Esther Bubley Daily Greyhound commute to Memphis September 1943

How do we know what’s really going on in China’s economy? Given that it’s – at least officially – under central control, that’s not easy. The Chinese leaders know their way around spin and propaganda; one might argue that their lives depend on it. Still, maybe following and connecting the dots as they appear in the news can be helpful. So I thought I’d squirrel together a few data and talking points from the past week, and see what comes out.

Of course the biggest news came 3 weeks ago, when the Custom Administration announced that Chinese exports in February dropped 18.1% from a year earlier. No matter what anybody may claim about Lunar New year, that’s a devastating number. It shows that China is simply losing its buyers. And for an economy that is singlemindedly focused on exports, that is earth shattering. But from inside the nation as well, there are increasing reports that things are not running smoothly.

The manufacturing index seems well embedded below the 50 break even point.

China Manufacturing Gauge Falls as Slowdown Deepens (Bloomberg)

China’s manufacturing industry weakened for a fifth straight month, according to a preliminary measure for March released today, deepening concern the nation will miss its 7.5% growth target this year. The Purchasing Managers’ Index from HSBC and Markit dropped to 48.1, compared with a 48.7 median estimate [..]

Real estate prices are starting to fall. Not everywhere, nor everywhere at the same pace, but for the many dozens of millions who’ve put their money in apartments, this is a grave worry.

Angry Chinese Homeowners Vent Frustrations After Price Cuts

Groups of angry homeowners put up banners and demanded their money back after Hong Kong-listed property developer Wharf Ltd. cut prices on new homes in an eastern Chinese city [..] They said they wanted their money back after prices at the project, called Phoenix Lake Garden, were cut by as much as 16% [..]

Debt levels among local governments are probably one of the murkiest issues in the country. It hardly matters at all what the state auditor says, because government-related debt is just the tip of the iceberg. In China, when you say local government, you say shadow banking. Local officials kept themselves sitting pretty through shadow borrowing. Where the money came from, how leveraged it is, who knows? WHat we do know for sure is that it’s much more expensive than ”official” loans.

China’s Local Government Debt Burden Varies Widely: Moody’s (CNBC)

China’s state auditor said in a report in December that local governments owe almost $3 trillion in outstanding debt as of the end of June last year, up 67% from the last audit in 2011. [..] Among the top 31 upper-tier local governments reporting government-related debt on their websites, indebtedness ranged from 69% to 156% of revenues, with the median at 108%, Moody’s said.

There are new forms of lending popping up, if only because the demand is so great due to debt needing to be rolled over and serviced, lest the scores of little emperors find themselves exposed.

China Banks Drained by Internet Funds Called Vampires (Bloomberg)

It has been labeled a “blood-sucking vampire” by a prominent commentator on state-run television. Executives at China’s largest banks have called for regulators to curb its rapid expansion. [..] The focus of this ire is Internet financing, specifically Yu’E Bao, the fund pioneered nine months ago by Alibaba Group Holding Ltd.’s online-payment affiliate Alipay. Its ease of use, involving a few taps on a smartphone, has drawn deposits from 81 million customers, more than the population of Germany, as they chase returns higher than China’s banks can offer. The total exceeded 500 billion yuan ($80 billion) as of Feb. 28 [..]

Despite surging pollution levels, China actively keeps drawing up plans to get more people into cities. It has understood that this is closely linked to growth numbers. We may find that short-sighted, and it is, but take a step back and imagine what US-style urban sprawl would look like on the scale of China.

China’s Urbanization Loses Momentum as Growth Slows (Bloomberg)

The pace of migration of rural Chinese to cities, a dynamic hailed by Premier Li Keqiang as key to the nation’s development, is set to slow by a third in coming years [..] Today’s report from the World Bank and the State Council’s Development Research Center, which helped inform the government’s plan, recommends changes including on land use to spur more-efficient and denser cities. That can save China $1.4 trillion from a projected $5.3 trillion in infrastructure spending over the next 15 years [..]

Bank runs look inevitable in China. At the first sign that Beijing loses only a little bit of control, people will demand cash to put into their mattresses. Cash that, just like in western nations, is of course not there if everyone wants it at the same time. The government’s biggest nightmare? There are many, but it might well be.

Hundreds Rush To Rural Chinese Banks After Solvency Rumours (Reuters)

Hundreds of people rushed on Tuesday to withdraw money from branches of two small Chinese banks after rumours spread about solvency at one of them, reflecting growing anxiety among investors as regulators signal greater tolerance for credit defaults. The case highlights the urgency of plans to put in place a deposit insurance system to protect investors against bank insolvency, as Chinese grow increasingly nervous about the impact of slowing economic growth on financial institutions.

Or could this be the biggest nightmare? China allegedly has 90,000 property developers in a system that even if it runs well only has space for maybe 30,000. How do you bring down numbers like that in an orderly fashion? I’m very glad that’s not my job. How many of those developers will go down with badly built properties, huge levels of bad debt and scores of very angry “investors”?

High Debt, Slow Sales Loom Over Chinese Property Firms (SCMP)

All eyes are now on a few Chinese real estate developers particularly vulnerable to slow sales and tight credit, as mainland China’s property market enters a new downturn. [..] At the end of June, Glorious Property (36%) and Hopson (42.8%) had the lowest ratio of cash versus short-term debt among all mainland Chinese developers rated by Moody’s.

China’s stimulus far outnumbers anything the US has done. And that’s when you get these insane debt levels. Which may be sort of bearable, temporarily, when exports keep growing at double digit rates. Not when they’re down 18%. Note also that China now needs $7-8 of new debt to generate $1 of economic growth, approaching levels that are set to doom western economies.

China Finds The Credit Habit Hard To Kick (Satyajit Das)

Chinese government debt, including local government debt, is about 55% of GDP –about $5 trillion (£3 trillion) – an increase of about 60% from 2010.

But the official Chinese government debt figure may not be complete, as it may exclude debts from local governments and central departments outside the finance ministry. If these items are included, China’s government debt including contingent liabilities would be higher, perhaps 90% of GDP. There has been a parallel increase in private sector debt. Corporate debt has increased sharply, approaching 150% of GDP. Traditionally considered compulsive savers, Chinese households have increased borrowing levels from about 20-30% to 40-50% of GDP. [..]

Another measure is the credit gap – the difference between increases in private sector credit growth and economic output. Research studies have found that 33 countries with credit gaps experienced a subsequent rapid slowdown in growth, typically by at least 50%. In China, the credit gap since 2008 is over 70% of GDP. Chinese credit intensity (the amount of debt needed to create additional economic activity) has increased. China now needs about $3-$5 to generate $1 of additional economic growth, although some economists put it even higher, at $6-$8. This is an increase from the $1-$2 needed for each dollar of growth 8 to 10 years ago.

