.m. in London, having slipped as much as 0.3% and risen as much as 0.4%. The gauge has advanced 7.7% in January as the European Central Bank unveiled a 1.1 trillion-euro ($1.2 trillion) quantitative easing program. A report at 11 a.m. Frankfurt time is projected to show a second month of deflation in the euro area, after a German consumer-price index turned negative for the first time since 2009.

“We’ll see a pickup in growth after QE, but it will be modest,” said Henrik Drusebjerg at Carnegie Investment Bank in Copenhagen. “Most European countries still need to do more reform. We are beginning to take a look at some European companies. I’m curious how aggressive to see Greece will be on their election promises.” Greece’s ASE Index rose for a second day, paring its weekly drop to 11%. Prime Minister Alexis Tsipras promised not to spring any surprises on Greece’s troika of official creditors. The nation’s banks slid this week amid concern a coalition led by Syriza, which won Sunday’s election, will challenge austerity measures. They recovered some losses after the head of ECB’s Supervisory Board said yesterday that the nation’s lenders can survive the current market turbulence.

Stocks higher, prices lower. Makes a lot of sense.

• Eurozone Slides Deeper Into Deflation (CNBC)

The euro zone slid further into deflation in January, underlining the case for the European Central Bank’s full-blown bond-buying program, announced earlier this month. Prices fell by 0.6% year-on-year in January, official flash estimates showed Friday, below the 0.5%-slide forecast by analysts polled by Reuters. In December, the region fell into deflation for the time since 2009, when prices fell by 0.2%. January’s further slide in prices was driven by an accelerating fall in energy costs, Eurostat said. Energy prices fell by a sharp 8.9% in January, compared with 6.3% in December. Prices in January for food, alcohol, tobacco and non-energy-related industrial goods also fell; only prices for services were seen rising. January’s figures come two weeks after after the ECB announced the launch of QE.

The program’s main purpose will be to boost inflation back towards the “just under 2%” level targeted by the central bank and sovereign bond purchases will start in March. In some much-needed good news for the euro zone, however, official figures also revealed that the region’s jobless level had fallen. Eurostat announced Friday that seasonally-adjusted unemployment in the single currency zone fell to 11.4% in December — the lowest recorded in the region since mid-2012, and down from 11.5% in November. By comparison, the unemployment rate stood at 5.6% in the U.S. in December 2014.

“All Europe’s leaders have to offer is broken societies and broken people.”

• We Must Stop Angela Merkel’s Bullying Or Let Austerity Win (Guardian)

All Europe’s leaders have to offer is broken societies and broken people. Over half of young people in Spain and Greece are without work, leaving them scarred: as well as mental distress, they face the increased likelihood of unemployment and lower wages for the rest of their lives. Workers’ rights, public services, a welfare state: all won at such cost by tough, far-sighted people, all being stripped away. There is a certain smugness expressed in Britain: just look across the waters at how bad things could be. Certainly Britain has been free of the euro. It has employed quantitative easing on a grand scale – though for the benefit of banks rather than people, and in an unsustainable, credit-fuelled mini-boom. But in any case, British workers have suffered the biggest fall in their paypackets since the Victorian era, and one of the worst of any EU country.

Britain’s rulers, just like those everywhere else in Europe, have punished their own people for the actions of an ever-thriving elite. That’s why Greece has to be defended urgently – not just to defend a democratically elected government and the people who put it there. European elites know that if Syriza’s demands are fulfilled, then other like-minded forces will be emboldened. Spain’s Podemos, a surging anti-austerity movement, will be more likely to triumph in elections this year. Syriza has already achieved change: the European Central Bank’s limited quantitative easing is partly a response to its rise. Even that well-known radical Reza Moghadam, Morgan Stanley’s vice-chairman of global capital markets and ex-head of the IMF’s European department, confirms Syriza’s strong negotiating position.

The precedent of an exit from the eurozone would lead to the market punishing other members, and to calls for the erasing of half of Greece’s debt. A victory is possible, but it depends on popular pressure right across Europe. If Syriza extracts concessions, it will be a stunning victory for all anti-austerity forces, and will help shift the balance of power in Europe. But if Greece loses, as those governments and banks that will now try to suffocate Syriza at birth intend? Then austerity will triumph over democracy. The future of millions of Europeans – Greek, French, Spanish and British alike – will be bleak indeed. That is why a movement to defend the already ruined nation of Greece is so important. Defeated Germany benefited from debt relief in 1953, and we must demand that for Greece today.

