Jack Delano Dear Folks … Greenville, SC. Air Service Command July 1943

I’ve done it before, but I’ll gladly revisit Yeats’ prophetic Second Coming written 95 years ago, because it contains truths about mankind that we will see emerge as we move forward. The line “Things fall apart; The centre cannot hold” will illustrate, and become, one of the leading drivers in the world as we used to know it. This is as true for, to pick an example, the EU, as it is for central bank policies. Both must diverge according to differing interests in different nations, and there’s nothing anyone can do about it, including central bank governors and political leaders. The latter will even choose to let the center fall apart if and when it seems to suit their popularity and election gains. British PM David Cameron serves as a nice example:

Cameron Risks Deeper EU Rift in Pact With Anti-Merkel AfD

U.K. Prime Minister David Cameron risked deeper isolation in the European Union as his party was drawn into a political alliance with an upstart German group that opposes Chancellor Angela Merkel. Cameron’s Conservatives will sit in the European Parliament alongside the “Alternative for Germany,” an anti-euro party which assails Merkel for wasting taxpayers’ money on bailing out southern European economies during the sovereign debt crisis. The outcome, announced today, alienates Britain’s key European ally at a time when Cameron is counting on Merkel to help keep the U.K. in the EU. The prime minister needs German help to shift the bloc toward freer trade and less regulation, while backing his drive to win back powers from Brussels. Cameron “is putting that key relationship at huge risk,” said Pawel Swieboda, head of the Warsaw-based Center for European Strategy.

Yesterday, Ambrose Evans-Pritchard wrote in There Is Life After Europe, But Let Us Stop The Triumphalism that there is only one way forward for those who want to keep the EU going, which is ever closer centralization, and since that is, will be and always was unacceptable for Britain, why not cut the umbilical cord right here and now and get it over with? In my view, he’s spot on in that one. I just wish Italy, Greece and Spain would draw the same conclusion. Britain has a referendum on EU membership soon, and as if that’s not bad enough for the establishment, first they have one on Scotland becoming independent. I tell ya, this will be the theme: people wanting independence. There was a line of people many miles long in Basque country this week to claim independence, Catalunya still wants it, there are dozens of movements across Europe who want it, and with zero chance the EU center will hold politically, many of them will get what they want in the rubble of the Union falling to pieces.

Let’s move to central banks. A very interesting piece at MarketWatch describes how politics decide policies at the supposedly independent (there’s that word again) ECB. the gist of the story: ECB head Mario Draghi is set to succeed Italian president Napolitano at around the latter’s 90th birthday (soon), Bundesbank head Jens Weidmann will succeed Draghi, and last week’s oh-so dramatic and historic ECB moves were the last there will be for now. No all-out bond buying that the markets desire.

The Backroom Deal That Took Bazooka Out Of ECB’s Hands

The Bundesbank’s approval for last week’s European Central Bank package of liquidity measures and interest-rate cuts into negative territory appears to be part of a wider-ranging realignment of responsibilities on the European scene. A series of interlinked initiatives could consolidate the position of reform-minded leaders in key areas of European policy-making, reinforcing economic and monetary union by eventually installing a German leader at the helm of the ECB. By limiting the cut in the ECB’s main interest rates to only 0.10%, and agreeing that rates have now reached their floor in Europe, Mario Draghi and Jens Weidmann, the presidents of the ECB and the Bundesbank, have effectively ended sporadic skirmishing that erupted after they took their jobs in 2011.

What Merkel and Weidmann may still allow before taking over full control of EU finances is buying up some the European too big to fail banks’ used toilet paper:

Banks to Get EU Approval to Use Wider Range of ABS Debt

European Union banks are set to win the right to use a wider range of asset-backed debt to meet their liquidity requirements as the bloc hunts for ways to boost the market for such securities. The European Commission is advocating that securitizations of loans to small businesses and consumers including car buyers should be allowed to count for as much as 15% of the buffers banks will be required to hold under the rule, according to an EU document obtained by Bloomberg News. Limits to the asset-backed debt that will be allowed would include that it must be from the “most senior tranche” of the securitization, that the instruments must have an issue size of at least $135 million and that the “remaining weighted average time to maturity is 5 years or less,” according to the document, prepared for a June 16 meeting with national experts.

Not just a minor detail, but still a sign the central bank policies have no – coordinated – center left to hold on to. Europe doesn’t want QE, but will go a ways to do what it can other than that to at least create the impression it seeks to ward off deflation. The Fed threatens to go the opposite way, says for instance Scotiabank:

An Earlier End To QE? (ScotiaBank)

The FOMC should (and might) accelerate the pace of QE reductions to $15 billion on Wednesday (June 18th). Furthermore, at its meeting on July 30th, the FOMC could – and should -announce a similar-sized reduction for the subsequent two months. Hence, the Fed would not have to wait until its September 17th meeting to announce the final leg. QE would then end two months earlier at the end of August rather than the end of October as markets currently expect. Such a path would generally afford the FOMC more freedoms, particularly at the September 17th press conference meeting. [..]

The Fed has indicated that it is “not of a pre-set course”. There are advantages of keeping investors on their toes and having them believe that the FOMC is nimble and flexible. In addition, it is likely that the Fed does not want to make the same mistakes made from 2004-2006 when it had become too predictable. The Fed should accelerate the QE withdrawal not just because it is currently being provided with the economic, geo-political, and market cover to do so, but also because the risks to financial stability are intensifying with the rise in the size of its balance sheet. Central bank-induced moral hazard continues to motivate risk-seekers and fuel asset inflation.