I personally find this one especially worrisome, because it raises the question: where do Chinese industry and Chinese local government get their credit? And under what terms? As a local official, if you need those $7-8 of new debt to generate $1 of growth, you’re probably going to take it, as long as interest rates allow for it. But what are you getting your community into for the future?

Who are China’s lenders? How solid are they? How leveraged? What’s the level of bad loans they already have on their books? And who are the borrowers? Does either side do proper research on the other?

In the end, just about everything is state owned, all factories, enterprises etc. And as we know from history (Soviet Union), parties involved figure out very quickly that state enterprises don’t need to make a killing; the profit would only go to the state anyway. So buyers, suppliers, middle men and local officials start skimming off profits.

A company will buy an X amount of steel or copper with credit from lender Y. It will then turn to lender Z and use the steel as collateral to get credit for the purchase of an even larger amount of copper or steel. And down the line, who is worth what anymore? The individuals involved have all loaded up their pockets, preferably with dollars, but what’s going to happen to the company that’s left with all that steel? I would expect imports to start falling quite dramatically.

Hong Kong’s Soaring Bank Exposure to China Sparks Credit Concerns (Reuters)

In just a few years, Hong Kong banks have ramped up lending to China from near zero to $430 billion [..] Foreign bank claims on China hit $1 trillion last year, up from nearly zero 10 years ago, Bank of International Settlements data shows. The biggest portion of that is provided by Hong Kong, according to analyst estimates of the BIS data. The $430 billion in loans outstanding represents 165% of Hong Kong’s GDP [..] By the end of 2013, Hong Kong banks’ net claims on China as a percentage of their total loan book was nearing 40%, compared with zero in 2010.

If Beijing no longer offers implicit guarantees of loans state banks have put on their books, these banks are going to be a whole lot worse off than merely “spooked”. And the economy will become even more dependent on financing from the deep dark shadows. Beijing has put so much money into the economy that doubling up on that is hardly an option anymore. What seems left for Xi and Li now is to try and manage the path down. Whether that’s even an option is a great unknown and anyone’s guess.

Spooked By Defaults, China Banks Begin Retreat From Risk (Reuters)

Some of China’s struggling firms are finally getting the reception that regulators have been hoping for — a cold shoulder from banks in the form of smaller and costlier loans. [..]There are signs that even state-owned firms, in the past fawned over by lenders for their government connections, have to contend with higher rates, lower lending limits and more onerous checks by banks. “Interest rates are going up 10% for the entire industry …” [..]

Some gauges of China’s corporate debt are already flashing red. Non-financial firms’ debt jumped to 134% of China’s GDP in 2012 from 103% in 2007, according to Standard & Poor’s. It predicted China’s corporate debt will reach “stratospheric levels” and become the world’s largest, overtaking the United States this year or next.

Don’t be surprised if heavy industry in China gets a series of very hard blows. The levels of leveraged finance will be crucial, and it’s not easy to be confident in that respect.

Default Risks Surge At China Steel Mills (FT)

Chinese steel mills were suffering a medley of woes in mid-March as sales slowed, production levels slumped and profits plunged, according to an investment bank survey published on Tuesday that foreshadows the rising risk of debt defaults in the world’s largest steel producer.

Macquarie Commodities Research, quoting a proprietary survey of Chinese steel mills and traders conducted in mid-March, found that large, medium and small steel mills were all enduring a contraction in orders compared to the same period in February, and profits had declined to historic lows. “Looking at profitability, it is clear why the smaller mills are making the largest cuts (in production) – for the first time in the history of the steel survey not one smaller mill reported that they are making money …

Oh yeah, why not give the developers, of which there are far too many to begin with, the option to sell mortgage-backed securities and things like that, offering people more great returns on their investments that way. Worked great in the US!

Chinese Developers Seek Alternative Financing As Investors Grow Wary (Reuters)

China’s property developers are turning to commercial mortgage-backed securities and looking at other alternative financing as creditors grow more discriminating in the face of rising concerns about the country’s real estate and debt markets. Bond buyers are shying away from second-tier developers because property sales have cooled as the economy slows. The expected bankruptcy of a local developer and the country’s first domestic bond default this month have heightened scrutiny of borrowers. [..]

Chinese regulators last week allowed developers Tianjin Tianbao Infrastructure Co. and Join.In Holding Co. to offer a private placement of shares, opening up a fund raising avenue that had been closed for nearly four years. New rules were also unveiled last week allowing certain companies to issue preferred shares [..]

Big one. Importers backing out of deals. A system built on quicksand falls back to earth. They have to pay back the loans they bought the soy and rubber with, and are squeezed between those payments and less demand for their products. China’s like an oceanliner at full steam ahead that needs to step on the brakes. Too much inertia.

China Soybean, Rubber Importers Renege on Deals (WSJ)

Chinese importers of soybeans and rubber are backing out of deals, adding to a wide range of evidence showing rising financial stress in the world’s second-biggest economy. Most purchases are private, with little data on the volumes affected, but traders at Asian trading firms say they are seeing a sharp rise in canceled contracts this year while other buyers are demanding heavy discounts. The U.S. Department of Agriculture confirmed that China has canceled orders for 517,000 metric tons of soybeans … [..]

The cancellations are a big worry for the commodity markets as exporters around the world had relied for years on China’s insatiable appetite for a wide range of raw ingredients. But now as jitters rise over the health of the economy, the fallout is rippling through into agricultural commodities, just weeks after the price of copper and iron ore tumbled on worries they had been used in risky Chinese financing deals. [..]

Rubber prices have dropped more than 20% since the beginning of the year, due to worries over China’s slowing economy and a global surplus of the commodity. Many sellers who bought at high prices are unwilling to sell at a loss, pushing up stocks at the port of Qingdao to near-record levels recently. Stockpiles in some other commodities like soybeans and iron ore are also high as buyers hang on.

More developers, more trouble. Pray tell, what’s the difference with the US, Ireland or Spain in 2006? Well, true, Chinese debt may well be even more leveraged.