We must champion Syriza’s call for the end of an austerity policy that has achieved nothing but social ruin, across Europe in favour of a strategy of growth. Syriza’s posters declared: “Hope is coming”. Its election must represent that everywhere, including in Britain, where YouGov polling reveals huge popularity for a stance against austerity and the power of big business. A game of high stakes indeed: one that, if lost, will mean countless more years of economic nightmare. This rerun of the 1930s can be ended – this time by the democratic left, rather than by the fascist and the genocidal right. The era of Merkel and the machine men can be ended – but it is up to all of us to act, and to act quickly.

“Nobody forced banks to lend money to the Greek government on nearly the same terms as they lent to, say, the German or Dutch governments.”

• Lies, Damned Lies And Greece’s Debt Default (MarketWatch)

Can we stop it, please, with the Greek debt panic? Can we stop pretending that this crisis is something it isn’t, or that it involves principles it doesn’t, or that there is no alternative other than more pain on the streets of Athens? There’s been a renewed flap following Sunday’s stunning Greek election victory for the radical Syriza party, which wants to renegotiate the country’s crippling debt burdens and escape the deflation trap imposed by external bankers. It’s time for some hard, yet simple, truths. Greece’s gross debts add up to around $320 billion in nominal value, according to the International Monetary Fund. That’s big compared to the Greek economy, but tiny compared to the world outside. It’s less than 3% of the entire eurozone economy, which is about $13.5 trillion.

So even if Greece refused to pay one more nickel of its debts — an outcome no one is suggesting — the eurozone could make up the difference with about eight days’ output … or an hour’s money-printing by the ECB. And the real value of the Greek national debt is even less than this nominal sum. That’s because the markets have already adjusted themselves sensibly to the situation. According to the National Bank of Greece, shorter-term government bonds are already trading at about 85 cents on the euro, while longer-term bonds are down to between 65 and 50 cents on the euro. According to calculations by Felix Brill at investment firm Wellershoff, publicly traded Greek government bonds are trading at an average of 70 cents on the euro. So, in real terms, a big chunk of that Greek debt has already been written off. Crisis? What crisis?

Second, the idea that a partial Greek debt default would somehow represent an earthquake in the world of finance, or endanger the eurozone, or be an improvident reward for the reckless and the feckless, is nonsense. Nobody forced German and other bankers to buy Greek government bonds at absurd prices during the bubble. Nobody forced banks to lend money to the Greek government on nearly the same terms as they lent to, say, the German or Dutch governments. And nobody forced the international honchos at the IMF, ECB or EC to take over those obligations from the banks a few years ago as a “bailout.”

“.. the worse the economy, the worse for the far right and the better for the far left.”

• Greece Turns Left, Europe Goes Right (Bloomberg)

Why has Greece chosen a far-left government at a time when discontented and frustrated voters elsewhere in Europe have turned to the far right? In northern Europe, the frustrated voters’ parties of choice are right wing and anti-immigrant. So how come frustrated Greeks made a sharp turn to the left, electing the near-communist Syriza party to lead the government? The choice of left over right is especially striking because Greece is a first port of call for so many new immigrants to Europe. If Spain’s Podemos party continues to grow, then the contrast between northern and southern Europe will be even more striking. A combination of economics, politics and history can shed light on the differences. The simplest – and most surprising – answer may be just this: the worse the economy, the worse for the far right and the better for the far left.

The southern European economies are in substantially deeper trouble than their counterparts in middle and northern Europe. This has two distinct political effects, which together explain the difference between a turn to the left and a turn to the right. First of all, Greece is facing austerity demands that come from the northern members of the European Union, especially Germany. That means the Greeks perceive the main bad guy as external, not internal, and see the neoliberalism of Angela Merkel as the immediate source of the pain. The resistance to reducing state employment, cutting budgets, and working harder for less money and shorter vacations becomes resistance to the market economy itself.