And Yellen et al think they have found the antidote to halting the stimulus too:

Fed Prepares to Keep Super-Sized Balance Sheet for Years to Come

Federal Reserve officials, concerned that selling bonds from their $4.3 trillion portfolio could crush the U.S. recovery, are preparing to keep their balance sheet close to record levels for years. Central bankers are stepping back from a three-year-old strategy for an exit from the unprecedented easing they deployed to battle the worst recession since the Great Depression. Minutes of their last meeting in April made no mention of asset sales. Officials worry that such sales would spark an abrupt increase in long-term interest rates, making it more expensive for consumers to buy goods on credit and companies to invest, according to James Bullard, president of the Federal Reserve Bank of St. Louis. That “is a widespread view in parts of the Fed, I think, and in financial markets,” Bullard said in an interview last week. While he disagrees with that perspective, it “won the day.”

The Fed is testing new tools that would allow it to keep a large balance sheet even after it raises short-term interest rates, a step policy makers anticipate taking next year. They would use these tools to drain excess reserves temporarily from the banking system. “It is pretty clear they are anticipating operating in a situation with a lot of reserves and a high balance sheet for a long time,” said former Fed governor Laurence Meyer, co-founder of Macroeconomic Advisers. The strategy, which would make the Fed one of the biggest players in money markets, carries risks. In a time of crisis, investors could flock to safe short-term instruments created by the Fed, potentially starving the rest of the financial system of funding. “The whole situation has created a lot of uncertainty,” said Karl Haeling at Landesbank Baden-Wuerttemberg in New York. “The Fed is increasingly stepping into what had been a private-sector function.”

The Fed’s asset purchases have expanded its balance sheet to 25% of gross domestic product from 6% at the start of 2007. Central banks from Japan to the U.K. also will have to develop strategies for operating with large portfolios. For example, the Bank of England’s is 24% of GDP, up from about 6% in 2007. “Ambitious use of a central bank’s balance sheet to channel credit to particular economic sectors or entities threatens to entangle the central bank in distributional politics and place the bank’s independence at risk,” Richmond Fed president Jeffrey Lacker, one of the biggest internal critics of the policy, said in a May 13 speech. The Fed’s purchases created $2.54 trillion of bank reserves in excess of what lenders are required to hold against deposits. The central bank needs to tie up or extinguish that money to raise the short-term interest rate above its current range of zero to 0.25%.

When I read stuff like that, I think the galls and guys at the Fed think they still rule the world. But I don’t think so, and maybe the best proof of that is that the Bank of Japan has eerily similar ideas:

Bank of Japan Mulls Keeping Big Balance Sheet After Target

Bank of Japan officials are considering maintaining a large balance sheet for the central bank even after it achieves its inflation target, reducing the risk of a surge in long-term bond yields, according to people familiar with the discussions. Under the potential strategy, the BOJ would use cash from maturing securities in its portfolio to buy long-term government debt, the people said, asking not to be named as the talks are private. Governor Haruhiko Kuroda and his colleagues have yet to meet their inflation target, and pledge to continue asset purchases until consumer prices are rising at a 2% pace.

The possibility of permanently large balance sheets – in Japan’s case, now amounting to more than half the size of the economy – may become a global legacy of unprecedented stimulus measures. “There’s no need for the BOJ balance sheet to go back to where it was,” said Hiromichi Shirakawa, chief Japan economist at Credit Suisse in Tokyo and a former central bank official. “It’s a realistic approach to keep the size of the balance sheet large for a while to avoid a spike in yields.” Any abrupt end to government bond purchases by Japan’s central bank could send borrowing costs soaring, because the BOJ currently purchases the equivalent of about 70% of the new securities issued.

These people think they own the planet. My one big issue with all these bloated balance sheets held forever is that is they work so well, why do the present leadership think their predecessors never went down that road? Do they think they’re that much smarter? Does Yellen see herself miles above Paul Volcker? The idea in Japan seems to be that buying up whatever you can while hugely increasing the money supply is the way to go if you want to beat down deflation. But without increase spending, velocity of money, you’re just going to create mayhem and uncertainty, will push velocity down, not up. As we saw yesterday, the Japanese are so stretched they’re using their savings on a massive scale just to keep their heads above water. But Shinzo Abe has his career all on red, so he must be ready to go down with his bet. And he will. And drag millions of elderly Japanese with him as he uses their pensions in a final and fatal bid to buy stocks from domestic businesses that have seen people buy less of their products for 20 years or more now. There are limits in the extent to which you can distort an economy, but central bankers are too megalomaniac too see them. Take China:

China Ramps Up Spending To Spur Economy

China’s central bank said on Wednesday it will keep monetary policy steady in 2014, even as the finance ministry said fiscal spending had surged nearly 25% in May from a year earlier, highlighting government efforts to energize the slowing economy. Total fiscal spending in May rose to 1.3 trillion yuan ($208.75 billion), quickening sharply from a 9.6% rise in the first four months of the year. China’s cabinet also revealed on Wednesday that it was now planning more big infrastructure projects, including highways, train networks and oil and gas distribution and storage facilities … The higher spending comes after the world’s second-biggest economy got off to a soft start to the year, growing at its slowest pace in 18 months in the first quarter. [..] … the recovery appears patchy and analysts do not rule out further stimulus measures, especially if the cooling property market starts to deteriorate rapidly.