China’s Developers Face Shakeout as Easy Money Ends (Bloomberg)

The collapse of a Chinese developer in a city south of Shanghai foreshadows a shakeout among the nation’s almost 90,000 real estate companies as the government reins in credit and the housing market slows. [..] Zhejiang Xingrun’s demise comes after a policy shift by Premier Li Keqiang to tighten credit. The effort to contain surging home prices comes after they climbed 60% since the government’s 4 trillion yuan of fiscal stimulus in 2008 to bolster the economy after the global financial crisis. Officials have stepped on the brakes even as economic growth was already estimated to grow 7.4% this year, the slowest pace since 1990 [..] China’s seven-day repurchase rate, which measures interbank funding availability, hit a record high of 10.8% on June 20

Bad banks are rarely a good idea. China is no exception. Wait till the state banks begin to wobble, that should be fun.

China’s Rapidly Expanding Black Box (WSJ)

China’s “bad bank” experiment is entering unchartered territory. China Cinda Asset Management, created as a bailout vehicle for China’s bad debts, is scooping up distressed loans at blistering pace. Assets rose by 51% last year to 384 billion yuan ($62 billion), much faster than earlier management guidance of 20% to 30% [..]

A loan bought for 30% to 40% of face value, as seems the company’s historical precedent, should provide enough cushion. But investors know little about the assets. Debt backed by a closed coal mine or property in a ghost city might be worth even less. Cinda, like much of China’s financial system, is still in many ways a black box. In the meantime, Cinda’s financial performance is weakening. Return on assets fell to 2.9% in 2013 from 3.4%, the third straight year of decline. And despite the rise in leverage, return on shareholder equity fell, to 13.8% from 15.8%.

So, anybody feel good about China after all that?

China. A behemoth government stimulus since 2008, a shadow banking system that has grown exponentially and is as opaque as can be, and a level of corruption most South American countries cannot touch. What’s not to like? And then it all comes back to earth. The transition from central control to free(r) market is never going to be easy, trying to juggle both at the same time is another thing still. And yes, China’s easily big enough to drag us all down with it.

I don’t know about you, but I don’t see this end well. The sunny side, though, is that we’ll need to start making a lot of our own stuff again. Sunny because, you know, we’ll create jobs. And can we please not do all the useless plastic trinkets, have a little more taste when we rebuild our manufacturing?

• Spanish CPI Shock Flags Euro Deflation Risks (Reuters)

The euro slid to a three-week low and government bond yields across the euro zone fell on Friday as a surprise fall in Spanish inflation bolstered investors’ bets the European Central Bank will ease policy next week to ward off the threat of a sustained bout of deflation. Spanish and Italian borrowing costs fell to their lowest in eight years, while stock markets drew support from the renewed potential for looser ECB policy and reports Beijing could fast track infrastructure spending to boost the Chinese economy.

The 0.2% annual rate decline in Spanish consumer prices this month was larger than expected and the weakest figure since October 2009. The Spanish numbers put preliminary German inflation data for March later in the day under even greater scrutiny for signs that the threat of deflation is spreading from peripheral euro zone economies like Spain to the bloc’s powerful core.

• UK Current Account Deficit Far Bigger Than Forecast (Guardian)

Disappointing news about the state of Britain’s trading position and further confirmation that squeezed households are driving down their savings have fanned fears about the sustainability of the recovery. Official data showed the current account deficit – Britain’s trade deficit, plus the losses UK plc makes on its overseas ventures – came in at £22.4bn in the fourth quarter of last year, way above forecasts from City economists. Separate data confirmed GDP rose 0.7% in the fourth quarter, as expected.

Economists focused on the current account gap, which was down only slightly from a record deficit of £22.8bn in the third quarter. It was well above a consensus forecast for a £14bn deficit in a Reuters poll. As a percentage of GDP, the deficit was 5.4%, down from 5.6% in the third quarter. The gap underlined fears about imbalances in the UK economy, said Rob Wood, chief UK economist at German bank Berenberg.

“This looks like a domestic recovery and it is quacking like one. Hence the UK’s colossal balance of payments deficit is showing no signs of closing,” he said. “The authorities have engineered a recovery, which should be celebrated. It is much better than stagnation. But the UK is storing up big problems for the future.”

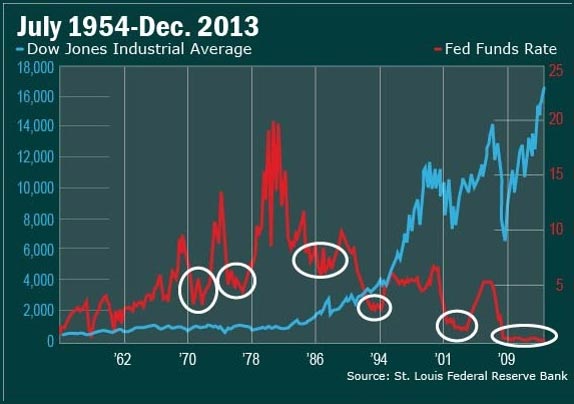

• 6 Charts To Help Decide When To Panic About Rate Hikes (MarketWatch)

Fed boss Janet Yellen wasted little time in spooking the markets at her first press conference, held earlier in March, hinting that the Fed could start hiking interest rates around six months after it finishes winding down its quantitative easing purchases. Wall Street reacted promptly with a sharp selloff, before the punditry pushed back hard, suggesting that Yellen misspoke, and that really, nothing serious is going to happen with interest rates for a long time. See Rex Nutting: The era of easy money is not over .

Still, Yellen has clearly put down a marker for the markets to consider, and it would be an imprudent investor who didn’t at least consider planning now for what will be a very different interest rate environment than has existed for nearly six years. To help with that, MarketWatch looked at five previous periods of relatively low and stable interest rates and how stocks (represented by the Dow Jones Industrial Average performed during and in the immediate aftermath of rising rates.

First a couple of points of comparison. The current low-interest-rate environment is unprecedented. It’s lasted far longer than any previous period of low rates. And the rates themselves have never been this low. And among the obvious caveats, there’s more to the markets than the fed funds rate, the Dow is not representative of the entire market, your investing time horizon makes a big difference , for many years the Fed didn’t specifically target the fed funds rate, etc.

• Paul Krugman: The Laureate of Keynesian Babble (David Stockman)

If you are not Professor Paul Krugman you probably agree that Washington has left no stone unturned on the Keynesian stimulus front since the crisis of September 2008. The Fed’s balance sheet started that month at $900 billion – a figure it had accumulated mostly in dribs and drabs over the course of its first 94 years. Bubbles Ben then generated the next $900 billion in 7 weeks of mad money printing designed to keep the tottering gambling halls of Wall Street afloat. And by the time the “taper” is over later this year (?) the Fed’s balance sheet will exceed $4.7 trillion.

