G. G. Bain Gloria Swanson in New York Sep 4, 1924

We all know that interest rates are at an ultra low level, whether it’s the rate on our savings accounts, our mortgages (though those are quite a bit higher, quelle surprise), central bank rates or yields on government bonds. All this, plus a watershed of global QEs, have led to stock exchanges at highs that have nothing at all to do anymore with the performance of the real economies they’re supposed to represent – and historically did.

Add to that that on stock exchanges, trading volumes are as ultra low as interest rates are, and from what trading is left, a substantial part is machines, i.e. high frequency, and we have a pretty clear idea of just how distorted our picture of our economies have become. We no longer have a clue what really happens, since we don’t know what is worth what. Share prices tell us nothing about a company’s performance, since any strength that is does appear to have left may as well stem from cheap credit borrowed at those same ultra low rates and used for stock buybacks and other purely financial moves.

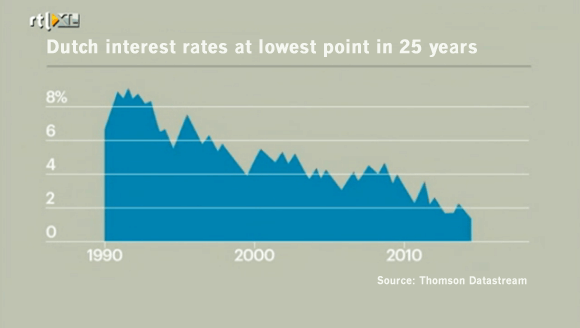

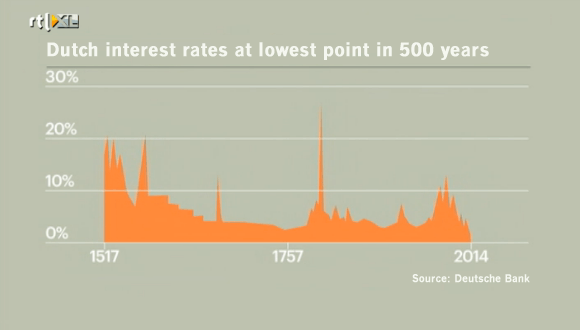

Still, wouldn’t it be nice to know, from a historical perspective, exactly how low have interest rates become? I saw a nice example today on Dutch business channel RTL-Z. The yield on the 10-year bond in Holland was 1.476% today. Which is not just the lowest the Dutch paid in the past 25 years:

But even in the past 500 years:

You wouldn’t even expect to see such rates in even the most buzzing or otherwise extreme economies, let alone in one that’s as anemic, other than in stock markets, as ours are today. To wit: purchasing managers indices (PMIs) in Europe all fell again today. Perhaps we need to recognize that today’s economy is indeed a very extreme one.

And if you get the feeling from what’s going on that in order for the central banks to be able put lipstick on their pig, they have to kill it in the process, you’re not far off at all. They’ve largely killed bond markets, and not much is left of equity either, as we saw yesterday. The only thing that keeps the zombie pig going is debt, and more debt.

But we shouldn’t forget that the financial world, which can be made to – seem to – show “healthy” growth this way, demands more growth each year, that it’s an exponential growth rate we’re talking about. And that, even central banks cannot deliver. Not for long.

I had an email exchange with Jeffrey Brown recently, since I wondered if he had updates available on his Export Land Model, which deals with declining amounts of oil available for export from oil producing countries, because of depletion rates and relentlessly rising domestic consumption. Jeffrey’s a longtime – and very smart – oil geologist also known as Westexas whom we know from our Oil Drum days. I couldn’t figure out a good way to write up what he sent me back then, but I’ll give it a shot after seeing something he wrote the other day in reply to an article on peakoilbarrel.com, North Dakota and the Bakken by County.

Jeffrey uses terms like Global Net Exports, Avalaible Net Exports, Cumulative Net Exports and Chindia’s Net Imports. That may look confusing at first glance, but it does make a lot of sense once you think about it. The overall idea is that even if total global oil production would not decline, an argument all too easily made by the shale faithful, oil available for sale in global markets would still fall rapidly, because of those domestic consumption numbers (oil producing countries grow both their economies and populations) and because of the surging demand from the 2.5 billion people living in China and India. This is how he puts – part of – the overall picture:

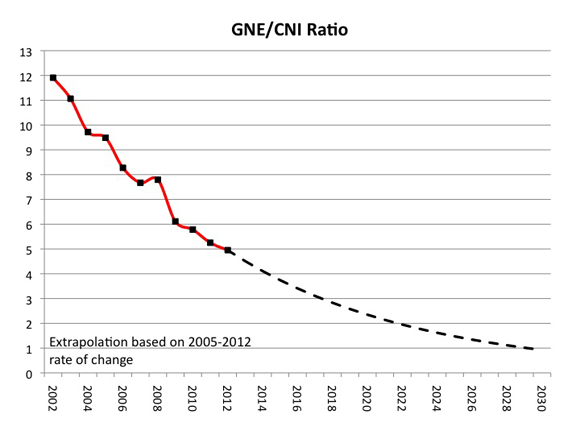

Of course, the really crazy low number is my estimate for the remaining volume of Available CNE (Cumulative Net Exports), i.e., the estimated cumulative remaining volume of GNE (Global Net Exports) available to importers other than China & India.

Available Net Exports (ANE), or GNE less CNI (Chindia’s Net Imports), were 41 mbpd in 2005 (or 15 Gb/year). Based on the 2005 to 2012 rate of decline in the GNE/CNI Ratio, I estimate that post-2005 Available CNE are on the order of about 170 Gb. At the 2005 rate of consumption in ANE, estimated post-2005 Available CNE would be depleted in about 12 years (analogous to a Reserve/Production Ratio).

From 2006 to 2012, cumulative ANE were about 95 Gb, which would put estimated remaining Available CNE at about 75 Gb at the end of 2012. At the 2012 rate of consumption in ANE, estimated remaining Available CNE would be depleted in about 6 years , i.e., the total estimated volume of Global Net Exports of oil available to about 155 net oil importing countries would be totally gone in 6 years (about 2,200 days). Of course, the expectation is for an ongoing decline in ANE, and the current extrapolated data suggest that ANE would theoretically approach zero around the year 2030.

As someone once said, what can’t continue tends not to continue, and there is no way we would have a functioning global economy if two countries consumed anything close to 100% to Global Net Exports of oil, but here’s the problem: Given an inevitable ongoing decline in GNE, unless the Chindia region cuts their GNE consumption at the same rate as the rate of decline in GNE, or at a faster rate, the resulting ANE decline rate will exceed the GNE decline rate, and the ANE decline rate will accelerate with time. It’s a mathematical certainty.

In any case, the projected rate of decline in the GNE/CNI Ratio puts us at a point in 2030 at which we cannot arrive, but the 2013 data will almost certainly show that we continued to slide toward a point at which we cannot arrive:

Quite the conundrum.

What we take away from this is that China and India’s demand for oil is rising so fast, in perhaps 10 years’ time available oil in the markets will either go to them or it will go to us, but not to both. Time to prepare to fight over the stuff, and make it unavailable for the poor at the same time?!

But only if there’s a profit in it.

• Admitting Problem Is First Step as HSBC Ditches ‘Optimism Bias’ (Bloomberg)

If recovery starts by admitting you have a problem, then HSBC economists are taking the first step. They say they’ve overestimated global growth prospects for each of the last three years by being too upbeat after the 2008 financial crisis. They’re now taking corrective action. “There is an optimism bias, largely reflecting an attachment to pre-crisis growth trends which, post-crisis, have mostly remained out of reach,” according to a report published last week by the team led by Stephen King, HSBC’s global head of economics and asset-allocation research. “Our latest projections are consistent with this sense of ennui.” HSBC hasn’t been alone. Its economists found that since the crisis their industry’s average estimate of inflation proved off by at least 1 percentage point in the U.S., U.K., Sweden and Spain and by 0.7 point in Germany. Those are big misses given that most major central banks target 2% inflation.

Divining growth has also flopped. In the U.S., for example, economists reckon expansion should be as much as 3% in the long run, yet it has averaged just 2% since 2000, according to HSBC. HSBC economists have cut their forecasts for global growth in each of the past three years. They did so again last week in reducing their 2014 forecast to 2.4% from 2.6%, which was down from the 2.8% seen at the end of 2012. The list goes on: Printing money was supposed to lead to higher inflation, yet hasn’t. A run-up in equity prices has failed to ignite economic activity, and house prices are booming even with weak inflation. Behind the errors lay a reliance on “simple rules of thumb,” say the London-based King and his colleagues. Economists are suffering from a bias toward optimism that suggests economic drivers are the same now as before 2008.

Tricks and sleeves.