The ex-communist radical left is the natural place for such resistance: The economic program of the left simply denies that such measures will actually help, and instead holds the promise of telling Europe to get lost.In northern Europe, economies may be in the doldrums, but no external European political force is pressing for fundamental structural change. Frustrated voters who see their job benefits scaled down even moderately thus need a different target. Those who arrived recently – immigrants – are the traditional objects of blame. The social contract may seem to be breaking down as a result of neoliberalism, but because no one has forced this change on northern European societies, it’s much easier to blame immigrants for burdening the state and making the social contract too expensive. Never mind if it’s true: The point is to blame anyone other than yourself.

Written pre-election.

• Open Letter To German Readers: What You Were Never Told About Greece (Tsipras)

Alexis Tsipras’ “open letter” to German citizens published on Jan.13 in Handelsblatt, a leading German language business newspaper

Most of you, dear readers, will have formed a preconception of what this article is about before you actually read it. I am imploring you not to succumb to such preconceptions. Prejudice was never a good guide, especially during periods when an economic crisis reinforces stereotypes and breeds biggotry, nationalism, even violence. In 2010, the Greek state ceased to be able to service its debt. Unfortunately, European officials decided to pretend that this problem could be overcome by means of the largest loan in history on condition of fiscal austerity that would, with mathematical precision, shrink the national income from which both new and old loans must be paid. An insolvency problem was thus dealt with as if it were a case of illiquidity.

In other words, Europe adopted the tactics of the least reputable bankers who refuse to acknowledge bad loans, preferring to grant new ones to the insolvent entity so as to pretend that the original loan is performing while extending the bankruptcy into the future. Nothing more than common sense was required to see that the application of the ‘extend and pretend’ tactic would lead my country to a tragic state. That instead of Greece’s stabilization, Europe was creating the circumstances for a self-reinforcing crisis that undermines the foundations of Europe itself. My party, and I personally, disagreed fiercely with the May 2010 loan agreement not because you, the citizens of Germany, did not give us enough money but because you gave us much, much more than you should have and our government accepted far, far more than it had a right to.

Money that would, in any case, neither help the people of Greece (as it was being thrown into the black hole of an unsustainable debt) nor prevent the ballooning of Greek government debt, at great expense to the Greek and German taxpayer. Indeed, even before a full year had gone by, from 2011 onwards, our predictions were confirmed. The combination of gigantic new loans and stringent government spending cuts that depressed incomes not only failed to rein the debt in but, also, punished the weakest of citizens turning people who had hitherto been living a measured, modest life into paupers and beggars, denying them above all else their dignity. The collapse of incomes pushed thousands of firms into bankruptcy boosting the oligopolistic power of surviving large firms.

Good series.

• Syriza’s Original 40 Point Manifesto (Zero Hedge)

The daily bulletin of Italy’s Communist Refoundation Party published today the apparently official program of the Greek coalition of the left, Syriza. Here the 40 points of the Syriza program.

1) Audit of the public debt and renegotiation of interest due and suspension of payments until the economy has revived and growth and employment return.

2) Demand the European Union to change the role of the European Central Bank so that it finances States and programs of public investment.

3) Raise income tax to 75% for all incomes over 500,000 euros.

4) Change the election laws to a proportional system.

5) Increase taxes on big companies to that of the European average.

6) Adoption of a tax on financial transactions and a special tax on luxury goods.

7) Prohibition of speculative financial derivatives.

8) Abolition of financial privileges for the Church and shipbuilding industry.

9) Combat the banks’ secret [measures] and the flight of capital abroad.

10) Cut drastically military expenditures.

11) Raise minimum salary to the pre-cut level, €750 per month.

12) Use buildings of the government, banks and the Church for the homeless.

13) Open dining rooms in public schools to offer free breakfast and lunch to children.

14) Free health benefits to the unemployed, homeless and those with low salaries.

15) Subvention up to 30% of mortgage payments for poor families who cannot meet payments.

16) Increase of subsidies for the unemployed. Increase social protection for one-parent families, the aged, disabled, and families with no income.

17) Fiscal reductions for goods of primary necessity.

18) Nationalization of banks.

“We will continue with our plan. We don’t have the right to disappoint our voters.”