Fiscal revenues rose 7.2% in May from the same month last year, slowing from a 9.2% rise in April. The ministry attributed the slower revenue growth in May to the slowdown in the economy and falling property transactions. [..] The PBOC’s pursuit of stable monetary policy contrasts strongly with the finance ministry’s mini-stimulus, which saw total fiscal spending rise 24.6% to 1.3 trillion yuan ($208.75 billion) in May as it brought forward spending sharply, from growth of 9.6% in the first four months of the year. Stimulus measures taken so far by Beijing include speeding up the construction of railway projects and public housing, as well as orders to local governments to fast-forward their fiscal spending to prime the economy for growth. Central government spending rose 15.8% in May from a year earlier while local government expenditure soared 26.9%, the finance ministry said.

The ECB is doing the watch the hand thing. Big words without much moolah behind them. The Fed looks so divided that a QE wind-down, probably an accelerated one, seems cast in stone, and the one thing that gets a majority of the votes is to hold what’s there until hell freezes over. But China and Japan don’t have the luxury of thinking that they’re doing relatively well – whether that thought is accurate or not -. They think that printing can make – make that force – people spend their money. Whether they have it or not. The US economy is being held up a bit by an increase in credit card debt. The EU focuses on Germany, attempts to ignore the PIIGS numbers, and finds itself in a German induced stalemate at least until Draghi’s gone. While at the same time ignoring separatist voices that are a much bigger threat to Brussels than the powers that be allow themselves to realize.

In China and Japan, the leadership finds itself in a struggle for bare survival. That’s a whole other story, and it will lead to whole other, and increasingly different, central bank policies, this year and next and next. That should be fun to watch. Perhaps the following example will make someone somewhere take a second look:

It May Be Four Rate Hikes In A Row For New Zealand (CNBC)

New Zealand’s central bank delivered its third consecutive rate hike on Thursday, and it’s likely to make that four in a row judging by hawkish comments, some analysts say. The Reserve Bank of New Zealand (RBNZ) lifted its key interest rate by 25 basis points to 3.25%. While that move was not a surprise, analysts had expected the central bank to suggest a slowdown in the pace of monetary tightening. Instead policy makers said further rate increases would be needed to curb inflation in a robust economy. “Effectively, the RBNZ is a lot more focused on domestic mortgage rates. There’s been a lot of competition in the domestic mortgage market in New Zealand which has been pushing rates down,” said Robert Rennie, the global head of foreign exchange strategy at Westpac Bank in Sydney. “The RBNZ is unhappy with that and there is a risk that we see another rate hike in July, which would make it four in a row,” he added.

New Zealand is the only developed economy in the world raising interest rates in the current economic cycle. Last week, the European Central Bank cut its key interest rate to a record low of 0.15%; the Bank of Japan continues to pump money into the economy in a fight against deflation. The U.S. Federal Reserve meanwhile is unwinding its asset-purchasing program but continues to keep its key rate at zero%. “Some of these economies in Asia are doing better so it makes sense for them to be raising rates,” Nariman Behravesh, chief economist at IHS, told CNBC. Consumer prices in New Zealand rose an annual 1.5% in the first in the year to March 31, down from 1.6% in the fourth quarter of 2013.

The Second Coming

Turning and turning in the widening gyre

The falcon cannot hear the falconer;

Things fall apart; the centre cannot hold;

Mere anarchy is loosed upon the world,

The blood-dimmed tide is loosed, and everywhere

The ceremony of innocence is drowned;

The best lack all conviction, while the worst

Are full of passionate intensity.

Just how insane is this? No really!

• There Are over 52 Million Vacant Homes in Chinese Cities (WSJ)

More than one in five homes in China’s urban areas is vacant, and a current housing-price correction is putting additional pressure on the owners of such empty properties, according to a nationwide survey by researchers from China’s Southwestern University of Finance and Economics. The vacancy rate of sold residential homes in urban areas reached 22.4% in 2013, or 49 million homes, up from 20.6% in 2011, according to the Survey and Research Center for China Household Finance, which conducted the analysis. The researchers surveyed households in 262 counties in 29 provinces, an expanded sample compared with 2011’s survey of households in 80 counties. As of August 2013, the amount of outstanding mortgage loans on vacant homes in China reached 4.2 trillion yuan ($674.33 billion), the report added.

The survey included homes left vacant by owners of multiple homes as well as those left empty by owners who have left the city to work elsewhere. In addition to the 49 million sold but vacant units, the survey estimated that China has 3.5 million homes that remain unsold. The survey said that vacant homes are more likely to add to homeowners’ burden and cause them to suffer a financial loss. If home prices fall by 30%, 11.2% of the vacant homes would be underwater on their mortgages, compared with just 3.3% of occupied homes, it said. While most Chinese cities have shown only mild home-price declines so far, many analysts are concerned that sustained price falls could result in more homeowners holding mortgages that exceed the value of their homes. [..] Another property survey released last month by brokerage CLSA Research found that 15% of homes completed in the past five years, or 10.2 million units, are vacant.

• An Earlier End To QE? (ScotiaBank)

The FOMC should (and might) accelerate the pace of QE reductions to $15 billion on Wednesday (June 18th). Furthermore, at its meeting on July 30th, the FOMC could – and should -announce a similar-sized reduction for the subsequent two months. Hence, the Fed would not have to wait until its September 17th meeting to announce the final leg. QE would then end two months earlier at the end of August rather than the end of October as markets currently expect. Such a path would generally afford the FOMC more freedoms, particularly at the September17th press conference meeting.