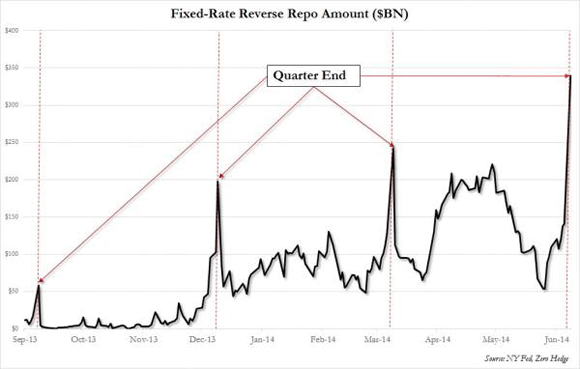

• The Purpose Of The Fed’s Reverse Repo: Window Dressing (Zero Hedge)

If there ever was any question as to what the purpose of the Fed’s Reverse Repo liquidity facility was, or is, the amount of reverse repos issued by the Fed to make banks appear healthier than they are and to cure whatever “high quality collateral” shortfalls banks are now chronically experiencing, should slam the door shut on any future debate just what the motive behind the Reverse Repo is.

Behold: a record $340 billion in reverse repos submitted by the world’s financial institutions with the Federal Reserve, an increase of $200 billion overnight, and amounting to a record $3.5 billion on average among the 97 operations participants. Considering this is a clear quarterly event, it goes without saying that all the reverse repo is, is a quarter-end window dressing mechanism underwritten by Mr. Chairmanwoman itself. That there was some $200 billion in excess reserve liquidity as of yesterday’s market close (which today was handed over to the Fed in exchange for one day rental of Treasurys), or that banks actually have a third of a trillion gaping shortfall in collateral, hardly needs discussion. Expect total reverse repo usage tomorrow to plunge by at least $150 billion as the banks will have fooled their regulator, which also happens to be the Fed, that they are safe and sound. Rinse, repeat, until the entire financial system collapses once again and people will ask “how anyone could have possibly foreseen this.”

• California Housing And The Bubble At Hand (Stockman)

Janet Yellen is an officious school marm. She constantly lectures us on Keynesian verities as if they were the equivalent of Newton’s Law or the Pythagorean Theorem. In fact, they constitute self-serving dogma of modern vintage that is marshaled to justify what is at bottom an economic absurdity. Namely, that through the primitive act of banging the securities “buy” key over and over and thereby massively expanding its balance sheet, the Fed can cause real wealth—-embodying the sweat of labor, the consumption of capital and the fruits of enterprise – to magically expand beyond what the free market would generate on its own steam. In a fit of professorial arrogance, Bernanke even had the gall to call this the helicopter money process. His contention was that the rubes on main street would happily scoop up the falling bills and coins and soon “spend” the economy into a fit of expansion.

In other words, according to Bernanke the essential ingredient in economic life is money demand, which is a gift of the state’s central banking branch, rather than production, savings, innovation and enterprise, which arise on the free market in consequences of millions of workers and businesses pursuing their own ends. Indeed, under Keynesian dogma the latter can be taken for granted; the supply of labor, enterprise and output is automatic and endless until an ethereal quantity called potential GDP is fully realized. To achieve the latter requires that the state dispense exactly the right level of money demand so that the rubes on main street will not stubbornly remain poorer than they need be. This unhappy estate happens, of course, owing to their inexorable propensity to withhold the production and enterprise of which they are capable (i.e. keep plants idle and labor unemployed).

Tolerate? You mean create.

• The Secret Reason The Fed Is ‘Tolerating’ Bubbles (TPit)

Swiss megabank UBS, one of the great beneficiaries of the Fed’s policies, ponders in its latest FX Comments how to deal with asset bubbles, “most importantly in housing markets,” a topic that is a “hotly debated issue among central banks.” Turns out, after nearly six years of printing money and inflicting ZIRP and financial repression on most developed economies, thus creating these asset bubbles in the first place, central bankers find themselves “essentially in an experimental phase.” Shouldn’t they have thought about this before? It seems. But publically, the Fed and other central banks are still vociferously denying that there are any asset bubbles.

In fact, the Fed prides itself in having “healed” the housing market: prices in many cities, including San Francisco, are now substantially higher than they were at the craziest peak of the last housing bubble. So in this environment of pandemic central-bank bubble-denials, UBS writes that “policymakers around the world are struggling with potential asset bubbles” that are “a logical and inevitable consequence of historically unprecedented monetary policies.” It took nearly six years to figure this out? The report goes on:

Asset prices have indeed in many cases reached stunning levels, quite obviously out of line with ‘fundamentals,’ for example in credit or government bond markets. The most dangerous of bubbles are deemed to be those in housing markets as their bursting could wreck whole economies.