• Greece’s New Young Radicals Sweep Away Age Of Austerity (Guardian)

One by one they were rolled back, blitzkrieg-style, mercilessly, ruthlessly, with rat-a-tat efficiency. First the barricades came down outside the Greek parliament. Then it was announced that privatisation schemes would be halted and pensions reinstated. And then came the news of the reintroduction of the €751 monthly minimum wage. And all before Greece’s new prime minister, the radical leftwinger Alexis Tsipras, had got his first cabinet meeting under way. After that, ministers announced more measures: the scrapping of fees for prescriptions and hospital visits, the restoration of collective work agreements, the rehiring of workers laid off in the public sector, the granting of citizenship to migrant children born and raised in Greece. On his first day in office – barely 48 hours after storming to power – Tsipras got to work. The biting austerity his Syriza party had fought so long to annul now belonged to the past, and this was the beginning not of a new chapter but a book for the country long on the frontline of the euro crisis.

“A new era has begun, a government of national salvation has arrived,” he declared as cameras rolled and the cabinet session began. “We will continue with our plan. We don’t have the right to disappoint our voters.” If Athens’s troika of creditors at the EU, ECB and IMF were in any doubt that Syriza meant business it was crushingly dispelled on Wednesday . With lightning speed, Europe’s first hard-left government moved to dismantle the punishing policies Athens has been forced to enact in return for emergency aid. Measures that had pushed Greeks on to the streets – and pushed the country into its worst slump on record – were consigned to the dustbin of history, just as the leftists had promised. But the reaction was swift and sharp. Within minutes of the new energy minister, Panagiotis Lafazanis, announcing that plans to sell the public power corporation would be put on hold, Greek bank stocks tumbled. Many lost more than a third of their value, with brokers saying they had suffered their worst day ever.

While yields on Greek bonds rose, the Athens stock market plunged. By closing time it had shed over 9%, hitting levels not seen since September 2012 and losing any gains it had clawed back since Mario Draghi, the European Central Bank chief, vowed to do “whatever it takes” to save the euro. By nightfall there was another blow as Standard & Poor’s revised its Greek sovereign rating outlook, taking the first step towards a formal downgrade. The agency warned that a bank run might also be in the offing, noting that “accelerated deposit withdrawals from Greek banks had created “a credit concern”. Perhaps prepared for the onslaught, Tsipras had also acted. On Tuesday, he met the Chinese ambassador to Athens to insist that while Syriza and its junior partner, the populist rightwing Independent Greeks party, would also be cancelling plans to privatise Piraeus port authority, the government wanted good relations with Beijing. China’s Cosco group, which already controls several docks in Piraeus, had been among four suitors bidding for the port.

RIght wing view of a left wing government.

• It’s Time For Greece To Leave The Eurozone And Move On (Telegraph)

The single currency was always a mistake, and I was one of a number of commentators who has always opposed its creation. Single currency areas can work only under one of three scenarios, none of which has ever been on the cards in Greece and much of Europe First, and ideally, you need an economy with radical levels of flexibility, a small government, a well-educated and motivated entrepreneurial workforce, and labour markets that adjust to shocks. A hit to demand leads to a very speedy reallocation of resources; workers are willing to take nominal pay cuts to keep their jobs; and the country bounces back quickly from shocks without suffering from massive unemployment. That is the ideal economic system — but sadly it is not on the agenda. Many libertarian economists, especially in the US but also in Europe, backed the euro because they thought it would trigger free-market reforms, but while some have taken place, they have been insufficient in scale and scope. Ultimately, you can’t impose an economic system on a reluctant society.

Second, an ultra-mobile pan-European society. In such a world — which doesn’t exist in anything like the way I’m imagining — unemployed people in Greece are able to move en masse to parts of the eurozone with better jobs prospects. This still happens to some extent in the US, where states like Texas have been fuelled by mass intra-state migration, and poor areas such as Detroit have simply lost their population. Workers do also move within the UK, and within other countries, though generally not enough. There is now lots of migration within Europe, but even the numbers we see aren’t enough to allow economies to adjust properly. There is no single European demos; people speak different languages and have different cultures. This won’t change for the foreseeable future.

Third, a massive pan-European welfare state with a federal tax system and permanent redistribution from rich to poor areas. In such a world, where the one-size-fits-all monetary policy is unable to cater for a hit to parts of the eurozone, fiscal policy kicks in. Germany and other richer parts send billions to poor states. In return, the power of nations to borrow is dramatically curtailed: member states lose much of their sovereignty. In such a world, Greece would simply not be allowed to borrow and spend as it saw fit, and many more functions currently operated by national governments would be transferred to Brussels.