So $4 trillion in new central bank liabilities in six years. All conjured out of thin air. All monetary vaporware issued in exchange for treasury and GSE paper that had originally financed the consumption of real labor, material and capital resources.

And if $4 trillion of monetary magic was not enough, the action on the fiscal front was no less fulsome. At the time in March 2008 that Goldman’s plenipotentiary in Washington, Secretary Hank Paulson, joined hands with the People’s Tribune from Pacific Heights, Speaker Nancy Pelosi, to revive Jimmy Carter’s infamous $50 per family tax rebate, hoping America’s flagging consumers would be induced to buy a flat-screen TV, dinner at Red Lobster or new pair of shoes, the public debt was $9 trillion. It will be $18 trillion by the time the current “un-ceiling” on the Federal debt completes its election year leave of absence next March.

Yet $9 trillion of added national debt in six years is not the half of it. Even our Washington betters do not claim to have outlawed the business cycle, and we are now in month 57 of this expansion. Given that the average expansion during the ten “recovery” cycles since 1950 has been 53 months, it might be argued that we are already on borrowed time fiscally. That is, we have already used up the forward area on Uncle Sam’s balance sheet that is supposed to be available to absorb the predictable eruption of red ink that will occur during the next recession or financial bubble collapse or China melt-down etc.

In fact, peering at the future through its Keynesian goggles, the CBO assumes that the US economy will accelerate to nearly 3.5% average GDP growth until it reaches “full employment” around 2017, and then will remain in that beneficent state for all remaining time, world without end! Yet even then it projects a cumulative deficit of nearly $10 trillion under “current policy” (i.e. bipartisan can-kicking of expiring tax and spending giveaways) over the next decade.

Given the self-evident economic headwinds both at home and abroad, however, it would not be unreasonable to set aside CBO’s Rosy Scenario 2.0 – a delusion I have some personal familiarity with, having invented the original version 33-years ago to the day. Indeed, a more prudent 10-year macroeconomic scenario might be simply “copy and paste”. That is to say, take the average growth rate of GDP, jobs, income and investment over the past decade and assume that the inevitable macroeconomic bumps and grinds of the next decade will average out about the same.

To be sure, some pessimists might note that more than 27 million working age citizens have dropped off the employment rolls since 2000; that presently 10,000 more are retiring each and every day; and that the ingredients of future growth have been radically short-changed, given that real investment in business fixed assets has averaged less than 1% annually for the past 14 years. So “copy and paste” might be hard to achieve in the real world ahead, but even then the added cumulative Federal deficit would total $15 trillion over the next decade under current policy.

In other words, until the sleepwalking denizens of the Washington beltway “do something” about a fiscal doomsday machine that has been put on auto-pilot since the 2008 crisis, the nation is likely to end up with upwards of $35 trillion of national debt by the middle of the next decade, while a “copy and paste” growth rate of nominal GDP (2000-2013= 4.0%) would end up at $25 trillion. In short, what is built into our fiscal future right now is a Big Fat Greek debt ratio of 140%.

Now comes Professor Krugman proposing to “do something”:

…. we should aggressively reverse the fiscal austerity of the last few years, getting government at all levels spending several points of GDP more to boost demand…. let’s say for the sake of argument that the right policy is two years of fiscal expansion amounting to 3% of GDP each year, plus a permanent rise in the inflation target to 4%. These wouldn’t be radical moves in terms of Econ 101 — they are in fact pretty much what textbook models would suggest make sense given what we have learned about macroeconomic vulnerabilities…

In short, Krugman wants to double-down on the lunacy we have already accomplished. His 4% inflation target is just code for re-accelerating the Fed’s money printing machine, thereby keeping real interest in deeply negative terrain for even more years beyond the seven-year ZIRP target the Fed has already promised. And while the Wall Street gamblers who prosper mightily from the free money carry trades enabled by this insult to honest financial markets might not even appreciate the favor, its possible that millions of Main Street households not “indexed” to Krugman’s beneficent 4% inflation target might well notice its impact. [..]

• Big Banks Leave $23 Billion on the Table in Fed Stress Tests (Bloomberg)

I wrote earlier today about the Fed’s stress tests, and how they’re a weird exercise in doing arithmetic in a fog: Your job, as a bank, is to:

- guess how much capital the Fed thinks you’ll have in a crisis,

- subtract out how much capital the Fed thinks you’ll need to have in a crisis,

- and ask to return that much money to shareholders.

Item 1 is the fog: The banks and the Fed calculate their stressed capital differently, and they get very different numbers. Item 2 is straightforward: It’s hard to calculate capital, but it’s easy to say how much you need; it’s nice simple round numbers like 4 or 5 or 8%. Item 3 is debatable: You might imagine a bank saying, you know what, we want to have more than the minimum amount of capital in a severely stressed scenario. I don’t spend a lot of time imagining that, but you and I probably have very different inner lives and far be it from me to interfere with yours.

Anyway how foggy is the arithmetic? I drew you a graph:

This graph — which is itself a bit foggy, so read the disclaimers1

— shows how much the five most notable non-Citi banks (Bank of America, Goldman Sachs, J.P. Morgan, Morgan Stanley and Wells Fargo) could have paid out, versus how much they did pay out. Citi is omitted because, you know, oops, it’s not allowed to pay out anything.2

Since Bank of America and Goldman Sachs originally asked to pay out more than they were allowed, I threw their initial asks into the chart too.The gist is that these five banks’ capital plans call for about $37 billion of increased payout to shareholders, but that they could have returned $60 billion. So they only got 62% of what they could have, and left $23 billion on the table. If the banks are gaming the stress tests, 62% is not a great score.

• Yellen Might Help Asia Kick the Easy-Money Habit (Bloomberg)

Janet Yellen could be excused for feeling whipsawed in Asia. In Tokyo 17 months ago, before taking over as head of the Federal Reserve, Yellen had to defend the U.S.’s monetary largess in front of a gathering of the testy central bankers. Now the region wants the Fed to go slow as it scales back on monetary stimulus.

Rather than fretting about the Fed’s tightening, Asia should be looking at the benefits as the world’s most powerful central bank charts a return to monetary normalcy. These include currency advantages for Asia’s exporters, deflating asset bubbles and focusing governments on organic economic growth and job creation without relying on excessive liquidity. “Tapering should actually be taken as endorsing a pro-risk environment as it is a confirmation of a strengthening U.S. recovery,” says Simon Grose-Hodge, head of investment strategy for South Asia at LGT Group in Singapore. “That should be good news for Asian exporters, especially if Fed policy also produces a stronger dollar.”