Given central-bank focus on enriching those who hold financial assets, identifying asset bubbles is, according to UBS “notoriously difficult.” In fact, it’s larded with risks: once central banks officially identify asset bubbles – not just a little “froth” – they have to do something about them or lose what is termed, as if it had been a great insider joke all along, their credibility. But from the point of view of those who hold these bubbly assets, there is never a right time. They’re their wealth bubbles that would get pricked. So “tolerating them for a bit longer might look tempting given the risk of pricking them at the wrong time,” UBS muses. But even the IMF, the official international bondholder bailout organ, had warned in June that “the era of benign neglect of house price booms is over.”

So how can central banks stop these bubbles they created, while denying that they exist, and even if they did exist, that central banks created them? It’s a bit of a quandary. One option would be to stop printing money and raise interest rates, the classic maneuver, “which would typically have been seen as the first, and possibly only, line of defense,” UBS explains wistfully. But it would wreak all sorts of havoc on the financial markets and deflate the wealth of those who’ve benefited from the money-printing binge.

Nice story there.

• EU Emergency Credit Line Can’t Halt Fear Of Bulgaria Bank Run (Guardian)

Dozens of depositors have withdrawn savings from Bulgaria’s third biggest bank despite assurances from the government and the European Union that their money was safe after a similar run shut down another major lender last week. Bulgarian authorities have arrested four people suspected of trying to destabilise the banking system in a concerted phone and internet campaign. However, the queues forming to withdraw cash have thrown a spotlight on weak economic governance in the EU’s poorest state. A credit line of 3.3bn levs (£1.3bn), requested by Bulgaria, was approved on Monday by the European commission. The EU executive, echoing the International Monetary Fund and economists, said the Bulgarian banking system was “well capitalised and has high levels of liquidity compared to its peers in other member states” of the 28-nation bloc.

President Rosen Plevneliev urged Bulgarians to keep faith with the banks in a national appeal on Sunday after emergency talks with political party leaders and central bank officials. “There is no cause or reason to give way to panic. There is no banking crisis, there is a crisis of trust and there is a criminal attack,” he said. Queues formed nevertheless outside branches of First Investment Bank, although they were smaller than on Friday. The lender says it has sufficient capital to meet clients’ demand. “I am here because I remember what happened nearly 20 years ago,” said one woman aged about 60 who gave her name only as Gergana. She was referring to a financial crisis in 1996-7 which sparked hyperinflation and the collapse of 14 banks. About two-thirds of Bulgaria’s banks are now foreign-owned, in sharp contrast to the mid-1990s.

Don’t worry, someone will come up with a positive spin.

• Eurozone Unemployment Stuck, ‘Recovery’ Stalls (CNBC)

The euro zone’s unemployment rate held steady in May, at 11.6%, in a further sign that the region’s bumpy recovery is struggling to take hold. It followed separate data which revealed that manufacturing activity in the euro zone slid to a seven-month low in June. Some 18.55 million people were unemployed across the currency bloc in May, according to Eurostat data published Tuesday, a fall of 28,000 from April. However this reduction in joblessness was not enough to drive the unemployment rate lower. The lowest unemployment rates were recorded in Austria and Germany, at around 5%. However joblessness remained worryingly high in Greece (26.8% in March 2014) and Spain (25.1%). The youth unemployment rate, meanwhile, came in at 23.3% for the euro zone in May. Joblessness among the under-25s was a particular issue in Greece, Spain and Croatia where the most recent figures put youth unemployment at 57.7%, 54% and 48.7% respectively.

Good graphs from Blodget.

• It’s Time To Remind You About The Possibility Of A Stock Market Crash (BI)

The stock market has had another good year so far. Despite concerns about high prices (from people like me), stocks have meandered higher over the past 6 months. And they are now, once again, setting new all-time highs. That’s good for me, because I own stocks. But I’m not expecting this performance to continue. In fact, the higher stocks move, the more concerned I get about a day (or days) of reckoning. Why? Because the higher stocks move, the farther their prices get farther away from the long-term average. This doesn’t mean the market will crash anytime soon — or ever. But it does mean that, unless it’s “different this time,” stocks are likely to perform very poorly from this level over the next 7-10 years. And it’s not just price that concerns me. There are three basic reasons I think future stock performance will be lousy:

- Stocks are very expensive

- Corporate profit margins are still near record highs

- The Fed is now tightening

Like the title, but don’t get your hopes up, this is from dumb-dumb right wing Telegraph. Still, even Jeremy Warner sees that it’s all debt, and debt only. But he still thinks the UK has enough growth anyway …

• We Must End This Addiction To Debt As The Engine Of Growth (Telegraph)

Growth is back – after a fashion – but debt levels are rising again, productivity growth in advanced economies is close to post- war lows, capital spending is becalmed, and in Britain, inroads into deep fiscal and current account deficits are proceeding only at glacial pace. Is this a sustainable economic model? The answer from the venerable Basel-based Bank for International Settlements is a definitive no. “As history reminds us, there is little appetite for taking the long-term view”, the BIS thunders in its latest annual report. “Few are ready to curb financial booms that make everyone feel illusively richer. Or to hold back on quick fixes for output slowdowns, even if such measures threaten to add fuel to unsustainable financial booms. Or to address balance sheet problems head-on during a bust when seemingly easier policies are on offer. The temptation to go for shortcuts is simply too strong, even if these shortcuts lead nowhere in the end”.

As you can see, the BIS has lost none of none of its penchant for dampening any suggestion of better times to come with another bucket load of gloom. The BIS is, if you like, the conscience of markets, bankers and policymakers, so pessimism and proselytising come naturally. It is the BIS’s job to warn of developing economic risks, however clement the conditions outside seem to be. This gives the central banks’ banker the characteristics of a stopped clock. Much of the time, it is going to be wrong, with the natural exuberance and animal spirits of markets oblivious to its warnings. Twice a day, however, it is going to be right, as indeed it was about the financial crisis, when it came closer than any to predicting the maelstrom to come.

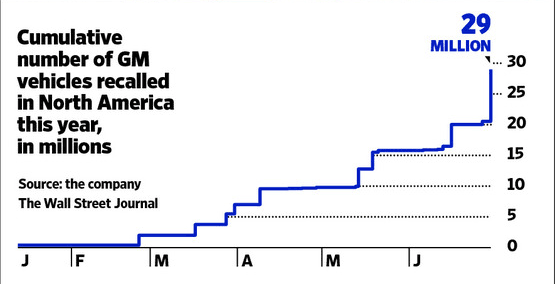

GM recalls more than the company’s combined U.S. sales for the years 2005 through 2013 … What sort of business are they in?

• GM to Recall 8.45 Million More Vehicles in North America (WSJ)

General Motors recalled another 8.5 million vehicles on Monday, including more than 8 million for ignition-switch defects, and said it knew of three deaths in accidents involving the affected cars. The nation’s largest auto maker also boosted its projected charge to earnings for recalls in the current quarter by $500 million to $1.2 billion. Monday’s action boosts to about 29 million cars and trucks that GM has recalled in North America this year – a number greater than the company’s combined U.S. sales for the years 2005 through 2013. The auto maker said it knows of seven crashes, eight injuries and three fatalities involving the cars recalled for the new ignition-switch problems, which includes models as old as 1997.

The fatalities occurred in two crashes involving Chevrolet Impalas in which the air bags failed to deploy, a GM spokesman said. There is no conclusive evidence that the defect caused those crashes, the company said. GM said its dealers will fix the ignition problem by converting the slot on the vehicles’ key head to a small hole, reducing the potential for swinging key chains to move the ignition out of the run position while the cars are being operated. [..] The National Highway Traffic Safety Administration said the ignition defects in the latest round of cars “can result in the air bag not deploying in the event of a crash. Until this recall is performed, customers should use only the ignition key with nothing else on the key ring when operating the vehicle.” The Detroit-based car maker spent $1.3 billion in the first quarter to cover recall costs. The updated second-quarter charge, previously pegged at $700 million, brings the total charges for recall repairs to $2.5 billion this year.

They’re TBTF anyway.

• After BNP, US Targets Range Of Firms On Illicit Money Flows (Reuters)

BNP Paribas’ guilty plea and agreement to pay nearly $9 billion for violating U.S. sanctions is part of a larger U.S. Justice Department shift in strategy that is expected to snare more major banks and other firms across the financial food chain. Two other major French banks, Credit Agricole and Societe Generale, Germany’s Deutsche Bank, and Citigroup’s Banamex unit in Mexico are among those being investigated for possible money laundering or sanctions violations, according to people familiar with the matter and public disclosures. The Justice Department and other U.S. authorities, including the Manhattan District Attorney, are probing Credit Agricole and Societe Generale for potentially violating U.S. economic sanctions imposed against Iran, Cuba and Sudan, one of the sources said. Credit Agricole and SocGen have disclosed that they are reviewing whether they violated U.S. sanctions.