Nothing sensational.

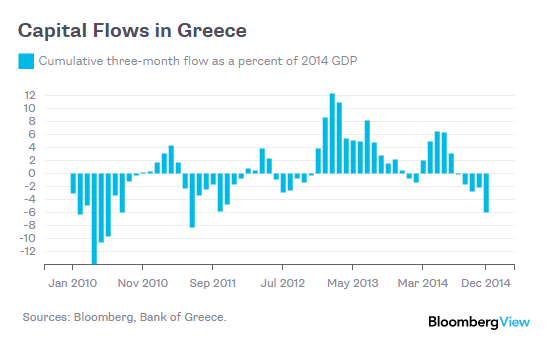

• Greece’s Predicament in One Scary Chart: Capital Flight (Bloomberg)

If the new prime minister of Greece, Alexis Tsipras, hopes to make a deal with his country’s creditors, time is of the essence. Judging from data on capital flows, Greece’s change of political course is rapidly eroding confidence that it will stay in the European currency union. Just because the 19 countries of the euro area share a currency doesn’t mean a euro in Greece is worth as much as a euro elsewhere. If, for example, Greece’s bank depositors start to worry that the country will exit the monetary union and leave them holding devalued drachma, they’ll move their money to a safer locale such as Germany, effectively trading their Greek euros for German ones. Such capital flight can be tracked (roughly) by looking at the accounts of central banks: If €1 billion moves out of Greece, the Bank of Greece records a corresponding €1 billion liability to the rest of the euro area.

Lately, the Greek central bank’s so-called intra-Eurosystem liabilities have been rising at a pace not seen since the darkest days of the European financial crisis. In December, when the previous Greek government announced the snap presidential vote that ultimately cleared the way for Tsipras and his far-left Syriza party to take power, the liabilities increased by about €7.6 billion, according to data compiled by Bloomberg. That’s more than in any month since May 2011 – and it happened even before Syriza won the Jan. 25 parliamentary election on a platform that included promises to end austerity and renegotiate the government’s onerous debts. Here’s a chart showing the estimated three-month cumulative capital flows between Greece and the euro area, as a% of Greek gross domestic product (positive numbers are inflows to Greece):

The capital flight from Greece contrasts sharply with the progress the country had been making since mid-2012, when ECB President Mario Draghi tamed markets with his promise to do “whatever it takes” to hold together the euro area. Over the two years through June 2014, the Bank of Greece’s intra-eurosystem liabilities declined by more than €75 billion as money flowed back in.

“(The) ruble weakened and as you might see, life still goes on here and we just keep on living..”

• Russia Extends Olive Branch To Greeks (CNBC)

Russian Finance Minister Anton Siluanov told CNBC that Russia would consider giving financial help to debt-ridden Greece—just days after the new Greek government questioned further European Union sanctions against Russia. Siluanov said Greece had not yet requested Russia for assistance, but he did not rule out an agreement between the two countries if Greece came asking. “Well, we can imagine any situation, so if such [a] petition is submitted to the Russian government, we will definitely consider it, but will take into account all the factors of our bilateral relationships between Russia and Greece, so that is all I can say. If it is submitted we will consider it,” Siluanov told CNBC on Thursday. Siluanov’s comments come two days after Greece’s new left-wing-led government distanced itself from calls to increase sanctions against Russia—indicating that Greece could be looking east to Russia for support.

On Tuesday, EU leaders issued a statement calling for “further restrictive measures” to be considered against Russia with regard to its involvement in the ongoing conflict in eastern Ukraine. After the statement, a representative for Greece’s newly elected Syriza party reported that the EU’s statement was made “without our country’s consent” and expressed “dissatisfaction with the handling of this.” On Thursday, Siluanov said that while Western-imposed sanctions against Russia thus far had been harmful, the country has managed to adapt. “The sanctions that have already been imposed against Russia did have (a) negative effect on us. However, Russia companies have adjusted and the Russian balance of payments has adjusted. (The) ruble weakened and as you might see, life still goes on here and we just keep on living,” he said.

Abenomics is an open festering wound.