True, there might be some short-term pain. Yellen’s March 19 comment that the Fed may begin lifting its overnight lending rate as soon as six months after it ends its bond purchases sent shock waves through markets. According to Frederic Neumann, co-head of Asian economics research at HSBC Holdings Plc in Hong Kong, market reactions to the Fed’s moves could “lead to capital outflows which would make debt-financed growth harder to sustain.” [..]

The main focus of the Fed’s action is, of course, the U.S. Nothing would stabilize Asia’s economies and brighten its prospects more than a recovery in the biggest economy. That goes for China, too. At $16.2 trillion, the U.S. is about double the size of Asia’s largest economy and the American consumer is still the key to growth there. With Europe underperforming and Japan doing all it can to maintain the yen’s 20% drop over the last 15 months, stronger U.S. demand is the best hope for China to maintain rapid growth.

• China’s Rapidly Expanding Black Box (WSJ)

China’s “bad bank” experiment is entering unchartered territory. China Cinda Asset Management, created as a bailout vehicle for China’s bad debts, is scooping up distressed loans at blistering pace. Assets rose by 51% last year to 384 billion yuan ($62 billion), much faster than earlier management guidance of 20% to 30%, according to a Morgan Stanley note. It’s also levering up, with the ratio of assets to equity rising to 4.6 from 4.2 in 2012, according to the company’s first quarterly report as a public company.

With debt distress among Chinese companies popping up daily, it makes sense for Cinda, listed in Hong Kong and majority-owned by the Ministry of Finance, to expand during the down cycle. The question for investors is how much money Cinda can make on these purchases, and when. The restructuring process typically takes one to two years, the company says. But the company as currently composed has never been through a credit down cycle. It’s hard to accomplish quick asset turnaround if the market value of collateral on bad loans is falling. With growth slowing and credit relatively tight, corporate defaults are spreading in property and coal, areas where Cinda has large holdings.

Much will depend on what Cinda pays for the distressed debt. A loan bought for 30% to 40% of face value, as seems the company’s historical precedent, should provide enough cushion. But investors know little about the assets. Debt backed by a closed coal mine or property in a ghost city might be worth even less. Cinda, like much of China’s financial system, is still in many ways a black box. In the meantime, Cinda’s financial performance is weakening. Return on assets fell to 2.9% in 2013 from 3.4%, the third straight year of decline. And despite the rise in leverage, return on shareholder equity fell, to 13.8% from 15.8%.

How to classify Cinda, with arms in restructuring, asset management and brokerage, remains an open question. Cinda trades around 1.4 times estimated 2014 book value, slightly below the average for Chinese securities firms. But given its tight relationship with the banking system, there’s an argument it should trade closer to where investors rate the commercial banks, which is even with book value. In a slowing economy, the asset recovery process that Cinda is supposedly so good at could prove more difficult than hoped. Investors should prepare for the “bad bank” to lose its premium value.

• China’s Developers Face Shakeout as Easy Money Ends (Bloomberg)

The collapse of a Chinese developer in a city south of Shanghai foreshadows a shakeout among the nation’s almost 90,000 real estate companies as the government reins in credit and the housing market slows. Zhejiang Xingrun Real Estate Co., a closely held developer based in Fenghua, is insolvent, with 3.5 billion yuan ($562 million) of debt. Its residential projects have been halted and authorities have detained its largest shareholder and his son, according to the city’s government.

Developers have proliferated since China began allowing private home ownership in 1998, causing a surge in demand and a rally in residential prices. For years, homebuilders binged on easy credit from banks and shadow financing from non-banks at higher interest rates. Now many developers are struggling with debt as thousands of apartment buildings across the country sit empty and the government abstains from providing further stimulus for the economy.

“It’s a positive sign that companies are not being propped up,” said Richard van den Berg, Hong Kong-based country manager for China at CBRE Global Investors, a unit of Los Angeles-based CBRE Group Inc. CBRE estimates there are about 30,000 “true” developers, not including construction and project companies. “That is far too many, even for a country as large as China. Consolidation needs to take place.”

Zhejiang Xingrun’s demise comes after a policy shift by Premier Li Keqiang to tighten credit. The effort to contain surging home prices comes after they climbed 60% since the government’s 4 trillion yuan of fiscal stimulus in 2008 to bolster the economy after the global financial crisis. Since becoming premier in March 2013, Li has refrained from using short-term stimulus measures, aiding government attempts to rein in shadow financing through companies with little transparency known as trusts.

Officials have stepped on the brakes even as economic growth was already estimated to grow 7.4% this year, the slowest pace since 1990, according to a Bloomberg News survey of 55 economists. China’s seven-day repurchase rate, which measures interbank funding availability, hit a record high of 10.8% on June 20 during the nation’s worst cash squeeze on record. China’s credit growth trailed analysts’ forecasts in February: the 938.7 billion yuan in aggregate financing fell 28% short of the median estimate in a Bloomberg News survey.

• China Soybean, Rubber Importers Renege on Deals (WSJ)

Chinese importers of soybeans and rubber are backing out of deals, adding to a wide range of evidence showing rising financial stress in the world’s second-biggest economy. Most purchases are private, with little data on the volumes affected, but traders at Asian trading firms say they are seeing a sharp rise in canceled contracts this year while other buyers are demanding heavy discounts. The U.S. Department of Agriculture confirmed that China has canceled orders for 517,000 metric tons of soybeans, used to make cooking oil, and compares to imports of 63.4 million tons last year. South American soybean contracts have also been canceled because of weak demand, says trade journal Oil World.

The cancellations are a big worry for the commodity markets as exporters around the world had relied for years on China’s insatiable appetite for a wide range of raw ingredients. But now as jitters rise over the health of the economy, the fallout is rippling through into agricultural commodities, just weeks after the price of copper and iron ore tumbled on worries they had been used in risky Chinese financing deals. Natural rubber, mostly grown in Southeast Asia and used to make products ranging from tires to latex gloves, is also getting hit as some buyers from China refuse to honor existing agreements, or look for ways to negotiate discounts. Two large Asian rubber producers, who asked not to be named, said Chinese buyers had defaulted on them.

Traders say buyers are trying to ask for discounts, citing reasons such as cargo arriving a few days late and claims about poor quality or contamination, said Bundit Kerdvongbundit, vice president of Von Bundit Co., Thailand’s second-largest natural rubber producer. The contracts are already signed, but Chinese importers “refuse to take cargo or pay unless they get discounts.” One comfort is that most companies trading with China have taken some sort of safeguards after widespread defaults in the wake of the 2008 global financial crisis, like asking for deposits, said Benson Lim, chief operating officer and head of global rubber trading at R1 International. However, “the business is so competitive that not all sellers are taking deposits, so they are hard-hit when buyers default,” he added.