SocGen said in its latest annual report that it is engaged in discussions with the Treasury Department’s Office of Foreign Assets Control over potential sanctions violations. Another source said the Justice Department’s bank integrity unit is deep into a probe of whether Citigroup’s Banamex operation failed to police money transfers across the U.S.-Mexico border. Citigroup has said it is cooperating with the inquiry, which also involves the Federal Deposit Insurance Corp. Separately, Citigroup is investigating an alleged fraud involving $565 million in loans at Banamex and as a result of that has fired a dozen employees. Prosecutors have also investigated potential sanctions breaches at Deutsche Bank, according to people familiar with the probe, though it is unclear how far that has progressed. The bank said in its last annual report that it had received requests for information from regulatory agencies and is cooperating with them.

Saw that coming from 20,000 miles away.

• China Regulators Use Creative Accounting To Boost Bank Lending (Bloomberg)

Chinese regulators increased banks’ capacity to lend money and bolster the slowing economy by changing the way loan-to-deposit ratios are devised. Banks from today can include in the calculation negotiable certificates of deposit sold to companies or individuals, the China Banking Regulatory Commission said in a statement yesterday. They can also exclude loans advanced to small enterprises and the rural sector that are backed by bonds, the CBRC said. Bank lending is capped at no more than 75% of deposits to prevent an overextension of credit. The changes in calculation may allow lenders such as Bank of Communications, which was approaching its limit under the previous methodology, to lower its ratio and advance more loans. Premier Li Keqiang is seeking to cut funding costs and feed credit into the world’s second-largest economy, which is forecast to expand in 2014 at the weakest pace in 24 years.

Easing the loan-to-deposit requirements “will help amplify lending, especially for banks that focus on small and medium-sized enterprises,” Richard Cao, a Shenzhen-based analyst at Guotai Junan Securities Co., said by phone. “This is an extension of the latest round of targeted easing.” Bank share performance was mixed today as the change fell short of market expectations for the inclusion of some interbank deposits in the calculation, according to analysts at HSBC and China International Capital. Banks can also exclude from the ratio calculation some loans backed by bonds with at least one year of maturity, and credit backed by funding from international financial organizations and foreign governments, the CBRC said. Rural banks can take out loans funded by their largest shareholder that were offered to farmers and smaller companies. Locally incorporated foreign banks can include among their deposits funding put in place by their parents for more than a year, according to the statement.

Just what we need: more bank profits. Guess who pays.

• Global Bank Profits Hit $920 Billion As Chinese Lenders Boom (Reuters)

China’s top banks accounted for almost one-third of a record $920 billion of profits made by the world’s top 1000 banks last year, showing their rise in power since the financial crisis, a survey showed on Monday. China’s banks made $292 billion in aggregate pretax profit last year, or 32% of the industry’s global earnings, according to The Banker magazine’s annual rankings of the profits and capital strength of the world’s biggest 1,000 banks. Last year’s global profits were up 23% from the previous year to their highest ever level, led by profits of $55 billion at Industrial and Commercial Bank of China (ICBC). China Construction Bank, Agriculture Bank of China and Bank of China filled the top four positions.

Banks in the United States made aggregate profits of $183 billion, or 20% of the global tally, led by Wells Fargo’s earnings of $32 billion. Banks in the eurozone contributed just 3% to the global profit pool, down from 25% before the 2008 financial crisis, the study showed. Italian banks lost $35 billion in aggregate last year, the worst performance by any country. Banks in Japan made $64 billion of profit last year, or 7% of the global total, followed by banks in Canada, France and Australia ($39 billion in each country), Brazil ($26 billion) and Britain ($22 billion), The Banker said.

Two articles that write up the same gloomy report.

• Insurer Warns Some Pooled Pensions Are Beyond Recovery (NY Times)

More than a million people risk losing their federally insured pensions in just a few years despite recent stock market gains and a strengthening economy, a new government study said on Monday. The people at risk have earned pensions in multiemployer plans, in which many companies band together with a union to provide benefits under collective bargaining. Such pensions were long considered exceptionally safe, but the Pension Benefit Guaranty Corporation reported in its study that some plans are now in their death throes and cannot recover. Bailing out those plans seems highly unlikely. But if they are simply left to die, the collapse of the federal insurance program is all but inevitable, the report said, leaving retirees in failed plans with nothing.