• Japan Braces For Falling Prices As Oil Collapses (CNBC)

Japan’s consumer inflation eased in December for a fifth straight month and the rate of price rises could slow further or even turn negative as the economy adjusts to lower oil prices, analysts say. The consumer price index (CPI) rose 2.5% in December from the year-ago period, government data showed on Friday, compared with Reuters’ forecast for a rise of 2.6% and down from the 2.7% print in November. The core Tokyo CPI for January, considered a leading indicator, rose 2.2% on year, in line with expectations and easing from 2.3% in December. Excluding the effects of the sales tax hike, the nationwide consumer price index (CPI) rose 0.5%.

With the collapse in oil prices yet to be reflected in consumer inflation, analysts say the numbers will look worse in the coming months, dealing a further blow to the Bank of Japan’s ambitious inflation targets. “There is a six-month lag before global LNG prices are factored into electricity prices – and it’s electricity prices, rather than the price of oil at the pumps, that counts for Japanese households,” said Credit Suisse economist Takashi Shiono. “The electricity companies are still scheduled to raise their prices in February, so we’ll have to wait until April for the lower oil prices to filter through to the headline inflation numbers,” he added. Credit Suisse is forecasting the CPI to turn negative by April, assuming that current levels of oil and the dollar-yen holds.

Shino expects CPI to fall by up to 0.3% in April and down 0.1% for the full-year ending March 2016. The BOJ has been betting that its massive quantitative easing program unleashed since April 2013 will defeat inflation for good and bring CPI stripped of sales tax hike up to 2% by financial year ending March 2016. But market watchers see the goal increasingly unlikely especially in the wake of crashing oil prices. Earlier this month, the BOJ cut its CPI forecast for 2015/16 to 1% from an earlier projection of 1.7%, reflecting the state of oil markets. “Inflation is still likely to moderate further. Less than half of the plunge in the price of crude oil has been passed on to consumers in the form of lower gasoline prices,” Capital Economics’ Marcel Thieliant said in a research note.

New Zealand?

• The Next Shot In The Currency War Will Be Fired By… (CNBC)

The currency war is getting out of control. A snapshot of the week so far in central banking: The Monetary Authorty of Singapore surprised markets Tuesday night with a policy switch to pursue a slower pace of currency appreciation, its main policy tool. Wednesday afternoon, New Zealand’s Reserve Bank kept policy unchanged, but significantly altered its language, saying it expects to see a “further significant depreciation” for the kiwi and that “the exchange rate remains unjustified in terms of current economic conditions. Hungary’s central bank struck a decidedly dovish note, hinting at easier policy ahead. The moves follow surprise policy changes from Denmark, India Canada and Switzerland earlier this month. That includes the European Central Bank. Despite a great deal of anticipation, Mario Draghi managed to surprise and impress financial markets with the ECB’s trillion-euro bond purchase program.

“The trend of central bank surprises continues, adding volatility to markets and highlighting a more uncertain global policy stance but one that is partially centered on (foreign exchange) ahead,” Camilla Sutton, chief FX strategist at Scotiabank, wrote in a note this week. “An environment of increased volatility and uncertainty is typically U.S. dollar positive.” The U.S. dollar has been the beneficiary of those moves and easy policies. In 2015 alone, the dollar has strengthened nearly 7% against the euro, more than 7% against the Canadian dollar and 6% against the New Zealand dollar. Over the past 12 months, the moves are in the double digits, with the dollar strengthening more than 20% against Sweden’s and Norway’s currencies, more than 17% against the euro and 13% against the yen.

Can the grandstanding stop now? Denmark has real problems.

• Denmark Surprises Market With Third Rate Cut In Two Weeks (Reuters)

The Danish central bank cut its key interest rate for the third time in two weeks to another historic low after intervening in the market to keep the crown within a tight range against the euro. The central bank cut its certificate of deposit rate to -0.5% from -0.35%, making a reduction of 45 basis points since Monday last week. While analysts said last week that its actions might not be enough to weaken the crown, few expected another cut so soon, especially as Denmark’s rate went below the eurozone equivalent of -0.20%, making it less attractive than the euro. Analysts have said the central bank tends to use interest rate tools after spending 10 to 15 billion crowns in intervention.