Rubber prices have dropped more than 20% since the beginning of the year, due to worries over China’s slowing economy and a global surplus of the commodity. Many sellers who bought at high prices are unwilling to sell at a loss, pushing up stocks at the port of Qingdao to near-record levels recently. Stockpiles in some other commodities like soybeans and iron ore are also high as buyers hang on.

• China Tries To Soothe Anxious Markets After Weak Forecasts (Reuters)

China’s premier, Li Keqiang, sought to reassure jittery global investors that Beijing was ready to support the cooling economy, saying the government had the necessary policies in place and would push ahead with infrastructure investment. Recent weak economic data and mounting signs of financial risks have dimmed outlook for the world’s second-largest economy, sparking talk of imminent government action or even a mini-stimulus plan to shore up growth. [..]

On Friday, Li said government has policies well prepared and would roll out targeted measures step by step to aid the economy, according to the Xinhua news agency. “We have gathered experience from successfully battling the economic downturn last year and we have policies in store to counter economic volatility for this year,” he said. “We will launch relevant and forceful measures according to what we have planned in our government work report,” he added, referring to his report to China’s annual parliament session earlier this month.

Among those measures are speeding up construction of basic infrastructure, including railways, highways and water conservation projects in the central and western provinces, as well as boosting trade and cutting companies’ financing costs. “The overall performance in the economy so far this year is relatively stable and we saw some positive changes, but we cannot neglect the increasing downward pressure and difficulties,” he said.

[..] … analysts said it is not easy for Beijing to turn on the stimulus taps, given an already acute overcapacity problem in some industries and the current government focus on putting structural reforms ahead of growth. “Those measures Li mentioned were not new. It only means government will start work on projects that have already been approved,” said Xiao Bo, economist at Huarong Securities in Beijing. “It’s impossible for the government to unveil stimulus policies as we haven’t solved the problems left over from the 4 trillion yuan spending,” he said, referring to China’s big stimulus package unveiled in late 2008 in response to the global financial crisis.

• Japan to Speed Up Stimulus as Consumer Spending Slows (Bloomberg)

Japan will speed up deployment of government cash in coming months as a surprise drop in consumer spending in February triggered concern the nation’s long-awaited inflation is now damaging purchasing power. Finance Minister Taro Aso told reporters that data showing a slump in household expenditure two months before the first sales-tax increase since 1997 was a problem, and Prime Minister Shinzo Abe’s administration will pour 40 percent of outlays for the next fiscal year into the April-June quarter. He’d already pledged to fast-track stimulus spending.

Data today also showed inflationary pressures are spreading even before the 3 percentage-point sales-tax increase take effect on April 1, as the price of durable goods soared the most since the early 1980s. With officials striving to prevent a repeat of the recession that followed the rise in the levy 17 years ago, the central bank also may face calls for action. “We can’t be optimistic about the resilience of the economy after the sales-tax hike,” said Naoki Iizuka, an economist at Citigroup Inc. in Tokyo. “It’s possible the government will have to compile another fiscal stimulus package this year. We expect the Bank of Japan will add easing in June or July.”

Household spending fell 2.5% in February from a year earlier, the first drop in six months, compared to the median estimate of economists for a 0.1% rise. Retail sales slowed, while a measure of inflation that strips out energy and fresh food increased the most since 1998.

• Japan Steps Off The Tax Cliff Tuesday — Can It Survive? (MarketWatch)

It was the mid-1990s. Japan had gone from a rising economic superpower to a nation in decline, mired in what would be known as “The Lost Decade.” And yet a recovery seemed just around the corner, as most economic indicators were popping back up to levels last seen during the heyday of the 1980s boom. The late Ryutaro Hashimoto was prime minister at the time, and with an eye to shoring up Japan’s finances, he decided to raise the consumption tax — a sort of national sales tax that covers almost all goods and services — by two percentage points to 5% at the start of the new fiscal year in April 1997.

The result was unmitigated recession, dashing any hope that Japan would quickly return to its rapid growth of the previous decade. And while some of this was likely due to the Asian financial crisis that broke out several months later, the tax hike has taken much of the blame. Until recently, the idea of another consumption-tax increase was inextricably linked to the idea of economic retreat. Unfortunately, Japan is also facing a huge public-debt load, at around 225% of annual GDP in 2013. Also, the nation could really use a corporate-tax cut — the Nikkei Asian Review cites data showing Japan’s effective corporate-tax rate is well above that in the U.S., U.K. and France, and is more than double what Germany charges.

To cut the debt and to pay for a possible easing of the corporate tax at some point down the road, Prime Minister Shinzo Abe is set to raise the consumption tax for the second time in Japanese history. And not just one hike either: While the rate will go to 8% from its current 5% on Tuesday, the government is planning another hike to 10% in October 2015 if all goes well with the April increase. But will Japan’s economy survive the shock?

Some clearly think it will not be pretty. Foreign money has recently been rushing out of Japanese stocks and bonds. As BK Asset Management managing director Kathy Lien said in a note Thursday: “Last week’s liquidation [of Japanese assets by foreign investors] was the largest amount ever, and the magnitude led many investors to believe that foreigners are growing concerned about the central bank’s nonchalant attitude on the risks posed by the increase in the consumption tax.”

That nonchalance can been seen in comments by Bank of Japan Gov. Haruhiko Kuroda last week in London: “Japan’s employment situation is far more favorable than that in 1997. The [BOJ] believes that, while Japan’s economy will temporarily decline immediately after the consumption-tax hike, it will continue to grow,” Kuroda said, according to a translation in the Nikkei. This hasn’t calmed everyone, however. As Capital Economics Japan economist Marcel Thieliant put it earlier this month: “Investors are eagerly waiting to see how sharply demand will slow. … There are certainly reasons for concern: Wage growth remains sluggish, and the sales-tax hike will further undermine household purchasing power.”

• Ukrainian Nationalists Threaten To Storm Parliament After Leader’s Killing (RT)

Over 1,500 nationalists from the Right Sector have circled Ukrainian parliament in Kiev threatening to storm it on Thursday. They demanded the resignation of the interior minister after their leader Muzychko was killed in a police operation. Up to 2,000 members of the Right Sector, which recently was revamped into a political party, flooded the square in front of Verkhovna Rada in the Ukrainian capital on Thursday night. The radicals, who brought car tires to burn with them, were banging on the Parliament’s doors, smashing the glass parts in them. Wearing masks and brandishing bats, they were shouting “Avakov, get out!”