There are of plenty of reasons to justify such a move: global interest rates are near historical lows levels; equity markets are at record high levels; the FTSE All-World index closing at an all-time high yesterday; the decade-low in volatility indices; the 6.3% Unemployment Rate; employment gains averaging 250K over the last two months; GDP forecasts for the remaining three quarters of 2014 fluctuating around 3% following the ‘transitory’ Q1 weather-induced slow down; the current lull (or temporary decline) in Ukrainian and Geo-political tensions; and lastly, the ECB accepting the stimulus baton. Remember, FOMC guidance last year prophesied that QE was expected to come to an end when the unemployment rate hit 7% and the first hike would occur when the rate hit 6.5%. In regards to this measurement, even the most dovish members have surprised themselves.

The Fed has indicated that it is “not of a pre-set course”. There are advantages of keeping investors on their toes and having them believe that the FOMC is nimble and flexible. In addition, it is likely that the Fed does not want to make the same mistakes made from 2004-2006 when it had become too predictable. The Fed should accelerate the QE withdrawal not just because it is currently being provided with the economic, geo- political, and market cover to do so, but also because the risks to financial stability are intensifying with the rise in the size of its balance sheet. Central bank-induced moral hazard continues to motivate risk-seekers and fuel asset inflation. Even the uber-doves on the FOMC are beginning to discuss with greater frequency the potential risks from Fed policy and the ‘froth’ in financial markets.

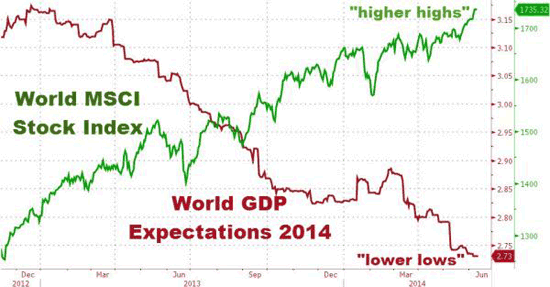

Good graph to follow.

• Global Death Cross Accelerates As World Bank Slashes Growth (Zero Hedge)

The World Bank joined the hallowed ranks of the IMF and admitted it was clueless last night, slashing growth estimates for every developed and developing nation from Brazil to the US. The “bumpy start” as they called it merely exacerbated what is now becoming a dismal joke as the death cross of GDP growth expectations and world stock market valuations diverge in an ever more fragile manner.

Bad sign.

• US New Commercial Loans Plunge Most Since Lehman (Zero Hedge)

Roughly two months ago, when we compared the loan data released by America’s largest, TBTF banks, and what the Fed’s own commercial bank data revealed in its weekly H.8 statement, we asked a simple question: “Is The Fed Fabricating Loan Creation Data?” Our summary then:

Is the Fed fabricating loan level data? Or, less dramatically, is the Fed merely once again goalseeking its weekly “data” to account for a world in which deposit expansion is no longer running at the pace seen in pre-taper days. It would be logical that the one “plug” the Fed would adjust to balance off its model is to boost lending activity, which would explain why the Fed is suggesting lending is surging. Unfortunately, lending is not only not surging, it is contracting, if only among the Big 4 banks in the first quarter. So whether the Fed has an ulterior motive, or is simply fudging for a lowered Fed reserve creation growth trendline, we believe the people deserve an answer: just what is really going on here?

Why is this data so important? Because absent a pick up in commercial bank lending, which should eventually match and surpass the amount of bank “assets” created by the Fed’s QE (which in 2013 amounted to $255 billion per quarter), then bank liabilities can’t grow nearly as fast, and as we showed earlier this week, neither can US GDP which is directly correlated to the amount of commercial bank liabilities in circulation. In other words, more than anything else, it is loan creation – i.e., money creation in its conventional pathway, via commercial banks not via the mutant, aborted process in which the Fed creates money only to ramp asset values – that is so critical for real, not artificial, not manipulated, US economic growth.

???

• Japan To Keep Printing Money For Years To Come, So Learn To Enjoy It (AEP)

There are no one-way bets in global finance, but Japan’s stock market comes close. The authorities are about to funnel large sums into Japanese stocks openly and deliberately under the next phase of Abenomics, both by regulatory fiat and by purchasing the Nikkei index directly with printed money. Prime minister Shinzo Abe is unshackling the world’s biggest stash of savings, the $1.3 trillion Government Pension Investment Fund (GPIF). Officials say the ceiling on equity holdings will rise from 12% to around 20% as soon as August, opening the way for a $100 billion buying blitz. Fund managers are suddenly in a race to get there first. Japan Post Bank – where Mrs Watanabe dutifully places the family money, confiscated from her Salaryman each month before he can spend it – is itching to rotate more of its $2 trillion holdings into equities before inflation pummels the bond market. So is Japan Post Insurance, no minnow either at $850 billion.

Mr Abe’s move comes sooner than expected and amounts to a market shock, though nobody should be shocked anymore as he keeps doubling down on the world’s most radical economic experiment. The Nikkei index stalled in December after rising almost 100% since September 2012, even though the Bank of Japan is still showering the economy with money, buying $75 billion of bonds each month. The BoJ’s balance sheet will reach 70% of GDP by March 2015, 3x the US Fed’s. The index is down 7% this year to 15,000, chiefly because foreigners have taken profits and pulled out $140 billion, causing some to write off Abenomics as a flop. Japan’s trust banks are picking up the baton. They added a record $2.5 billion last week, some of it on behalf of the GPIF itself as it adapts to the new order.