It added that the program “is more likely than not to run out of money within the next eight years” as plan after plan collapses. The multiemployer pension sector, which covers 10 million Americans, represents a mixed bag of financial strength and weakness. The aging of the work force, the decline of unions, deregulation and two big stock crashes have all taken a grievous toll. Ten percent of the people covered are in severely underfunded plans, the study said. The federal insurer is not making any recommendations about what to do at the moment, said Joshua Gotbaum, its director. “This is a legally required actuarial report whose purpose is solely to project the range of outcomes for plans and the P.B.G.C.”

• Federal Pension Plan Safety Net Faces Severe Funds Squeeze (WSJ)

The federal safety net for a type of private-sector pension plan common in the transportation, construction and other industries is at risk of collapse in coming years, according to a report released Monday. Such an outcome has the potential to affect more than a million people. The federal Pension Benefit Guaranty Corp. program that covers multi-employer pensions “is more likely than not to run out of funds in eight years, and highly likely to do so within 10 years,” the agency said in releasing new projections. The PBGC collects insurance premiums from employers that offer the pensions and helps retirees in insolvent plans by paying them reduced pensions. But the likely failure of several big plans means that the PBGC’s limited resources for helping retirees in failed multi-employer plans likely will be tapped out in coming years.

This year’s report estimates that the $8.3 billion long-term deficit the federal backup plan for multi-employer plans faced in fiscal year 2013 will widen to $49.6 billion by fiscal year 2023. The deficits don’t mean that the backup plan can’t pay now. The PBGC’s new projections “show that insolvencies affecting more than a million of the 10.4 million people in multi-employer plans are now both more likely and more imminent,” the PBGC said. This year’s PBGC projections rely on a new methodology that the agency regards as more realistic about what troubled pension funds can and can’t do to shore themselves up—for instance, plans could raise employer-contribution requirements, but that would tend to drive off remaining participants, accelerating the downward spiral. The options for lawmakers are politically difficult. Bailouts of troubled plans or of the safety-net program itself could spark a backlash among voters, while forcing benefit cuts on beneficiaries—particularly current retirees—would be painful and unpopular.

No kidding.

• Ancient Baby Boom Reveals Dangers Of Population Growth (HNGN)

Researchers mapped out one of the oldest-known baby booms in North American history. The “growth blip” occurred among southwestern Native Americans between 500 and 1300 A.D. A crash in the baby boom is believed to have followed soon after, Washington State University reported. To make their findings the researchers looked at data on thousands of remains from hundreds of sites across the U.S. The team assembled a detailed Neolithic Demographic Transition in which the area’s stone tools reflect a cultural transition from cutting meat to pounding grain. “It’s the first step towards all the trappings of civilization that we currently see,” Tim Kohler, WSU Regents professor of anthropology, said. Maize is believed to have been grown in the region as early as the year 2000 B.C., by 400 B.C. the crop is believed to have made up 80% of the peoples’ calories. At this time birth rates were on the rise, and continued to climb until 500 A.D.

Around 900 A.D. populations remained high but birth rates started to fluctuate. One of the largest-known droughts occurred in the Southwest occurred in the mid-1100s. Even in this time of conflict birth rates remained high. “They didn’t slow down — birth rates were expanding right up to the depopulation,” Kohler said. “Why not limit growth? Maybe groups needed to be big to protect their villages and fields.” “It was a trap,” he said. “A Malthusian trap but also a violence trap.” The northern southwest contained about 40,000 people mid-1200s, but only 30 years later it was mysteriously empty. The population may have been too large to feed itself as the climate changed, causing the society to collapse. As people began to leave it would have been difficult maintain the social unity required for the population to defend themselves and obtain new infrastructure. “Population growth has its consequences,” the researcher said.

“The Colorado is essentially a dying river. Ultimately, Las Vegas and our civilisation in the American South West is going to disappear, like the Indians did before us.”

• The Race To Stop Las Vegas From Running Dry (Telegraph)

Outside Las Vegas’s Bellagio hotel tourists gasp in amazement as fountains shoot 500ft into the air, performing a spectacular dance in time to the music of Frank Sinatra. Gondolas ferry honeymooners around canals modelled on those of Venice, Roman-themed swimming pools stretch for acres, and thousands of sprinklers keep golf courses lush in the middle of the desert. But, as with many things in Sin City, the apparently endless supply of water is an illusion. America’s most decadent destination has been engaged in a potentially catastrophic gamble with nature and now, 14 years into a devastating drought, it is on the verge of losing it all. “The situation is as bad as you can imagine,” said Tim Barnett, a climate scientist at the Scripps Institution of Oceanography. “It’s just going to be screwed. And relatively quickly. Unless it can find a way to get more water from somewhere Las Vegas is out of business. Yet they’re still building, which is stupid.”