The parliament building was empty except for guards, some administrative staff and reporters. All the MPs had earlier left the building through an underground tunnel, RIA Novosti reported. The protesters were threatening to break into the parliament if their demands were not met, journalists reported from the scene. The Rada’s security in the meantime concentrated in front of the entrance to the building and prepared water cannons, urging the journalists inside not to approach the windows looking onto Constitution Square. Several hours into the standoff activists announced the rally was over for tonight as they decided not to storm the building just yet, but reconvene tomorrow.

• Ukraine Security Officials Mull Banning Right Sector Radical Movement (RT)

Following a siege of Kiev parliament building by the Right Sector nationalists, Ukraine’s security officials have discussed banning the movement during an urgent security meeting, a source in Batkivshchina party told RIA. According to the source, the meeting was attended by the acting Interior Minister Arsen Avakov, National Security and Defense Council chief Andrey Parubiy, as well as Oleg Tyagnibok, the leader of nationalist Svoboda party.

During the meeting, Avakov suggested a complete ban of the organization given the radicalization of the Right Sector, the source said. Parubiy was allegedly supportive of the idea of dismantling the neo-Nazi movement and said such a move would allow those present at the meeting to whitewash themselves of having any connections to the radicals, the source said. Tyagnibok reportedly did not take any sides. According to the source, the proposal will be further discussed on Friday “within a wider circle.”

Meanwhile on Friday, Verkhovna Rada is also expected to hold an emergency session to discuss the possibility of Avakov’s resignation, after hundreds of Ukrainian nationalists gathered outside the parliament building threatening to storm it unless Avakov takes personal responsibility for the killing of one of their leaders and resigns. The right-wing militant leader Muzychko, also known as Sashko Bilyi, was killed in a police raid against his gang in Rovno, western Ukraine.

The Interior Ministry plans in the next couple of days to unveil the audio files related to the attempted arrest and subsequent killing of Muzychko, Avakov said on his Facebook page on Friday. “The Ministry of Internal Affairs will disclose all documents, material, video and audio evidence,” Interior Minister Arsen Avakov said, saying that within the next two days all the audio files relating to Tuesday’s shootout will be declassified. “This will give the public more information about the activities involved in the case. Everyone will be able to decide who is the hero and who vulgar bandit “Avakov said.

• Protests Resurge In Kiev Over Radical Leader’s Killing, Austerity (RT)

The Ukrainian parliament is witnessing a second day of picketing, as hundreds of Right Sector activists pressure MPs to sack the interior minister. Earlier other protesters tried to force their way into Kiev’s Rada to stop a vote on austerity measures. Just a month after street protests forced President Viktor Yanukovich from the country, Ukrainian capital faces a new wave of anti-government demonstrations.

The worst action against the authorities is staged by the Right Sector, an umbrella organization of radical activists, who played the key part in the February bloody stand-off. At least a thousand of the activists are standing guard around the Verkhovna Rada building on Friday demanding that the MPs vote on sacking the freshly-appointed interior minister. The protesters accuse Arsen Avakov of ordering what they call a political assassination of one of their leaders, Aleksandr Muzychko. The notorious Right Sector brute, who made media waves in Ukraine thanks to videos of him bullying officials and threatening to hang Avakov, was gunned down in a police raid aimed at arresting him.

Right Sector vowed revenge for their comrade’s death and for a second day are attempting to pressure Ukrainian lawmakers into sacking Avakov. A draft bill to that effect has been filed with the parliament on Friday by an independent MP, a move which may have stopped a planned siege of the building by the radicals.

The legislators do not appear to be happy with the protest rally at their doorstep. Speaker Aleksandr Turchinov, who was also appointed acting president of Ukraine, branded the Right Sector’s actions a provocation. “The Ukrainian parliament is the foundation of the legitimate Ukrainian power. Without this foundation there would be no power at all,” he said. “There is an attempt to destabilize the situation in Ukraine, it its center, in its heart, in Kiev,” Turchinov added, further alleging that the Right Sector activist may be agent provocateurs hired by Russia. He didn’t explain how exactly Moscow, which put Right Sector leader on the international wanted list, can give orders to the fiercely nationalistic organization.

• City On The Edge Holds Key To Ukraine Future (Reuters)

After 23 years of independence, the paradoxes and interplay of money and politics in Ukraine, of corruption and democracy, of ties to Russia and the West, of a national history marked by regional and linguistic rivalries, are nowhere more evident than in this city of a million and its region, home to one Ukrainian in 10 and producing a fifth of the country’s industrial output. How Donetsk and the wider Don basin respond to the collapse of Yanukovich’s hold on national power and his flight to Russia from pro-Western protesters in distant Kiev will help determine whether the Ukrainian state holds together and whether it may finally offer most of its people prosperity and the rule of law.

An election on May 25 to replace Yanukovich – all candidates should be known next week – may confirm Ukraine on the course set by its interim government, of ties to the European Union and IMF-prescribed market reforms, after the ousted leader triggered his downfall by shunning an EU deal in favor of Russian aid. Founded by a 19th-century Welsh engineer called Hughes who called it Yuzovka after himself, renamed Stalino as it drove the industrialization of the Soviet Union, today’s Donetsk can shape the next stage of Ukraine’s slow emergence from totalitarian rule in the fraught space between Russia and the European Union.

Stand on Lenin Square, though, among the Russian tricolors and Soviet red flags, and the utter confusion of emotions unleashed by last month’s bloody events in the capital is clear. Denouncing wage cuts and the power of oligarchs who made fortunes in the murky years after the Soviet collapse in 1991, a permanent protest picket calls for the return of the ousted president. Yet Yanukovich’s 2010 election campaign was funded by Akhmetov and the president oversaw four years of stagnation as his own family became, by repute, among the country’s richest. “He’s not the worst of them,” said pensioner Valentina Petrovna in justifying her support for the fallen leader during a rally by 3,000 people on Lenin Square last weekend.

Voicing indignation that the opulence of Yanukovich’s home had been exposed to public scorn, she said the same treatment should be accorded other politicians – notably arch-rival Yulia Tymoshenko and other enormously wealthy presidential contenders.

• Bank of England Poised To Act Over House Prices (Guardian)

The Bank of England has said it is poised to take fresh steps to slow down Britain’s housing market if the pickup in prices and mortgage demand threatens a new property bubble. In the light of what it called “increasing momentum”, the Bank said it stood ready to take “proportionate and graduated action” if it proved necessary. The Bank’s focus on the recovery in the housing market was highlighted in a statement published after last week’s meeting of its financial policy committee (FPC), whose task is to prevent the economy being derailed by wild swings in asset prices.