“It has become expensive to have Danish crowns and the (upward) pressure is therefore expected to ease off, but whether the rate cuts are enough to turn off the ‘stream’ into the market is still uncertain,” Danske Bank chief economist Steen Bocian said in a note. The central bank has intervened every month since September, aside from December, as the crown has strained at the upper limit of its trading band with the euro. But crown buying accelerated after the Swiss National Bank scrapped the franc’s cap against the euro. It also cut interest rates to -0.75%. Some analysts think the Danish central bank may have more cuts up its sleeve. “The objective is to push down money market rates and make it less attractive to hold crowns,” a bank spokesman said. “We expect a reaction so we don’t need to intervene and the crown will weaken.”

“Germany was an exception to the pattern, but provisional figures for January show that is no longer the case. Deflation in Germany suggests the eurozone will experience faster falls in prices in the months ahead.”

• Denmark, Deutschland And Deflation (BBC)

There have been two important, connected economic developments in Europe. New official figures from Germany show that prices have fallen, by 0.5%, over the previous 12 months. Meanwhile the Danish Central Bank has cut one of its main interest rates for the second time in a week. It is a rate paid to commercial banks for excess funds parked at the central bank. It was already below zero. Now it is even lower – minus 0.5%. It means banks have to pay to leave money at the central bank, above certain specified limits. Negative interest rates are another example of the strange financial world that has emerged in the aftermath of the financial crisis. What is the connection between falling prices – or deflation – in Germany and the Danish central bank? It is about Denmark’s 35-year policy of tying its currency, the krone, to the euro, and before that to the German mark.

That peg has come under increasing strain as the European Central Bank, the ECB, has taken steps to combat deflation. Falling prices arrived for the eurozone as a whole last month. Germany was an exception to the pattern, but provisional figures for January show that is no longer the case. Deflation in Germany suggests the eurozone will experience faster falls in prices in the months ahead. There is a debate to be had about whether deflation really is a problem and if so how serious, but the ECB clearly thinks it is. The steps it has taken to address low inflation, and then deflation, have made it harder for financial market investors to make money in the eurozone. The ECB cut interest rates and last week launched its quantitative easing programme, which also tends to reduce returns on financial assets. So investors piled into other currencies, including the krone, pushing it higher, though not so high that it has gone above the top of the central bank’s target band.

But the economy is doing great!

• Young Workers Hit Hardest By Wages Slump Of Post-Crash Britain (Guardian)

British workers are taking home less in real terms than when Tony Blair won his second general election victory in 2001, with men and young people hit hardest by the wage squeeze that followed the financial crisis, according to new research. The Institute for Fiscal Studies thinktank said wages were 1% lower in the third quarter of 2014 than in the same period 13 years earlier after taking inflation into account. Jonathan Cribb, an author of the report, said: “Almost all groups have seen real wages fall since the recession.” However, the study finds that women have been relatively cushioned from the worst of the wage cuts because they are more likely to be in public sector jobs, where wages fell less rapidly during the early years of the downturn.

Aided at the start of the crisis by the relative stability of public sector wages, women’s average hourly pay fell by 2.5% in real terms between 2008 and 2014, the IFS found, while men’s pay fell by 7.3%. The IFS also singled out younger workers as among the biggest victims of the falling living standards that have become widespread in post-crash Britain. “Between 2008 and 2014, there is a clear pattern across the age spectrum, with larger falls in earnings at younger ages,” the thinktank found in a detailed study of the state of the labour market. Labour immediately seized on the figures as evidence that Britain was trapped in a “cost of living crisis”. Rachel Reeves, the shadow work and pensions secretary, said: “This report shows David Cameron has overseen falling wages and rising insecurity in the labour market. Only Labour has a plan to tackle low pay and to earn our way to rising living standards for all.”

“Are they completely out of their minds? The US has been totally ‘lost in the jungle’ and is dragging us there as well.”

• Gorbachev Accuses US Of Dragging Russia Into New Cold War (RT)

Mikhail Gorbachev has accused the US of dragging Russia into a new Cold War. The former Soviet president fears the chill in relations could eventually spur an armed conflict. “Plainly speaking, the US has already dragged us into a new Cold War, trying to openly implement its idea of triumphalism,” Gorbachev said in an interview with Interfax. The former USSR leader, whose name is associated with the end of the Cold War between the Soviet Union and the United States, is worried about the possible consequences. “What’s next? Unfortunately, I cannot be sure that the Cold War will not bring about a ‘hot’ one. I’m afraid they might take the risk,” he said.