The crisis stems from the Las Vegas’s complete reliance on Lake Mead, America’s largest reservoir, which was created by the Hoover Dam in 1936 – after which it took six years to fill completely. It is located 25 miles outside the city and supplies 90% of its water. But over the last decade, as Las Vegas’s population has grown by 400,000 to two million, Lake Mead has slowly been drained of four trillion gallons of water and is now well under half full. […]

100% of California is now classified as in “severe drought” and rivers are so low 27 million young migrating salmon are having to be taken to the ocean in trucks. Nevada and California are just two of seven states that rely for water on the 1,450-mile Colorado River, which rises in the Rocky Mountains and used to empty into the Gulf of California in Mexico – but which now rarely reaches the sea, running dry before that. In 1922 seven US states – California, Nevada, Arizona, Wyoming, Utah, Colorado and New Mexico – first divided up how much river water each could use, and the amounts have been bitterly contested ever since, including by Mexico, which also takes water from it. One proposal is for landlocked Nevada to pay billions of dollars to build solar-powered desalination plants in the Pacific off Mexico, taking Mexico’s share of Colorado River water in exchange. But Mr Mrowka said: “The Colorado is essentially a dying river. Ultimately, Las Vegas and our civilisation in the American South West is going to disappear, like the Indians did before us.”

More sad.

• Emperor Penguins Waddling To Extinction (AFP)

Global warming will send Antarctica’s emperor penguins into decline by 2100, scientists project, calling for the emblematic birds to be listed as endangered and their habitat better protected. The world’s largest penguin species came to global fame with a 2005 documentary, March of the Penguins, portraying their annual trek across the icy wastes, and the 2006 cartoon movie Happy Feet. The new study sheds light on the birds’ reliance on sea ice for breeding and raising their young. The ice also protects their prey – fish and krill – by maintaining the food chain. Declining sea ice caused by climate change would place all 45 known emperor penguin colonies into decline by 2100, according to the population simulation.

“At least two-thirds (of colonies) are projected to have declined by (more than) 50% from their current size” by the end of the century, said the paper published in the journal Nature Climate Change. Dynamics differ between colonies, but “the global population is projected to have declined by at least 19%,” after growing 10% up to 2048, it added. The team said colonies located between the eastern Wedell Sea and the western Indian Ocean will see the biggest declines, while those in the Ross Sea will be least affected. In fact, the Ross Sea penguin population will continue to grow until 2100, after which the trend will reverse. “Our results indicated that at least 75% of the emperor penguin colonies are at least vulnerable to future sea ice change, and 20% will probably be quasi-extinct by 2100,” the paper said.

Long and detailed article, part 1 of a series.

• The Human Cost Of China’s Untold Soil Pollution Problem (Guardian)

Soil pollution has received relatively little public attention in China. Despite the fact that it poses as big a threat to health as the more widely covered air and water pollution, data on soil pollution has been so closely guarded that it has been officially categorised as a “state secret”. Until recently the Chinese government also resisted media efforts to draw attention to local cancer epidemics in China’s newly industrial areas. It was not until February 2013 that the Ministry of Environmental Protection (MEP) finally admitted that “cancer villages” existed in China, and released a list that included the area around Lake Tai and the villages of Fenshui and Zhoutie. Some civil society experts have estimated that there are 450 cancer villages in China, and believe the phenomenon is spreading.

The story of the cancer hotspot of Yixing is characteristic: in the rush to develop that engulfed China from the 1990s, local officials were eager to invite factories and chemical plants into the area, and their already weak environmental controls were often disregarded entirely. “Government officials just care about GDP,” Zhang complained. “They were happy to welcome any polluting firm.” So, for a time, were the villagers who found jobs in the new factories. The first real signs of the troubles to come were in Lake Tai itself, and were the subject of a long campaign by another resident of Yixing township, the fisherman turned environmentalist Wu Lihong. In the early 1990s, Wu grew worried about the deterioration of Lake Tai’s once famously pure waters. He organised a local environmental monitoring group that he called Defenders of Tai Lake, to collect water samples from the lake and its feeder rivers.

Home › Forums › Debt Rattle Jul 1 2014: Lowest Rates in 500 Years, Oil Shortages in 10 Years