The statement noted that mortgage demand was up 40% in the year to January, while surveys by the main mortgage lenders suggested prices were around 10% higher in February than a year earlier. It said: “In a continuation of a longer-term trend, mortgages at loan-to-income ratios above four times accounted for a higher share of new mortgages in the third quarter of 2013 than at any time since the data series began in 2005. New mortgage lending at high loan-to-value ratios remained low by historical standards, though the number of mortgage products offering higher loan-to-value ratios had doubled over the previous six months.

“Given the increasing momentum, the FPC will remain vigilant to emerging vulnerabilities, will continue to monitor conditions closely and will take further proportionate and graduated action if warranted.” Threadneedle Street intends to oblige banks and building societies to carry out stringent stress tests later this year to see whether they would find themselves in trouble in the event of a slump in house prices or a sharp rise in interest rates.

• UK Consumers In ‘£5 Billion Black Hole’ Of Hidden Debt (Guardian)

UK consumers are struggling with almost £5bn of hidden debt, made up of rent arrears, and unpaid council tax and household bills, according to a report by thinktank Demos. In a report entitled The Borrowers, the organisation said the sum, which equates to almost £200 a household, has been ignored by official debt figures, despite including the type of borrowing that was most likely to be detrimental to consumers. Demos has created a “harm index” which ranks the impact of different types of debt according to their financial, emotional and social consequences, based on the experiences of people who have encountered each type of borrowing.

While mortgages tend to be a consumer’s largest debt, and borrowing amounts to more than £1tn across the UK, Demos gave it a harm rating of just 23 out of 100. By contrast, the types of debt people felt had the worst impact included payday loans, which scored 68 out of 100, council tax arrears, 62, utility bills, 57, and doorstep lending, 50. Lenders pay a levy to the regulator, the Financial Conduct Authority, to fund financial education and debt advice for consumers, and the thinktank said loan companies that caused the most harm should pay the highest levy.

Demos is also calling for a traffic light rating system for all credit products and their adverts to alert consumers to the associated risks. This information could include, for example, the proportion of borrowers who default on or roll over their original loan, the average amount repaid per £100 borrowed, and the risks of not repaying. The hidden debt figure is based on data from property company LSL and debt charity StepChange, as well as government statistics on council tax arrears, and is supported by the results of a poll of almost 1,800 adults.

Demos said the lack of official figures on housing and utilities arrears created an incomplete picture of the national debt problem. The report’s author, Jo Salter, said: “There’s a £5bn black hole in official debt statistics and our research shows just how arrears on rent, council tax and utility bills often have just as big a negative impact on people as payday lending.

• Crimean Military Dolphins Now Train With Russian Navy (RT)

The combat dolphins of Crimea will now serve the Russian Black Sea Fleet. They will assist divers in searching for sunken ships and lost underwater equipment, Russian naval forces said. The research facility called Kazachya Bukhta, not far from Sevastopol, which explores the military use of common bottlenose dolphins, the best-known member of the dolphin family, was founded back in 1965.

The Soviet Navy used sea mammals to patrol the area, rescue lost naval swimmers or locate underwater mines. Some of them even were able to seek and destroy submarines using kamikaze methods. However, the dolphins were also used for less aggressive purposes, trained for underwater search for lost military equipment. The Crimean military dolphins belonged to Ukraine from the fall of the USSR up to March 2014, when after Crimea’s inclusion to Russia they began operating under the Russian flag.

They could now prove to be very useful to the Russian Navy, but for peaceful tasks, believes Captain Yury Plyachenko, the head of the counter-sabotage forces of the Black Sea Fleet from 1988-1992. First, the cetaceans can inspect the underwater pipes including gas pipelines and cable systems. The dolphins can also help Russian Ministry of Emergency Situations to retrieve lost objects underwater. Dolphins will help the Russian navy as they can search for lost torpedoes and shipwrecks in the training areas, he said.

• Brazil looks to ban Monsanto’s Roundup (RT)

Brazil’s public prosecutor wants to suspend use of glyphosate, the active ingredient in Monsanto’s pervasive herbicide Roundup. A recent study suggested glyphosate may be linked to a fatal kidney disease that has affected poor farming regions worldwide. The Prosecutor General’s office is also pursuing bans on the herbicide 2,4-D and seven other active herbicide ingredients in addition to glyphosate: methyl parathion, lactofem, phorate, carbofuran, abamectin, tiram, and paraquat, GMWatch reported.

The Prosecutor General of Brazil “seeks to compel the National Health Surveillance Agency (ANVISA) to reevaluate the toxicity of eight active ingredients suspected of causing damage to human health and the environment,” according to the prosecutor’s website. “On another front, the agency questions the registration of pesticides containing 2,4-D herbicide, applied to combat broadleaf weeds.” The two actions have already been filed with Brazil’s justice department.

The prosecutor is also seeking a preliminary injunction that would allow the Ministry of Agriculture, Livestock and Supply to suspend further registration of the eight ingredients until ANVISA can come to a conclusion. The country’s National Biosafety Technical Commission has been asked to prohibit large-scale sale of genetically modified seeds resistant to the 2,4-D as ANVISA deliberates.

Last week, Brazil’s Federal Appeals Court ruled to cancel use of Bayer’s Liberty Link genetically-modified maize. Earlier this month, France banned the sale, use, and cultivation of Monsanto’s genetically-modified maize MON 810. New research found insects in the United States are developing a resistance to the genetically-engineered maize.

As for glyphosate, new research suggests it becomes highly toxic to the human kidney once mixed with “hard” water or metals like arsenic and cadmium that often exist naturally in the soil or are added via fertilizer. Hard water contains metals like calcium, magnesium, strontium, and iron, among others. On its own, glyphosate is toxic, but not detrimental enough to eradicate kidney tissue.

The glyphosate molecule was patented as a herbicide by Monsanto in the early 1970s. The company soon brought glyphosate to market under the name “Roundup,” which is now the most commonly used herbicide in the world. Two weeks ago, Sri Lanka banned glyphosate given the links to an inexplicable kidney disease, Chronic Kidney Disease of Unknown etiology, known as CKDu, according to the Center for Public Integrity. CKDu has killed thousands of agricultural workers, many in Sri Lanka and El Salvador. El Salvador’s legislature approved in September a ban on glyphosate and many other agrochemicals, yet the measure is not yet law.

Home › Forums › Debt Rattle Mar 28 2014: The China Clock Goes Tick Tock