Gorbachev’s criticism of Washington comes as the West is pondering new sanctions against Russia, blaming it for the ongoing military conflict in eastern Ukraine, and alleging Moscow is sending troops to the restive areas. Russia has denied the allegations. “All we hear from the US and the EU now is sanctions against Russia,” Gorbachev said. “Are they completely out of their minds? The US has been totally ‘lost in the jungle’ and is dragging us there as well.” Gorbachev suggests the situation in the EU is “acute” with significant differences among politicians and different levels of prosperity among member nations. “Part of the countries are alright, others – not so well, and many, including Germany, are excessively dependent on the US.”

“..suicide is often considered the most honorable course of action. That is because their death will bring about the end of any investigation into their alleged corruption..”

• China’s Anti-Corruption Campaign Boosts Suicide Rate (FT)

The Chinese Communist party has launched a nationwide survey to ascertain how many of its members have committed suicide since President Xi Jinping unveiled an anti-corruption campaign two years ago. The crackdown has so far led to warnings or disciplinary action for about a quarter of a million cadres but it has also been accompanied by a sharp rise in suicides among officials, according to numerous Chinese media reports. In recent days the party has sent out a questionnaire to officials across the country asking them to identify the number and details of “unnatural deaths”, including suicides, of party members since December 2012. That is when President Xi launched the graft clean-up that has become his most prominent policy since he took power in November that year.

As well as hundreds of thousands of “flies”, as party rhetoric describes low-level officials, Mr Xi’s anti-corruption drive has also netted dozens of high-ranking “tigers”, including the former head of China’s domestic security services, Zhou Yongkang, and former vice-chairman of the Chinese military, Xu Caihou. China’s state-controlled media have published several articles vilifying allegedly corrupt officials for killing themselves while under investigation but for family members and associates of these officials suicide is often considered the most honorable course of action. That is because their death will bring about the end of any investigation into their alleged corruption, protecting any accomplices or associates and allowing their families to keep their assets, ill-gotten or otherwise.

Officials found guilty of corruption are not only handed lengthy prison sentences or even the death penalty; they and their families are invariably stripped of generous state pensions and all their assets. Children of disgraced officials are also sometimes forced to leave prestigious schools or high-profile jobs. China’s main anti-corruption body, the Central Commission for Discipline and Inspection, is in effect an extralegal entity with enormous powers to detain indefinitely and “discipline” any of the country’s 87 million party members. Legal scholars, family members and rights activists in China have raised serious concerns about the prevalence of torture in CCDI investigations and several of the “suicides” reported in the past two years are believed to be cover-ups of deaths that happened during torture sessions.

“Until the motion was passed, animals in France, including domestic pets and farm animals, had the same status as a sofa.”

• Animals In France Finally Recognized As ‘Living, Sentient Beings’ (RT)

It has taken the French parliament more than 200 years to officially recognize animals as “living, sentient beings” rather than “furniture,” finally upgrading their embarrassing status that dates back to Napoleonic times. While amendments to the Civil Code were first approved in November, the National Assembly voted on the motion Wednesday, according to AFP. The Assembly had to give its final word after debate with the Senate over several clauses, including the animals’ status. Until the motion was passed, animals in France, including domestic pets and farm animals, had the same status as a sofa. When the civil code was wrapped up by Napoleon back in 1804, animals were considered as working farm beasts and viewed as an agricultural force designated as goods or furniture.

A two-year fight led by the French animal rights organization Fondation 30 Million d’Amis (Foundation of 30 Million Friends) has resulted in the long-awaited change. The charity’s president, Reha Hutin, insisted that the new legislation was needed to stop horrendous acts of cruelty toward animals. Currently, the law on the cruel treatment of animals in France comprises the punishment of a maximum two-year prison term and a 30,000-euro fine. “France is behind the times here. In Germany, Austria and Switzerland they have changed the law so it says that animals are not just objects,” Hutin told The Local. “How can the courts in France punish the horrible acts that are carried out against animals if they are considered no more than just furniture?” she said.

Home › Forums › Debt Rattle January 30 2015