• Bank of Japan Mulls Keeping Big Balance Sheet After Target (Bloomberg)

Bank of Japan officials are considering maintaining a large balance sheet for the central bank even after it achieves its inflation target, reducing the risk of a surge in long-term bond yields, according to people familiar with the discussions. Under the potential strategy, the BOJ would use cash from maturing securities in its portfolio to buy long-term government debt, the people said, asking not to be named as the talks are private. Governor Haruhiko Kuroda and his colleagues have yet to meet their inflation target, and pledge to continue asset purchases until consumer prices are rising at a 2% pace. The possibility of permanently large balance sheets – in Japan’s case, now amounting to more than half the size of the economy – may become a global legacy of unprecedented stimulus measures. The BOJ discussions parallel preparations at the Federal Reserve to avoid an exit strategy of asset sales.

“There’s no need for the BOJ balance sheet to go back to where it was,” said Hiromichi Shirakawa, chief Japan economist at Credit Suisse Group AG in Tokyo and a former central bank official. “It’s a realistic approach to keep the size of the balance sheet large for a while to avoid a spike in yields.” Any abrupt end to government bond purchases by Japan’s central bank could send borrowing costs soaring, because the BOJ currently purchases the equivalent of about 70% of the new securities issued. Kuroda has repeatedly said it’s too early to map out an exit strategy from stimulus. The central bank’s balance sheet has expanded to 52% of gross domestic product since Kuroda unleashed record easing in April 2013, compared with 25% for the Fed and 24% for the Bank of England. The BOJ held 165 trillion yen ($1.6 trillion) of long-term Japanese government bonds as of May 31.

How can this NOT be all over?

• China Metal Financing Fears Spread To Singapore (FT)

An investigation into metals financing in a northeastern Chinese port city has cast a chill in Singapore, where a surge of business financing imports into China has bankers increasingly worried. A Chinese company’s alleged use of metal as collateral to get loans from several international banks shows that commodity-backed loans are not as safe as bankers assumed. More and more of these loans originate from Singapore as international banks move their China business out of Hong Kong, leading Chinese firms to set up shop in the tropical entrepot to tap offshore dollar liquidity. Last week, Qingdao Port said police had opened an investigation into alumina and copper held at Dagang Port, one of several ports under its management. Traders rushed to move metal out of Qingdao. Chen Jihong, founder of aluminium producer Dezheng Resources, was detained by Chinese authorities several weeks ago in connection with a different investigation in another province, people familiar with the matter in Qingdao said.

His disappearance caused banks to check their exposure to his firm, and suspect that the same metal had been pledged multiple times by one or more of its subsidiaries. The case highlights what bankers do not know about their clients in China. “Usually if there was a government crackdown on import financing the internal risk managers weren’t that worried because they thought the loans were safe. The possibility of a fraud has risk managers a lot more concerned,” said metals analyst Sijin Cheng, of Barclays in Singapore. Foreign banks are confident lending money at international interest rates to Chinese commodity importers if they have secured the loans. International traders often help, splitting the difference between the cost of the foreign currency loan and the higher interest rates in China.

Lovely!

• China Checks Strategic Commodities Reserves Amid Qingdao Probe (Bloomberg)

The Chinese agency that stockpiles strategic commodities is checking to ensure its copper purchases are free of collateral risks amid an investigation of metals at Qingdao Port, said people with knowledge of the matter. The State Reserve Bureau bought at least 200,000 metric tons of copper from bonded storage areas in March and April, said the people, who asked not to be identified because they aren’t authorized to speak publicly about the information.The agency joins banks including Standard Chartered Plc, Citigroup Inc. and Standard Bank Group in reviewing potential fallout from Qingdao, where public security authorities are examining alleged fraud involving metals pledged as collateral to obtain loans.

Copper futures in London fell for the first time in three days amid concern that the probe will curb demand for the metal. “The easing in copper prices is a continuation of the uncertainty enveloping the market in the wake of the China port inventory situation,” said Gavin Wendt, founder and senior resource analyst at Sydney-based Mine Life Pty. “Externally there are positive indicators in terms of growth statistics, both in China and the U.S., but these are being overshadowed by what’s going on in terms of the port situation.”

Everthing they do goes awry.

• China Bond Auction Fails As PBOC Stifles Carry Trades (Zero Hedge)

It appears the PBOC is hell-bent on destroying any trend idea for carry traders to jump on. After 4 days of strengthening the CNY… and sell-side strategists already jumping on the new trend bandwagon with trade recommendations, the PBOC surprised last night and weakened the currency fixing. It is clear from this action that the PBOC is serious about stopping the hot flows… the problem is, it has consequences. Last night saw China unable to sell its entire 1 year bond offering (even at a rate of 3.32% – dramatically higher than European or US short-dated debt). Copper prices have stumbled, USDJPY is fading and US equities doing the same for now as carry unwind butterflies flapping their wings in onshore CNY can cause hurricanes in global liquidity fed capital markets.

After 4 days of strengthening the CNY fix, the PBOC weakened it last night – throwing trend followers off completely… But this meant, unable to hedge the FX exposure, demand for bonds was subdued… *CHINA MOF FAILS TO SELL SOME 1-YEAR BONDS, TRADER SAY Even as they offered 3.32% (plenty of yield for anyone desperate)… Which led to major Copper weakness… And the ubiquitous JPY carry over which is driving US stocks… With increasing chatter of an earlier withdrawal from QE in the US and now the PBOC really stirring the pot, perhaps the new normal is about to morph into a status quo attempting to increase uncertainty – instead of suppress volatility – as we noted previously. As we recently noted, central banks will need more FX and asset market volatility in order to provide low rates for an extended period. The argument goes like this:

1) Low realized and implied volatility have come as a surprise to investors

2) Investors are underinvested out of skepticism that the low rates, low volatility environment will persist

3) If the central bank mantra of “low rates, low vol forever” persists in asset markets, investors will buy high beta assets and add leverage

4) Asset prices will respond much more to rates incentives than (so-called) rates sensitive sectors of the economy

5) Central banks want to keep the low rates without creating an asset bubble and will purposely induce volatility to calm speculationAnd that is not priced in…

Really?

• Japan’s Top Creditor Title at Risk as Surplus End Looms (Bloomberg)

Japan risks losing its position as the world’s top creditor nation, as dwindling savings become insufficient to finance growing public debt, a Bloomberg News survey of economists indicates. A run of current-account surpluses that drove Japan’s net asset position to the largest in the world starting in 1991 is set to reverse, according to 10 of 16 economists in a Bloomberg News survey, with nine projecting sustained deficits by the end of 2020. Japan had net assets of 325 trillion yen ($3.2 trillion) at the end of 2013, with China in second place with 208 trillion yen, according to Japan’s finance ministry.

As an aging population draws down its savings, Japan will become more dependent on foreign creditors to finance its budget deficits and manage the world’s biggest debt burden. A swing to current-account deficits could augur a surge in bond yields as investors reassess the nation’s prospects, and clear the way for China to overtake it as the world’s biggest net creditor. “Chances are high that China will surpass Japan as early as 2020 in the size of net overseas assets,” said Hidenori Suezawa, a financial market and fiscal analyst at SMBC Nikko Securities Inc. “The issue will be whether Japan can attract enough foreign capital to make up for the current-account deficits as countries like the U.S. do.”

• IMF Sounds Global Housing Alarm (FT)

The world must act to contain the risk of another devastating housing crash, the International Monetary Fund warned on Wednesday, as it published new data showing house prices are well above their historical average in many countries. The warning from the IMF shows how an acceleration in global house prices from already high levels has emerged as one of the major threats to economic stability, with countries making limited progress in keeping them under control. Min Zhu, the IMF’s deputy managing director, said the tools for containing housing booms were “still being developed” but that “this should not be an excuse for inaction”.

House prices “remain well above the historical averages for a majority of countries” in relation to incomes and rents, Mr Zhu said in a speech to the Bundesbank last week, which was only released on Wednesday because it clashed with a European Central Bank announcement. “This is true for instance for Australia, Belgium, Canada, Norway and Sweden,” he said. In the wake of the global recession central bankers have cut interest rates to record lows, pushing house prices to a level that the IMF regards as a significant risk to economies as diverse as Hong Kong and Israel. In Canada, for example, house prices are 33% above their long-run average in relation to incomes and 87% above their long-run average compared with rents. The figures for the UK are 27% relative to incomes and 38% relative to rents.

Even if we don’t hold stocks, we still are. How crazy is that?

• We’re All Saps In The Stock Market’s Shell Game (MarketWatch)

The stock market often resembles the shell game Three-Card Monte, an analogy that will become more obvious in the coming weeks. In Three-Card Monte, it seems so easy to find the “money card.” But after placing a bet, victims invariably lose. Why? First, they are falsely led to believe they can win. Second, they don’t realize the other “players” are actually in on the fix. In Wall Street’s version of this ruse, investors don’t realize how much misleading information is fed to them. This “analysis” is designed to make it appear that making money in the market is easy. As the Dow Jones and S&P 500 make all-time highs, it seems like anyone can get rich. And just like in Three-Card Monte, investors are looking in the wrong places for information. Instead of being mesmerized by the all-time highs, investors should be focused on the market’s deteriorating internal conditions.

For example, as the market climbs higher on lower volume, fewer and fewer stocks are participating (i.e. making new highs). This is a red flag. Also, sentiment indicators are reaching extreme levels. The VIX is at a six-year low; the RSI (relative strength indicator) has surpassed 70 (meaning the market is overbought), Investor’s Intelligence is over 60% bullish (the second-highest ever). So many large cap stocks have gone parabolic, there has to be a day of reckoning. Moreover, margin balances are at record levels. When the market goes south, the excess margin will accelerate the downturn. All of this translates into a stealth market bubble that keeps growing, but is happening so slowly few see it.

Read this.

• Here’s Why the US Student Loan Market Is Completely Insane (BW)

President Obama made news this week by expanding a student loan program to broaden the eligibility of borrowers and proposing to limit monthly payments to 10% of a student borrower’s income. On the margin, such moves might help. But the administration’s efforts don’t address a more fundamental problem: These loans aren’t calibrated for risk. In other words, students from Harvard and less-prestigious regional colleges are thrown in the same bucket, despite quite different risk profiles. Under Federal Deposit Insurance Corporation (FDIC) rules governing the insurance of banks, lenders can’t differentiate among schools in assessing credit risk as they do with home buyers and car owners.

As a result, “the government has made it difficult for banks to price to default rates,” says Mike Cagney, founder of Social Finance, a socially based student lending operation known informally as SoFi. “By accepting FDIC insurance, banks lose pricing flexibility and can’t charge interest rates commensurate with the quality of schools—and default rates vary widely by schools.” SoFi has funded more than $650 million in loans to 7,000 borrowers since its founding in 2011. Says Cagney: “The definition of a predatory lender is someone who pushes loans on an individual who can’t afford to pay them back. Under that definition, many of the educational loans made today could be considered predatory.”

HA!

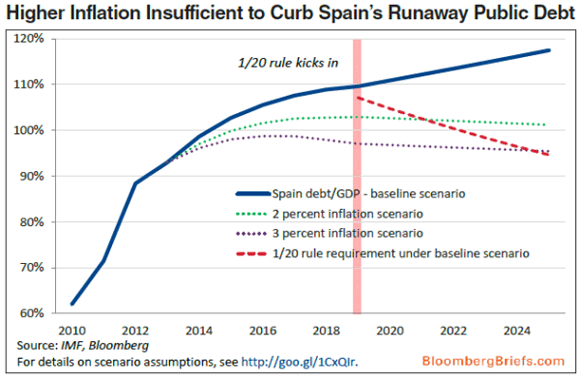

• Will Spain Default? (Zero Hedge)

With 10Y yields trading below those of US Treasuries, asking the question of Spain’s rising default risk seems risible but as Bloomberg’s Maxime Sbaihi notes, the longer the euro flirts with deflation, the higher the risk that the heavily indebted (and becoming more so) countries will be tempted to default. Of course, this ‘concern’ is entirely ignored by the ‘market’ as Draghi has promised enough liquidity to soak up every short-dated bond but as the European Union’s so-called “1/20 rule” suggests – requiring states to reduce excessive (over 60% Debt/GDP) by 1/20th every year or face a fine of 0.2% of GDP – Spain, it appears has 5 options to escape this vicious circle… and one of those is restructuring… To reduce its public debt, Spain can choose among five options, which are not mutually exclusive.

1) The first is to attempt to grow GDP faster than public debt in order to reduce the ratio. According to International Monetary Fund forecasts, annual GDP growth in Spain will remain below 1.3% until 2020. This is not enough to stabilize the debt ratio, according to Bloomberg Brief calculations.

2) The second option is to pursue fiscal adjustment until the primary balance — the budget balance without debt interest payments — reaches a surplus. With a primary deficit of 4%, Spain still needs further consolidation, heightening political risk from voters who show increasing signs of austerity fatigue. Reducing the deficit too quickly might also endanger the recovery.

3) Another option is financial repression, involving state-dictated measures such as interest-rate caps, direct lending to the government or regulation of capital flows. This runs up against reputation risk, political backlash and legal issues, especially in a currency union. Yet it remains a possibility after some features were implemented during the banking sector bailout in Cyprus.

4) Another even more radical option is to restructure or fully default on the debt. That has become more conceivable with the Greek precedent and years of austerity fatigue. In a December 2013 paper on debt restructuring, Carmen Reinhart and Ken Rogoff warned: “restructurings will be needed, particularly, for example, in the periphery of Europe, far beyond anything discussed in public to this point.”

5) One final option is to rely on inflation. Spain’s public debt is fixed in nominal terms, except for one €5 billion inflation-linked bond issuance last month. Higher inflation means a lower real value for repayments. Given the current debt stock, even 3% inflation in Spain would only reduce public debt to GDP by 1 percentage point by 2025, according to Bloomberg Brief calculations based on IMF projections

Repression has been tried and the banks are already neck deep in it… growth is a joke in the new normal… fiscal adjustment is simply (as we have seen) too much pain for politicians… and inflation is going the wrong way… leaving one option (as unpalatable as it is)… default/restructure.

Pension? Don’t count on it.

• US Public Pension Plans Need Boom And Bubble Forever Or Go Bust (TPit)

Public pension plans of states and cities have been in a heap of trouble for years. Promises of juicy pensions after a relatively short time on the job, with many decades of life expectancy remaining, are easy for politicians to make and buy votes with, and for unions to demand to please their membership. But they’re a tad expensive to live up to. Some have been involved in bankruptcies of their municipalities, including those of Detroit. Others are headed that way. Now the Center for Retirement Research at Boston College released a study, based on 150 public pension funds, that sheds light on just how essential a permanently booming economy and everlasting bubbles in the stock and bond markets are to the survival of these funds – and how they’re already integrated into the calculus.

The best-case scenario, which is also the base scenario, assumes return on investment is 7.7% for all plan assets combined, for all years to come. So we’re in the biggest credit bubble in history, when 10-year Treasuries yield 2.6%, and paper with short maturities yields close to zero. Even many junk bonds don’t yield 7.7%, and defaults are excluded from the scenario. So stocks – over 50% of the assets in these plans – and other assets have to make up the difference. Last year they did, and in some of the prior years they did, but then there was the crash of the financial crisis, and before then, it was the crash of the dotcom era, and in the future, the swoon will have some other name, but there will be a swoon.

But there is no swoon in the future of these plans. Assuming the unlikely scenario of an eternal return of 7.7% annually, some of these pension funds are in worse trouble than others. A small coterie, like the Louisiana State Parochial Employees fund, is funded over 100%. But most plans are in trouble. Some of the worst sinners: Alaska Teachers with a funded ratio of 47.9%, Connecticut SERS (41.2%), Illinois Teachers (40.6%), Chicago Municipal employees (37.0%), Illinois SERS (34.2%), Chicago Police (30.9%), or Kentucky ERS (25.8%). Some of the sinners are relatively small plans, but several are large, such as the Illinois SERS, Illinois Teachers, and Connecticut SERS. If markets were allowed to swoon, these babies would be wiped out.

• It May Be Four Rate Hikes In A Row For New Zealand (CNBC)

New Zealand’s central bank delivered its third consecutive rate hike on Thursday, and it’s likely to make that four in a row judging by hawkish comments, some analysts say. The Reserve Bank of New Zealand (RBNZ) lifted its key interest rate by 25 basis points to 3.25%. While that move was not a surprise, analysts had expected the central bank to suggest a slowdown in the pace of monetary tightening. Instead policy makers said further rate increases would be needed to curb inflation in a robust economy. “Effectively, the RBNZ is a lot more focused on domestic mortgage rates. There’s been a lot of competition in the domestic mortgage market in New Zealand which has been pushing rates down,” said Robert Rennie, the global head of foreign exchange strategy at Westpac Bank in Sydney. “The RBNZ is unhappy with that and there is a risk that we see another rate hike in July, which would make it four in a row,” he added.

New Zealand is the only developed economy in the world raising interest rates in the current economic cycle. Last week, the European Central Bank cut its key interest rate to a record low of 0.15%; the Bank of Japan continues to pump money into the economy in a fight against deflation. The U.S. Federal Reserve meanwhile is unwinding its asset-purchasing program but continues to keep its key rate at zero%. “Some of these economies in Asia are doing better so it makes sense for them to be raising rates,” Nariman Behravesh, chief economist at IHS, told CNBC. Consumer prices in New Zealand rose an annual 1.5% in the first in the year to March 31, down from 1.6% in the fourth quarter of 2013.

• The Backroom Deal That Took Bazooka Out Of ECB’s Hands (MarketWatch)

The Bundesbank’s approval for last week’s European Central Bank package of liquidity measures and interest-rate cuts into negative territory appears to be part of a wider-ranging realignment of responsibilities on the European scene. A series of interlinked initiatives could consolidate the position of reform-minded leaders in key areas of European policy-making, reinforcing economic and monetary union by eventually installing a German leader at the helm of the ECB. By limiting the cut in the ECB’s main interest rates to only 0.10 percentage points, and agreeing that rates have now reached their floor in Europe, Mario Draghi and Jens Weidmann, the presidents of the ECB and the Bundesbank, have effectively ended sporadic skirmishing that erupted after they took their jobs in 2011.

The conclusion of hostilities could pave the way for a still more dramatic rapprochement if Weidmann replaces former Banca d’Italia Gov. Draghi as ECB president in the next few years, as some observers believe is likely if Draghi takes over from 88-year-old Giorgio Napolitano as Italy’s president in Rome. Matteo Renzi, the new Italian prime minister, is emerging as a pivotal European figure following his more comfortable-than-expected win in last month’s European parliamentary elections. German Chancellor Angela Merkel has fastened on Renzi as a potentially reliable ally in the swirling battle for influence caused by oscillating power struggles between Berlin, Paris, London and other capitals. In particular, Renzi has close relations with Draghi, contrasting to the ECB chief’s habitual leaning to keep his distance to Italian politicians.

Oh well …

• Enron-Style Accounting Deprives Americans Of Economic Growth (Forbes)

It’s not a widely known, but in gross domestic product (GDP) terms, President Jimmy Carter presided over one of the longest and most expansive periods of economic growth in postwar history. Most readers would say the latter can’t be, that the ‘malaise’ president delivered only contraction and misery, but GDP said otherwise. Of course, the fact that GDP registered growth is the first clue that it’s a more-than-worthless number. Diane Coyle, author of a new book GDP: A Brief But Affectionate History, wouldn’t agree that the number is worthless, but she does acknowledge that it does not measure human wellbeing or welfare. No it doesn’t, and while Coyle doesn’t hide her bias in favor of the hubristic conceit that says economists can credibly measure country economic activity, her book is still an important read for, if nothing else, revealing to readers just how unwittingly fraudulent the practice of economics is.

For those who don’t already know, gross domestic product (GDP) is the standard measure of the size of a country’s economy, and depending on whom you speak to, it carries with it great importance. When a growth deficit called into question the ability of Greece’s government to pay its debts, the country’s GDP loomed large according to Coyle; the irony there that Greece’s borrowing capacity was allegedly decided by a “handful of people” in a “dusty room” in the suburbs of Athens attempting to divine its output. You can’t make this up.

Yes, it’s true, the economics profession believes that country economies comprised of millions, and sometimes billions of individuals, can be measured. No doubt GDP in the U.S. is calculated with quite a bit more sophistication than in Greece, but the naive arrogance underlying the statistic remains for all to see. A profession that was largely blind to the economic crack-up taking place inside Iron Curtain countries back in the ‘70s (GDP signaled actual growth) still thinks unimaginative office drones in Washington, D.C. can divine the dynamism – or lack thereof – taking place in the real world.

Home › Forums › Debt Rattle Jun 12 2014: Things Fall Apart; Central Banks Cannot Hold